What is the Automotive Axle Market Size?

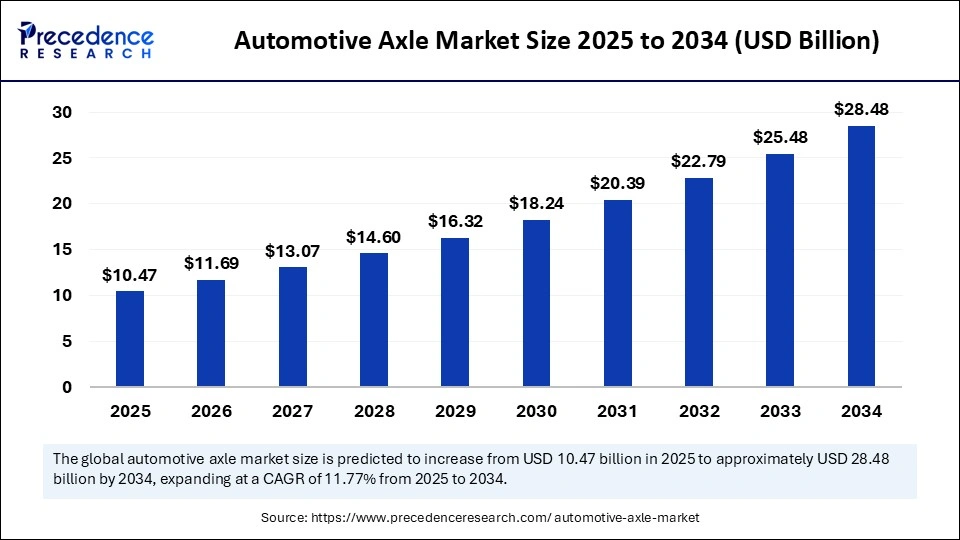

The global automotive axle market size is accounted at USD 10.47 billion in 2025 and predicted to increase from USD 11.69 billion in 2026 to approximately USD 28.48 billion by 2034, expanding at a CAGR of 11.77% from 2025 to 2034. The market growth is attributed to the rising adoption of electric vehicles and increasing demand for advanced, energy-efficient axle systems.

Market Highlights

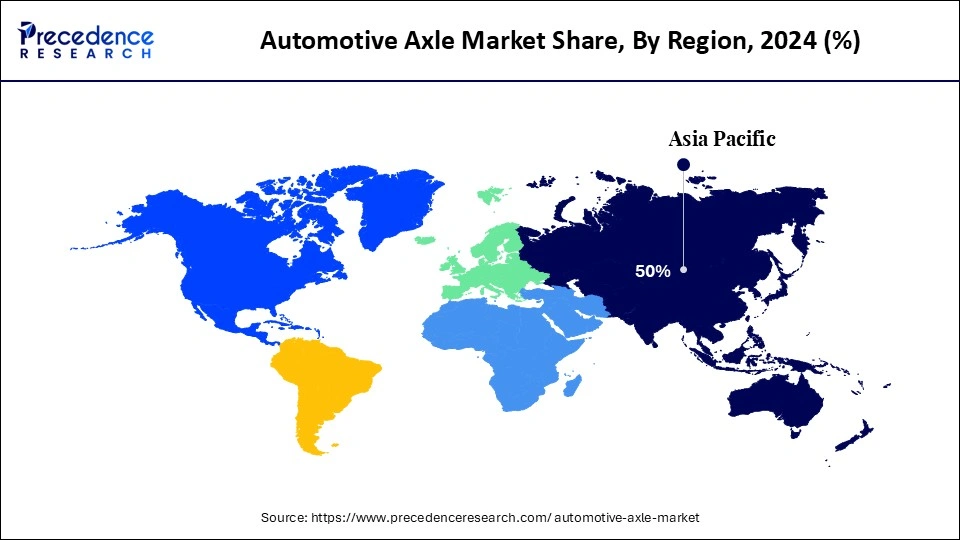

- Asia Pacific segment dominated the global market with the largest market share of 50% in 2024.

- By region, the South America segment is expected to grow at the fastest CAGR during the forecast period.

- By axle type, the drive axle segment accounted for a considerable market share of 65% in 2024.

- By axle type, the lift axle segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By vehicle type, the passenger cars segment captured the biggest market share of 61% in 2024.

- By vehicle type, the light commercial vehicles segment is set to experience the fastest CAGR from 2025 to 2034.

- By propulsion type, the internal combustion engine (ICE) segment contributed the highest market share of 85% in 2024.

- By propulsion type, the above electric vehicles segment is anticipated to grow with the highest CAGR during the studied years.

- By material, the steel segment held the maximum market share of 73% in 2024.

- By material, the composite materials segment is projected to expand rapidly in the coming years.

- By sales channel, the OEM segment generated the major market share of 70% in 2024.

- By sales channel, the aftermarket segment is predicted to witness significant growth over the forecast period.

Strategic Overview of the Global Automotive Axle Industry

There is great expansion in the car axle market, which can be attributed to the increasing adoption of electric vehicles. By the first quarter of 2024, global sales of electric vehicles had surpassed 3 million, representing a 25% increase over the same period in the previous year. It is worth noting that China contributed significantly to global EV sales, accounting for nearly half a million units during the specified period, underscoring the country's pivotal role in the EV market.

This influx of EVs is expected to drive the need for the development of more sophisticated axle technologies, including e-axles, which are integral to the efficient operation of electric drive-trains. E-axles, which now contain the electric motor, power electronics, and the transmission in a single device, offer several benefits over conventional axle systems. They help reduce weight, improve energy efficiency, and maximize space utilization in the automobile, which are vital in increasing the range of EVs. Furthermore, the current development of e-axle systems will aid such a change, aligning with the general aim of lowering emissions and facilitating eco-friendly transport solutions.(Source: https://www.iea.org)

Artificial Intelligence: The Next Growth Catalyst in Automotive Axle

Artificial intelligence is driving the automotive axle market at a rapid pace by transforming the process of designing, producing, and maintaining the driving system for companies. To achieve a balance between lightweight construction and high-torque capacity axles.

Automakers use AI-based modeling tools to construct axles capable of supporting fuel-efficient cars and electric mobility platforms. Furthermore, manufacturers utilize real-time machine learning systems on the shop floor to detect faults, automate machining operations, and minimize the use of energy in producing axles.

Automotive Axle MarketGrowth Factors

- Growing Adoption of Connected and Smart Vehicles: The rising integration of IoT and telematics in vehicles is driving demand for axles that are compatible with real-time monitoring and predictive maintenance systems.

- Driving Lightweight Vehicle Design: Increasing emphasis on fuel efficiency and emission reduction is propelling the use of lightweight axle components made from advanced alloys and composites.

- Boosting Commercial Fleet Modernisation: Expanding commercial transportation networks and fleet upgrades are fuelling the adoption of high-performance axles for trucks and buses.

- Rising Demand for Off-Highway and Construction Vehicles: Growth in mining, construction, and industrial operations is increasing the need for durable, heavy-duty axles capable of handling extreme loads.

Market Outlook

- Market Growth Overview: The Automotive Axle market is expected to grow significantly between 2025 and 2034, driven by strong vehicle demand and a robust manufacturing base, rapid adoption of e-axle systems, increasing use of lightweight materials, and advancement in safety and modular architectures.

- Sustainability Trends: Sustainability trends involve green manufacturing processes, rapid adoption of E-axles, and the circular economy and recycling.

- Major Investors: Major investors in the market include BlackRock, Inc., The Vanguard Group, Inc., Dimensional Fund Advisors LP, State Street Corporation, and FMR LLC.

- Startup Economy: The startup economy is focused on e-axle technology and components, light weighting and material innovation, and predictive maintenance and IoT.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 11.69 Billion |

| Market Size in 2025 | USD 10.47 Billion |

| Market Size by 2034 | USD 28.48 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.77% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | South America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Axle Type, Vehicle Type, Propulsion Type, Material, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Rising Adoption of Electric Vehicles Driving Growth in the Automotive Axle Market?

Increasing demand for electric vehicles is expected to accelerate growth in the automotive axle market. In electric cars, automakers develop superior e-axles that integrate motors, power electronics, and transmission systems to achieve greater efficiency and performance. Planned alliances among EV manufacturers and suppliers of axles contribute to innovation in small, scalable e-axles to facilitate platforms of vehicles. This not only enhances competitiveness, but also defines the future drives train architectures around the world. (Source: https://auto.economictimes.indiatimes.com)

These developments were highlighted by growing evidence in 2024. According to reports by the IEA, China has accounted for almost 80% of the growth in global EV sales, as the total has increased by 25%. European Automobile Manufacturers (ACEA) statistics show that electric vehicles (EVs) had a 13.6% full-year share of new car registrations in the European Union in 2024, surpassing that of diesel, which fell to approximately 11.9%. The automakers also hasten cooperation between battery, motor, and axle experts to streamline designs that minimize energy loss and balance torque delivery. Moreover, the growing demand for commercial vehicles is anticipated to drive significant demand for advanced axle solutions.(Source:https://www.acea.auto)

Restraint

High Axle Component Costs Hampering Market Growth

High manufacturing and material costs restrain the growth of the advanced axle market, especially in developing regions. Premium alloys, precision machining, and electronics used in independent and e-axles contribute to the production cost. This is expected to reduce the cost of fleet upgrades in cost-sensitive markets. Moreover, the disruptions in sourcing raw materials, semiconductors, and precision components hamper axle production schedules.

Opportunity

How are Infrastructure Investments in Emerging Regions Fuelling the Automotive Axle Market?

Surging investments in infrastructure development are expected to drive market expansion for heavy-duty axles, thereby creating significant opportunities for the market. In the Asia-Pacific, Middle East, and African regions, mining activities and massive industrial processes have led to the need for vehicles with robust axle systems. Increased sales of off-highway trucks, construction machinery, and buses provide opportunities.

Front, rear, and tandem axle manufacturers are designing their axles to withstand extreme loads. The China Association of Automobile Manufacturers (CAAM) emphasized that the automobile output of heavy-duty trucks in China was above 3,362,203 units in 2024, as a result of ongoing infrastructure development and mining activities. Major suppliers of components such as ZF Friedrichshafen AG, Schaeffler Group, BorgWarner Inc., and Continental AG are investing in heavy-duty axles with high torque capabilities. Furthermore, the spurring adoption of advanced mobility solutions is projected to create demand for technologically integrated axles.(Source: https://www.ceicdata.com)

Segmental Insights

Axle Type Insights

Why Did Drive Axles Dominate the Automotive Axle Market in Recent Years?

The drive axle segment dominated the automotive axle market in 2024, accounting for an estimated 65% market share, primarily due to its extensive use in passenger cars, light commercial vehicles, and heavy trucks. Drive axles are used to provide torque to the wheels and to provide stability to a vehicle when under load.

Broad selection of layouts in the driveline used in rear-, front-, and all-wheel-drive designs, which is why they are universally applicable across vehicle categories. Furthermore, the heavy-duty uses require reinforcement drive axles designed with long service cycles of torque and load, thus facilitating the segment.

The lift axle segment is expected to grow at the fastest rate in the coming years, driven by operators' desire to gain operational flexibility, which will result in reduced tyre wear and lower running costs for partial-load shipments. Moreover, the use of lift axles by the logistics operators is intended to enhance fuel economy during back-haul deliveries, further propelling their demand.

Vehicle Type Insights

What Factors Propelled Passenger Cars to Lead the Automotive Axle Market by Vehicle Type?

The passenger cars segment held the largest revenue share in the automotive axle market in 2024, accounting for 61% of the market share, due to their use of compact, mid-size, and crossover models on the same drive-axle platform being standardised. In 2024, the European Union had more than 259 million registered passenger cars, indicating the huge installed base generating replacement and OEM axle demand.

In an effort by manufacturers to promote the production efficiency of these cars. Support a wide range of driveline plans required to support front-, rear-, and all-wheel-drive models. Additionally, the urbanisation and increasing number of passenger vehicles in various developing economies are expected to fuel the demand for passenger cars' axle technology.

The light commercial vehicles segment is expected to grow at the fastest CAGR in the coming years, owing to the increased demand for light commercial vehicles (LCVs). The growth of e-commerce and the shortening of urban delivery times fuelled fleet renewals in 2024.

Compelled operators to spec light commercial fleet axles designed to optimise payload, minimise unsprung mass, and incorporate telematics. Furthermore, a growing need to develop compact e-axles and modular axle assemblies tailored to cargo vans in the coming years.

Propulsion Type Insights

How Did Internal Combustion Engine (ICE) Axles Secure Dominance in the Automotive Axle Market?

The internal combustion engine (ICE) segment dominated the automotive axle market in 2024, holding a market share of approximately 85%. The need for heavy-duty torque management, effective noise and vibration mitigation, and extended service life on ICE platforms drove this dominance.

The manufacturers design axles to be extremely durable and cost-effective in passenger, commercial, and heavy-duty markets. Additionally, tier-1 suppliers introduced new metallurgy, heat-treatment, and sealing technologies to increase service life at higher cumulative mileage, thereby strengthening ICE axles as the sub-segment leader.

The electric vehicles (EVs) segment is expected to grow at the fastest rate in the coming years, owing to the increased electrification of light-duty and commercial fleets. In Europe, the ACEA noted that battery-electric vehicle registrations increased by 15.6% annually in 2024, indicating a growing momentum for electrified driving.

OEMs and Tier-1 suppliers hurried the adoption of e-axles, with a focus on increased torque density. Smaller packages on flexible platforms, and the use of regenerative braking to increase energy recovery. Moreover, governments and other international agencies with incentives for facilitating the adoption of EVs which establish structural demand for e-axle technologies in the coming years.(Source: https://www.acea.auto)

Material Insights

Why Does Steel Continue to Dominate as the Preferred Material in the Automotive Axle Market?

The steel segment held the largest revenue share in the automotive axle market in 2024, accounting for an estimated 73% market share, as they are strong, durable, and economical. The segment had the advantage of large access to high-grade steel and developed a global supply chain for mass production at reasonable prices.

The World Steel Association reports that the total production of crude steel worldwide was 1.89 billion tonnes in 2023, providing a sufficient material base for building axles in passenger and commercial vehicles. Furthermore, the prevalence of advanced high-strength steel (AHSS) use also helped improve axle performance, further facilitating growth in the automotive axle market. (Source: https://worldsteel.org)

The composite materials segment is expected to grow at the fastest CAGR in the coming years, as more manufacturers are required to adopt lightweight components that enhance vehicle efficiency. This heightens the need to find solutions to lighten the axles, thereby counteracting the weight of the battery pack and increasing the driving range.

The composite axles offer significant weight savings over conventional steel, making them appealing to both the passenger EV and high-performance vehicle markets. Additionally, the trend of innovation makes composites the most vibrant sector for developmental axle materials.

Sales Channel Insights

What Drives the OEM Channel to Dominate the Automotive Axle Market?

The OEM segment dominated the automotive axle market in 2024, holding a market share of about 70%, due to the direct attachment of axles to new car frameworks. Automakers focused on OEM-supplied axles to ensure the same level of quality, safety certification, and compatibility with advanced drive line systems, including e-axles and hybrid models. Furthermore, the local axle production networks within the regional manufacturing centres in China, India, and Mexico were at the centre of serving the global OEM demand.

The aftermarket segment is expected to grow at the fastest rate in the coming years, driven by rising vehicle parc sizes, longer vehicle lifespans, and increasing maintenance rates.

As ACEA notes, in the EU, the average age of passenger vehicles was 12.3 years in 2024, indicating an increasing reliance on aftermarket solutions for axle and other part replacements. Additionally, the growing economies increase the rate of axle wear, which in turn enhances the demand for affordable and high-quality aftermarket products, particularly in commercial vehicles and older passenger fleets.(Source: https://www.acea.auto)

Regional Insights

Asia Pacific Automotive Axle Market Size and Growth 2025 to 2034

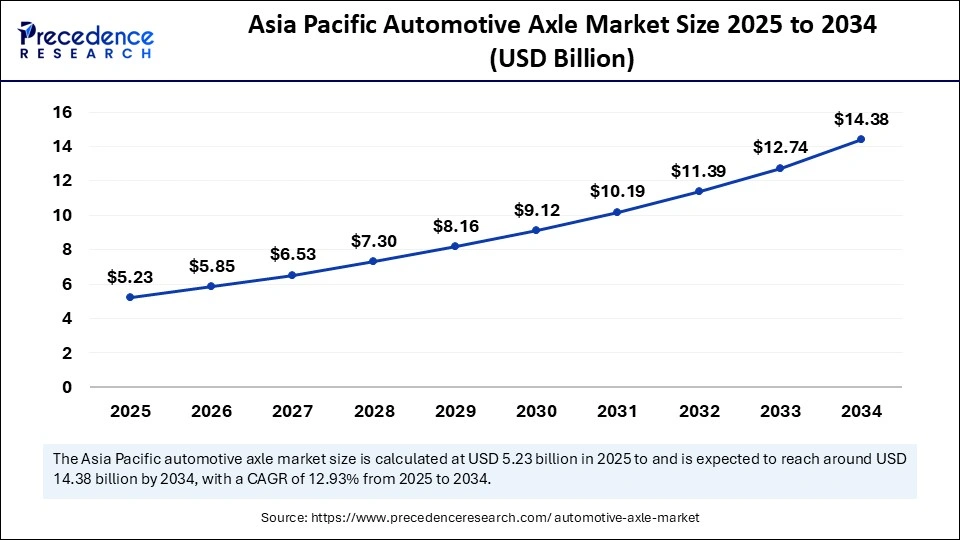

The Asia Pacific automotive axle market size is exhibited at USD 5.23 billion in 2025 and is projected to be worth around USD 14.38 billion by 2034, growing at a CAGR of 11.88% from 2025 to 2034.

Why Does Asia Pacific Lead the Automotive Axle Market in Regional Demand?

Asia Pacific led the automotive axle market, capturing the largest revenue share in 2024, accounting for 50% of the market share, due to its dominance in vehicle production and the swiftly growing domestic market in the continent. By the figures published by the ACEA report, China manufactured over 30,165,390 million vehicles in 2024, representing over 32% of world production. These large volumes of production directly translated to high demand for axles in both the OEM and aftermarket.

The hegemony of the region can also be justified by the growth of electric vehicle (EV) initiatives. In 2024, BYD, Tata Motors, Hyundai, and Toyota were at the forefront of EV production, triggering a surge in demand for sophisticated e-axles. Other suppliers, including Hyundai WIA, Dana Incorporated, and ZF Friedrichshafen, increased their localised production capabilities to suit the local sourcing of key OEMs. Moreover, the regional governments' support of electrification and local production in countries such as India and China which led to the development of a favourable environment for the automotive axle market. (Source:https://www.acea.auto)

South America is anticipated to grow at the fastest rate in the market during the forecast period, as automotive production rebounds more quickly and emerging markets increase their demand. In 2024, the production of vehicles in Brazil reached 2.55 million units, representing a 10% increase from the previous year, indicating strong demand for heavy-duty and commercial vehicles. (Source:https://tradingeconomics.com)

The growing logistics networks and infrastructure development in the region, especially in Brazil, Chile, and Colombia. This growth is likely to support the demand for axles, especially of light commercial vehicles (LCVs) and heavy-duty trucks utilised in logistics and construction. Moreover, it is expected that the implementation of flexible-fuel policies, including the E30 policy in Brazil, will further increase vehicle production and, consequently, demand for axles. (Source: https://tradingeconomics.com)

Asia Pacific: China Automotive Axle Market Trends

China's automotive axle market growth is driven by the strong vehicle production in China and other emerging economies. The government initiatives and shift towards electric vehicles (EVs). The advancement in lightweight materials and a growing focus on safety features. The rising demand, fueled by the logistics and transportation fleet, drives market growth.

South America: Brazil Automotive Axle Market Trends

Brazil's automotive axle market leadership is primarily driven by its extensive domestic automotive manufacturing infrastructure, large consumer base, and a substantial number of vehicles in operation. Furthermore, government initiatives in Brazil promoting the automotive sector's growth and investment in R&D have reinforced its domestic position in the regional market.

Value Chain Analysis of the Automotive Axle Market

- Raw Material Sourcing

This initial stage involves acquiring essential materials such as steel, aluminum, copper, and various alloys used in axle production.

Key Players: Tier 2 and Tier 3 suppliers. - Component Manufacturing (Tier 2 & Tier 3 Suppliers)

In this stage, raw materials are processed into specific parts like castings, forgings, bearings, and other intricate components used to build the axle system.

Key Players: SKF AB (bearings), The Timken Company (bearings), Gestamp (various components) - System Assembly (Tier 1 Suppliers)

Tier 1 suppliers integrate components from lower tiers into complete axle systems, which are then supplied directly to Original Equipment Manufacturers (OEMs).

Key Players: ZF Friedrichshafen AG, Dana Incorporated, American Axle & Manufacturing, Inc. (AAM), Meritor, Inc., and GKN Automotive Limited. - Vehicle Assembly (OEMs)

Original Equipment Manufacturers (OEMs) design and assemble the final vehicles, incorporating the axle systems delivered by Tier 1 suppliers.

Key Players: Daimler AG, Toyota, General Motors, Volkswagen, and Ford Motor Company. - Distribution and Aftermarket Services

The final stage involves the sale of vehicles through dealerships and the supply of replacement axles and components to the aftermarket for maintenance and repairs.

Key contributors: Meritor, Inc. and Dana Incorporated.

Top Companies in the Automotive Axle Market & Their Offerings:

- American Axle & Manufacturing Holdings, Inc. (AAM): As a Tier 1 supplier, AAM designs, engineers, and manufactures driveline and drivetrain systems, including axles and driveshafts, for the global automotive industry.

- BASF SE: BASF is a major chemical producer that contributes to the automotive axle market by supplying high-performance materials like engineering plastics and advanced coatings.

- BorgWarner Inc.: BorgWarner contributes to the market through its expertise in propulsion systems, including the supply of e-axles, integrated drive modules, and various driveline components.

- Cummins Inc.: Known primarily for engines, Cummins also impacts the axle market indirectly by supplying integrated powertrain solutions for commercial vehicles, which require robust axles designed for heavy-duty applications.

- Daimler AG: As an Original Equipment Manufacturer (OEM) of passenger cars (Mercedes-Benz) and commercial vehicles (Daimler Truck), Daimler is a major end-user of automotive axles.

- Dana Incorporated: Dana is a leading global supplier of drive and motion technologies, including advanced axle systems for all types of vehicles. The company is at the forefront of e-axle development and production, supporting both traditional combustion and electrified platforms.

- Eaton Corporation plc: Eaton contributes through its vehicle group, which supplies components that interact with axle systems, such as differentials and transmission technologies, aimed at improving vehicle efficiency and performance.

- GKN Automotive Limited: GKN specializes in driveline technologies, providing a range of axle and e-axle systems, sideshafts, and other power delivery solutions to global OEMs.

- Hyundai Transys Inc.: A subsidiary of the Hyundai Motor Group, Hyundai Transys manufactures a variety of automotive components, including axles and transmission systems. They primarily supply the captive market within the Hyundai and Kia vehicle ranges.

- Iveco Group NV: As a major commercial vehicle OEM, Iveco designs and produces a wide range of trucks, buses, and specialized vehicles that use various axle systems. They procure or manufacture axles that meet the demanding requirements for heavy-duty commercial transport.

- JTEKT Corporation: JTEKT is a key supplier of bearings, driveline components, and steering systems that are integrated into axle assemblies. They play a vital role in providing high-precision components that ensure the efficient and reliable operation of the axle system.

- Knorr-Bremse AG: Primarily known for braking systems, Knorr-Bremse contributes to the safety and functionality of commercial vehicle axles by providing advanced braking, suspension, and air supply systems. Their products are critical components that interact directly with the axle and wheel ends.

- Magna International Inc.: Magna is a major Tier 1 supplier that provides complete vehicle components and systems, including driveline and powertrain solutions like axles and e-axles. The company is involved in modular and scalable designs that support both traditional and electrified platforms.

- MAN Truck & Bus AG: An OEM in the commercial vehicle sector, MAN manufactures a diverse range of trucks and buses that require robust, specialized axles designed for heavy loads and durability. They are end-users of axles and incorporate them into their final vehicle designs.

- Meritor Inc. (now part of Cummins): Meritor was a global leader in providing drivetrain, mobility, braking, and aftermarket solutions primarily for commercial vehicles, including a full range of heavy and medium-duty axles. Their acquisition by Cummins solidified their position as a core axle supplier within a larger powertrain company.

- Schaeffler Technologies AG & Co. KG: Schaeffler supplies precision components for engine, transmission, and chassis applications, including bearings and electromechanical components crucial for axle systems. They are focused on e-mobility solutions, providing components for e-axles and hybrid modules.

- Shaanxi Automobile Group Transmission Co., Ltd. and Shaanxi Fast Auto Drive Group Co., Ltd.: These companies are major Chinese suppliers specializing in transmissions, driveshafts, and axles, particularly for the large commercial vehicle market in China. They support the domestic Chinese market's vast truck and bus production with essential driveline components.

- Volkswagen Group Components: This internal division of the Volkswagen Group develops and manufactures various components, including axles and e-axle systems for the group's multiple vehicle brands (e.g., VW, Audi, Porsche). They play a critical role in standardizing and supplying components across one of the world's largest OEMs.

- ZF Friedrichshafen AG: ZF is a dominant global Tier 1 supplier and a major player in driveline and chassis technology, providing comprehensive axle systems, including advanced e-axles.

Automotive Axle Market Companies

- American Axle & Manufacturing Holdings, Inc.

- BASF SE

- BorgWarner Inc.

- Cummins Inc.

- Daimler AG

- Dana Incorporated

- Eaton Corporation plc

- GKN Automotive Limited

- Hyundai Transys Inc.

- Iveco Group NV

- JTEKT Corporation

- Knorr-Bremse AG

- Magna International Inc.

- MAN Truck & Bus AG

- Meritor Inc.

- Schaeffler Technologies AG & Co. KG

- Shaanxi Automobile Group Transmission Co., Ltd.

- Shaanxi Fast Auto Drive Group Co., Ltd.

- Volkswagen Group Components

- ZF Friedrichshafen AG

Recent Development

- In April 2025, ZF Commercial Vehicle Solutions (CVS) secured a multi-year contract to supply several thousand units of its AxTrax 2 electric axle to a leading Indian manufacturer. The AxTrax 2 will power a new fleet of zero-emissions intercity buses, reinforcing ZF's commitment to supporting India's expanding commercial vehicle electrification initiatives and strengthening its presence in the electric mobility sector.

- In October 2024, MOOG announced the launch of its new line of Constant Velocity (CV) axles, engineered for high performance and durability. The CV axles are constructed with premium materials, feature heat-treated components for enhanced strength, neoprene boots to prevent contamination, and high-quality grease for optimal lubrication. These axles deliver precise fitment and reliability across a wide range of vehicle models, addressing the demanding standards of automotive professionals and enthusiasts.

- In June 2025, AAM announced a supply agreement with Scout Motors to provide front electric drive units (EDUs) and rear e-Beam axles for the all-new electric Scout Traveller SUV and Scout Terra pickup truck. Built on a body-on-frame chassis, both vehicles are configurable with either a 100% battery-electric or gasoline-fueled range-extended energy system, enabling customers to transition to electrified mobility according to their preferences while ensuring optimal performance and versatility.

(Source: https://www.ashokleyland.com)

(Source: https://press.zf.com)

(Source: https://www.garrettmotion.com)

(Source: https://www.tenneco.com)

(Source: https://www.aam.com)

Segments Covered in the Report

By Axle Type

- Drive Axle

- Dead Axle

- Lift Axle

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric Vehicle (EV)

- Hybrid

By Material

- Steel

- Aluminum

- Composite Materials

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting