What is the Alzheimer Therapeutics Market Size?

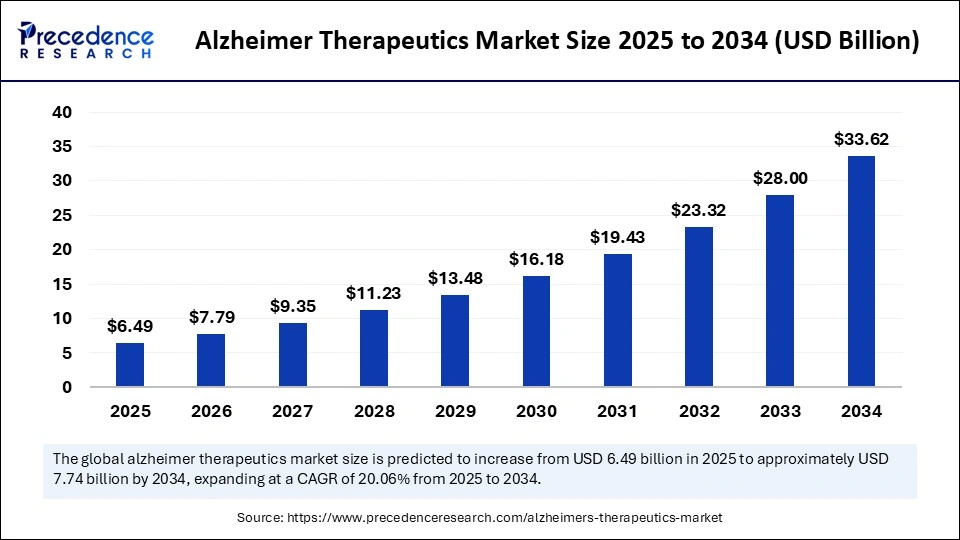

The global alzheimer therapeutics market size accounted for USD 6.49 billion in 2025 and is predicted to increase from USD 7.79 billion in 2026 to approximately USD 33.62 billion by 2034, expanding at a CAGR of 20.06% from 2025 to 2034. The increased prevalence of Alzheimer's disease and advancements in disease-modifying therapies are driving the global Alzheimer therapeutics market.

Market Highlights

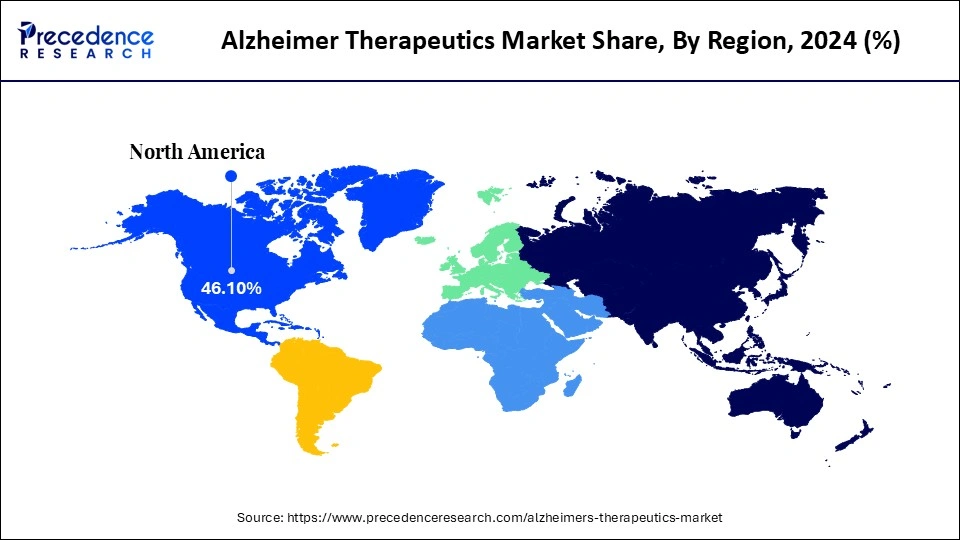

- By region, North America dominated the global alzheimer therapeutics market, with the largest share of 46.10% in 2024.

- The Asia Pacific is projected to grow at a significant CAGR of 10.90% from 2025 to 2034.

- By product type, the cholinesterase inhibitors segment contributed the largest market share of 38.40% in 2024.

- By product type, the anti-amyloid monoclonal antibodies segment is projected to grow at a 12.80% CAGR from 2025 to 2034.

- By stage of Alzheimer's disease, the mild to moderate Alzheimer's disease segment led the market by holding the largest share of 46.7 0% in 2024.

- By stage of Alzheimer's disease, the mild cognitive impairment (MCI) Due to Alzheimer's segment is projected to grow at a 11.20% CAGR from 2025 to 2034.

- By route of administration, the oral segment dominated, holding the largest share of 61.30% in 2024.

- By route of administration, the intravenous (IV) segment is growing at a notable CAGR of 10.60% between 2025 and 2034.

- By end-user, the hospital pharmacy segment led the market while holding the largest share of 44.90% in 2024.

- By end-user, the online pharmacy segment is expected to grow at a 11.80% CAGR between 2025 and 2034.

What are Alzheimer Therapeutics?

The alzheimer therapeutics market is experiencing rapid growth, driven by a deeper understanding of the disease and the introduction of new disease-modifying therapies (DMTs). Alzheimer's therapeutics are the treatments for Alzheimer's disease, including both medications for the management of symptoms and new therapies to modify the disease progression. Cholinesterase inhibitors and NMDA receptor antagonists are symptomatic treatments that enhance cognitive function by targeting neurotransmitters such as glutamate and acetylcholine. Pharmaceutical companies are focusing on the development of disease-modifying therapies for targeting the underlying pathology, like tau tangles and amyloid plaques.

The rising aging population is a major factor driving market growth across the globe, as the aged population is more sustain to Alzheimer's disease. This increased prevalence of disease has shifted the emphasis on advanced therapies and personalized medicines. Awareness of Alzheimer's disease has increased, fueling the diagnosis rate, driven by government initiatives to promote awareness and funding of sustainable treatment solutions. Strong investments in R&D and support from favorable reimbursement policies are fueling this growth.

Key Technological Shift in Alzheimer Therapeutics Market

The Alzheimer's therapeutics industry is undergoing in significant technological shift due to sustainable advancements in disease-modifying therapies (DMTs) and innovative diagnostic methods. The new approaches in targeting therapeutics like disease-modifying therapies, amyloid beta, and tau proteins are enhancing outcomes of patients with early-stage Alzheimer's. FDA approvals for monoclonal antibodies like that are and can be cognitively declining in early Alzheimer's patients.

Innovations in blood-based diagnostics enable earlier diagnosis and treatment decisions. Additionally, advancements in gene editing and stem cell therapies are offering potential for regenerative medicines and personalized medicines. Adoption of AI-driven neuroimaging further enhances diagnostic accuracy and efficiency.

Biogen Inc., Eisai Co., Ltd, and Eli Lilly & Company are the major companies fueling the technological shift in the Alzheimer therapeutics market. AbbVie Inc., AC Immune, Cassava Sciences, and C2N Diagnostics are focusing on disease-modifying therapies, digital health technologies, and the development of personalized medicines and treatments.

Alzheimer Therapeutics Market Outlook

Azhimer Therapeutics' innovations and development industry is expected to grow rapidly between 2025 and 2034 due to the increased prevalence of Alzheimer's disease and advancements in disease-modifying therapies. The expanding advanced healthcare infrastructure in North America and the Asia Pacific is a significantly factor in the industrial growth.

Leading players are expanding their reach in personalized medicines and targeting therapies for cutting-edge Alzheimer's therapeutics. North America, Asia Pacific, Latin America, and Europe are seeking spectacular expansion with the rising geriatric population, prevalence of disease, and improvements in healthcare infrastructure.

Pharmaceutical companies like Roche, Bristol Myers Squibb, Sanofi, Novartis AG, Eisai Co., Ltd, AbbVie Inc., and Biogen Inc. are the major investors in Alzheimer therapeutic discovery and drug developments. Furthermore, venture capital funds, including the Dementia Discovery Fund (DDF), are investing more than $550 million to support innovative treatments for Alzheimer's.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.49 Billion |

| Market Size in 2026 | USD 7.79 Billion |

| Market Size by 2034 | USD 33.62 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.06% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Stage of Alzheimer's Disease, Route of Administration, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Alzheimer TherapeuticsMarket Segment Insights

Product Type Insights

The cholinesterase inhibitors segment led the alzheimer therapeutics market, with a share of 38.40% in 2024, due to their wide use in clinical practice for symptom management, including donepezil, galantamine, and rivastigmine. The cholinesterase inhibitors are widely used for mild to moderate Alzheimer's disease. These products have advanced efficacy management of Alzheimer's symptoms. The clinical trials targeting tau proteins, synaptic dysfunction, and neuroinflammation are driving the use of cholinesterase inhibitors. Government support through National Alzheimer's plans and research bodies is fueling drug development, leading to a boost use of cholinesterase inhibitors.

The anti-amyloid monoclonal antibodies segment is growing fastest at a 12.80% CAGR over the forecast period, driven by its widespread use in disease-modifying treatments. The U.S. FDA approvals for drugs like Donanemab and Lecanemab are fueling the segment's growth. The anti-amyloid monoclonal antibodies target and clear amyloid beta plaques, slowing cognitive decline and re-energizing drug developments based on the amyloid cascade hypothesis. The large pipelines for research and development of novel monoclonal antibodies, like Gantenerumab, are projected to expand the segment's reach in the coming years.

Stage of Alzheimer’s Disease Insights

In 2024, the mild to moderate Alzheimer's disease segment dominated the market, with a share of 46.7 0%, due to increased use of cholinesterase inhibitors like Rivastigmine, Galantamine, and Donepezil for the treatment of patients with mild to moderate Alzheimer's disease. The increased prevalence of Alzheimer's disease requires a well-established efficacy to manage symptoms. The majority of patients are diagnosed with mild to moderate Alzheimer's disease, creating large patient pools, driving the need for both existing treatments like cholinesterase inhibitors and novel, high-cost options. Researchers are focusing on developing and testing drugs for mild to moderate Alzheimer's disease stages with high-cost treatment options, leading to a boost in focus on enhancing accessibility and economic sustainability.

The mild cognitive impairment (MCI) Due to Alzheimer's segment is expected to grow fastest with a 11.20% CAGR from 2025 to 2034, due to increased prevalence in the elderly population. The mild cognitive impairment (MCI) is creating opportunities to target disease-modifying therapies (DMTs) like donanemab and lecanemab. These therapies help to slow cognitive declines. The growing focus on strategies for slowing disease progression and management of modifiable risk factors is fueling innovation in mild cognitive impairment (MCI). Additionally, the ongoing development of novel therapies like anti-amyloid drugs and their approvals to use in mild cognitive impairment (MCI) patients are contributing to the segment's growth.

Route of Administration Insights

In 2024, the oral segment dominated the market, with a share of 61.30%, due to its convenient nature and cost-effectiveness. The oral administration is practical, secure, and straightforward for both caregivers and patients. The wide availability of oral medications like NMDA receptor antagonists and cholinesterase inhibitors is fueling the segment's growth. Patients prefer oral administration due to lower healthcare costs, fewer needs for hospital visits, and the market availability and accessibility of numerous oral drug options. The ongoing approvals for oral drugs like benzgalantamine are further supporting the market.

The intravenous (IV) segment is expected to lead the market, over the forecast period, with a 10.60% CAGR, due to growing approvals for novel disease-modifying monoclonal antibody (mAb) treatments, like donanemab and lecanemab. The intravenous (IV) route of administration enhances efficacy and sustained therapeutic effects. The intravenous (IV) has been effective in slowing disease progression, reducing amyloid beta plaques, and slowing cognitive decline. The increasing demand for disease-modifying therapies is fueling innovations and the development of intravenous (IV) medications. Additionally, the ongoing research and development of therapies like next-generation immunotherapies and alternative infusion routes are fostering the expansion of the segment in the upcoming period.

End-User Insights

The hospital pharmacy segment dominated the market, with a share of 44.90% in 2024, due to its strategic role in patient care. Hospital pharmacies have high prescription rates and a significant role in integrated care. The growing number of hospitalizations of Alzheimer's patients is contributing to this growth. The centralized procurements and need for sophisticated and coordinated care drive patient preference for hospital pharmacies. The ongoing access to novel and complex treatment solutions and medications like disease-modifying drugs drives the need for qualified medical professionals. Hospital pharmacies offer direct relationships with pharmaceutical companies, facilitating timely treatments.

The online pharmacy segment is growing fastest at an 11.80% CAGR over the forecast period, driven by increased adoption of digital platforms and patient convenience. The online pharmacy provides convenient delivery of medications. The widespread internet access and the accelerated shift in behavior due to the COVID-19 pandemic have boosted patient preference for online purchase of medicines. Additionally, the online pharmacies are cost-effective compared to hospital and retail pharmacies, as they can offer competitive pricing and discounts. The rising shift toward home deliveries is fueling the segment's growth.

Alzheimer TherapeuticsMarket Regional Insights

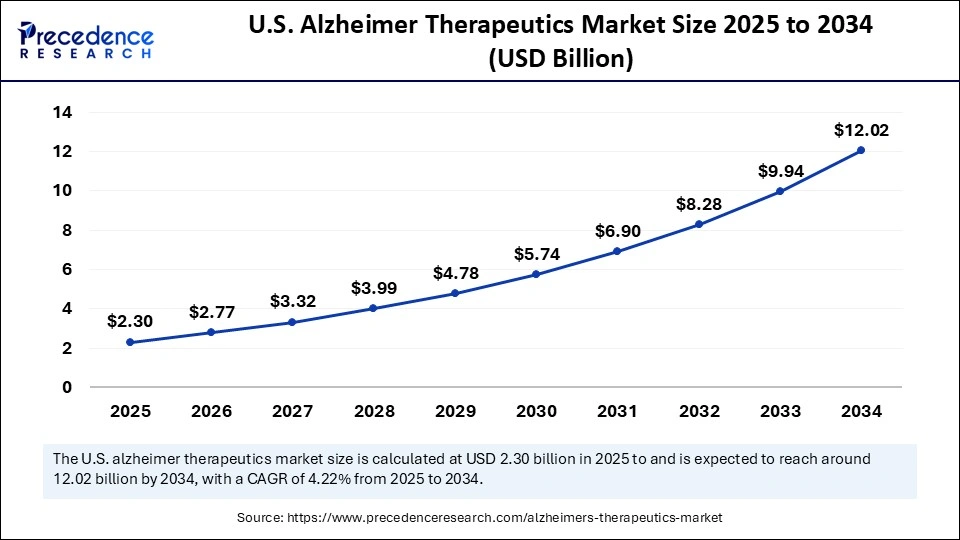

The U.S. alzheimer therapeutics market size is evaluated at USD 2.30 billion in 2025 and is projected to be worth around USD 12.02 billion by 2034, growing at a CAGR of 4.22% from 2025 to 2034.

Why Does North America Lead the Alzheimer Therapeutics Market?

North America dominates the global Alzheimer therapeutics market, holding a share of 46.10% in 2024, due to a large number of clinical trials and increasing research funding. The Government of North America is investing heavily in pharmaceutical and biopharmaceutical companies to enhance the focus on novel disease-modifying treatments. North America is conducting more than 180 trials and 138 novel drug pipelines to address multiple disease processes, and incorporating repurposed agents. The strong healthcare infrastructure and growing prevalence of Alzheimer's disease are fueling market growth. Additionally, the presence of major pharmaceutical companies like Eisai, Biogen, and Eli Lilly is boosting innovations in Alzheimer's therapeutics.

Strong Healthcare Infrastructure: To Boost the U.S. Market

The U.S. is a major player in the regional market, driven by robust healthcare infrastructure and strong investments in research activities by pharmaceutical companies. The U.S. pharmaceutical industry is witnessing significant growth in innovations and developments of novel anti-amyloid therapeutics like donanemab and lecanemab. Key Companies like AB Science, Annovia Bio, TauRx Therapeutics, and BioVie are fueling the development of numerous therapies. The large pipelines of upcoming drugs and innovative approaches in personalized medicines with leveraging advanced technologies, are expected to mature the U.S. market.

Asia Pacific is the fastest-growing region in the global market, with an expected growth of 10.90% CAGR from 2025 to 2034, driven by the rising geriatric population and government initiatives. Expanding healthcare infrastructure and investments in R&D are fueling innovations and developments of novel treatments, like tau aggregation inhibitors (TAIs) for slowing Alzheimer's disease. Asia has experienced a large growth in awareness of neurodegenerative disease. The Alzheimer's Disease International (ADI) organization is involved in sustainable support from the government in regional developments and impacting on national dementia plans, particularly in Malaysia and the Maldives. The expanding online pharmaceuticals and government-supported activities to manage disease in Asia are solidifying its position in the global market.

China's Innovative Approaches to Fuel Alzheimer Therapeutics Market Growth

China is a major player in the regional market due to the expanding healthcare infrastructure, the rising aging population, and the growing prevalence of disease in the country. More than 16 million people in China have been affected by Alzheimer's. China has introduced a national action plan for combating dementia by 2030. The continuous development of novel treatments and the official approval of lecanemab are further adding to this growth. The strong pharmaceutical focus on disease-modifying therapies and utilization of biomarkers in drug development are maturing China's market.

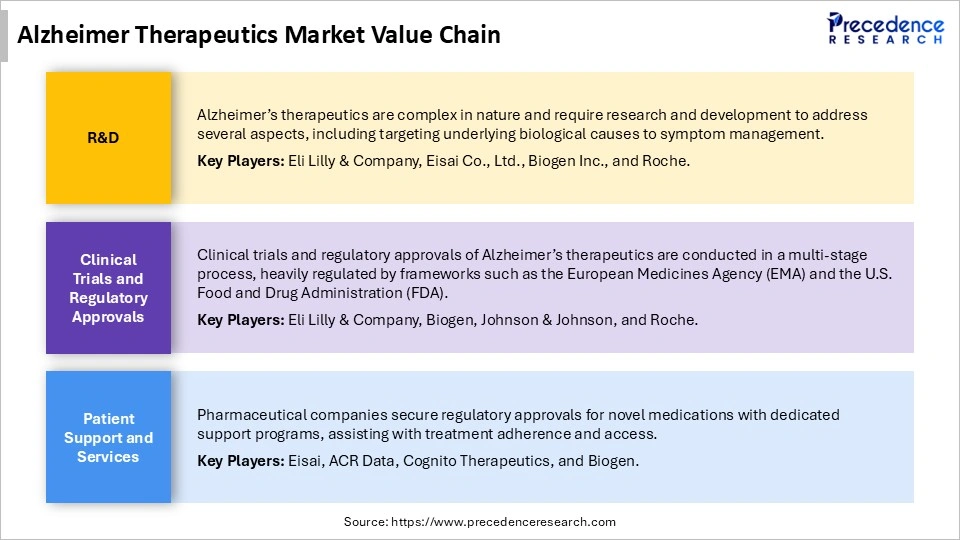

Alzheimer Therapeutics Market Value Chain

Alzheimer�s therapeutics are complex in nature and require research and development to address several aspects, including targeting underlying biological causes to symptom management. Key Players: Eli Lilly & Company, Eisai Co., Ltd., Biogen Inc., and Roche.

Clinical trials and regulatory approvals of Alzheimer�s therapeutics are conducted in a multi-stage process, heavily regulated by frameworks such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA). Key Players: Eli Lilly & Company, Biogen, Johnson & Johnson, and Roche.

Pharmaceutical companies secure regulatory approvals for novel medications with dedicated support programs, assisting with treatment adherence and access. Key Players: Eisai, ACR Data, Cognito Therapeutics, and Biogen.

Other Alzheimer Therapeutics Market Players

- AbbVie

- Johnson & Johnson

- Takeda Pharmaceutical

- GlaxoSmithkline (GSK)

- Pfizer, Inc.

- Merck & Co.

- H. Lundbeck A/S

- Daiichi Sankyo Co., Ltd.

- AC Immune

Recent Developments

- In July 2025, Eisai Co., Ltd. announced the benefits of the latest findings to continue treatment with lecanemab-irmb, an anti-amyloid beta protofibril antibody, for the early treatment of Alzheimer's disease. This announcement was made in collaboration with Biogen Inc. at the Alzheimer's Association International Conference (AAIC) 2025, held in Toronto, Canada, and virtually. (Source: https://www.eisai.com)

- In April 2025, at the AD/PD 2025 International Conference of Alzheimer's and Parkinson's Diseases in Vienna, Australia, Roche presented new advances in therapeutics and diagnostics for Alzheimer's disease. The presentation covered results from the ongoing trontinemab Phase Ib/IIa Brainshuttle AD study, which showed a dose-dependent, rapid reduction of amyloid in the brain, as well as the potential of the Elecsys pTau181 plasma test to rule out amyloid pathology. (Source: https://www.gene.com)

- In May 2025, Sanofi announced a collaboration with Vigil Neuroscience, Inc., to enhance Sanofi's early-stage pipeline, including VG-3927, for evaluation in a Phase 2 clinical study for Alzheimer's disease. Sanofi is receiving significant support for its strategic focus on neurology from this acquisition. (Source: https://www.sanofi.com)

Alzheimer Therapeutics Market Segment Covered in the Report

By Product Type

By Stage of Alzheimers Disease

By Route of Administration

By End User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting