U.S. Digital Therapeutics Market Revenue to Attain USD 17.48 Bn by 2033

U.S. Digital Therapeutics Market Revenue and Trends 2025 to 2033

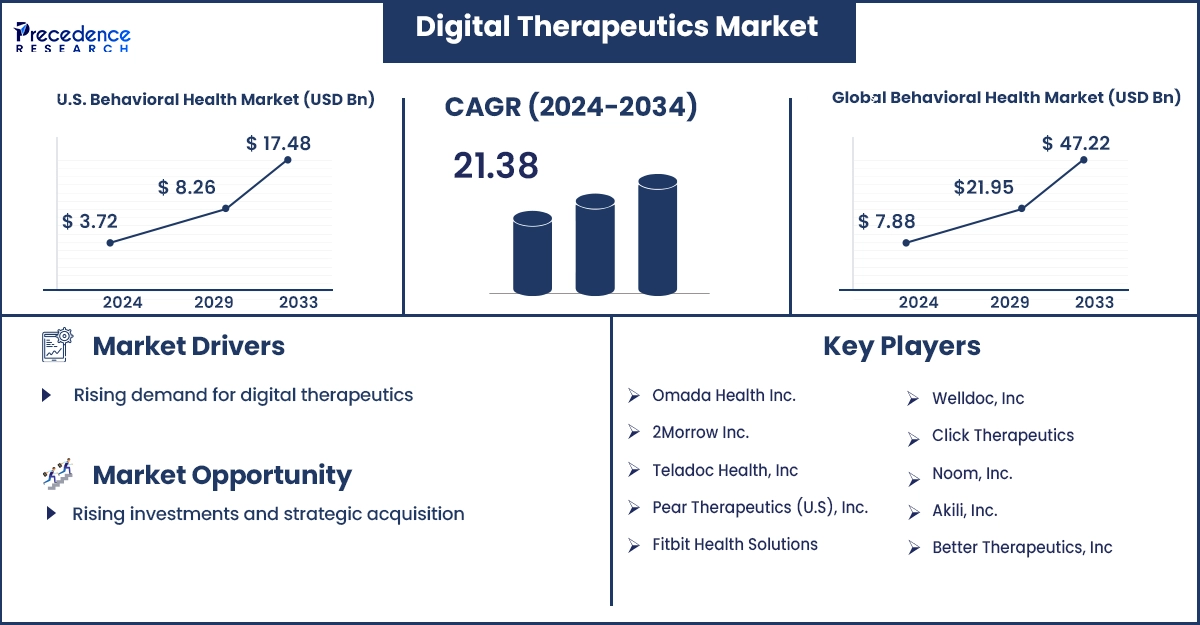

The global U.S. digital therapeutics market revenue surpassed USD 3.72 billion in 2025 and is predicted to attain around USD 17.48 billion by 2033, growing at a CAGR of 21.38%. The growth of the market is attributed to the rising focus on improving patient outcomes while reducing healthcare costs.

Market Overview

Digital therapeutics (DTx) involve the use of digital tools and software to manage, prevent, or treat medical conditions. Digital therapeutics are transforming the healthcare landscape, bringing cutting-edge technologies. They are used either alone or in combination with other technologies to optimize patient care and enhance health outcomes. The U.S. digital therapeutics market is witnessing rapid growth due to the increasing awareness about the benefits of digital therapeutics among healthcare professionals and patients alike.

The growing prevalence of diabetes, cardiovascular disease, obesity, and psychiatric disorders is boosting the growth of the market. Digital therapeutics are evidence-based and often FDA-approved and thus are actual alternatives or substitutes to traditional pharmacologic treatments. The emergence of AI-driven platforms, wearable technology, and mobile apps are paving the way for digital therapeutics. These technologies not only increase patient engagement but also enable real-time health monitoring, enhancing the effectiveness of digital therapeutics. Digital therapeutics provide an alternative to reduce hospital readmissions and costs. The rising focus on a patient-centric care approach is likely to boost the growth of the market. Although regulatory hurdles, data privacy concerns, and reimbursement challenges remain significant barriers, the market is expected to grow rapidly due to the rising advancements in digital health solutions.

Highlights of the U.S. Digital Therapeutics Market

Product Insights

The devices segment led the market with the largest share in 2024. This is mainly due to the increased need for remote patient monitoring. Wearable devices enable seamless integration and enhance the delivery of DTx solutions. These devices provide real-time monitoring of health, enabling active management of diseases like diabetes and cardiovascular disease. The inclusion of these devices into daily routines has increased patient participation and compliance with treatment regimens.

The software segment is expected to grow at a significant rate in the coming years. The growth of the segment can be attributed to the rising demand for software-based solutions. The widespread use of smartphones and wearable devices are boosting the need for DTx software solutions, providing individualized interventions. Technological advancements led to the development of sophisticated software-based DTx solutions, supporting segmental growth.

Application Insights

The diabetes segment dominated the market with the largest share in 2024. This is mainly due to the increased prevalence of diabetes. DTx solutions offer an efficient way to manage diabetes through remote monitoring and personalized intervention. Meanwhile, the obesity segment is projected to grow at a rapid pace in the coming years. DTx solutions offer dietary guidance and exercise tracking, enabling one to manage weight effectively. The rising obesity rates further support segmental growth.

Sales Channel Insights

The business-to-business (B2B) segment led the market in 2024. This channel allows DTx companies to reach a wider audience. B2B channels enable the selling of products in bulk quantities, boosting sales.

Major Trends in the U.S. Digital Therapeutics Market:

Technological Advancements

Technological advancements are paving the way for innovations in digital therapeutics. Mobile technology and wearable devices have enabled the delivery of DTx solutions. The integration of artificial intelligence (AI) and machine learning (ML) algorithms into DTx solutions is enhancing the effectiveness of therapies. These technologies support real-time monitoring of patients and intervention, which enhances treatment effectiveness and patient engagement.

Strategic Collaborations

Collaborations among pharma companies, digital health companies, and healthcare providers have the potential to transform the landscape of the market. Partnerships between these companies help accelerate the integration of DTx solutions in clinical practice. Healthcare providers can prescribe DTx solutions to their patients, boosting their usage.

Increasing Acceptance

Healthcare providers are now more and more adopting DTx solutions for remote monitoring of patients. Telehealth and telemedicine platforms enable the seamless integration of DTx solutions, enhancing accessibility for patients.

Country Insights

Massachusetts and New York are becoming a hub for digital health innovation, with high concentrations of academic centers, healthcare organizations, and biotech firms on integrating digital health solutions. California is also emerging as a major force in the market due to the presence of leading tech companies like Silicon Valley, boosting the development of digital health solutions. There is an uptick in the adoption of digital therapeutics, driven by initiatives for addressing chronic health conditions. There is a high adoption of DTx solutions to manage diabetes and cardiovascular diseases.

U.S. Digital Therapeutics Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 3.72 Billion |

| Market Revenue by 2033 | USD 17.38 Billion |

| CAGR | 21.38% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments in the U.S. Digital Therapeutics Market

- In April 2024, the U.S. FDA approved Rejoyn, a prescription digital therapeutic app that was co-developed by Otsuka Pharmaceutical and Click Therapeutics. The app was designed to treat major depressive disorders (MDD). The app is meant to provide cognitive tasks that monitor brain patterns, providing an innovative, drug-free intervention.

- In January 2024, Eli Lilly and Company, an American multinational pharmaceutical company, introduced LillyDirect, a new digital healthcare platform that provides access to treatments for diabetes, migraine, and obesity.

U.S. Digital Therapeutics Market Key Players

- Omada Health Inc.

- 2Morrow Inc.

- Teladoc Health, Inc

- Pear Therapeutics (U.S), Inc.

- Fitbit Health Solutions

- Welldoc, Inc

- Click Therapeutics

- Noom, Inc.

Akili, Inc. - Better Therapeutics, Inc

Market Segmentation

By Application

- Obesity

- Diabetes

- CNS Disorders

- Gastrointestinal Disorders

- CVD Disease

- Smoking Cessation

- Respiratory Diseases

- Others

By Product

- Software

- Device

By Distribution Channel

- Business-to-business

- Business-to-consumers

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/2410

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344