Vitamin B-Complex Ingredients Market Size and Forecast 2025 to 2034

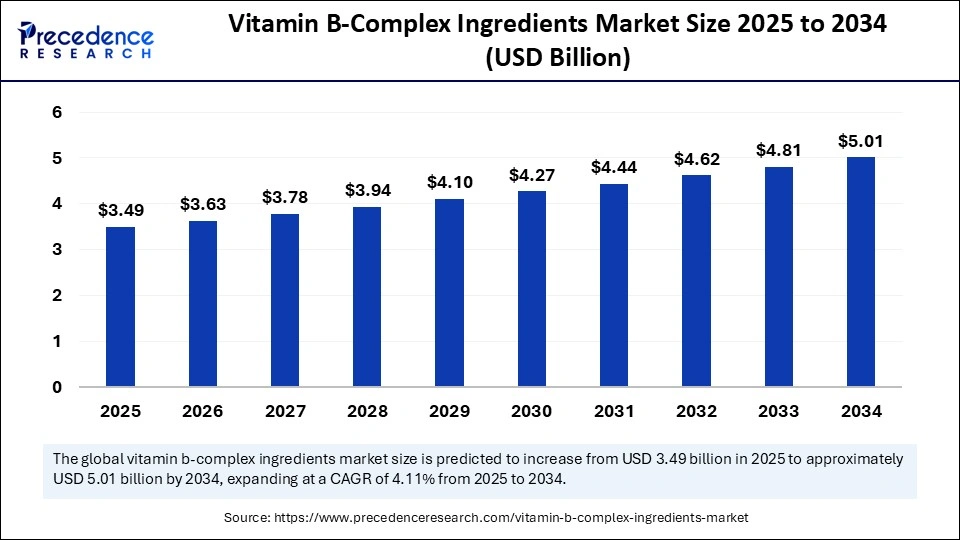

The global vitamin B-complex ingredients market size accounted for USD 3.35 billion in 2024 and is predicted to increase from USD 3.49 billion in 2025 to approximately USD 5.01 billion by 2034, expanding at a CAGR of 4.11% from 2025 to 2034. Increasing awareness about vitamin B complex and its crucial functions in the body, prevalence of diseases due to low immunity, vitamin deficiency, and innovative healthcare product launches by several key players in the market are driving factors for the market.

Vitamin B-Complex Ingredients MarketKey Takeaways

- In terms of revenue, the global vitamin B-complex ingredients market was valued at USD 3.35 billion in 2024.

- It is projected to reach USD 5.01 billion by 2034.

- The market is expected to grow at a CAGR of 4.11% from 2025 to 2034.

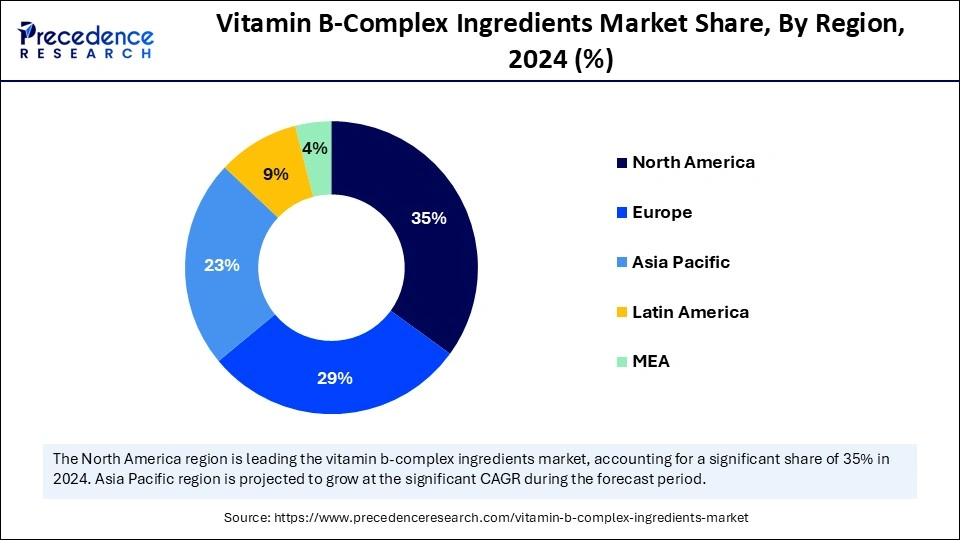

- North America dominated the vitamin B-complex ingredients market with the largest market share of 35% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By vitamin type, the vitamin B12 (Cobalamin) segment held the biggest market share of 20% in 2024.

- By vitamin type, the vitamin B7 (Biotin) segment is expected to witness the fastest CAGR during the foreseeable period.

- By formulation type, the tablets segment contributed the highest market share of 40% in 2024.

- By formulation type, the powders segment is expected to witness the fastest CAGR during the foreseeable period.

- By end-use industry, the dietary supplements segment generated the major market share of 45% in 2024.

- By end-use industry, the functional foods & nutraceuticals segment is expected to witness the fastest CAGR during the foreseeable period.

How is AI transforming the vitamin B-complex ingredients market?

Artificial intelligence cannot directly affect the process or extraction of vitamin B complex, though AI can be utilized for dosage recommendations, quality control, along research related to vitamin B deficiency. AI algorithms can analyze healthcare datasets of different people and their health-related information that can be gathered from various sources to train AI models. AI can further monitor if a person needs Vitamin B complex or not, and if yes, then how much quantity he or she requires daily to avoid unnecessary consumption that may lead to other complications related to kidney function. Dosage recommendations can be accurate by AI due to its ability to analyze data and offer insight from it. AI can further use quality control and manufacturing purposes in the vitamin B-complex ingredients market.

U.S. Vitamin B-Complex Ingredients Market Size and Growth 2025 to 2034

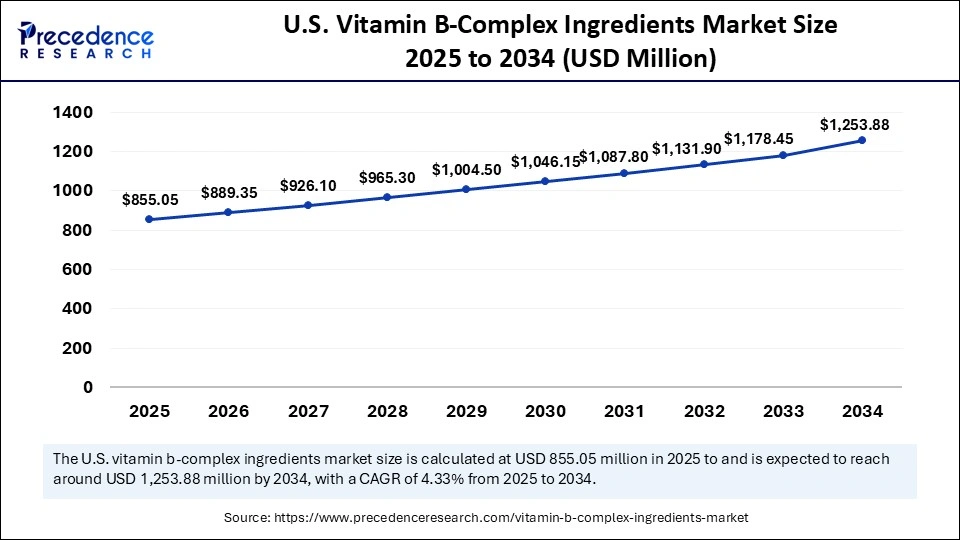

The U.S. vitamin B-complex ingredients market size was exhibited at USD 820.75 million in 2024 and is projected to be worth around USD 1,453.88 million by 2034, growing at a CAGR of 4.33% from 2025 to 2034.

North America

What makes North America a leader in the vitamin B-complex ingredients market?

North America held the largest market share of nearly 35% in 2024. There are several factors that allow market establishment, including an affluent consumer base due to high disposable income, increasing demand for health & wellness supplements, well-regulated frameworks for food safety that support the growth of the nutraceutical sector, along with robust manufacturing infrastructure with ongoing research and development. A growing number of people have been diagnosed with lifestyle-related diseases due to reasons like unhealthy food habits, sedentary workstyle, and hectic schedule, enabling people to opt for healthcare supplements to fill the nutritional gap for their well-being, which includes the consumption of vitamin B complex as well. High purchasing power contributes to the market's growth in the region.

Moreover, favorable and progressive regulations support market scalability with innovation in dietary supplements like personalized healthcare supplements or products design for particular age groups or people having similar diseases. Leading countries like the U.S. and Canada boast well-structured logistics and proper distribution networks, allowing wider access to the market.

Asia Pacific

What are the growth reasons for the vitamin B-complex ingredients market?

Asia Pacific is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The region is growing due to a combination of factors like an increasing middle-class population having more disposable income that can be spent on proactive healthcare solutions, growing health consciousness, increasing rate of urbanization, and a balanced lifestyle with a specific diet and healthcare supplements. Developing countries like India, Japan, and China are witnessing an increasing population rate, especially the younger generation have become more health-oriented and are opting for fortified foods with dietary supplements. The government also contributed to the expansion of the market by social health care campaigns to spread awareness among people.

Market Overview

Vitamin B-complex ingredients consist of a group of water-soluble vitamins that play critical roles in energy metabolism, neurological function, and red blood cell formation. The B-complex includes B1 (Thiamine), B2 (Riboflavin), B3 (Niacin), B5 (Pantothenic acid), B6 (Pyridoxine), B7 (Biotin), B9 (Folate/Folic acid), and B12 (Cobalamin). These ingredients are widely used in dietary supplements, fortified foods and beverages, functional foods, and pharmaceuticals to prevent deficiencies and support overall health. The vitamin B-complex ingredients market growth is driven by increasing consumer awareness about nutrition, rising incidences of vitamin B deficiencies, an expanding geriatric population, and the growing demand for preventive healthcare. Ingredients are available in synthetic and natural forms, with manufacturers focusing on high-purity, bioavailable formulations suitable for different delivery formats, including tablets, capsules, powders, and liquids.

What are the key trends in the vitamin B-complex ingredients market?

- Adoption of functional foods and Beverages: The increasing adoption of functional foods and beverages with vitamin B complex as a main ingredient due to its various benefits, like strong immunity support, showcases a growing trend of vitamin B complex in the global market. This trend is driven by growing emphasis of consumers for readily available and essential nutrients in a single food package. People are also seeking specific vitamins incorporated with ready-to-drink beverages, fortified cereals, and energy bars, further expanding the market growth.

- Increasing demand for supplements with nutrients: Many consumers across the globe are adopting a proactive approach to health by embracing various supplements that can fulfil their daily nutritional needs, including vitamin B complex to provide a strong immune system, boost energy levels, and help in the healing process for people in the post-surgical phase. This is majorly helpful for the geriatric population, as they tend to lose energy due to nutritional loss with age.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.01 Billion |

| Market Size in 2025 | USD 3.49 Billion |

| Market Size in 2024 | USD 3.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.11% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vitamin Type, Formulation Type, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing shift towards preventive healthcare

A significant driving factor for the expansion of the vitamin B-complex ingredients market is the growing shift to adopt preventive healthcare as a lifestyle instead of treating it later. People are becoming more health-conscious and understanding the importance and key role of essential nutrients like vitamin B complex to maintain overall health is further driving the market growth. Also, the WHO has revealed the major deficiencies that people witnessed include a deficiency of vitamin B complex worldwide, further making people aware of the role of nutrients and how they affect overall life quality.

In addition to this, people are embracing fitness and wellness trends while practising different fitness techniques coupled with healthcare sessions that offer training about the basics of the human system and how to stay healthy without having any deficiency, further fuels demand for supplements with vitamin B-complex.

Restraint

intense competition

Despite having numerous benefits and potential to expand largely, the vitamin B-complex ingredients market still has some hurdles like increase competition between well-established players and newly entered brands that offer similar benefits and create pricing pressure to attract consumers and retain. Also, maintaining a high quality of vitamin B complex as a supplement is a challenge for manufacturers while keeping volume high, further creating a barrier for market expansion.

Opportunity

Personalized nutritional demand

Personalized nutrition presents a prominent opportunity that drives the vitamin B-complex ingredients market growth by offering targeted supplements as per consumers' needs and genetic variations, which influence the absorption of vitamin B supplements and utilize them for better metabolism processes. Specific genetic variations can impact a person's metabolism and may require other supplements as a catalyst to process and absorb vitamin B-complex supplements. Also, people with specific health conditions like pregnancy, post-operative recovery phase, other health conditions, and old age may require tailored nutritional supplements to align with their health condition and offer the best results, creating a lucrative opportunity for the market's growth globally.

Vitamin type Insights

Why does vitamin B12 highly affect people's health?

The vitamin B12 segment held the largest market share of nearly 20% in 2024. Vitamin B12 is essential for nerve health, the formation of red blood cells, and plays a crucial role in sustaining the overall energy of the human body and affecting its functioning in every aspect. It also has a crucial role in the synthesis of DNA, which is a basic yet highly impacting factor of the human system. Vitamin B12 is often prescribed for people who have absorption or digestion issues, where they can't synthesize vitamin B12 and use it for further functioning. Therefore, a vitamin B complex supplement provides all eight vitamins, including vitamin B12, also fueling the segment's growth.

The vitamin B7 segment is expected to witness the fastest CAGR during the foreseeable period. Vitamin B7 is also known as biotin. It is strongly associated with the health of hair, skin, and nails, creating its high demand in the market. It is now increasingly incorporated with various cosmetics and haircare products due to its benefits. Also, people's demand for natural and clean-label hair/skin care products is fulfilled by biotin, which further fuels the segment's growth.

Formulation type Insights

Why is vitamin B consumed mostly in the form of tablets?

The tablets segment held the largest market share of nearly 40% in 2024. Tablet form of vitamin B is purchased by consumers most often due to its easy swallowing, convenient packaging, and longer shelf life. A major driving factor is increasing awareness about the benefits of vitamins B complex and the growing addition of these vitamins into several other supplements that are manufactured in tablet form. Fostering the dietary supplement sector and easy access to these supplements at online and offline channels are other reasons for the segment's growth.

The powders segment is expected to witness the fastest CAGR during the foreseeable period. Segment is expanding due to its flexibility in the blending process with precise dosing. Powders can easily blend with other formulations, making them a popular choice for consumers and manufacturers as well. Powders offer an accurate and adjustable dosage of vitamin B complex as per a person's needs. They can be customized for different targets, like fitness enthusiasts, athletes, and skin and haircare routine supplements, further expanding the segment's growth.

End-use industry Insights

How do dietary supplements help the vitamin B-complex ingredients market grow further?

The dietary supplements segment held the largest market share of nearly 45% in 2024. Major reasons behind this growth include increasing awareness about the crucial role of vitamins and minerals for healthy functioning. Vitamin B complex is well known for its critical role in energy production and cell health. A dietary supplement provides convenience to consume vitamin B complex easily, especially for people having a busy lifestyle and restrictions on some foods. It has a concentrated amount of vitamin B complex to fulfill daily requirements in an easy way.

The functional foods & nutraceuticals segment is expected to witness the fastest CAGR during the foreseeable period. Increasing health awareness and a proactive lifestyle led people to adopt healthy food habits and the incorporation of functional foods & nutraceuticals to prevent lifestyle-led diseases like obesity, CVDs, and hypertension, and others. Since vitamin B complex plays a critical role in different bodily functions, people are opting for its consumption as a fortified food.

Value Chain Analysis

- Raw Material Procurement (Farms, Fisheries, etc.)- Wheat, rice, corn, green leafy veggies, and legumes are some of the key sources of vitamin B complex. The source of raw material mainly depends on natural sources and fermentation processes.

Key players- large agriculture farms, Fermenta Biotech Ltd, Antibiotice, RX Pharmachem, HealthTech BioActives, and others

- Processing and Preservation

This is a crucial stage of the market where conversion of raw materials into an applicable vitamin B complex ingredient is performed with less nutrient reduction.

Key players- Amway India, Himalaya Wellness

- Quality Testing and Certification

This stage offers an intense testing of the safety, efficacy, and purity of final products. Various scientifically backed analyses and techniques have been performed at this level, and then certification is offered.

Key players- NSF International, Consumer Lab.com, USP, and others

Vitamin B-Complex Ingredients Market Companies

- BASF SE

- DSM Nutritional Products

- Lonza Group AG

- Evonik Industries AG

- Kyowa Hakko Bio Co., Ltd.

- Zhejiang Medicine Co., Ltd.

- FMC Corporation

- Amway Corporation

- GlaxoSmithKline PLC

- Pfizer Inc.

- Glanbia Nutritional

- Cargill, Incorporate

- ADM (Archer Daniels Midland)

- Naturex SA

- Vitablend Nederland B.V.

- Nutritional Products International

- Alfa Aesar (Thermo Fisher)

- Hunan Nutramax Inc.

- Roquette Frères

- Synthite Industries

Recent Developments

- In February 2025, Neurobion Forte introduced a sabse Bada B campaign to raise awareness about vitamin B deficiency and symptoms related to it. The Neurobion Sabse Bada B campaign includes a TV commercial and outreach plan to highlight the role of Vitamin B in nerve health and its symptoms.(Source: https://www.afaqs.com)

- In February 2025, LUCOFAST launched an innovative hydration drink design to support energy levels, recovery with strong immune support, which includes essential electrolytes and vitamin B complex. LUCOFAST addresses this growing demand with a fast-absorbing formula that replenishes essential nutrients lost due to sweat, stress, and physical exertion. (Source:https://www.indianretailer.com)

Segments Covered in the Report

By Vitamin Type

- Vitamin B1 (Thiamine)

- Synthetic

- Natural Extracts

- Vitamin B2 (Riboflavin)

- Synthetic

- Natural Extracts

- Vitamin B3 (Niacin/Niacinamide)

- Synthetic

- Natural Extracts

- Vitamin B5 (Pantothenic Acid)

- Synthetic

- Natural Extracts

- Vitamin B6 (Pyridoxine/Pyridoxal)

- Synthetic

- Natural Extracts

- Vitamin B7 (Biotin)

- Synthetic

- Natural Extracts

- Vitamin B9 (Folate/Folic Acid)

- Synthetic

- Natural Extracts

- Vitamin B12 (Cobalamin)

- Synthetic

- Natural Extracts

- Others

- Mixed B-Complex Ingredients

By Formulation Type

- Tablets

- Capsules

- Powders

- Liquids & Syrups

- Others

By End-Use Industry

- Dietary Supplements

- Fortified Foods & Beverages

- Pharmaceuticals

- Functional Foods & Nutraceuticals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting