What is the AI-Powered Industrial Vision Systems Market Size?

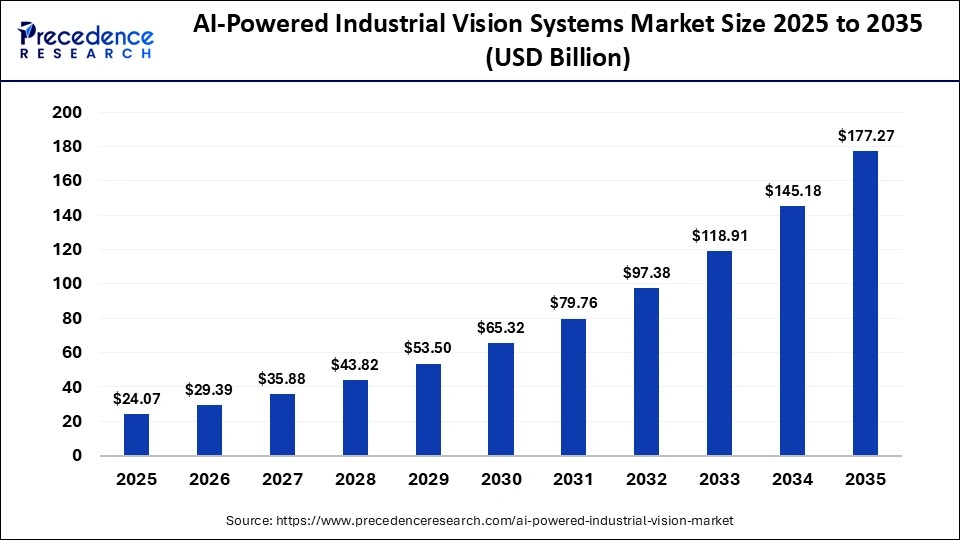

The global AI-powered industrial vision systems market size was calculated at USD 24.07 billion in 2025 and is predicted to increase from USD 29.39 billion in 2026 to approximately USD 177.27 billion by 2035, expanding at a CAGR of 22.10% from 2026 to 2035.The AI-powered industrial vision systems market is driven by increasing industrial automation, growing emphasis on quality inspections, integration of Industry 4.0 technologies, and investments in AI and robotics technology.

Market Highlights

- North America led the AI-powered industrial vision systems market in 2025.

- Asia-Pacific is expected to grow at the highest CAGR during the forecast period.

- By deployment type, the on-premise segment led the market in 2025.

- By deployment type, the edge-based segment is expected to grow at the highest CAGR during the forecast period.

- By technology type, the 2D-vision systems segment dominated the market in 2025.

- By technology type, the deep learning models segment is expected to grow at the highest CAGR between 2026 and 2035.

- By application type, the defect detection and quality assurance segment led the market in 2025.

- By application type, the robotic pathfinding and object localization segment is expected to expand at a notable CAGR from 2026 to 2035.

- By end user type, the automotive manufacturing segment led the market in 2025.

- By end user type, the pharmaceutical production and compliance segment is expected to expand at the highest CAGR from 2026 to 2035.

Technology Shifts in the AI-Powered Industrial Vision Systems Market

Technology shifts in the market emphasize speed and precision improvement in intelligent vision capabilities. Rule-based image processing is being largely replaced by deep learning-based image processing. Complex defects and product changes can be managed in a better manner with enhanced computer vision algorithms. 3D vision and depth sensing are being integrated with existing infrastructure to facilitate better identification of position and robot guidance. Edge AI is another major technology shift, which allows image processing to be done on cameras and on-board devices, resulting in lower latency limitations.

What is the AI-Powered Industrial Vision Systems Market?

The AI-Powered Industrial Vision Systems Market included advanced machine vision solutions that integrate cameras, sensors, and imaging hardware with AI technologies. These solutions find applications in manufacturing, automotive, electronics, pharmaceuticals, food and beverages, and logistics. This technology facilitates defect detection, quality inspection, object recognition, robotic guidance, predictive maintenance, and safety monitoring. Unlike traditional rule-based vision systems, AI-based solutions learn from data and adapt to product variations. This makes them highly reliable in dynamic production environments and suitable for smart factory adoption.

AI-Powered Industrial Vision Systems Market Trends

- Collaborations & Partnerships: Information technology companies are collaborating for the development of AI-based solutions, vision systems, and automation technologies. These partnerships facilitate improved results in detecting defects, faster inspection, and flexibility in manufacturing. For instance, Omron collaborated with Cognex to integrate AI-powered vision technology into factory automation systems.

- Government Initiatives: Governments are investing in the development of AI-enabled vision technology through the promotion of smart manufacturing, Industry 4.0 initiatives, and automation policies. The emphasis in these initiatives is on cost efficiency and quality improvement. For instance, the European Union promoted Industry 4.0 programs for AI vision system deployment in advanced industries.

- Business Expansions: Industrial vision firms are expanding their product offerings to address increasing demand for real-time inspection and quality solutions. Expansion strategies are targeted at AI algorithms, integrated cameras, and 3D vision solutions. For instance, Keyence expanded its lineup of AI-based vision solutions for inspection applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 24.07Billion |

| Market Size in 2026 | USD 29.39 Billion |

| Market Size by 2035 | USD 177.27 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 22.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment Mode, Technology Type, Applications Type, End Users Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Deployment Type Insights

Why Did the On-Premise Segment Dominate the AI-Powered Industrial Vision Systems Market?

The on-premise segment led the market in 2025. The market growth of this segment can be attributed to the rising need for precise image processing in the manufacturing sector. This segment facilitates accurate vision technology integration and usage without any delays. These systems allow manufacturing plants to hold their sensitive information within the ecosystem. It is easier to deploy AI-based vision technology within a production organization, as it can be easily integrated with existing PLCs and robots. There is less dependency on internet connectivity as the operations are streamlined within the production premises.

The edge-based segment is expected to grow at the highest CAGR during the forecast period. The market growth of this segment is due to increasing demand from the manufacturing sector to have real-time intelligence systems installed. By processing at the edge, the inspection would be faster, and corrective action can be taken at once. This segment facilitates less dependency on the network and central system and helps to improve reliability in remote environments. The market growth of this segment is further driven by the rise in smart manufacturing and AI-based automation.

Technology Type Insights

Why Did the 2D-Vision Systems Segment Dominate the AI-Powered Industrial Vision Systems Market?

The 2D-vision systems segment dominated the market in 2025. The market growth of this segment is due to its reliability in performing routine inspection-related operations. This segment is widely adopted by various organizations to inspect the surface of objects for possible defects and for industrial parameters measurement purposes. 2D-vision systems are easier to install and calibrate compared to other systems in the market. The market growth of this segment is further driven by its cost-effectiveness and integration capability with other industrial equipment.

The deep learning models segment is expected to grow at the highest CAGR between 2026 and 2035. The market growth of this segment is because the manufacturers are increasingly opting for smart inspection solutions. Deep learning offers accurate inspection results, as it analyzes large amounts of image data and becomes more accurate over time. There has been a significant improvement in the ease of implementation of this technology due to advancements in hardware and software optimization. The market growth of this segment is further driven by increasing emphasis on automation and zero-defect manufacturing.

Application Type Insights

Why Did the Defect Detection and Quality Assurance Segment Dominate the AI-Powered Industrial Vision Systems Market?

The defect detection and quality assurance segment led the market in 2025. The market growth of this segment can be attributed to manufacturers' focus on achieving consistent output quality. AI-enabled vision systems facilitate real-time inspection across fast-moving production lines. Early identification of defects helps to minimize downtime, recalls, and operational losses. Automated quality checks reduce dependence on manual inspection and human error. The market growth of this segment is further driven by strong demand from automotive, electronics, and industrial manufacturing sectors.

The robotic pathfinding and object localization segment is expected to expand at a notable CAGR from 2026 to 2035. The market growth of this segment is because manufacturers are increasingly deploying advanced robotic technologies along all lines of production and warehousing. Vision- based systems help robots to detect the accurate position, orientation, and movement of objects. AI models support real-time navigation and adaptive path planning in dynamic environments. AI-based vision systems enhance flexibility in automation and operational efficiency. The market growth of this segment is further driven by the increasing use of autonomous and collaborative robots across various industries.

End User Type Insights

Why Did the Automotive Manufacturing Segment Dominate the AI-Powered Industrial Vision Systems Market?

The automotive manufacturing segment led the market in 2025. The market growth of this segment can be attributed to a high degree of automation incorporated into the production lines of vehicles. The car manufacturing industry uses vision-based systems to perform body inspections, weld checks, paint analysis, and parts alignment. These processes need to be consistent and flawless, and any minute mistake can cause recalls and safety hazards. The market growth of this segment is further driven by investments in smart factories and the rising production of electric vehicles.

The pharmaceutical production and compliance segment is expected to expand at the highest CAGR from 2026 to 2035. The market growth of this segment is due to the increasing adoption of automation technologies in production lines by pharmaceutical companies. There are stringent regulatory norms to be met to ensure rigorous inspection and traceability. Camera- based vision systems can be used to inspect labels, check dosage form, and monitor contamination. AI-based vision systems are being increasingly used for the serialization of packages.

Regional Insights

What Made North America the Leading Region in the AI-Powered Industrial Vision Systems Market?

North America led the AI-powered industrial vision systems market in 2025. The market growth in this region is due to its advanced manufacturing sector, especially in the automotive, electronics, and aerospace industries. These sectors require highly efficient quality inspection and automation processes. This region has widely adopted the Industry 4.0 program and technologies such as AI, robotics, and smart factories. The market growth in this region is further driven by favorable government policies and initiatives for the industrial adoption of AI-based solutions.

U.S AI-Powered Industrial Vision Systems Market Analysis

The U.S. leads the market in North America due to its robust economy and large-scale production in various sectors. The automotive, electronics, aerospace, and semiconductor sectors have their production facilities in the U.S. This nation also has many prominent and new technology-based businesses in AI and machine vision. The government actively invests in AI and other related technologies, which helps in faster industry adoption. The market growth in this country is further driven by joint innovation programs conducted by premier academic institutes and information technology corporations.

Why is Asia Pacific the Fastest Growing Region in the AI-Powered Industrial Vision Systems Market?

Asia-Pacific is expected to grow at the highest CAGR in the AI-powered industrial vision systems market during the forecast period. The market growth in this region can be attributed to rapid industrialization and rising emphasis on optimized production. This region is witnessing an increase in manufacturing in the motor vehicles, electronics, and household products sectors. Investments in AI, robotics, and Industry 4.0 programs are accelerating the industry adoption. The market growth in this region is further driven by supportive government initiatives and rising awareness of the productivity and cost-optimizing advantages of AI technologies.

China AI-Powered Industrial Vision Systems Trends

China leads the AI-powered industrial vision systems market in the Asia Pacific due to its large industrial base, which covers the automobile and electronics industries. This country is witnessing the rapid adoption of industrial automation and AI technologies to boost production and decrease labor costs. Government policies and support for smart factories and AI innovations accelerate the market adoption. The market growth in this country is further driven by rising demand for quality products and optimized production processes.

Who are the Major Players in the Global AI-Powered Industrial Vision Systems Market?

The major players in the AI-powered industrial vision systems market include Qualcomm Technologies, Inc., Advanced Micro Devices, Inc. (AMD), International Business Machines Corporation (IBM), NVIDIA Corporation, Cognex Corporation, KEYENCE CORPORATION, Teledyne Technologies Inc., FANUC Robotics, ABB Robotics, SenseTime, LandingAI, Mech-Mind Robotics, Averroes.ai, OMRON Group and Ripik.AI.

Recent Developments

- In May 2025, Neousys Technology launched NRU-171V-PPC, which is an IP66-rated AI panel that can operate in harsh environments. This device uses the NVIDIA Jetson Orin NX module that enables high AI capability(up to approximately 100 TOPS). This product has high-bandwidth camera connectivity, allowing real-time vision and object detection.(Source: https://www.automate.org)

- In June 2025, Cognex Corporation launched the OneVision Platform, which offers a simpler process for building and deploying AI vision applications into the cloud. This platform assists in the rapid deployment and development of vision models without the need for expensive on-premise infrastructure.(Source: https://www.cognex.com)

- In May 2025, UnitX Labs launched FleX & GenX Inspection Platforms. FleX is an AI-driven inspection solution that facilitates highly accurate, inline inspection powered by generative AI and multiple imaging channels. GenX also uses generative AI to generate synthetic defect data, which helps to boost the accuracy of anomaly detection capability of AI algorithms.(Source: https://www.automate.org)

Segments Covered in This Report

By Deployment Mode

- On-premise

- Cloud-based

- Edge-based

By Technology Type

- 2D Vision Systems

- 3D Vision Systems

- Deep Learning Models

- Generative AI Modules

- Embedded AI Chips

By Applications Type

- Defect Detection & Quality Assurance

- Robotic Pathfinding & Object Localization

- Predictive Equipment Monitoring

- Workplace Safety & Hazard Surveillance

- Automated Sorting & Classification

By End Users Type

- Automotive Manufacturing

- Semiconductor & Electronics Fabrication

- Food Processing & Packaging

- Pharmaceutical Production & Compliance

- Warehouse Automation & Logistics

- Heavy Machinery & Metal Fabrication

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting