What is the Vegan Protein Powder Market Size?

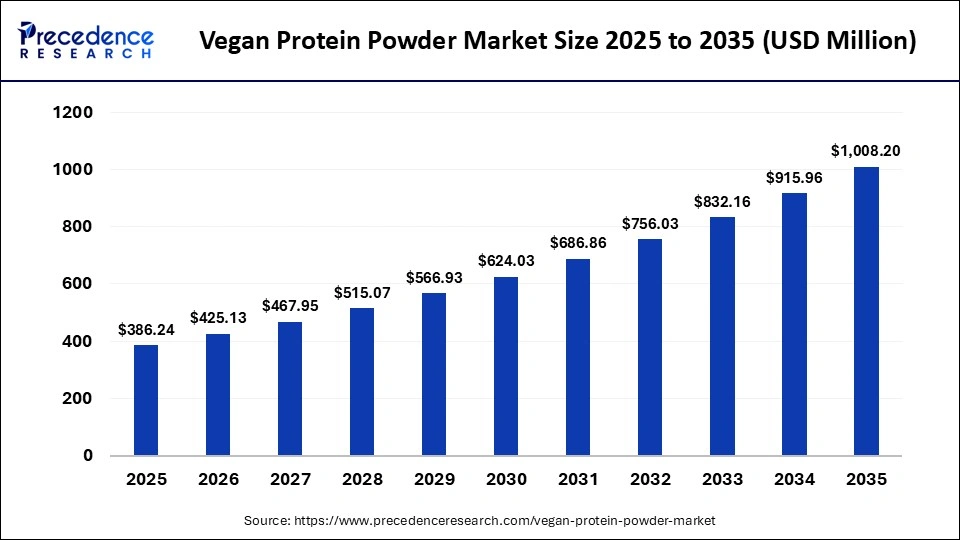

The global vegan protein powder market size was valued at USD 386.24 million in 2025 and is predicted to increase from USD 425.13 million in 2026 to approximately USD 1,008.20 million by 2035, expanding at a CAGR of 10.07% during the forecast period from 2026 to 2035. The growth of this market is being fueled by a rapid shift toward plant-based diets and heightened concerns around environmental sustainability and ethical sourcing.

Key Takeaways

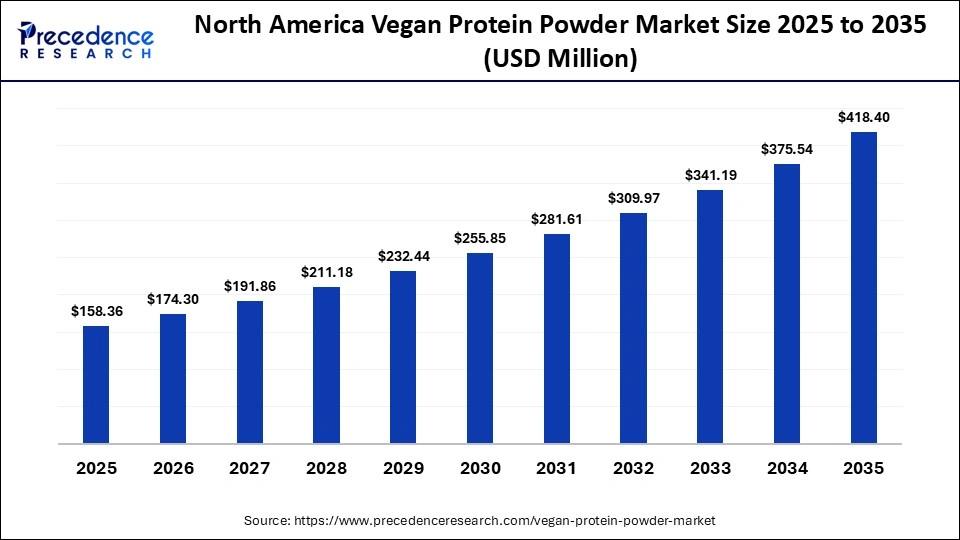

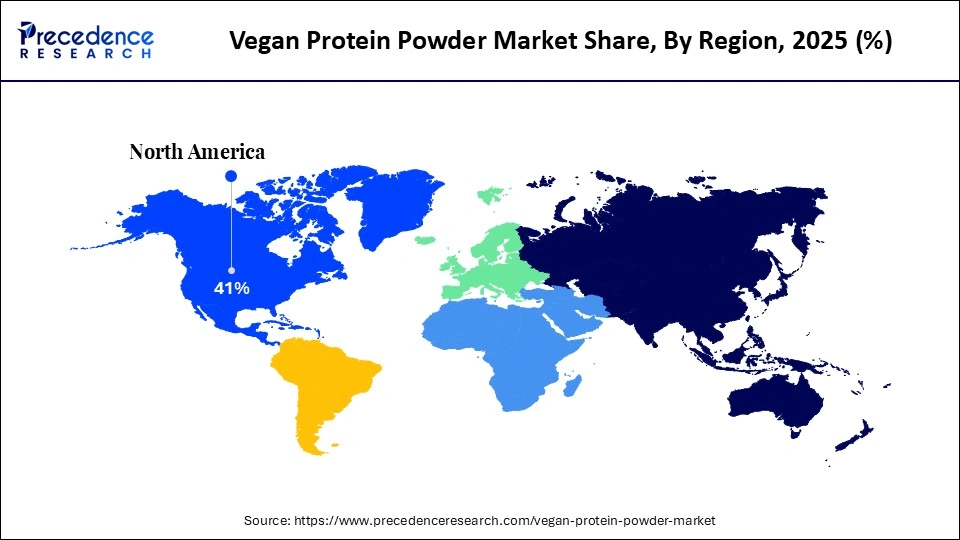

- North America dominated the market with the highest share of 41% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By source, the pea protein segment dominated the market with the largest share in 2025.

- By source, the algae-based proteins segment is expected to grow at a noteworthy CAGR during the forecast period.

- By flavor, the chocolate and coffee segment held the maximum market share in 2025.

- By flavor, the unflavored segment is predicted to grow at the fastest CAGR during the predicted timeframe.

- By end-use, the dietary supplements segment dominated the vegan protein powder market in 2025.

- By end-use, the sports nutrition segment is expected to grow at a significant rate during the forecast period.

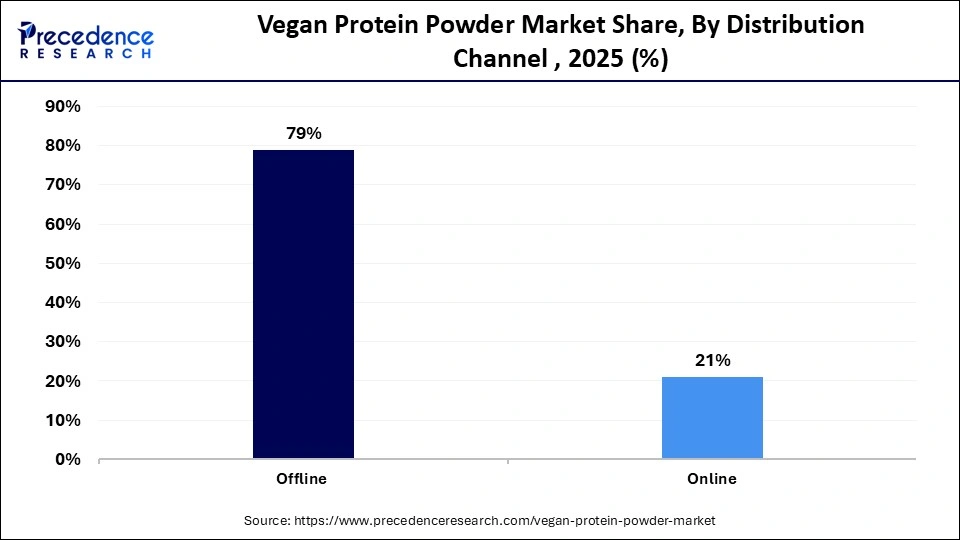

- By distribution channel, the offline segment contributed the biggest market share 79% in 2025.

- By distribution channel, the online segment is observed to grow at the fastest rate during the forecast period.

What is the Vegan Protein Powder Market?

The vegan protein powder market centers on the development of plant-derived protein products made from sources such as pea, soy, rice, and hemp. These powders are extensively used in sports nutrition, meal replacements, and functional food applications, particularly among individuals seeking plant-based and dairy-free dietary options. Increasing awareness of sustainable nutrition and clean label products is contributing to the steady expansion of this market.

To enhance nutritional quality and consumer appeal, manufacturers are blending different plant proteins to achieve improved amino acid balance. The inclusion of functional ingredients such as probiotics and antioxidants further strengthens product innovation. Ongoing advancements in food processing technologies are improving solubility, texture, and flavor, addressing previous limitations and supporting higher consumer satisfaction.

How is AI Impacting the Vegan Protein Powder Market?

AI is impacting the market by optimizing product development, production efficiency, and consumer engagement. Machine learning and data analytics help manufacturers analyze trends, nutritional requirements, and consumer preferences to formulate innovative protein blends. AI-powered supply chain management improves sourcing of plant-based ingredients, reduces waste, and ensures consistent product quality. Additionally, AI-driven marketing and recommendation systems enable personalized product suggestions, enhancing customer experience and boosting sales in a competitive market.

Vegan Protein Powder Market Trends

- Growing health and environmental awareness: Consumers who actively prioritize their health are significantly influencing the demand for plant-based protein products, including meat alternatives and protein powders. Beyond personal wellness, many individuals are choosing these options to reduce their environmental footprint and avoid animal-derived ingredients.

- Demand for personalized nutrition:The shift toward customized nutrition is driving the market. With the support of AI, brands can now develop protein blends tailored to individual dietary preferences, fitness goals, and medical needs. This personalized approach not only enhances nutritional balance but also empowers consumers to make more informed and effective health choices.

- Regulatory standards:Evolving regulatory frameworks and Stricter labeling standards are encouraging companies to adopt transparent, clean-label practices and organic certifications. At the same time, rising demand for personalized solutions is opening opportunities for brands to introduce specialized formulations.

- Strengthened food safety: Regulatory bodies across major markets closely monitor ingredient approvals, manufacturing process, and labelling accuracy to ensure consumer protection. These measures help guarantee that vegan protein products are safe, accurately labelled, and free from harmful or misleading components. Clear disclosure of nutritional content and adherence to quality standards remain essential for maintaining consumer confidence.

- Certifications and quality assurance: To build trust and remain competitive, manufacturers increasingly pursue recognized food safety and quality certifications. Such credentials not only demonstrate compliance with regulations but also reassure consumers about the product's integrity and quality.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 386.24 Million |

| Market Size in 2026 | USD 425.13 Million |

| Market Size by 2035 | USD 1,008.20 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.07% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Source Type, Flavor, End-Use, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Source Type Insights

Why Did the Pea Protein Segment Lead the Market?

The pea protein segment led the vegan protein powder market, accounting for the largest share in 2025. This is because it is widely recognized as a complete protein source providing all nine essential amino acids. Its strong inclusion in protein shakes, smoothies, and functional beverages is driven by its high protein content. Additionally, pea protein is considered hypoallergenic and easy to digest, making it a preferred alternative to many other plant-based proteins while minimizing issues such as bloating or digestive discomfort.

The algae-based protein segment is projected to expand at the fastest rate during the forecast period. This is because of its rich nutritional composition, including high protein content and essential amino acids, combined with sustainability benefits, making it the preferred choice among environmentally conscious consumers. Advanced extraction and processing technologies have improved efficiency and enhanced functional properties of algal proteins, supporting segmental growth.

FlavorInsights

What Made Chocolate and Coffee the Dominant Segment in the Market?

The chocolate and coffee segment dominated the vegan protein powder market with a major share in 2025 due to strong consumer preference for familiar and indulgent flavors that enhance taste and overall product appeal. These flavors make plant-based protein powders more enjoyable and easier to incorporate into daily routines, boosting repeat purchases. Additionally, widespread availability, established consumer trust, and compatibility with a variety of recipes and beverages have further reinforced the popularity of chocolate and coffee flavors in this market.

The unflavored segment is expected to grow at the fastest rate over the forecast period. The growth of the segment is driven by the increasing demand for clean-label products free from artificial additives and preservatives. Clear ingredient labeling and minimal processing make unflavored vegan protein powders particularly attractive to health-focused buyers.

End-UseInsights

How Does the Dietary Supplements Segment Dominate the Market?

The dietary supplements segment accounted for the largest share of the vegan protein powder market in 2025. The major reason behind the segment's dominance is the growing consumer preference for plant-based, natural, and organic supplementation. With the increased prevalence of lifestyle-related conditions, such as obesity, diabetes, cardiovascular disorders, and other chronic illnesses, individuals shifted to protein-enriched diets, driving the inclusion of vegan protein powder in dietary supplements.

The sports nutrition segment is projected to expand at the fastest growth rate over the forecast period. This is mainly due to rising awareness for fitness, muscle recovery, and active living among athletes and fitness enthusiasts. Consumers are seeking high-quality, easily digestible protein sources to support muscle recovery, endurance, and overall performance without relying on animal-based products. Additionally, the rising popularity of gym culture, fitness programs, and personalized nutrition plans is driving demand for vegan protein powders specifically formulated for sports and active lifestyles.

Distribution Channel Insights

How Does the Offline Segment Dominate the Market?

The offline segment led the vegan protein powder market in 2025 because supermarkets and convenience stores remain key distribution points due to their broad product availability and consumer trust. Retailers are expanding shelf space for plant-based products in response to growing interest in sustainable and ethical consumption. The enhanced in-store visibility and competitive pricing with immediate access continue to support strong offline sales.

The online segment is expected to expand at the fastest rate during the forecast period. This is mainly due to the convenience of digital shopping platforms, which allow consumers to explore diverse product opinions, compare prices, and access subscription-based purchasing models. E-commerce has improved product accessibility and direct-to-consumer engagement, thereby accelerating sales of vegan protein powders.

Regional Insights

North AmericaVegan Protein Powder Market Size and Growth 2026 to 2035

The North America vegan protein powder market size is projected to attain around USD 418.40 million by 2035, increasing from USD 158.36 million in 2025, with a CAGR of 10.20% from 2026 to 2035.

What Made North America the Dominant Region in the Vegan Protein Powder Market?

North America dominated the vegan protein powder market by capturing the largest share in 2025. The region's dominant position in the market is supported by rising demand for protein-rich diets and greater awareness of the benefits of plant-based nutrition. Increased demand for vegan proteins from food and beverage manufacturers, along with advancements in ingredient extraction technologies, is further supporting market expansion. In addition, the region's well-established nutraceutical and functional food sector, strong gym and sports culture, and the growing preference for health, wellness, and clean-label products are likely to sustain the region's leadership in the market.

U.S. Vegan Protein Powder Market Size and Forecast 2026 to 2035

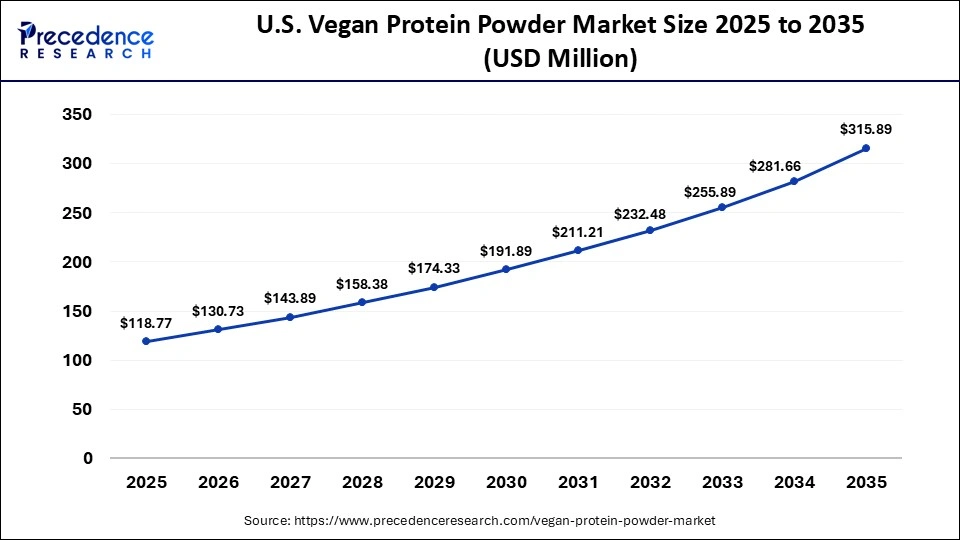

The U.S. vegan protein powder market size was evaluated at 118.77 million in 2025 and is predicted to reach 315.89 million by 2035, at a 10.28% CAGR between 2026 and 2035.

U.S. Market Trends

The U.S. leads the North American vegan protein powder market due to the growing consumer preference for plant-based diets. The market growth is also driven by fitness-oriented consumers and increasing demand for clean-label sports nutrition products. Supportive government initiatives, along with brands emphasizing allergen-free, sustainable products, are strengthening the market.

How is the Opportunistic Rise of Asia-Pacific in the Vegan Protein Powder Market?

Asia Pacific is projected to witness the fastest growth during the forecast period. This is mainly due to the growing health awareness and rising disposable incomes, along with a growing fitness culture. Plant-based and vegan products are gaining popularity, supported by innovations in plant protein ingredients that better replicate the taste and texture of animal proteins. However, preferences vary across countries, with consumers in China and Japan showing a stronger inclination toward soy protein, while Indian consumers are increasingly embracing plant-based protein options.

India Market Trends

The vegan protein powder market in India is growing steadily. This is because a large portion of the population faces protein deficiency, which has increased awareness about the importance of protein for muscle development and overall immunity. Additionally, campaigns such as Veganuary India have highlighted the rising interest in plant-based lifestyles. A significant number also feel that maintaining a vegan diet is manageable, as adequate vegan food options are available. As veganism continues to gain traction, brands are focusing on targeted marketing strategies to connect with consumers who prioritize plant-based nutrition and fitness.

Vegan Protein Powder Market Value Chain Analysis

- Raw Material Procurement:In the vegan protein industry, raw material procurement deals with a strategic procedure of purchasing, evaluating, processing, sourcing, and packaging of nutritional and convenient protein products from various natural, plant-based sources.

- Packaging and Branding: This stage focuses on creating packaging that ensures protein powders remain stable, safe, and fresh by protecting them from contamination, light, and moisture.

Waste Management and Recycling:The waste management and recycling of vegan protein powder focus on the health and - wellness of consumers seeking convenience and plant-based, nutritious, sustainable, and vegan products.

Vegan Protein Powder Market Companies

- MuscleBlaze

- Nutricore Bioscience Pvt.Ltd

- Fz Nutrition

- Healthoxide Vegan Plant Protein

- Nutralike Health Care/ Nutralike Formulation Pvt Ltd

- Amway India

- Bigmuscles Nutrition

- KOS Organic Plant Protein

- Myfitfuel Plant Pea Protein Isolate

- Naked Nutrition

- Nutrilite Protein

- Paradise Nutrition Inc

- Orgain Organic Protein Plant-Based Powder

- Naked Pea Protein Farms

- Nutrilite Protein

- Vega Sport Premium Protein

- Garden of Life Raw Organic Protein

- Ghost Whey Protein

- Optimum Nutrition Gold Standard Whey

- Organic India Protein

- Plant Protein

- Vega Protein Greens

- Makers Nutrition

Recent Developments

- In September 2025, Danone launched a high-protein variant of its Silk brand to rejuvenate consumer interest in plant-based dairy and nutrition products, including vegan protein formats.

- In September 2025,Leafy Wellness debuted a new plant-based protein powder in India that blends modern nutrition science with ayurvedic traditions.

- In October 2025,Singapore-based Shandi Global entered the Indian market with Chanza, a chickpea-based plant protein chunk product that offers plant protein options for consumers.

- In October 2025,Prienova showcased its vegan protein formulations alongside other nutrition innovations at Supply Side Global 2025, highlighting the industry's focus on functional proteins.

- In November 2025, Aquatein introduced India's first vegan protein water on World Vegan Day, offering 15-gram plant protein and electrolytes per bottle, targeting hydration and muscle recovery.

Segments Covered in the Report

By Source

- Hemp Protein

- Pea Protein

- Brown Rice Protein

- Soy Protein

- Algae-based (Spirulina)

- Protein Blends

By Flavor

- Unflavored

- Chocolate and Coffee

- Vanilla

- Strawberry

- Banana

By End Use

- Dietary Supplements

- Sports Nutrition

By Distribution Channel

- Offline

- Online

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting