What is the Thin Film Solar Cell Market Size?

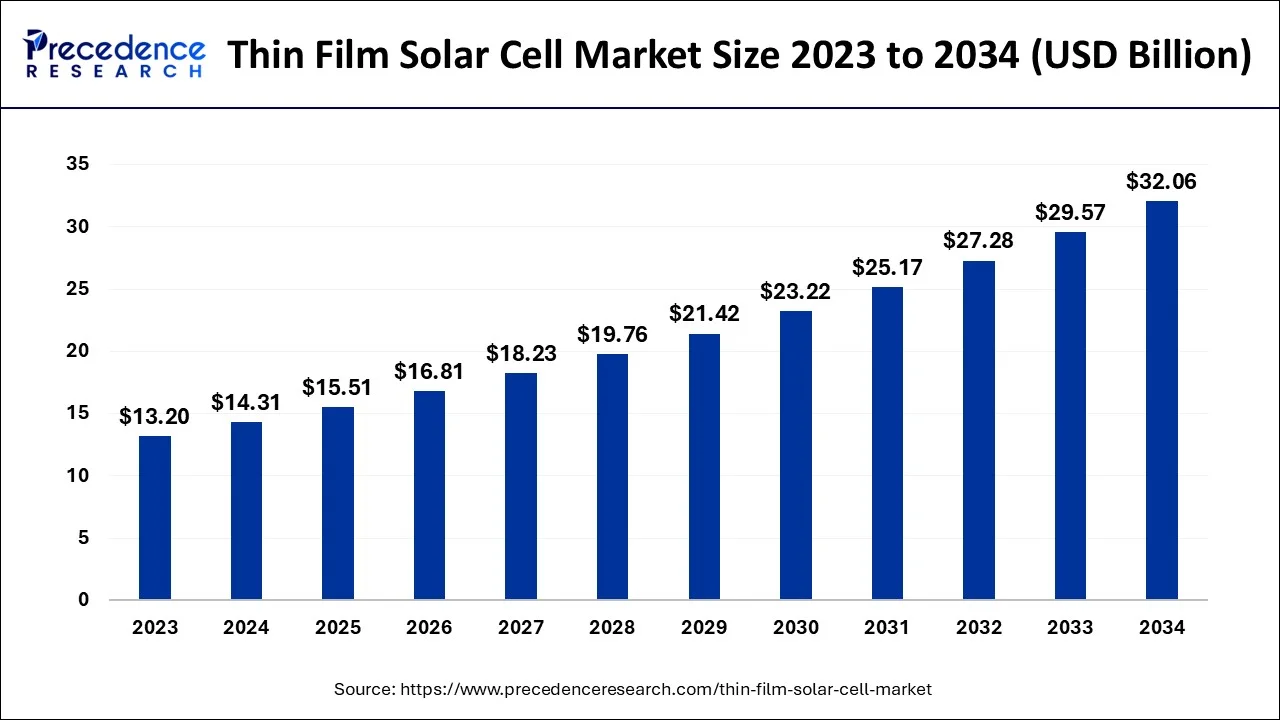

The global thin film solar cell market size is calculated at USD 15.51 billion in 2025 and is predicted to increase from USD 16.81 billion in 2026 to approximately USD 32.06 billion by 2034, expanding at a CAGR of 8.40% from 2025 to 2034.

Market Highlights

- By installation, the on-grid segment has made up a market share of around 71% in 2024 and growing at a CAGR of 8.6% from 2025 to 2034.

- By end user, the utility segment has generated a market share of around 62% in 2024. However, the commercial segment is expected to reach at a CAGR of 8.8% from 2025 to 2034.

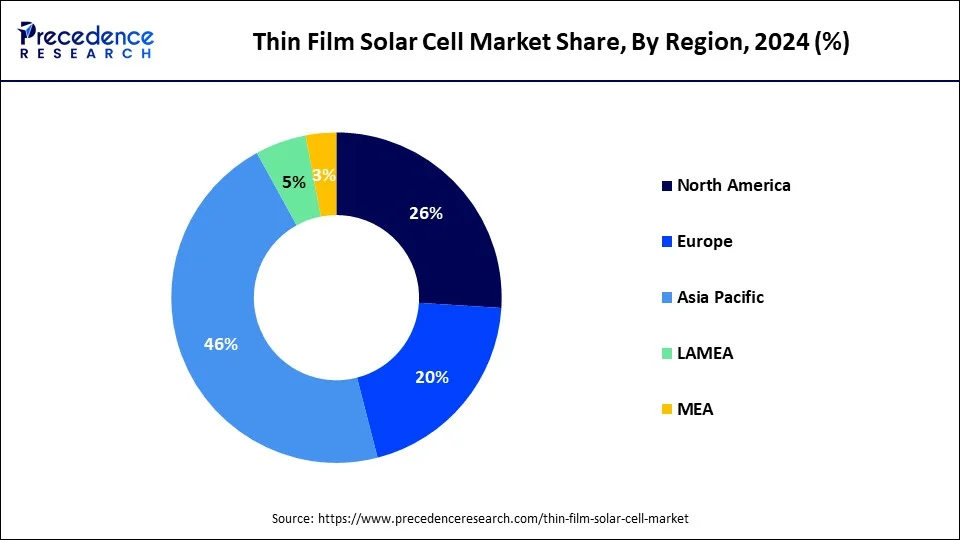

- Asia-Pacific has contributed 46% of the revenue share in 2024. Moreover, LAMEA is anticipated to grow at a CAGR of 8.9% over the forecast period.

What is a Thin Film Solar Cell?

The market for thin-film solar cells appears to be relatively fragmented on a global scale. The industry for slender solar panels is very competitive, as evidenced by the presence of numerous international and local manufacturers. To take the top spot in the market, businesses operating in it are using a variety of organic and inorganic methods, including mergers, partnerships, acquisitions, and collaborations. Market players for thin-film solar cells are expanding their investment in R&D initiatives. They can able to strengthen existing product portfolios and build next-generation items thanks to their efforts.

The market with thin-film solar cells is expected to grow significantly in the upcoming years as a result of such factors. A revolutionary kind of solar cell called a thin film solar panel is constructed of several thin sheets of photovoltaic elements. Thin-film solar energy is also identified as thin-film photovoltaic solar cells (TFPV). Thinner than typical P-N junction solar cells, they come in a variety of thicknesses (a few nano-meters, frequently 20 times smaller than c-Si wafers).

Based on the kind of photovoltaic solar material they employ, thin-film solar panels can be categorized into four different categories. These include dye-sensitized solar cells (DSC) and other photovoltaics, cadmium sulfide, copper indium gallium di-selenide (CIS or CIGS), copper indium telluride (CdTe), and electrode materials (a-Si) and other slender silicon. The thin-film solar array is also made by depositing thin semiconductor films on plastic, glass, or metal.

What are the Growth Factors of the Thin Film Solar Cell Market?

People from all across the world have increased their use of sustainable energy during the past several years. This element is fueling the expansion of sales in the market for thin film solar cells worldwide. Furthermore, the utilization of solar energy has increased globally as a result of the steady drop in solar prices. As a result, chances for players in the worldwide solar cell thin film industry to generate revenue are increasing. The focus of businesses in the worldwide solar cell thin film industry is on technological development. This element is fueling the expansion of the solar cell thin film industry on a global scale.

Aside from this, the global urbanization trend is driving the demand for thin film solar cells. This is true for both established and emerging nations. Throughout the projected period, the thin film solar cells market is anticipated to expand at a consistent CAGR. The increasing government efforts to integrate green sources into the grid are what is driving the market for thin film solar cells globally. The market is also anticipated to develop in the coming years as a result of rising awareness about using renewable power and legislative actions to reduce carbon emissions.

Thin-film solar cells, the most recent generation of solar cells, feature multiple thin photovoltaic component coatings. Thin-film solar panels are upcoming in the planetary business because they are extremely economical, utilize less material, are safe, produce less waste, and are very simple to create. The rise in administrative prices and market aid initiatives has augmented the claim for renewable electricity as an effectual and complementary approach to reducing carbon emissions.

Additionally, as the need forrooftop solar photovoltaic (PV)installation has gained considerable traction, it is projected that the market for thin-film solar cells would present growth opportunities. The market for thin-film solar cells is also projected to be driven by R&D to enhance solar cell endurance and performance, which will create new opportunities for market growth. The sector is expanding as a result of things like enhanced deployment adaptability, a rise in global energy demand, and advancements in thin-film solar cells' efficiency and performance.

Thin Film Solar Cell Market Outlook

- Industry Growth Overview: The thin-film solar cell market will continue to grow steadily from 2025 to 2030, due to stronger solar adoption, orders for urban rooftop installations, and strong government commitments to clean energy targets. Demand for thin film solar cells will grow fastest in Asia-Pacific and Europe, where solar solutions that are more cost-effective and less cumbersome to weigh compared to conventional crystalline solar panels will increasingly gain market share.

- Sustainability Trends: Sustainability goals are also a driver of thin film PV technology adoption, given its cleaner energy alternative and lowest carbon footprint, coupled with recyclability. Many manufacturers are announcing enhanced commitment to more renewable materials in their thin film products, including cadmium telluride (CdTe) and copper indium gallium selenide (CIGS), in light of their renewable capabilities and global net-zero commitments.

- Global expansion: Many leading thin film solar PV technology players are expanding into emerging global solar markets such as India, Vietnam, and Brazil, with abundant sunlight and government incentives. Leading companies such as First Solar and Hanergy are able to ramp up production for local use in those regions, as this will help to lower their logistics costs and meet local demand.

- Key Investors: Thin film solar companies are receiving strong backing from institutional investors and renewable energy funds looking towards long-term ESG benefits. Recent funding rounds indicate high confidence driven by the ability to develop higher efficiency modules and other green infrastructure that can scale.

- Startup Community: Startups focused on perovskite-based and hybrid thin film technologies are gaining massive interest from VCs. Companies such as Oxford PV and Solarion are developing flexible, transparent solar films that are easy to integrate into buildings and vehicles.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 32.06 Billion |

| Market Size in 2026 | USD 16.81 Billion |

| Market Size in 2025 | USD 15.51 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.40% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

- Acceptance of solar energy worldwide - This element is fueling the expansion of sales in the market for thin-film solar cells worldwide. Additionally, a steady drop in solar energy costs has led to a rise in the use of solar energy on a global scale. As a result, chances for companies in the worldwide solar cell thin film market to generate revenue are growing.

- More people live in cities in both developed and developing countries - Companies involved in the solar cell thin film industry are concentrating on new technologies. This element is furling the expansion of the solar cell thin film industry on a global scale. Aside from this, the market for thin film solar cells is being stimulated by an increase in urbanization in both developed and developing parts of the world.

- Implementation of strict energy restrictions and standards - The requirement for energy-efficient technologies is increasing, and thin-film photovoltaic technologies are being used more and more for a wide range of uses in the international market, including consumer electronics, military, and space. The need for these responsible and eco-friendly products has also risen as a consequence of the establishment of strict energy norms and regulations.

Key Market Challenges

- High levels of competition and a changing regulatory environment - The market faces several difficulties, including fierce competition and an ever-changing regulatory environment. The accelerating pace of technological advancement is one of the key worldwide industry trends which might make it more difficult for organizations to succeed. These factors could pose significant obstacles for such businesses that engage with in sector of the market throughout the anticipated time and limit their market share.

- The availability of scarce finances and resources - The absence of a technically sound business landscape that might support R&D efforts is one of the major obstacles facing the thin-film photovoltaic sector. Additionally, the availability of scarce financial resources and money may limit companies' capacity to provide clients with effective thin-film solar solutions. As a result, they wouldn't be able to take a sizable chunk of the global market share.

Key Market Opportunities

Development and research to create new and better energy-efficient alternatives

- Key actors who operate in a market environment may take advantage of various chances. For instance, companies should concentrate on R&D to develop and promote better and more innovative energy-efficient products. Additionally, there is a chance to increase the degree of automation within company operations by integrating new technological services.

Segments Insights

Type Insights

In 2024, the cadmium telluride category dominated the worldwide thin-film solar cell market, and it is anticipated that it will continue to grow at the quickest rate throughout the prediction period and is because it is non-toxic, absorbs a large broad range of spectrums, and works well enough in low lighting conditions, albeit it quickly lost efficiency. It also has cheap operation and production costs. Because cadmium may be produced as a byproduct of the smelting, mining, and refining of lead, zinc, and copper, cadmium-telluride (CdTe) solar cells with thin films could be produced at low prices. Cadmium telluride is used in this photoelectric technique to produce photovoltaic panels at a comparatively low cost. This is the only renewable power technology that uses the smallest amount of water during manufacturing.

Compared to those other thin film solar cells, CdTe thin coating PV solar panels have better cell efficiencies ranging from 16.7%. The production of CdTe PV is a leading industry in the US. Leading this field's development and research has been the National Renewable Energies Laboratory (NREL). In 2018, CdTe produced electricity at a price that was significantly lower than or on par with that of conventional fossil fuel sources of energy. There is scope for more development.

Technology Insights

In 2024, the market for on-grid dominated the world's thin-film solar cell industry, and it is anticipated that it would continue to develop at the quickest rate throughout the forecast timeframe. This is due to an expanding electrical distribution and transmission system that will drive demand during the projected period because of the incorporation of electricity generated by renewable resources into the grid.

Application Insights

In 2024, the utility market dominated the worldwide thin-film solar cell market, and it is anticipated that it would continue to develop at the quickest rate throughout the forecast period. The implementation of significant developments is on the rise, and development and research spending are rising to lower installation and maintenance costs, which chance of boosts consumer needs.

Regional Insights

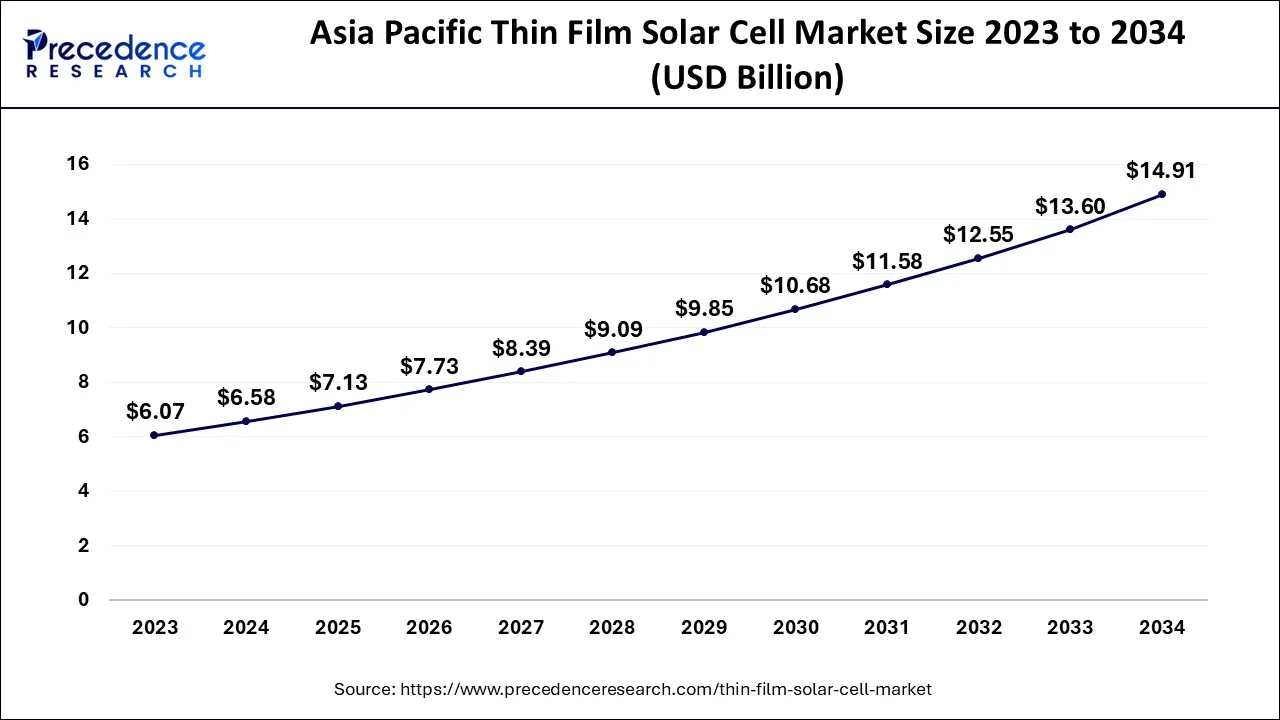

Asia Pacific Thin Film Solar Cell Market Size and Growth 2025 to 2034

The Asia Pacific thin film solar cell market size is evaluated at USD 7.13 billion in 2025 and is predicted to be worth around USD 14.91 billion by 2034, rising at a CAGR of 8.51% from 2025 to 2034.

Asia-Pacific was the largest region in the world for thin-film solar cells in 2024, and it is anticipated that it will continue to expand at the highest rate. Numerous factors, including industrialization, a sizable consumer base, and urbanization, are to blame for this. China is among the largest solar Photovoltaicmarkets around the world, accounting for around 50% of the world's consumption of solar energy in 2018.

APAC has accounted for a significant portion of the thin layer solar PV market due to the growing implementation of solar Photovoltaic panels in commercial, utility-scale, and residential applications. Utility-scale solar Photovoltaic facilities in China mostly employ thin-film technology. A draught policy was published by China's National Commission for Development and Reform in 2018 that would raise the target forrenewable energyfrom 20% to 35% by 2032. In 2019, it's anticipated that over 40 GW of new renewable energy capacity will be linked to the grid, with about 50% of the capacity coming from large-scale solar projects. Smaller, decentralized systems are anticipated to provide the remainder of the market share. The Tokyo Olympic Games' organizing committee from Japan declared its intention to use only sustainable power in 2018.

Additionally, the planners want to buy sustainable power from utility providers and put solar panels up everywhere they can. To produce a portion of the energy required for the 2020 Games, the board is planning to construct several solar roadways built of polymer crystalline silicon. In consequence, it is anticipated that this will increase the request for thin-coating solar PV shortly. Thin-film photovoltaic is anticipated to have substantial growth throughout the projection period because of reasons such as the impending utility-scale projects, supporting legislation, and incentives.

Europe - Charging Toward a Cleaner Tomorrow

Europe grew at a considerable rate in the thin film solar cell market with strong environmental strategies, advancements in green energy, and high rooftop solar demand. Countries in the EU supported renewable energy adaptation through various native subsidies, as well as carbon reduction policies, which fostered ideal market conditions for solar development.

Germany - The Solar Trailblazer

Germany led the European market, using advanced manufacturing, research programs, and heavy investment in sustainable energy. Strong government policies supporting solar panel adoption and the highest installation of solar panels throughout the nation may have driven the increase in thin-film technology.

Latin America - Solar Horizons Unfolding

Latin America exhibited sustained economic growth in the thin film solar cell market by leveraging abundant sunlight, improved policies, and cheap renewable energy. In particular, the focus on rural electrification for energy access and national policies of clean energy generation provide ample room for market expansion.

Brazil led the market due to several large-scale solar projects - backed by governmental programs supporting renewables, with strong sunlight resources, friendly financing, and the influx of corporate investment generating a solar power market space in Latin America.

Middle East & Africa - The Sunbelt Reawakens

The Middle East and Africa (MEA) region experienced solid market expansion supported by abundant solar radiation, declining panel costs, and governmental renewable energy initiatives. Increasing urbanization and power demands led to significant opportunities for thin film solar expansion.

United Arab Emirates - Building Tomorrow with Sunlight

The UAE led the regional market as it developed large solar parks, established sustainability goals, and rolled out smart city projects. The creation of the Dubai Clean Energy Strategy led to the accelerated adoption of thin film solar and the diversification of energy in the UAE.

Thin Film Solar Cell Market Top Companies

- Ascent Solar Technologies Inc.

- Folsom AG

- First Solar

- Global Solar, Inc.

- Hanergy mobile energy

- Hankey Asia Ltd.

- Kaneka corporation

- MiaSole Hi-Tech Corp.

- Mitsubishi Heavy Industries

- Oxford Photovoltaics

- Shunfeng International Clean Energy

- SUNG

- Trony Solar.

- Xunlight Kunshan Co. Ltd.

Recent Developments

- For about Rs 2,100 crore in Mar 2021, Siemens, a significant player in the global market, purchased 99.22 shareholdings of C&S Electrical Ltd from the industry's founders.

- To increase the effectiveness of their products, businesses in the thin-film semiconductor market, including Evolar, have incorporated digital technology into their business operations.

Segments Covered in the Report

By Type

- Cadmium Telluride

- Amorphous Thin-film Silicon

- Copper Indium Gallium Selenide

- Microcrystalline Tandem Cells

- Thin-film Polycrystalline Silicon

- Others

By Technology

- On-grid

- Off-grid

By Application

- Residential

- Commercial

- Utility

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content