Insulin Drugs and Delivery Devices Market Revenue to Attain USD 45.90 Bn by 2033

Insulin Drugs and Delivery Devices Market Revenue and Trends 2025 to 2033

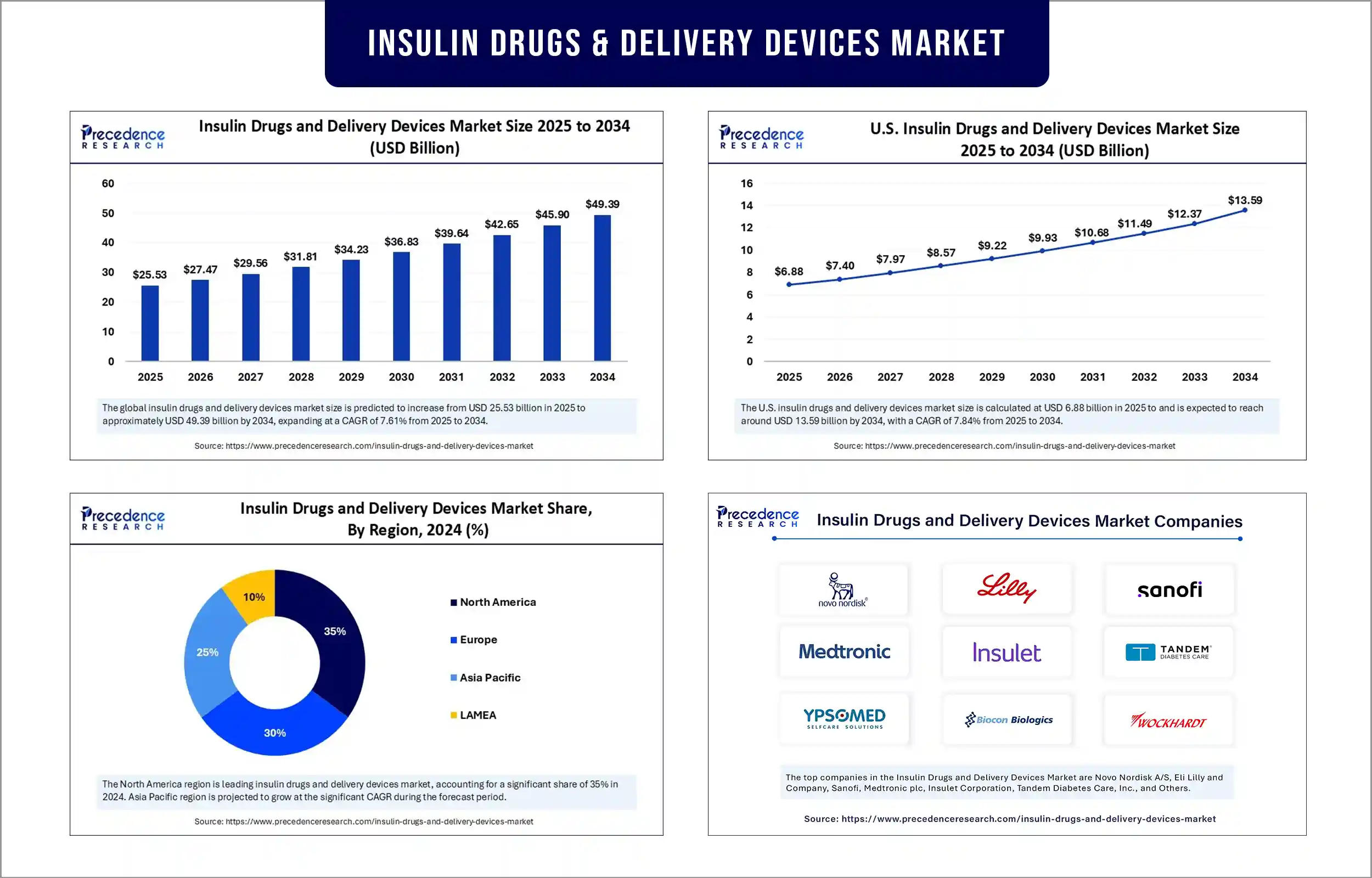

The global insulin drugs and delivery devices market revenue surpassed USD 25.53 billion in 2025 and is predicted to attain around USD 45.90 billion by 2033, growing at a CAGR of 7.61%. The market is rising due to the escalating global diabetes burden, technological innovations, and increasing adoption of convenient, patient-centric treatment solutions.

Market Overview

The insulin drugs & delivery devices market is experiencing significant growth due to a rise in the incidence of diabetes globally, driven by sedentary lifestyle activity, obesity, and aging populations. The market continues to expand due to increased awareness of diabetes management and the adoption of more complex delivery devices, including insulin pens, insulin pumps, and smart glucose monitoring devices, all leading to greater patient access in managing diabetes. Continuous innovation in the space through the development of faster-acting insulin formulations and the continued development of more connected devices brings value to patients by providing greater convenience and better adherence, driving demand for insulin drugs and delivery devices. Along with government support initiatives, reimbursement for patients is also a catalyst, and the growth of healthcare delivery systems in emerging economies is another essential driver. As the medical space shifts towards a more patient-centric model in which diabetes care for patients is personalized, the role of insulin therapies and delivery systems will continue to be a critical driver in improving health outcomes for patients.

Segment Insights

- By product type, the insulin delivery devices segment held the largest share of the market in 2024, propelled by technological advancements, enhanced patient convenience, and greater uptake of insulin delivery pens, pumps, and smart monitoring devices.

- By diabetes type, the type 2 diabetes segment led the market while capturing the largest revenue share in 2024 due to its high prevalence, driven by an aging population, lifestyle changes linked to diabetes, and reliance on new insulin delivery methods.

- By end-user, the hospitals segment dominated the market in 2024, holding the largest share. This is mainly due the increased patient volumes in these settings, driven by the availability of sophisticated drug delivery devices, healthcare professional, and a high focus on patient-centric care. There is a high demand for more efficient and accurate solutions for diabetes management among people, which hospitals can offer.

- By distribution channel, the retail pharmacies sustained dominance in the market in 2024 due to their accessibility, ability to offer individualized patient support, and a growing demand for efficient and immediate solutions for diabetes care.

Regional Insights

North America led the global insulin drugs & delivery devices market, fueled by high diabetes prevalence, advanced healthcare infrastructure, and the swift adoption of new treatment technologies. The region benefits from substantial R&D investments, which foster the development of next-generation insulin forms and connected delivery devices. Key factors supporting market growth in North America include the presence of major market players, favorable reimbursement policies, extensive awareness programs, and conducive conditions for product penetration. The demand for patient-friendly devices like insulin cartridges, pens, and pumps is also a significant driver.

Asia-Pacific is the fastest-growing region in the market, driven by a rapid rise in diabetes cases, urbanization, and lifestyle factors. Increased support for healthcare improvements and government programs to raise awareness of diabetes prevalence and treatment are also contributing factors, along with the growing affordability of advanced devices. Technological advancements and strategic partnerships between global manufacturers and local distributors will further increase accessibility and market penetration across China, India, Japan, and other regions. The additional population requiring treatment and management due to rural development and demographic health programs focused on early diagnosis, treatment, and management is another key reason for the forecast growth.

Insulin Drugs and Delivery Devices Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 25.53 Billion |

| Market Revenue by 2033 | USD 45.90 Billion |

| CAGR from 2025 to 2033 | 7.61% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Development

- On February 18, 2025, Merilog was approved by the U.S. FDA, as the first rapid-acting insulin biosimilar available in both a 3 mL prefilled pen and a 10 mL vial. (Source: https://www.medscape.com)

Insulin Drugs and Delivery Devices Market Key Players

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi

- Medtronic plc

- Insulet Corporation

- Tandem Diabetes Care, Inc.

- Ypsomed AG

- Biocon Biologics Ltd.

- Wockhardt Ltd.

- Becton, Dickinson and Company (BD)

- F. Hoffmann-La Roche Ltd

- Abbott Laboratories (for CGM-integrated devices)

- Jiangsu Wanbang Biopharmaceuticals

- Julphar Gulf Pharmaceutical Industries

- MannKind Corporation

- Roche Diabetes Care

- Valeritas, Inc. (acquired by Zealand Pharma)

- Cellnovo Group SA

- Nipro Corporation

- Gerresheimer AG (device component supplier)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6552

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344