Veterinary Antihistamines Market Size and Forecast 2025 to 2034

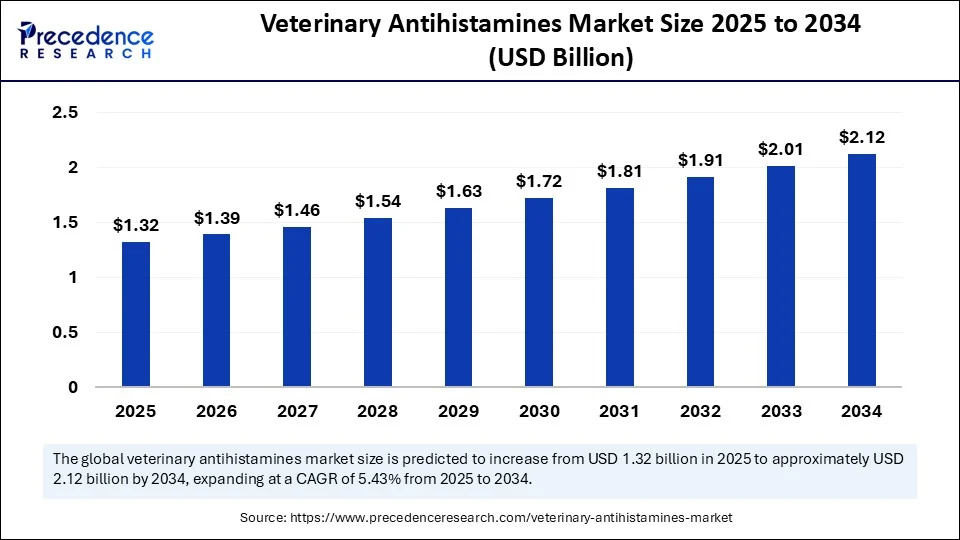

The global veterinary antihistamines market size accounted for USD 1.25 billion in 2024 and is predicted to increase from USD 1.32 billion in 2025 to approximately USD 2.12 billion by 2034, expanding at a CAGR of 5.43% from 2025 to 2034. The veterinary antihistamines market is experiencing rapid growth because of increasing pet ownership, rising prevalence of allergies among animals, and improvements in veterinary care. The rising demand for safe and effective allergy medications for companion animals contributes to the market's continual growth.

Veterinary Antihistamines MarketKey Takeaways

- In terms of revenue, the global veterinary antihistamines market was valued at USD 1.25 billion in 2024.

- It is projected to reach USD 2.12 billion by 2034.

- The market is expected to grow at a CAGR of 5.43% from 2025 to 2034.

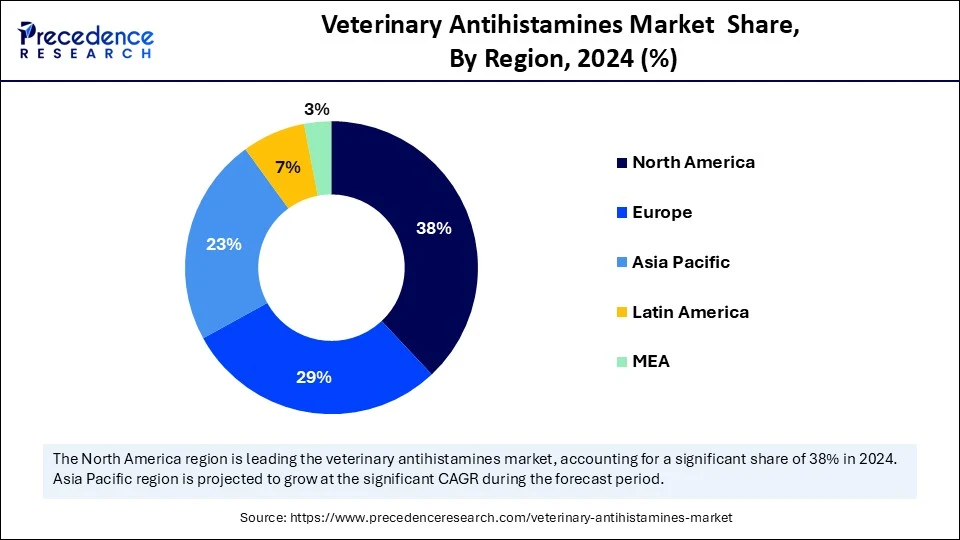

- North America led the veterinary antihistamines market with the highest revenue share of 38% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By drug type, the H1 receptor antagonists (H1 blockers) segment held the biggest market share 60% in 2024.

- By drug type, the H2 receptor antagonists (H2 blockers) segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By dosage form, the tablets & capsules segment captured the highest market share of 45% in 2024.

- By dosage form, the oral liquids & suspensions segment is expected to expand at a notable CAGR over the projected period.

- By animal type, the dogs segment contributed the biggest market share of 50% in 2024.

- By animal type, the cats segment is expected to expand at a significant CAGR over the projected period.

- By distribution channel, the veterinary clinics & hospitals segment generated the major market share of 55% in 2024.

- By distribution channel, the online pharmacies segment is expected to expand at a notable CAGR over the projected period.

Impact of AI on the Veterinary Antihistamines Market

Artificial intelligenceis revolutionizing the market by optimizing drug discovery and development. AI analyses vast amounts of data to identify potential new antihistamine compounds, accelerating drug development. It also helps in developing personalized treatment by analyzing data about animal's medical history and breed. Companies like Zoetis are utilizing generative AI to refine the development of more precise antihistamines for treating allergies in pets. Texas A&M has already developed a VetClinPathGPT that uses the AI tool to diagnose animal allergic reactions. This allows for the better use of antihistamines for allergy therapy. As AI-created diagnostics and treatment are fully integrated into the veterinary field, it will only be a matter of time before veterinary antihistamines are similarly improved in innovation and product use efficiency.

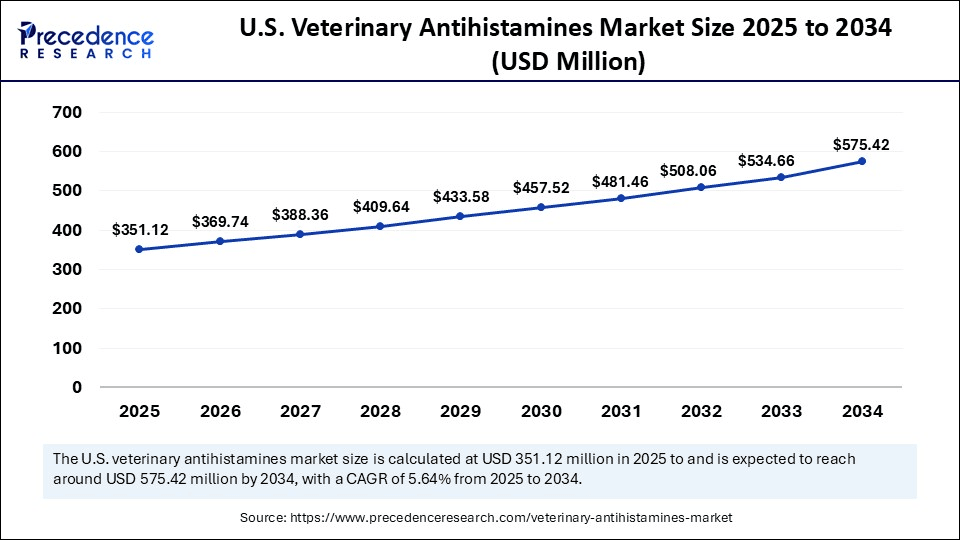

U.S. Veterinary Antihistamines Market Size and Growth 2025 to 2034

The U.S. veterinary antihistamines market size was exhibited at USD 332.50 million in 2024 and is projected to be worth around USD 575.42 million by 2034, growing at a CAGR of 5.64% from 2025 to 2034.

Why Did North America Dominate the Veterinary Antihistamines Market in 2024?

North America dominated the veterinary antihistamines market by capturing the largest share in 2024. The region's dominance in the market stems from its well-established veterinary infrastructure and regulatory environment. There is a greater awareness of pets' health and wellness among pet owners, seeking veterinary care, including treatment for allergies. The region also has a high rate of pet ownership. Increased demand for specialized veterinary services further bolstered the market's growth.

The U.S. is a major contributor to the North American market. The country is home to a large number of market players, including Zoetis, Elanco Animal Health, and Merck Animal Health. The country also boasts a well-established distribution network, ensuring the timely availability of antihistamines. Additionally, the growing number of veterinary hospitals and clinics is contributing to market growth.

What Makes Asia Pacific the Fastest-Growing Market for Veterinary Antihistamines?

Asia Pacific is emerging as the fastest-growing market, with rising regulatory and government support for the veterinary pharmaceutical industry. The rising prevalence of allergies in animals further boosts the demand for antihistamines. Local manufacturers have been increasing the pipeline for biological and skin care therapeutics. Moreover, the expansion of veterinary infrastructure further supports market growth.

China has tightened regulation of veterinary drugs; however, the newly established procedures provide expedited paths to approval and reduce the number of trials needed to demonstrate a safe and effective biological product. This has accelerated the development and introduction of new pet medicines in Asian countries. China's MARA has improved the conduct of clinical trials, shortened license applications from years to months, added serious capital into the bio veterinary drug sector and expanded the pipeline of veterinary allergy medications.

Market Overview

The veterinary antihistamines market comprises pharmaceutical products and compounds used to manage allergic reactions and hypersensitivity disorders in animals, particularly in companion and livestock species. These drugs function by blocking histamine receptors (H1 and H2), which are responsible for allergic symptoms such as inflammation, itching, gastrointestinal distress, and respiratory issues. Antihistamines are used in treating conditions like atopic dermatitis, urticaria, allergic rhinitis, insect bites, anaphylaxis, and vaccine reactions. The market spans over-the-counter and prescription drugs in various dosage forms tailored for different animal species.

Veterinary Antihistamines MarketGrowth Factors

- Increasing focus on animal health: The growing awareness among pet owners and livestock farmers of animal health and preventive care services has led to a greater use of antihistamines to address allergic responses and provide increased comfort for their animals.

- Increase in veterinary dermatological conditions: As the incidence of skin allergies, rashes, and pruritus (itching) in animals increases, the need for effective antihistamine treatment options within both non-commercial and commercial veterinary services is also expanding.

- Development of innovative drug products: Ongoing advancements in delivery systems, including chewable, injectable, and flavored tablets, provide increased options for pet and livestock owners to enhance compliance with veterinary treatment.

- Growth of veterinary clinics and services: The increase in veterinary hospitals and clinics, as well as the global adoption of veterinary telemedicine, improves access to animal health services and results in more people being prescribed and using antihistamines to treat their animals.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.12 Billion |

| Market Size in 2025 | USD 1.32 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.43% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Dosage Form, Animal Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

DriversCould Increasing Environmental Allergens in Pets Contribute to the Demand for Veterinary Antihistamines?

Increasing environmental allergens have come to be a significant driver in the veterinary antihistamines market and recent updates to government and associated organizations' websites, including the U.S. Food and Drug Administration (FDA) and USDA's Animal and Plant Health Inspection Service, note that pet allergies are increasing, particularly among veterinary clinics, which have identified increased allergy-related dermatologic diseases.

In 2023, the FDA reported a significant increase in pets exhibiting signs of allergies due to rising pollution in urban areas and a shifting seasonal pollen pattern. Antihistamines induce a physical response that results in relief from symptoms of itching, impaired function due to inflammation or general discomfort. The increase of allergic reactions to environmental allergens is propelling the veterinary antihistamines market forward.

Restraint

Are Stringent Regulations Affecting the Growth of the Veterinary Antihistamines Market?

One major constraining factor for the veterinary antihistamines market is the regulatory risk and stricter regulations enforced by regulatory bodies such as the FDA. In August 2024, new FDA policies (e.g., Guidance for Industry #256) mandate that veterinary compounding pharmacies discontinue stocking bulk antihistamines in their offices. Instead, they must be prescribed for each individual patient by a licensed veterinarian. Compounding is only allowed when no FDA-approved alternative has been developed or marketed, putting the onus and cost of new drugs on veterinarians and pet owners. This limits access since veterinarians must now authorize prescriptions to be sent to an off-site source, increases the administrative burden, and may also deter the use of antihistamines.

(Source: https://www.fda.gov)

Additionally, in December 2023, the FDA released warning letters to unapproved OTC antimicrobial animal drugs, reflecting that there will be increased scrutiny across veterinary products. Limiting regulatory authority is a constraining factor in market growth, as higher access and compliance costs create additional barriers. Moreover, obtaining approval for new drugs is lengthy and expensive, limiting market entry.

(Source: https://www.hoganlovells.com)

Opportunity

Does Increasing Pet Ownership Create New Opportunities in the Veterinary Antihistamines Market?

Yes, increasing pet adoption rates worldwide create immense opportunities in the market. Shelter Animals Count (SAC) recorded total adoptions for dogs and cats reached 4.2M (2M dogs and 2M cats), a slight 0.4% increase (17,000 more adoptions) from 2023. The cat adoption rate is up by almost 2%. The numbers themselves are promising; dogs had an adoption rate of 57%, while cats had an adoption rate of 64%.

(Source: https://www.shelteranimalscount.org)

These numbers are indicative of a strong trend in companion animal ownership, and ultimately, more pets lead to a greater need for pet health services. When more animals are owned, there is a greater need for health and disease management, including allergies, such as skin irritations, food sensitivities, and environmental allergens, thereby presenting immense opportunities for veterinary care providers and drug manufacturers.

Drug Type Insights

Why Did the H1 Receptor Antagonists (H1 Blockers) Segment Held the Largest Share of the Veterinary Antihistamines Market in 2024?

The H1 receptor antagonists (H1 blockers) segment dominated the market while holding the largest share in 2024. The segment's dominance stems from its widespread use in treating allergic reactions, such as dermatitis or pruritus, as well as seasonal allergies. H1 receptor antagonists are commonly used in canines, where skin allergies are relatively common disorders and would serve as a trusted solution. This drug type is used in both chronic and acute situations. H1 blockers are often used as a first-line treatment in veterinary practices globally.

The H2 receptor antagonists (H2 blockers) segment is expected to grow at the fastest CAGR during the forecast period, as pet owners become more aware of gastrointestinal disorders that can manifest in companion animals. H2 receptor antagonists are increasingly prescribed for acid-related issues such as gastric ulcers and reflux, especially in aging pets. H2 receptor antagonists are increasingly utilized in both companion animals and performance animals due to the growing awareness of medications specifically directed at internal health conditions, where owners are growing aware of the impact of comprehensive wellness management.

Dosage Form Insights

What Made Tablets & Capsules the Dominant Segment in the Market?

The tablets & capsules segment dominated the veterinary antihistamines market in 2024 due to the increased demand for oral formulations for long-term treatment approaches. Tablets and capsules are still the most commonly used dosage forms because of their long shelf life, precise dosing, and ease of administration in medium to large-sized pets, especially dogs. They can be used in different strengths or combinations and are appropriate for routine orders in veterinary medicine. Pet owners recognize these formats, and many tablets can be flavored or crushed, assisting with compliance.

The oral liquids & suspensions segment is anticipated to grow at the fastest rate in the upcoming period. This is mainly due to the higher usage, particularly for small pets and kittens, where precise dosing is essential and swallowing pills can be difficult. Oral liquids and suspensions are often more palatable and easier to administer, improving compliance with medication. They are being used more frequently in pediatric veterinary care and home care protocols.

Animal Type Insights

How Does the Dogs Segment Dominate the Veterinary Antihistamines Market in 2024?

The dogs segment dominated the market in 2024 due to the increased dog ownership rates worldwide, as they are considered the preferred pet for companionship. Dogs are the largest consumers of veterinary antihistamines, considering that they often suffer from numerous allergic reactions, flea bite sensitivities, and general skin problems. Veterinary antihistamines are typically recommended as part of a treatment plan for managing chronic dermatitis and environmental allergies in dogs.

The cats segment is likely to expand at the highest CAGR over the projection period due to the rising prevalence of feline-specific allergies and sensitivities. Cat allergies have been underdiagnosed to date and are now more readily recognized in practice as society becomes better equipped to utilize veterinary diagnostics, particularly for assessing allergy symptoms. As the cat population and visits to veterinarians increase, the antihistamine products specifically designed for cats continue to make up a larger share of the market.

Distribution Channel Insights

Why Did the Veterinary Clinics & Hospitals Segment Dominate the Market in 2024?

The veterinary clinics & hospitals segment dominated the veterinary antihistamines market with the largest revenue share in 2024, as they are considered the most trusted and regulated place of care for pet treatment. The majority of antihistamines require a professional diagnosis, and if a veterinarian prescribes antihistamines, they will likely dispense the product directly after the consultation. This route of purchase assures product legitimacy, professional advisement and instructions, and a ready supply of antihistamines, making it the channel of choice for pet owners. Moreover, the easy availability of antihistamines in these settings enables timely interventions, enhancing patient compliance and outcomes.

The online pharmacies segment is expected to grow at the fastest rate due to the convenience, variety of products, and doorstep delivery they offer. Pet owners often seek to switch brands to enhance their pet's health. However, these pharmacies offer a range of products from multiple brands, attracting a wider audience of pet owners. These pharmacies also offer remote consultations, allowing pet owners to avoid unnecessary visits to clinics and reduce healthcare costs. Moreover, these pharmacies offer competitive pricing and subscription-based methods, encouraging pet owners to repeat purchases.

Veterinary Antihistamines Market Companies

- Zoetis Inc.

- Boehringer Ingelheim Animal Health

- Elanco Animal Health

- Merck Animal Health

- Virbac

- Dechra Pharmaceuticals

- Vetoquinol

- Ceva Santé Animale

- Bayer Animal Health (now part of Elanco)

- Norbrook Laboratories

- Bimeda

- Neogen Corporation

- Phibro Animal Health

- Vétoquinol

- Ourofino Saúde Animal

- Kyoritsu Seiyaku Corporation

- Med-Pharmex

- KRKA Pharmaceuticals

- Chanelle Pharma

- PetIQ Inc.

Recent Developments

- In September 2024, The FDA approved Zenrelia (ilunocitinib tablets) for the management of allergic dermatitis in dogs. This once-daily oral product works to reduce itch and inflammation and adds an additional non-steroidal treatment option to the range of antihistamine-alternative therapies. (Source: https://www.fda.gov)

- In July 2024, Merck Animal Health completed its acquisition of Elanco's aqua business as it looks to expand its focus on animal health innovation and service delivery. In pursuing this idea, Merck Animal Health could shift investments toward the antihistamine and dermatological categories within the veterinary care of companion animals.

(Source: https://www.merck.com)

Segments Covered in the Report

By Drug Type

- H1 Receptor Antagonists (H1 Blockers)

- Diphenhydramine

- Hydroxyzine

- Chlorpheniramine

- Clemastine

- Others

- H2 Receptor Antagonists (H2 Blockers)

- Ranitidine

- Famotidine

- Cimetidine

- Others

- Others (Dual-acting, mast-cell stabilizers, etc.)

By Dosage Form

- Tablets & Capsules

- Injectables

- Oral Liquids & Suspensions

- Topical Creams & Gels

- Others (powders, chewables, sprays)

By Animal Type

- Dogs

- Cats

- Equine

- Cattle

- Swine

- Others (goats, rabbits, exotic pets)

By Distribution Channel

- Veterinary Clinics/Hospitals

- Retail Pharmacies

- Online Pharmacies

- Others (distributors, pet shops)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting