Airflow and Zone Control Equipment Market Size and Forecast 2025 to 2034

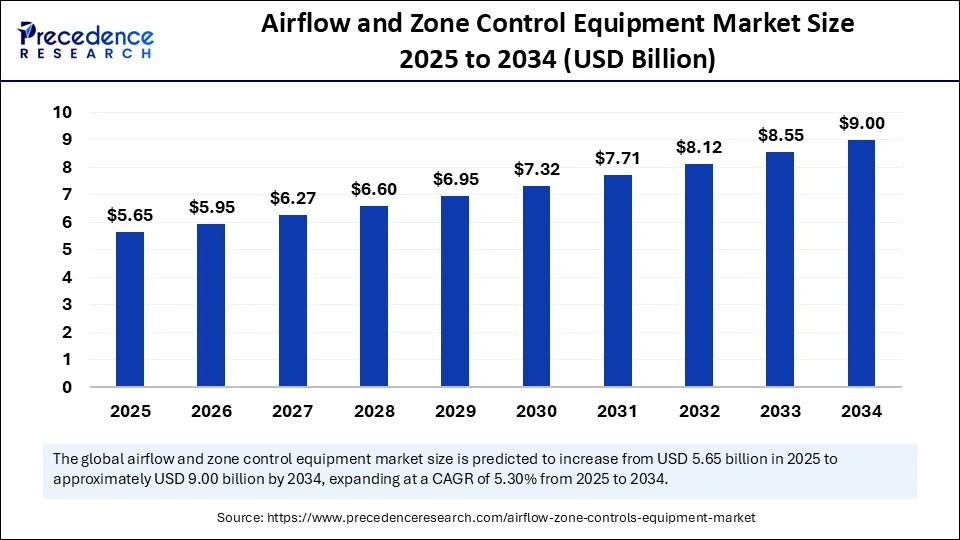

The global airflow and zone control equipment market size accounted for USD 5.37 billion in 2024 and is predicted to increase from USD 5.65 billion in 2025 to approximately USD 9.00 billion by 2034, expanding at a CAGR of 5.30% from 2025 to 2034. The growth of the market is attributed to the increasing demand for energy-efficient HVAC systems, rising commercial infrastructure development, and regulatory mandates for indoor air quality across industrial, healthcare, and residential sectors.

Airflow and Zone Control Equipment MarketKey Takeaways

- In terms of revenue, the airflow and zone control equipment market is valued at $ 5.65 billion in 2025.

- It is projected to reach $9.00 billion by 2034.

- The market is expected to grow at a CAGR of 5.30% from 2025 to 2034.

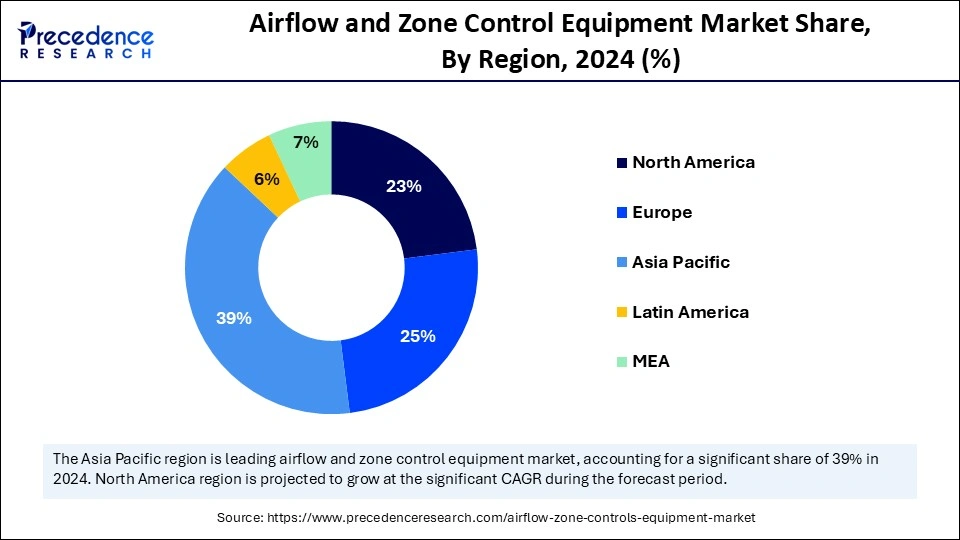

- Asia Pacific dominated the airflow and zone control equipment market with the largest revenue share of 39% in 2024.

- North America is expected to grow at the fastest CAGR of 5.4% from 2025 to 2034.

- By product, the dampers segment held the largest revenue share of 34% in 2024.

- By product, the airflow regulators segment is expected to grow at a significant CAGR from 2025 to 2034.

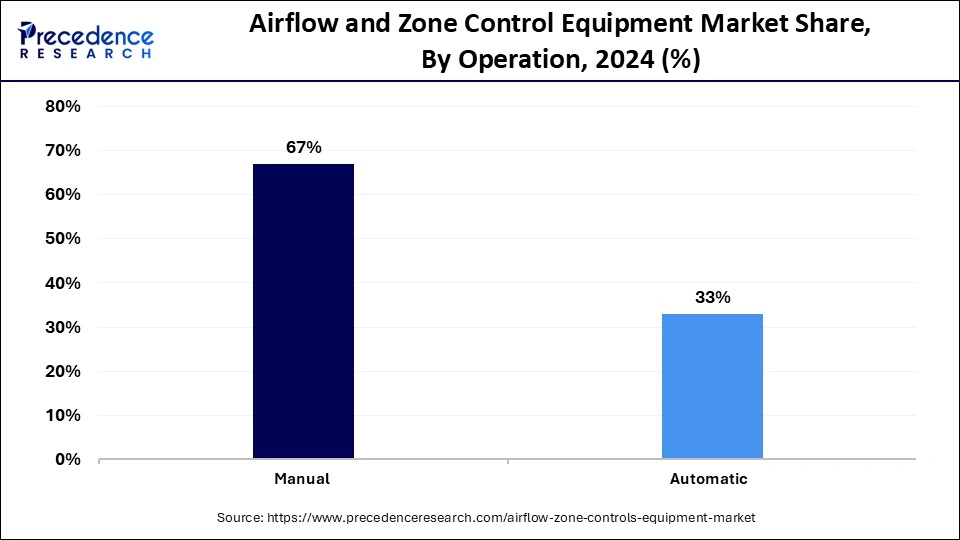

- By operation, the manual segment contributed the highest revenue share of 67% in 2024.

- By operation, the automatic segment is expected to grow at the fastest CAGR from 2025 to 2034.

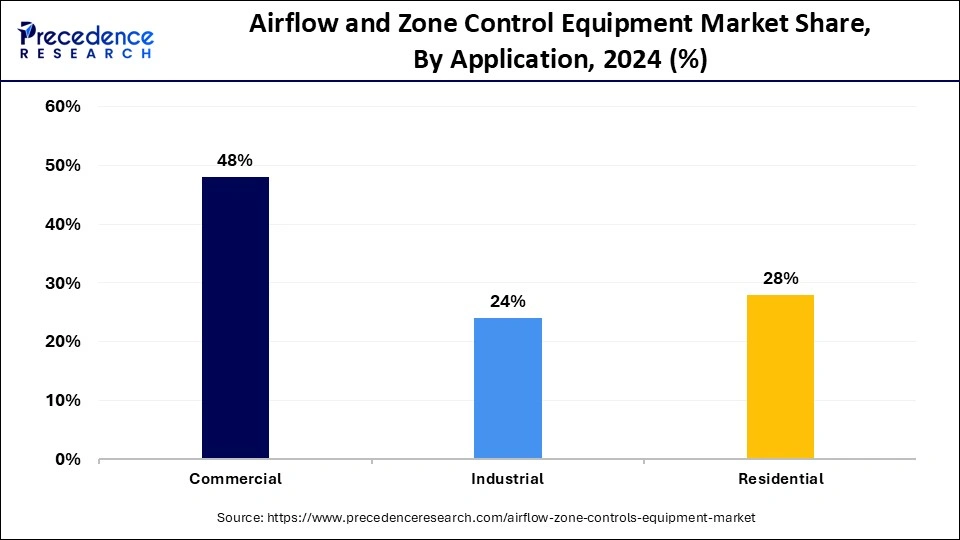

- By application, the commercial segment generated the major revenue share of 68% in 2024.

- By application, the residential segment is expected to grow at the fastest CAGR from 2025 to 2034.

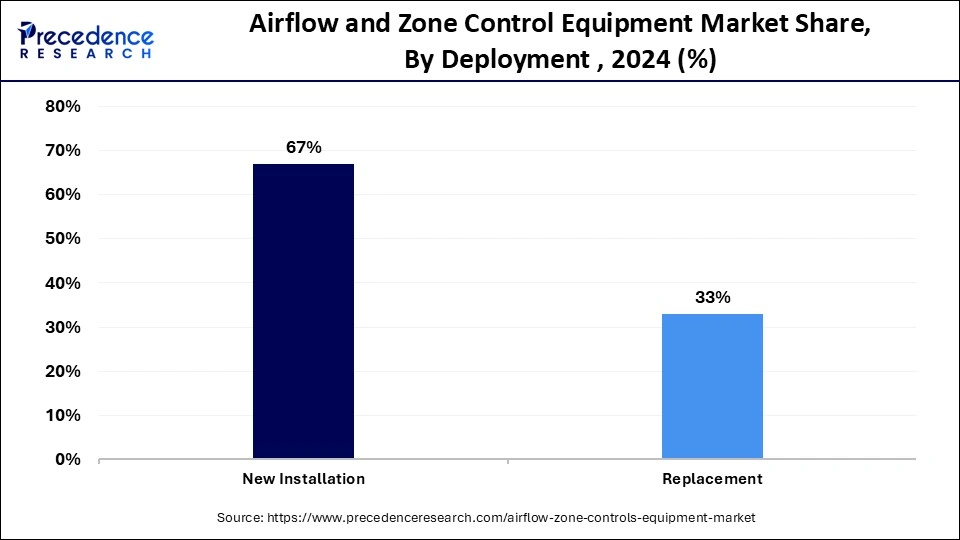

- By deployment, the new installation segment captured the biggest revenue share of 68% in 2024.

- By deployment, the replacement segment is expected to expand at a significant CAGR between 2025 and 2034.

- By distribution channel, the wholesale stores segment held the major revenue share of 52% in 2024.

- By distribution channel, the online segment is expected to grow at the highest CAGR from 2025 to 2034.

How is AI Transforming the Airflow and Zone Control Market?

Artificial intelligence is significantly impacting the market by enabling intelligent real-time and HVAC system management. Machine learning algorithms can optimize the distribution of airflow according to temperature, humidity, occupancy patterns, and indoor air quality, resulting in considerable energy savings and enhanced comfort. Additionally, it facilitates predictive maintenance by detecting damper and regulator issues before they become serious, which minimizes downtime. Furthermore, AI systems easily interface with smart buildings, enabling users to control airflow zones through voice assistants or smartphone apps. Efficiency and customization are being improved by AI.

Asia Pacific Airflow and Zone Control Equipment Market Size and Growth 2025 to 2034

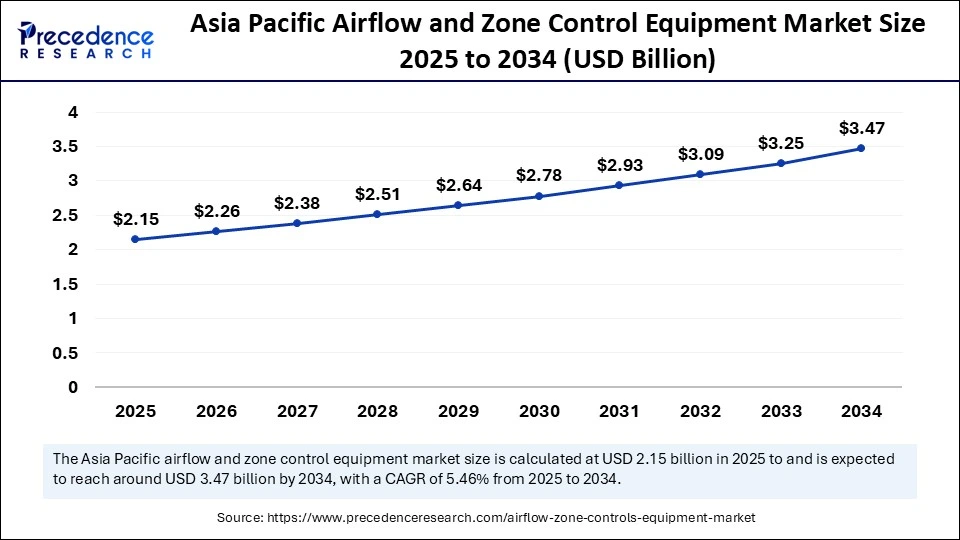

Asia Pacific airflow and zone control equipment market size was exhibited at USD 2.04 billion in 2024 and is projected to be worth around USD 3.47 billion by 2034, growing at a CAGR of 5.46% from 2025 to 2034.

Asia Pacific dominated the market with the largest share in 2024 by holding more than 39% of revenue share, due to the strong building industry growing investment in commercial infrastructure and the rate of urbanization. Growth in smart cities, high-rise buildings, and industrial facilities that need effective ventilation and zoning solutions are driving the need for sophisticated HVAC systems.Additionally, developers and building managers are incorporating automated airflow controls into new projects as a result of increased awareness of indoor air quality and energy efficiency. Government policies that support smart infrastructure and green buildings bolster the region's market dominance.

North America is growing at a CAGR of 5.4% in the upcoming years, supported by a rising shift toward energy-efficient buildings and retrofitting of aging HVAC infrastructure. The increasing adoption of smart home systems, building automation, and AI-driven HVAC technologies is accelerating demand across residential and commercial sectors. Moreover, stricter energy efficiency standards and financial incentives are pushing building owners to upgrade to automated airflow solutions. The growing emphasis on indoor air quality, especially in healthcare and office spaces, is also contributing to market momentum

Europe remains the notable region in the airflow and the zone control equipment market motivated by a strong emphasis on sustainability and strict building energy performance regulations. In both new construction and retrofits, smart HVAC solutions are becoming more and more popular, especially in office buildings, public spaces, and industrial settings. Widespread integration of zone control systems is encouraged by the drive for carbon neutrality and adherence to building codes such as EPBD and EN standards. Market expansion is also supported by the region's early adoption of BMS and green certification initiatives.

Market Overview

The airflow and zone control equipment market is gaining momentum, driven by growing demand for energy efficiency, smart HVAC integration across residential and commercial infrastructure, and precise climate control. Zone control techniques like demand-controlled ventilation (DCV), smart actuators, and VAN are becoming more and more popular as building codes change to require higher levels of indoor air quality (IAQ) and energy efficiency. Intelligent airflow systems are being incorporated into HVAC design at an accelerated rate due to the trend toward smart buildings, IoT-based facilities, and green constructions.

Effective air circulation and filtration technologies are also becoming more and more important in the public and private sectors because of increased heatwave pollution and awareness of climate change. Energy management software and zone control systems are increasingly being combined by HVAC contractors to increase long-term operational effectiveness and regulatory compliance.

Why is the Demand for Airflow and Zone Control Equipment Increasing across Industries?

Growing concerns about energy costs are driving the demand for airflow and zone control equipment. Healthcare facilities need to control airflow precisely to avoid contamination, and data centers need to be continuously cooled to maintain operational dependability. Energy efficiency and user comfort are enhanced by zoning in commercial and educational buildings. By lowering HVAC loads and power consumption, the equipment also helps achieve decarbonization objectives.

Airflow and zone control systems have become crucial for achieving ESG goals and green certification standards like LEED as industries place a greater emphasis on sustainable practices. In manufacturing, zone controls enhance safety and productivity by controlling ventilation in high-risk areas. Furthermore, the retail and hospitality industries are using intelligent zoning to adjust climate conditions according to occupancy levels, which lowers overhead costs and improves guest satisfaction.

Airflow and Zone Control Equipment Market Growth Factors

- Energy Efficiency Rules: Stricter global regulations and demand for energy savings boost the adoption of smart airflow systems.

- Smart & IoT HVAC: the growing use of connected, automated systems for real-time airflow control in buildings.

- Indoor Air Quality (IAQ): Post-COVID focus on cleaner, healthier indoor environments is increasing demand for advanced ventilation solutions.

- Urbanization & Construction: Infrastructure growth, especially in Asia Pacific, is driving new installations.

- HVAC System Upgrades: Retrofitting older buildings with efficient zone control systems fuels steady market demand.

- Data Centers Expansion: Rising data center builds require precise airflow management for thermal control.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.00 Billion |

| Market Size in 2025 | USD 5.65 Billion |

| Market Size in 2024 | USD 5.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.30% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, Component, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rise in Smart Building

The rising trends of smart cities and intelligent infrastructure drive the growth of the airflow and zone control equipment market. Automated airflow systems that interface with building management systems (BMS) are now required in smart homes and buildings. Internet of things (IoT)-enabled VAN boxes, actuators, and dampers enable remote operation and real-time data collection. These systems prolong equipment life, optimize energy in HVAC systems, and allow for customized comfort zones. Additionally, the need for high-tech, adaptable spaces is particularly high in commercial offices, hospitals, and educational institutions, supporting market expansion.

Technological Advancements

Ongoing technological advancements ensure the long-term growth of the market. Recent developments, including wireless communication, machine learning-enabled flow optimization, and smart dampers with thermal dispersion, are expanding the capabilities of airflow and zone control equipment. System responsiveness, dependability, and simplicity of integration with legacy infrastructure are enhanced by these technologies. Additionally, cloud-based airflow management is becoming more popular since it makes performance improvements and remote diagnostics possible. To introduce AI-powered systems, businesses such as Honeywell, Siemens, and Johnson Controls are investing in R&D. Innovation in sensor technology is improving the airflow control capability of this equipment.

Restraint

Complex Installation & Maintenance

Installing and maintaining airflow and zone control systems can be complex, hampering the growth of the airflow and zone control equipment market. These systems frequently require extensive rewiring, duct adjustments, and BMS integration while retrofitting. Installing these systems into existing legacy systems also requires specialized expertise and knowledge, which potentially increases installation and maintenance costs. In retrofit scenarios where budgets are frequently limited, the adoption of airflow and zone control equipment decreases due to the significant cost, causing project delays.

Opportunities

Surge in Green Building Certifications

The demand for intelligent and energy-efficient airflow systems is rising as a result of the increasing acceptance of LEED, BREEAM, WELL, and IGBT certifications. To meet sustainability standards, builders are seeking these certifications to demonstrate that their buildings have exact control over ventilation, thermal zones, and indoor air quality. This tendency is particularly noticeable in healthcare facilities, educational institutions, and commercial office buildings. Products for zone control and airflow contribute to improved comfort, reduced energy consumption, and advanced green building objectives.

Retrofitting of Aging Infrastructure

Many structures around the world, particularly in North America and Europe, are over 30 years old and do not have contemporary airflow zoning. This offers a huge opportunity for retrofitting as builders and owners are looking for lower utility costs and compliance with newer energy codes. Without having to replace the entire HVAC system, smart retrofitting with airflow and zone control equipment improves comfort and energy efficiency. Governments of various nations are providing subsidies and incentives to modernize existing commercial infrastructure, opening up growth avenues.

Product Insights

Dampers segment dominated the market by holding more than 34% of revenue share in 2024 as they are the most popular choice for commercial and industrial HVAC installations because of their affordability and ease of use. Because of their low maintenance requirements and compatibility with both new construction and retrofits, facility managers strongly favor them. Dampers are a basic airflow control component that facilitates zone-specific balancing and energy savings without the hassle of automation. During design, they are frequently incorporated into ductwork and for setups that are ready for the future, they are now available with smart interfaces. This segment's strength is further fueled by its increasing adoption in office buildings, shopping centers, and schools.

- On 17 March 2025, Honeywell announced the launch of its new smartmod damper series. Integrated position feedback and BACnet MS/TP interface for building automation integration.

(Source: https://www.honeywell.com)

Airflow regulators is emerging as the fastest-growing segment due to the need for precise airflow in real time. Improved indoor air quality and energy efficiency are made possible by their capacity to automatically modify ventilation based on occupancy and environmental factors. Both pneumatic and electronic versions are being used in high-tech settings like data centers, cleanrooms, and medical facilities. The appeal of BMS and AI-driven systems is growing as regulators incorporate them more and more. The growing regulation on comfort emissions and ventilation control is also advantageous to the market.

- On 5 February 2025, Emerson introduced its clarity electronics airflow regulatory system. Machine learning optimization designed for HVAC and medical equipment applications.

Operation Insights

Manual segment dominated the market with the biggest revenue share of 67% in 2024. Budget-conscious projects and older buildings are dominated by manual airflow systems due to their ease of use and low installation costs. These systems are appealing in small-scale or simple HVAC settings because they don't require wiring or digital calibration. They are frequently utilized in mild commercial settings where dynamic control is not a top concern. Their lengthy operational life and low maintenance requirements are guaranteed by their mechanical nature. This conventional method is still applicable when cost-effectiveness outweighs the need for automation.

Automatic segment is emerging as the fastest growing due to automated airflow control systems expanding quickly due to the growing need for energy compliance and smart buildings. These systems use sensors, actuators, and remote interfaces to react in real-time to changes in occupancy and climate. Because of its potential for energy savings and zoning flexibility, automation is becoming more and more popular among building owners. Automated systems are also retrofit projects and are further accelerated by their integration with cloud dashboards, predictive maintenance tools, and IoT platforms.

- On 22 April 2025, Siemens announced its Climatix automated damper controller. Wireless ZigBee connectivity and cloud-based analytics for energy optimization.

(Source: https://www.siemens.com)

Application Insights

Commercial segment dominated the market by holding more than 68% of revenue share in 2024, driven by increased HVAC complexity and comfort standards. To meet occupancy safety and energy goals offices, hospitals, schools, and retail establishments need precise ventilation. These facilitate investments in BMS-integrated zoning systems to control temperature and indoor air quality at the room level. In commercial projects reliability, scalability and long-term return on investment are crucial deciding factors. The dominance of this market is also maintained by adherence to ventilation regulations and worker comfort programs.

Residential segment is growing faster in the market driven by the rising popularity of smart homes and energy-efficient living. Homeowners are adopting Wi-Fi-enabled airflow systems to control comfort and cut energy bills. Smart thermostats, zone dampers, and DIY kits are tailored for residents looking to customize temperature by room or time of day. These systems are especially attractive to new-age buyers who prioritize connected living and air quality. Voice control, mobile apps, and automation features further enhance adoption among tech-forward households.

- On 8 May 2025, Ecobee unveiled its smart vent accessory. Enables residential motorized zone control via standard vents compatible with Alexa and Google Home.

(Source: https://www.ecobee.com)

Deployment Insights

New installation segment dominated the market with the biggest revenue share of 68% in 2024, because zoning systems are incorporated into HVAC design from the beginning. During construction, architects and contractors are increasingly requesting airflow equipment to optimize energy efficiency and adhere to regulations. During the building phase, zoning controls and smart dampers are integrated to lower costs and increase lifecycle efficiency. Developers are using these tools to increase the value of their properties and obtain green certifications. The strength of this segment is also aided by the standardization of zoning in contemporary building codes.

Replacement segment is growing at the fastest CAGR in the market due to the growing need to update antiquated systems. Owners of buildings are updating outdated HVAC systems to meet new regulations, lower energy costs, and improve indoor air quality. Smart actuators and wireless control are features of retrofit kits that speed up and lower the cost of installations. Upgrades are also encouraged by financial incentives and growing maintenance expenses for outdated systems. Demand for retrofits is particularly high in older residential complexes and commercial buildings that are undergoing energy retrofits.

- On 15 June 2025, belimo launched its retrofit actuator kit. Converts manual dampers into motorized units with BACnet and EnOcean wireless compatibility.

(Source: https://www.belimo.com)

Distribution channel Insights

Wholesale stores segment dominated the airflow and zone control equipment market in 2024 with the largest revenue share of 52%, driven by bulk purchasing benefits and contractor trust; wholesale stores remain the dominant distribution channel for airflow control equipment. These outlets provide technical support, consistent inventory, and discounted rates, making them popular among HVAC professionals. They also serve as primary sources for large-scale commercial projects needing tailored solutions. On-site assistance and same-day availability further strengthen their appeal. The established relationship between brands, wholesalers, and technicians sustains their dominance in traditional procurement.

Online segment is growing at the fastest CAGR in the market driven by the surge in digital purchasing and product accessibility; the online channel is growing the fastest in this market. E-commerce platforms offer a broad product range, real-time comparisons, and fast delivery, attractive to both DIY users and small contractors. Consumers value the convenience of shopping for airflow solutions with integrated tech specs, customer reviews, and how-to videos. With brands increasingly launching web-exclusive kits, this channel continues to gain momentum. Pandemic-induced digital shifts have only accelerated its adoption.

Airflow and Zone Control Equipment MarketCompanies

- Panasonic Corporation

- Carrier

- Broan-NuTone, LLC

- Zehnder America

- Daikin Industries, Ltd.

- Greenheck Fan Corporation

- Ruskin

- Aldes Group (American Aldes Ventilation Corporation)

- Trane Technologies

- RenewAire

- S&P USA Ventilation Systems, LLC

- Zonex Systems

- Arzel Zoning

- Aprilaire

Latest Announcements

- On 11 June 2025, Siemens and NVIDIA launched to accelerate industrial AI adoption across building systems. NVIDIA CEO stated, “Our partnership with Siemens brings NVIDIA AI to the world's leading enterprises.”

- On 3 March 2025, Siemens AG launched an AI-powered industrial software portfolio. Siemens CEO stated, “AI has emerged as a transformative force across industries.”

Recent Developments

- On 25 March 2025, Trane launched new 90-110ton models with digital Symbio 500 controls and low GWP refrigerant (R-4548) featuring standard leak detection and improved modular installation flexibility.

- On 12 March 2025, Airzone releases a new version simplifying design and integration for inverter/VRF applications, enabling more efficient multi-zone control in commercial buildings.

- On 6 January 2025, Hemco launched a factory-installed or field-installed airflow monitor. The unit features a 115V/60Hz AC supply, designed to provide real-time airflow alarm for ducts, enhancing safety and performance monitoring in HVAC systems.

Segments Covered in the Report

By Product

- Dampers

- VAV (Variable Air Volume)

- Airflow Regulators

- Zoning Panels

- Others

By Operation

- Manual

- Automatic

By Application

- Commercial

- Residential

- Industrial

By Deployment

- New Installation

- Replacement

By Distribution Channel

- Online

- Retail Stores

- Wholesale Stores

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting