What is the Insulin Drugs and Delivery Devices Market Size?

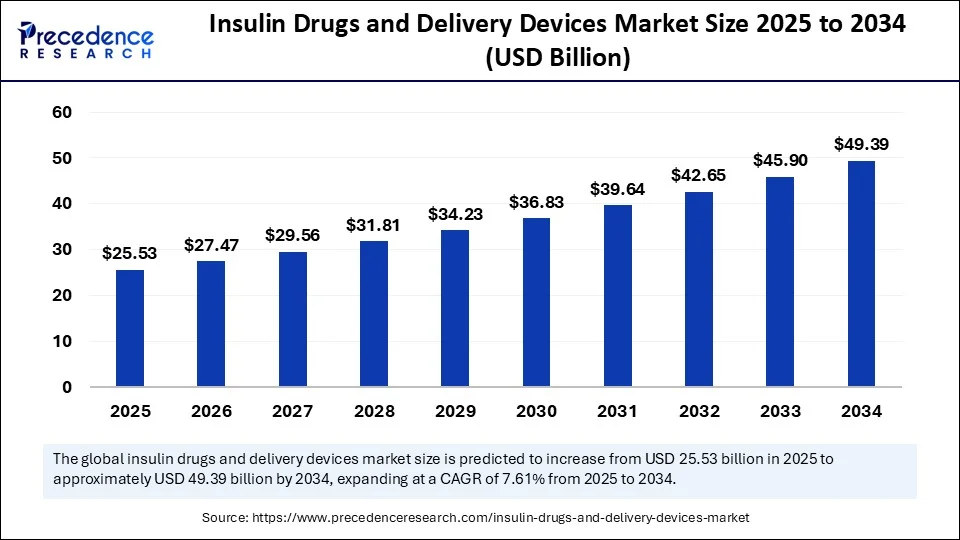

The global insulin drugs and delivery devices market size is calculated at USD 25.53 billion in 2025 and is predicted to increase from USD 27.47 Bbillion in 2026 to approximately USD 49.39 billion by 2034, expanding at a CAGR of 7.61% from 2025 to 2034. The market is experiencing significant growth due to the increasing global prevalence of diabetes, which is driving the demand for effective insulin therapies and advanced delivery devices. This market growth is further supported by innovations in insulin formulations and the development of user-friendly devices such as pens, pumps, and inhalers. Additionally, the rising adoption of smart insulin delivery systems is expected to accelerate market growth in the coming years.

Insulin Drugs and Delivery Devices Market Key Takeaways

- In terms of revenue, the global disposable urine bags market was valued at USD 23.72 billion in 2024.

- It is projected to reach USD 49.39 billion by 2034.

- The market is expected to grow at a CAGR of 7.61% from 2025 to 2034.

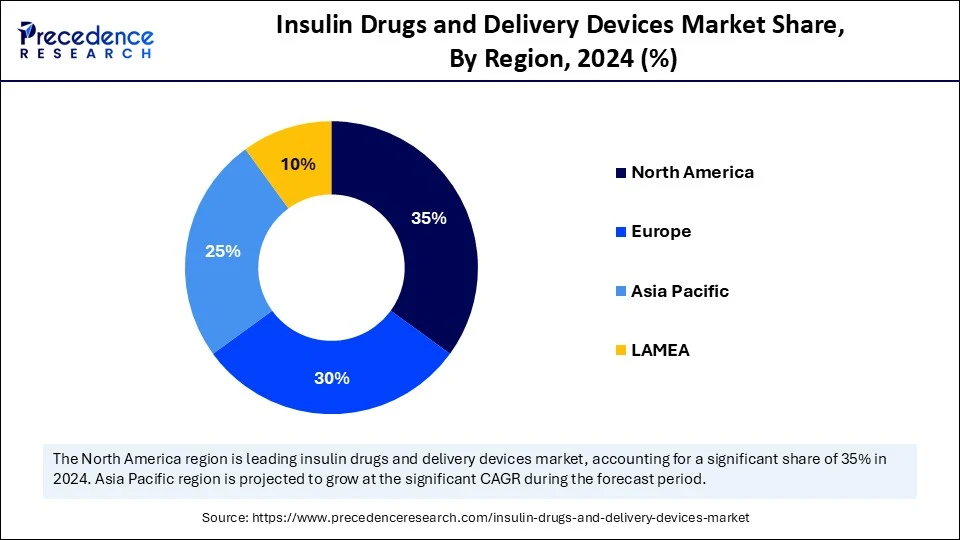

- North America dominated the market with the largest share of 35% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By product type, the insulin delivery devices segment captured the largest market share in 2024.

- By product type, the insulin drugs segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By diabetes type, the type 2 diabetes segment dominated the market with a 70% share in 2024.

- By diabetes type, the gestational diabetes segment is expected to grow at a significant CAGR over the projected period.

- By end user, the hospitals segment dominated the market in 2024.

- By distribution channel, the retail pharmacies segment led the market with a major market share of 50% in 2024.

- By distribution channel, the online sales segment is expected to grow at a significant CAGR from 2025 to 2034.

Strategic Overview of the Global Insulin Drugs and Delivery Devices Industry

The insulin drugs and delivery devices market encompasses pharmaceutical formulations of insulin used to treat diabetes, along with mechanical and electronic devices designed to administer insulin accurately and safely. This market addresses the needs of patients with Type 1, Type 2, and gestational diabetes, focusing on improving glycemic control and increasing patient convenience. Insulin products encompass various analogs and biosimilars, while delivery devices range from traditional syringes to advanced automated insulin pumps and pens. The rising diabetic population, lifestyle changes, innovation in insulin analogs, adoption of connected devices, and healthcare reimbursement policies drive the market.

Artificial Intelligence: The Next Growth Catalyst in Insulin Drugs and Delivery Devices

Artificial intelligence (AI) is transforming the insulin drugs and delivery devices market by enhancing glycemic control, improving the patient experience, and streamlining drug development and delivery. AI analyzes continuous glucose monitoring data to predict glucose fluctuations and adjusts insulin doses instantly, reducing the risks of hypo- and hyperglycemia. It also powers smart insulin pens and automated delivery systems, increasing dosing accuracy, patient compliance, and reducing management burdens. AI-driven mobile apps and wearables provide real-time glucose data, personalized feedback, and education, empowering patients to actively control their diabetes and prevent complications. Moreover, AI also helps in drug discovery and development by predicting properties and efficacy of novel formulations.

What Are the Key Trends in the Insulin drugs and Delivery Devices Market?

- Technological Advancements in Insulin Delivery and Monitoring: Innovations like continuous glucose monitoring systems provide real-time glucose data, enabling better insulin management and reducing complications such as hypoglycemia. Insulin pumps also offer automated or programmable insulin delivery, leading to improved glycemic control and a better quality of life for many individuals living with diabetes.

- Growing Awareness and Understanding of Diabetes Management: Increased public awareness about diabetes and the benefits of modern insulin delivery methods encourages individuals to seek early diagnoses and adopt effective management solutions. Patient self-management education empowers individuals to understand their condition better and adhere to treatment plans.

- Government Initiatives and Support: Government programs provide support for the prevention, early diagnosis, and management of diabetes, including access to essential medicines and technologies. Favorable reimbursement policies for diabetes care further promote market expansion.

- Innovations in Products: Ongoing research and development efforts lead to the introduction of new and improved insulin delivery devices and therapies, attracting more patients and healthcare providers. This includes advancements in insulin analogs, pumps, continuous glucose monitors, and even non-invasive insulin delivery methods.

Market Outlook:

- Market Growth Overview: The Insulin Drugs and Delivery Devices market is expected to grow significantly between 2025 and 2034, driven by the adoption of advanced devices, the shift towards patient-centric solutions, and the integration of digital health.

- Sustainability Trends: Sustainability trends involve the development of reusable devices and circular programs, eco-friendly materials and packaging, and sustainable manufacturing and sourcing.

- Major Investors: Major investors in the market include Novo Nordisk A/S, Eli Lilly and Company, Medtronic plc, Abbott Laboratories, and Insulet Corporation.

- Startup Economy: The startup economy is focused on the integration of digital health platforms, biotech innovation for biosimilars and novel drugs, and venture capital and strategic investment.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 49.39 Billion |

| Market Size in 2026 | USD 27.47 Billion |

| Market Size in 2025 | USD 25.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.61% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Diabetes Type, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Diabetes

A major factor driving the growth of the insulin drugs and delivery devices market is the increasing prevalence of diabetes, especially type 2, which is closely linked to lifestyle changes and aging populations. This significantly boosts the demand for user-friendly, technologically advanced delivery systems, insulin therapy, and related devices. This growth is further supported by sedentary lifestyles, unhealthy diets, and heightened awareness of ongoing diabetes management. Educational campaigns and initiatives promote better understanding and encourage individuals to seek treatment and adopt advanced insulin delivery options.

Restraints

High Cost of Advanced Insulin Delivery Devices

The primary challenge in this market is the high cost of advanced insulin delivery devices, which create barriers for potential buyers, especially in low- and middle-income countries. Developing and manufacturing these high-tech devices require substantial expenses due to technological complexity, regulatory hurdles, and strict quality standards. Devices like digital insulin pumps and smart pens offer greater precision but remain costly for many in the diabetic community. Limited access caused by high prices, reimbursement issues, and lack of awareness hampers widespread adoption, further creating challenges.

Opportunity

Development of Automated Insulin Delivery

A significant future opportunity lies in the development of automated insulin delivery (AID) systems, especially for people with type 1 diabetes. These systems mark a major advance in diabetes care, shifting away from manual injections toward automated solutions. They continuously monitor glucose levels and adjust insulin delivery in real time, easing the burden on users and improving glycemic control. These systems integrate continuous glucose monitors, insulin pumps, and algorithms to automate insulin management, making blood sugar control more convenient and effective. Moreover, the rising development of new insulin formulations and demand for personalized medicine opens up new growth opportunities.

Segment Insights

Product Type Insights

What Made Insulin Delivery Devices the Dominant Segment in the Insulin drugs and Delivery Devices Market in 2024?

The insulin delivery devices segment dominated the market while holding the largest share in 2024. This is primarily because more patients are adopting these devices, and technological advances have made them more user-friendly, portable, and easier to operate, resulting in better outcomes and convenience. Insulin pumps offer features like automated delivery that decrease the need for multiple daily injections, particularly benefiting those with type 1 and type 2 diabetes requiring frequent insulin doses. Additionally, increased awareness of management of diabetes and the benefits of insulin pumps, along with government initiatives to improve access, are fueling adoption.

The insulin drugs segment is expected to grow at a rapid pace during the forecast period. The growth of the segment is primarily driven by rising diabetes prevalence, innovations in insulin formulations and delivery methods, and increased patient awareness. Breakthroughs in insulin formulations, such as faster-acting and longer-acting analogs, improve treatment effectiveness and convenience. As awareness of insulin therapy's benefits grows, so does adoption. Many regions also have supportive policies that facilitate better access to insulin drugs and devices. The shift toward personalized medicine further contributes to segmental growth.

Diabetes Type Insights

Why Did the Type 2 Diabetes Segment Lead the Insulin drugs and Delivery Devices Market in 2024?

The type 2 diabetes segment dominated the market in 2024. This is mainly because of the increasing number of patients with type 2 diabetes, who often require insulin. This significantly prompts the need for effective drug delivery devices. Advanced delivery technologies like pumps and continuous glucose monitoring systems have improved treatment effectiveness. Although type 2 diabetes is usually managed with lifestyle interventions and oral medications, many patients eventually need insulin to control blood sugar levels. Devices like insulin pumps and continuous monitors help improve glycemic control, lessen daily injections, and automate management, reducing the need for fingerstick tests.

The gestational diabetes segment is expected to expand at the highest CAGR over the projection period, driven by the increasing GDM rates and awareness of the risks of untreated GDM. Understanding the complications, such as preeclampsia, high birth weight, and higher risk of type 2 diabetes for both mother and child, drives demand for effective management strategies, including insulin therapy. The demand for effective insulin management during pregnancy to prevent complications further spurs the growth of this segment.

End User Insights

How Does the Hospitals Segment Dominate the Market in 2024?

The hospitals segment dominated the insulin drugs and delivery devices market in 2024, driven by an increase in diabetes-related hospital admissions. The availability of advanced insulin delivery devices is a key factor boosting patient volume in these settings. Additionally, the rising demand for close monitoring and management of blood glucose levels among both diabetic and non-diabetic patients admitted to hospitals. Hospitals play a crucial role in educating patients and their families about proper insulin injection techniques, device usage, and self-management strategies, which is especially important for newly diagnosed patients or those transitioning from hospital to home care.

The homecare settings segment is expected to experience rapid growth in the coming years, primarily due to patients' preference for self-management and a shift toward decentralized care. The aging population is driving demand for user-friendly devices, such as smart pens and patch pumps, which make at-home management easier. Home care options can reduce hospital readmissions and lower healthcare costs, making them attractive for both patients and healthcare systems. The rise of telemedicine further enhances home care by allowing real-time monitoring of glucose levels and insulin delivery, facilitating timely interventions.

Distribution Channel Insights

Why Did the Retail Pharmacies Segment Dominate the Insulin drugs and Delivery Devices Market in 2024?

The retail pharmacies segment held the largest share of the market in 2024. This is because of their accessibility, convenience, and personalized support from pharmacists. Patients prefer retail pharmacies for immediate access to insulin and supplies, along with face-to-face guidance from pharmacists who can assist with usage and address concerns. These pharmacies have established infrastructure for dispensing medications and managing insurance claims, simplifying the process for patients. This preference is further strengthened by the widespread availability of retail pharmacies within local communities, making it easier for patients to manage their diabetes effectively, offering competitive pricing on insulin and related products, and making these options affordable for many patients.

The online sales segment is expected to expand at the fastest CAGR in the upcoming period, primarily due to its convenience, cost-effectiveness, and increasing adoption during and after the pandemic. Online pharmacies provide price comparisons, doorstep delivery, and discounts, making them attractive to consumers. They also enable users to compare prices from various retailers, potentially leading to significant savings, especially with generic or private-label brands. Additionally, online platforms extend the reach of insulin products to a broader patient population, including those in underserved areas. The integration of digital health tools and telemedicine with online pharmacies further enhances the convenience and efficiency of insulin delivery.

Regional Insights

U.S. Insulin Drugs and Delivery Devices Market Size and Growth 2025 to 2034

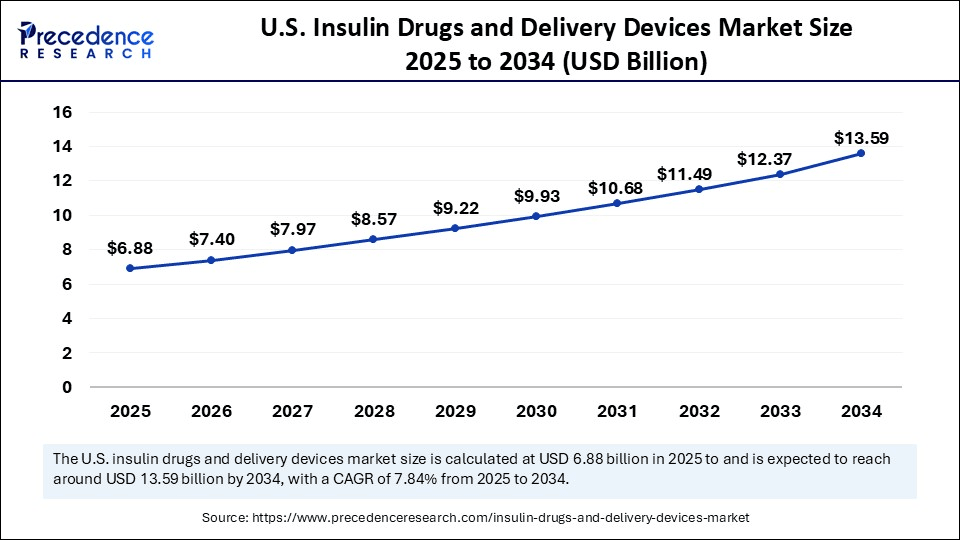

The U.S. insulin drugs and delivery devices market size is exhibited at USD 6.88 billion in 2025 and is projected to be worth around USD 13.59 billion by 2034, growing at a CAGR of 7.84% from 2025 to 2034.

What Made North America the Dominant Segment in the Insulin drugs and Delivery Devices Market in 2024?

North America dominated the insulin drugs and delivery devices market in 2024. This dominance stems from the high prevalence of diabetes, strong healthcare infrastructure, and active government support for research and development. The region also benefits from advanced technological adoption, favorable reimbursement policies, and a high level of patient awareness regarding diabetes management. It is a hub for innovation, with companies developing advanced insulin delivery devices like continuous glucose monitors, insulin pumps, and smart insulin pens. Leading pharmaceutical and medical device companies such as Eli Lilly and Company, Novo Nordisk, Sanofi, Medtronic, Insulet Corporation, Tandem Diabetes Care, and Abbott are heavily involved in research, development, and commercialization, further propelling market growth.

- In November 2024, Sol-Millennium Medical Group announced the launch of InsuJet™ Needle-free Device, specifically designed for insulin administration in diabetic patients. It uses advanced jet injection technology to deliver precise doses without needles. This product reduces the discomfort associated with insulin delivery and eases anxiety caused by needle injections by making insulin delivery simpler, faster, and needle-free.(Source: https://www.businesswire.com)

U.S. Insulin drugs and Delivery Devices Market Trends

The U.S. is a major contributor to the market due to its large and growing diabetic population, significant healthcare spending, and an ecosystem of innovation led by major players like Eli Lilly, Novo Nordisk, Sanofi, and device manufacturers such as Medtronic, Insulet, and Tandem Diabetes Care. This environment fosters the development of advanced therapies and innovative delivery methods, including automated insulin delivery systems, smart insulin pens, andcontinuous glucose monitoring devices, all aimed at improving patient outcomes and convenience.

What Makes Asia Pacific the Fastest-Growing Region in the Insulin drugs and Delivery Devices Market?

Asia Pacific is expected to expand at the fastest rate in the upcoming period. This is mainly due to a rapidly growing diabetic population, rising healthcare awareness, and increasing disposable incomes. These factors boost demand for both insulin drugs and innovative delivery systems like insulin pens and pumps, especially in countries such as China and India. Rising incomes, particularly among the middle class, are enabling greater access to both basic and advanced insulin delivery devices. Moreover, investments in healthcare infrastructure and government initiatives like national health missions improve access to diabetes care and treatments. Many governments are also encouraging local production of insulin and related devices through supportive policies, helping to reduce costs and expand access.

India Insulin drugs and Delivery Devices Market Trends

India plays a critical role in the market, driven by its significant diabetes burden. It has the second-largest diabetic population worldwide. This substantial patient base fuels the demand for insulin drugs and delivery devices. Increasing diabetes prevalence, coupled with rising public awareness and government initiatives like the NP-NCD program and the Jan Aushadhi Pariyojana, aimed at promoting accessible and affordable treatment, are key growth drivers. Technological advancements, supported by the Make in India initiative and ongoing research into innovative delivery systems like AI-driven models, are also vital.

Why is Europe Considered a Notable Region in the Insulin drugs and Delivery Devices Market?

Europe is a notable region in the market. The growth of the market in Europe is mainly fueled by a rising prevalence of diabetes and an aging population. These factors increase the demand for insulin pens, pumps, and other delivery devices. Innovations such as smart insulin pens, insulin pumps, and their integration with continuous glucose monitoring are improving patient compliance and controlling blood sugar more effectively, thereby boosting market growth. Supportive government policies, ongoing efforts to enhance healthcare infrastructure, and reimbursement schemes, are also crucial to market expansion.

What Opportunities Exist in Latin America?

The market holds great potential for expansion in Latin America. This is mainly due to the rising prevalence of diabetes, especially type 2 diabetes. This increase is further driven by lifestyle changes, including higher consumption of processed foods, more sedentary lifestyles, and genetic predisposition. The Brazilian regulatory agency ANVISA launched a pilot program to support the development of medical devices that could improve public health, including those related to diabetes management. Several Latin American countries are adopting public health policies to tackle diabetes and obesity, such as promoting healthier diets, encouraging physical activity, and improving access to healthcare, which contributes to this growth.

What Factors Contribute to the Insulin drugs and Delivery Devices Market in the Middle East & Africa?

The market in the Middle East & Africa is expected to grow at a steady rate due to increasing rates of diabetes, rising healthcare spending, and government initiatives that promote better diabetes management, leading to improved access to care and greater adoption of advanced treatment options. Many governments are launching initiatives to raise awareness, promote early diagnosis, and improve access to affordable treatments like insulin and delivery devices. Additionally, advancements in technology and strategic collaborations are further driving growth, especially in countries like Saudi Arabia, the UAE, and South Africa.

Europe: Germany Insulin Drugs and Delivery Devices Market Trends

Germany's insulin drugs and delivery devices market is driven by advanced, integrated diabetes management solutions. The growing adoption and public reimbursement of continuous glucose monitoring systems and hybrid closed-loop insulin pumps. The ageing population supports government regulations that promote home-based digital healthcare solutions.

Latin America: Mexico Insulin Drugs and Delivery Devices Market Trends

The Mexican market is growing due to the rising prevalence of diabetes and increasing awareness of early diagnosis and long-term disease management. Adoption of advanced technologies such as smart insulin pens, insulin pumps, and integrated CGM-enabled systems is expanding as patients shift toward better glycemic control solutions. Digital health platforms and telemedicine are enhancing adherence by enabling remote monitoring and real-time therapy adjustments.

Middle East & Africa: Saudi Arabia Insulin Drugs and Delivery Devices Market Trends

Saudi Arabia dominates the Middle East & Africa market due to its high diabetes prevalence, strong healthcare infrastructure, and significant government investment in chronic disease management. The country's well-developed reimbursement systems and national diabetes prevention programs further drive large-scale adoption of advanced insulin therapies and delivery technologies. Growing partnerships with global pharmaceutical companies strengthen product availability and innovation in the Saudi market.

Value Chain Analysis of the Insulin Drugs and Delivery Devices Market

- Research & Development (R&D) and Drug Discovery

This initial stage involves significant investment in the discovery of new insulin analogues (like long-acting or rapid-acting) and the development of more effective delivery mechanisms.

Key Players: Novo Nordisk, Eli Lilly. - Raw Material Sourcing and Active Pharmaceutical Ingredient (API) Production

This stage involves obtaining the high-purity biological materials and chemicals required to synthesize insulin API. - Manufacturing/Operations

This core stage involves two parallel processes: the formulation, filling, and packaging of insulin drugs and the production of delivery devices.

Key Players: Medtronic, Insulet Corporation (Omnipod), and Ypsomed - Outbound Logistics and Distribution

This stage focuses on getting the temperature-sensitive insulin products from manufacturing facilities to wholesalers, hospitals, pharmacies, and increasingly, directly to patients' homes.

Key Players: DHL, FedEx, and specialty healthcare distributors like McKesson Corporation and AmerisourceBergen manage this complex supply chain. - Marketing and Sales

This stage involves promoting products to healthcare professionals, hospitals, and patients while navigating a complex regulatory and reimbursement landscape.

Key Players: Novo Nordisk, Eli Lilly, Medtronic, Insulet

Insulin Drugs and Delivery Devices Market Companies

- Novo Nordisk A/S: This company is a global leader in diabetes care, known for producing a wide range of innovative insulin drugs (like Ozempic and Rybelsus) and advanced delivery pens.

- Eli Lilly and Company: A major pharmaceutical manufacturer, Eli Lilly pioneered the mass production of insulin and continues to develop novel insulin therapies and diabetes management solutions.

- Sanofi: Sanofi is a key player in the insulin market, providing both long-acting and rapid-acting insulins that form the backbone of many diabetes treatment regimens. The company ensures a global supply of affordable insulin options.

- Medtronic plc: A leading medical device company, Medtronic provides a range of insulin pumps and continuous glucose monitoring (CGM) systems. Their integrated solutions help automate insulin delivery and improve patient outcomes.

- Insulet Corporation: Insulet is known for its tubeless "Omnipod" insulin pump system, which has revolutionized convenience and mobility for diabetes patients. Its innovation in patch pumps has captured a significant market share.

- Tandem Diabetes Care, Inc.: This company specializes in the development of innovative insulin pumps with predictive low glucose suspend technology, such as the t:slim X2. Their focus on user-friendly, automated systems advances personal diabetes management.

- Ypsomed AG: A Swiss medical tech company, Ypsomed develops injection systems for self-administration, including insulin pens and pump systems like the mylife YpsoPump. Their focus is on simple, reliable, and ergonomic device designs.

- Biocon Biologics Ltd.: As a biopharmaceutical company, Biocon focuses on developing and manufacturing biosimilar insulins, offering more affordable alternatives to branded drugs. This increases access to essential insulin in emerging markets.

- Wockhardt Ltd.: Wockhardt contributes to the market by producing a range of pharmaceutical formulations, including insulin and related products. It is a key supplier in India and other global markets.

- Becton, Dickinson and Company (BD): BD is a major supplier of injection devices, including insulin syringes and pen needles, which are widely used by patients worldwide. Their products ensure the safe and effective administration of insulin.

- F. Hoffmann-La Roche Ltd: Roche Diabetes Care is a global provider of Accu-Chek blood glucose monitoring systems and insulin pumps, helping patients track their levels and manage their treatment. The company is instrumental in providing self-monitoring tools.

Abbott Laboratories (for CGM-integrated devices): Abbott is a leader in continuous glucose monitoring (CGM) with its Freestyle Libre system, which integrates data sharing with smart devices and insulin pumps. - Jiangsu Wanbang Biopharmaceuticals: A Chinese pharmaceutical company, it plays a key role in the Asia-Pacific market by developing and distributing various forms of insulin. Its focus on the domestic market in China helps meet the demands of a large population.

- Julphar Gulf Pharmaceutical Industries: A prominent pharmaceutical manufacturer in the Middle East, Julphar produces insulin products to serve the regional market. It ensures local availability of critical medication.

- MannKind Corporation: MannKind is known for Afrezza, an inhaled insulin delivery system that provides a needle-free alternative for patients. This unique product addresses the needs of those who prefer not to use injections.

- Roche Diabetes Care: This subsidiary of the Roche Group provides integrated personalized diabetes management (iPDM) solutions, including blood glucose meters and data management software. They help connect data from various devices to improve patient care.

- Valeritas, Inc. (acquired by Zealand Pharma): Known for its V-Go wearable insulin delivery device, Valeritas offered a simple, low-cost alternative to traditional pumps. This product addressed the needs of Type 2 diabetes patients who required basal and bolus insulin.

- Cellnovo Group SA: Cellnovo was an innovator in the connected insulin pump market with a wireless, patch-like system that included mobile connectivity. While facing financial challenges, its technology contributed to the connected care trend.

- Nipro Corporation: Nipro is involved in the manufacturing of medical devices, including syringes and other disposable products for insulin delivery. The company is a key global supplier of medical equipment components.

Gerresheimer AG (device component supplier): Gerresheimer is a crucial supplier of specialty glass and plastic primary packaging solutions for the pharma industry, including insulin cartridges and pens.

Recent Developments

- In February 2024, Tandem Diabetes Care launched the Tandem Mobi, the world's smallest automated insulin delivery system for diabetes management. Now available to eligible U.S. customers, the Mobi utilizes Control-IQ technology to help prevent blood sugar fluctuations and improve time in range for users. John Sheridan, CEO, expressed enthusiasm about offering this new technology to the diabetes community.

(Source: https://investor.tandemdiabetes.com) - In March 2024, Awiqli, a long-acting basal insulin, was introduced for adults with diabetes, administered weekly. It helps control high blood sugar and complements other insulins used in type 1 and type 2 diabetes management, where it may be used together with tablets or injections. It must always be used alongside short- or rapid-acting insulins in both types of diabetes.

(Source: https://www.novonordisk.ca)

Segments Covered in the Report

By Product Type

- Insulin Drugs

- Rapid-Acting Insulin

- Long-Acting Insulin

- Short-Acting Insulin

- Intermediate-Acting Insulin

- Premixed Insulin

- Biosimilar Insulin

- Others

- Insulin Delivery Devices

- Insulin Pens

- Reusable Pens

- Disposable Pens

- Smart Insulin Pens

- Insulin Pumps

- Tethered Pumps

- Patch Pumps

- Sensor-Integrated Pumps (Automated Insulin Delivery)

- Insulin Syringes

- Needle-Free Injectors

- Jet Injectors

- Others

- Insulin Pens

By Diabetes Type

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

- Others (e.g., steroid-induced, MODY)

By End User

- Hospitals

- Diabetes Clinics/Centers

- Homecare Settings

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Sales

- Direct Tender/Bulk Procurement

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting