What is the Transportation System and Analytics Market Size?

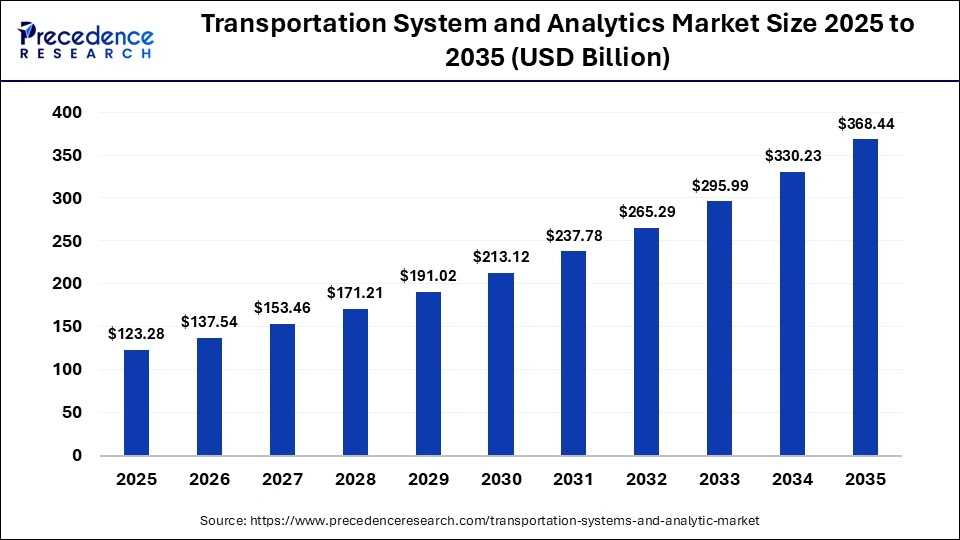

The global transportation system and analytics market size was calculated at USD 123.28 billion in 2025 and is predicted to increase from USD 137.54 billion in 2026 to approximately USD 368.44 billion by 2035, expanding at a CAGR of 6.24% from 2026 to 2035. The transportation system & analytics market is poised for unprecedented expansion, driven by the growing demand for data-driven decision-making and the increasing integration of automated systems and predictive analytics. The market is also driven by smart city initiatives, growth of e-commerce & logistics, connectivity expansion (IoT/5G), and sustainability imperatives.

Market Highlights

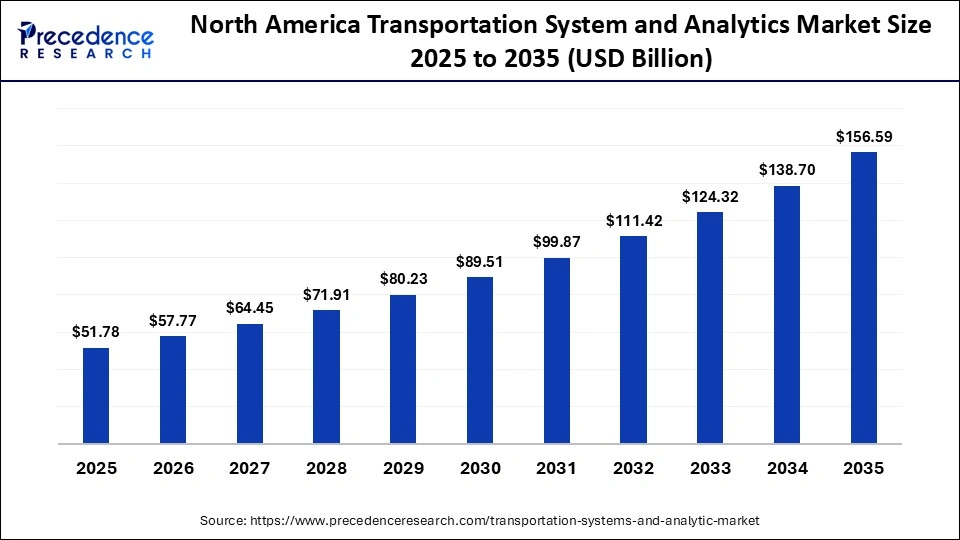

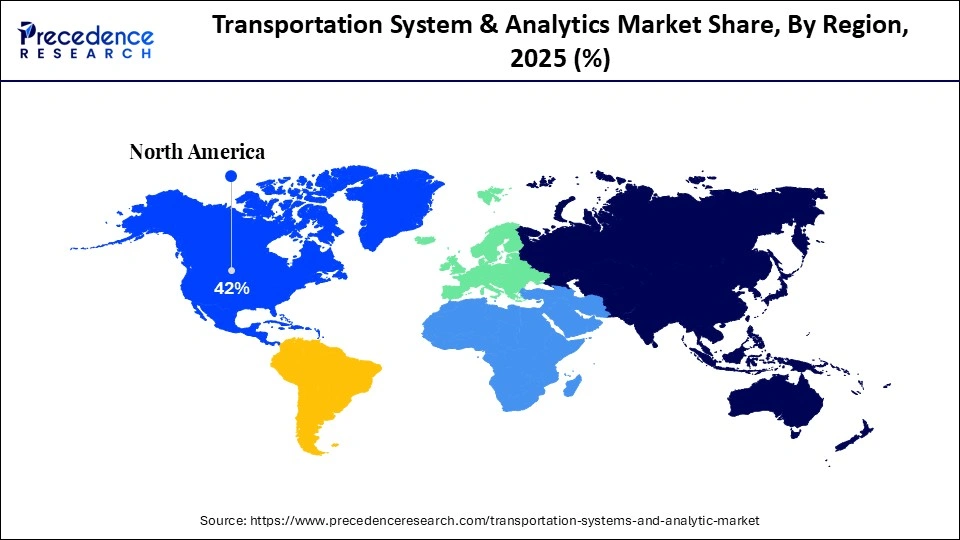

- North America dominated the market, holding the largest market share of approximately 42% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR in the market between 2026 and 2035.

- By solution/analytics type, the descriptive analytics segment held the largest transportation system & analytics market share of approximately 50% in 2025.

- By solution/analytics type, the predictive analytics segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By deployment/platform, held a dominant position in the market with a share of approximately 55% in 2025.

- By deployment/platform, the cloud/SaaS segment is expected to grow with the highest CAGR in the market during the studied years.

- By mode of transport/sub-system, the roadways segment led the global market with a share of approximately 45% in 2025.

- By mode of transport/sub-system, the multimodal/logistics hubs segment is expected to witness the fastest growth in the transportation system & analytics market over the forecast period.

- By application/use case, the traffic & mobility management segment accounted for the highest revenue share of approximately 40% in the market in 2025.

- By application/use case, the last-mile delivery/logistics analytics segment is expected to grow with the highest CAGR in the market during the studied years.

- By end user/sector, the government/public transportation authorities segment held a major revenue share of approximately 48% in the market in 2025.

- By end user/sector, the mobility service providers segment is set to grow at a significant rate of 22% CAGR between 2025 and 2034.

What is Transportation System & Analytics?

The transportation system & analytics market covers integrated transportation systems (including infrastructure, vehicles, telematics, control & communication modules) and analytics solutions that collect, process, and analyze data from transportation networks for optimization of traffic flow, fleet management, public transit, logistics, and mobility services. This includes solutions, such as fleet telematics, traffic management systems, transport management systems (TMS), predictive analytics, real-time monitoring dashboards, and AI/ML-driven decision support. The domain spans road, rail, air, maritime, and multimodal systems.

What is the Role of AI in the Transportation System & Analytics Market?

As artificial intelligence (AI) technology continues to evolve, it emerges as a transformative force and drives innovation in transportation systems and analytics by enabling proactive, data-driven, and autonomous operations. AI-powered systems can analyze real-time data from sensors, cameras, and GPS to adjust traffic signals, predict congestion hotspots, and reroute vehicles. They can optimize public transport schedules and can analyze massive amounts of historical and real-time data to make accurate forecasts for demand fluctuations, traffic patterns, and any potential disruptions.

- For instance, In June 2025, Amazon launched three groundbreaking AI innovations to deliver packages to their customers faster by enabling delivery location accuracy, product demand prediction, and intelligent robotics, creating real-world value for their customers, employees, and delivery partners.

Transportation System & Analytics Market Outlook

- Industry Growth Overview: Between 2026 and 2030, the industry is expected to experience accelerated growth, driven by globalization, a surge in hyper-population, the rising adoption of efficient logistics management of transportation networks, and an increasing need for high travel convenience.

- Global Expansion: Leading players are expanding their geographical presence. For instance, in May 2024, Hitachi Rail announced the completion of its €1,660m acquisition of Thales' Ground Transportation Systems (GTS) business, expanding its global presence in 51 countries with the majority of its revenues coming from higher-return signalling and systems. The closing strengthens the company's strategic focus on helping current and potential Hitachi Rail and GTS customers through the sustainable mobility transition.

- Major Investors: Several global strategic investors and major market players in the market support startups and small- and medium-sized enterprises. For instance, in November 2025, IntrCity SmartBus, a tech-enabled inter-city bus network platform, closed a ₹250 crore Series D round, led by venture capital firm A91 Partners. The company plans to use this funding towards improving customer travel experience, upgrading fleet management technology platform, and providing deeper and wider coverage to Tier-II and Tier-III cities.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 123.28 Billion |

| Market Size in 2026 | USD 137.54 Billion |

| Market Size by 2035 | USD 368.44 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution/Analytics Type, Deployment/Platform, Mode of Transport/Sub-System, Application/Use Case, End-User/Sector, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regulatory landscape

| Country/Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Department of Transportation (DOT) |

Federal Motor Vehicle Safety Standards (FMVSS) DOT/NHTSA Automated Vehicle (AV) Framework (2025) |

Autonomous Vehicles, Vehicle Telematics, and Safety Goals | The regulatory framework ensures Autonomous Vehicles (AV) systems comply with FMVSS safety standards. Leveraging AI in telematics for predictive maintenance and crash avoidance systems, while ensuring data privacy |

| European Union | European Commission | Electronic Freight Transport Information (eFTI) Regulation (EU 2020/1056 | Personalized Mobility, Safety and Compliance, Logistics Optimization, and Safety and Standards | Implementing AI for automated traffic enforcement, congestion prediction, and intelligent signals. Ensuring AI-driven vehicles comply with existing safety and testing norms |

| India | Ministry of Road Transport and Highways (MoRTH) | The Motor Vehicles Act, 1988, along with the Motor Vehicles (Amendment) Act, 2019 | Autonomous Vehicles (AVs), Smart Traffic Management, and Vehicle Telematics |

Regulation of vehicle-generated data for predictive maintenance and safety monitoring, ensuring compliance with existing data privacy and security laws. The existing act covers broad safety norms; specific regulations are needed to address AI-driven automation, testing, and liability. |

Segmental Insights

Solution/Analytics Type Insights

Which Solution/Analytics Type Segment Dominated the Market in 2025?

The descriptive analytics segment dominated the transportation system & analytics market, with a share of approximately 50% in 2025, because it provides valuable insights into performance, operations, and safety by efficiently analyzing historical data from a wide range of sources. Cities often utilize descriptive analytics to comprehend peak congestion times, traffic flow, and driver behavior by analyzing data from cameras, GPS trackers, and traffic sensors.

The predictive analytics segment is expected to grow at the fastest CAGR in the market between 2026 and 2035. Predictive analytics uses AI algorithms, machine learning (ML), and historical data to forecast future market trends. It allows for a proactive approach, which improves the decision-making process, efficiency, and safety. Urban planners often use predictive models that include historical patterns, weather, and real-time sensor data to forecast congestion, which suggests alternative routes to drivers, leading to smoother traffic flow.

Deployment/Platform Insights

Why Did the On-premises Segment Dominate the Market?

The on-premises segment held a major revenue share of approximately 55% in the transportation system & analytics market in 2025, due to the ability of on-premise solutions for full control over data, systems, and security. Several large logistics companies prefer on-premises systems to maintain control over sensitive operational data, such as driver information, real-time vehicle tracking, freight details, and others. On-premises is critical for meeting strict internal security standards.

On the other hand, the cloud/SaaS segment is expected to expand rapidly in the market with a CAGR in the coming years. Cloud-based and SaaS solutions are significantly transforming the market by offering cost-effective and accessible platforms. They also leverage advanced technologies, such as AI and ML, to enhance efficiency, visibility, and scalability. SaaS solutions offer centralized dashboards to monitor vehicle location, driver behavior, fuel consumption, and predictive maintenance schedules using real-time data.

Mode of Transport/Sub-System Insights

How the Roadways Segment Dominated the Market?

The roadways segment accounted for the highest revenue share of approximately 45% in the transportation system & analytics market in 2025, as roadways are a dominant mode of transport globally. The integration of analytics into road systems plays a crucial role in enhancing safety, improving efficiency, and managing the complexities of increasing logistics demands. Road networks are the critical backbone of national transportation systems, connecting rural and urban areas. They offer the primary environment for the deployment and developmentof autonomous vehicles (AVs).

On the other hand, the multimodal/logistics hubs segment is expected to witness the fastest growth in the market over the forecast period. Multimodal and logistics hubs are crucial nodes in the market, facilitating the efficient transfer of goods between different modes of transport, such as rail, road, air, and sea. Transportation analytics plays a vital role in optimizing the operations of the multimodal/logistics hubs by providing data-driven insights that reduce costs, enhance efficiency, and improve visibility across the supply chain.

Application/Use Case Insights

Which Application/Use Case Segment Led the Market?

The traffic & mobility management segment led the global transportation system & analytics market with a share of approximately 40% in 2025, because it uses advanced analytics to control, monitor, and optimize the movement of vehicles in real-time within the transportation system. The traffic & mobility management heavily relies on these data-driven insights to improve congestion, pollution, and safety, particularly in urban areas. Adaptive traffic control systems optimize rerouting vehicles to reduce congestion and enhance road efficiency.

The last-mile delivery/logistics analytics segment is expected to show the fastest growth with a CAGR of over the forecast period. Delivery/logistics analytics significantly optimize transportation, warehousing, and distribution operations. Historical and real-time data allow businesses to improve efficiency, reduce costs, and optimize supply chain resilience.

End-User/Sector Insights

Why Did the Government/Public Transportation Authorities Segment Dominate the Market?

The government/public transportation authorities segment held the largest revenue share of approximately 48% in the transportation system & analytics market in 2025, as they utilize analytics to improve service reliability, optimize planning, and manage resources. By analyzing data from ticketing systems and GPS trackers, authorities can predict passenger demand. This allows the proper bus and train schedules to improve service frequency, reduce waiting times, and optimize resource allocation.

The mobility service providers segment is expected to be the fastest-growing in the market over the studied years. Mobility service providers leverage massive amounts of mobility data to optimize their own operations and provide crucial information that influences urban planning and traffic management. They increase the range of transportation options available to consumers for last-mile connectivity.

Regional Insights

How Big is the North America Transportation System and Analytics Market Size?

The North America transportation system and analytics market size is estimated at USD 51.78 billion in 2025 and is projected to reach approximately USD 156.59 billion by 2035, with a 11.70% CAGR from 2026 to 2035.

Which Factors Drive the Market in North America?

North America held the largest revenue share of approximately 42% in the transportation system & analytics market in 2025. The region's dominance is supported by increasing investments in smart infrastructure, rising traffic congestion in urban areas, and the growing adoption of modern technologies, such as AI and IoT. Additionally, the increasing population and rising traffic congestion in urban areas boost the demand for systems that effectively manage and mitigate traffic issues.

What is the Size of the U.S. Transportation System and Analytics Market?

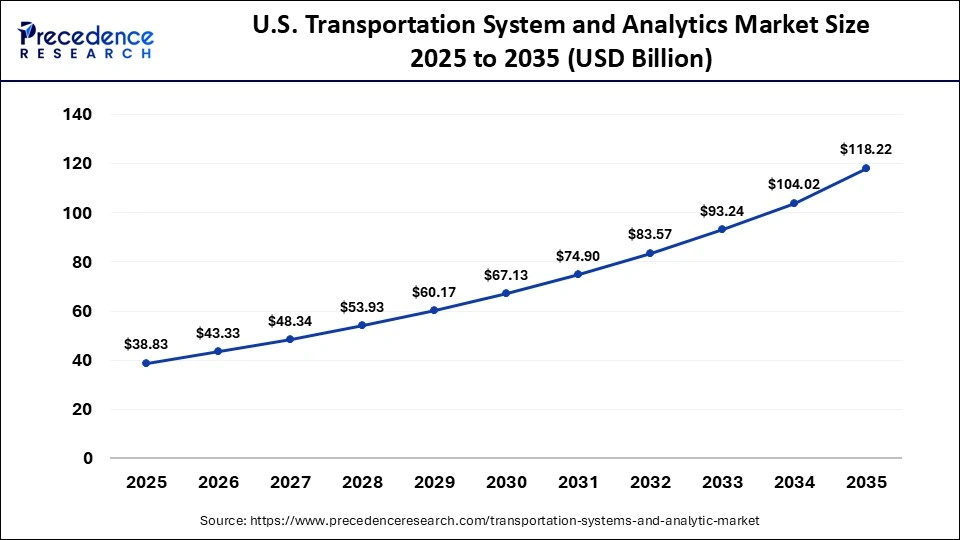

The U.S. transportation system and analytics market size is calculated at USD 38.83 billion in 2025 and is expected to reach nearly USD 118.22 billion in 2035, accelerating at a strong CAGR of 11.78% between 2026 and 2035.

U.S. Market Trends

The U.S. leads the transportation system and analytics market in North America. It has an extensive road network and established supply chains, creating a need for analytics to effectively manage transportation systems. Moreover, the supportive government framework and the rising adoption of data analytics, cloud-based solutions, and real-time tracking are anticipated to contribute to the overall growth of the market.

How is the Asia-Pacific Region Growing in the Market?

Asia Pacific is expected to be the fastest-growing region in the transportation system & analytics market in the coming years. Factors contributing to the market's growth in the region include the rapid urbanization, large trade hub with complex logistics, increasing use of analytics for route optimization, and the growing need for traffic management to reduce carbon emissions. Moreover, the government initiatives to modernize roads, the growing demand for solutions to manage urban traffic and congestion, and the increasing presence of prominent logistics companies are anticipated to fuel the market's expansion in the coming years.

India Market Trends

India is experiencing growth, owing to the development of smart transportation infrastructure, technological advancements like AI and IoT, the increasing demand for data-driven decision-making in logistics and public transit, the growing need for operational efficiency, and the rising focus on sustainability. Governments are increasingly investing in smart city projects that use transportation systems and analytics to improve mobility, manage traffic, and enhance infrastructure.

Will Europe Grow in the Transportation System & Analytics Market?

The European region is anticipated to grow at a notable CAGR in the forthcoming years. Factors such as increasing demand for operational efficiency in logistics and urban areas, stringent environmental regulations, and the ongoing digital transformation of the transportation sector. The increasing integration of AI, the Internet of Things (IoT), and big data is significantly improving traffic management, fleet management, and logistics across Europe. In addition, government initiatives, such as smart city programs and safety regulations, are expected to further drive market growth in the region.

Germany Market Trends

Germany's market is experiencing significant growth, fuelled by the country's increasing shift to cloud-based solutions (SaaS), increasing need to improve urban mobility, rising focus on enhancing public safety, increasing demand for efficient transportation management systems (TMS), and the rise of the e-commerce industry. Several government programs in the country are promoting the adoption of intelligent transportation systems. Sustainability goals are increasingly pushing the growth of the market, with the rising focus on decarbonization and efficiency in the transportation sector.

Who are the Major Players in the Global Transportation System & Analytics Market?

The major players in the transportation system & analytics market include IBM Corporation, Siemens AG, Cisco Systems, Inc., Oracle Corporation, SAP SE, Trimble Inc., TomTom International BV, Cubic Corporation, Kapsch TrafficCom AG, Alteryx, Inc., Hexagon AB, McKinsey & Company, HERE Technologies, GE Digital, and Verizon Connect.

Recent Developments

- In July 2025, Namma Yatri launched Namma Transit, a personal transit assistant, to transform the way Bengalureans use public transport. The goal is to make daily commutes smoother, faster, greener, and more affordable by guiding users step-by-step throughout their entire journey. The app provides real-time alerts about train arrival times, station exits, and reminders to users.(Source: https://analyticsindiamag.com)

- In January 2025, Deloitte collaborated with May Mobility to bring new data and insight offerings to market, improving and optimizing rider and community safety for their joint municipal and business customers. The collaboration was made to generate insights from May Mobility's sensor and environmental data to help enhance autonomous transportation safety, efficiency, sustainability, equity, and utility.(Source: https://www.deloitte.com)

Segments Covered in the Report

By Solution/Analytics Type

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

By Deployment/Platform

- On-Premises

- Cloud / SaaS

- Hybrid

By Mode of Transport/Sub-System

- Roadways

- Urban traffic management

- Highway/freight monitoring

- Rail & Metro Systems

- Air Transport & Airports

- Maritime / Ports & Shipping

- Multimodal / Logistics Hubs

By Application/Use Case

- Traffic & Mobility Management

- Fleet & Asset Management

- Last-Mile Delivery / Logistics Analytics

- Public Transit & Smart City Mobility

- Safety, Security & Compliance Analytics

By End-User/Sector

- Government / Public Transportation Authorities

- Logistics & Freight Companies

- Fleet Operators (commercial, corporate)

- Mobility Service Providers (ride-hailing, MaaS)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content