Cold Chain Equipment Market Revenue to Attain USD 132.91 Bn by 2033

Cold Chain Equipment Market Revenue and Trends 2025 to 2033

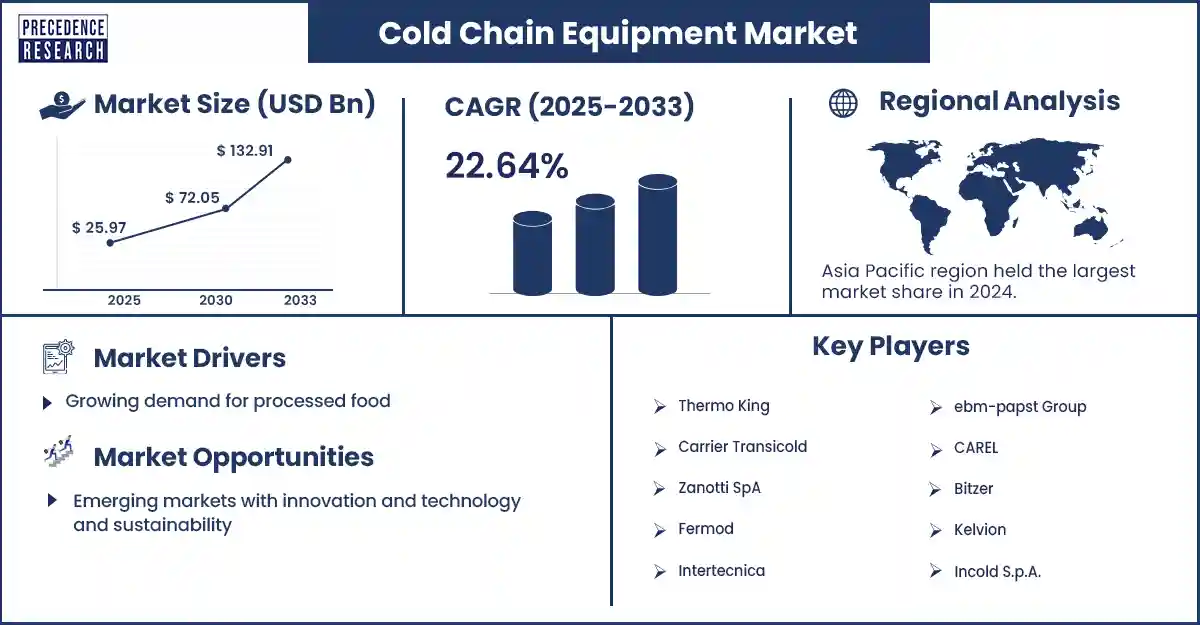

The global cold chain equipment market revenue reached USD 25.97 billion in 2025 and is predicted to attain around USD 132.91 billion by 2033 with a CAGR of 22.64%.

Market Overview

The cold chain equipment market continues to grow rapidly because businesses in many sectors are recognizing the need to preserve temperature integrity for perishable goods. With rising consumer demand for safer products, especially for food and pharmaceuticals, there is a strong demand for advanced and reliable refrigeration solutions, pushing this market to new heights. Businesses are increasingly willing to invest in innovative cold storage units, refrigerated transport, and temperature-controlled packaging technology to minimize spoilage and ensure regulatory compliance while maintaining product integrity and shelf life.

Integrating smart technologies, such as internet of things (IoT), advanced sponsors, monitoring, or data logger, in cold chain equipment improves functionality and revolutionizes cold chain activities from simply transporting products at acceptable temperature levels to enhanced temperature monitoring and responsiveness, representing a more efficient and intelligent cold chain system. This upgrade improves logistics providers' decision-making by providing visibility and traceability in the supply chain and making fully informed decisions. However, the high costs of cold chain equipment and high energy consumption can create challenges and limit market growth. These challenges also present opportunities for the development of energy-efficient cold chain equipment. Developing energy-efficient and eco-friendly cold chain solutions, such as natural refrigerants and renewable energy-powered systems, can address energy consumption challenges and significantly reduce operational costs.

Major Trends in the Cold Chain Equipment Market

Emergence of Intelligent Cold Chain Technologies

A prevalent trend in the cold chain equipment space is the rapidly increasing uptake of smart refrigeration solutions that are powered by IoT, artificial intelligence, and machine learning. Cold chain operators are progressively turning to smart technologies such as real-time monitoring systems, predictive maintenance technologies, and automated temperature control solutions. These technologies can reduce spoilage, ensure compliance, and obtain end-to-end visibility in logistics operations. The technology-first approach is heavily marketed as a differentiator, highlighting operational efficiency, decreasing energy costs, and enhancing decision-making.

Sustainability Trends

Cold chain equipment consumes significant amounts of energy, leading to increased environmental concerns. This encourages manufacturers to develop energy-efficient cold chain solutions with natural refrigerants and solar units that reduce carbon footprints, lower operational costs, and comply with environmental regulations. This ultimately drives innovation in green technologies and supports market expansion.

Individualization & Modularity

Today’s businesses are preferring cold chain solutions that meet specific needs. Pharmaceutical, biotechnology, and food & beverages companies are attracted to modular tools, customized cold room solutions, and cold chain solutions. Stringent regulations regarding product safety and integrity encourage these businesses to go for customized cold storage solutions that meet stringent regulations.

Last-Mile Logistics Needs

Because of the growth of e-commerce and D2C business models, there is a high demand for smaller, portable cold storage. There is a strong focus on last-mile cold chain efficiencies that enable portability, GPS tracking, and compactness. Cold chain brands are increasingly optimizing solutions with logistics providers to create co-branded solutions that deliver temperature-controlled, safe, and fast delivery of fresh or ready-to-eat products. The increasing focus on last-mile delivery solutions for perishable goods creates opportunities for market expansion.

Report Highlights of the Cold Chain Equipment Market

Type Insights

The storage equipment segment dominated the market with the largest share in 2024. Storage equipment plays an important role in cold chain infrastructure as it extends product shelf life while maintaining quality. Storage equipment is categorized Into three subcategories: transit storage, off-grid storage, and on-grid storage. The demand for off-grid storage is high due to the increased need to minimize food losses after harvest and processing. In addition, transit storage equipment is heavily utilized to transport perishable goods.

Application Insights

The fish, meat, and seafood segment held the largest share of the market in 2024. Fish, meat, and seafood must be refrigerated because harmful bacteria can grow on meat once an animal is slaughtered. Cold storage options are ideal to ensure good quality, shelf life, and safety of meat products. The rise in the demand for processed meat products is a key factor bolstering the growth of the segment.

Regional Insight

North America registered dominance in the cold chain equipment market, holding the largest share in 2024. This is mainly due to the increased demand for temperature-controlled storage solutions in the food and pharmaceutical industries. The region has a well-developed cold chain infrastructure, boosting the demand for associated equipment like cold storage. There is a high consumption of perishable food products and pharmaceuticals, creating the need for cold chain solutions to maintain product quality and safety. The U.S. is a major player in the market, with a large number of logistic providers are heavily investing in sophisticated cold chain solutions to meet the demand for last-mile delivery. With growing environmental concerns, the demand for green technologies is rising, supporting market growth.

Asia Pacific is expected to be the fastest-growing region in the cold chain equipment market. Rapid industrialization, urbanization, and high consumer demand for quality food products are driving the growth of the market. Countries like China and India are spending heavily in developing sophisticated cold chain infrastructure to support last-mile delivery. The rapid expansion of the pharmaceutical and food industries creates the need for cold chain equipment for storage and transportation.

Cold Chain Equipment Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 25.97 Billion |

| Market Revenue by 2033 | USD 132.91 Billion |

| CAGR 2025 to 2033 | 22.64% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In October 2024, Enhanced Innovations Pvt Ltd., a Bengaluru-based healthcare solutions provider, developed a portable, battery-powered cooling device that can be used to transport and store temperature-sensitive medical supplies, such as vaccines and diagnostic samples.

- In September 2024, Indicold, a leading player in India’s cold chain industry, launched the nation’s first rack-clad Automated Storage and Retrieval System (ASRS) frozen facility. Located in Ahmedabad, this state-of-the-art facility contains over 7,000 pallets, marking the dawn of a new era in automated frozen storage in India.

Cold Chain Equipment Market Key Players

- Thermo King

- Carrier Transicold

- Zanotti SpA

- Fermod

- Intertecnica

- ebm-papst Group

- CAREL

- Bitzer

- Kelvion

- Incold S.p.A.

- Rivacold srl

- Kason Industries, Inc.

- CHG Europe BV

- Viessmann

- Schmitz Cargobull

Market Segmentation

By Type

- Storage Equipment

- Transportation Equipment

By Application

- Meat

- Dairy & Frozen Desserts

- Bakery & Confectionary

- Processed Food

- Pharmaceuticals

- Vegetables & Fruits

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/3014

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344