Solder Materials Market Size and Forecast 2025 to 2034

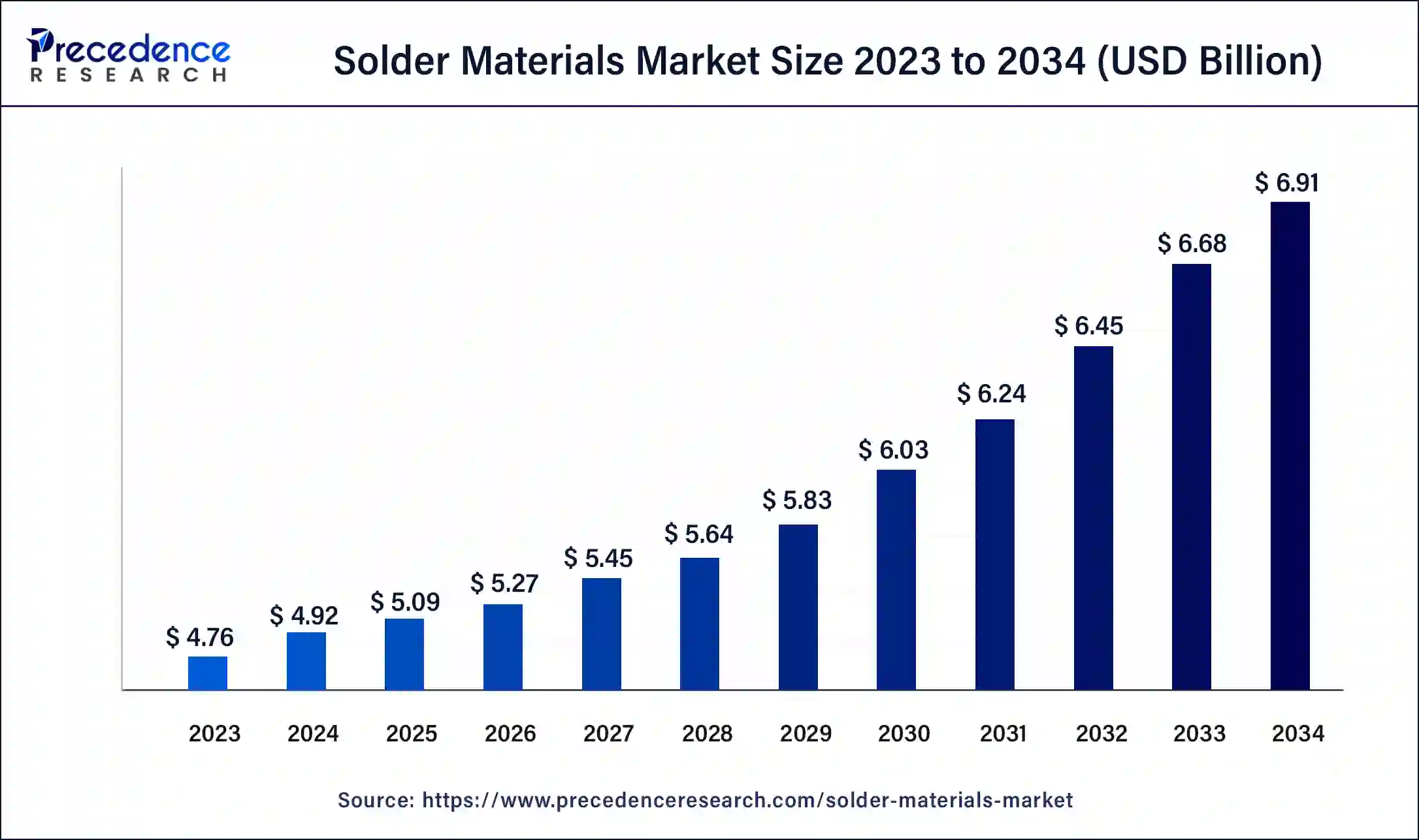

The global solder materials market size was valued at USD 4.92 billion in 2024 and, and is projected to hit around USD 5.09 billion by 2025, is anticipated to reach around USD 6.91 billion by 2034, growing at a CAGR of 3.44% over the forecast period 2025 to 2034. Proliferation of smart electronics in various applications like automotive, consumer electronics, aerospace and defence are fuelling the demand for robust supply chain for solder materials, driving the solder materials market globally.

Solder Materials Market Key Takeaways

- In terms of revenue, the market is valued at $5.09 billion in 2025.

- It is projected to reach $6.91 billion by 2034.

- The market is expected to grow at a CAGR of 3.46% from 2025 to 2034.

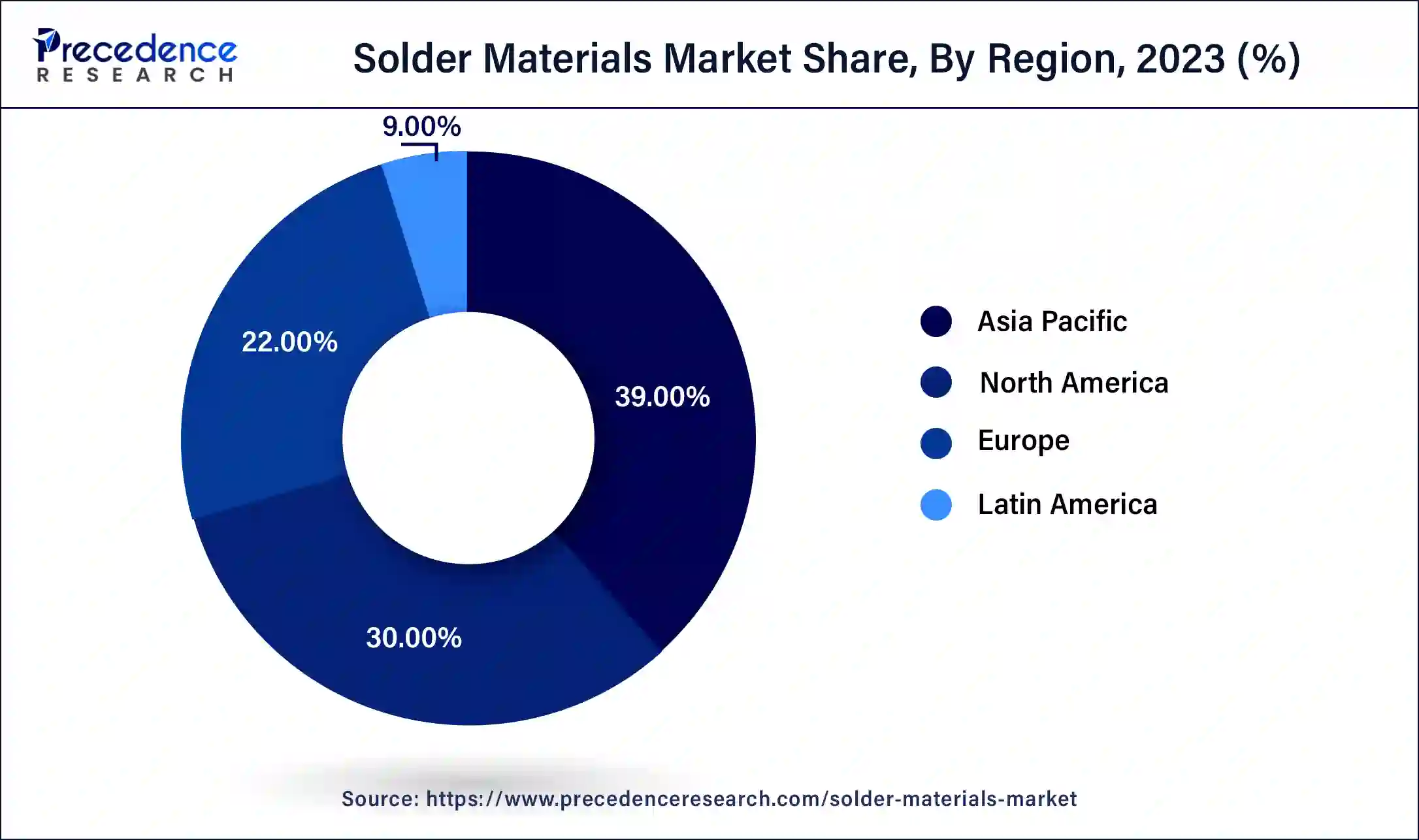

- Asia Pacific accounted for the largest market share of 39% in 2024.

- North America is anticipated to witness the fastest growth in the market during the forecasted years.

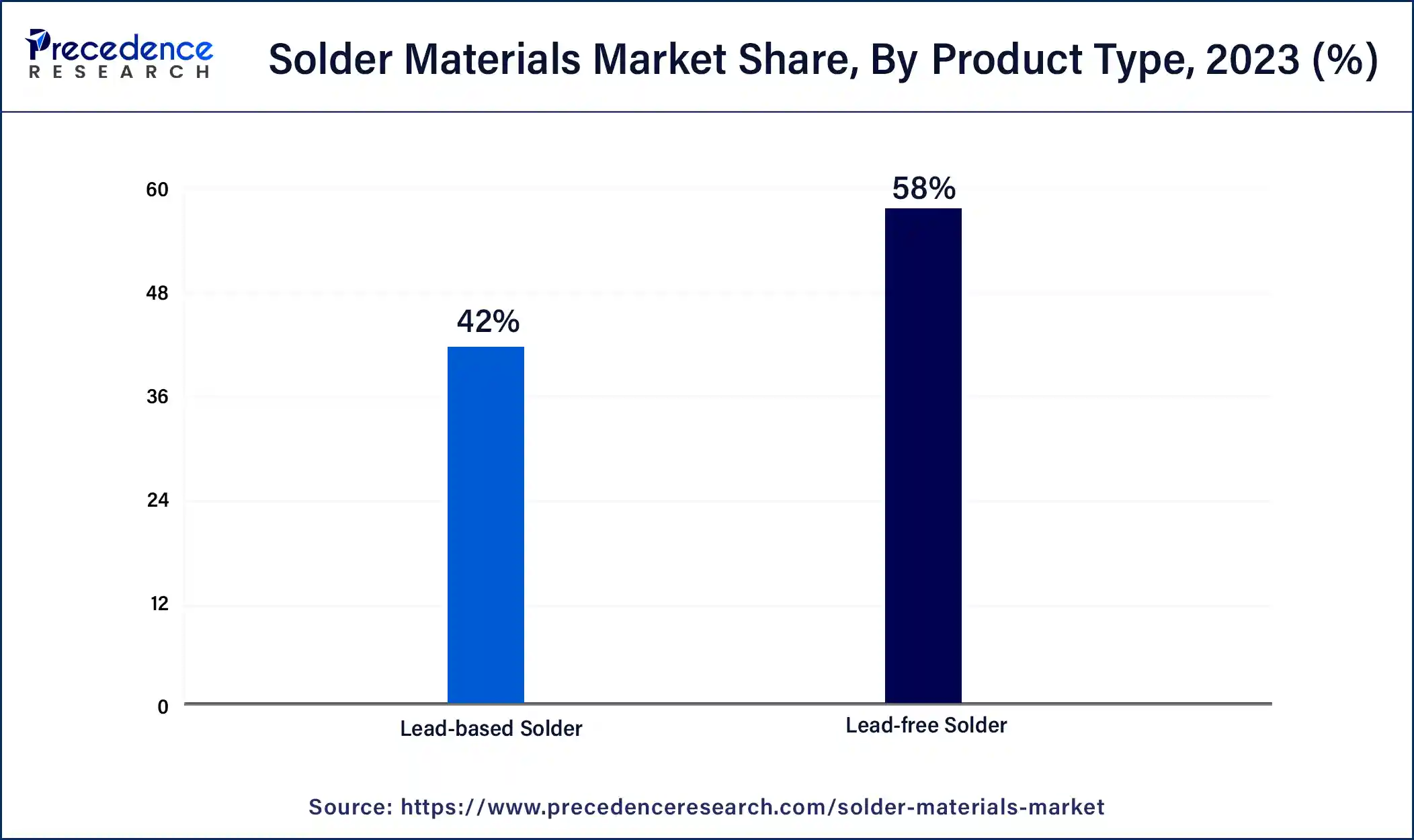

- By type, the lead-free solder segment generated the highest market share of 58% in 2024.

- By type, the lead-based solder segment will register as the fastest growth in the market in the upcoming period.

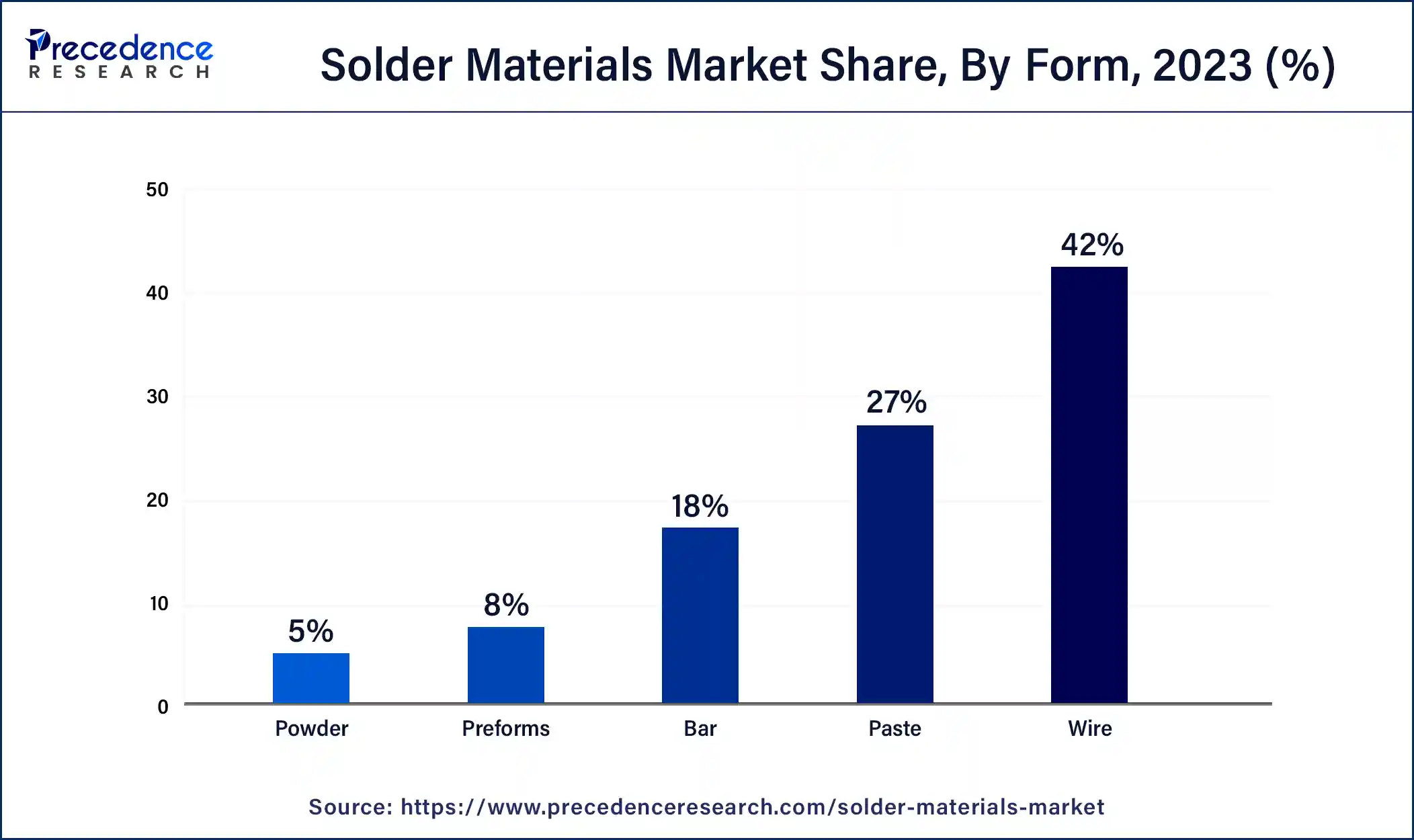

- By product, the wire segment recorded the highest market share of 42% in 2024.

- By process, the wave/reflow segment accounted for the largest share of the market in 2024.

- By end-use industry, the consumer electronics segment has held the largest market share of 61% in 2024.

- By end use, the automotive segment is projected to witness the fastest growth in the market during the foreseeable period.

AI Impact on the Solder Materials Market

AI is significantly impacting the solder materials market by optimizing production processes and enhancing the performance of products while improving quality as well. Machine learning algorithms allow predictive maintenance to reduce downtime and increase efficiency in manufacturing. AI-based systems analyze a huge amount of data in real-time, which allows precise control over the manufacturing process of soldering. It helps acknowledge the temperature control needed, the composition of the material, and other crucial parameters while soldering.

Additionally, AI also helps to detect defect and quality assurance with the help of advanced imaging techniques to detect flawed parts that might missed by human detection method. It leads to lower cost, few defects and lower wastes and increases overall quality of the product.

Asia Pacific Solder Materials Market Size and Forecast 2025 to 2034

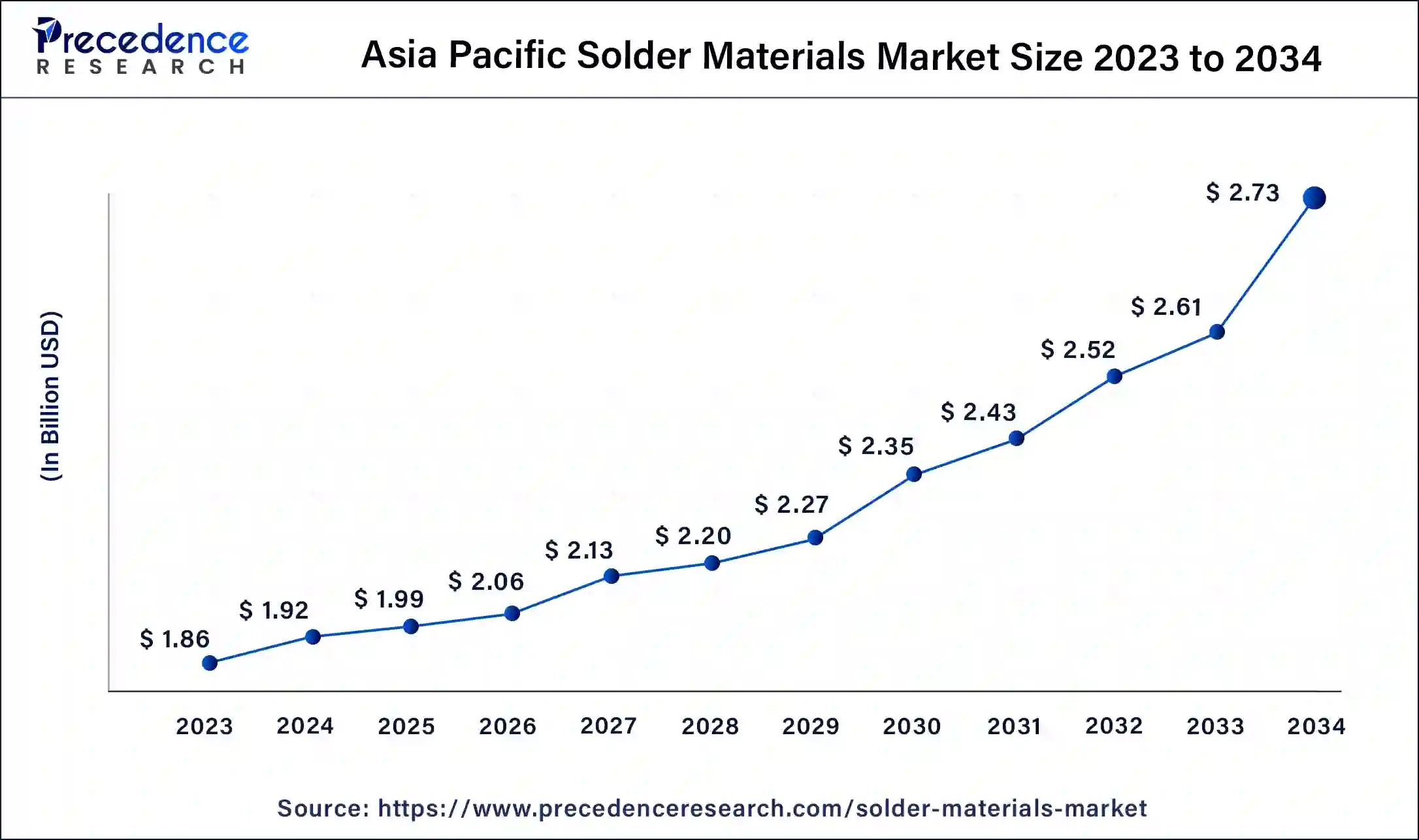

Asia Pacific solder materials market size is exhibited at USD 1.99 billion in 2025 and is projected to be worth around USD 2.73 billion by 2034, poised to grow at a CAGR of 3.58% from 2025 to 2034.

Asia Pacific accounted for the largest share of the solder materials market in 2024. The region's leadership is due to the proliferation of the electronics sector in the economically developing countries of China, Japan, and South Korea. Large-scale production of consumer electronics, semiconductors, and automotive electronics is the driving factor of the Asia Pacific market.

- In August 2024, CLINTON, NY, as one of the leading materials providers to the electronics assembly industry, Indium Corporation is proud to feature its innovative Durafuse solder technology at Productronica India.

In addition to this, robust supply chain and, strong infrastructure investments, and the adoption of cutting-edge technology in the electronics sector are fuelling the market further. Also, due to the growing urban population in Asia Pacific, many governments and public-private partnership projects aimed toward the development of public infrastructure and utility infrastructure have been initiated in the region.

In May 2025, the Union Cabinet approved a ₹3,706 crore semiconductor manufacturing facility to be set up in Jewar, Uttar Pradesh, as a joint venture between HCL and Foxconn. The new unit will be set up near Jewar Airport in the Yamuna Expressway Industrial Development Authority (YEIDA) region. The facility will produce display driver chips for mobile phones, laptops, automotive systems, PCs, and other devices with display interfaces. The plant will have a design capacity of 20,000 wafers per month.

- In May 2022, the Asian Development Bank (ADB) approved a policy-based loan to help the government of the Philippines for the development of infrastructure projects during the upcoming period.

North America is anticipated to witness the fastest growth in the solder materials market during the forecasted years. The growth of this region is due to various factors, such as the strong presence of major key players expanding in the electronics, aerospace, automotive, and defense sectors. The increasing inclination to adopt EVs and the proliferation of renewable energy sectors is driving the demand for high-performance solder materials. Reliable and efficient soldering is required due to the stringent government regulations and the rise in the automated manufacturing sector.

North America has also benefited from technological advancements in the metal alloy and its usage for the soldering process, leading to market expansion in the region. Also, lead-free and eco-friendly alternatives promoted by the government supported the market strongly and strengthened its roots globally. Promoting sustainable and environmentally friendly practices with a robust infrastructure for the supply chain is fuelling the growth of the market in North America.

Market Overview

The solder materials market is expanding for various reasons, such as increasing demand for smart electronics in various applications, which is further anticipated to hold its dominance over the globe. Traditional solder materials have several drawbacks, including high melting temperature point, which causes unwanted stress during the process of reflow, and defects in the joints, which leads to restricted applications. To overcome these drawbacks, various sub-microns and nanoparticle-based solder materials have been introduced in recent years.

Region-wise, the U.S. solder material market is anticipated to propel primarily due to the expansion of the electronics refurbishing industry. The presence of electronic aftermarkets and increasing production of electronic devices fuelling the solder materials market growth. For advanced solder materials production like Sn-Bi-Ag alloy is introduced by major key players with the help of huge investments in the field of R&D for solder material mitigates the thermal excursion during assembly, eliminating the compulsion to use conventional wave soldering method and increases energy efficiency.

Solder Materials Market Growth Factors

- Expanding sector for smart electronics.

- Introduction of sub-microns and nano-particle-based solder materials by major key players.

- Growing electronic refurbishing industry.

- Extensive research and development for advanced solder materials.

- Introduction of eco-alternatives for lead soldiers due to their toxic nature.

- Introduction of automation process in soldering method.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.91 Billion |

| Market Size in 2025 | USD 5.09 Billion |

| Market Size in 2024 | USD 4.92 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.44% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Form, Process, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Expansion of the smart electronics sector

A significant driver for the solder materials market is the expansion of the electronics industry, which is fueled by ongoing advancements and automation integration. Electronic solder helps to connect electric wires to devices, and electronic components to Printed circuit board-PCB. There is a material known as flux, found inside a core of solder, which aids in improving mechanical strength along with electrical contact. A lead-free rosin core solder is a common type of electronic solder used widely in the electronic industry, and it is generally made of tin and copper alloy. The electronic market has computers, communication devices, servers, and electronic consumer goods. Different electronic products need various types of electronic soldiers.

Moreover, the driving factors for PCB and mount devices include the rising trend for the miniaturization of mobile devices like touch screens and displays. Rising demand for these products increases the consumption of solder materials. The solder material market is also expected to proliferate due to energy-efficient devices and the manufacturing of electronic devices in emerging nations like India and China.

Restraints

Volatile nature of raw material prices

The major drawback for the solder material market is the volatile nature of raw material prices, creating a barrier to the expansion of the market globally. Manufacturing of solder materials such as steel, copper, brass, and aluminum depends upon the availability of the materials, including the affordability of these raw materials for soldering. Despite the numerous applications of soldering, its price can vary due to market volatility. Prices of raw materials are totally dependent upon the global economic conditions, the supply and demand balance of the materials, inventory availability, and storage. Any kind of disruption leads to a shortage of raw materials and causes hindrances in the global solder materials market.

Opportunity

The rapid growth of EV adoption

A significant opportunity that the solder materials market presents is the rapid growth of EVs across the globe with technological advancements, fuelling the market indirectly. Since solder materials play important roles in the production of EV components, propelling the solder materials demand on a larger scale. Governments worldwide put stringent regulations in place to lower carbon emissions and clean energy usage, enabling an increase in demand for reliable and high-performance solder materials. With the growing adoption of EVs, specialized solder materials that can be compatible with technically advanced automobiles play a crucial role.

Product Type Insights

The lead-free solder segment is estimated to have the largest share of the solder materials market in 2024. The dominance of this segment is due to the stringent regulations for environmental safety. Developed countries like America and Europe have imposed strict regulations for hazardous chemical wastes by major industrial companies, fuelling the adoption of lead-free products in the market and driving the lead-free solder segment in the global market. Counterparts for lead-based alloys are tin, copper, and silver alloys, which are like the performance lead-based alloys but work as lead-free soldering. This transition is growing in the market due to the inclination of consumers toward eco-friendly products in the electronics industry.

The lead-based solder segment will register as the fastest growth in the solder materials market in the upcoming period. The growth of this segment is due to the benefits offered by lead-based products, like excellent mechanical properties, low cost, and easy usage. Such advantages make it an ideal choice for various applications. Also, it has a lower melting point, which ensures less thermal damage, which is again an additional benefit.

FormInsights

The wire segment dominated the global solder materials market in 2023. The market is further segmented into paste, bar, performs, and powder. The growth of the wire segment is due to the increasing application in electronics manufacturing. The wire is versatile and user-friendly, which is an important aspect of the connection between the PCB and the components mounted on it. The wire is generally used in rework processes and manual soldering methods, therefore fuelling this segment's growth.

Process Insights

The wave/reflow segment accounted for the largest share of the solder materials market in 2023. The growth of this segment is due to the proliferation of surface mount technology, namely, MIT. This process delivers highly precise, consistent, and efficient soldering; hence, wave/reflow soldering is used in the mass production of electronic components. Since the consumer and electronics sectors are expanding at a noticeable rate, wave/reflow soldering asserts its dominance in the solder materials market due to the preference of most manufacturers.

ApplicationInsights

The electronics segment led the global solder materials market in 2023. The significance of this segment is related to the innovations in smartphones, IoT devices, and wearable devices, underscoring the need for a soldering method. The increase in the semiconductor industry and miniaturized components further proliferate the electronics segment.

- In June 2024, China's electronics manufacturing industry posted a strong performance in the first four months of this year. The combined profits of major companies in the sector soared 75.8 percent year on year to 20.3 billion U.S. dollars in the January to April period, according to the Ministry of Industry and Information Technology.

The automotive segment is projected to witness the fastest growth in the solder materials market during the foreseeable period. The growth of this segment is due to the global adoption of hybrid and electric vehicles instead of conventional petrol-based vehicles. Advancements in EVs, such as autonomous driving technology and other multimedia systems, are fuelling the automotive segment in the solder materials market.

- According to data from Wards Intelligence, the combined sales of hybrid vehicles, plug-in hybrid electric vehicles, and battery electric vehicles (BEV) in the United States rose to 16.3% of total new light-duty vehicle (LDV) sales in 2023.

Solder Materials Market Companies

- Element Solution Inc

- Fusion, Inc

- Henkel AG & Co. KGaA.

- Indium Corporation

- Koki Company Limited

- Lucas Milhaupt

- Premier Industries

- Qualitek International, Inc

- Senju Metal Industry Co., Ltd

- Shital Metals Pvt Ltd

- Stannol GmbH Co. KG

Recent Developments

- In September 2024, Tata Electronics signed a memorandum of understanding (MOU) with Tokyo Electron to acquire equipment and services for its under-construction chip units in Gujarat and Assam. The collaboration will also focus on workforce training and R&D initiatives, aiming to produce semiconductor chips for various applications globally.

- In February 2025, Yamaha Motor announced its plan to launch a new YRP10e entry-level solder paste printer with a focus on ease of use while inheriting the base performance of the premium YRP10 printer. The new generation of the YR Series platform has excellent rigidity and is equipped with Yamaha's proprietary 3S head and stencil adsorption function, providing high-speed printing performance with a core tact time of 6 seconds and a high printing accuracy.

- In April 2025, AIM Solder, a leading manufacturer of solder assembly materials, announced a strategic partnership with Persang Alloy Industries Pvt. Ltd. (PAI), one of India's largest manufacturers of solders. The collaboration marks a significant step in expanding product offerings and enhancing service capabilities for customers around the world.

- In September 2024, DELO conducted in-house feasibility studies, electrically and mechanically connecting miniLED dice using directional conductive adhesives.DELO proves the feasibility of adhesives as soldering alternatives for mini LEDs

- In July 2022, Indium Corporation partnered with Safi-Tech to innovate and develop new solder products. This collaboration seeks to bolster Indium's solder materials portfolio by integrating cutting-edge solutions and technologies. By harnessing Safi-Tech's specialized knowledge, the partnership is dedicated to crafting high-performance solder products, ensuring they align with the industry's dynamic demands.

Segments Covered in the Report

By Product Type

- Lead-based Solder

- Lead-free Solder

By Form

- Wire

- Paste

- Bar

- Preforms

- Powder

By Process

- Screen Printing

- Wave/Reflow

- Selective Soldering

By Application

- Electronics

- Automotive

- Aerospace

- Industrial

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting