What is the AI Platform Cloud Service Market Size in 2026?

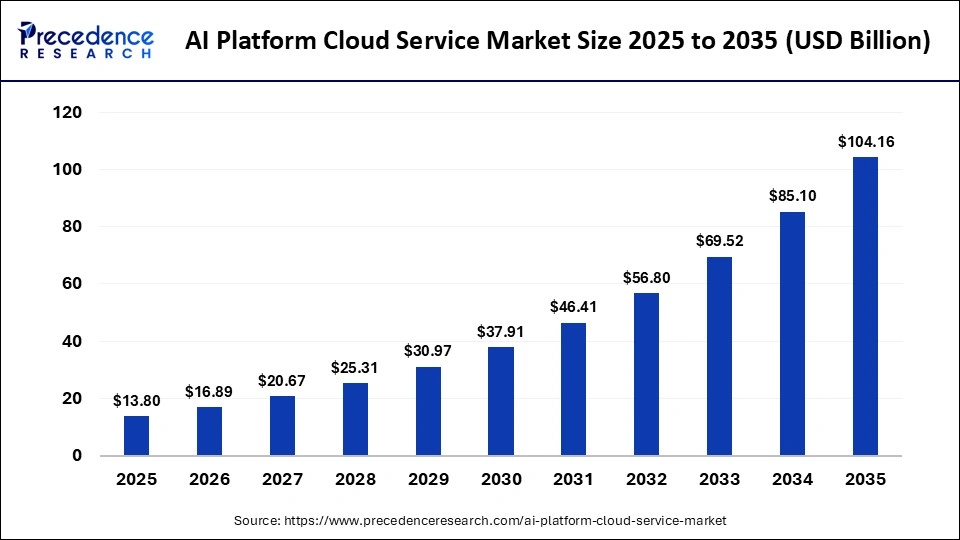

The global AI platform cloud service market size was calculated at USD 13.80 billion in 2025 and is predicted to increase from USD 16.89 billion in 2026 to approximately USD 104.16 billion by 2035, expanding at a CAGR of 22.40% from 2026 to 2035. The market is driven by accelerating digital transformation across industries, rising demand for real-time data analytics, and the need to automate routine business processes. Additionally, the increasing adoption of AI and machine learning models for cost-effective, scalable infrastructure, without heavy investment in on-premises hardware, is further fueling market expansion.

Key Takeaways

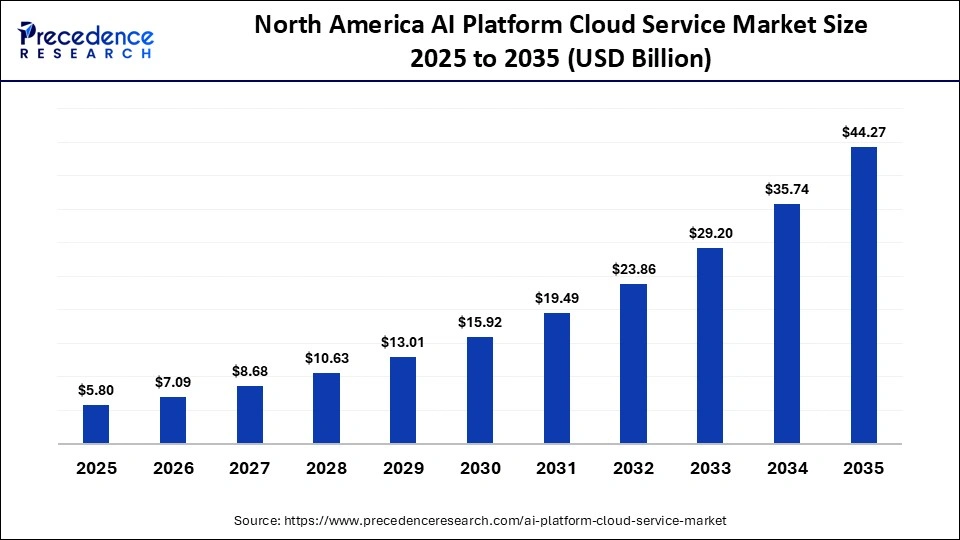

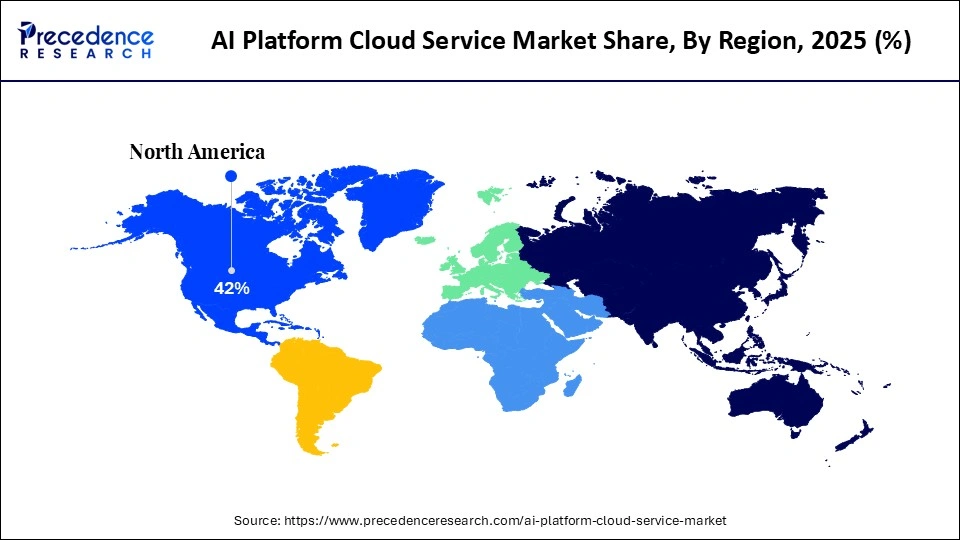

- North America held the largest market share of nearly 42% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR during the foreseeable period.

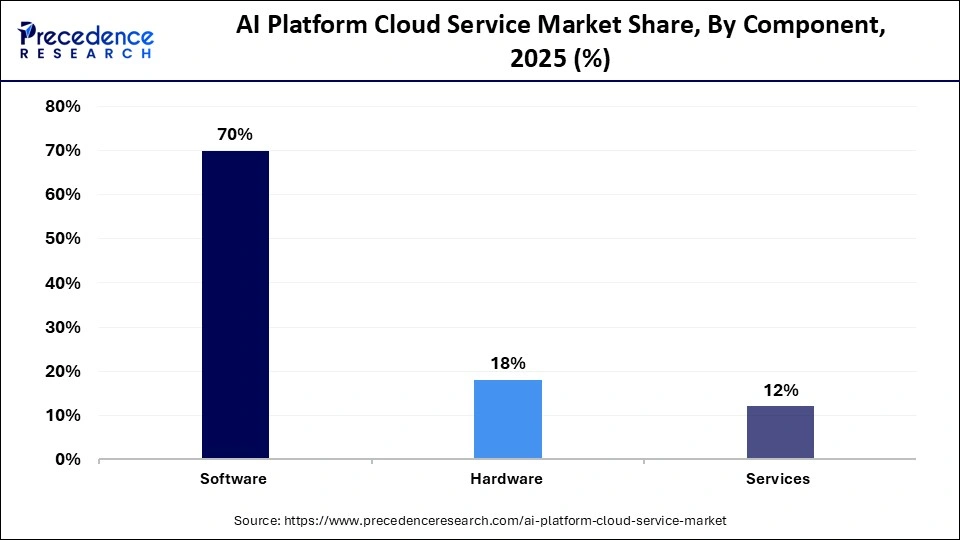

- By component, the software segment held the largest market share of nearly 70% in 2025.

- By component, the services segment is expected to grow at the fastest CAGR during the foreseeable period.

- By deployment mode, the public cloud segment held the largest market share of nearly 70% in 2025 and is projected to grow at the fastest CAGR during the forecasted years.

- By application/technology, the machine learning and deep learning segment held the largest market share of nearly 35% in 2025.

- By application, the natural language processing segment is expected to grow at the fastest CAGR during the foreseeable period.

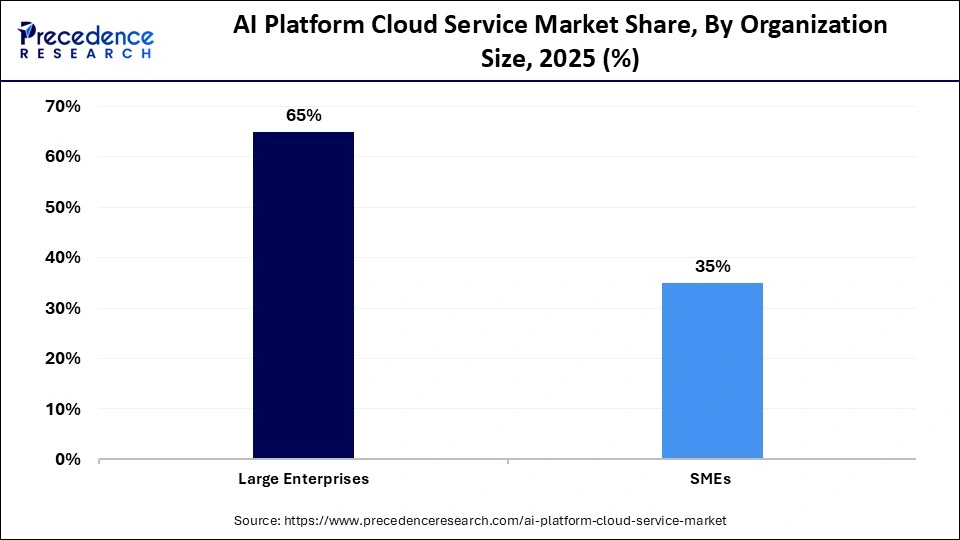

- By organization size, the large enterprises segment held the largest market share of nearly 65% in 2025.

- By organization size, the SMEs segment is projected to grow at the fastest CAGR during the foreseeable period.

- By vertical/end user, the BFSI segment held the largest market share of nearly 30% in 2025.

- By vertical/end user, the healthcare and life sciences segment is expected to grow at the fastest CAGR during the foreseeable period.

Market Overview

The AI platform cloud service market provides cloud-based platforms that enable enterprises to build, deploy, manage, and scale artificial intelligence applications. These services include tools for machine learning, NLP, computer vision, data analytics, and AI lifecycle management hosted through public, private, or hybrid cloud models. Adoption is driven by digital transformation, demand for scalable AI infrastructure, and growth in AI-driven automation across industries. Increasing AI integration in business workflows fuels platform adoption globally.

Key Technological Shifts in the AI Platform Cloud Service Market

The integration of Generative AI into the AI platform cloud services sector is rapidly transforming the market by shifting infrastructure focus from CPU-based to GPU-centric AI factories. This transition accelerates software development and improves security through predictive threat detection models, ultimately optimizing resources for better outcomes in cost-effective ways. In addition, leading cloud platforms such as AWS, Google Cloud, and Azure are rapidly democratizing access to AI, enabling organizations to leverage pre-trained models without expensive in-house hardware.

Generative AI facilitates intelligent resource management, enhances security, advances automation, and enables faster innovation cycles. Gen AI helps accelerate the development of new applications, such as generative AI chatbots, by leveraging personalized customer experiences. Gen AI optimizes cloud usage by predicting demand and dynamically allocating resources. It further strengthens cloud security with a predictive threat detection model and automates mundane tasks like code generation, debugging, and testing as well, underscoring its potential to significantly reshape the future direction of the market.

AI Platform Cloud Service Market Trends

- The market is witnessing a significant transformation with the rise of generative AI and LLM expansion that enables businesses to develop tailored AI applications for content creation, coding, and data analysis.

- AI-as-a-Service (AIaaS) is expanding quickly, as cloud providers offer API-driven and pre-trained models, such as image recognition and natural language processing, eliminating the need for extensive in-house AI expertise and dedicated infrastructure investments.

- Self-healing cloud systems are emerging as a major trend, where AI autonomously manages cloud environments through auto-scaling, predictive maintenance, and infrastructure optimization, reducing human intervention and operational costs.

- The integration of edge AI with cloud platforms is reshaping market dynamics by shifting AI inferencing closer to data sources, reducing latency, enabling real-time decision-making, and leveraging the cloud primarily for intensive model training and storage.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.80 Billion |

| Market Size in 2026 | USD 16.89 Billion |

| Market Size by 2035 | USD 104.16 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 22.40% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment Mode, Application/Technology, Organization Size, Vertical/End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Why Does the Software Segment Dominate the AI Platform Cloud Service Market?

The software segment dominated the market while holding the largest share of nearly 70% in 2025, driven by its provision of ready-to-use development tools, AI model deployment frameworks, and real-time monitoring capabilities. Cloud-based software enables organizations to harness advanced AI functionalities without significant capital investment in hardware infrastructure, offering flexibility, scalability, and cost efficiency. Its cloud-native architecture allows developers to rapidly build and deploy applications, including generative AI solutions and intelligent chatbots. Consequently, major technology providers such as Amazon Web Services, Google Cloud, and Microsoft Azure continue to heavily invest in software-driven AI innovations to maintain competitive advantage and technological leadership.

The services segment is expected to grow at the fastest CAGR during the foreseeable period due to the increasing demand for integration, maintenance, and after-sales support to seamlessly deploy AI services while bypassing the traditional way that mandates specialized IT infrastructure within organizations, which is highly expensive. Many companies are adopting subscription-based AI services that lower the total cost of ownership and let them focus on core operations to drive the companies' vision rather than managing infrastructure.

Deployment Mode Insights

Why Did the Public Cloud Segment Lead the AI Platform Cloud Service Market?

The public cloud segment led the market with the largest share of nearly 70% in 2025 and is expected to grow at the fastest CAGR throughout the forecast period. This is mainly due to its unmatched scalability, flexibility, and cost efficiency, eliminating the need for heavy investments in on-premises infrastructure. Public cloud platforms provide access to high-performance GPUs and TPUs on a subscription basis, making advanced AI capabilities accessible even to small and mid-sized enterprises. Additionally, providers such as Amazon Web Services and Microsoft Azure offer pre-configured AI/ML services, development tools, and libraries, further accelerating global adoption of public cloud-based AI solutions.

Application/Technology Insights

What Made Machine Learning and Deep Learning the Dominant Segment in the AI Platform Cloud Service Market?

The machine learning and deep learning segment dominated the market, holding the largest share of nearly 35% in 2025, as they provide foundational algorithms for predictive analytics, automation, and complex pattern recognition, which are crucial for businesses looking to adopt AI technologies. ML is rapidly transforming data-intensive sectors like e-commerce, healthcare, and finance by offering personalization engines, fraud detection, and predictive maintenance for seamless business operations. These technologies play a crucial part in developing LLMs that are highly in demand, which need significant cloud computing resources, further reinforcing the segment's dominance.

The natural language processing segment is expected to grow at the fastest CAGR during the projection period, driven by the rapid growth of unstructured data across enterprises that requires advanced analysis for actionable insights without extensive in-house expertise. The integration of advanced NLP technologies, including large language models (LLMs) and generative AI, into cloud platforms enables organizations to automate complex workflows, enhance customer interactions, and streamline decision-making processes. By offering these capabilities through scalable cloud infrastructure, providers eliminate the need for separate, resource-intensive deployments, further accelerating segment growth.

Organization Size Insights

Why Does the Large Enterprises Segment Lead the AI Platform Cloud Service Market?

The large enterprises segment held the largest market share of nearly 65% in 2025, as they often deal with huge datasets that require training models, along with the substantial investment by large enterprises to build AI infrastructure. Training LLMs also need huge computing power and high-performance GPUs that can be rented from hyperscale providers like Azure and AWS. Large enterprises majorly focus on AI technologies to get tangible and long-term benefits rather than hype, which increases their work efficiency further.

The SMEs segment is expected to grow at the fastest CAGR during the forecast period, driven by the availability of cost-effective, plug-and-play AI cloud solutions that enable scalable adoption without heavy capital expenditure. Cloud-based AI platforms delivered through Software-as-a-Service (SaaS) allow SMEs to quickly deploy intelligent applications without investing in complex infrastructure. These solutions enhance customer engagement and operational efficiency through tools such as AI-powered chatbots for 24/7 support, automated invoicing, and inventory optimization systems, thereby accelerating segment growth.

Vertical/End User Insights

Why Did the BFSI Segment Lead the AI Platform Cloud Service Market?

The BFSI segment led the market by holding a major share of nearly 30% in 2025 due to the sector's critical need for secure handling of sensitive financial data and advanced AI-powered fraud detection amid rising cybercrime risks. Cloud platforms provide robust security frameworks, audit trails, and compliance support for evolving regulations such as GDPR and DORA, making them highly suitable for financial institutions. Additionally, the growing shift toward hyper-personalized banking experiences and AI-driven virtual assistants requires scalable, high-performance cloud infrastructure capable of supporting complex AI deployments, further fueling the segment's large-scale growth.

The healthcare and life sciences segment is expected to grow at the fastest CAGR during the foreseeable period due to immense pressure to deliver mission-critical tasks like accelerated drug discovery, real-time clinical decision support, and administrative automation within a rapidly digitalized healthcare landscape. The sector generates massive volumes of complex data from genomics research, clinical trials, electronic health records, and medical imaging, requiring substantial computing power and advanced analytics capabilities. AI platform cloud services provide scalable infrastructure and high-performance processing to efficiently manage, analyze, and derive insights from this data, thereby significantly fueling segment growth.

Regional Insights

How Big is the North America AI Platform Cloud Service Market Size?

The North America AI platform cloud service market size is estimated at USD 5.80 billion in 2025 and is projected to reach approximately USD 44.27 billion by 2035, with a 22.54% CAGR from 2026 to 2035.

What Made North America a Leader in the AI Platform Cloud Service Market?

North America led the market by holding a major share of nearly 42% in 2025 due to a combination of factors including massive investments in AI research and development, a skilled talent pool, and clear regulatory frameworks such as FDA guidelines. Early adoption by leading technology companies and the presence of major hyperscalers like Amazon Web Services, Microsoft Azure, and Google Cloud further strengthened the region's dominance. These providers have developed expansive data center networks essential for training and deploying large-scale AI models, reinforcing North America's leadership in the global AI cloud services sector.

For example, Amazon web services have introduced its project Ranier, a huge AI cluster based on GPUs, for Anthropic with a $4 billion investment backed by AWS. Similarly, a leading tech giant, Microsoft, recently spent a whopping amount of $80 billion on data centers to handle AI workloads. In addition to this, companies in the region are largely investing and rapidly embracing AI as a service for innovation and higher operational efficiency while complying with regulatory shifts, further expanding the market's growth in North America.

What is the Size of the U.S. AI Platform Cloud Service Market?

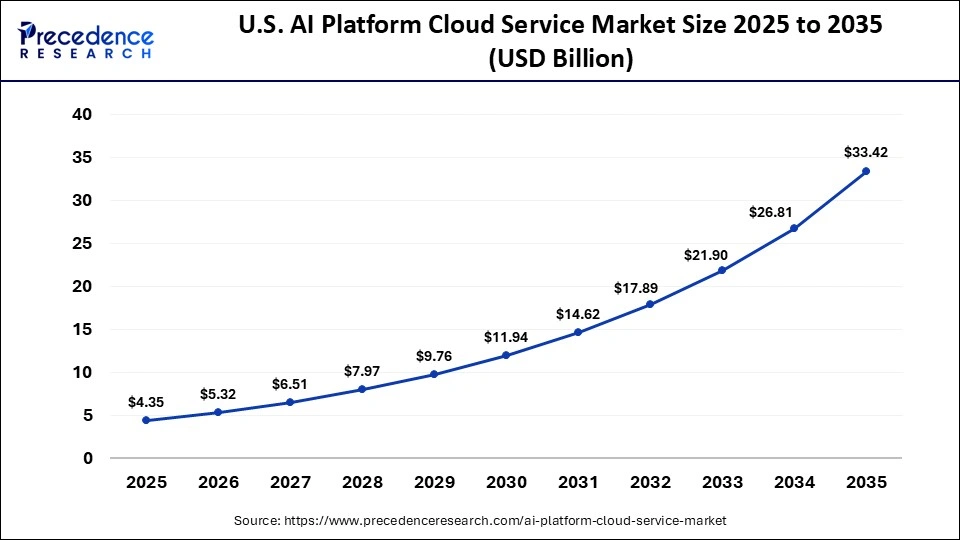

The U.S. AI platform cloud service market size is calculated at USD 4.35 billion in 2025 and is expected to reach nearly USD 33.42 billion in 2035, accelerating at a strong CAGR of 22.62% between 2026 and 2035.

U.S. AI Platform Cloud Service Market Analysis

The U.S. is considered a major player in the North American market due to the active presence of leading cloud providers offering highly scalable, high-performance computing infrastructure. This robust ecosystem has fostered AI innovators like OpenAI, which develops foundational AI models. Companies across sectors are aggressively deploying AI-powered analytics and automation, fueling the growth of AI-as-a-Service in the region. Strategic collaborations among leading players to share resources and expertise are further strengthening the market's foundation and accelerating adoption.

For instance, in October 2025, NVIDIA announced that it is actively working with the U.S. DOE national labs and leading companies to build a robust AI infrastructure in the U.S. for the industrial revolution, backed by multiple active projects to support AI technologies and their adoption.

Why is Asia Pacific Growing in the AI Platform Cloud Service Market?

Asia Pacific is projected to grow at the fastest CAGR in the market during the foreseeable period, driven by the rapid expansion of generative AI, massive data generation, ongoing infrastructure development, and government-backed AI initiatives. The region is witnessing the wide adoption of AI cloud platforms across multiple sectors. For instance, the finance sector is leveraging AI for fraud detection, 24/7 automated customer service, and risk management, while manufacturing, logistics, and healthcare sectors are increasingly using AI to optimize supply chains, accelerate drug discovery, and enable personalized medicine. These cross-sector applications are fueling robust market growth throughout Asia Pacific.

China AI Platform Cloud Service Market Analysis

China is leading the market within Asia Pacific, driven by massive data generation, AI-native demand, and state-backed digitalization initiatives that prioritize large-scale production over experimentation. The country produces nearly 20% of the world's data, providing critical resources for training large language models (LLMs) and computer vision applications. This enormous data volume is fueling demand for cloud-based storage and high-performance processing, with AI platforms efficiently handling and analyzing datasets to generate actionable insights at scale.

AI Platform Cloud Service Market Companies

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google LLC

- IBM

- Oracle Corporation

- Infosys Limited

- Wipro Limited

- Baidu Inc.

- Cloudera Inc.

- Salesforce Inc.

- SAP SE

- Tencent Holdings Ltd.

- Snowflake Inc.

- NVIDIA Corporation

- Yandex NV

Recent Developments

- In February 2026, a leading tech giant, Oracle NetSuite, introduced a new AI feature across its cloud business software while launching a separate integration platform to automate workflows between NetSuite and third-party applications, aiming to reduce manual work and speed up mundane, repetitive back-office tasks.(Source: https://itbrief.co.uk)

- In February 2026, a global technology group, e&, headquartered in Abu Dhabi, is deploying Oracle Fusion Cloud HCM on OCI dedicated region by leveraging AI across human resources and aiming to fulfil data sovereignty demands.(Source: https://www.computerweekly.com)

Segments Covered in the Report

By Component

- Software

- Hardware

- Services

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application/Technology

- Machine Learning and Deep Learning

- Natural Language Processing

- Computer Vision

- Robotics and Other

By Organization Size

- Large Enterprises

- SMEs

By Vertical/End-User

- Healthcare and Life Sciences

- BFSI

- Retail and E-commerce

- IT and Telecom

- Manufacturing

- Government and Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting