What is the Programmable Logic Controller Market Size?

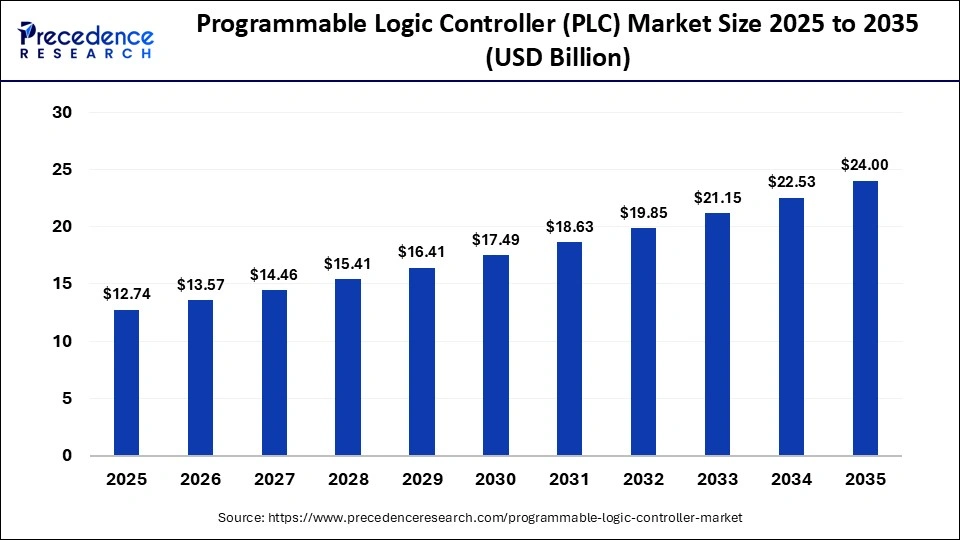

The global programmable logic controller market size accounted for USD 12.74 billion in 2025 and is predicted to increase from USD 13.57 billion in 2026 to approximately USD 24.00 billion by 2035, expanding at a CAGR of 6.54% from 2026 to 2035. The programmable logic controller market is driven by growing industrial automation and demand for efficient, reliable real-time process control.

Market Highlights

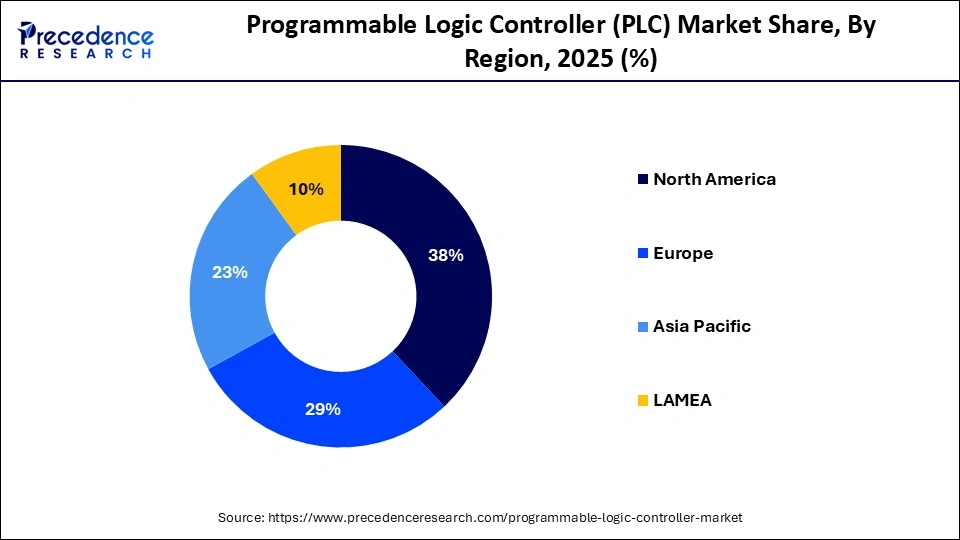

- Asia Pacific dominated the market, holding the largest market share of 38% in 2025.

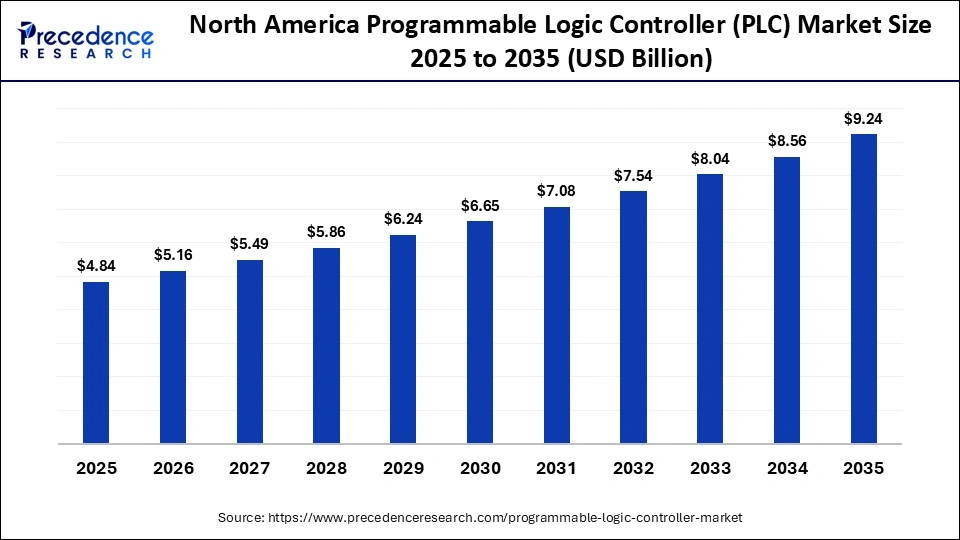

- North America is expected to expand at the fastest CAGR between 2026 and 2035.

- By type, the modular PLCs segment contributed the highest market share of 45% in 2025.

- By type, the compact/fixed PLCs segment is growing at a solid CAGR of 7% between 2026 and 2035.

- By offering, the hardware segment held the major market share of 60% in 2025.

- By offering, the software & services segment is expected to grow at a remarkable CAGR of 10% between 2026 and 2035.

- By end-use industry, the manufacturing segment captured the highest market share of 35% in 2025.

- By end-use industry, the water & wastewater segment is expanding at a remarkable CAGR of 9% between 2026 and 2035.

- By application, the process control segment accounted for the largest share of 32% in 2025.

- By application, the motion control & safety applications are set to grow at a notable CAGR of 11% CAGR between 2026 and 2035.

- By programming language, the ladder logic segment contributed the major market share of 50% in 2025.

- By programming language, the structured text segment is expected to expand at a remarkable CAGR 12% between 2026 and 2035.

- By distribution channel, the system integrators & automation partners segment held the biggest share of 40% in the market during 2025.

- By distribution channel, the direct sales are set to grow at a remarkable share of 10% CAGR between 2026 and 2035.

Revolutionizing Industrial Intelligence: How Innovation Is Powering the Programmable Logic Controller Market

The global programmable logic controller market is the industrial level of digital control systems designed to automate, control, and monitor machines and processes across various industrial settings. They are extensively used in factories, power stations, oil and gas production and extraction, water and wastewater treatment systems, transportation systems, and intelligent infrastructure. Programmable logic controllers provide efficient, safe, and consistent industrial operations by converting sensor input signals and implementing programmed logic to control outputs.

The market expansion is mainly due to the accelerating pace of industrial automation and smart manufacturing worldwide. Industry 4.0 projects are compelling companies to upgrade their legacy architecture to meet the new requirements of sophisticated programmable logic controllers with greater processing capacity, modularity, and ease of connectivity. A combination of PLCs, IoT, AI-based analytics, SCADA, and industrial Ethernet networks is facilitating real-time data exchange, predictive maintenance, and operational visibility.

Key AI Integration in the Programmable Logic Controller Market

Artificial intelligence is rapidly changing industrial automation by being integrated into Programmable Logic Controllers, making control systems smarter, predictive, and adaptive. Real-time sensor data can be analyzed by AI-powered programmable logic controllers, anomalies detected, and processes optimized without human intervention, leading to improved operational efficiency and fewer downtimes. PLCs with machine learning algorithms can detect and prevent equipment failures before they disrupt production. Quality control is improved through AI integration, where production parameters, defects, and processes are constantly adjusted to produce consistent output. AI-based programmable logic controllers assist in optimizing processes, energy use, and scheduling, which aligns with Industry 4.0 and smart manufacturing programs.

Programmable Logic Controller Market Outlook

- Industry Growth Overview: The programmable logic controller market is undergoing a consistent expansion because of the increased automation in industries, intelligent factory production, and the modernization of the old systems. Further demand is increasing across discrete and process industries as integration with IoT, AI, and industrial Ethernet intensifies.

- Global Expansion: PLCs are spreading widely across the world, and the demand in Asia Pacific, Europe, and North America is high because of the rapid industrialization and Industry 4.0 programs. Emerging markets are also investing in automation to enhance productivity and operational efficiency.

- Major Investors: The major market competitors, including Siemens, Rockwell Automation, Schneider Electric, Mitsubishi Electric, and ABB, are still spending a lot of resources in research and development, and online digital automation systems. To enhance global market presence, these firms are building a product portfolio through smart, connected programmable logic controllers.

- Startup Ecosystem: Startups in the PLC software defined, edge control, and open automation platforms are innovating in the programmable logic controller ecosystem. Such providers as Codesys-based solution providers, Stratus Technologies, and startups working on cloud-connected and virtual PLC solutions are examples.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.74 Billion |

| Market Size in 2026 | USD 13.57 Billion |

| Market Size by 2035 | USD 24.00 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.54% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Offering, End-Use Industry, Application, Programming Language, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Why Did the Modular PLCs Segment Hold a 45% Share in the Programmable Logic Controller Market 2025?

Modular PLCs: In 2025, the modular PLCs segment commanded 45% market share in the programmable logic controller market, underscoring its dominance in industrial automation. Programmable logic controllers may also be designed to be highly flexible, and the manufacturer can add an I/O module, a communication interface, or a special function block with little or no effect on the base system, depending on production needs. Their scalability makes them ideal for handling large, complex operations across industries such as automotive, oil and gas, chemicals, and power generation. Also, modular designs ease maintenance and reduce downtime, since one can replace a module without necessarily shutting down the entire system.

Compact/Fixed PLCs: The segment is expected to grow at a 7% CAGR during the forecast period and has proven to be the most dynamic, as these devices are less expensive, easier to install, and less space-consuming. These PLCs are generally used to automate small- to medium-scale tasks, and they include built-in I/O, communication ports, and basic programming features. They are not complex or costly, which attracts SMEs and manufacturers who may not have a substantial automation budget. Compact programmable logic controllers are well-suited to stand-alone machines, packaging lines, or modular production cells where flexibility is not a major concern but reliability and ease of operation are.

Offering Insights

Why did the Hardware Segment Hold a 60% Share in the Programmable Logic Controller Market during 2025?

Hardware: The segment held 60% of the market in 2025 because the equipment was essential to industrial automation infrastructure. Control system hardware, such as CPU modules and power supply units, is the heart of the control system, as it allows real-time signal processing and control, and provides reliability under severe industrial operating conditions. The segment's leadership was aided by the high demands of the manufacturing, energy, automotive, and process industries for a robust, scalable control system. Hardware upgrades and extensions also helped stimulate demand, particularly for modular PLC systems. The focus on the efficiency and stability of operations, and on the ease with which it can be integrated with SCADA, IoT, and industrial networks, also contributed to the spread of programmable logic controller hardware.

Software & Services: This segment is projected to grow at a 10% CAGR from 2026 to 2035, driven by rising demand for programming, visualization, diagnostics, and maintenance services. The software allows for manipulating logic, automating processes, and developing custom control strategies, and visualization and diagnostics tools enable real-time monitoring. Installation, commissioning, maintenance, and technical services ensure optimal system performance, minimize downtime, and extend the PLCs' lifecycles. Increased software applications and value-added service packages help manufacturers achieve greater operational efficiency, higher process performance, and adherence to industry requirements, leading to a gradual increase in this segment.

End-Use Industry Insights

Why Did Manufacturing Lead the Programmable Logic Controller Market in 2025?

Manufacturing: This segment was the largest in the programmable logic controller market in 2025, with a 35% share, owing to its widespread use in the automotive, electronics, food and beverage, pharmaceuticals, and chemicals sectors. The role of PLCs is important in automating production lines, managing machinery, and real-time monitoring of inputs and outputs to ensure high efficiency in operations, product quality, and workplace safety. The implementation of Industry 4.0, smart factories, and digital twin technologies is rapidly increasing the need for programmable logic controllers, as manufacturers seek predictive maintenance, reduced downtime, and energy optimization. The modular, small PLCs are flexible, readily expandable, and affordable, making them well-suited to a complex manufacturing environment.

Water & Wastewater: The segment is set to experience significant growth in the coming years, with an approximate 9% CAGR, likely driven by advances in automated water management and the demand for smart infrastructure. PLCs enable real-time monitoring and control of pumps, valves, chemical dosing, and filtration systems to ensure they operate efficiently and meet environmental standards. The adoption of programmable logic controllers is increasing due to investments in municipal and industrial water treatment facilities, the growing demand for sustainable water use, and the need to detect water leaks. Increased urbanization, population growth, and industrialization in developing regions are other factors driving demand for automated water and wastewater systems.

Application Insights

Why Did the Process Control Segment hold a 32% Share in the market for programmable logic controllers during 2025?

Process Control: This segment accounted for 32% of the market in 2025, driven by its essential role in controlling complex industrial operations across the oil and gas, chemicals, pharmaceuticals, and power generation sectors. Process controls are implemented using process control PLCs that measure and control key parameters, such as temperature, pressure, flow, and chemical composition, in real time to ensure product consistency, operational safety, and regulatory compliance. The application of smart manufacturing and digital transformation projects that enable programmable logic controllers to operate in an automated, remote, and energy-efficient manner also promotes development. Greater automation in industries, the emphasis on operational efficiency, and the need to upgrade old systems are all contributing to market demand worldwide.

Motion Control & Safety Applications: The motion control & safety applications segment is set to grow at a CAGR of 11% during the forecast period, driven by increased automation in robotics, packaging, material handling, and industrial machinery. The PLCs available in this segment provide regulation of proper motion performance, collision prevention, and integration of emergency shutdown and safety measures to ensure productivity and staff safety. The industries that have automated manufacturability cells, robotic assembly lines, and conveyor systems are the main drivers of demand because they are highly sensitive to precise positioning and synchronized action. In addition, the growing need for Industry 4.0 initiatives, smart factories, and real-time analytics is driving the use of programmable logic controllers in motion control and safety.

Programming Language Insights

Why Did the Ladder Logic Segment Lead the Programmable Logic Controller Market in 2025?

Ladder Logic (LD): The segment led the market while holding a 50% share in 2025. Ladder logic allows the engineer to design, implement, and troubleshoot control sequences with minimal engineering time and errors. Its graphical representation is based on electrical relay logic, making it easier for engineers used to traditional control systems to transition to it. The fact that most programmable logic controller hardware is compatible with the language, coupled with its ease of maintenance and technicians' familiarity with it, further solidifies its strong control in manufacturing and process industries, as well as in hybrid industries. This is because of its strength, stability, and scalability, which make it well-suited for quick deployment, guaranteeing high operational efficiency and low downtime.

Structured Text (ST): The segment is projected to grow at a significant CAGR of 12% over the forecast period. Structured text is especially appropriate for process-intensive industries such as chemicals, pharmaceuticals, and energy that require high-level programming, scalability, and precision. It enables engineers to integrate advanced logic and mathematical operations with other external software platforms, which are in increasing demand in Industry 4.0 and smart manufacturing solutions. Structured text programming will gain significant momentum as industries require more automation, intelligence, predictive maintenance, and connections to AI-powered analytics.

Distribution Channel Insights

Why Did the System Integrators & Automation Partners Segment Hold a 40% Share in 2025?

System Integrators & Automation Partners: The segment accounted for 40% of the market in 2025 due to their reputation fodeliveringng end-to-end automotive automation for complex industrial projects. These partners provide full-service delivery, including system design, code, connections to SCADA, HMIs, and IoT solutions,as well as installation, commissioning, and maintenance. To reduce risks during the deployment process, integrators offer turnkey solutions, accelerate the project timeline, and maximize the system's performance. They are useful to the extent that they bridge the gap between the complex technology of the PLC and industry-specific operational requirements, helping manufacturers achieve greater productivity, reduced downtime, and decreased energy consumption. The rise in the utilization of Industry 4.0, smart factories, and digital transformation programs can only enhance the demand for system integrators.

Direct Sales (OEM / Vendor to End User): The direct sales (OEM) segment, with a 10% expected CAGR, is expected to grow strongly. Introduction of programmable logic controllers in equipment as original equipment manufacturers progress into installing the PLCs directly into machinery and industrial equipment. Programmable logic controller solutions in a turnkey format, which are pre-configured, simplify installation, reduce commissioning time, and reduce the need for further system integration, are appealing to both small and medium-sized enterprises and to integrated automation projects. In this way, OEMs can provide machines that have automatic capabilities, which increase the value of their products and efficiency for their end-users. With the move toward smarter, connected equipment and companies investing in IoT-based solutions, the direct sales channel is becoming increasingly popular.

Region Insights

How Big is the North America Programmable Logic Controller Market Size?

The North America programmable logic controller market size is estimated at USD 4.84 billion in 2025 and is projected to reach approximately USD 9.24 billion by 2035, with a 6.68% CAGR from 2026 to 2035.

Why is North America undergoing the Fastest Growth in the Programmable Logic Controller Market?

The North American programmable logic controller market is experiencing the fastest growth globally, as more people adopt smart manufacturing, Industry 4.0, and digital transformation across the manufacturing, energy, and industrial sectors. The US is at the forefront by investing in high-level automation, robotics, and IoT-controlled systems that enhance operational efficiency, predictive maintenance, and real-time monitoring. Firms are upgrading legacy systems to modular, networked programmable logic controllers that can be easily integrated with SCADA, HMI, and analytics systems. The growing focus on energy conservation, workplace safety, and regulatory compliance is also driving demand for programmable logic controller solutions. The area enjoys strong research and development and is home to the most prominent manufacturers of programmable logic controllers, enabling the quick implementation of advanced automation systems.

What is the Size of the U.S. Programmable Logic Controller Market?

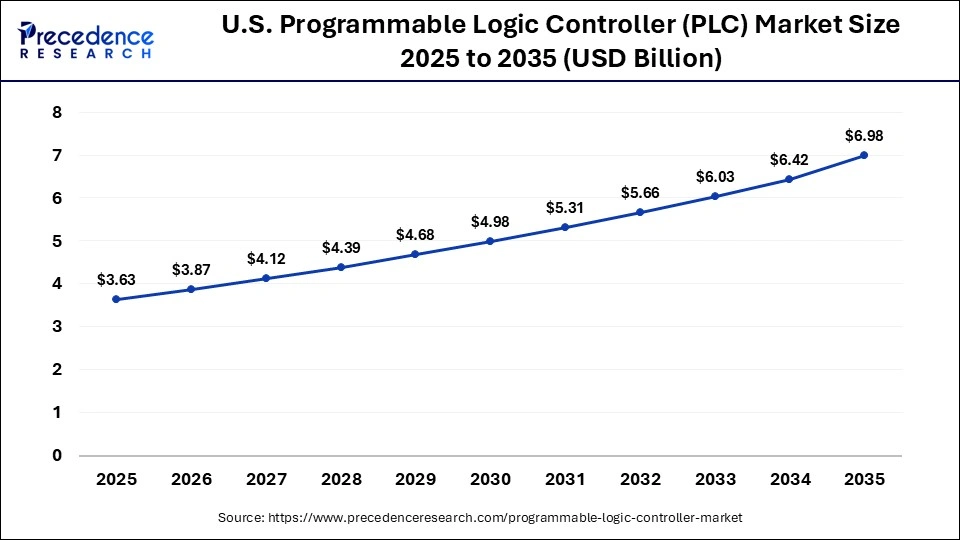

The U.S. programmable logic controller market size is calculated at USD 3.63 billion in 2025 and is expected to reach nearly USD 6.98 billion in 2035, accelerating at a strong CAGR of 6.76% between 2026 and 2035.

U.S Programmable Logic Controller Market Analysis

The U.S. programmable logic controller market has been growing rapidly due to the proliferation of smart manufacturing, automation, and Industry 4.0 initiatives across the discrete and process industries. The automotive, chemicals, food and beverage, pharmaceutical, and energy industries are among the major industries using PLCs to monitor and predict maintenance needs and optimize their processes in real-time. Integrated solutions with SCADA, HMI, and IoT, Modular and networked PLC solutions are becoming increasingly popular and enable operational efficiency, energy optimization, and reduced downtime. U.S. manufacturers are replacing the old ones with new ones that have AI and are cloud- and programmable logic controller-compatible, enabling scalable, flexible production processes.

Why Did Asia Pacific Lead the Global Programmable Logic Controller Market in 2025?

In 2025, Asia Pacific was the largest market, holding a 38% share, supported by high levels of industrial activity, expanding manufacturing output, and widespread adoption of automation across China, Japan, India, and South Korea. The region's leadership is driven by strong demand from automotive, electronics, food and beverage, and chemical industries, where programmable logic controllers are essential for process control, real-time monitoring, and production efficiency.

Manufacturers across the region are increasingly deploying advanced PLC systems as investment in smart factory infrastructure and connected production environments rises. In China, market growth is reinforced by the modernization of domestic manufacturing facilities, large-scale infrastructure projects, and the growing integration of AI-enabled and IoT-connected PLC architectures to improve operational visibility and control. Continued R&D activity, tightening energy-efficiency requirements, and sustained investment in industrial automation are further consolidating Asia Pacific's position as the leading regional market for programmable logic controllers.

China Programmable Logic Controller Market Trends

The Chinese programmable logic controller market is developing healthily, driven by intensive industrialization, the manufacturing sector's development, and the government's active promotion of smart factory and digital transformation initiatives. Other industries that PLCs are also being applied to include the automotive, electronics, chemicals, and food and beverage sectors, in the endeavor to achieve actual control of their processes, predictive maintenance, and operational efficiency. Technology adoption and knowledge transfer are accelerating through strategic alliances between Chinese manufacturers and international programmable logic controller vendors, which are consolidating China as the largest and most rapidly evolving programmable logic controller market in the Asia Pacific.

Why Is the European Programmable Logic Controller Market Experiencing Notable Growth?

The European programmable logic controller market is recording sustainable growth due to superior execution of industrial automation and Industry 4.0 initiatives, and an emphasis on efficiency in manufacturing and process domains. Regulatory frameworks that promote energy efficiency and ensure safety and environmental compliance are driving the shift to automated and connected industrial systems. The European market is enjoying a strong industrial base, a high level of technology, and high investments in advanced programmable logic controller solutions, R&D, and the modernisation of the older control systems. The relationships among industry players, research institutions, and system integrators also facilitate the development and adoption of new programmable logic controller technologies.

UK Programmable Logic Controller Market Trends

The UK programmable logic controller market is registering consistent growth, fuelled by the adoption of automation, digital manufacturing, and Industry 4.0 practices in the manufacturing and process industries. The most important industries, such as automotive, food and beverage, pharmaceuticals, and chemicals, are also adopting PLCs for real-time process control, predictive maintenance, and energy-efficient operations. UK manufacturers are replacing their old systems with flexible, scalable, and easily connectable modular and compact PLCs. As concerns about safety, efficiency, and sustainability become increasingly important, the UK programmable logic controller market will continue to grow favorably.

Why Is the MEA Programmable Logic Controller Market Gaining Momentum?

The Middle East and Africa programmable logic controller market is on the verge of growth due to the rise of industrialization, the development of infrastructure, and the growth of automation technologies in the oil and gas industry, chemicals, water treatment, and electricity. Countries like Saudi Arabia, the UAE, and South Africa are investing in smart manufacturing, power plants, and automated processing to improve operational efficiency and minimize dependence on labor. The progress of government digitization, the diversification of the industrial sphere, and the use of energy-consumption systems. The need to increase productivity, reduce downtime, and lower operational costs as industries in the region aim to meet regulatory standards underscores the need for stable, scalable, and low-cost programmable logic controller solutions.

Why Is the Latin American Programmable Logic Controller Market Emerging Rapidly?

Latin American programmable logic controller is a fast-emerging market, as automation across manufacturing, energy, automotive, and food and beverage industries is increasing in Brazil, Mexico, and Argentina. The region has access to abundant raw materials, an expanding labor force, and a government push towards the modernization of industries and digitalization. Increasing demand for energy-saving and dependable industrial processes, as well as for predictive maintenance and operational optimization, further promotes the development of the PLC market. Technology transfer, localized support, and accelerated deployment of automation solutions are being enabled by strategic alliances with PLC vendors worldwide and system installers. With offshoring industries focusing on process efficiency, workforce safety, and cost reduction, the use of advanced programmable logic controller systems is widely adopted in Latin America.

Top Vendors in Programmable Logic Controller Market & Their Offerings

- Siemens AG

- Rockwell Automation, Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- ABB Ltd.

- Omron Corporation

- Honeywell International Inc.

- Emerson Electric Co.

- Bosch Rexroth AG

- Hitachi, Ltd.

- Panasonic Industry Co., Ltd.

- Delta Electronics, Inc.

- Fuji Electric Co., Ltd.

- IDEC Corporation

- General Electric Company (GE)

Recent Developments

- In February 2024, WEG introduced the PLC 410 system solutions aimed at automating industrial processes in the paper and pulp, metallurgy, pharmaceutical, and sugar sectors. OEM manufacturing also uses these PLC systems, offering simple scalability and system expansion.(Source: https://www.weg.net)

- In April 2023, Siemens launched the Simatic S7-1500V, a fully virtual programmable logic controller, at Hannover Messe 2023, thereby broadening its Simatic portfolio. The virtual PLC enables hosting PLC computing in software environments to supplement conventional hardware controllers and meet the specific market demand for flexible automation.(Source: https://press.siemens.com)

Segment Covered in the Report

By Type

- Compact/Fixed PLCs

- Modular PLCs

- Rack-Mounted PLCs

By Offering

- Hardware

- CPU Modules

- I/O Modules

- Power Supply Modules

- Software

- Programming Software

- Visualization & Diagnostics Software

- Services

- Installation & Commissioning

- Maintenance & Support

By End-Use Industry

- Manufacturing (Discrete & Process)

- Automotive

- Energy & Power

- Oil & Gas

- Chemicals & Petrochemicals

- Food & Beverages

- Water & Wastewater

- Metals & Mining

- Pharmaceuticals

By Application

- Assembly Line Automation

- Process Control

- Motion Control

- Packaging & Material Handling

- Safety & Emergency Shutdown Systems

By Programming Language

- Ladder Logic (LD)

- Function Block Diagram (FBD)

- Structured Text (ST)

- Instruction List (IL)

- Sequential Function Chart (SFC)

By Distribution Channel

- Direct Sales (OEM/Vendor to End User)

- System Integrators & Automation Partners

- Distributors & Resellers

By Region

- North America

Europe - Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting