What is the Solder Flux Market Size?

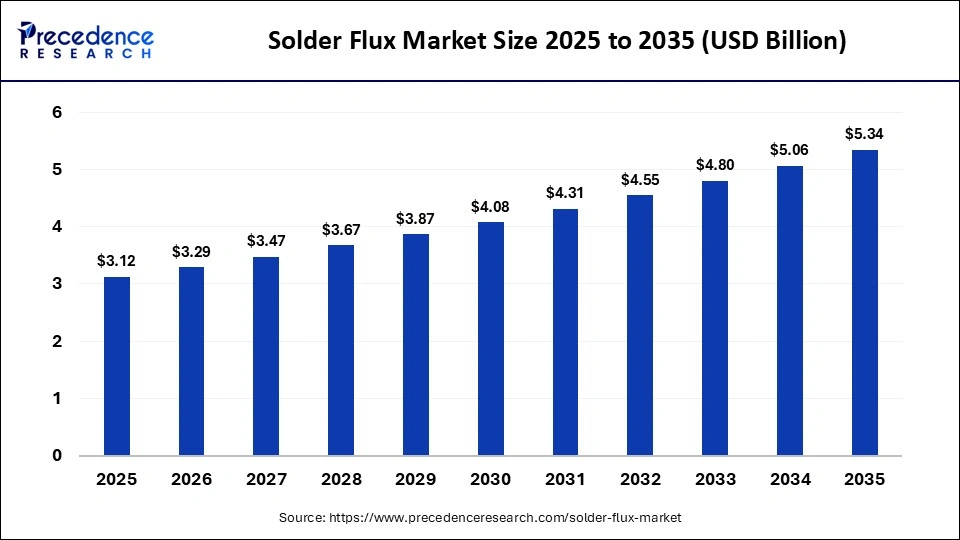

The global solder flux market size was calculated at USD 3.12 billion in 2025 and is predicted to increase from USD 3.29 billion in 2026 to approximately USD 5.34 billion by 2035, expanding at a CAGR of 5.53% from 2026 to 2035. The market for solder flux is experiencing unprecedented growth, driven by rapid advancements in manufacturing technologies and increasing demand across various sectors such as the automotive, consumer electronics, and telecom industries.

Market Highlights

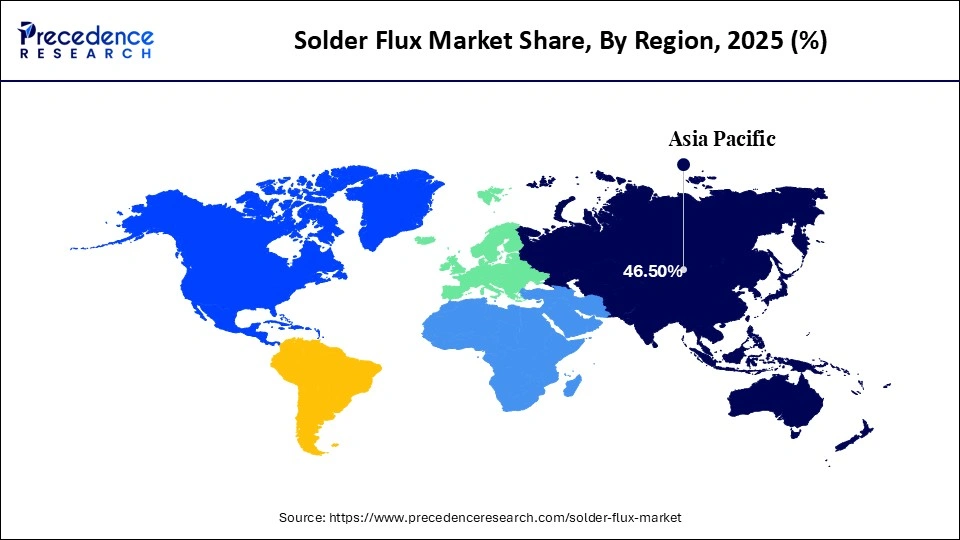

- Asia Pacific dominated the market, holding the largest market share of 46.5% in 2025.

- North America is expected to grow at a CAGR of 6.0% between 2026 and 2035.

- By product type, the no-clean flux segment held the major market share of 51.7% in 2025.

- By product type, the rosin-based flux segment is growing at a remarkable CAGR of 5.2% between 2026 and 2035.

- By application/soldering process, the reflow soldering segment contributed the biggest market share of 48.7% in 2025.

- By application/soldering process, the selective soldering segment is poised to grow at a CAGR of 5.25% between 2026 and 2035.

- By form, the liquid flux segment generated the highest market share of 42.5% in 2025.

- By form, the paste flux segment is expanding at a CAGR of 5.1% between 2026 and 2035.

- By end-use industry, the consumer electronics segment captured the largest market share of 42.4% in 2025.

- By end-use industry, the automotive segment is set to grow at a notable CAGR of 5.3% between 2026 and 2035.

Solder Flux Market Overview

The solder flux market encompasses chemical formulations used in soldering processes to clean and activate metal surfaces, remove oxides, and promote proper wetting, solder flow, and joint integrity across electronics, automotive, industrial, and electromechanical assemblies. These formulations play a critical functional role in ensuring electrical reliability, mechanical strength, and long-term performance of solder joints, particularly as component sizes shrink and circuit densities increase.

Flux types, including no-clean, rosin-based, and water-soluble systems, are selected based on assembly requirements, residue tolerance, and post-soldering cleaning needs. No-clean fluxes are widely used in high-volume electronics manufacturing where minimal residue and reduced cleaning steps are required. Rosin-based fluxes continue to be applied in applications demanding strong activation for challenging surface conditions, while water-soluble fluxes are preferred in high-reliability sectors that mandate thorough residue removal.

These flux formulations support efficient and repeatable soldering across printed circuit board manufacturing, surface mount technology assembly lines, and controlled reflow soldering processes. As electronics manufacturers adopt finer pitch components, lead-free solders, and higher thermal profiles, flux chemistry is increasingly engineered to deliver precise activation windows, thermal stability, and compatibility with automated, high-throughput production environments.

How Are AI-Driven Innovations Reshaping the Solder Flux Market?

In the rapidly evolving technological landscape, the integration of artificial intelligence (AI) is significantly accelerating the growth of the solder flux market by embedding data-driven control across formulation, application, and inspection stages. In manufacturing environments, AI-enabled process control systems continuously analyze temperature profiles, solder paste behavior, flux activity windows, and conveyor speeds, allowing real-time adjustment of process parameters. This reduces defect rates such as insufficient wetting, solder balling, and void formation, while also lowering material waste and improving overall yield in high-volume electronics assembly lines.

AI is increasingly integrated into robotic soldering and dispensing systems, where machine learning models optimize flux volume, placement accuracy, and dispensing speed based on board design, component density, and solder alloy characteristics. These systems enhance speed, precision, and repeatability, which is critical for surface mount technology lines handling fine-pitch components, micro-BGAs, and high-density interconnect boards. Automated flux application driven by AI reduces operator dependency and ensures consistent coverage across complex PCB layouts.

Solder Flux Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to experience accelerated growth. The growth of the solder flux market is driven by the rising expansion of electronics production, rapid growth in automotive electronics, and strong pushes for lead-free/halogen-free solutions for environmental compliance (RoHS).

- Global Expansion: Several leading players in the solder flux market, including Indium Corporation, Heraeus, and AIM Solder, are employing various strategic initiatives to strengthen their global footprint and meet the ongoing demand from the automotive, electronics, and telecommunications industries through strategic initiatives such as new investments in new production facilities and strategic partnerships/collaborations. For instance, in June 2024, AIM Solder, a leader in delivering innovative solder assembly materials, announced a new distribution partnership with EIS, North America's leading specialty distributor and fabricator of electrical and electronic process materials. This partnership intends to significantly enhance AIM Solder's distribution network in Mexico, providing extensive access to our superior solder products through EIS's well-established channels.

- Sustainability Trends: Sustainability is reshaping the solder flux market landscape, with a rising demand for eco-friendly and high-performance fluxes and stringent environmental requirements. Regulations like Restriction of Hazardous Substances (RoHS) and REACH have mandated the phase-out of lead in electronic manufacturing, which increases the use of high-performance lead-free fluxes. The market is experiencing a strong push for fluxes that are halogen-free, less toxic, and with lower VOC emissions. Several manufacturers are increasingly investing in R&D to create formulations using non-toxic components that are safer for both the environment and workers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.12 Billion |

| Market Size in 2026 | USD 3.29 Billion |

| Market Size by 2035 | USD 5.34 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.53% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application/Soldering Process, Form, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

What Causes the No-Clean Flux Segment to Dominate the Solder Flux Market?

The no-clean flux segment held the largest market share of 51.7% in 2025. No-clean fluxes are designed to leave minimal, non-corrosive, and non-conductive residue post-soldering process, which eliminates the need for post-soldering cleaning to save time, material, and cost in electronics manufacturing. The growth of the segment is driven by the increasing demand from consumer electronics, automotive, and automation, which are driving the demand for advanced formulations like no-clean.

The rosin-based flux segment is expected to grow at a remarkable CAGR of 5.2% between 2026 and 2035. Rosin flux is more sustainable and considered a natural alternative to synthetic fluxes. With the increasing emphasis on eco-friendly manufacturing practices, several manufacturers are actively seeking and adopting the rosin-based fluxes. Rosin-based flux is rapidly gaining popularity due to its improved performance and reliability in applications across various industries.

Application/Soldering Process Insights

Which Segment Is Dominated by the Application/Soldering Process in the Solder Flux Market?

The reflow soldering segment is dominating the solder flux market by holding a majority share of 48.7% in 2025. The growth of the segment is driven by the increasing trend for miniaturization, IoT, 5G, and automotive electrification (EVs). Moreover, the rising demand for energy-efficient, reliable, and sustainable flux solutions across the automotive, consumer, and aerospace sectors.

On the other hand, the selective soldering segment is expected to grow at a significant CAGR of 5.25% between 2026 and 2035. The growth of the segment in the solder flux market is driven by the increasing miniaturization of electronic devices, rising adoption of sustainable manufacturing practices, and the growing demand for high reliability across various industries, including automotive electronics (particularly for electric vehicles and ADAS), defense, aerospace, and others. Additionally, the increasing trend toward automation and Industry 4.0 integration is anticipated to drive the growth of the segment in the coming years.

Form Insights

What Causes the Liquid Flux Segment to Dominate the Solder Flux Market?

The liquid flux segment is dominating the solder flux market with a 42.5% share in 2025, largely because liquid formulations integrate seamlessly into automated, high-throughput soldering environments. Liquid fluxes are particularly well suited for wave soldering, selective soldering, and spray or foam fluxing systems used in large-scale PCB assembly, where uniform coverage, controlled activation, and repeatable application are essential. Their low viscosity allows precise deposition on densely populated boards, supporting consistent solder wetting and reduced defect rates across long production runs.

On the other hand, the paste flux segment is the fastest-growing in the solder flux market with a 5.1% expected CAGR, driven by structural shifts in electronics design and assembly. Paste fluxes are increasingly preferred in applications requiring localized, high-precision soldering, particularly in surface mount technology lines assembling fine-pitch components, micro-connectors, and advanced packaging formats. Their controlled rheology supports accurate placement during stencil printing and automated dispensing, which is critical for minimizing bridging and voids in miniaturized assemblies.

End Industry Insights

What Has Led the Consumer Electronics Segment to Dominate the Solder Flux Market?

The consumer electronics segment dominated the solder flux market in 2025 with a 42.4% share. The growth of the segment is majorly attributed to the increasing continuous demand for devices like smartphones, tablets, and wearables, requiring high-quality, reliable soldering for miniaturized components, driving innovation in flux for better performance and efficiency. The rising shift towards AI, IoT, and smart devices propels demand for new electronic gadgets, driving the growth of the segment in the coming years.

On the other hand, the automotive segment is a significant and rapidly growing application segment with a 5.3% expected CAGR. The growth of the segment is primarily driven by the surging demand for high-performance and reliable soldering in complex components like infotainment, ADAS, and EV battery systems. The increasing trends in miniaturization and stringent environmental rules are anticipated to propel the segment's expansion in the coming years.

Regional Insights

What is the Asia Pacific Solder Flux Market Size?

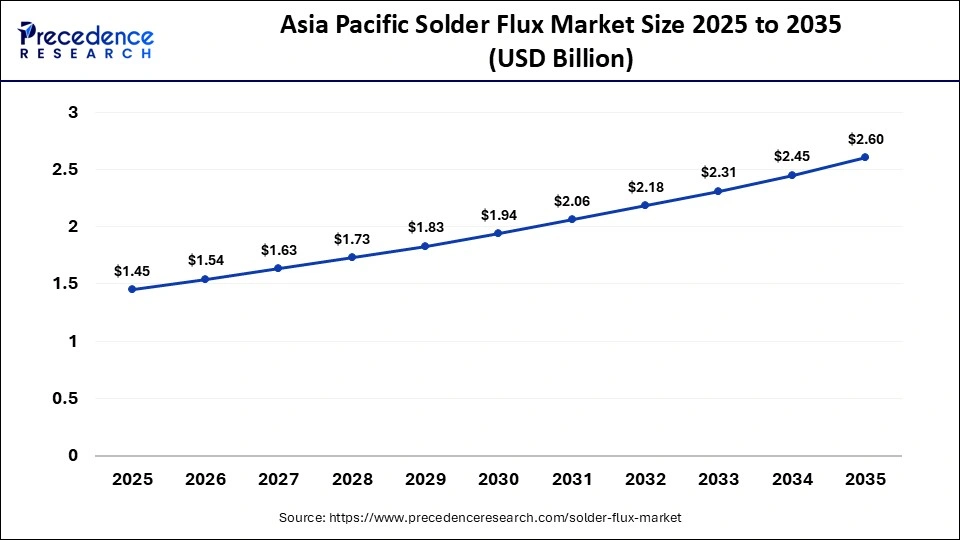

The Asia Pacific solder flux market size is expected to be worth USD 2.60 billion by 2035, increasing from USD 1.45 billion by 2025, growing at a CAGR of 6.00% from 2026 to 2035.

What Has Led the Asia Pacific Region to Dominate the Solder Flux Market?

Asia Pacific dominated the solder flux market in 2025, holding the largest market share, driven by strong end-market demand and manufacturing scale rather than short-term cyclical factors. Leadership is supported by high consumer demand for electronics, active government support for domestic electronics production, and accelerating adoption of eco-friendly and lead-free soldering materials. Widespread implementation of Industry 4.0 practices across electronics assembly plants is also increasing demand for advanced solder flux formulations that deliver consistent performance in highly automated SMT and selective soldering environments.

The region hosts the world's most concentrated electronics manufacturing base across China, South Korea, Japan, and Taiwan, where large-scale production of semiconductors, consumer electronics, automotive electronics, and telecom equipment sustains high solder flux consumption. The presence of established regional suppliers such as DUKSAN Hi-Metal Co., Ltd., KOKI Company Ltd., Tamura Corporation, and Nihon Superior Co., Ltd. further strengthens supply-chain depth and accelerates adoption of next-generation flux chemistries tailored to fine-pitch, high-density PCB assemblies.

China Solder Flux Market Analysis

China leads the solder flux market. China is a major contributor to the solder flux market, driven by the rapid adoption of automation for high-volume production, increasing shift to lead-free soldering, rapid industrialization, and rising government initiatives such as Made in China 2025. The high domestic production and increasing demand for consumer electronics, such as smartphones, PCs, and other gadgets are accelerating the market's revenue. In addition, the stringent environmental regulations and increasing demand for eco-friendly and high-performance fluxes are substantially spurring the demand for solder flux. Such a combination of factors is anticipated to boost the growth of the solder flux market in the Asia Pacific region.

What Causes the North American Solder Flux Market to Grow at the Fastest-Growing CAGR?

The North American region is emerging as the fastest-growing market for solder flux, supported by accelerating adoption of IoT, AI, and Industry 4.0 technologies across electronics manufacturing. These technologies are driving higher levels of automation, tighter process control, and increased PCB complexity, which in turn require advanced solder flux formulations capable of delivering consistent wetting, residue control, and reliability under fine-pitch and high-density assembly conditions. Manufacturers across the region are upgrading SMT lines, selective soldering systems, and automated inspection platforms, increasing demand for high-performance liquid and paste fluxes tailored for automated production environments.

Growth is further reinforced by a strong shift toward green manufacturing practices, largely driven by stringent environmental and workplace regulations enforced by agencies such as the U.S. Environmental Protection Agency. These regulations are accelerating adoption of low-VOC, halogen-free, and lead-free flux chemistries across electronics and automotive assembly operations. In parallel, rapid expansion of the electronics industry, rising production of automotive electronics, increasing consumer purchasing power, and continued rollout of 5G infrastructure are increasing PCB production volumes, directly supporting higher solder flux consumption across North America.

United States Solder Flux Market Analysis

The United States solder flux market is experiencing significant growth, driven by a combination of regulatory pressure, advanced manufacturing practices, and rising demand from electronics-intensive industries. Strict emission and workplace safety regulations at the federal and state levels are accelerating the transition toward low-VOC, halogen-free, and lead-free flux formulations, particularly in high-volume electronics manufacturing. At the same time, a strong focus on industrial automation is reshaping soldering operations, with manufacturers deploying highly automated SMT lines, selective soldering, and precision dispensing systems that require fluxes with consistent activation behavior and minimal residue.

Growth is further reinforced by ongoing miniaturization trends and expanding electronics content across automotive, telecommunications, and consumer electronics sectors. Increasing production of electric vehicles, ADAS modules, telecom infrastructure, and compact consumer devices is driving demand for high-performance fluxes capable of supporting fine-pitch components and dense PCB layouts.

Which Factors Are Responsible for the Growth of the Solder Flux Market in the European Region?

The European region holds a substantial market share in the solder flux market, driven by rising adoption of industrial automation to achieve consistent flux application and solder joint quality. Electronics manufacturers across the region are investing in advanced surface mount technology lines, selective soldering systems, and automated inspection to support high-reliability assembly requirements. At the same time, increased investment in 5G infrastructure is expanding demand for telecom equipment, base stations, and networking hardware, all of which require high-density PCB assemblies and precise soldering processes that rely on stable and high-performance flux formulations.

Regulatory pressure is a defining growth driver in Europe. Strict environmental and chemical compliance frameworks enforced across the European Union are compelling manufacturers to adopt lead-free and halogen-free soldering solutions, directly influencing flux chemistry selection. Rapid expansion of the consumer electronics industry is further reinforcing demand, with rising production of smartphones, tablets, wearables, smart home appliances, and connected devices increasing PCB manufacturing volumes. This combination of automation-driven quality requirements, telecom infrastructure rollout, and regulation-led transition to compliant soldering materials is sustaining steady flux demand across European electronics manufacturing hubs.

Germany Solder Flux Market Analysis

Germany is experiencing significant growth in the solder flux market, supported by continued industrial expansion and the rising integration of electronics in vehicles, particularly in electric vehicles and advanced driver-assistance systems. Automotive electronics manufacturing in the country requires high-reliability soldering for power electronics, sensors, control units, and connectivity modules, which is increasing demand for advanced liquid and paste fluxes compatible with fine-pitch components and lead-free solders. In parallel, growing product applications in the telecommunications sector, including network infrastructure, data centers, and industrial communication equipment, are reinforcing steady consumption of solder flux across high-density PCB assembly lines. Rapid advancements in manufacturing technologies are further shaping demand patterns. German electronics manufacturers are adopting highly automated surface mount technology lines, selective soldering, and precision dispensing systems that require flux formulations with tight activation windows and residue control.

What Are the Significant Factors Driving the Growth of the Middle East & Africa Region in the Solder Flux Market?

The solder flux market is expected to grow at a notable rate in the Middle East & Africa region. The Middle East & Africa region's growth is primarily driven by the rapid expansion of manufacturing and industrial activities and rising demand for consumer electronics such as smartphones, wearables, and IoT devices. The supportive government initiatives, such as smart city projects in the UAE, Dubai, and Saudi Arabia, substantially increased the adoption of flux for connected devices. Additionally, the stringent environmental regulations and integration of smart technologies, such as IoT, AI, and automation, significantly contribute to the region's growth.

South Africa Solder Flux Market Analysis

The country is experiencing remarkable growth. The country's growth is driven by rapid industrial growth, increasing investment in smart infrastructure development, rising adoption of industrial automation, and an increasing shift towards eco-friendly solutions. The increasing demand for automotive electronics and consumer electronics is driving the demand for high-quality soldering materials for complex PCBs. These factors collectively are expected to propel the

Who are the Major Players in the Global Solder Flux Market?

The major players in the solder flux market include Henkel AG & Co. KGaA, Kester (Illinois Tool Works Inc.), Alpha Assembly Solutions, Indium Corporation, AIM Solder, Senju Metal Industry Co., Ltd., Heraeus Holding GmbH, Shenmao Technology Inc., Tamura Corporation, Inventec Performance Chemicals, KOKI Company Ltd., Balver Zinn Josef Jost GmbH & Co. KG, Superior Flux & Mfg. Co., MG Chemicals, and Nordson Corporation.

Recent Developments

- In August 2025, Indium Corporation, a global leader in materials refining, smelting, manufacturing, and supply, announced the global availability of WS-910 Flip-Chip Flux, a new water-soluble flip-chip dipping flux designed to meet the demands of cutting-edge semiconductor devices.(Source: https://www.bisinfotech.com)

- In June 2025, Researchers in South Korea found that the contamination by small amounts of soldering flux residues during heterojunction PV module manufacturing can induce significant long-term performance degradation. Careful control of flux application methods and incorporating drying steps are proposed as potential solutions.(Source: https://www.pv-magazine.com)

Segments Covered in the Report

By Product Type

- No-Clean Flux

- Rosin-Based Flux

- Water-Soluble Flux

- Synthetic Flux

By Application/Soldering Process

- Reflow Soldering

- Wave Soldering

- Selective Soldering

- Hand Soldering

By Form

- Liquid Flux

- Paste Flux

- Gel Flux

- Solid Flux

By End-Use Industry

- Consumer Electronics

- Automotive

- Industrial Electronics

- Aerospace & Defense

- Telecommunications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting