What is the AI in Mining Market Size?

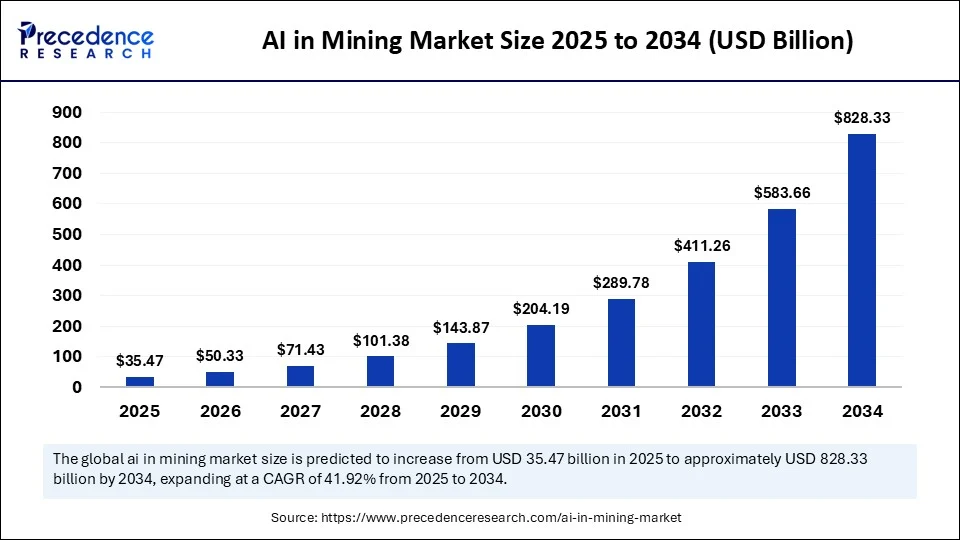

The global AI in mining market size is accounted at USD 35.47 billion in 2025 and predicted to increase from USD 50.33 billion in 2026 to approximately USD 828.33 billion by 2034, expanding at a CAGR of 41.92% from 2025 to 2034. The growth of the market is driven by advancement in AI and ML models that can be utilized for safe mining process, government backed mining initiatives, and unprecedented benefits offered by artificial intelligence in the mining industry.

Market Highlights

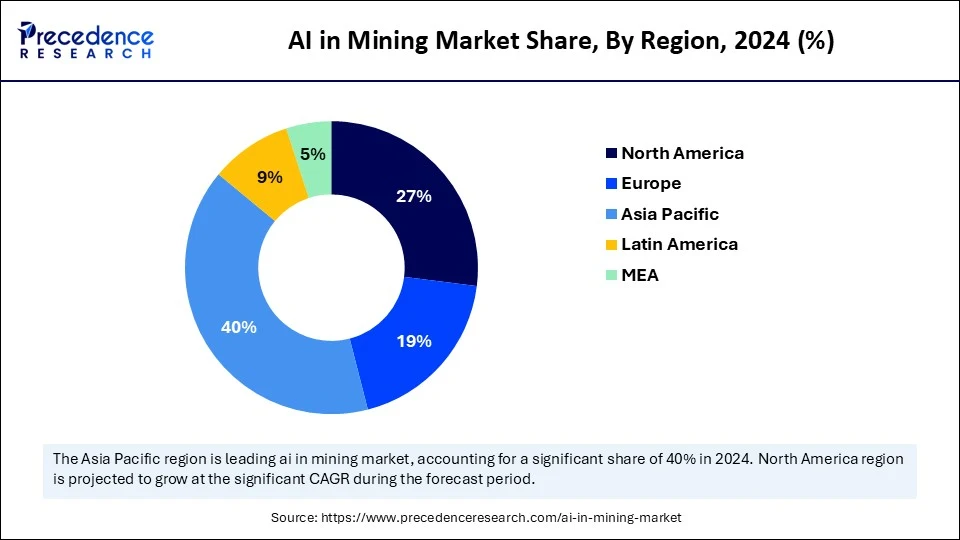

- Asia Pacific dominated the AI in mining market with the largest market share of 40% in 2024.

- North America is expected to witness the fastest growth during the forecast period.

- By technology, the machine learning segment held the biggest market share of 30% in 2024.

- By technology, the deep learning segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the exploration segment captured the highest market share of 25% in 2024.

- By application, the predictive maintenance segment is expected to witness the fastest growth during the projection period.

- By end use industry, the metal mining segment contributed the biggest market share of 40% in 2024.

- By end use industry, the non-metallic mining segment is expected to grow at the highest CAGR between 2025 and 2034.

- By solution type, the software segment generated the major market share of 50% in 2024 and is expected to witness the fastest growth during the forecasted years.

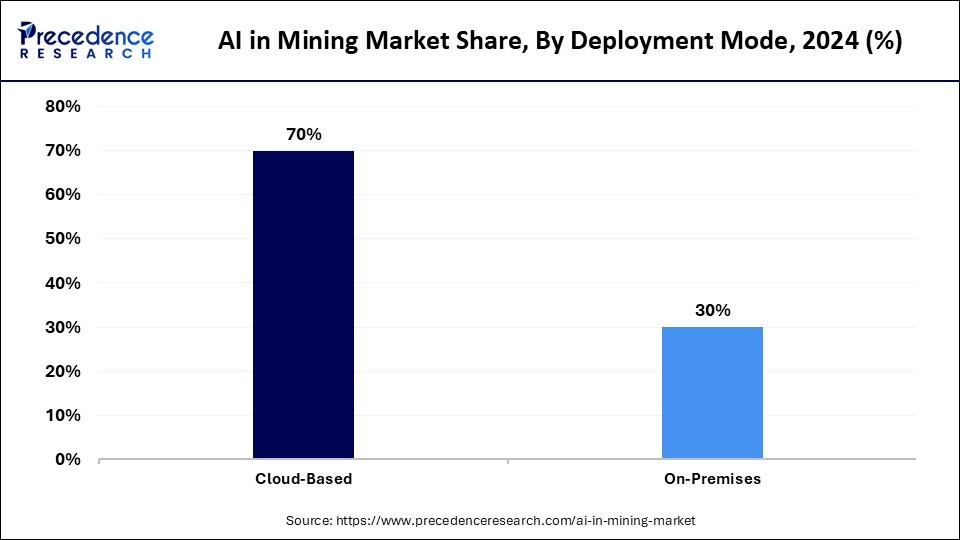

- By deployment mode, the cloud-based segment accounted for the largest market share of 70% in 2024.

- By deployment mode, the on-premises segment is expected to register the fastest CAGR during the forecasted years of 2025-2034.

- By mining type, the surface mining segment held the major market share of 55% in 2024.

- By mining type, the underground mining segment is expected to witness the fastest CAGR during the forecasted years.

Market Overview

The AI in mining market refers to the integration of artificial intelligence technologies, including machine learning, deep learning, data analytics, and natural language processing, into the mining industry. These technologies are used to optimize operations, enhance safety, reduce costs, improve resource management, and automate tasks in the exploration, extraction, and processing stages. AI solutions are also applied in predictive maintenance, monitoring, environmental impact assessment, and autonomous mining operations.

How Does AI Promote the Enhancement in Mining?

- Mineral exploration with ML models: A key trend in the AI in mining market is the advancement of mining processes through machine learning techniques, which deliver precise and efficient outputs. Machine learning models are highly beneficial in integrating geospatial data and satellite imagery to uncover untapped mineral deposits using historical data. This innovation reduces the overall cost of mining compared to conventional exploration methods. Consequently, leading companies like KoBold are leveraging AI to discover rare earth elements crucial for cutting-edge technologies.

- Digital twin technology usage: Digital twins, also known as virtual replicas of physical entities, are gaining traction in the mining sector. This technology provides real-time simulation of mining operations and their potential outcomes, aiding in better decision-making and planning before the start of the mining process, thereby reducing uncertainty.

- Better supply chain management: The integration of AI in mining is revolutionizing supply chain management by optimizing logistics and inventory. Companies can use predictive analytics to better forecast demand and streamline the supply chain, reducing costs and boosting the reliability of mining operations. It also aids in mineral traceability and ensures ethical sourcing practices.

AI in Mining Market Outlook:

- Global Expansion: The broader applications, like predictive maintenance, autonomous equipment, and enhanced mineral exploration, are bolstering the comprehensive developments.

- Major Investor: Tata Steel UK secured £7m in funding for the ADAPT-EAF project, an AI-enhanced research initiative to establish advanced low-CO2 steel production solutions.

- Startup Ecosystem: exodigo facilitates AI-powered subsurface mapping services, allowing companies to "see" underground without extensive digging.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 35.47 Billion |

| Market Size in 2026 | USD 50.33Billion |

| Market Size by 2034 | USD 828.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 41.92% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, End-Use Industry, Solution Type, Deployment Mode, Mining Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased safety with predictability

A significant factor driving the adoption of AI in the mining sector is the need for enhanced safety for workers and the ability to provide precise predictions about minerals and their location to minimize resource wastage. Various mining processes can be automated by artificial intelligence tools, which include the drilling process, sorting, and hauling. Such an approach leads to enhanced productivity and minimizes overall labour costs. Furthermore, AI can detect potential failures in mining equipment, enabling timely intervention to prevent downtime and accidents. This is highly valued by workers and industrialists, as it offers unprecedented safety for on-ground personnel.

Restraint

Hesitation to adopt and high initial investment

Despite its many benefits, the adoption of AI in mining could be perceived as a threat to laborers and their job security, leading to protests from labor organizations. Like any new technology, AI challenges the existing work culture, making conventional mining practices hesitant to adopt it due to a lack of knowledge and concerns about job security. This hesitation is a major obstacle to AI's expansion in the mining industry. Moreover, the high initial investment required for implementing AI technologies, including infrastructure and training, hampers the market growth. Data privacy and security concerns are also significant, as AI systems rely on large datasets, making them vulnerable to cyberattacks and data breaches.

Opportunity

Automation of complex mining methods

A major opportunity for AI in mining market lies in the growing focus on automating complex tasks and reducing environmental hazards. Predictive AI models help in mineral exploration by pinpointing mineral locations, minimizing financial risks, and manual efforts. AI and automated machinery, such as self-driving vehicles and robotic drilling, enhance operational efficiency while prioritizing worker safety by limiting exposure to hazardous areas.

On a sustainability level, AI efficiently manages non-renewable resources like water and land restoration, optimizing waste management to ensure higher production rates with minimal resource wastage. This aligns with strict regulations aimed at preventing the manipulation of rare earth elements and illegal trading patterns.

Segment Insights

Technology Insights

How does the machine learning segment dominate the AI in mining market in 2024?

The machine learning segment dominated market with the largest share of 30% in 2024. The dominance of the segment is attributed to various factors, such as enhanced safety, higher productivity, improved process optimization, and remote operations with real-time monitoring through ML models. Machine learning models facilitate the optimization of resource extraction and accelerate mineral discovery by identifying patterns and potential deposits through the analysis of molecular structures, making geological exploration more efficient.

The deep learning segment is expected to grow at the fastest CAGR during the forecast period. The segment is expanding because deep learning models have the ability to analyze complex data in mineral exploration, simplifying interpretations of factors like water reservoirs, underlying mineral types, and potential drawbacks to accessing them. The rising need for predictive maintenance further supports segmental growth, as deep learning models can predict equipment failures, enabling proactive maintenance.

Application Insights

Why did the exploration segment dominate the AI in mining market in 2024?

The exploration segment dominated the market, holding a 25% share in 2024. Exploration is a key objective in the mining process as it offers diverse possibilities and potential ways to find out new minerals and rare earth elements that can be utilized for various purposes. AI enhances this process by offering models that predict new mineral types with minimized costs and increased efficiency. AI-based machines, such as drones, are used for deep earth exploration, and 3D models help determine mineral structures and locations, improving exploration methods without compromising safety.

The predictive maintenance segment is expected to experience the fastest growth during the projection period. This is mainly due to the rising need for a proactive maintenance approach to ensure operational efficiency. Predictive maintenance accurately identifies patterns in real-time data, offering insights into potential future machine failures. This reduces operational costs and boosts efficiency by optimizing maintenance schedules, preventing major failures and downtime.

End Use Industry Insights

What made metal mining the dominant segment in the AI in mining market?

The metal mining segment dominated the market while holding the largest share of 40% in 2024. The dominance of the segment is attributed to the rising demand for metals across various industries. AI can offer deep insight about metal resources and drilling areas, optimizing resource extraction by minimizing waste. By analyzing a huge amount of data, AI models can pinpoint the exact location of metal deposits while monitoring safety aspects of drilling and predict potential threats during complex tasks like mining, deep drilling, and extracting ores.

The non-metallic mining segment is expected to witness the fastest growth in the upcoming period. The segment growth is attributed to the efficient sorting and processing of non-metallic materials like sand, limestone, potash, and gravel. The non-metallic mining segment is projected to experience the fastest growth. AI provides automated haulage systems for efficient material handling and minimizes the need for human labor in hazardous environments.

Solution Type Insights

Why did the software segment lead the market in 2024?

The software segment led the AI in mining market by capturing the largest market share of 50% in 2024 and is expected to sustain its growth trajectory throughout the forecast period. The dominance of software stems from its ability to solve core mining processes without the need for human intervention. AI-based software optimizes mining operations like exploration, extraction, and processing, even at large volumes, increasing efficiency, reducing downtime, and boosting productivity. AI-based software helps derive the most accurate and economically feasible spots and methods, enhancing safety. It also helps mining enterprises manage their portfolios based on environmental regulations and provides effective solutions.

Deployment Mode Insights

How does the cloud-based segment dominate the AI in mining market in 2024?

The cloud-based segment held the largest market share of 70% in 2024. Cloud-based deployment provides various benefits, including high flexibility and scalability, cost efficiency for large expenditures, and remote accessibility with real-time collaborative ability, which reduces the need for physical presence as a team. Cloud platforms further offer management of large datasets with centralized storage, which makes training for AI models much easier with such unified datasets.

The on-premises segment is expected to register the fastest CAGR during the forecasted years of 2025-2034. The segment is expanding due to its ability to offer high security and control over confidential data within an enterprise, thereby reducing the chances of cyberattacks, as data can be processed near the point of generation. It further offers low latency, real-time processing, which is a crucial aspect for sectors like mining. The growing focus on security further propels the segmental growth.

Mining Type Insights

Why did the surface mining segment lead the market?

The surface mining segment led the AI in mining market, holding the largest market share of 55% in 2024. Surface mining includes extractable resources in large volumes and terrain that is relatively accessible, which is ideal for implementing AI solutions. AI algorithms can optimize speeds, payloads, and routes of haul trucks, which reduces fuel consumption. Thus, equipment and machinery on a large scale in surface mines, which encompasses excavators, haul trucks, and other machines, create maximum possibilities for automation and AI-based optimization.

The underground mining segment is expected to expand at the fastest CAGR during the projection period. Underground mining involves high risk and potential threats like blasting or hazardous rockfalls, gas leaks, and other unpredictable issues due to drilling, haulage systems, and the overuse of exploration methods. Here, AI can offer unprecedented safety tools with predictive maintenance by analyzing equipment data and environmental conditions underneath, which minimizes potential risks and reduces the need for human intervention in underground mining.

Regional Insights

Asia Pacific AI in Mining Market Size and Growth 2025 to 2034

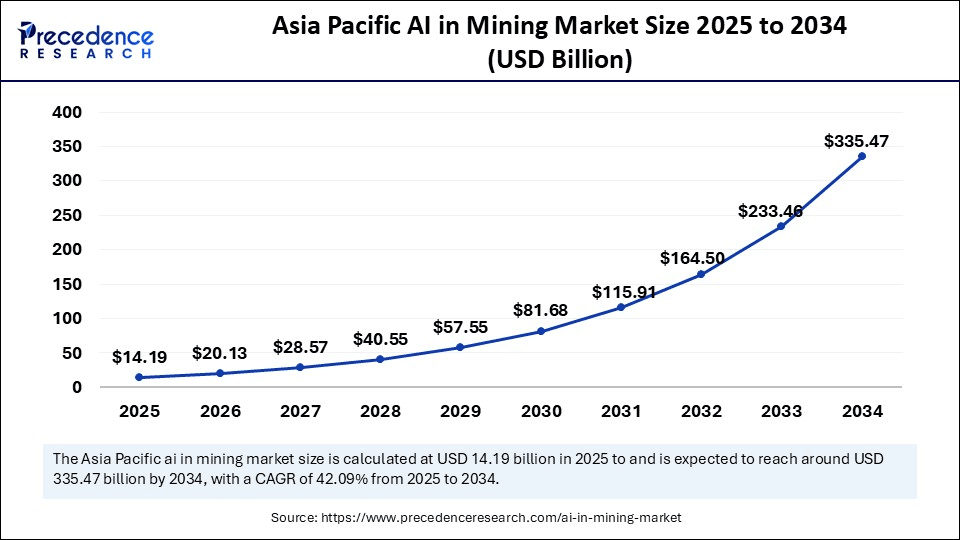

The Asia Pacific AI in mining market size is exhibited at USD 14.19 billion in 2025 and is projected to be worth around USD 335.47 billion by 2034, growing at a CAGR of 42.09% from 2025 to 2034.

What made Asia Pacific the dominant region in the AI in mining market in 2024?

Asia Pacific registered dominance in the market while holding the largest market share of 40% in 2024. The region boasts a large number of mineral reservoirs and huge-scale mining operations, boosting the demand for automation. Government-backed projects and the rapid expansion of the mining industry, along with rapid adoption of cutting-edge technologies like AI/ML, to boost and optimize mining processes for efficiency and high-end outcomes, support market growth.

Highest Mineral Concentration: China Market Analysis

The region is also leading in mineral production, which includes the production and exploration of iron ore, copper, coal, and other rare earth elements that are crucial for semiconductor technologies and are extensively used for the manufacturing of batteries. China has been initiating end-to-end automation and technology-focused mining for maximum production. China has the highest mineral concentration and is responsible for more than 50% of the production of 18 minerals. It also has reserves of more than 35 minerals with concentrations of 10% or more. India is integrating AI-powered tools in the mining industry to reduce operational costs, enhance safety, and become a leader in the global mining industry.

- For instance, in March 2025, the Indian Ministry of Mines is set to launch the country's first-ever auction of exploration licenses in Goa, which will help unlock untapped and crucial deep-seated mineral resources in India.(Source: https://www.pib.gov.in)

What factors contribute to the AI in mining market in North America?

North America is expected to witness the fastest growth during the forecast period. The region is proliferating due to robust digital infrastructure with early adoption of innovative technologies in a leading sector, including mining. Leading countries like the U.S. and Canada boast tech-driven mining companies that are highly equipped with AI-powered tools for mining monitoring, autonomous operations, further excelling its assertion in AI deployment. The U.S. produces nearly 50% of the 7 minerals and has more than 10% reserves of 12 minerals.

Shifting Towards Autonomous: U.S. Market Analysis

The major growth of the U.S. market has been advancing with the wider enforcement of autonomous vehicles and equipment. Such as Exyn Technologies offers Level-4A autonomous drones for underground mapping, which navigate difficult areas without a human pilot, cutting survey times and boosting safety in US sites such as Northern Star's Pogo mine in Alaska.

Substantial Companies' Initiatives are Fostering Europe

With the lucrative growth of AI in mining market in Europe, numerous companies are leveraging their variety of initiatives in the market. Such as, Dundee Precious Metals (DPM) employs AI for safety monitoring with SORA, which investigates CCTV footage for PPE compliance. It also enhances grinding and flotation processes with Metso Optimizers, escalating efficiency at its Ada Tepe and Chelopech mines.

Immersive AI-assisted Digital Twins: UK Market Analysis

An important advancement in the UK market is the improvements in AI-driven digital twin, such as Anglo American is a significant adopter, and increasingly uses AI-enabled digital twin technology at its Quellaveco copper mine (Peru) to simulate and accelerate processes, estimate operational challenges, and optimize resource usage (e.g., water optimisation).

Ongoing Extensive Developments are Supporting MEA

A significant expansion of the MEA AI in mining market, with a rise in developments, like the Saudi Arabian Mining Company (Ma'aden) widely adopting AI with Microsoft 365 Copilot to accelerate workforce productivity, AI-enabled systems, especially Fleet Space Technologies' ExoSphere for mineral exploration, and implementing autonomous mining robots with OffWorld for underground operations.

UAE's AI Mining Boom Accelerates

The UAE's AI in mining market is growing rapidly, driven by national digitalization goals and efficiency demands. Key technologies like predictive analytics and autonomous systems are optimizing operations, reducing costs, and boosting safety across the sector. This strategic integration is accelerating the industry's technological future.

Key Players in AI in Mining Market and their Offerings

- Tata Steel- A vital company explores extensive technologies in predictive maintenance, autonomous vehicles, and 3D mapping.

- Posco- It uses AI to facilitate operational effectiveness, safety, and supply chain management.

- Nornickel- A leader primarily offers smelting to raise safety, improve production, and boost environmental monitoring.

- Newmont- It has executed a metallurgical digital twin with Metso's Geminex technology at its Lihir gold plant in Papua New Guinea.

- Ma'aden- It leveraged a four-year contract with a joint venture (JV) among Fleet Space Technologies and Tahreez to employ the AI-driven ExoSphere technology for real-time 3D subsurface imaging.

Recent Developments

- In June 2025, to revolutionize mining industry, artificial intelligence/ machine learning models are going to be used first time for mineral exploration in Rajasthan, India. (Source: https://www.thenewsminute.com)

- In May 2025, BHP is going to develop its first Industry AI hub in Singapore, aiming to accelerate digital revolution and AI adoption in the mining and resources field.(Source: https://www.bhp.com)

Segments Covered in the Report

By Technology

- Machine Learning

- Deep Learning

- Natural Language Processing

- Computer Vision

- Robotics & Automation

- Data Analytics

- IoT (Internet of Things)

By Application

- Exploration

- Geological Data Analysis

- Exploration Planning

- Mineral Discovery

- Extraction

- Automated Drilling

- Blasting Optimization

- Remote Mining Equipment Control

- Processing

- Ore Sorting

- Process Optimization

- Smelting and Refining Automation

- Predictive Maintenance

- Equipment Health Monitoring

- Predictive Analytics for Downtime

- Safety and Security

- Hazard Detection

- Autonomous Vehicles for Mining

- Surveillance Systems

- Environment and Sustainability

- Environmental Impact Monitoring

- Waste Management

- Supply Chain and Logistics

- Supply Chain Optimization

- Demand Forecasting

- Transportation Automation

By End-Use Industry

- Metal Mining

- Copper

- Gold

- Silver

- Aluminum

- Zinc

- Nickel

- Coal Mining

- Non-Metallic Mining

- Oil Sands Mining

- Other Mineral Mining (e.g., Lithium, Rare Earths)

By Solution Type

- Software

- AI Platforms

- Data Management Tools

- AI-Driven Analytics Software

- Hardware

- Robotics and Drones

- Sensors and Actuators

- Autonomous Mining Vehicles

- Services

- AI Consulting

- System Integration

- Support and Maintenance

By Deployment Mode

- Cloud-Based

- On-Premises

By Mining Type

- Surface Mining

- Underground Mining

- Mountaintop Removal Mining

- Placer Mining

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting