What is the Serine Amino Acid Market Size in 2026?

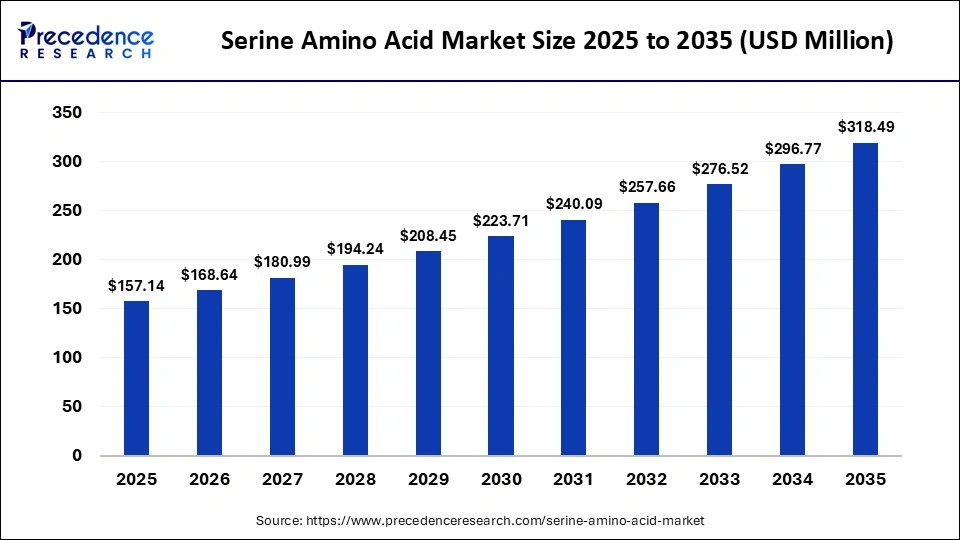

The global serine amino acid market size was calculated at USD 157.14 million in 2025 and is predicted to increase from USD 168.64 million in 2026 to approximately USD 318.49 million by 2035, expanding at a CAGR of 7.32% from 2026 to 2035. The market is driven by the increasing demand for nutritional supplements, pharmaceuticals, and functional foods that leverage serine's role in protein synthesis, metabolism, and neurological health.

Key Takeaways

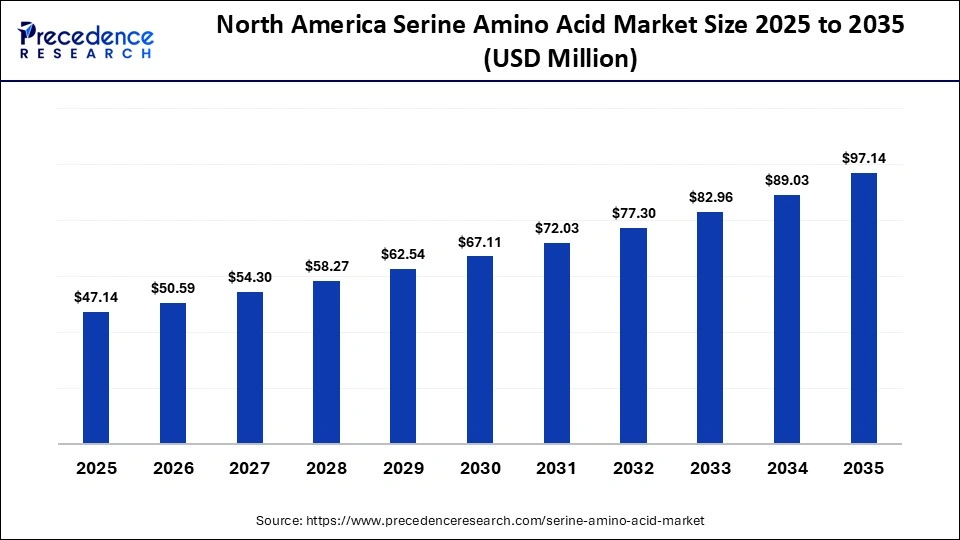

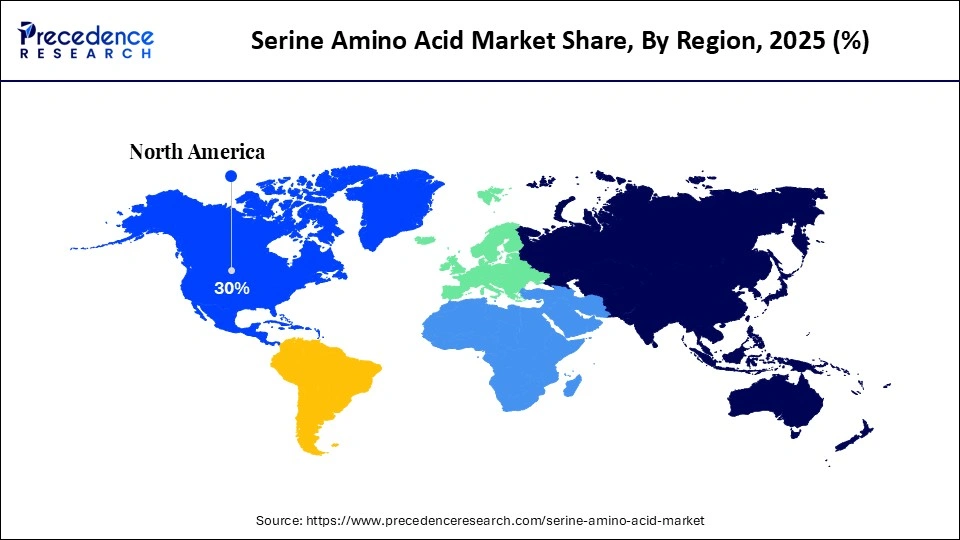

- North America accounted for the largest share of 30% 2025.

- By region, Asia Pacific is expected to grow at the fastest CAGR during the forecasted years.

- By grade, the pharmaceutical grade segment dominated the market in 2025.

- By grade, the food grade segment is expected to grow at a significant rate in the market over the forecast period.

- By application, the food and beverages segment held the largest share of the market in 2025.

- By application, the cosmetics and personal care segment is expected to show considerable growth in the market over the forecast period.

- By manufacturing process, the fermentation segment held a significant share of the market in 2025.

- By manufacturing process, the chemical synthesis segment is anticipated to show considerable growth in the market over the forecast period.

- By product form, the powder segment held a significant share in 2025.

- By product form, the liquid segment is anticipated to show considerable growth in the market over the forecast period.

Market Overview

Serine is a vital amino acid involved in the synthesis of neurotransmitters and the regulation of brain functions, making it an important contributor to mental health support. Its growing applications across the pharmaceutical, cosmetic, and nutraceutical sectors are driving market demand. The rising prevalence of neurological and metabolic disorders has fueled the use of serine and its analogues in the development of antidepressants, antipsychotics, and cognitive health supplements. Additionally, increasing consumer focus on healthy living and preventive medicine has expanded its use in dietary supplements. In the personal care industry, serine is valued for its hydrating, skin-repairing, and anti-aging properties, making it a key ingredient in high-end skincare formulations.

How are Advanced Technologies Impacting the Serine Amino Acid Market?

Advanced technologies like artificial intelligence (AI) and the Internet of Things (IoT) are making the serine amino acid market highly productive and innovative. Artificial intelligence-based bioinformatics tools are aiding in the development of more complex analysis of the metabolic pathways and strain optimization, which allows manufacturers to increase serine yield and reduce the fermentation period and consumption of resources. IoT bioreactors are used to monitor vital parameters such as the temperature, pH level, oxygen supply, nutrient level, and contamination risks in real-time. Active data collection and automatic corrections reduce human intervention, reduce operational errors, and ensure quality assurance of batches. Such smart production systems also enhance traceability and lead to regulatory compliance.

Serine Amino Acid Market Trends

- The rising prevalence of neurological disorders and expanding global research into neuroprotective therapeutics are driving increased use of serine in antidepressants, antipsychotics, and cognitive health formulations.

- Growing consumer interest in preventive medicine and brain health products is fueling the inclusion of serine in functional foods and cognitive health supplements.

- The anti-aging, skin-repairing, and moisturizing properties of serine are boosting its popularity in high-end skincare products, as consumers increasingly seek scientifically supported formulations with amino acids as key ingredients.

- Advances in bio-based fermentation and enzymatic synthesis are improving production efficiency, enhancing purity, reducing costs, and enabling large-scale sustainable manufacturing of serine.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 157.14 Million |

| Market Size in 2026 | USD 168.64 Million |

| Market Size by 2035 | USD 318.49 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Grade, Application, Manufacturing Process, Product Form, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Grade Insights

Why Does the Pharmaceutical Grade Segment Lead the Serine Amino Acid Market?

The pharmaceutical grade segment led the market with the largest revenue share in 2025, owing to its wide use in formulations of drugs for treating neurological and metabolic ailments. Pharmaceutical-grade serine is very pure, complies with the required quality standards, and has superior bioavailability consistency that is very crucial in therapeutic use. Pharmaceutical-grade serine amino acid is crucial in the manufacture of drugs for schizophrenia, depression, impaired thinking, and other degenerative disorders. The rising clinical studies on amino acid-based therapies and the rise in biotechnology investments have also contributed to segmental dominance.

The food grade segment is expected to grow at the highest CAGR during the forecast period due to the growing consumer awareness of health, nutrition, and functional food. Increased demand for amino acids-enriched food products and drinks has prompted manufacturers to use food-grade serine amino acid in dietary formulations. Consumers are increasingly seeking protein-enriched snacks, energy drinks, and wellness-focused products that support metabolic health and muscle performance. Additionally, the growing emphasis on preventive care and fitness-oriented lifestyles, coupled with trends such as clean labels and preference for scientifically validated nutritional ingredients, is further promoting innovation and adoption of serine in fortified food products.

Application Insights

Why Did the Food and Beverages Segment Contribute the Most Revenue in the Market?

The food and beverages segment held the largest share of the market in 2025, driven by growing consumer focus on balanced nutrition, immunity support, and protein enrichment. Serine is increasingly used in sports nutrition products, fortified beverages, protein bars, and dietary supplements as a functional ingredient to enhance nutritional value. Rising awareness of metabolic health and active lifestyles has fueled demand for amino acid-based formulations. Manufacturers are expanding their product portfolios to meet consumer needs for offerings that are both functional and performance-enhancing, further reinforcing the dominance of this segment in the market.

The cosmetics and personal care segment is expected to grow at a significant rate in the market, driven by the rising demand for amino acid-powered skincare and anti-aging products. Serine is valued for its humectant, skin-repairing, and conditioning properties, making it a popular ingredient in facial creams, serums, and lotions. Global trends toward clean, dermatologically tested, and bio-based formulations have encouraged brands to incorporate safe and sustainable ingredients. Additionally, increasing consumer spending on premium skincare products and growing awareness about ingredient transparency are further driving the adoption of serine in personal care formulations.

Manufacturing Process Insights

Why Did the Fermentation Segment Lead the Serine Amino Acid Market?

The fermentation segment led the market while holding the largest revenue share in 2025, owing to the increased demand for bio-based and naturally produced amino acids in the food & beverages, pharmaceuticals, cosmetics, and animal nutrition industries. The ferment-based production is more sustainable and environmentally friendly compared to the traditional chemical production since it relies on microbial strains and renewable feedstocks. The rapid shift toward clean-label and non-synthetic food also reinforced the segment's leading position in the market.

The chemical synthesis segment is expected to grow at a significant CAGR over the forecast period because of its benefits of high-purity production and scalability. The use of chemical synthesis techniques allows for the control of the conditions of the reaction precisely, and results in a consistent quality and the degree of purity needed in specific pharmaceutical and research uses. With the growing need for serine in drug formulations, biotechnology research, and specialty chemicals, chemical synthesis provides a dependable source of production, especially when high-quality requirements are of the essence.

Product Form Insights

Why Did the Powder Segment Dominate the Serine Amino Acid Market?

The powder segment dominated the serine amino acid market in 2025 due to its stability, ease of storage, and extended shelf life. Powdered serine is highly preferred in dietary supplements, functional foods, pharmaceuticals, and animal feed because it allows for accurate dosing and easy blending with other compounds. The growing popularity of powdered amino acid supplements is further supported by increasing demand for protein-enriched formulations and health-focused products, reinforcing the segment's dominance in the market.

The liquid segment is expected to grow substantially in the serine amino acid market due to its rising usage in the production of pharmaceutical injectables, cosmetic formulations, and ready-to-use nutritional products. In biotechnology and clinical nutrition, liquid serine is easier to incorporate and is rapidly absorbed in homogeneous formulations. The growing trend of personalized medicine and liquid-based dietary supplements is further supporting segment growth. Additionally, in the cosmetics sector, liquid serine is widely used in skincare and hair care products to provide conditioning and hydrating benefits, reinforcing its increasing adoption.

Region Insights

North America Serine Amino AcidMarket Size and Growth 2026 to 2035

The North America serine amino acid market size is estimated at USD 47.14 million in 2025 and is projected to reach approximately USD 97.14 million by 2035, with a 7.50% CAGR from 2026 to 2035.

What Made North America the Leading Region in the Global Serine Amino Acid Market?

North America led the serine amino acid market by capturing the largest share in 2025, owing to the increased production of pharmaceutical, nutraceutical, and functional foods, in which serine amino acid is widely used. The region benefits from a well-developed healthcare infrastructure, high healthcare expenditure, and significant investments in biotechnology research. Rising incidences of neurological and metabolic disorders have further increased the use of serine in therapeutics and supplements. Additionally, growing consumer awareness around amino acid supplementation and preventive healthcare has strengthened market penetration in the region.

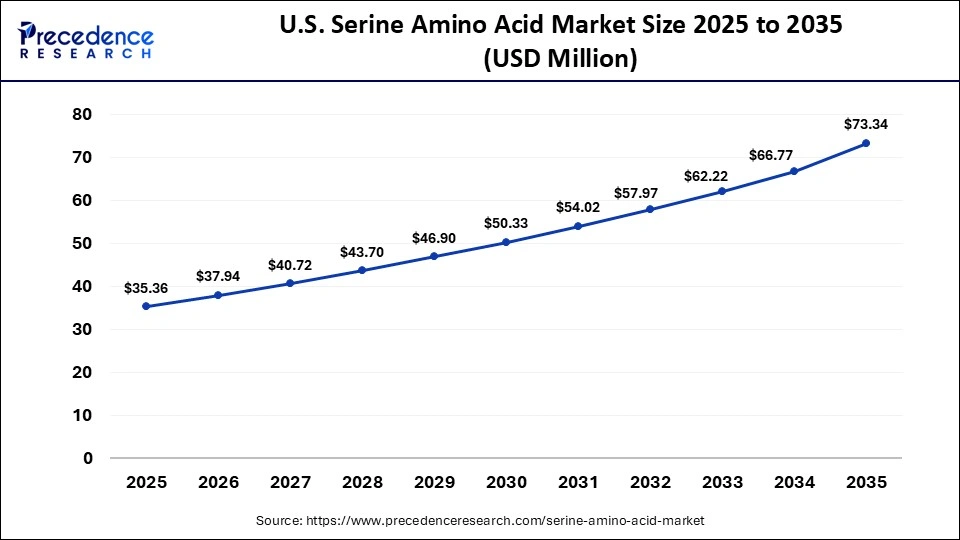

U.S. Serine Amino Acid Market Size and Growth 2026 to 2035

The U.S. serine amino acid market size is calculated at USD 35.36 million in 2025 and is expected to reach nearly USD 73.34 million in 2035, accelerating at a strong CAGR of 7.57% between 2026 and 2035.

U.S. Market Trends

The serine amino acid market in the U.S. is expanding due to strong demand across pharmaceutical, nutraceutical, and functional food sectors, supported by a well-established healthcare infrastructure, a large number of leading research centers, and significant biotechnology investments. There is a rising rate of neurological and metabolic disorders, which is significantly increasing the use of serine in therapeutics and dietary supplements.

Why is Asia Pacific Considered the Fastest-Growing Region in the Serine Amino Acid Market?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period, driven by increasing awareness of health and wellness among consumers. Rising disposable incomes and changing dietary trends are fueling demand for amino acid-enriched supplements, functional foods, and cosmetic products. The region is also witnessing significant growth in pharmaceutical manufacturing and biotechnology investments, particularly in China, India, Japan, and South Korea. Additionally, Asia Pacific is emerging as a cost-effective manufacturing hub, supported by advances in fermentation technology and large-scale biomanufacturing capacity.

India Market Trends

The serine amino acid market in India is growing due to rising health and wellness awareness and demand for functional foods, dietary supplements, and cosmetic products. Expanding pharmaceutical manufacturing in the country, along with improvements in fermentation technology and large-scale biomanufacturing, are further driving production and adoption.

How is the Opportunistic Rise of Europe in the Serine Amino Acid Market?

Europe is expected to grow at a considerable CAGR in the upcoming period, driven by rising pharmaceutical applications, growing demand for functional foods, and increasing consumption of cosmeceuticals. The region's robust quality control measures support the production of high-quality amino acids and promote research into therapeutic applications. Growing focus on mental and cognitive health, preventive nutrition, and dietary supplementation has boosted the use of serine. Additionally, demand for neuroprotective and skin-rejuvenating products is rising due to the ageing population. Continuous R&D initiatives and strategic partnerships among biotechnological and pharmaceutical companies are expected to further drive the European market's growth.

Serine Amino Acid Market Companies

- Evonik Industries AG (Germany)

- Ajinomoto Co., Inc. (Japan)

- KYOWA HAKKO BIO CO., LTD. (Japan)

- Merck KGaA (Germany)

- Thermo Fisher Scientific Inc. (United States)

- CJ CheilJedang Corporation (South Korea)

- Tokyo Chemical Industry Co., Ltd. (TCI) (Japan)

- Mitsui Chemicals, Inc. (Japan)

- Wacker Chemie AG (Germany)

- Amino GmbH (Germany)

- Archer Daniels Midland Company (ADM) (United States)

- Cargill, Incorporated (United States)

- Royal DSM N.V. (Netherlands)

- Yuki Gosei Kogyo Co., Ltd. (Japan)

- Shandong Haide Biological Technology Co., Ltd. (China)

Recent Developments

- In December 2025, Croda signed a strategic alliance with AMINO GmbH to increase its biopharmaceutical operations and enhance the worldwide supply of high-purity amino acids, such as serine. The partnership aims to increase the levels of production to meet the expanding demands in the pharmaceutical and biotechnological fields.(Source: https://www.croda.com)

- In April 2024, SJD Barcelona Children's Hospital conducted clinical trials showing that L‑serine was effective in treating neurological patients with GRIN gene mutations. These results aroused more interest among the biotech and pharmaceutical industries, resulting in the production of new serine-based treatment of genetic neurological disorders.(Source: https://www.sjdhospitalbarcelona.org)

Segments Covered in the Report

By Grade

- Food Grade

- Pharmaceutical Grade

- Chemical Grade

By Application

- Food and Beverages

- Animal Feed

- Pharmaceuticals

- Cosmetics and Personal Care

By Manufacturing Process

- Fermentation

- Chemical Synthesis

By Product Form

- Powder

- Liquid

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting