Aerospace 3D Printing Materials Market Size and Forecast 2025 to 2034

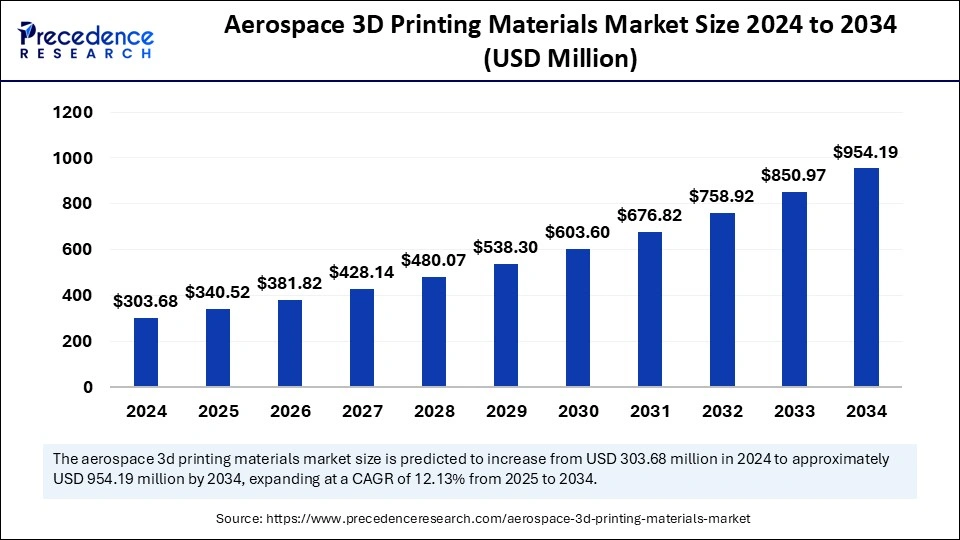

The global aerospace 3D printing materials market size was calculated at USD 303.68 million in 2024 and is predicted to increase from USD 340.52 million in 2025 to approximately USD 954.19 million by 2034, expanding at a CAGR of 12.13% from 2025 to 2034. The market growth is attributed to the increasing adoption of additive manufacturing for producing lightweight, high-performance aerospace components to enhance fuel efficiency.

Aerospace 3D Printing Materials Market Key Takeaways

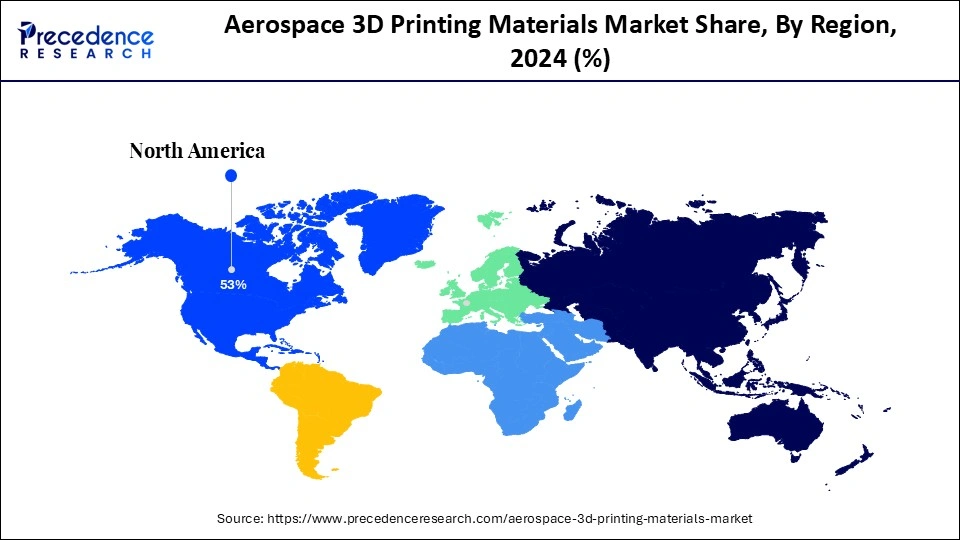

- North America dominated the global market with the largest market share of 53% in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By material type, the plastic segment contributed the highest market share in 2024.

- By material type, the metal segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By printing technology, the fused deposition modeling (FDM) segment accounted for a considerable market share in 2024.

- By printing technology, the direct metal laser sintering (DMLS) segment is anticipated to grow at the highest CAGR over the studied years.

- By platform, the aircraft segment led the global market in 2024.

- By platform, the spacecraft segment is projected to expand rapidly in the coming years.

- By application, the prototyping segment captured the biggest market share in 2024.

- By application, the functional parts segment is projected to grow at the fastest CAGR in the near future.

- By end product, the structural component segment generated the major market share in 2024.

- By end product, the engine component segment is projected to expand rapidly in the coming years.

Impact of Artificial Intelligence on the Aerospace 3D Printing Materials Market

The aerospace 3D printing materials sector experiences a revolutionary change by utilizing Artificial Intelligence technologies to improve material selection processes while optimizing production accuracy and supply chains. AI analyzes material properties, which helps identify the most durable and lightweight materials, considering factors like strength and weight. This results in the development of better aerospace components with structural strength. During extreme conditions, Artificial Intelligence models determine material behavior to cut down on physical testing requirements. By integrating AI in additive manufacturing, the aerospace industry can achieve rapid product prototyping with shortened production times and eco-friendly material utilization.

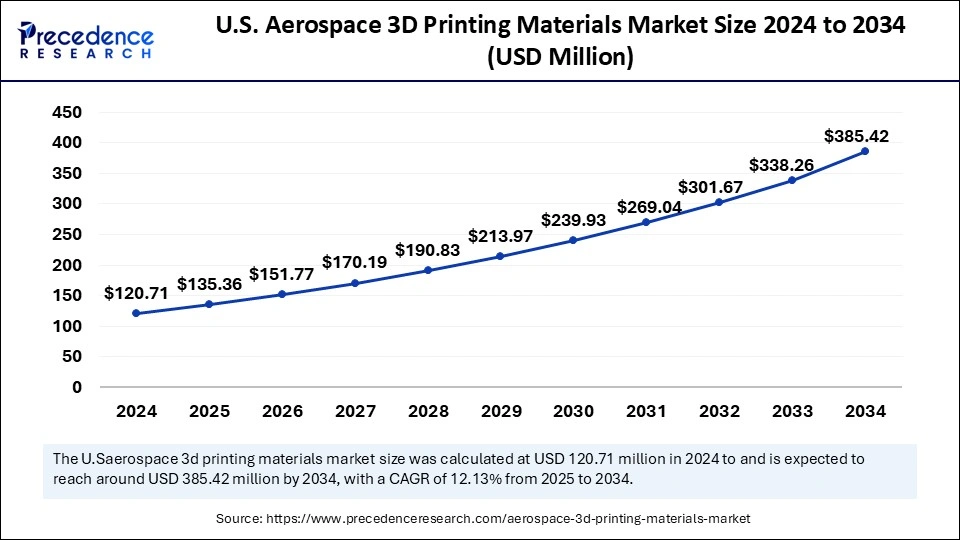

U.S. Aerospace 3D Printing Materials Market Size and Growth 2025 to 2034

The U.S. aerospace 3D printing materials market size was exhibited at USD 120.71 million in 2024 and is projected to be worth around USD 385.42 million by 2034, growing at a CAGR of 12.31% from 2025 to 2034.

North America led the aerospace 3D printing materials market by capturing the largest share in 2024. This is mainly due to the presence of leading aircraft manufacturing companies such as Boeing and Lockheed Martin. The region is also known for the early adoption of aerospace 3D printing technologies. There is a high adoption of aerospace 3D printing in Boeing, Lockheed Martin, and Northrop Grumman's production lines, which improve aircraft and spacecraft component efficiency and performance. Governments around the region are investing heavily to boost defense infrastructure, significantly boosting the demand for 3D printing to develop military aircraft. In the last few years, the U.S. Department of Defense has increased investment in 3D printing research to develop military drones, including the one created by Firestorm Labs specifically for hostile operational areas. The region's aerospace sector benefits from Federal Aviation Administration (FAA) certification processes, which empower wider use of printed aircraft parts.

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The market growth in the region can be attributed to the rising government initiatives to promote the use of additive manufacturing. The rapid expansion of the aerospace sector is one of the key factors supporting market growth. The implementation of domestic satellite and aircraft production programs in countries like China, Japan, and India contributes to market expansion. The Civil Aviation Administration of China (CAAC) helps aircraft manufacturers integrate commercial aircraft components made through advanced manufacturing techniques. In addition, the rising defense budget contributes to market expansion. Regional companies are investing heavily in additive manufacturing to boost the production of aircraft and spacecraft.

- In May 2024, ISRO achieved a major milestone by successfully testing a liquid rocket engine that is manufactured through additive manufacturing technology.

Market Overview

The aerospace 3D printing materials market is growing at a rapid pace due to the increasing production of aircraft and spacecraft. There is a high demand for lightweight aircraft parts among aircraft manufacturers to achieve better fuel efficiency and decrease emissions rates. 3D printing, also known as additive manufacturing, allows manufacturers to fabricate difficult-to-achieve complex geometries. The technological process involves object manufacturing through successive layer construction, starting from digital designs made from metal alloys, polymers, and composite materials. The rising need for rapid prototyping to accelerate aircraft development and the rising demand for customized aerospace parts further boost the adoption of 3D printing technology in the aerospace industry, propelling the market growth.

Aerospace 3D Printing Materials Market Growth Factors

- Advancements in Material Science: Continuous innovations in high-performance polymers and metal powders are anticipated to enhance the durability and efficiency of 3D-printed aerospace components.

- Increasing Adoption in Military Applications: Defense organizations heavily use additive manufacturing for producing lightweight, durable aircraft and drone components.

- Expansion of MRO Facilities: The growing number of maintenance, repair, and overhaul (MRO) centers is projected to boost market growth. These centers are engaged in producing on-demand spare parts.

- Customization for Space Missions: The rising demand for tailor-made components in satellite and deep-space exploration programs is likely to fuel the adoption of aerospace 3D printing.

- Reduction in Manufacturing Lead Times: The ability of additive manufacturing to shorten production cycles is anticipated to accelerate its integration into the aerospace sector.

- Decentralization of Production: The shift toward localized and distributed manufacturing is expected to reduce dependency on traditional supply chains, enhancing efficiency and cost-effectiveness.

- Adoption of Smart Manufacturing Technologies: The integration of artificial intelligence and digital twin technology in 3D printing processes is projected to optimize production efficiency and quality control.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 954.19 Million |

| Market Size in 2025 | USD 340.52 Million |

| Market Size in 2024 | USD 303.68 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.13% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Printing Technology, Platform, Applications, End product, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Need for Rapid Prototyping and Production

The increasing need for rapid prototyping and full-scale production is anticipated to drive the growth of the aerospace 3D printing materials market. Rapid prototyping enabled by 3D printing allows for quicker product development cycles. This further enables aerospace companies to respond quickly to changing market demands by bringing new products to market faster. Aircraft manufacturers heavily rely on additive manufacturing to develop parts with intricate geometries. The rising government investments in the aerospace sector for boosting the production of military aircraft further drive market growth. The aerospace industry is heavily focusing on implementing 3D printing technologies to faster the development cycles and minimize production expenses. In February 2025, Firestorm Labs showcased its capability to 3D print drones in a few hours at its California facilities while highlighting the advantages of additive manufacturing for producing complicated aerospace parts.

Restraint

Technical Challenges in Large-Scale Production

Complexities associated with large-scale production using 3D printing are anticipated to hinder the growth of the aerospace 3D printing materials market. The task of keeping material qualities uniform across extensive aerospace components is challenging, encouraging aircraft manufacturers to shift toward alternative technologies over 3D printing. Additional post-processing techniques have become mandatory for fixing printing defects, which extend production durations and boost production costs. The manufacturing capabilities of 3D printing currently fail to achieve effective mass production. Moreover, scaling up production to meet the demands of large-scale production is challenging, limiting the adoption of 3D printing.

Opportunity

Growing Adoption of 3D Printing in Space Exploration

Expanding space missions and satellite deployments are anticipated to create immense opportunities in the aerospace 3D printing materials market. In September 2024, the European Space Agency (ESA) accomplished an important space milestone through International Space Station (ISS) printing operations that successfully created the first metal part in microgravity conditions. The technological leap allows spacecraft to fabricate components as needed, which diminishes requirements for space resupply missions and boosts the affordability of space operations. Due to their space-grade performance needs, the use of high-performance materials, such as heat-resistant alloys and radiation-shielding polymers, continues to grow for enhancing space structure durability and safety. Additive manufacturing within space exploration operations boosts operational efficiency and creates new possibilities that lead toward advanced space travel.

Material Type Insights

The plastic segment dominated the aerospace 3D printing materials market in 2024. This is mainly due to the increased usage of high-performance polymers, including polyetherimide (PEI) or ULTEM. These polymers boast outstanding mechanical strength with thermal resistance capabilities, making them suitable for use in interior components of aircraft, such as lighting systems and electric switches. The rise in the demand for lightweight materials further bolstered the segment. Since high-performance polymers are lightweight, corrosion-resistant, and flexible, they enhance the durability and possibilities of innovative designs, further improving aircraft's fuel efficiency.

The metal segment is expected to grow at the fastest rate in the coming years. The rising focus on improving fuel efficiency is a key factor boosting the demand for metals in the aerospace industry. Metals like titanium and aluminum alloys are heavily preferred for high-performance applications due to their strength-to-weight ratio, resistance to high temperatures, and durability. They are widely used in engine components and structural elements. Through metal 3D printing, aerospace companies can create complex engine components, which lead to better fuel economy with superior aircraft performance.

Printing Technology Insights

The fused deposition modelling (FDM) segment held a considerable share of the aerospace 3D printing materials market in 2024. This is a common 3D printing method for developing intricate components. FDM uses extruded thermoplastic filaments to create durable, lightweight parts at affordable costs. It provides aerospace producers with enhanced manufacturing efficiency, seamlessly generating intricate parts without complex procedures. Furthermore, FDM's material-efficient production, with its less waste generation, makes it suitable for large-scale productions.

The direct metal laser sintering (DMLS) segment is projected to expand at the highest CAGR over the studied years. DMLS produces accurate metal parts that are necessary for aerospace applications. This technology uses powdered particles of metal that are melted by laser beams to make complex designs, leading to improved aircraft performance while reducing fuel usage. This technology is suitable for metals like titanium and aluminum alloy, which meet the aerospace industry's requirements for strong, durable material components. Furthermore, the production of prototypes through DMLS, combined with waste reduction, leads to shorter production timelines and lower production costs.

Platform Insights

The aircraft segment dominated the aerospace 3D printing materials market in 2024, as the aviation industry actively adopted 3D printing for manufacturing intricate components. Aircraft production has further accelerated due to the adoption of 3D printing. As aircraft manufacturers seek lightweight, durable components that meet high safety requirements, the need for 3D printing increases. The segment continues to grow as companies seek to optimize their manufacturing while decreasing material usage. The rise in government investments to boost the production of military aircraft further supports segmental growth.

The spacecraft segment is projected to expand rapidly in the coming years. Space agencies heavily rely on additive manufacturing to create intricate components for their satellite systems and space exploration equipment. The 3D printing technology optimizes space applications since it enables the creation of components with complex designs, optimized material characteristics, and reduced weight of components. In 2023, NASA launched a test rocket made entirely from 3D-printed parts. This highlights the 3D printing's capability in spacecraft development.

Application Insights

The prototyping segment held the largest share of the aerospace 3D printing materials market in 2024. The segment growth is driven by the rising focus on accelerating the production process. 3D printing reduces lead time for prototyping, enabling manufacturers to speed up product development activities. Aerospace manufacturers used additive manufacturing methods to build prototypes matching end-product performance criteria. Engineers can test each manufacturing aspect, such as aerodynamics, strength behavior, and material performance, during the prototyping stage before starting large-scale production. Prototyping further reduces waste generation and makes the development process faster. Advancements in high-performance polymers and metals led to better and more durable prototype construction, making 3D printing indispensable in aerospace.

The functional parts segment is projected to grow at the fastest rate in the near future, owing to the growing demand for lightweight yet high-strength aircraft components to improve fuel efficiency and performance outcomes. 3D-printed parts can be designed with intricated features, reducing the need for multiple components. Customized 3D printed parts eliminate the need for parts assembly, boosting aircraft development. Aerospace companies are steadily implementing 3D printing techniques for producing final components. The ability to manufacture intricate shapes through additive manufacturing technologies provides better structural value and material weight reduction potential.

End Product Insights

The structural component segment dominated the aerospace 3D printing materials market in 2024. This is mainly due to the rise in the need for optimized structural designs that are tailored to specific applications. 3D printing enables the creation of integrated components, reducing assembly complexity and weight. This further improves aircraft performance. The rise in the demand for customized parts to optimize aircraft design further bolstered the segment.

The engine components segment is projected to lead the market in the assessment years. The segment growth can be attributed to the increasing need for lightweight components to enhance engine performance. 3D printing enables the creation of engine parts, such as turbine and combustion chamber, with intricate designs. Aircraft and spacecraft manufacturers heavily prefer Direct Metal Laser Sintering (DMLS) to create strong and lightweight engine components that resist high temperatures and mechanical strain. Furthermore, the need to develop advanced propulsion systems and a requirement to decrease aviation emissions fuel the segment growth. In December 2023, NASA successfully tested a Rotating Detonation Rocket Engine combustor within 251 seconds, which generated over 5,800 pounds of thrust, demonstrating the potential benefits of 3D printed components in future propulsion systems.

Aerospace 3D Printing Materials Market Top Companies

- Stratasys Ltd

- Norsk

- Materialise

- Höganäs AB

- GE

- ExOne

- EOS

- 3D Systems, Inc

Latest Announcement by Industry Leader

- In March 2025, Stratasys announced the launch of AIS Antero 800NA and AIS Antero 840CN03 as validated materials for the Stratasys F900. This marks a significant milestone in qualified additive manufacturing for the aerospace and defense sectors. “These new AIS Antero materials represent a major advancement in integrating additive manufacturing into the production of aerospace and defense platforms,” said Foster Ferguson, Vice President of the Industrial Business Unit at Stratasys. “By combining top-tier performance with a well-established qualification framework, we are empowering manufacturers to innovate more rapidly and confidently adopt 3D printing for qualified end-use applications across multiple locations within an enterprise.”

Recent Developments

- In July 2024, Bright Laser Technologies (BLT) introduced two new additive manufacturing materials, including a high-strength aluminum alloy specifically developed for 3D printing applications in the aerospace sector.

- In March 2025, Bambu Lab officially launched its next-generation 3D printer. The Bambu Lab H2D is an all-in-one desktop fused deposition modeling system that includes 3D printing, laser engraving, cutting, and plotting functionalities.

- In October 2023, Airbus Helicopters established a new 3D printing facility at its Donauwörth site, significantly enhancing its in-house capabilities for this innovative manufacturing process. The company operates three machines for producing titanium components, four for plastic parts, and, as a new addition, a machine that can create components made of aluminum. This process, known as additive manufacturing, can be utilized for serial production as well as for creating components for prototypes.

Segments Covered in the Report

By Material Type

- Metal

- Plastic

- Others

By Printing Technology

- Continuous Liquid Interface Production (CLIP)

- Direct Metal Laser Sintering (DMLS)

- Fused Deposition Modeling (FDM)

- Selective Laser Sintering (SLS)

- Stereolithography (SLA)

By Platform

- Aircraft

- Spacecraft

- UAVs

By Application

- Functional Parts

- Prototyping

- Tooling

By End Product

- Structural Components

- Engine Components

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting