Pulmonary Alveolar Proteinosis (PAP) Drugs Market Size and Forecast 2025 to 2034

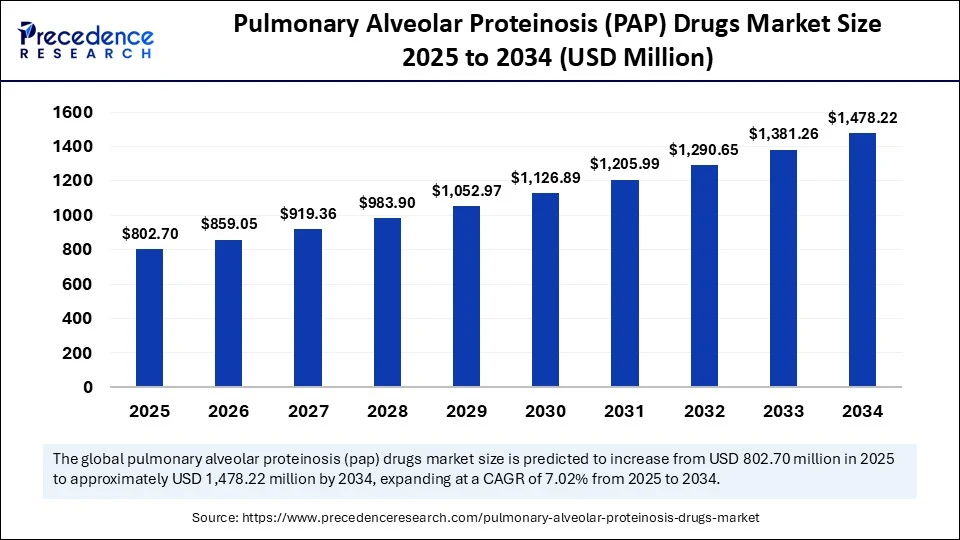

The global pulmonary alveolar proteinosis (PAP) drugs market size was estimated at USD 750.05 million in 2024 and is predicted to increase from USD 802.70 million in 2025 to approximately USD 1,478.22 million by 2034, expanding at a CAGR of 7.02% from 2025 to 2034. The market is experiencing significant growth due to the rising prevalence of rare lung disorders and a heightened focus on targeted therapies. This growth is further supported by advancements in biologics and the development of both inhaled and systemic treatment options. Additionally, an increase in clinical research and orphan drug designations is expected to further accelerate market expansion.

Pulmonary Alveolar Proteinosis (PAP) Drugs Market Key Takeaways

- In terms of revenue, the global pulmonary alveolar proteinosis (PAP) drugs market was valued at USD 750.05 million in 2024.

- It is projected to reach USD 1,478.22 million by 2034.

- The market is expected to grow at a CAGR of 7.02% from 2025 to 2034.

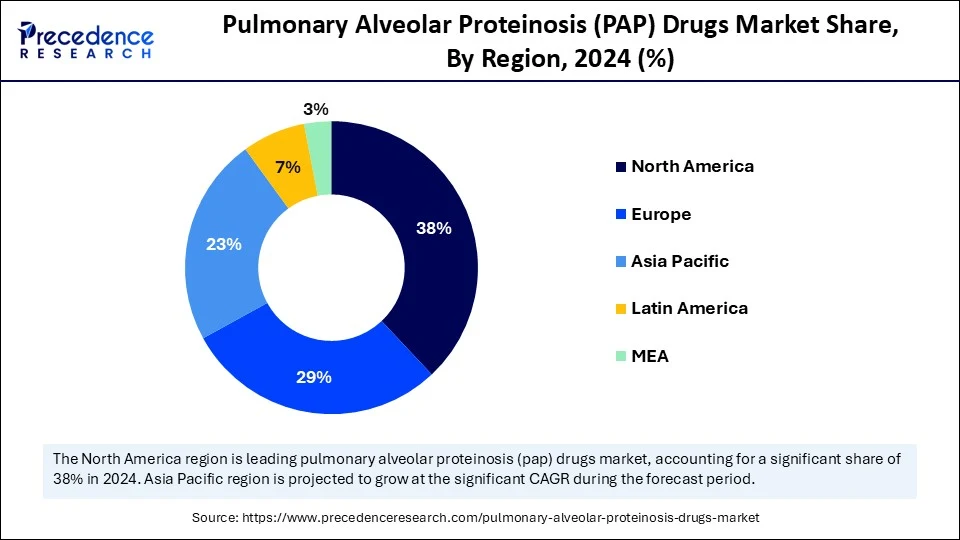

- North America dominated the pulmonary alveolar proteinosis (PAP) drugs with the largest market share of 38% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By therapeutic class/drug modality, the inhaled recombinant GM-CSF segment captured the biggest market share of 50% in 2024 and is expected to sustain growth during the forecast period.

- By formulation & delivery, the nebulized aqueous solutions segment contributed the highest market share of 60% in 2024.

- By formulation & delivery, the pre-filled, patient-friendly device + drug combos segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By indication/pap type, the autoimmune pulmonary alveolar proteinosis (aPAP) segment generated the major market share of 70% in 2024.

- By indication/pap type, the secondary pap segment is expected to witness the fastest CAGR during the foreseeable period.

- By treatment setting, the hospital/specialty pulmonary center segment held the largest market share of 55% in 2024.

- By treatment setting, the outpatient/home administration segment is projected to grow at a CAGR between 2025 and 2034.

- By patient segment/use case, the recurrent/relapsing disease segment captured the maximum market share of 50% in 2024.

- By patient segment/use case, the newly diagnosed symptomatic patients (first-line drug therapy) segment is anticipated to grow at a significant CAGR from 2025 to 2034.

How Can AI Make an Impact in the Pulmonary Alveolar Proteinosis (PAP) Drugs Market?

Artificial intelligence (AI) is transforming the PAP drugs market through its applications in drug discovery, personalized medicine, and diagnostics. AI-powered tools can speed up drug development by identifying potential drug targets, optimizing formulations, and predicting patient responses to therapies. AI algorithms also analyze extensive biological datasets to identify potential protein targets for PAP treatment. AI can not only optimize drug formulations and predict drug responses based on patient-specific characteristics, but also lead to more personalized and effective treatment strategies. AI can significantly shorten the drug development timeline by streamlining the identification and validation of potential drug candidates, potentially reducing the time from years to months.

U.S. Pulmonary Alveolar Proteinosis (PAP) Drugs Market Size and Growth 2025 to 2034

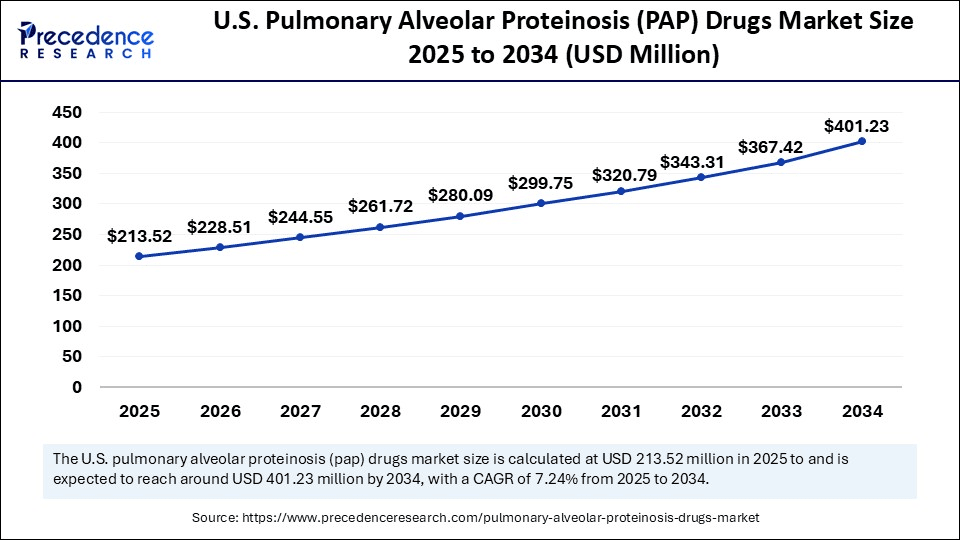

The U.S. pulmonary alveolar proteinosis (PAP) drugs market size was exhibited at USD 199.51 million in 2024 and is projected to be worth around USD 401.23 million by 2034, growing at a CAGR of 7.24% from 2025 to 2034.

North America led the pulmonary alveolar proteinosis (PAP) drugs market in 2024, primarily driven by a higher prevalence of autoimmune pulmonary alveolar proteinosis (PAP), robust research and development activities, and a well-established healthcare infrastructure. There is a greater awareness of PAP among healthcare professionals and the public in this region, enabling more timely diagnosis and treatment. The strong clinical research infrastructure supports the development of targeted biologics and other innovative treatments. Regulatory agencies in the U.S. and Europe provide pathways and incentives to expedite the development and approval of therapies for rare diseases. Pharmaceutical and biotechnology companies, including Savara Pharmaceuticals, which focused on Molgradex, an inhaled formulation of recombinant human GM-CSF, and Avalyn Pharma, are actively engaged in developing and testing new therapies for PAP.

The U.S. Pulmonary Alveolar Proteinosis (PAP) Drugs Market Trends

The U.S. plays a dominant role in the market due to its robust healthcare infrastructure, high disease awareness, and strong clinical research capabilities, attracting both pharmaceutical companies and consumers seeking advanced diagnostics and treatments. It serves as a major hub for developing and commercializing therapies, including targeted biologics like GM-CSF, as evidenced by the involvement of companies such as Partner Therapeutics and Savara Inc. This leadership is further strengthened by the FDA's orphan drug designations and accelerated approval pathways that incentivize drug development for rare conditions.

Canada Pulmonary Alveolar Proteinosis (PAP) Drugs Market Trends

Canada is evolving in its role within the market, benefiting from a strong healthcare system and ongoing efforts to enhance rare disease management. The growing emphasis on innovation, particularly in biologics and biosimilars, along with government support for biomanufacturing and life sciences, fosters research and development opportunities within the country, creating potential for local companies and partnerships with global pharmaceutical players. Canada's pharmaceutical market is also influenced by its unique drug coverage policies, including public and private insurance systems, and a growing awareness and demand for advanced therapies for conditions like PAP.

Asia Pacific Pulmonary Alveolar Proteinosis (PAP) Drugs Market Trends

Asia Pacific is experiencing the fastest growth in the pulmonary alveolar proteinosis (PAP) drug market, driven by increased awareness, a rising prevalence of respiratory diseases, and advancements in healthcare infrastructure. The high burden of respiratory diseases in this region, including those that can lead to secondary PAP-like infections, contributes to the demand for PAP treatments. Improved diagnostic capabilities, such as advancements in imaging techniques like CT scans and bronchoalveolar lavage fluid (BALF) analysis, are leading to more diagnoses. Additionally, increased healthcare expenditure in many Asia Pacific countries, including China, India, and Japan, is improving access to specialized treatments like whole-lung lavage and emerging therapies.Market Overview

The pulmonary alveolar proteinosis (PAP) drugs market includes pharmacologic therapies and adjunctive biologic or interventional treatments specifically developed for PAP, a rare lung disorder. This condition is characterized by the accumulation of surfactant in the alveoli, often caused by autoantibodies against GM-CSF (autoimmune PAP, or aPAP) or secondary/genetic factors.

The market consists of inhaled and systemic pharmacotherapies (such as inhaled recombinant GM-CSF formulations), immunomodulatory drugs like off-label anti-B cell therapies, supportive biologics, and drug-related services (including drug delivery devices, nebulizers, and specialty compounding). These treatments aim to reduce the surfactant burden, restore alveolar macrophage function, improve gas exchange, and lessen the need for whole-lung lavage (WLL). Recent late-stage successes of inhaled GM-CSF candidates have significantly altered the drug market dynamics for aPAP.

What are the Key Trends in the Pulmonary Alveolar Proteinosis (PAP) Drugs Market?

- Advancements in GM-CSF Therapy: Ongoing research aims to optimize the delivery methods for GM-CSF, such as inhalation versus injection, and to understand its efficacy across different types of pulmonary alveolar proteinosis (PAP). This focus is leading to improved diagnoses and treatment options.

- Development of Targeted Therapies: The creation of drugs that specifically target the underlying causes of PAP, including anti-GM-CSF antibodies, is driving market growth.

- Growing Prevalence of Autoimmune PAP:The increasing incidence of autoimmune PAP cases, attributed to factors such as genetic predisposition and environmental exposures, is resulting in a larger patient population that requires these therapies.

- Rising Healthcare Expenditure: The market is also benefiting from increased investment in research and development, along with enhancements in healthcare infrastructure in developing countries. This investment is contributing to overall market expansion.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,478.22 Million |

| Market Size in 2025 | USD 802.70 Million |

| Market Size in 2024 | USD 750.05 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.02% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapeutic Class / Drug Modality, Formulation & Delivery, Indication / PAP Type, Treatment Setting, Patient Segment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Awareness and Advancements in the Diagnostics and Therapies

A primary driver of this market is increasing awareness and advancements in the diagnostics and therapies for rare diseases. Improved understanding of PAP among healthcare professionals and the public results in earlier diagnosis and intervention.

Advanced diagnostic tools, such as HRCT imaging, bronchoalveolar lavage analysis, and GM-CSF antibody tests, enable more accurate and timely diagnoses, particularly for autoimmune PAP (aPAP). The development of new therapeutic approaches, including GM-CSF replacement therapy, targeted biologics like Rituximab, and novel investigational agents, expands treatment options beyond traditional whole lung lavage.

Restraint

Lack of Approved Disease-Modifying Therapies

The main restraint in this market is the lack of approved disease-modifying therapies. Although WLL is the current standard of care, it is considered a palliative treatment rather than a cure. While WLL can help clear surfactant and improve symptoms, it does not address the underlying cause of the disease.

Currently, there are no drugs specifically approved to treat the root cause of PAP, although GM-CSF replacement therapy and other methods are showing promise. The PAP market is open to new drugs that can directly target the underlying mechanisms of the disease, whether those relate to genetic mutations in congenital PAP or the autoimmune response in autoimmune PAP.

Opportunity

Expansion of Targeted Therapies

A key future opportunity in this market lies in the expansion of targeted therapies that address the disease's underlying causes. This includes treatments that enhance GM-CSF (granulocyte-macrophage colony-stimulating factor) or target anti-GM-CSF antibodies, as well as potential gene therapies and stem cell approaches. Recombinant human GM-CSF, administered via inhalation or injection, has shown efficacy in some patients by facilitating the body's ability to clear surfactant.

Advances in our understanding of the genetic basis of PAP and the role of macrophages are paving the way for potential gene therapies and stem cell-based treatments. While CT scans can initiate diagnosis, research into more accurate and accessible diagnostic methods is ongoing.

Therapeutic Class / Drug Modality Insights

The inhaled recombinant GM-CSF (granulocyte-macrophage colony-stimulating factor) segment dominated the market in 2024 and is expected to sustain growth during the forecast period. This is mainly due to its targeted delivery and ability to address the underlying cause of the disease. Nebulized GM-CSF directly targets the alveoli, where the disease pathology occurs, and helps restore the function of alveolar macrophages, which are crucial for clearing surfactant buildup. This approach minimizes systemic side effects and offers a less invasive alternative to whole lung lavage, a more traditional but also riskier treatment with clinical benefits for PAP patients, including improved gas exchange, reduced lung density, and decreased dependence on oxygen therapy.

Formulation & Delivery Insights

The nebulized aqueous solutions led the pulmonary alveolar proteinosis (PAP) drugs market in 2024. This is because its targeted therapy delivers medication directly to the lungs, the primary site affected by PAP. This approach bypasses the need for the drug to travel through the bloodstream and reduces the potential for systemic side effects. Nebulizers are relatively easy to use, making them ideal for patients who may struggle with other inhaler types, such as children, the elderly, or those with cognitive impairments or severe respiratory distress. The growing trend of home healthcare makes nebulizers a valuable tool, allowing patients to receive necessary treatment from the comfort of their homes.

The pre-filled, patient-friendly device + drug combos segment is the fastest-growing part of the market. This is mainly due to their ability to simplify treatment and improve patient outcomes. This segment eliminates the need for patients or healthcare providers to measure or mix medication, making drug administration easier and more convenient. These devices also reduce the risk of errors and improve patient compliance, especially in home care and self-administration settings. Pre-filled syringes are manufactured under strict quality control measures, ensuring consistent and accurate drug concentration and purity, with better patient care and reducing the risk of accidental needle sticks or contact with harmful substances during preparation.

Indication / PAP Type Insights

The autoimmune pulmonary alveolar proteinosis (aPAP) segment captured a dominant position in the pulmonary alveolar proteinosis (PAP) drugs market. This is due to its high prevalence, as aPAP is the most common form of PAP, affecting the majority of adult patients. This form is characterized by the presence of anti-GM-CSF autoantibodies, which disrupt the normal function of macrophages in clearing surfactant from the lungs. Additionally, understanding that aPAP is caused by autoantibodies against GM-CSF has led to targeted therapies. The discovery of anti-GM-CSF autoantibodies has enabled the development of specific diagnostic tests, facilitating early and accurate diagnosis of aPAP.

The secondary PAP segment is experiencing the fastest growth during the forecast period. This is because secondary PAP is more prevalent than primary autoimmune PAP, with hematological disorders being a significant contributing factor. Conditions such as myelodysplastic syndromes, leukemia, immunodeficiencies, and toxin exposures can impair alveolar macrophage function, leading to secondary PAP. Secondary PAP can also be misdiagnosed as other respiratory illnesses, especially in immunocompromised patients, which may delay appropriate treatment.

Treatment Setting Insights

The hospital/specialty pulmonary center segment dominated the pulmonary alveolar proteinosis (PAP) drugs market in 2024. This is mainly due to the specialized nature of PAP treatment, which often involves procedures like WLL and GM-CSF therapy that require advanced medical facilities and expertise. These treatments are best administered in hospital settings with specialized pulmonary centers equipped to handle rare lung diseases and potential complications. Moreover, because PAP is a rare disease, most cases are handled by specialized centers that have the necessary experience.

The outpatient/home administration segment is the fastest-growing in the market. This is mainly driven by increased awareness, improved treatment options, and a shift toward patient-centered care. Better understanding of the underlying causes and mechanisms of PAP, especially autoimmune PAP, has led to the development of more targeted therapies. Recombinant human rhGM-CSF administered via inhalation has shown promising results in treating autoimmune PAP. This therapy can be administered at home, reducing the need for frequent hospital visits. There is a growing emphasis on patient convenience and well-being, with a preference for treatments that can be managed at home instead of in a hospital.

Patient Segment / Use Case Insights

The recurrent/relapsing disease segment led the pulmonary alveolar proteinosis (PAP) drugs market in 2024, is particularly relevant in the autoimmune PAP segment. This is because autoimmune PAP, the most common form, involves the immune system mistakenly attacking lung cells, leading to surfactant buildup. It is a chronic condition that can relapse even after treatment. Since its cause involves a persistent immune response rather than a one-time event, repeated treatments like WLL or inhaled GM-CSF are often necessary, driving demand for PAP therapies. The recurrent nature of the disease fuels demand for PAP drugs, including options like WLL, inhaled GM-CSF, and potential future therapies like rituximab.

The newly diagnosed symptomatic patients (first-line drug therapy) segment is the fastest-growing in the market. This growth is due to increased awareness, earlier diagnosis, and the development of targeted therapies like GM-CSF replacement. Better understanding of PAP and its diagnostic tools, such as CT scans and bronchoalveolar lavage, has led to early diagnosis of symptomatic patients. Initiating effective treatment early with therapies like GM-CSF can significantly improve symptoms, lung function, and quality of life for newly diagnosed patients, leading to improved long-term outcomes.

Pulmonary Alveolar Proteinosis (PAP) Drugs Market Value Chain Analysis

- R&D

The research and development (R&D) focus on developing treatments for this rare lung disease, particularly for the aPAP, with therapies like inhaled GM-CSF and rituximab for improved diagnostics and standardized care.

Key Players: Savara Inc., Sanofi Genzyme, Bayer HealthCare Pharmaceuticals, F. Hoffmann-La Roche Ltd.

- Clinical Trials and Regulatory Approvals

Clinical trials for these drugs are exploring therapies like inhaled GM-CSF, rituximab, gene therapy, and targeting lipid metabolism. Currently, whole lung lavage remains the gold standard treatment, and there are no FDA-approved medications specifically for PAP to establish their efficacy and safety.

Key Players: Savara Inc., Partner Therapeutics, Inc., Sanofi Genzyme, Novartis AG, GlaxoSmithKline plc.

- Formulation and Final Dosage Preparation

This revolves around optimizing drug delivery and maximizing treatment efficacy. GM-CSF replacement therapy, a common approach for restoring macrophage function, is available via subcutaneous injections or inhalation via nebulizers, requiring careful formulation for stability and bioavailability.

Key Players: Savara Inc., Sanofi Genzyme, F. Hoffmann-La Roche Ltd, Novartis AG

- Packaging and Serialization

The packaging needs to protect the product and not interact with it. Serialization, using unique codes like 2D data matrix codes on individual packages like vials, syringes, inhalers, is mandated for traceability, anticounterfeiting, and patient safety, as per regulations like the DSCSA.

Key Players: SoftGroup, Arvato Systems, OPTEL, Amcor plc, Gerresheimer AG

- Distribution to Hospitals, Pharmacies

The distribution of these to hospitals and pharmacies relies on a specialized supply chain, utilizing channels like hospital and retail pharmacies, online platforms, and home care settings. Strict regulations, such as GDP, ensure product quality throughout the process with the adoption of technologies like digitalization and cold chain logistics.

Key Players: Philips Respironics, Partner Therapeutics, Inc., FedEx Corporation, DB Schenker, AstraZeneca plc.

- Patient Support and Services

Patient support and services are crucial, helping patients access treatments like WLL and potentially GM-CSF replacement therapy, along with providing education and support for managing this chronic condition.

Key players: Sanofi, Novartis AG, GlaxoSmithKline plc., Pfizer, Partner Therapeutics, Inc.

Pulmonary Alveolar Proteinosis (PAP) Drugs Market Companies

- Savara, Inc.

- Partner Therapeutics, Inc.

- Nobelpharma Co., Ltd.

- Amgen Inc.

- Sanofi (historical owner/partner for GM-CSF assets)

- Pfizer Inc.

- AstraZeneca plc

- Novartis AG

- Roche / Genentech

- Johnson & Johnson (Janssen)

- Takeda Pharmaceutical Company Limited

- Mallinckrodt Pharmaceuticals

- Baxter International Inc.

- Biogen Inc.

- Regeneron Pharmaceuticals, Inc.

- GlaxoSmithKline plc (GSK)

- Teva Pharmaceutical Industries Ltd.

- Viatris / Mylan

- Specialty CDMOs & biologics manufacturers

- Rare-disease / pulmonary biotech specialists

Leaders' Announcements

- In April 2023, Partner Therapeutics announced that its partner Nobelpharma had received PMDA approval for the inhaled use of Leukine (sargramostim), branded as Sargmalin in Japan, to treat aPAP. Partner Therapeutics will manufacture Sargmalin, thereby enhancing treatment options for patients in Japan. The investigation into inhaled sargramostim aims to address GM-CSF signaling blockage in aPAP, promoting better lung function.

(Source: https://www.prnewswire.com)

Recent Developments

- In March 2024, Savara Inc. announced the launch of the aPAP ClearPath Dried Blood Spot (DBS) Test in the U.S. This test allows for the diagnosis of aPAP, a rare autoimmune lung disease, using a finger-prick blood sample. It demonstrates a high correlation and has achieved 100% analytical sensitivity and specificity. Dr. Ali Ataya from the University of Florida praised the test for reducing logistical barriers and facilitating earlier diagnosis.

(Source: https://investors.savarapharma.com) - In December 2024, Savara began a rolling submission of a Biologics License Application (BLA) to the FDA for MOLBREEVI, a potential treatment for aPAP, which currently has no approved medicines in the U.S. or Europe. MOLBREEVI received Fast Track and Breakthrough Therapy Designations in 2019, and Savara plans to request priority review upon completing the submission, buoyed by positive outcomes from the Phase 3 IMPALA-2 trial.

(Source: https://www.businesswire.com)

Segments Covered in the Report

By Therapeutic Class / Drug Modality

- Inhaled recombinant GM-CSF

- Systemic GM-CSF therapy

- B-cell depleting / immunomodulatory drugs

- Plasmapheresis/immunoadsorption

- Small molecules / targeted immunomodulators

- Cell therapies & regenerative biologics

- Supportive/adjunctive agents

By Formulation & Delivery

- Nebulized aqueous solutions

- Dry-powder inhaler (DPI) formulations

- Injectable/subcutaneous formulations

- Pre-filled, patient-friendly device + drug combos

- Combination device + drug

By Indication / PAP Type

- Autoimmune PAP

- Secondary PAP

- Hereditary/congenital PAP

By Treatment Setting

- Outpatient clinic/home administration

- Hospital/specialty pulmonary center

- Ambulatory infusion center

By Patient Segment

- Newly diagnosed symptomatic patients

- Recurrent/relapsing disease

- WLL-refractory or WLL-intolerant patients

- Pediatric vs adult patient groups

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting