What is the SiC Powder Market Size?

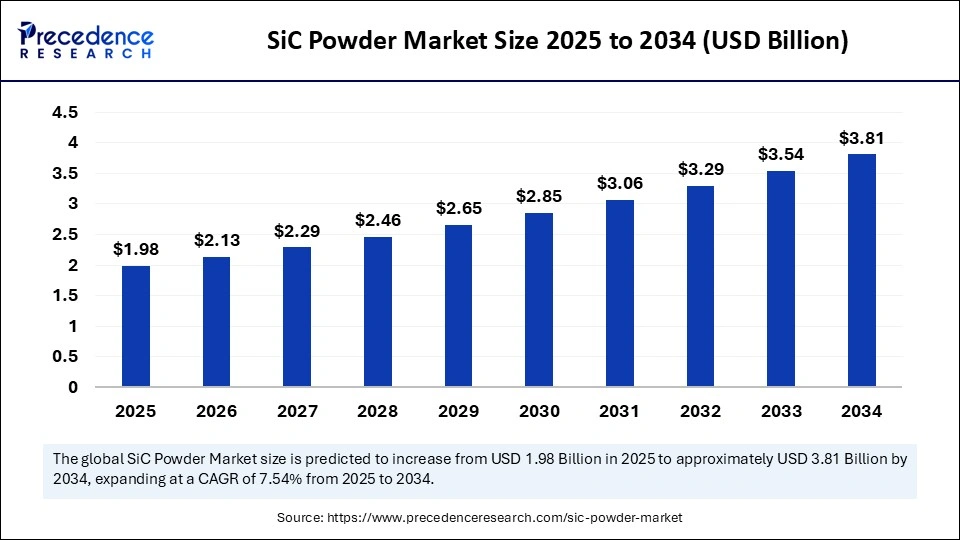

The global SiC powder market size accounted for USD 1.84 billion in 2024 and is predicted to increase from USD 1.84 billion in 2025 to approximately USD 3.81 billion by 2034, expanding at a CAGR of 7.54% from 2025 to 2034. The market growth is attributed to rising adoption of electric vehicles, developing renewable energy infrastructure, and increasing deployment of high-frequency 5G applications.

SiC Powder Market Key Takeaways

- In terms of revenue, the global SiC powder market was valued at USD 1.84 billion in 2024.

- It is projected to reach USD 3.81 billion by 2034.

- The market is expected to grow at a CAGR of 7.54% from 2025 to 2034.

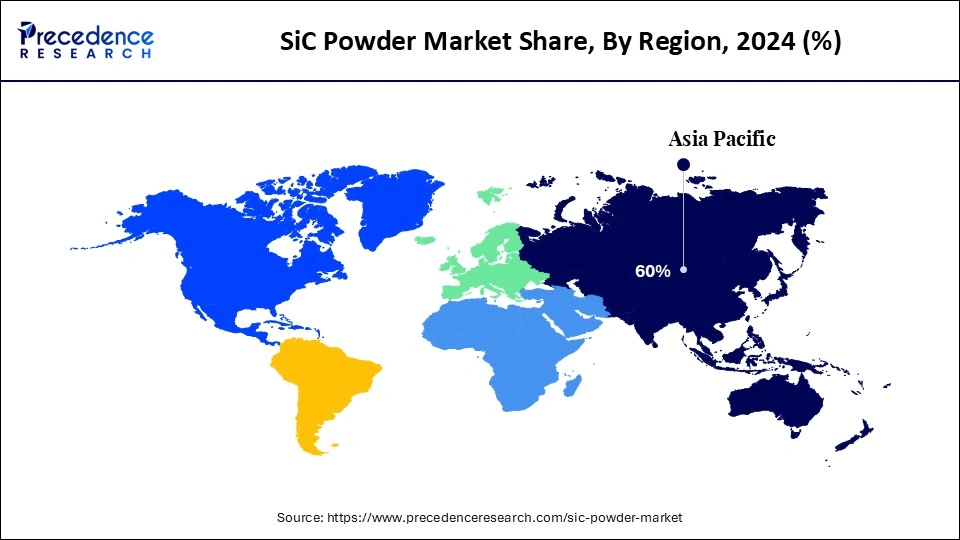

- Asia Pacific dominated the global SiC powder market with the largest share of 60% in 2024, and is expected to sustain the position in the coming years.

- By type, the black SiC powder segment held the major market share of 55% in 2024.

- By type, the green SiC powder segment is projected to grow at a CAGR between 2025 and 2034.

- By purity level, the 97-99% segment contributed the biggest share of 50% in 2024.

- By purity level, the ≥99% segment is expanding at a significant CAGR between 2025 and 2034.

- By particle size, the micro segment held the maximum market share of 60% in 2024.

- By particle size, the nano-sized powder segment is expected to grow at a significant CAGR over the projected period.

- By application, abrasive segments accounted for significant market share of 35% in 2024.

- By application, the electronics & semiconductor segment is expected to grow at a notable CAGR from 2025 to 2034.

- By end-use industry, industrial manufacturing segments generated the major market share of 40% in 2024.

- By end-use industry, automotive projects are expected to grow at a notable CAGR from 2024 to 2034.

Market Overview

The growing popularity of electric vehicles is likely to stimulate the fast growth of silicon carbide (SiC) powder usage in the supply chains of power electronics, leading to the expansion of the SiC powder market. Engineers have so far favored SiC powder due to its features of a wide bandgap, high thermal conductivity, and high breakdown field strength. That enables power modules to work at higher voltages, faster switching rates, and higher temperatures and reducing cooling needs and enhancing system-level efficiency. To create traction inverters, onboard chargers, and DC-DC converters on contemporary EV platforms, manufacturers use SiC powder in crystal growth and sintering to make wafers and substrates to support the machinery.

The semiconductor trade organizations took note of supply constraints in the field of production of SiC wafers in 2024. Still, the upstream players were able to enter into long-term contracts with the feedstock providers and invest in process controls to stabilize throughput. Furthermore, increased investments in renewable energy infrastructure are expected to drive the increase in SiC powder usage further as grid operators implement high-efficiency converters to manage the rise in intermittent generation.(Source: https://www.semiconductors.org)

Impact of Artificial Intelligence on the SiC Powder Market

The emerging opportunities in the SiC powder market through artificial intelligence (AI) are substantial in terms of enhancing efficiency in the value chain, starting with material processing, up to the subsequent applications. AI-driven modeling helps producers optimize crystal growth, resulting in powders that are suitable for powering electronics and car uses. Moreover, manufacturing plants are introducing AI-powered quality control systems, which identify abnormalities in real-time and decrease wastage, thereby lowering costs.

SiC Powder Market Growth Factors

- Driving Demand for Ultra-Fast Charging Infrastructure: Expanding networks of high-power EV chargers rely on SiC components that deliver reduced switching losses and improved efficiency.

- Boosting Aerospace and Defense Applications: Growing integration of SiC-based power devices in satellites, radar systems, and electric propulsion enhances power consumption in high-reliability domains.

- Rising Emphasis on Energy Efficiency Standards: Stringent government regulations on industrial power electronics accelerate the shift from silicon to SiC solutions.

- Propelling Semiconductor Miniaturization Trends: Advanced chipmakers increasingly adopt SiC substrates to achieve smaller, lighter, and thermally stable devices.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.81 Billion |

| Market Size in 2025 | USD 1.98 Billion |

| Market Size in 2024 | USD 1.84 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.54% |

| Dominating Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Purity Level, Particle Size, Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Increasing Demand for Electric Vehicles Expected to Drive the Growth of the SiC Powder Market?

Increasing demand for electric vehicles is expected to strengthen growth across the SiC powder market. Automakers use Power electronics based on SiC to enhance the efficiency of traction inverters, onboard chargers, and DC-DC converters. Engineers have developed SiC components to achieve higher switching frequencies and reduced conduction losses, thereby increasing driving range and reducing charging time. Industry reports indicate that nearly 14 million new electric cars were registered worldwide in 2023, with a global stock of electric cars reaching 40 million vehicles. (Source: https://www.virta.global)

This reflects the magnitude of component demand that was also experienced during the period. According to the U.S. Department of Energy, the annual sales of new light-duty plug-in vehicles reached 1 million new cars in 2023, which led to OEM sourcing policies and increased activities in the search for high-purity powder grades. Semiconductor industry organizations claimed that suppliers of SiC wafers and devices were limited in ramps. Furthermore, spurring innovation in aerospace and defense applications is likely to boost the utilization of SiC powder. (Source:https://www.energy.gov)

Restraint

High Production Costs Expected to Limit Wider Adoption

High production costs are expected to limit wider adoption, further hindering the market. The processes of energy-intensive carbothermal reduction and advanced purification of SiC powder are employed to produce a high-purity product. The cost pressures make entry into the market by small players difficult, and downstream industries are usually reluctant to abandon their traditional silicon solutions, even though they technically seem to be superior to SiC. Furthermore, the expansion through raw material supply limitations is anticipated to hamper the market growth.

Opportunity

Why Are Growing Investments in Renewable Energy Infrastructure Anticipated to Accelerate SiC Powder Market Growth?

Growing investments in renewable energy infrastructure are anticipated to accelerate the use of SiC powder, further creating immense opportunities for the market. Silicon components that are more energy-efficient and have higher power density are being increasingly incorporated into solar inverters, wind turbine converters, and grid-connected storage systems. Suppliers of powder enjoy renewable targets in Europe, the United States, China, and India that are supported by the government, leading to massive deployment of semiconductor solutions that consume less energy. (Source: https://www.iea.org)

The developers of utility-scale renewable energy are again choosing SiC over traditional silicon due to its high endurance in the presence of high voltage and high temperatures. The International Energy Agency estimated in 2024 that additions to global renewable power capacity hit almost 510 gigawatts, up by 50% in 2024 compared to 2023, the highest growth rate in more than 20 years. According to a verification by the European Commission, solar installations in the EU reached a new annual record in growth. They increased by 56 gigawatts by 2024, highlighting the growing need to develop effective inverter technologies. Furthermore, the surging adoption of 5G networks is projected to elevate demand for SiC powder in high-frequency applications, thus boosting the market.(Source:https://www.solarpowereurope.org)

Type Insights

Why is Black SiC Powder dominating the SiC Powder Market landscape?

The black SiC powder segment dominated the SiC powder market in 2024, accounting for an estimated 55% market share, due to its wide application in abrasive, refractory, and metallurgical applications. Black SiC is being used in industries as grinding wheels, sandblasting media, and refractory linings due to its hardness and being cost-effective than the old material. Furthermore, the influence of the sub-segment is expected to be reinforced by increasing infrastructure development in the Asia-Pacific and increased investments in manufacturing production in India and China.

The green SiC powder segment is expected to grow at the fastest rate in the coming years, owing to its electronics-grade use in semiconductors, power devices, and optoelectronics. Producers use refined green SiC with increased purity and improved edges to wield green SiC for precision grinding, wafer slicing, and thermal management solutions in high-performance electronics. Additionally, the increase in the 5G infrastructure placement is likely to continue the growth of this segment in the coming years.

Purity Level Insights

How are 97–99% Purity Grades Sustaining Leadership in the SiC Powder Market?

The 97–99% segment held the largest revenue share in the SiC powder market in 2024, accounting for 50% of the market share, due to the growing demand of the heavy industries and the manufacturers of abrasives. Additionally, the manufacturers offer a collection of grit sizes and bonded product shapes that are applicable in foundry fluxes, kiln linings, and metallurgical deoxidation, further facilitating the segment.

The ≥99% segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing use of power semiconductors and high-frequency equipment. Device manufacturers are demanding high impurity limits and narrow particle-size distributions in their wafer-grade feedstock. Furthermore, the makers of equipment and scientists of materials are lobbying standardized test methods for 99% powders, thus reducing the qualification process and also enabling faster commercialization in all power electronics industries.

Particle Size Insights

Why Do Micro-sized SiC Powders Hold the Largest Share in the SiC Powder Market?

The micro (200 mesh – sub-micron) segment dominated the SiC powder market in 2024, holding a market share of about 60%, due to its ability to provide consistent hardness, thermal stability, and wear resistance, even in grinding wheels, lapping compounds, and blasting processes. Additionally, the growing prevalence of micro powders used in ceramic matrix composites, structural ceramics, and polishing is expected to propel the segment growth.

Nano-sized powder segment is expected to grow at the fastest CAGR in the coming years, owing to the increase in demand for high-performance electronics, energy storage, and advanced ceramics. The manufacturers refine these powders to obtain high surface area, uniform morphology, and high sintering activity, hence useful in semiconductor substrates, battery anodes, and next-generation composites.

- In 2024, researchers and semiconductor manufacturers also considered nano-sized SiC feedstock to be integrated into thermal management systems and wide bandgap devices due to the reported high power density efficiency. Furthermore, nanoscale powders are also being considered in advanced R&D for aerospace, biomedical implants, and defense applications, further facilitating the market for nano-sized SiC powder.(Source: https://www.mdpi.com)

Application Insights

What Makes Abrasives the Leading Application in the SiC Powder Market?

Abrasives segment held the largest revenue share in the SiC powder market in 2024 accounting for an estimated 35% market share, due to the growing application in automotive, construction, and heavy machinery industries.

The abrasives manufactured by silicon carbide are used by manufacturers of grinding wheels, cutting tools, polishing media, and sandblasting with their high hardness, toughness, and thermal resistance. Moreover, the greater infrastructure development in Asia-Pacific in 2023-2024 and the Indian construction investment were going up in double digits, solidifying the consumption of SiC abrasives.

The electronics & semiconductor segment is expected to grow at the fastest rate in the coming years, owing to the increasing use of wide-bandgap semiconductors in electric vehicles, renewable energy systems, and 5G networks. The producers refine high-purity SiC powders to provide substrates as well as MOSFETs, Schottky diodes, and thermal management solutions, to satisfy industry needs of efficiency in high-voltage and high-temperature environments.

- In 2024, the European EU Chips Act provided funds to finance the development of advanced semiconductor material, such as SiC substrates and wafers, to expeditious supplier and process certification. Furthermore, the governments and industry initiatives were focused on scaling the production of SiC devices via funding, investments in facilities, and qualification roadmaps, and decreasing supplier-to-fab timescales.(Source: https://www.european-chips-act.com)

End-Use Industry Insights

How Is Industrial Manufacturing Maintaining Dominance in the SiC Powder Market?

The industrial manufacturing segment dominated the SiC powder market in 2024, accounting for 40% of market share, due to the material producing a consistent hardness, thermal stability, and abrasion resistance to maintain the life of tools and minimize downtimes. They are used in micro and industrial-grade SiC powders to produce production plants that are intended to be ground, cut, and used as refractories.

Engineers bond SiC-based abrasives and refractories into metalworking, ceramic, and glass production lines to reduce machining time and enhance surface finish tolerances on high-volume assemblies. In the steel, foundry, and mining industries, procurement departments became more restrictive with their supply contracts in 2024 due to increased demand. According to UNIDO, the world was producing more industrial goods at an average annual rate of 3.3% in 2024, which was the highest in the Asia-Pacific region. Additionally, the demand for advanced ceramics and refractories increases steadily in 2024, which supports increased use of mid-purity SiC powders.(Source: https://www.unido.org)

The automotive segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing transport electrification. To make SiC wafers, MOSFETs, and high-efficiency inverters, reducing system losses and thermal management in traction systems, OEMs and tier-one suppliers use 99% purity and nano/micro-engineered powders. In 2024, material scientists had perfected the distribution of the particle size and purity, a factor that reduced the duration of the designation process of the device.

This accelerated the timeframe that large car manufacturers needed to approve their suppliers. The International Energy Agency (IEA) stated that the world had sold more than 14 million units of EVs in 2024, which is an 18% growth over the year 2023, increasing the demand for SiC-based power electronics directly. Furthermore, the semiconductor investment projects throughout the EU aim to boost SiC wafer capacity in the EU to bolster the growth potential of this sub-segment. (Source: https://www.iea.org)

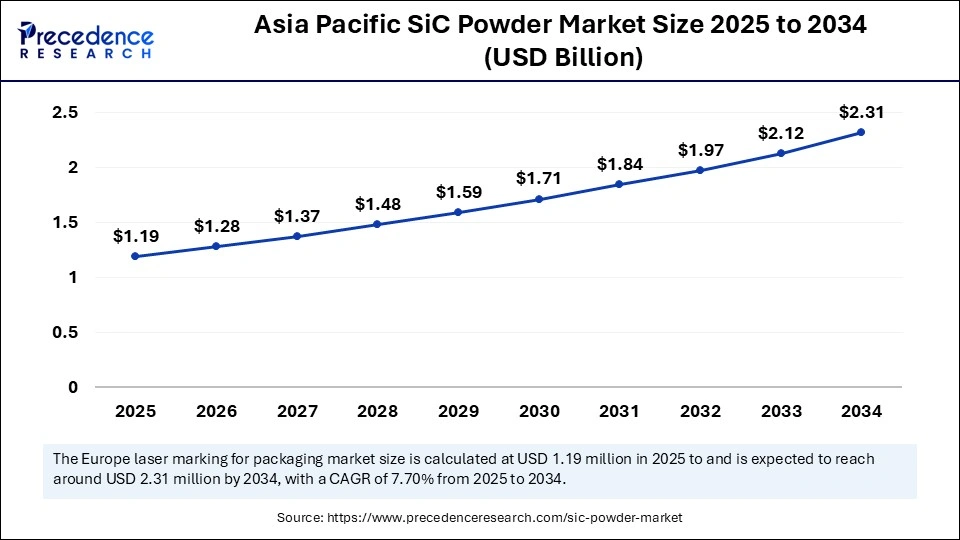

Asia Pacific SiC Powder Market Size and Growth 2025 to 2034

The Asia Pacific SiC powder market size is evaluated at USD 1.19 billion in 2025 and is projected to be worth around USD 2.31 billion by 2034, growing at a CAGR of 7.70% from 2025 to 2034.

Why is Asia-Pacific leading the global SiC Powder Market?

Asia Pacific led the SiC powder market, capturing the largest revenue share in 2024, which held a market share of about 60%, and is seen to sustain the position, due to the presence of large clusters of ceramics, metals, and abrasives in China, India, Japan, and Southeast Asia. This continuous demand for micro- and industrial-grade powders, which are utilized in grinding, refractories, and bonded abrasives, depends. The proximate supply chains enabled the regional manufacturers to reduce the lead times and cut down on logistics costs, and the volume certainty to the powder producers. (Source: https://stat.unido.org)

In 2023, UNIDO claimed that over 56.7% of overall manufacturing value-added was produced in Asia, and in Q4 2024. UNIDO reported that manufacturing continued at an upward trend through Q4 2024, which is cited by procurement teams that are adding more orders to industrial-grade SiC. According to the Indian Ministry of Heavy Industries, new production-based incentives were valued at 2.3 billion dollars. That encompassed materials used in advanced ceramics and high-temperature uses to increase the domestic demand of processed SiC inputs. Additionally, the proximity to the bulk production of powdered SiC further supports the long-term leadership of the region in terms of industrial consumption of SiC.(Source:https://pmedrive.heavyindustries.gov.in)

SiC Powder Market Companies

- Saint-Gobain S.A.

- Washington Mills Electro Minerals Ltd.

- ESD-SIC b.v.

- Navitas Advanced Materials

- AGSCO Corporation

- Carborundum Universal Ltd. (CUMI)

- Grindwell Norton Ltd. (Saint-Gobain subsidiary)

- Entegris, Inc.

- SK Siltron Co., Ltd.

- Dow Corning (DuPont spin-off involvement in SiC)

- Fiven ASA

- Xiamen Powerway Advanced Material Co., Ltd.

- Pacific Rundum Co., Ltd.

- TankeBlue Semiconductor Co., Ltd.

- Snam Abrasives Pvt. Ltd.

Recent Developments

- In August 2025, the Defence Research and Development Organisation (DRDO) announced a major step forward in strengthening India's advanced materials ecosystem by releasing a Request for Proposal (RFP) under the Technology Development Fund (TDF) Scheme. The call invites domestic vendors to participate in the development of high-purity silicon carbide (SiC) source powder, a vital input for bulk crystal growth. This initiative reflects DRDO's push to advance strategic technologies, reduce import reliance, and foster domestic innovation for defence-grade applications.

- In June 2025, Singapore's Agency for Science, Technology, and Research (A*STAR), through its Institute of Microelectronics (IME), launched the world's first 200mm industrial-grade open R&D line for silicon carbide. The facility integrates end-to-end processes, from material growth and defect characterization to device fabrication and testing. Designed to tackle challenges such as high costs and fragmented expertise, the initiative is expected to accelerate the commercialization of SiC for electric vehicles, data centers, and power grid applications.

- In June 2025, alongside the launch of its 200mm SiC R&D line, A*STAR's Institute of Microelectronics (IME) unveiled additional semiconductor initiatives. These include a lead-free piezoMEMS program and a pay-per-use EDA tool platform, designed to expand access to innovation in a cost-intensive sector. By providing open collaboration channels for startups, research institutions, and global companies, IME aims to accelerate market readiness for advanced semiconductor technologies while reducing dependency on closed, infrastructure-heavy models.

(Source: https://idrw.org)

(Source: https://www.expresscomputer.in)

(Source: https://www.trendforce.com)

(Source: https://www.eetimes.com)

(Source: https://www.ieee-pels.org)

(Source: https://www.asm.com)

Segments Covered in the Report

By Type

- Green SiC Powder (High Purity, Electronics Grade)

- Black SiC Powder (Metallurgical & Abrasives Grade)

By Purity Level

- < 97% (Industrial Grade)

- 97–99% (Refractory & Abrasives Grade)

- ≥ 99% (Semiconductor & Electronics Grade)

By Particle Size

- Macro (Above 200 mesh)

- Micro (200 mesh – sub-micron)

- Nano-Sized Powder

By Application

- Abrasives (Grinding, Cutting, Lapping, Polishing)

- Refractories (Kiln Furniture, Foundry Products)

- Metallurgical Applications (Deoxidizers, Recarburizers)

- Ceramics (Armor, Wear Parts, Thermal Components)

- Electronics & Semiconductors (SiC Wafers, Power Devices)

- Energy (Solar, Nuclear, LEDs)

- Others (Composite Materials, Additive Manufacturing)

By End-Use Industry

- Automotive & Transportation (EVs, Brakes, Clutches)

- Electrical & Electronics (Power Devices, 5G, LED)

- Aerospace & Defense

- Energy & Power (Renewables, Nuclear)

- Industrial Manufacturing

- Healthcare (Medical Devices, Implants – limited use)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting