Thermoplastic Elastomer Market Size To Rise USD 46 Billion By 2030

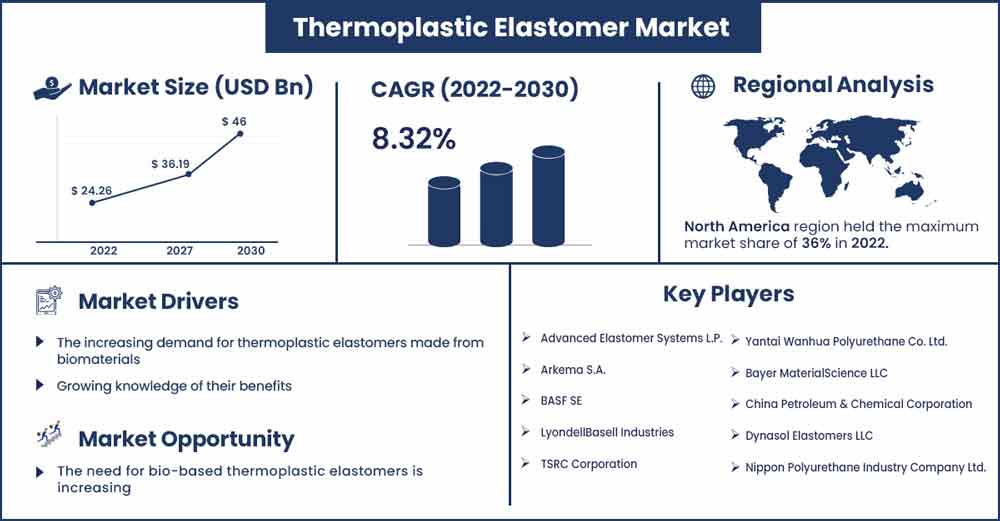

The global thermoplastic elastomer market size surpassed USD 24.26 billion in 2022 and is projected to rise to USD 46 billion by 2030, anticipated to grow at a strong CAGR of 8.32 percent during the projection period from 2022 to 2030.

Elastomeric and thermoplastic qualities are combined in thermoplastic elastomers, which are polymers. Thermoplastic rubber is a common name for them. These materials are soft and flexible, and after being stretched, they can retract to their original length. These elastomers have excellent qualities, such as resistance to heat and oil, tearing, low permeability, and enhanced adhesion. Numerous end-user sectors, including those in the automotive, consumer products, healthcare, construction, and many more, use thermoplastic elastomers. Over the anticipated years, the market is anticipated to be driven by the automotive industry's need for thermoplastic elastomers to produce lightweight vehicle components. Additionally, the market is anticipated to grow in the coming years as a result of this product's acceptance by numerous sectors due to its eco-friendly and simple-to-recycle nature.

Additionally, it is estimated that the rising popularity of high-performance cars among consumers and the growing trend to replace thermoset rubber with thermoplastic elastomers will fuel the market during the projected period.

Report Highlights:

- On the basis of type, the thermoplastic vulcanizates segment will have a larger market share in the coming years period, the amount of revenue generated through the use of this product will grow well in the coming year. The market share is projected to be dominated by thermoplastic vulcanizates. Their capacity to reuse and recycle production scrap and waste can be linked to the causes. Ethylene propylene diene monomer (EPDM)/polypropylene thermoplastic vulcanizate (PP TPV) is the most prevalent kind of TPV.

- On the basis of application, the automotive segment has the biggest market share in the thermoplastic elastomer market during the forecast period. Because so many electronic and electrical components are used in automotive applications, such as passenger airbags, safety belt tensioners, and electric motor housings for windows and seating, the use of TPE has skyrocketed. Applications in under-the-hood components are also being found for recently developed grades with improved hydrolytic stability.

What is the regional impact in the thermoplastic elastomer market?

- The biggest market share was held by North America in the thermoplastic elastomer market during the forecast period. Due to the significant demand in the packaging, building, electrical and electronic, automotive, and electrical and electronic industries, the North American area is one of the main consumers of plastics. Due to its numerous advantages, ease of molding, and ability to take on specific shapes, TPE and other polymers are used extensively across all industries.

- Plastic is a popular choice among automakers, which enables them to produce their products more affordably and boost profits. One of the world's top producers of crude oil is Canada. The region's rising plastic consumption and falling crude oil prices are fostering the expansion of the plastic market.

- Petrochemicals generated from crude oil are used to make a variety of polymers and materials, including TPE. The use of TPE additives by manufacturers to give strength, lightweight and durability when employed in any product is on the rise.

Thermoplastic Elastomer Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 26.28 Billion |

| Projected Forecast Revenue in 2030 | USD 46 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 8.32% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 To 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics:

Drivers:

The rise of the global sector over the past few years has been greatly aided by rising consumption across a variety of applications, including automotive, electrical and electronics, industrial, medical, and consumer goods. Over the projected period, a key element driving the global industry is anticipated to be rising demand in the production of automotive components. The use of plastics in place of metals and alloys in-vehicle components has been mandated through regulatory action taken by environmental agencies with the goal of reducing carbon emissions through improved fuel efficiency.

The demand for high-performance, lightweight passenger cars among consumers has fueled plastic innovation in the automobile industry. These elements have expanded the use of thermoplastics in the aforementioned application. Thermoplastic elastomers (TPEs) are preferred in terms of application since they have better physical and chemical characteristics than thermoset plastics. Over the projected period, it is anticipated that the high substitution rate of TPU and TPO for ethylene propylene diene monomer (EPDM) in construction materials will support global industry demand.

Due to the increase in construction and infrastructure development activities, the market for thermoplastic elastomers will keep growing quickly. The explosive use of thermoplastic elastomers in electric vehicles will raise the market value. Due to the fast global urbanization and rising disposable income of consumers, the market for thermoplastic elastomers has developed exponentially.

Restraints:

The market for thermoplastic elastomers will face challenges due to the volatility or swings in raw material prices.

Opportunities:

Biobased thermoplastic elastomers are produced using renewable resources like vegetable oils and fatty acids. For industries like electronics, sporting goods, and footwear, it offers equal and even superior qualities to those of standard thermoplastic elastomers. The creation of biobased thermoplastic elastomers lowers the consumption of non-renewable resources and enhances the biodegradability of the material.

For manufacturers of thermoplastic elastomers, new prospects are being opened up by biobased thermoplastic elastomer innovations and commercialization. Additionally, a lot of producers of synthetic thermoplastic elastomers, such BASF and Lubrizol, have moved their emphasis to the creation of environmentally benign and long-lasting goods. For instance, BASF and Lubrizol began producing biobased thermoplastic elastomers for a number of industries, including textile, automotive, industrial, and electronics.

Challenges:

The market offers a variety of thermoplastic elastomers that are distinguished according to price and performance requirements. Depending on the applications' profit margins, a certain type of thermoplastic elastomer is used. The demand for other thermoplastic elastomers is being challenged by the rising trend of streamlining the difficult selection process when selecting a particular type due to the growing emphasis on specific types and the ability to fulfill numerous purposes. This circumstance has increased the adaptability of one kind of thermoplastic elastomer and driven down their price. The car industry is the principal culprit in this predicament, where thermoplastic elastomers are replacing more expensive and substantial thermoplastic vulcanizates. PVC and thermoplastic polyurethane films are anticipated to replace thermoplastic polyolefin in automotive applications over the projection period. Replacement in the intra-thermoplastic elastomer segment is thus a problem for the overall market's expansion.

Recent Developments:

- In March 2020 - Asahi Kasei Corporation acquired Veloxis Pharmaceuticals Inc. This acquisition will increase the company's visibility in the pharmaceutical sector. Asahi Kasei is committed to hastening the process of becoming a provider of healthcare on a worldwide scale. Asahi Kasei will collaborate with the significantly expanded management team and staff of Veloxis to maximize the value of both the existing pharmaceutical companies and those that are acquired.

Major Key Players:

- Advanced Elastomer Systems L.P.

- Arkema S.A.

- BASF SE

- LyondellBasell Industries

- TSRC Corporation

- Yantai Wanhua Polyurethane Co. Ltd.

- Bayer MaterialScience LLC

- China Petroleum & Chemical Corporation

- Dynasol Elastomers LLC

- Nippon Polyurethane Industry Company Ltd.

- Avient Corporation

- Teknor APEX Company

- Huntsman Corporation

- Kraton Polymers LLC

- LG Chemicals

Market Segmentation:

By Type

- Thermoplastic Polyurethane (TPU)

- Styrenic Block Copolymer (TPE-S)

- Thermoplastic Vulcanizates

- Thermoplastic Copolyester

- Elastomeric Alloys (TPE-V or TPV)

- Others

By Application

- Automotive

- Footwear

- Wires & Cables

- Building & Construction

- Others

By Material

- Poly Styrenes

- Poly Olefins

- Poly Ether Imides

- Poly Urethanes

- Poly Esters

- Poly Amides

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2392

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333