Tantalum Carbide (TaC) Coated Graphite Substrate Market Revenue to Attain USD 313.74 Mn by 2033

Tantalum Carbide (TaC) Coated Graphite Substrate Market Revenue and Trends 2025 to 2033

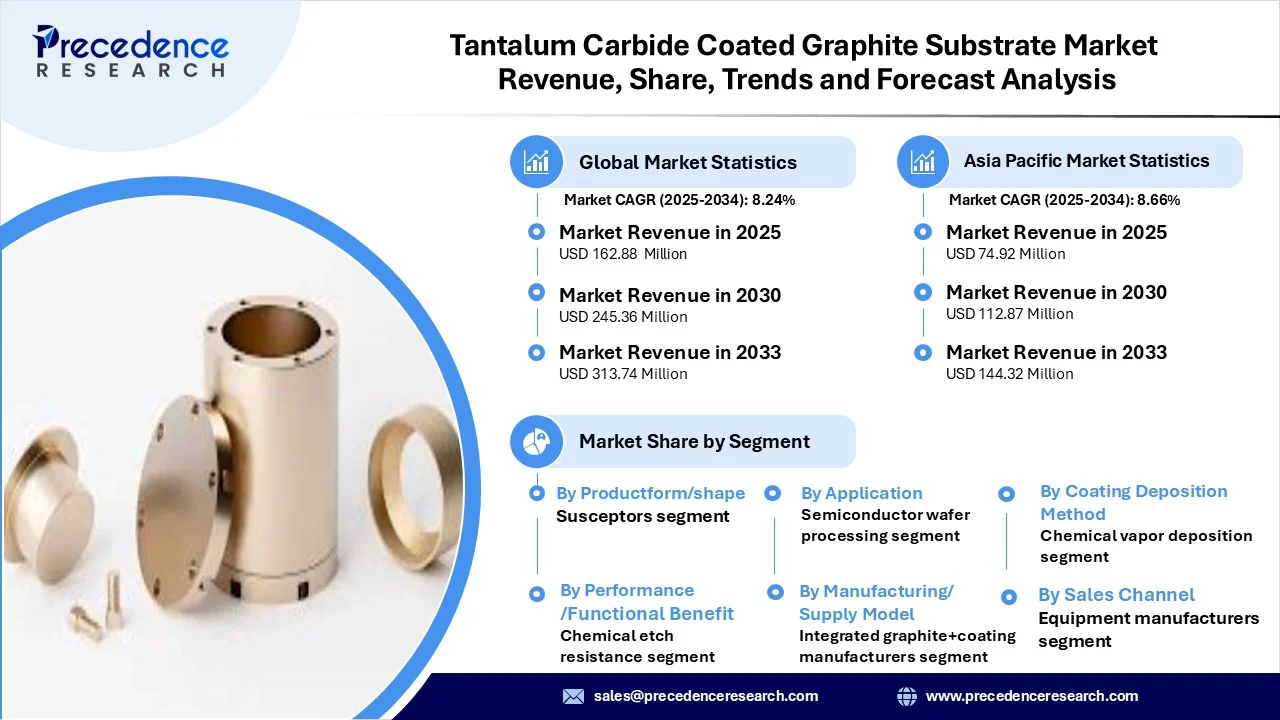

The global tantalum carbide (TaC) coated graphite substrate market revenue reached USD 162.88 million in 2025 and is predicted to attain around USD 313.74 million by 2033 with a CAGR of 8.54%. The market is driven by growing demand in the aerospace and semiconductor sectors, driven by the need for advanced, heat-resistant materials.

Tantalum Carbide (TaC) Coated Graphite Substrate Market: Key Drivers & Emerging Opportunities

The tantalum carbide (TaC) coated graphite substrate market involves high-performance materials used in demanding industrial settings, defined by TaC coatings on graphite for enhanced thermal stability and corrosion resistance. Technological advancements in coating techniques are leading to more uniform and efficient Tantalum Carbide (TaC) coatings, expanding applications, and potentially reducing costs. Growth is also driven by rising demand in key sectors like aerospace, defense, semiconductor manufacturing, and electronics, the need for high-performance materials with superior properties, the expansion of the energy sector requiring materials resistant to radiation and high temperatures, and sustainability initiatives promoting longer material lifespans.

Segment Insights

- By product form/shape, the susceptor segment dominated the market because susceptors are critical, high-performance components in various growing industries like semiconductors and LEDs.

- By coating deposition method, the chemical vapor deposition (CVD) method led the market because it produces high-purity, dense, and uniform coatings with exceptional adhesion.

- By graphite substrate type/grade, the high-purity isotropic graphite segment accounted for the market dominance due to its superior and uniform material properties, which are essential for demanding applications in the semiconductor and aerospace industries.

- By application / end-use, the semiconductor / SiC & GaN crystal growth segment dominated the market due to its exceptional thermal stability, chemical inertness, and ability to drastically improve crystal quality for producing these advanced semiconductors.

- By performance / functional benefit, the chemical/ etch resistance segment dominated the market primarily due to the severe, highly corrosive conditions in semiconductor manufacturing, particularly during etching and epitaxial growth.

- By manufacturing/supply model, integrated suppliers represented the market dominance due to the high costs, complexity, and critical quality control requirements involved in producing this advanced material.

- By sales channel/customer type, the OEMs and direct qualified supplier relationships dominated the market due to the specialized, high-performance nature of the product and its critical applications.

- By pricing/value tier, the engineered / high-specification parts segment led the market due to the unique properties that are indispensable for high-stakes industries like semiconductors, aerospace, and nuclear energy.

Tantalum Carbide (TaC) Coated Graphite Substrate Market Key Players

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 162.88 Million |

| Market Revenue by 2033 | USD 313.74 Million |

| CAGR from 2025 to 2033 | 8.54% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Insights

Asia Pacific dominated the tantalum carbide (TaC) coated graphite substrate market. This is due to robust industrialization, expanding electronics and semiconductor sectors, significant investments in advanced materials, localized manufacturing, and strategic government initiatives in many countries like China, Japan, and South Korea. Additionally, countries like China, Japan, and South Korea have massive electronics and semiconductor industries, major consumers of these specialized substrates for high-tech applications.

North America is anticipated to be the fastest-growing region in the market. This is primarily due to its strong industrial base in aerospace, defense, and electronics, coupled with significant investment in R&D for high-temperature materials and smart coatings. The increasing demand for TaC-coated graphite substrates from sectors like electric vehicles, renewable energy, and 5G infrastructure fuels market expansion in the region.

Tantalum Carbide (TaC) Coated Graphite Substrate Market Key Players

- Toyo Tanso Co., Ltd.

- Tokai Carbon Co., Ltd.

- Mersen Group

- Momentive Technologies

- Bay Carbon, Inc.

- Ningbo HIPER Technologies

- VeTek Semiconductor

- Semicorex / Semicorex Group

- Semicera

- Stanford Advanced Materials

- Xinsheng Novel Materials Technology

- Liufang Technology

- NK-Carbon / NK Coatings

- ACME

- Specialized contract coaters / local CDMOs

Recent Development

- In July 2025, Materion completed its previously announced acquisition of manufacturing assets for tantalum solutions. This strategic investment expands Materion’s global footprint with a facility in Asia to better support and service global Tier I semiconductor customers and strengthens Materion’s position as a leading supplier of deposition materials.

(Source: https://investor.materion.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6831

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344