U.S. Category Management Software Market Size and Forecast 2025 to 2034

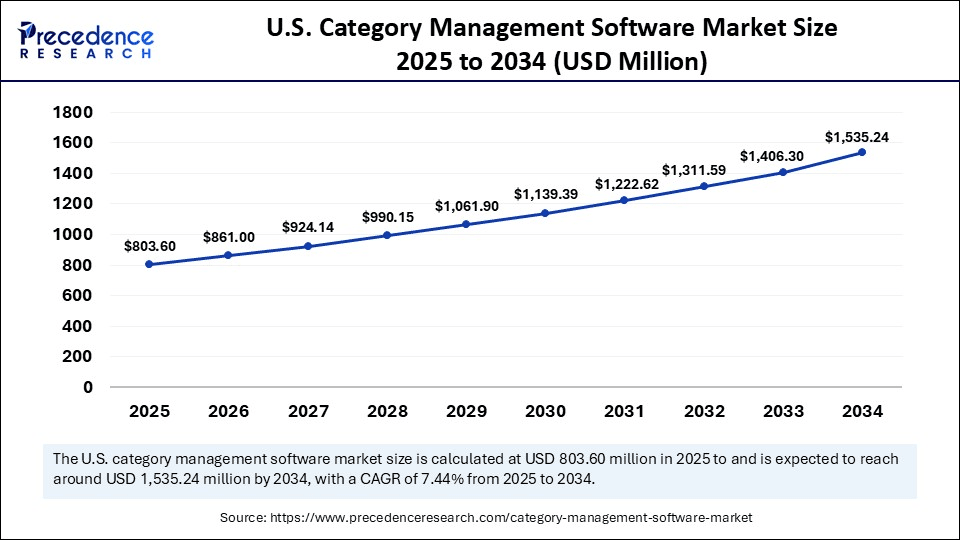

The U.S. category management software market size accounted for USD 749.07 million in 2024 and is predicted to increase from USD 803.6 million in 2025 to approximately USD 1,535.24 million by 2034, expanding at a CAGR of 7.44% from 2025 to 2034. With the growing complexity of consumer behavior and data, these platforms enable strategic decision-making for profitability and customer satisfaction.

U.S. Category Management Software Market Key Takeaways

- By deployment mode, the cloud-based segment held the largest market share of 52% in 2024,

- By deployment mode, on-premise is expected to grow at a remarkable CAGR of between 2025 and 2034,

- By component, the software segment led the market in 2024.

- By component, the service segment is observed to grow at the fastest CAGR in the market during the forecast period.

- By organization size, the large segment contributed the highest market share of 62% in 2024.

- By organization size, SME segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application, the product assortment optimization segment captured the biggest market share in 2024.

- By end-user industry, the retail category management segment generated the major market share of 38% in 2024,

Smart Shelves: AI reshapes category strategy

Artificial Intelligence is revolutionizing category management software by automating decisions that were once reliant on manual input and intuition. AI algorithms analyze vast amounts of customer data, sales trends, and competitive dynamics to suggest ideal product assortments and placements. Retailers now use predictive analytics to forecast demand, reduce stockouts, and improve inventory turnover. Machine learning models also help personalize promotions by segmenting customer preferences in real time. Natural language processing allows teams to extract insights from unstructured feedback like reviews or surveys. As a result, AI is driving a new era of precision and responsiveness in retail category planning.

Efficiency Meets Intelligence: Navigating the Modern Retail Landscape

The U.S. category management software market refers to digital platforms and tools that help organizations optimize procurement, retail planning, supplier collaboration, and strategic sourcing by organizing goods and services into specific categories. These platforms integrate data analytics, AI-driven insights, inventory planning, supplier benchmarking, and collaborative decision-making tools to improve cost savings, supplier performance, and operational efficiency. The market is expanding rapidly due to the rise of digital procurement, retail automation, and demand for real-time, category-specific decision intelligence.

The U.S. category management software market is experiencing steady growth as both physical and digital retailers seek better control over their merchandising strategies. The software helps streamline key processes such as space planning, product lifecycle management, and planogram development. Rising competition, inflationary pressures, and evolving consumer expectations are compelling companies to in smarter data-driven solutions.

U.S. Category Management Software MarketTrends

- Cloud-based category management platforms are seeing increased adoption due to scalability and lower IT overhead

- AI and machine learning integration are enabling real-time decision-making and advanced demand forecasting.

- Omnichannel synchronization is becoming essential, ensuring consistent product strategies across in-store and digital channels.

- Data visualization and dashboard enhancements are simplifying complex category insights for non-technical users

- Sustainability considerations are influencing assortments, with software helping track environmental KPIs.

- Customization and user-friendly interfaces are being prioritized to improve adoption among merchandising teams.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,535.24 Million |

| Market Size in 2025 | USD 803.6 Million |

| Market Size in 2024 | USD 749.07 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.44% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Mode, Component, Organization Size, Application, End-User Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Data-Driven Retailing Fuels Software Demand

One of the primary drivers of the U.S. category management software market is the exponential growth of retail data. Retailers now deal with large volumes of customer behavior, sales, seasonal trends, and inventory metrics, making manual category planning inefficient. Category management tools offer advanced analytics and visualization that help convert data into actionable strategies. Companies can identify high-performing SKUs, phase out underperforming items, and manage promotions more effectively. The software also enhances collaboration between suppliers and retailers, ensuring mutual alignment on category goals. As retail margins shrink, the demand for tools that optimize every shelf inch and decision point continues to rise.

Restraint

Integration Complexities and High Initial Costs Pose Barriers

Despite its benefits, the U.S. category management software market faces restraints due to the high initial implementation cost and integration complexity. Many legacy retailers still rely on manual tools or fragmented systems that resist change. Customizing the software to work with existing POS, ERP, or supply chain systems can be time-consuming and resource-intensive. Training staff to adapt to new technologies also requires investment in time and skills. Smaller players may find the ROI unclear in the short term, deterring adoption. Additionally, security concerns related to data access and sharing between partners can act as adoption hurdles.

Opportunity

Unlocking Growth Through Personalization and Localization

There is significant opportunity in leveraging category management software for hyper-local and personalized retail strategies. As consumer preferences vary by region, demographic, and even neighbourhood, a one-size-fits-all approach no longer works. Software that allows dynamic, data-backed localization of assortments, pricing, and promotions is in high demand. Additionally, integrating shopper loyalty data enables precise targeting of campaigns and product placement. Small and medium retailers entering the digital ecosystem also represent untapped potential. With AI-powered modules and user-friendly interfaces, the market is primed for expansion beyond large enterprise users.

Country-level Insights

U.S. acts as a significant contributor to the overall U.S. category management software market, particularly high for omnichannel-ready platforms that can align in-store and online product displays. Companies are using predictive analytics to optimize holiday planning, dynamic pricing, and customer loyalty programs. Retailers are also leveraging these platforms to test sustainable assortments and measure environmental impact. Integrated dashboard and mobile apps are empowering merchandising teams on the floor with real-time insights. North American vendors often bundle solutions with advanced data security and compliance features, ensuring enterprise-grade reliability. With rising consumer expectations and fierce competition, the region will continue to lead innovation and adoption in this field.

Segment Insights

Deployment Mode Insights

How Cloud-based segment is dominating the market?

The cloud-based segment dominated the market in 2024, due to its flexibility, scalability, and low upfront investment. Companies are increasingly adopting SaaS platforms to streamline operations without heavy IT infrastructure. With real-time data access, remote monitoring, and multi-location integration, cloud software ensures agility in today's fast-moving food industry. AI, Internet of Things, and machine learning further enhance operational intelligence. Cloud systems are also crucial for enabling predictive maintenance and demand forecasting, helping manufacturers stay ahead of market shifts. As cybersecurity features improve, even highly regulated segments are growing confident in cloud-based compliance solutions.

Many enterprises are choosing hybrid or full-cloud models to reduce downtime and improve efficiency across production lines. Cloud software also supports automatic updates, reducing the need for manual intervention and keeping systems up to date. Cost-effective subscription models appeal to both large and small enterprises, promoting widespread adoption. Cloud platforms enable easy integration with third-party logistics, e-commerce, and raw material vendors, creating a seamless digital economy. As remote work and decentralized operations continue, cloud-based food manufacturing software ensures continuity and adaptability. With increasing global internet penetration, even manufacturers in emerging economies are embracing the cloud shift.

The on-premises is expected the fastest growth in the U.S. category management software market during the forecast period, as manufacturers handle sensitive formulations or proprietary processes often prefer on-premise systems for enhanced control and data sovereignty. The perceived security and customization flexibility of on-premise platforms attract businesses with complex legacy systems. Many large enterprises still rely on these solutions due to their ability to deeply integrate with existing infrastructure. For companies operating in regions with inconsistent internet connectivity, on-premise deployment ensures uninterrupted functionality. Additionally, some manufacturers favor full ownership of their software, viewing it as a long-term capital investment.

Component Insights

The software segment dominated the U.S. U.S. category management software market in 2024, accounting for the largest share due to the increasing reliance of retailers and manufacturers on advanced digital tools for planning, analytics, and execution. With the surge in e-commerce, omnichannel retailing, and data-driven decision-making, businesses across the U.S. have prioritized the adoption of sophisticated category management platforms to optimize product assortment, shelf space, pricing, and promotions. These software solutions help streamline collaboration between suppliers and retailers, improve inventory turnover, and enhance consumer satisfaction through tailored merchandising strategies.

The service segment is expected to grow at a notable rate during the forecast period. As more retailers and CPG brands adopt category management platforms, the need for expert consulting and managed services is rising, especially among mid-sized and smaller enterprises that lack in-house data analytics or IT capabilities. Service providers are playing a crucial role in helping businesses interpret complex data outputs, design optimized category strategies and ensure seamless integration with existing retail and ERP systems.

Organization Size Insights

The large enterprise segment dominated the U.S. category management software market in 2024, due to their scale, complexity, and global operations. These organizations require robust, enterprise-grade platforms capable of integrating thousands of processes across multiple geographies. Customizable ERP, advanced analytics, and AI-powered decision systems are commonly implemented. Budget flexibility allows them to invest in comprehensive digital transformation programs. Their focus is often on optimizing efficiency, maintaining brand trust, and ensuring global regulatory compliance. As innovation accelerates, large enterprises also act as early adopters and trendsetters in this space.

In enterprise environments, category software is part of a larger digital transformation initiative. Teams use real-time dashboards to optimize seasonal promotions and align with strategic KPIs. These platforms also aid in sustainability tracking, which is increasingly important to large retailers. The scale of data processed allows deeper machine learning applications for demand sensing. Advanced scenario modeling helps retail executives simulate pricing or assortment changes. As complexity grows, large enterprises will continue to fuel platform innovation and expansion.

The small & medium enterprises (SMEs) are expected to experience the fastest growth in the market during the forecast period. due to more accessible, affordable, and cloud-based solutions. As consumer demands evolve and competition stiffens, SMEs are turning to digital tools for cost control and product innovation. Many vendors now offer modular, subscription-based software that fits SME budgets and needs. These tools help in streamlining procurement, batch production, inventory, and quality checks without heavy upfront investment. Government incentives and digital literacy programs are also encouraging SMEs to adopt software solutions. With mobile-first interfaces, many tools are usable even in rural or semi-urban production units.

Small & medium enterprises (SMEs) in fast-moving retail categories are using these tools to optimize SKUs and avoid overstocking. They rely on built-in analytics to identify fast-moving products and improve profit margins. The software helps in building better relationships with suppliers through data transparency. AI-powered modules help even smaller teams make intelligent decisions. As competition intensifies, SMEs are investing in category software to professionalize their operations. The growth of localized and specialty stores further fuels this trend.

Industry Vertical Insights

The retail segment dominated the U.S. category management software market in 2024, due to their high product turnover and dynamic consumer behavior. Supermarkets, department stores, and convenience outlets all depend on this software to maintain optimal assortments. Seasonal planning, promotional cycles, and supplier negotiations are managed more effectively through centralized platforms. These industries also benefit from visualization tools like planograms and space optimization. Integrated demand forecasting helps retailers respond to shifting preferences in real time. The ability to analyze consumer buying behavior at a granular level gives a major strategic edge.

Retailers also use the software to align physical and digital shelf strategies. Pricing, bundling, and endcap decisions are now data-informed rather than gut-driven. FMCG companies use it to improve category performance in partner retail environments. Collaboration between retailers and brands has become smoother with shared metrics and templates. Private label strategies are also being guided by insights from category platforms. As the most data-rich industry, retail continues to drive innovation in the space.

Application Insights

The product assortment optimization segment dominated the U.S. category management software market in 2024, these tools allow users to build store-specific assortments based on data such as sales history, demographic trends, and space constraints. Planograms help in visualizing shelf layout, identifying gaps, and ensuring compliance across locations. Teams use them to simulate changes before physical implementation, saving time and reducing costs. Assortment tools ensure each store carries the right product mix to maximize profitability and customer satisfaction. This functionality is especially critical for seasonal planning and new product introductions.

End-user Industry Insights

The retail segment dominated the U.S. category management software market in 2024, retailers rely heavily on these platforms to optimize shelf space, product placement, and inventory turnover across thousands of SKUs. The rise of omnichannel shopping has only amplified the need for cohesive and agile retail category strategies. With consumer preferences shifting rapidly, real-time insights from category management tools help maintain competitiveness. Promotions, pricing strategies, and in-store merchandising are seamlessly coordinated through these systems. As brick and motor stores evolve alongside e-commerce, retail-focused solutions are becoming indispensable.

Retailers are also leveraging AI features within these tools to tailor assortments based on local demographics and buying patterns. Enhanced visual planogram tools make it easier to collaborate across departments and with suppliers. Retailers benefit from improved supplier relationships through transparent data sharing. Category software also reduces overstocking and understocking issues, improving margins. Major chains and regional retailers alike are investing in robust platforms to drive consistency and profitability. The segment continues to grow as customer-centric retailing becomes standard practice.

The e-commerce and online marketplaces is expected the fastest growth in the U.S. category management software market during the forecast period. E-commerce businesses are increasingly adopting these tools to streamline supplier selection, contract negotiation, and spend analysis. With global supply chains facing ongoing disruption, smarter sourcing strategies are more valuable than ever. Category tools help align procurement activities with business goals and cost-saving targets. They also enable risk management by mapping supplier dependencies and market dynamics. Strategic category planning in procurement empowers companies to move from reactive to proactive decision-making.

U.S. Category Management Software Market Companies

- Oracle Corporation

- JDA Software (Blue Yonder)

- Infor

- Epicor Software Corporation

- Revionics (an Aptos Company)

- 4R Systems

Recent Developments

- In July 2025, AffiniPay, a prominent provider of legal practice management software, integrated payments, and embedded fintech solutions for professionals, has earned a spot on CNBC's 2025 list of the World's Top Fintech Companies. The company is recognized in the payments category, joining industry giants such as Visa, Adyen, and Affirm.

(Source: https://uk.finance.yahoo.com)

Segments Covered in the Report

By Deployment Mode

- Cloud-Based

- On-Premise

- Hybrid

By Component

- Software

- Services

- Consulting

- Implementation & Integration

- Support & Maintenance

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application

- Product Assortment Optimization

- Supplier Collaboration & Negotiation

- Category Performance Analytics

- Space Planning & Planogramming

- Pricing & Promotion Management

- Inventory & Replenishment Optimization

By End-User Industry

- Retail

- Grocery/Supermarkets

- Apparel & Footwear

- Electronics

- Convenience Stores

- Consumer Packaged Goods (CPG)

- E-Commerce & Online Marketplaces

- Manufacturing (Non-Retail)

- Healthcare & Pharmaceuticals

- Automotive

- Food & Beverage

- Logistics & Distribution

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting