What is the Automatic Labeling Machine Market Size?

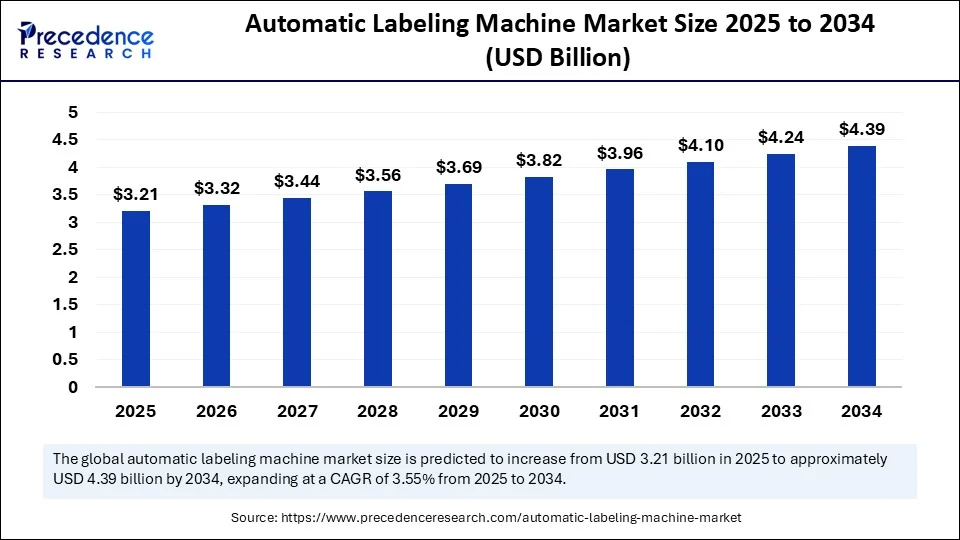

The global automatic labeling machine market size is calculated at USD 3.21 billion in 2025 and is predicted to increase from USD 3.32 billion in 2026 to approximately USD 4.53 billion by 2035, expanding at a CAGR of 3.50% from 2026 to 2035. The market growth is attributed to increasing demand for high-speed, accurate, and compliant labeling solutions across various industries.

Automatic Labeling Machine Market Key Takeaways

- In terms of revenue, the global automatic labeling machine market was valued at USD 3.10 billion in 2025.

- It is projected to reach USD 4.53billion by 2035.

- The market is expected to grow at a CAGR of 3.50% from 2026 to 2035.

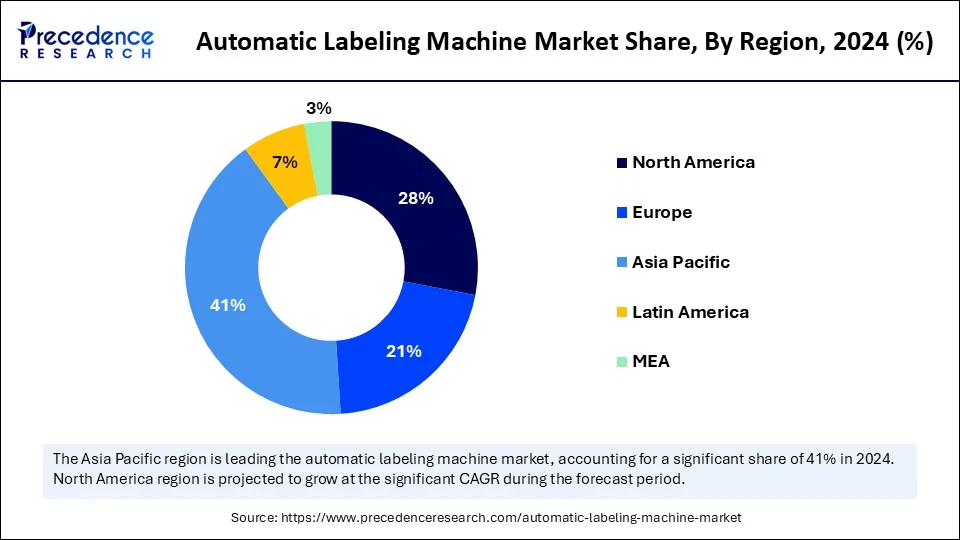

- Asia Pacific dominated the automatic labeling machine market with the largest market share of 41% in 2025.

- Middle East and Africa are expected to grow at a notable CAGR from 2026 to 2035.

- By type, the pressure-sensitive labelers segment held the biggest market share of 38% in 2025.

- By type, the RFID labeling machines segment is projected to grow at a significant CAGR in between 2026 and 2035.

- By technology, the fully automatic machines segment contributed the highest market share of 55% in 2025.

- By technology, the print & apply systems segment is expanding at a significant CAGR between 2026 and 2035.

- By orientation, the side labelers segment captured the major market share of 33% in 2025.

- By orientation, the top and bottom labelers segment is expected to grow at the highest CAGR over the projection period.

- By application, bottlers and jars segment generated the highest market share of 40% in 2025.

- By application, pouches and flexible packaging segment is expected to grow at a notable CAGR from 2026 to 2035.

- By end-user, the food & beverage segment accounted for significant market share of 37% in 2025.

- By end user, the e-commerce and logistics segment is projected to grow at a significant CAGR between 2026 and 2035.

- By speed capacity, the 101–300 labels/minute segment held the major market share of 45% in 2025.

- By speed capacity, the above 300 labels/minute segment is projected to grow at the highest CAGR between 2025 and 2035.

Strategic Overview of the Global Automatic Labeling Machine Industry

The automatic labeling machine market includes production, sales, and integration of machinery that applies labels to various products, containers, packages, or pallets automatically. These machines enhance production efficiency, ensure consistent label placement, and support compliance with industry labeling standards. Widely used in food & beverage, pharmaceuticals, cosmetics, logistics, and manufacturing, automatic labeling machines come in various configurations such as wrap-around, front-and-back, top-and-bottom, and tamper-evident systems.

The demand for automatic labeling machines is increasing due to the need for greater speed, consistency, and cost efficiencies by manufacturers. Such machines attach labels to a wide variety of containers, including bottles, pouches, and cartons, with minimal human interaction required. Pressure-sensitive application, print-and-apply modules, RFID encoding, and machine vision. Automation in packaging is expected to increase in the food and pharmaceutical industries, as these sectors require labeling systems that ensure compliance and provide traceability. Furthermore, a rise in traceability requirements and food safety implementations worldwide is likely to spur investment in next-generation labeling systems.

Artificial Intelligence: The Next Growth Catalyst in Automatic Labeling Machine

Artificial intelligence (AI) is enhancing the functionality, precision, and effectiveness of automatic labeling machines by integrating smart decision-making capabilities across all aspects of label application. Manufacturers are installing AI-powered vision technologies in these machines to enable the real-time monitoring and identification of broken packaging. AI algorithms analyze vast datasets from production lines to help them operate more efficiently, reduce downtime, and predict when mechanical failures are likely to occur. Additionally, AI provides a competitive advantage to businesses in terms of increased productivity, waste reduction, and operational efficiency in facilities that conduct high-speed operations.

Automatic Labeling Machine Market Growth Factors

- Rising Emphasis on Smart Packaging Integration: The growing demand for intelligent labeling that interacts with consumer apps or track-and-trace systems is fueling system upgrades.

- Boosting Adoption of Serialized Pharmaceutical Distribution: Regulatory shifts toward unit-level serialization in the drug supply chain are driving the installation of precision labeling equipment.

- Growing Deployment in Contract Manufacturing Units: The shift toward third-party packaging and private labeling is driving demand for flexible and high-throughput labeling machinery.

- Surging Investment in Hygienic Machine Design Standards: Sectors such as dairy and nutraceuticals demand washdown-ready machines, driving the adoption of stainless steel and IP-rated labeling systems.

Automatic Labeling Machine Market- Trade Analysis

- Export Distribution: Over 1,754 shipments took place worldwide during the reporting period, with China leading the way, followed by Vietnam and South Korea, indicating Asia's robust manufacturing base.

- Largest Importing Countries: Vietnam, the United States, and India are the primary import partners, indicating increasing levels of packaging and automation in the Southeast Asian, North American, and South Asian regions.

- Buyer Base: The majority of inbound shipments originate from countries developing their production line faster than others; more specifically, mid- to large-size companies will need consistent labels.

- Market Reach: The exports indicate consumption in areas beyond the conventional markets (Mexico, Indonesia, and Russia), suggesting that the items are starting to invade new, developing economies.

(Source: https://www.volza.com )

Market Outlook:

- Market Growth Overview: The Automatic Labeling Machine market is expected to grow significantly between 2025 and 2034, driven by rapid industrialization and automation, the booming E-commerce sector, and expanding end-user industries.

- Sustainability Trends: Sustainability trends involve the adoption of lineless label technology, eco-friendly and recyclable label materials, and reduced material usage and optimized application.

- Major Investors: Major investors in the market include ProMach, Inc., Krones AG, Barry-Wehmiller Companies, Inc., Tetra Laval Group, Bobst Group SA, and Dover Corporation.

- Startup Economy: The startup economy is focused on sustainable materials and application innovation, venture capital funding for insurtech & automation, and niche market solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 4.53 Billion |

| Market Size in 2025 | USD 3.21 Billion |

| Market Size in 2026 | USD 3.32 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.50% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East and Africa |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Technology, Orientation, Application, End-User, Speed Capacity, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Focus on Automation

The increasing demand for automation in manufacturing and packaging processes is expected to drive the growth of the automatic labeling machine market. Automated label machines in the food, beverage, pharmaceutical, and cosmetics industries are used to increase production and ensure label accuracy. The automatic labeling machines automate packaging tasks, reducing labor dependency, errors, and occasional high output. Businesses are focusing on machine availability and uniformity, which automated systems provide with productivity. PMMI stated that in 2024, a large number of packaging facilities in North America had incorporated some form or level of automation with labeling machines. The necessity aligns with the industry's preference for Industrial 4.0, with connected and intelligent machinery being a key highlight of modern factory upgrades. Furthermore, the availability of advanced automatic labeling machines for manufacturing lines further boosts market expansion and growth.

Restraint

High Initial Capital Investment Limits the Adoption Among Smaller Manufacturers

High initial capital investment is expected to slow down market penetration among small and mid-sized manufacturers. High-end automatic labeling machines are expensive, especially those equipped with smart sensors, AI components, and built-in vision systems. The issue is that small businesses may struggle to afford investment due to low production volumes and constrained operating budgets. Furthermore, such a capital-intensive characteristic of automation projects remains a barrier that businesses must consider when calculating ROIs in the short term.

Opportunity

Technological Advancements

Ongoing advancements in sensor technology and machine vision are likely to create immense opportunities for the players competing in the market. The new labeling machines feature intelligent sensors, semi-automatic detection, and diagnostic-enabled machines that utilize AI and the Internet of Things. The improved machine intelligence helps with self-correction and predictive maintenance, making operations more reliable. Such technology development promotes ongoing process improvement and optimal returns on investment. In 2024, the International Federation of Robotics (IFR) reported that substantial industrial packaging robots installed had an embedded vision module. This adaptive sensing tool is designed to mark an evident industry trend towards smarter and feedback-based labeling strategies, thus further facilitating the market.

(Source: https://ifr.org)

Segment Insights

Type Insights

Why Did the Pressure-Sensitive Labelers Segment Dominate the Automatic Labeling Machine Market in 2025?

The pressure-sensitive labelers segment dominated the market, accounting for a 38% share in 2025. This is mainly due to their provision of high labeling deployment rates and minimum changeovers. These labelers are well-suited for large packaging lines due to their versatility and compliance with primary and secondary packaging lines. Manufacturers in the food, beverage, pharmaceutical, and personal care categories heavily favored pressure-sensitive labeling systems.

Such machines do not need water or heat. Hence, they can be used in delicate product packaging. New versions of linerless labeling machines by companies such as Krones AG, Herma GmbH, and Avery Dennison were released, featuring increased precision control and improved handling of linerless labels. According to the 2024 report, VDMA noted that more labeling systems were being exported, primarily German-engineered pressure-sensitive systems, to Asia and North America due to their compatibility with a variety of package types. Furthermore, the enhanced market demand across high-end production lines and all of the middle-tier facilities facilitates the segment.

The RFID labeling machines segment is expected to grow at the fastest CAGR in the coming years, owing to the increased use of smart labeling in logistics, pharmaceuticals, and electronics industries. RFID offers capabilities for automatic identification, real-time inventory tracking, and enhanced visibility of supply chains. Videojet Technologies and Domino Printing Sciences are examples of firms that offer RFID-based solutions, providing fast encoding and application on diverse substrates. Moreover, the use of RFID is increasing worldwide in response to international anti-counterfeiting and traceability directives, thereby fueling the segment.

Technology Insights

How Does the Fully Automatic Labeling Machines Segment Dominate the Market in 2025?

The fully automatic machines segment dominated the automatic labelling machine market, accounting for a 55% share in 2025. This is primarily due to the growing demand for high-speed, uninterrupted labeling of objects in mass production. Such labeling machines are becoming increasingly common in industries to comply with regulatory labeling requirements. Additionally, large manufacturers introduced fully automatic models in 2025, featuring improved PLC control and servo drives, to meet the demand for intelligent automation and propel the segment.

The print & apply systems segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing need for dynamic labeling, which requires variable information, such as barcodes and tracking codes. Other manufacturers in the logistics, pharmaceutical, and consumer electronics industries require this flexibility to comply with regulations on their products and identify them at the product level. Videojet Technologies, Markem-Imaje, and Domino Printing Sciences, among other companies, have been offering enhanced print-and-apply products that support high-resolution thermal transfer printing at higher speeds. Furthermore, the increasing demand for serially packaged operations, particularly in European and Asian economies, further fuels the segment.

Orientation Insights

What Made Side Labelers the Dominant Segment in the Automatic Labeling Machine Market in 2025?

The side labelers segment dominated the market, holding a 33% share in 2025, as they are widely applied in various industries, making the brand visible and compliant with regulations. Side labelers are also flexible, as they handle bottles, jars, boxes, and other vials of varying sizes while maintaining both speed and high levels of accuracy in labeling. They can suit primary labeling duties due to their capacity to manage fast-paced production lines and their ability to fit conveniently into conveyors. Furthermore, the production of sustainable packaging has increased among Japanese OEMs, thereby further propelling the demand for side labelers.

The top & bottom labelers segment is expected to grow at the fastest rate in the coming years, owing to the growing demand for dual-surface labeling in areas near clamshell containers, pouches, cartons, and flat packages. With the use of such systems, manufacturers can print primary product data on the top surface and regulatory or barcode data on the bottom in a single pass. Furthermore, the packaged-robotics-enabled top & bottom labelers are used to enhance the precision of motion control, further facilitating the segment growth.

Application Insights

Why Did the Bottles & Jars Segment Dominate the Automatic Labeling Machine Market in 2025?

The bottles & jars segment held the largest revenue share of the market in 2025 due to their high demand in the food & beverages, pharmaceutical, personal care, and household products industries. Major manufacturers are redeveloping their labeling equipment of rotary and in-line bottling to provide faster label dispensing machines and smart synchronization capabilities. Moreover, pharmaceutical firms in Europe and Southeast Asia have refurbished their bottle labeling lines to comply with serialization requirements, thereby boosting demand for this type of product manufacturing.

The flexible packaging & pouches segment is expected to grow at the fastest CAGR in the coming years. The flexible packaging is lightweight, re-closable, and space-efficient, making it suitable for handling snacks, frozen food, pet care products, nutraceutical products, and hygienic products. Additionally, the increase in automated pouches and other flexible formats in the world production hub further necessitates the use of automated labeling machine technology.

End-User Insights

How Does the Food & Beverage Sector Dominate the Market in 2025?

The food & beverage segment dominated the market with a 37% share in 2025. This is primarily due to the growing demand for high-speed labeling to meet regulatory, branding, and shelf-desirability requirements across the packaged food industry. Labeling systems are designed and optimized for this industry to support a greater variety of container forms and diverse moisture-sensitive surface possibilities, meeting hygienic design standards. Additionally, the surge in demand for high-speed labelers is driven by increased exports to the Asia Pacific region, which further boosts the segment.

The e-commerce & logistics segment is expected to grow at the fastest CAGR in the upcoming period due to the rising volume of online deliveries. E-commerce businesses require tracking items at a given level. Shipping containers, shipping boxes, corrugated containers, and polybags are all types of containers that require accurate and dynamic labeling to facilitate order creation, associate barcodes, and integrate inventory in real time.

AI-based automated labelers in 2024 that support inspection with AI, thermal inkjet technology, and RFID smart tagging to suit rapidly moving fulfillment centers. In a 2025 briefing released by the International Federation of Robotics (IFR), there was an increase in the implementation of robotized labeling in urban distribution centers. In France, India, and South Korea, efforts have been made to increase production volumes as demand rises. Furthermore, the e-commerce and logistics sector is focusing on the adoption of next-generation labeling machines, thus further facilitating the market.

Speed Capacity Insights

Why Did the 101–300 Labels/Minute Segment Dominate the Market in 2025?

The 101–300 labels/minute segment dominated the automatic labeling machine market, holding a 45% market share in 2025, due to its high utilization in mid-scale production settings, such as the food processing, cosmetics, household products, and pharmaceutical industries. The machines in this category provide the best compromise between speed, precision, and price. Therefore, becoming attractive to new manufacturers as well as established competitors who are interested in moderate throughput. Furthermore, the development of new mid-speed models with integrated vision systems and in-place monitoring implementation facilitated by the use of IoT further fuels the segment.

The above 300 labels/minute segment is expected to grow at the fastest rate in the coming years due to the increasing demand for high-throughput systems in large-scale production and distribution establishments. High-speed labelers enable faster production cycles, lower unit costs per label, and compliance in the mass-volume industries of beverages, personal care, and logistics. In 2024, Domino Printing Sciences, Schneider Electric, and Uhlmann Pac-Systeme released high-speed labeling machines of the new generation featuring servo motors, an intelligent label feeding system, and cloud-based diagnostics. Additionally, the proliferation of automated labeling infrastructure further underscores the importance of utilizing these high-speed labeling technologies.

Regional Insights

What is the Asia Pacific Automatic Labeling Machine Market Size?

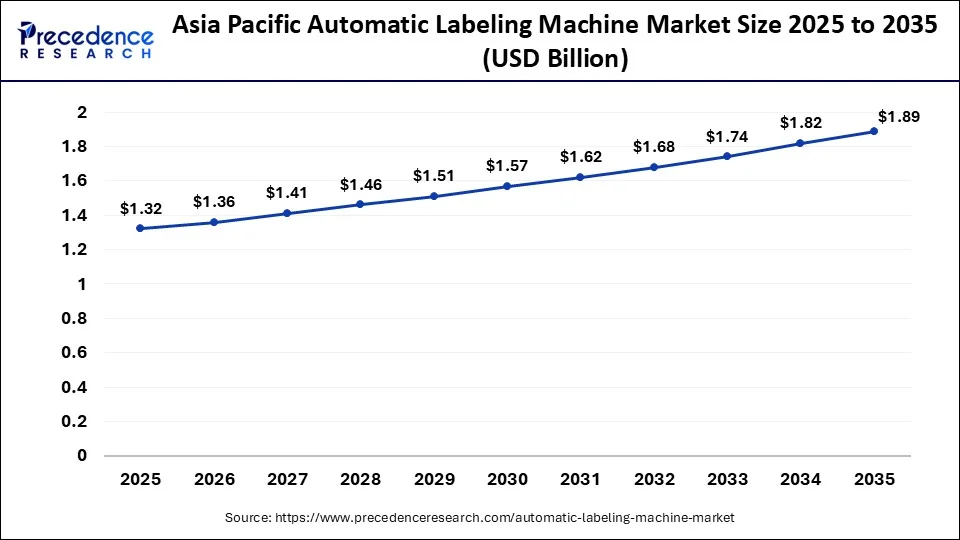

The Asia Pacific automatic labeling machine market size is exhibited at USD 1.32 billion in 2025 and is projected to be worth around USD 1.89 billion by 2035, growing at a CAGR of 3.65% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Automatic Labeling Machine Market in 2025?

Asia Pacific led the automatic labeling machine market, capturing a 41% share of the market in 2025. This is primarily due to the presence of strong manufacturing industries, including pharmaceuticals, food processing, and cosmetics. The regional governments encouraged industrial automation through policymaking and subsidization, which further contributed to the adoption of labeling machines. Southeast Asian contract packagers have increased capital expenditures, investing in labeling solutions equipped with sensors and correcting errors with the assistance of AI. South Korean and Singapore-based packaging innovation hubs collaborated with automation giants to enhance R&D on high-speed and compact labeling machines, featuring a specialized design tailored to the conditions of dense factory settings in Asia.

A sharp increase in machine vision acceptance on Chinese packaging lines has enhanced print precision and decreased waste. India and Vietnam simplified labeling procedures to align with existing standards in Europe and North America, thereby expanding regional exportation of labeled packaged goods. Labeling equipment achieved record orders in Taiwan and Indonesia cells, driven by modernization work spurred by policy. Furthermore, the smart labeler in the Asian-Pacific region has experienced significant growth between textile and agrochemical processing facilities, within which product tracking at the product level has become a key compliance factor.

The Middle East & Africa is expected to grow at the fastest CAGR in the coming years, owing to industrial modernization, liberalization of trade, and changing regional regulations on packaging. It is expected that the emergence of consumer-packaged goods, e-commerce, and healthcare investment in Brazil, Mexico, UAE, and South Africa generate the need for cost-effective and durable labeling solutions. Some logistics centers in the UAE and Egypt are utilizing modular labeling systems in conjunction with ERP software to enhance supply chain transparency. Additionally, the increasing demand for automation, which reduces labor and improves packaging accuracy in an energy-constrained environment, also facilitates market growth in these sectors.

Asia Pacific: China Automatic Labeling Machine Market Trends

The Chinese rapid industrialization, rising labor costs, and a booming e-commerce sector, integrating smart technologies, such as IoT and AI for quality control and predictive maintenance, are enhancing accuracy and efficiency. The market is also heavily influenced by regulatory compliance needs and a push for sustainable labeling solutions.

North America: Smart Labeling Systems Driving Industrial Efficiency:

The automatic labelling machine market is one of the most dominant markets in North America, as it continues to drive rapid growth due to the widespread adoption of automated technology and the high standards of labelling that are enforced within the food & beverage, pharmaceuticals, and consumer goods industries in North America. Due to the large investment the U.S. makes in industrial automation, it dominates the automatic labelling machine industry in North America.

U.S. Automatic Labeling Machine Market Trends

The U.S. market is growing steadily as manufacturers across the food & beverage, pharmaceuticals, cosmetics, and logistics sectors increasingly adopt automation to boost production speed, accuracy, and regulatory compliance. Demand is driven by the need to replace manual labeling with high-speed, reliable systems that reduce labor costs, minimize errors, and support traceability through barcode and variable data printing.

Europe: Technology Adoption and Regulatory Influence:

The automatic labelling machine market in Europe is heavily focused on meeting regulations and having a sustainable approach to labelling. As the majority of countries enforce stringent legal guidelines around labelling products in the food, pharmaceuticals, and consumer goods industries, there is a growing need for precise labelling with traceability throughout the entire supply chain.

Germany Automatic Labeling Machine Market Trends

Germany's market is witnessing strong growth driven by the increasing demand for automation across industries such as food & beverage, pharmaceuticals, cosmetics, and logistics. As manufacturers focus on improving operational efficiency, reducing labor costs, and meeting stringent regulatory requirements, there is a rising shift towards high-speed, accurate labeling solutions.

Middle East & Africa: Saudi Arabia Automatic Labeling Machine Market Trends

Saudi Arabia's market growth is driven by the widespread adoption of smart technologies like IoT and AI for improved traceability and quality control. There is a strong emphasis on high-quality, tamper-evident, and sustainable labeling solutions to meet stringent regulations and consumer demands.

Value Chain Analysis of the Automatic Labeling Machine Market

- Inbound Logistics: This stage involves the procurement of raw materials and components necessary for manufacturing automatic labeling machines.

Key Players: HERMA - Operations: This stage encompasses the design, engineering, and assembly of automatic labeling machines.

Key Players: Krones AG and Pack Leader Machinery Inc. - Outbound Logistics: Outbound logistics covers the distribution and transportation of finished labeling machines to customers worldwide, including direct sales to large corporations and sales through distributors and system integrators.

- Marketing and Sales: This stage focuses on promoting and selling labeling machines to various end-user industries, emphasizing features like speed, accuracy, reliability, and integration capabilities.

Key Players: ID Technology LLC (North America-focused) and Sato Holdings Corporation - Service: The service stage involves providing installation support, maintenance, training, and spare parts for the lifetime of the machine.

Key Players: Accutek Packaging Equipment Co., Inc. and Nita Labeling Equipment

Automatic Labeling Machine Market Companies

-

Krones AG: Krones is a major global player that contributes to the market by providing highly automated, integrated labeling solutions as part of complete bottling and packaging lines for the beverage and liquid food industries.

-

FUJI Seal International Inc:This company contributes through its expertise in shrink sleeve labeling and other innovative packaging technologies, providing specialized machines and materials that meet the demand for eye-catching, high-quality packaging.

- World Pack Automation Systems Private Limited: Based in India, this company contributes to the regional market by offering a wide range of automatic labeling machines tailored to the diverse needs of food, pharmaceutical, and consumer goods sectors.

- Langguth: Langguth specializes in high-performance labeling machines designed for challenging applications and materials, contributing expertise in specialized labeling and reliability for industrial environments. Their machines are known for durability and precision in demanding industrial settings.

- Quadrel Labeling Systems: Quadrel contributes to the North American market by providing a variety of pressure-sensitive labeling systems, known for their modular design and customizability to meet specific product labeling requirements.

- Pack Leader Machinery Inc.: A global provider, Pack Leader contributes to the market by offering a comprehensive line of automatic labeling systems that balance affordability, ease of use, and reliability, serving a wide range of industries globally.

- KWT Machine Systems Co. Ltd.: This company contributes by developing and manufacturing advanced labeling and packaging machinery for the Asian and global markets, often integrating smart technologies into their systems.

- HERMA Labeling Machines: HERMA is a German-based company known for its high-precision, modular labeling machines and adhesive materials, contributing expertise in technology and quality engineering to the global market.

- Label-Aire Inc.: This U.S.-based company specializes in pressure-sensitive labeling equipment and systems, known for their reliable "wipe-on" and "tamp-on" application technologies.

- Nita Labeling Equipment: Nita contributes to the North American market by providing a range of labeling machines with a strong emphasis on flexibility and user-friendly operation, catering to the specific needs of different-sized companies.

- Novabel AB: Based in Sweden, Novabel focuses on providing labeling solutions for the Nordic and European markets, emphasizing innovation and customer-specific integrations within the packaging industry.

- Sato Holdings Corporation: A global provider of auto-identification solutions, Sato contributes by integrating labeling machines with data tracking and IoT technologies, enhancing traceability and supply chain management.

- Accutek Packaging Equipment Co. Inc.: Accutek provides a wide array of packaging solutions, including labeling machines, contributing by offering scalable and affordable options for companies across different sectors, from startups to large corporations.

- ID Technology LLC: A leading provider of labeling, coding, and marking solutions in North America, ID Technology contributes by offering integrated systems and services that help companies meet labeling compliance and efficiency goals.

Recent Developments

- On April 29, 2025: LemuGroup Ultra Compact 3 Launch:

LemuGroup introduced the Ultra Compact 3, a resource-efficient end-of-line automation labelling system. The system is designed to help small and medium converters boost productivity and achieve a 2-year ROI in label production workflows.

(Source: https://www.lemugroup.com) - In January 2024, Domino Printing Sciences launched the Mx-Series print and apply labelling machines, designed for automated, GS1-compliant coding to meet rising traceability demands across global supply chains. The machines are built to integrate seamlessly into modern logistics lines, ensuring fast and accurate product and pallet labeling.

(Source: https://www.domino-printing.com) - In February 2023, At PrintPack 2025, Epson India showcased the SurePress L-6534VW, receiving strong feedback and closing new sales, following its earlier presentation at Labelexpo India 2024. Company executives noted increased interest from traditional offset printers looking to expand into digital label production.

(Source: https://www.printweek.in) - In October 2024, SATO Europe introduced the LR4NX Series in 35 countries, targeting high-volume applications in food, manufacturing, and e-commerce through a made-to-order model. The launch aligns with SATO's strategy to expand its auto-ID solutions across the European region by enhancing operational efficiency.

(Source: https://www.satoeurope.com)

Segments Covered in the Report

By Type

- Self-Adhesive/Pressure-Sensitive Labelers

- Horizontal Wrap Labelers

- Vertical Wrap Labelers

- Front & Back Labelers

- Shrink Sleeve Labeling Machines

- Full Body Sleeves

- Tamper-Evident Sleeves

- In-Mold Labeling Machines

- Blow Molding Labeling

- Injection Molding Labeling

- Glue-Based Labeling Machines

- Cold Glue Labelers

- Hot Melt Glue Labelers

- RFID Labeling Machines

- Print & Apply RFID Labelers

- Inline RFID Encoding Labelers

By Technology

- Semi-Automatic Labeling Machines

- Fully Automatic Labeling Machines

- Print & Apply Labeling Systems

By Orientation

- Top & Bottom Labelers

- Side Labelers

- Corner Wrap Labelers

- 360-Degree Wrap Labelers

By Application

- Bottles & Jars

- Beverage Bottling

- Pharmaceuticals

- Boxes & Cartons

- E-commerce Packaging

- Retail Shelf-Ready Packaging

- Pouches & Sachets

- Tubes & Cylindrical Containers

- Pallets & Large Items

By End-User

- Food & Beverage Industry

- Pharmaceutical & Healthcare

- Cosmetics & Personal Care

- Chemical & Agrochemical

- Logistics & Transportation

- Consumer Electronics

- Retail & E-commerce

By Speed Capacity

- Up to 100 Labels/Minute

- 101–300 Labels/Minute

- Above 300 Labels/Minute

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting