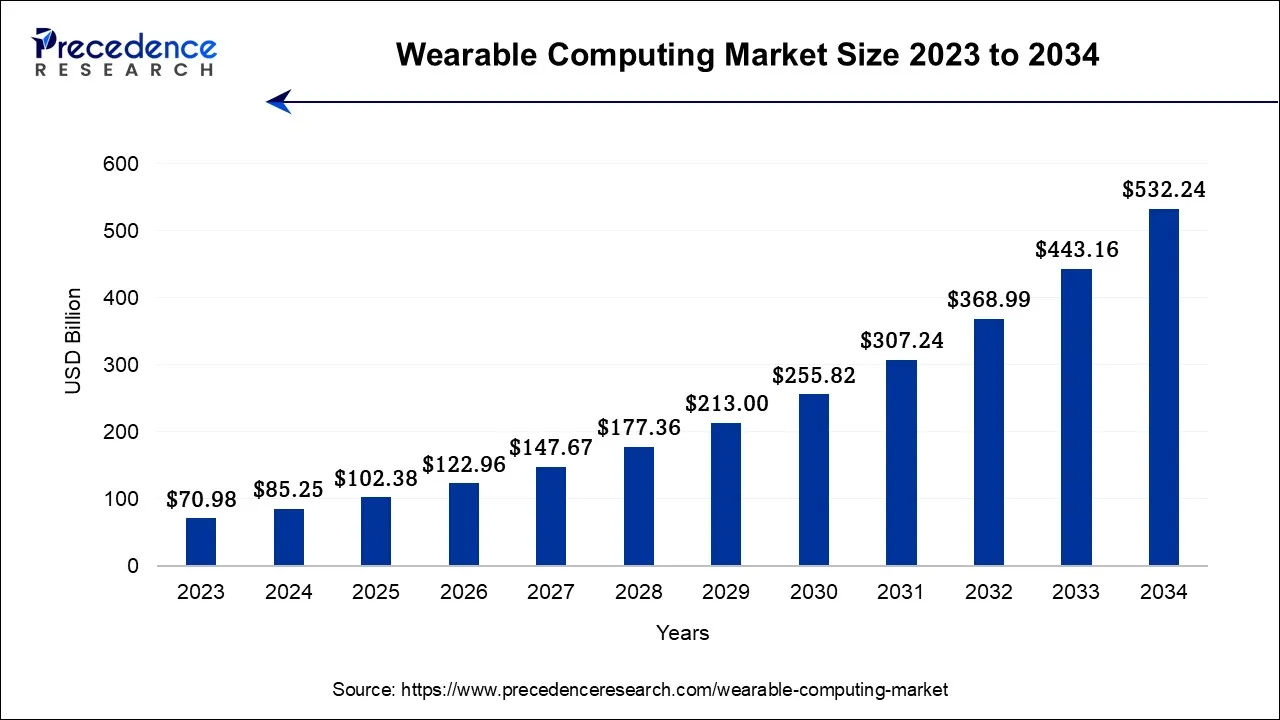

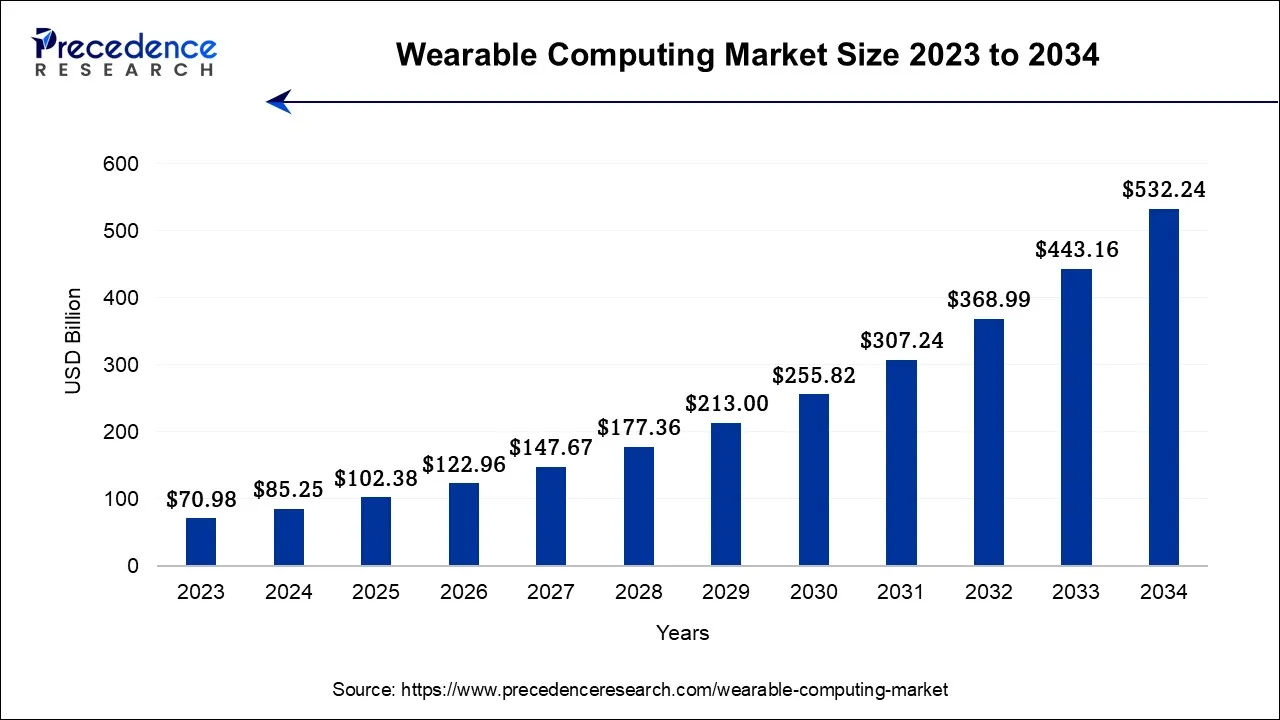

Wearable Computing Market Size and Forecast 2025 to 2034

The global wearable computing market size was valued at USD 85.25 billion in 2024, and is projected to hit around USD 102.38 billion by 2025, and is anticipated to reach around USD 532.24 billion by 2034, expanding at a CAGR of 20.1% over the forecast period from 2025 to 2034.

Wearable Computing Market Key Takeaways

- In terms of revenue, the market is valued at $102.38 billion in 2025.

- It is projected to reach $532.24 billion by 2034.

- The market is expected to grow at a CAGR of 20.1% from 2025 to 2034.

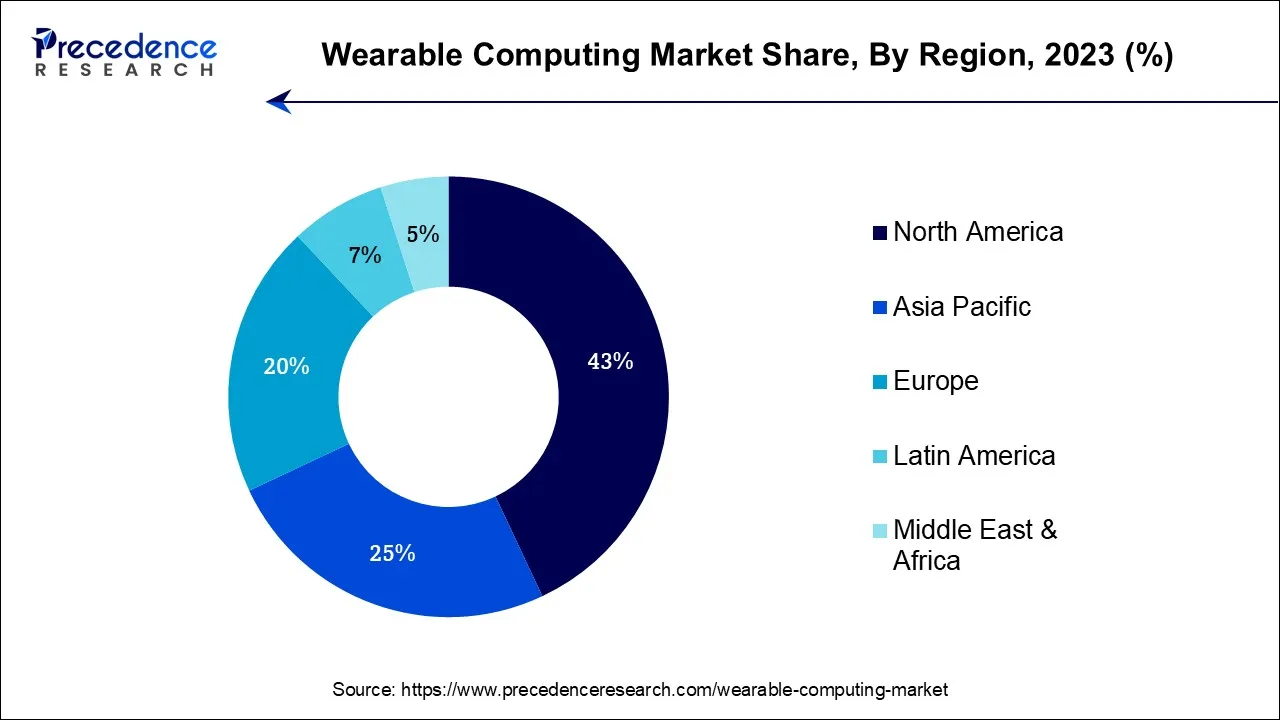

- North America contributed more than 43% of revenue share in 2024.

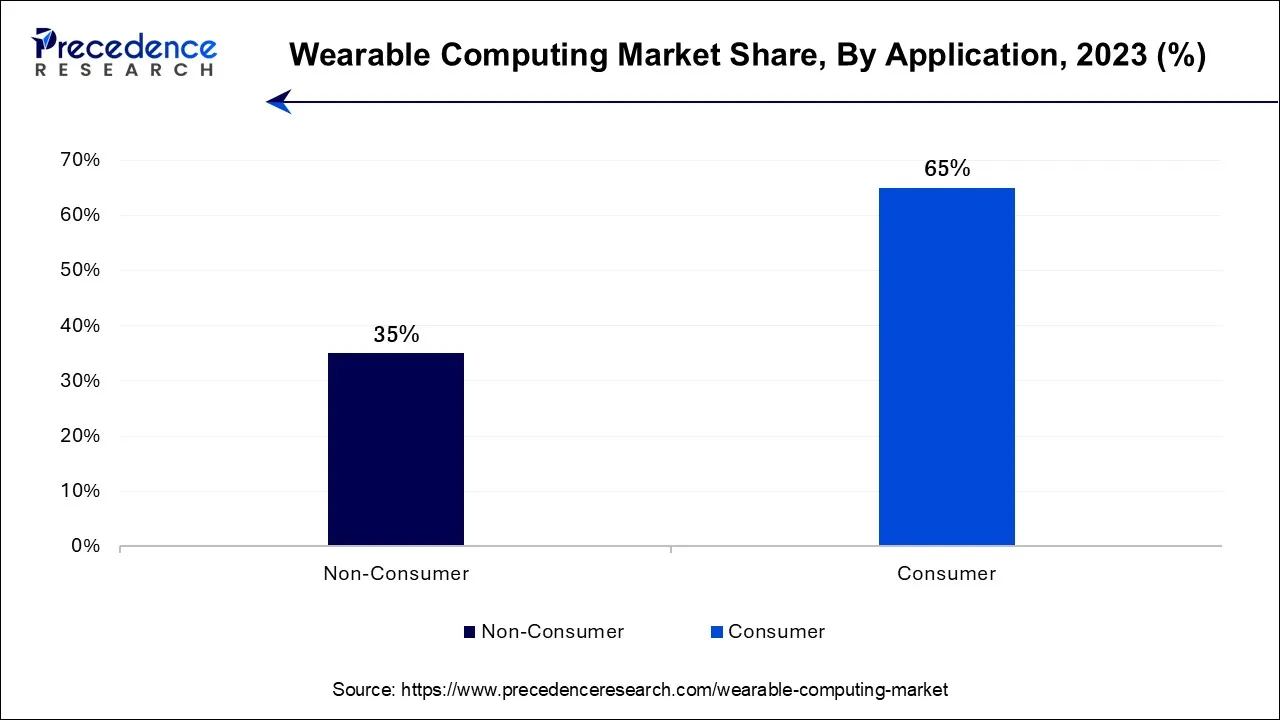

- By Application, the consumer segment led the global market with the largest revenue share of 65% in 2024.

- By Application, the non-consumer segment is expected to expand at the fastest CAGR of 18.7% during the projected period.

- By Connectivity, the bluetooth connectivity segment held the largest market share of 33.8% in 2024.

- By Connectivity, the 4G/5G connectivity segment is anticipated to grow at the fastest CAGR over the projected period.

- By Product Type, the fitness trackers segment generated the largest revenue share of 24.9% in 2024.

- By Product Type, The body-worn cameras segment is predicted to grow at a noteworthy CAGR of 15.9% over the predicted period.

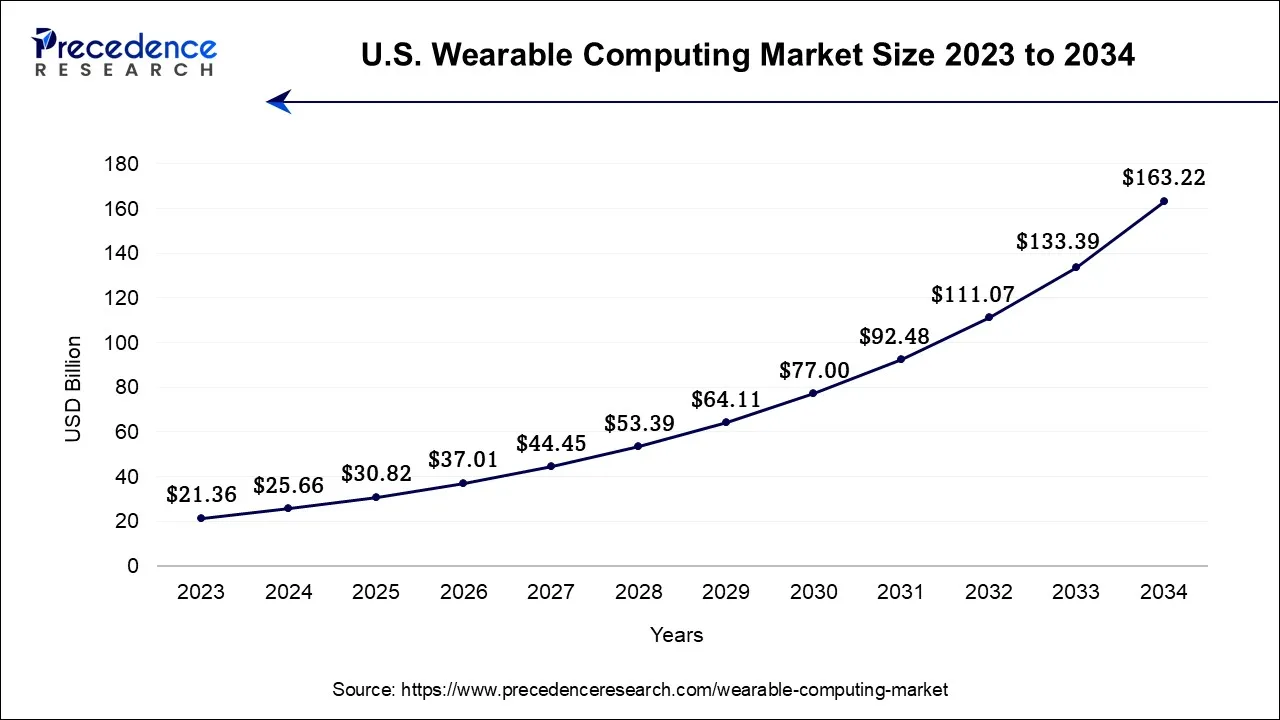

U.S. Wearable Computing Market Size and Growth 2025 to 2034

The U.S. wearable computing market size accounted for USD 25.66 billion in 2024 and is projected to be worth around USD 163.22 billion by 2034, poised to grow at a CAGR of 20.32% from 2025 to 2034.

North America has held the largest revenue share 43% in 2024. First, it boasts a robust economy with high disposable income levels, driving consumer demand for wearable technology. Second, the region is home to numerous tech giants and innovative startups that continually push the boundaries of wearable computing. Third, strong healthcare infrastructure and a focus on remote patient monitoring have boosted healthcare-related wearables. Lastly, supportive regulatory frameworks and a culture of early technology adoption have contributed to North America's dominance in the wearable computing market, making it a lucrative and influential region for industry growth and innovation.

Currently, North America is dominating the wearable computing market. North America is known for its technological companies. The advancement and rapid development of the region marked a strong presence in the market of the region. The demand for smartphones paves the way for innovation for new technologies, and encourages new businesses as well.

Asia-Pacific is a hub for manufacturing, making it a cost-effective production center for wearable technology. Furthermore, government initiatives in countries like China and India to promote digital healthand smart city technologies have propelled the adoption of wearables, particularly in the healthcare and fitness sectors. These factors collectively contribute to Asia-Pacific's substantial market growth.

Market Overview

The wearable computing market denotes the burgeoning industry focused on the manufacturing and distribution of wearable electronic gadgets designed for attachment to the human body. These encompass devices like smart timepieces, health monitors, and augmented reality glasses. They offer an extensive repertoire of functions, from health surveillance and interpersonal connectivity to entertainment and productivity augmentation. The sector has witnessed remarkable growth in recent years, primarily propelled by technological advancements, escalating consumer desire for interconnected devices, and the infusion of artificial intelligence. This field persists in its pursuit of innovation, with companies vying to develop increasingly compact, potent, and multifunctional wearables tailored to diverse consumer preferences and requirements.

Technological Advancement

Technological advancements in the wearable computing market feature IoT, sensors, battery, and electronics. The sensor technology supports miniaturization and exceeds monitoring through environmental conditions and parameters. IoT connectivity helps to connect wearables to other networks and devices, to allow data sharing and remote monitoring. The electronics industry is discovering dynamic wearable devices, grasping at development and innovation for expansion. Battery technology improves and enhances battery lifespan, supporting wearable devices.

Communication technology such as Bluetooth and 5G is currently running on high demand. AI and machine learning are major contributors to the wearable computing market. This has benefited the health sector as well, with its health monitoring feature. The innovation and advancement lead to developmental growth, securing the future of modern technology and the market.

Wearable Computing Market Growth Factors

The landscape of wearable computing is a thriving arena dedicated to crafting and delivering electronic wearables intended for adorning the human form. These encompass an array of devices like smartwatches, fitness trackers, and augmented reality glasses. Their functionalities span health monitoring, communication, entertainment, and productivity augmentation, rendering them an increasingly integral part of contemporary living. The market has witnessed remarkable expansion, buoyed by a multitude of factors, and it continues to present lucrative business prospects.

At the core of the wearable computing market's dynamism is the constant drumbeat of technological evolution. Breakthroughs in miniaturization, battery endurance, and computational prowess have empowered manufacturers to forge more diminutive yet more potent wearables with extended capabilities. Furthermore, the infusion of artificial intelligence and machine learning has metamorphosed these wearables into intricate instruments for health tracking and personalized user interactions.

Another profound driver is the escalating consumer appetite for interconnected devices. The yearning for seamless harmony with smartphones and other IoT apparatuses has led to an upswing in wearable adoption. End-users are in pursuit of devices that proffer convenience, real-time data accessibility, and the capacity to streamline their daily routines.

The health and fitness domain has emerged as a pivotal catalyst for market expansion. Wearables designed to monitor physical activity, heart rhythms, sleep patterns, and assorted health metrics have witnessed burgeoning demand among health-conscious individuals. The COVID-19 pandemic served to accelerate this trend, spotlighting the significance of remote health monitoring and telemedicine. Yet, despite its growth trajectory, the wearable computing domain grapples with several challenges. Foremost among them are apprehensions regarding privacy and security. These devices gather sensitive user data, and reconciling the need for data collection to enhance functionality with respecting user privacy remains a complex conundrum.

Interoperability poses another formidable challenge. The market teems with a cornucopia of wearable devices, frequently featuring proprietary operating systems and ecosystems. The seamless synchronization and integration of diverse brands and platforms present a formidable obstacle. Moreover, market saturation and intensifying competition raise concerns. As the market matures, companies must continually innovate to distinguish their products and provide unique value propositions to consumers.

The wearable computing sphere proffers a bounty of business opportunities. The sustained innovation in wearables, particularly within the healthcare sector, holds boundless potential. Entrepreneurs and enterprises can explore alliances with healthcare providers and insurers to forge wearable-centric health monitoring solutions. Customization and personalization emerge as focal points for growth. Enterprises can pivot towards crafting bespoke wearables catering to specific industries or niche markets, such as sports, fashion, or corporate applications.

Additionally, the development of applications and services capitalizing on wearable-generated data beckons opportunities for software developers and data analytics entities. These services can elevate user experiences and offer invaluable insights for both businesses and individuals within this fluid and progressive industry. In summation, the wearable computing market's trajectory is distinguished by its ongoing technological evolution, mounting consumer demand, and a growing emphasis on health and fitness. While challenges persist, entrepreneurs and organizations can harness the market's evolution by addressing privacy concerns, improving interoperability, and innovating novel business paradigms to cater to the diverse demands of consumers in this dynamic sphere.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 532.24 Billion |

| Market Size in 2025 | USD 102.38 Billion |

| Market Size in 2024 | USD 85.25 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 20.1% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Connectivity, Product Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Health and fitness trends

The wearable computing industry is experiencing robust expansion due to the prevailing health and fitness trends, which are fundamentally reshaping consumer inclinations. With a growing emphasis on well-being, consumers are turning to wearables that provide real-time physical activity tracking, vital sign monitoring, and personalized health insights, driving a surge in demand for these devices. These gadgets empower individuals to take proactive steps toward improved health by monitoring metrics such as step counts, heart rate, sleep patterns, and calorie intake. The seamless integration of fitness and health applications with wearables offers a comprehensive approach to wellness, enabling users to set fitness objectives, access workout guidance, and monitor progress effortlessly. The COVID-19 pandemic has further underscored the importance of health monitoring, telehealth, and remote work, amplifying the need for wearables that align with these evolving trends. As health and fitness continue to take center stage in people's lives, the wearable computing market is poised for ongoing growth and continual innovation.

Restraints

Privacy concerns

Privacy apprehensions present a substantial impediment to the burgeoning wearable computing market. With these devices amassing an abundance of personal information, encompassing health data, location details, and biometrics, users are increasingly cautious about potential breaches and the potential misuse of their data. Heightened by well-publicized data breaches and privacy scandals, these concerns act as a significant deterrent, dissuading individuals from embracing wearables and limiting their willingness to share intimate data with these devices.

Consequently, users may resist the adoption of wearables or curtail the utilization of specific features, such as health tracking, due to lingering anxieties about data security. This hesitancy poses a brake on market expansion and impedes the crucial process of building trust essential for the widespread acceptance of wearable technology. To address these concerns, wearable manufacturers must prioritize robust data encryption, transparent data management practices, and transparent user consent procedures, while regulatory bodies play an instrumental role in establishing and enforcing privacy standards to instill confidence among consumers and facilitate market growth.

Opportunities

Personalized user experiences

Personalized user experiences stand as a pivotal opportunity within the wearable computing market. These experiences are forged by the growing integration of advanced data analytics and artificial intelligence within wearable devices, enabling the effective collection and interpretation of user data. Harnessing this data, wearables can deliver customized content, recommendations, and insights, elevating the overall user experience. In the realm of health and fitness, personalization translates into tailored workout plans and dietary guidance, motivating individuals toward their specific objectives. Wearable devices can optimize productivity by offering precise, user-centric notifications that reduce information overload.

Moreover, this personalization extends to the entertainment sphere, delivering content suggestions and preferences aligned with individual behaviors and tastes, enhancing the enjoyment of various digital media forms. In healthcare, wearables provide personalized health insights and medication reminders based on individual health metrics, leading to improved well-being and heightened user satisfaction. This focus on personalized experiences not only fosters user loyalty but also generates opportunities for businesses to develop bespoke apps, services, and content that cater to the distinct needs and desires of each user.

Application Insights

According to the Application, the Consumer sector has held 65% revenue share in 2024. The preeminence of the consumer segment within the wearable computing market is chiefly driven by its expansive and varied consumer base. Wearable devices, encompassing smartwatches, fitness trackers, and augmented reality eyewear, proffer a diverse range of functionalities that cater to the everyday requirements of consumers, spanning health monitoring, communication, entertainment, and productivity augmentation. These gadgets' widespread appeal for personal usage, coupled with assertive marketing strategies and brand recognition, has culminated in a significant market foothold. Furthermore, the consumer sector's affordability and user-centric designs have broadened the accessibility of wearables to a more extensive spectrum of users, further cementing its leading position in the market.

The Non-Consumer sector is anticipated to expand at a significant CAGR of 18.7% during the projected period its diverse range of applications across industries. In sectors like healthcare, manufacturing, and logistics, wearables are used for employee safety, productivity enhancement, and data collection. In healthcare, wearables assist in remote patient monitoring and medical professionals' tasks. Industries leverage wearables for training and maintenance purposes. Moreover, wearables have established a strong presence in the enterprise sector for task optimization. These non-consumer applications, driven by the need for efficiency and safety, have contributed significantly to the substantial market growth held by the non-consumer segment.

Connectivity Insights

In 2024, the Bluetooth connectivity sector had the highest market share of 33.8% on the basis of the connectivity. The dominance of the Bluetooth segment in the wearable computing market can be attributed to its multifaceted utility and extensive user acceptance. Bluetooth technology facilitates effortless connections between wearables and various devices, augmenting their functionality and user-friendliness. This connectivity enables wearables to seamlessly synchronize with smartphones, providing instantaneous data access, notifications, and remote control capabilities.

Furthermore, Bluetooth ensures wide-ranging compatibility with diverse peripherals and accessories, enhancing the versatility of wearables. Consequently, Bluetooth-equipped wearables have emerged as the favored choice for consumers, solidifying the preeminence of this segment within the market.

The 4G/5G connectivity is anticipated to expand at the fastest rate over the projected period. The prominence growth of the 4G/5G connectivity segment within the wearable computing market can be attributed to its pivotal role in enhancing device functionality and user experiences. It facilitates real-time data transmission, ensuring seamless communication, updates, and synchronization with smartphones and other interconnected devices. High-speed data connectivity empowers wearables to deliver robust features, including health monitoring, timely notifications, and interactive app experiences, thereby augmenting their versatility and user value. As the demand for uninterrupted connectivity, rapid data transfer, and minimal latency continues to surge, the adoption of 4G and 5G technologies in wearables remains paramount, cementing their dominant position in the market landscape.

Product Type Insights

The fitness trackers segment held the largest revenue share of 24.9% in2024. The dominance of fitness trackers in the wearable computing market can be attributed to their pervasive popularity and utilitarian appeal. These devices align seamlessly with the global surge in fitness and well-being consciousness, offering functionalities such as step monitoring, heart rate tracking, sleep analysis, and workout guidance. They serve as an accessible gateway for consumers seeking to monitor their physical health and activity levels, all while being cost-effective compared to more comprehensive smartwatches. The straightforwardness of fitness trackers, coupled with their dedicated focus on health and fitness, resonates across a broad spectrum of users, underpinning their substantial market presence.

The body-worn cameras sector is anticipated to grow at a significantly faster rate, registering a CAGR of 15.9% over the predicted period. The Body-worn cameras segment commands significant growth in the market due to its widespread adoption across various sectors. Law enforcement agencies use them for evidence collection and officer accountability, while industries like healthcare and transportation utilize them for safety and security purposes. Additionally, the increasing need for transparency and accountability in public and private organizations has driven demand. These cameras enhance safety, deter misconduct, and provide valuable documentation, making them indispensable tools in a world increasingly concerned with surveillance, accountability, and the protection of both individuals and assets.

Wearable Computing Market Companies

- Apple Inc.

- Fossil Group

- Garmin Ltd.

- Google LLC

- NIKE, Inc.

- Samsung

- Sony Corp.

- Sensoria

- Huawei Technologies Co.

- Xiamoi Inc.

- Wireless Logic

Recent Developments

- In May 2025, Careband, a pioneer in context-aware health and safety wearables, announced the award of U.S. patent no 12290339 “edge computing system with low power wide area network connectivity and autonomous or semi-autonomous machine learning.” (Source - https://www.thefastmode.com)

- In October 2024, QWR transformed wearable technology with head-worn computers, targeting enterprise sectors like education, healthcare, and defense. The transitional efforts by the company are reshaping the future of the wearable computing market. (Source - https://yourstory.com)

- In May 2025, Huawei released two new wearable devices, the WATCH FIT 4 Pro and WATCH FIT 4, for Australian consumers. The expansion of business by a strategic invention of the product is raising the business standards of the region. (Source - https://channellife.com.au)

- In January 2022, Matterport announced its partnership with Retail VR (a French virtual reality developer).

- In December 2022,Meta acquired Netherlands-based 3D smart glass maker Luxexcel. The latter is proficient in designing elements required for an augmented reality (AR) experience within a prescription lens, such as holographic film and projectors.

- In February 2023,Wellstar Healthcare collaborated with Moth+Flame, a VR communication technology developer. The training provided by Moth+Flame reduced the anxiety levels around difficult conversations by 57%.

- In February 2023,the Indian wearable brand Gizmore partnered with Optiemus Electronics Limited to manufacture nearly 1 million smartwatches annually.

Segments Covered in the Report

By Application

- Consumer

- Non-Consumer

By Connectivity

- Bluetooth

- Wi-Fi

- 4G/5G

- Others

By Product Type

- Smart Watches

- Smart Jewelry

- Fitness Trackers

- Body-worn Cameras

- Head Mount Displays

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting