Patient Monitoring Devices Market Size To Rise USD 89.75 Bn By 2032

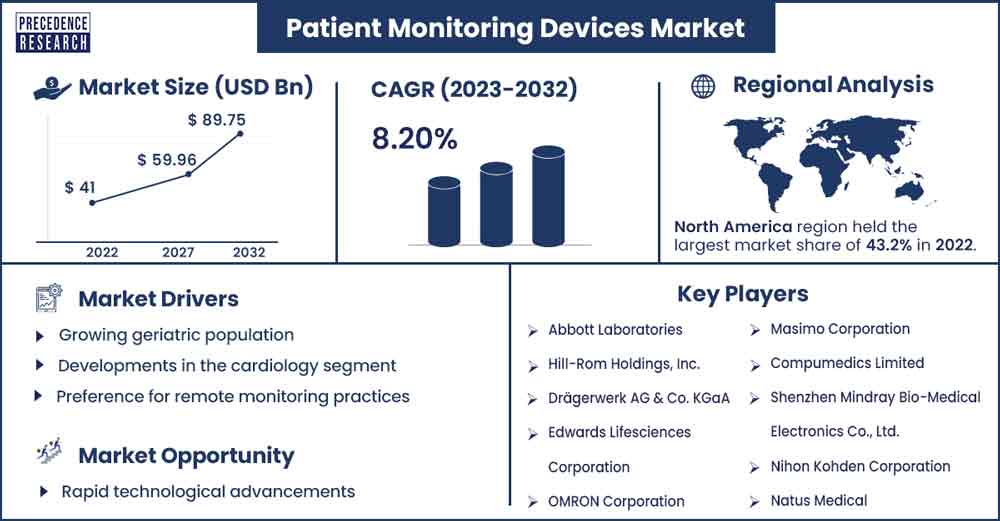

The global patient monitoring devices market size exceeded USD 41 billion in 2022 and is expected to rise to USD 89.75 billion by 2032, poised to grow at a CAGR of 8.2% from 2023 to 2032.

Market Overview

Patient monitoring devices measure, record, transfer, and display important biometric parameters like heart rate, SPO2, blood pressure, and temperature. In hospitals and clinics, high-capacity, multi-function monitors are frequently used to ensure excellent patient care. Portable patient monitors, designed to be compact and energy-efficient, allow for use in remote areas or by paramedics for field diagnosis. They also facilitate the monitoring of patients and the communication of data to healthcare providers in different locations.

The rising popularity of wearable patient monitoring technologies is driving market growth. These devices, including biosensors and innovative implants, serve various purposes like continuous monitoring of glucose levels, temperature, blood pressure, pulse oximetry, and glucose levels. The next-generation wearables are integrated with Wearable biosensors, utilizing Internet of Things (IoT) technologies to measure vital signs such as weight, blood sugar, blood pressure, and electrocardiography (ECG). They transmit this data to a central server through mobile wireless networks. Advancements in these sensor and interconnection technologies are crucial in simplifying healthcare, reducing stress for many patients, and helping healthcare professionals perform their duties more effectively and efficiently.

The growth of the patient monitoring market is driven by factors such as the increasing burden of chronic diseases due to lifestyle changes, the increase in the geriatric population, a growing preference for home and remote monitoring, and the ease of use of portable devices. For instance, according to the June 2022 update of the Centers for Disease Control and Prevention (CDC), six out of ten Americans are affected by one or more chronic diseases, including diabetes, cancer, heart disease, and stroke.

These chronic illnesses, among others, are the primary contributors to healthcare costs and significant causes of death and disability in the United States. Additionally, medical device companies are investing in advanced monitoring equipment to meet the rising demand for enhanced connectivity and data accessibility.

- According to a HexaHealth journal published in October 2022, approximately 200,000 surgeries are conducted annually in the United States, with an additional 60,000 surgeries performed in India.

Regional Snapshot

The patient monitoring market in North America is anticipated to experience significant growth in the foreseeable future. The substantial factors contributing to this growth include the increasing elderly population, a rise in chronic diseases, a demand for wireless and portable systems, and well-structured reimbursement policies to reduce out-of-pocket expenses. These factors contribute to the region's substantial market share in patient monitoring.

In North America, Canada has a significant patient base requiring monitoring services. According to the Canadian Chronic Disease Surveillance System report, in November 2022, around 6.3 million adults aged 65 and older will be living with chronic conditions in the coming years. In the United States, its dominating market expansion involves key drivers, including product launches and approvals by substantial players in the country.

- In November 2023, Masimo Corporation announced that the FDA had granted 510(k) clearance for both over-the-counter (OTC) and prescription use (Rx) of the Masimo W1 medical watch. This clearance broadens the permitted uses of the Masimo W1 as a medical device for adults, allowing its use in hospitals, clinics, long-term care facilities, and at home in the United States.

- In December 2023, Edwards Lifesciences Corporation outlined its refined focus and strategy for sustained growth in the long term. The company will also provide insights into its technology pipeline and offer financial guidance during its annual investor conference.

- In July 2022, Sleepiz, a Switzerland-based medical technology company, received U.S. FDA clearance for its Sleepiz One+ contactless device, which can monitor respiration and heart rate during sleep. This non-contact respiratory monitoring device is among the first of its kind.

Patient Monitoring Devices Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 44.16 Billion |

| Projected Forecast Revenue by 2032 | USD 89.75 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 8.2% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing geriatric population

Another important aspect of the market's dynamics is the increasing elderly population and the necessity to improve healthcare access for them. According to the United Kingdom's Department of Health, effectively implementing telehealth or remote monitoring technology can reduce the risk of patient mortality by up to 45% and emergency hospitalizations by 20%.

Developments in the cardiology segment

The cardiology segment is anticipated to experience significant growth in the patient monitoring market. These devices are crucial in diagnosing and monitoring various heart and cardiovascular disorders. The key driver for this segment's development is the escalating number of cases and fatalities related to cardiovascular diseases, along with an increasing frequency of cardiac surgeries. As per a CDC update in January 2023, approximately 6.2 million adults in the United States experience heart failure annually. Continuous patient monitoring post-surgery is vital to track potential complications and recovery rates, highlighting the crucial role of cardiac patient monitoring. The growth of cardiac surgeries is expected to further contribute to the expansion of this segment.

Preference for remote monitoring practices

The market is witnessing a growing trend of increased awareness regarding remote patient monitoring (RPM). Technological advancements and the cost-effectiveness of RPM have led to widespread adoption over the years. People are increasingly inclined to monitor their health daily using home-use monitoring devices. Wearable devices allow patients to easily track parameters such as body temperature, respiratory rate, heart rate, and blood pressure in point-of-care settings without disrupting their daily routines. The affordability of these devices is increasing with their rising adoption. Additionally, the growing use of remote patient monitoring provides medical practitioners with a comprehensive understanding of patient health, leading to improved care management and reduced emergency room visits.

Restraint

Data privacy concerns

Patient monitoring systems handle sensitive patient data, and safeguarding the security and privacy of this information is vital to upholding patient trust and adhering to healthcare regulations. Any data breaches or unauthorized access to patient information can result in severe consequences, including legal and reputational issues for healthcare providers and monitoring system manufacturers. Consequently, this is a limiting factor in the market.

Opportunity

Rapid technological advancements

Integrating artificial intelligence (AI) and machine learning (ML) can revolutionize patient monitoring systems, offering predictive analytics, personalized treatment recommendations, and early detection of health issues. Incorporating AI and ML algorithms enhances clinical decision-making and improves patient outcomes. Rapid technological advancements, including miniaturization, wireless connectivity, wearable sensors, and data analytics, have created compact, portable, and user-friendly patient monitoring devices. These innovations, adaptable to healthcare settings, home care, and mobile applications, increase adoption across various healthcare environments.

Recent Developments

- In April 2023, Honeywell unveiled a real-time health monitoring system to capture and record patients' vital signs in hospitals and remote settings. The solution utilizes advanced sensing technology through a skin patch, instantly connecting vital sign data to healthcare providers via mobile devices and an online dashboard.

- In January 2023, Senet and Telli Health introduced the first remote patient monitoring (RPM) hardware powered by LoRaWAN. This technology aims to extend healthcare services to more patients globally in remote and underserved areas, including indigenous communities, promoting healthcare equity and inclusivity. It also lays the groundwork for offering additional smart home services shortly.

Major Key Players

- Abbott Laboratories

- Hill-Rom Holdings, Inc.

- Drägerwerk AG & Co. KGaA, Edwards Lifesciences Corporation

- OMRON Corporation

- Masimo Corporation

- Compumedics Limited

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Nihon Kohden Corporation

- Natus Medical

- Medtronic plc (Ireland), Koninklijke Philips N.V.

- GE Healthcare

- Getinge AB

- Boston Scientific Corporation

- Dexcom, Inc.

- Nonin

- BIOTRONIK

- SCHILLER

- BioTelemetry, Inc.

Market Segmentation

By Product

- Cardiac Monitoring Devices

- ECG Devices

- Implantable Loop Recorders

- Event Monitors

- Mobile Cardiac Telemetry Monitors

- Smart/Wearable ECG Monitors

- Blood Glucose Monitoring Systems

- Self-monitoring Blood Glucose Systems

- Continuous Glucose Monitoring Systems

- Multi-parameter Monitoring Devices

- Low-acuity Monitoring Devices

- Mid-acuity Monitoring Devices

- High-acuity Monitoring Devices

- Temperature Monitoring Devices

- Handheld Temperature Monitoring Devices

- Table-top Temperature Monitoring Devices

- Wearable Continuous Monitoring Devices

- Invasive Temperature Monitoring Devices

- Smart Temperature Monitoring Devices

- Respiratory Monitoring Devices

- Pulse Oximeters

- Spirometers

- Capnographs

- Peak Flow Meters

- Hemodynamic/Pressure Monitoring Devices

- Hemodynamic Monitors

- Blood Pressure Monitors

- Disposables

- Fetal& Neonatal Monitoring Devices

- Fetal Monitoring Devices

- Neonatal Monitoring Devices

- Neuromonitoring Devices

- Electroencephalograph Machines

- Electromyography Machines

- Cerebral Oximeters

- Intracranial Pressure Monitors

- Magnetoencephalography Machines

- Transcranial Doppler Machines

- Weight Monitoring Devices

- Digital

- Analog

- Other Patient Monitoring Devices

By End-use

- Hospitals

- Home Care Settings

- Ambulatory Surgery Centers

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1288

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308