What is the Automotive Coolant Market Size?

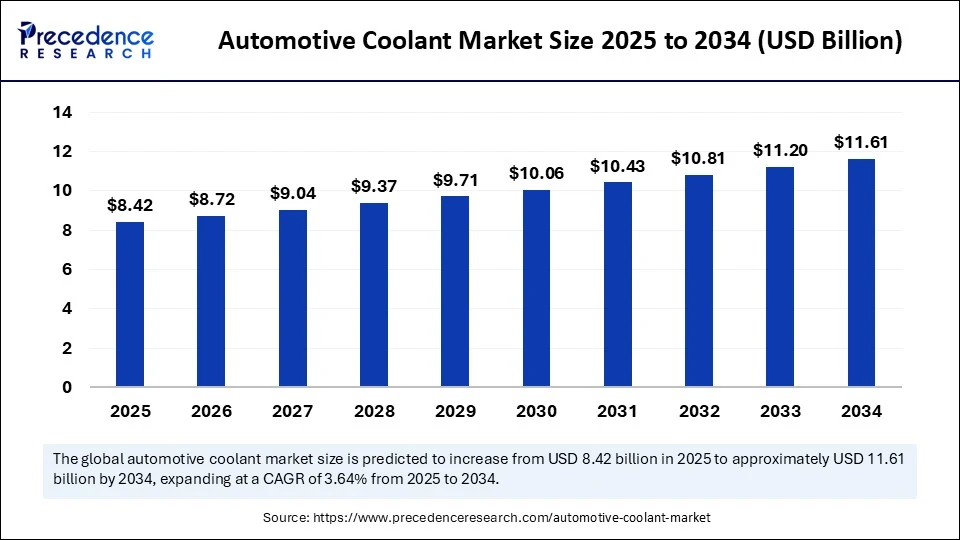

The global automotive coolant market size is calculated at USD 8.42 billion in 2025 and is predicted to increase from USD 8.72 billion in 2026 to approximately USD 11.61 billion by 2034, expanding at a CAGR of 3.64% from 2025 to 2034. The growth of the market is attributed to the rising vehicles production and stringent emission regulations.

Automotive Coolant Market Key Takeaways

- In terms of revenue, the automotive coolant market was valued at USD 8.12 billion in 2024.

- It is projected to reach USD 11.61 billion by 2034.

- The market is expected to grow at a CAGR of 3.64% from 2025 to 2034.

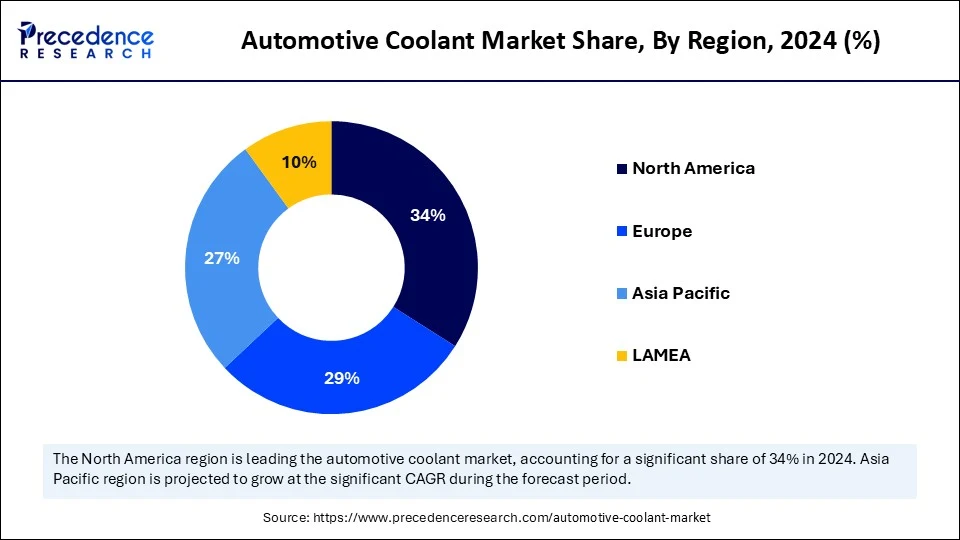

- North America accounted for the largest revenue share of 34% 2024.

- Asia-Pacific is expected to expand at the fastest CAGR in the market between 2025 and 2034.

- By vehicle type, the commercial vehicles segment held the largest market share in 2024.

- By vehicle type, the passenger vehicles segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By chemical, the ethylene glycol segment held the largest market share in 2024.

- By chemical, the propylene glycol segment is expected to grow at the highest CAGR between 2025 and 2034.

- By coolant type, the IAT segment held the largest market share in 2024.

- By coolant type, the OAT segment is expected to grow at a significant CAGR between 2025 and 2034.

Artificial Intelligence: The Next Growth Catalyst in Automotive Coolant

Artificial intelligence (AI) is rapidly transforming the automotive coolant industry by making vehicle maintenance smarter, more predictive, and more efficient. Traditionally, coolant systems have been reactive, requiring manual inspection and scheduled maintenance. However, AI is shifting this model toward predictive diagnostics, enabling onboard vehicle systems to monitor coolant levels, temperature fluctuations, and potential leaks in real time. One of the most promising developments is AI-powered thermal management systems in electric and hybrid vehicles. These systems continuously analyze sensor data to regulate engine temperature and battery cooling needs, optimizing coolant flow based on driving patterns, ambient conditions, and load stress. This not only enhances performance but also extends the life of vehicle components and improves fuel or battery efficiency.

AI algorithms also help manufacturers design new coolant formulations that are optimized for different driving environments, emission standards, and electric drivetrain requirements. Machine learning tools analyze vast data sets to predict how coolant compositions interact with various engine materials, reducing development time and improving product precision. Moreover, AI is utilized in aftermarket services to personalize coolant change intervals, enabling fleet managers and vehicle owners to minimize downtime and costs. In this way, AI is not just making cooling systems smarter; it is redefining how cooling systems interact with the vehicle's brain.

Strategic Overview of the Global Automotive Coolant Industry

Automotive coolants play a crucial role in maintaining vehicle performance and preventing engine overheating, corrosion, and freezing in extreme temperatures. The automotive coolant market is evolving into a critical component of vehicle design, especially as the automotive industry transitions from traditional internal combustion engines (ICEs) to electric and hybrid models. The market is poised for consistent growth due to increasing vehicle production, rising demand for high-performance engines, and the harsh climate conditions faced in several regions. A major factor driving this market is the diversification of vehicle types. While ICEs still require substantial coolant use to manage engine temperatures, electric vehicles (EVs) now demand specialized coolants for battery thermal regulation. This shift has given rise to a new class of non-conductive, biodegradable, and thermally stable coolants, pushing innovation across the supply chain.

In emerging economies, growing middle-class populations and rising car ownership are contributing to higher coolant consumption, particularly in aftermarket refills. Meanwhile, developed nations are seeing demand for long-life and eco-friendly coolants that meet environmental standards like REACH and GHS. OEMs are increasingly forming partnerships with chemical manufacturers to develop proprietary formulations tailored to their vehicle models. As global automotive production rises and consumers increasingly prioritize vehicle longevity, the demand for advanced, eco-friendly, and efficient coolants is steadily growing. The need for efficient thermal management, especially in high-performance and electrified vehicles, is likely to fuel market growth.

What are the Key Trends in the Automotive Coolant Market?

- Shift Toward Long-Life Coolants: Extended drain intervals reduce the frequency of maintenance, making long-life ethylene glycol and OAT-based coolants more desirable.

- Electric Vehicle Integration: EVs require non-conductive, advanced thermal fluids, creating new formulations and expanding coolant applications beyond engines to battery and inverter cooling.

- Eco-Friendly Solutions: Growing awareness of environmental impact is driving demand for biodegradable, low-toxicity coolants with minimal hazardous materials.

- Aftermarket Growth: DIY coolant kits and rising vehicle servicing needs are fueling growth in the aftermarket segment, especially in Asia-Pacific and Latin America.

- Partnerships and Product Innovation: OEMs are collaborating with chemical companies to co-develop performance-boosting and environment-compliant coolant solutions.

Market Outlook:

- Market Growth Overview: The automotive coolant market is expected to grow significantly between 2025 and 2034, driven by the sustainability and environmental regulations, growing vehicle fleet, and technology innovation.

- Sustainability Trends: Sustainability trends involve a shift towards non-toxic & bio-based fluids, extended life formulation, and recycling and re-refining programs.

- Major Investors: Major investors in the market include ExxonMobil Corporation, Chevron Corporation, TotalEnergies, BASF SE, Dow Inc., and OEMs.

- Startup Economy: The startup economy is focused on sustainable & bio-based alternatives, specialized additives and materials, and recycling and upcycling technology.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.61 Billion |

| Market Size in 2025 | USD 8.42 Billion |

| Market Size in 2026 | USD 8.72 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type,Chemical Type, Coolant Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Global Vehicle Parc

The primary driver of growth in the automotive coolant market is the rising global vehicle parc, a term that refers to the increasing number of vehicles in operation, both old and new. As more vehicles hit the road, particularly in fast-growing economies like India, China, Brazil, and Southeast Asia, the need for efficient engine and battery cooling solutions continues to expand. Modern vehicles are now engineered for higher efficiency and performance, which in turn generates more heat, especially in compact engine bays. This evolution has made advanced cooling systems essential to maintaining optimal operating conditions and avoiding costly damage.

Additionally, the increasing consumer preference for long-distance travel, off-road utility vehicles, and performance cars require coolants that can operate under higher stress and fluctuating climate conditions, further driving innovation and demand. Regulatory pressures are also pushing manufacturers toward formulations that comply with emission standards and reduce environmental toxicity. As a result, coolants are evolving into sophisticated chemical blends that offer not just temperature control but also corrosion resistance, longevity, and reduced environmental impact.

Fleet owners and commercial vehicle operators are demanding efficient coolants. In logistics, downtime due to overheating can lead to major financial losses. Hence, there is a growing demand for high-efficiency, low-maintenance coolants that offer longer change intervals and reduced system wear. In summary, the coolant market is driven by a combination of vehicle complexity, performance expectations, regulatory frameworks, and the expanding scope of vehicle usage, all of which demand more effective and intelligent coolant solutions.

Restraint

Volatility in Raw Material Prices and Lack of Standardization

Fluctuations in the cost of raw materials, particularly glycol-based compounds and corrosion inhibitors, affect production costs, creating challenges for manufacturers as they strive to maintain affordability in a price-sensitive market. Another major barrier is the lack of awareness about the benefits of coolants in certain markets. In regions where consumers prioritize fuel over fluid care, coolants are often neglected or replaced with inferior substitutes, such as plain water, leading to system inefficiency and hurting demand for quality coolant products. Furthermore, inconsistent standards across countries make it difficult for global players to introduce uniform products.

Some regions still lack strict regulatory frameworks for coolant formulation, resulting in the sale of counterfeit or low-grade products that undermine trust in premium brands. In the context of electric vehicles, a key restraint is the lack of standardization in coolant requirements. Different battery chemistries and architectures require distinct thermal management solutions, making it challenging for manufacturers to scale a single product across various EV platforms.

Opportunity

Rapid Shift to EV

The global shift toward electric mobility is redefining the automotive coolant market, creating a substantial opportunity for next-generation coolant systems. Unlike traditional internal combustion engines, electric vehicles (EVs) and hybrid vehicles generate heat through batteries, inverters, and electric motors requiring high-performance, non-conductive, and environmentally safe coolants for thermal management. This transition has opened up a completely new application segment.

Coolants are no longer just about engine protection; they are becoming essential to managing battery life, range, and safety in EVs. Start-ups and chemical giants alike are racing to develop custom formulations for different EV components, offering a vast potential for growth in a market once dominated by conventional products. Furthermore, the rise of connected vehicles and autonomous technologies is creating demand for advanced thermal fluids that cool multiple digital and control systems. From onboard sensors to computing modules, managing heat efficiently is becoming a performance-critical factor. In developing regions, growing automotive ownership and an expanding middle class provide another major opportunity, especially in the aftermarket.

Consumers are increasingly investing in vehicle maintenance and long-life coolants, resulting in increased sales of refill kits and DIY solutions. With increasing environmental regulations and the push for sustainable mobility, biodegradable, long-lasting coolants tailored to high-tech vehicles represent a massive untapped market. For manufacturers and chemical innovators, the opportunity lies not just in volume but in value, delivering smart, eco-friendly solutions for an evolving automotive ecosystem.

Vehicle Type Insights

Why Did the Commercial Vehicles Segment Dominate the Market in 2024?

The commercial vehicles segment dominated the automotive coolant market with the largest revenue share in 2024, primarily because of their intensive operational cycles, large engine capacity, and prolonged on-road usage. Commercial vehicles, ranging from heavy-duty trucks and buses to delivery vans and industrial fleets, typically run for extended hours under high loads, generating substantial heat that necessitates robust and long-lasting coolant systems. Unlike personal vehicles, commercial vehicles are often exposed to harsh driving environments, such as high-temperature zones, long-haul routes, and off-road terrains. This makes efficient coolant circulation critical not just for engine protection but also to ensure fuel efficiency and regulatory compliance, especially with emission standards like Euro VI or Bharat Stage VI.

Fleet operators rely heavily on preventive maintenance, where coolants play a key role. Downtime can result in significant financial losses, so fleet managers prefer long-life, high-performance coolants that reduce the frequency of coolant changes and extend engine life. This is especially true in logistics, public transportation, mining, and construction sectors, where vehicle wear and tear are extreme. Moreover, the commercial segment is also witnessing the rising adoption of alternative drivetrain technologies, such as hybrid trucks and electric buses. These vehicles also require specially formulated coolants for battery and motor temperature regulation, creating opportunities for specialized thermal fluids within this space.

On the other hand, the passenger vehicles segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is attributed to rising car ownership and evolving consumer attitudes toward vehicle maintenance. As emerging economies urbanize and incomes rise, millions of new car buyers are entering the market, and with them comes a growing demand for quality coolant systems. In modern passenger vehicles, especially turbocharged or hybrid models, engines are more compact yet powerful, increasing their thermal sensitivity. To avoid overheating, corrosion, or early engine fatigue, manufacturers equip vehicles with sophisticated cooling systems, where coolants are no longer a basic commodity but a vital performance fluid.

Car owners today are also more aware of long-term vehicle health. With extended warranties and rising fuel prices, maintaining engine efficiency becomes a priority. As a result, there is an increased shift from basic water-based solutions to glycol-based, branded coolants with corrosion inhibitors and long-life formulations. Additionally, the rising trend of personalized, connected, and electric passenger cars adds new thermal management challenges. EVs, for instance, require cooling not only for their motors but also for batteries and onboard electronics, making coolants essential to vehicle safety and longevity.

Chemical Type Insights

How Does the Ethylene Glycol Segment Dominate the Automotive Coolant Market in 2024?

The ethylene glycol (EG) segment dominated the market with a major revenue share in 2024 due to its excellent thermal properties, widespread availability, and cost-effectiveness. Used for decades in both antifreeze and coolant formulations, EG offers superior heat transfer performance, enabling efficient engine cooling in all weather conditions, from freezing winters to scorching summers. One of the major reasons for its dominance is its low freezing point and high boiling point when mixed with water, making it suitable for a wide range of climatic zones. Whether it's the icy roads of Canada or the desert highways of the Middle East, EG-based coolants maintain engine stability and prevent system failures.

From a manufacturing perspective, ethylene glycol is also easily adaptable to various technologies, including Inorganic Additive Technology (IAT), Hybrid Organic Acid Technology (HOAT), and Organic Acid Technology (OAT). This adaptability allows manufacturers to create custom coolant solutions for specific vehicle needs ICEs, hybrids, and even select EV systems. Moreover, EG is a favorite among OEMs and aftermarket suppliers due to its predictable performance and compatibility with most engines. It helps prevent scale, corrosion, and rust within radiators and engine components, extending service life and reducing maintenance costs.

On the other hand, the propylene glycol (PG) segment is expected to grow at the fastest rate in the coming years. This is mainly due to its low toxicity profile, making it a safer, more environmentally responsible alternative to traditional ethylene glycol-based formulations. Unlike ethylene glycol, which is toxic to humans and animals if ingested, propylene glycol is considered non-toxic and biodegradable, making it ideal for eco-conscious consumers, fleet managers, and OEMs that are focused on sustainability. Its growing adoption is largely seen in passenger vehicles, electric vehicles, and urban fleets, where environmental impact and safety are major concerns.

Although slightly less efficient in thermal conductivity compared to ethylene glycol, propylene glycol compensates with better safety, corrosion resistance, and compatibility with newer engines and lightweight components. It is being increasingly used in closed-loop systems where coolant leakage must be minimized and toxicity risk eliminated, such as school buses, electric city fleets, and shared mobility platforms.

Coolant Type Insights

What Made IAT the Dominant Segment in the Automotive Coolant Market?

The IAT segment dominated the market with the biggest share in 2024. Conventional Coolants, also known as Inorganic Additive Technology (IAT), are widely preferred in older vehicles, light trucks, and legacy fleets. Known for their reliable, time-tested formula, IAT coolants contain silicates and phosphates that provide immediate corrosion protection and are compatible with most radiator materials. The dominance of IAT is largely driven by its widespread use in the aftermarket, particularly in developing countries and among cost-conscious consumers. These coolants are also often recommended for older OEM models, and with many such vehicles still active globally, the demand for IAT remains strong.

Another reason for IAT's market dominance is its affordability and accessibility. With shorter drain intervals (typically around 2 years or 30,000 miles), users replace them more frequently, which feeds into recurring aftermarket demand. They are also easy to produce, store, and distribute, making them popular in rural garages, roadside service shops, and non-franchise workshops. Moreover, IAT-based coolants are non-reactive with common radiator components, which reduces the risk of compatibility issues when flushing or topping off coolant systems. For quick service turnarounds and reliable, no-surprise performance, many mechanics and fleet operators still swear by IAT coolants.

Meanwhile, the OAT (Organic Acid Technology) segment is expected to grow at the fastest CAGR during the projection period, thanks to its extended lifespan, superior corrosion resistance, and alignment with modern engine designs. Unlike conventional coolants that rely on silicates and phosphates, OAT coolants use carboxylate acids to provide long-lasting protection without forming deposits inside the cooling system. What makes OAT stand out is its extended drain intervals—often lasting up to 5 years or 150,000 miles. This reduces maintenance costs significantly and appeals to both OEMs and consumers who prefer minimal intervention.

Fleet managers, especially in commercial transport, are rapidly switching to OAT coolants to reduce service downtime and increase operational efficiency. OAT is especially compatible with aluminium-based components and modern compact engines, which are more sensitive to heat. It is also widely used in hybrid and electric vehicles, where non-conductive, stable coolant formulations are necessary to avoid damaging electronic and battery systems.

Regional Insights

U.S. Automotive Coolant Market Size and Growth 2025 to 2034

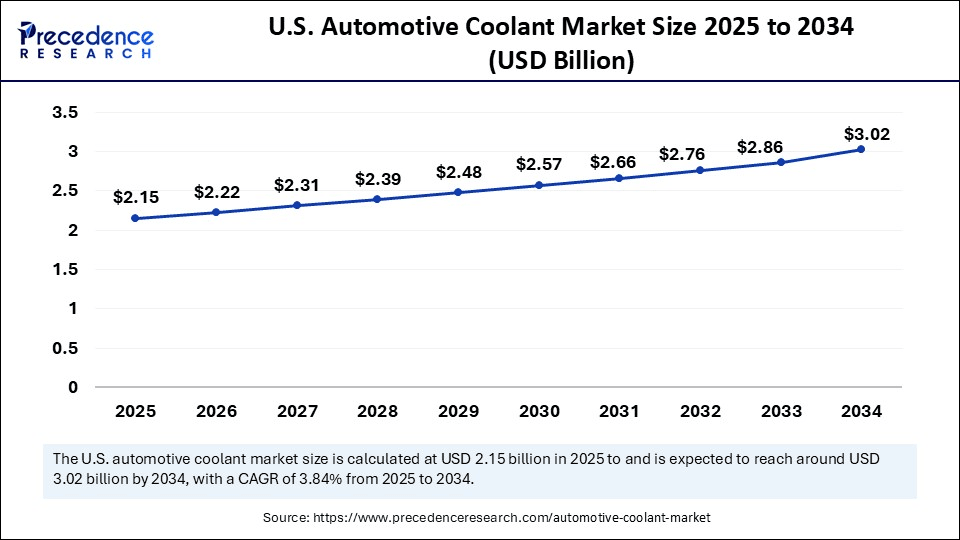

The U.S. automotive coolant market size is exhibited at USD 2.15 billion in 2025 and is projected to be worth around USD 3.02 billion by 2034, growing at a CAGR of 3.84% from 2025 to 2034.

What Made North America the Dominant Region in the Automotive Coolant Market in 2024?

North America continues to dominate the global automotive coolant market, owing to its mature automotive ecosystem, well-established maintenance culture, and steady demand for both OEM and aftermarket services. With millions of vehicles on the road, many of which are aging, there is a constant and growing need for engine protection, corrosion control, and thermal efficiency, which coolants effectively deliver. The U.S. and Canada have long been home to large-scale automotive manufacturers, fleets, and commercial vehicle operators, all of whom rely on performance-driven coolant systems to maximize engine longevity and reduce operational downtime. In colder climates, freeze protection is another key concern, making anti-freeze coolant blends essential in personal and commercial vehicles alike.

U.S. Automotive Coolant Market Trends

The region boasts a highly developed network of auto repair shops, service centers, and DIY enthusiasts. Consumers here are brand-conscious and more likely to invest in premium, long-life coolants that comply with OEM specifications and meet sustainability benchmarks. With the growing adoption of electric and hybrid vehicles, particularly in California and the Pacific Northwest, there is increasing demand for advanced non-conductive and battery-compatible coolants. Furthermore, stringent emission norms and environmental standards push manufacturers to develop bio-based and non-toxic coolants, further expanding the premium coolant category.

What Factors Support Asia Pacific Automotive Coolant Market Growth?

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period, owing to its sheer vehicle volume, expanding middle-class population, and rapid growth of the mobility sectors. Countries like China, India, Indonesia, Thailand, and Vietnam are witnessing an unprecedented surge in vehicle ownership, fueled by rising incomes, urbanization, and government incentives for electric mobility. What sets Asia-Pacific apart is the coexistence of old and new technologies. While some markets still rely on traditional internal combustion engine (ICE) vehicles, others, such as China and South Korea, are leading the way in EV production and adoption, creating diverse coolant requirements across the region.

India Automotive Coolant Market Trends

In India and Southeast Asia, the aftermarket coolant segment is booming, with customers increasingly aware of the importance of regular vehicle maintenance. Still, cost sensitivity prevails, which makes affordable, extended-life coolants highly popular among both commercial and personal vehicle owners. Meanwhile, Japan and China are advancing the development of advanced thermal fluids for EV battery packs, signaling a major opportunity for specialized coolant formulations. These nations are investing in domestic manufacturing of coolants, reducing reliance on imported brands, and promoting local innovation.

Asia-Pacific also benefits from a strong OEM manufacturing base, with global and regional automakers producing millions of vehicles annually. This provides ample ground for partnerships between auto companies and chemical firms to co-create coolant solutions that are climate-adapted, cost-effective, and regulation-compliant. With its diverse consumer needs, massive vehicle base, and fast-moving technology shifts, Asia-Pacific stands as a critical region shaping the next era of automotive cooling solutions.

Why is Europe Racing Ahead in Coolant Innovation?

Europe is expected to grow at a notable rate, driven by its commitment to sustainability, technological advancement, and emission control regulations. As nations across the EU continue to prioritize clean mobility and green innovation, demand for high-performance, eco-friendly coolants is accelerating. European consumers and manufacturers alike are increasingly opting for organic acid technology (OAT) and hybrid organic acid technology (HOAT) coolants, which offer longer life cycles, minimal environmental toxicity, and superior compatibility with new engine designs. These coolants are particularly favored in German and Scandinavian automotive sectors, where both luxury and commercial vehicles demand high thermal performance under varying weather conditions.

The rise of electric vehicles (EVs) in Europe has also contributed to the coolant market's growth. Countries such as Norway, the Netherlands, and the UK have adopted aggressive EV targets, and as a result, there's increased R&D around dielectric and battery-cooling fluids, which are non-conductive, thermally efficient, and tailored to high-voltage systems. Moreover, Europe's strict vehicle safety and environmental compliance policies are pushing OEMs and aftermarket brands to innovate cleaner, safer, and more efficient coolant solutions. Even in public transport fleets and logistics companies, fleet managers are turning to high-performance, maintenance-reducing coolants that support sustainability.

Value Chain Analysis of the Automotive Coolant Market

- Inbound Logistics

This stage involves the procurement of raw materials, primarily base fluids such as ethylene glycol (EG), propylene glycol (PG), and glycerin, along with various corrosion inhibitors and performance-enhancing additives.

Key Players: BASF SE and Dow Inc. - Operations

Operations encompass the blending, formulation, and packaging of the raw materials into finished automotive coolants (e.g., OAT, IAT, HOAT formulations.

Key Players: ExxonMobil Corp., Royal Dutch Shell PLC, Chevron Corp., and Old World Industries LLC (PEAK). - Outbound Logistics

Outbound logistics covers the distribution of packaged coolants to original equipment manufacturers (OEMs) for factory-fill and to the vast aftermarket network of wholesalers, retailers, and service centers.

Key Players: Valvoline Inc. and Indian Oil Corp. Ltd. - Marketing and Sales

This stage involves promoting product benefits, such as extended life coolants and eco-friendly formulations, to OEMs, service providers, and end-consumers.

Key Players: Castrol, Valvoline, and Prestone - Service

The service stage focuses on post-purchase support, proper usage information, and end-of-life management of coolants.

Top Companies in the Automotive Coolant Market & Their Offerings:

- Exxon Mobil Corporation (U.S.): As a global energy and chemical giant, ExxonMobil contributes significantly to the automotive coolant market through the production of base fluids (ethylene and propylene glycol) and additives, as well as the manufacturing and distribution of branded coolant products under its various oil and lubricant brands.

- BASF SE (Germany): A leading global chemical company, BASF is a major supplier of high-quality base glycols and performance additives that are essential components for advanced automotive coolants.

- TotalEnergies (France): A broad energy company, TotalEnergies is a key player in the coolant market, supplying base fluids and manufacturing a comprehensive range of coolant and antifreeze products for various vehicle types globally.

- Chevron Corporation (U.S.): Chevron contributes to the market as a major producer of base oils and glycols and also manufactures a full line of coolants under brands like Havoline and Delo.

- Shell Plc (U.K.): Through its lubricants business, Shell manufactures and distributes a wide range of coolants designed for various vehicle applications worldwide.

- OLD WORLD INDUSTRIES (U.S.): This major, privately held company contributes significantly to the North American market with its well-known PEAK-branded coolants and antifreeze.

- Prestone Products Corporation (U.S.): A market leader in North America, Prestone specializes in branded coolants and antifreeze products that are widely available to consumers and service centers.

- Arteco (U.S.): As a major manufacturer and supplier of engine coolants and heat transfer fluids, Arteco provides high-performance OAT (Organic Acid Technology) coolants and advanced inhibitor packages to global automotive and heavy-duty industries.

- Recochem Corporation (Canada): A leading global manufacturer and distributor of automotive fluids, Recochem contributes by providing a wide range of private-label and branded coolants across North America and beyond.

- MOTUL (France): Known for its high-performance lubricants, Motul also offers a specialized range of coolants and antifreeze products designed for high-performance and specialty vehicles.

- BP PLC (U.K.): BP is involved in the market through its Castrol brand, which is a globally recognized supplier of a wide range of automotive fluids, including coolants and antifreeze products. They leverage the Castrol brand's reputation for quality and performance to serve both OEM and aftermarket demand.

- Valvoline Inc. (U.S.): A prominent provider of automotive services and products, Valvoline contributes to the coolant market with a strong line of branded coolants and antifreeze available in its extensive service center network and retail stores. Their dual-channel presence is a key market advantage.

- Sinopec (China): As one of China's largest integrated energy and chemical companies, Sinopec is a major player in the Asian coolant market, producing large volumes of base fluids and branded coolants for both the domestic and international markets.

Automotive Coolant Market Companies

- Exxon Mobil Corporation (U.S.)

- BASF SE (Germany)

- TotalEnergies (France)

- Chevron Corporation (U.S.)

- Shell Plc (U.K.)

- OLD WORLD INDUSTRIES (U.S.)

- Prestone Products Corporation (U.S.)

- Arteco (U.S.)

- Recochem Corporation (Canada)

- MOTUL (France)

- BP PLC (U.K.)

- Chevron Corporation (U.S.)

- Valvoline Inc. (U.S.)

- Sinopec (China)

Recent Developments

- In June 2025, Setco Automotive Limited launched its Automotive Water Pump, expanding its product portfolio into engine cooling solutions for LCVs and MHCVs. The water pump ensures optimal coolant circulation and thermal stability. It features a long-life seal, high load-bearing capacity, improved Noise, Vibration & Harshness (NVH) isolation, and a thermal-optimized impeller material grade.

(Source: https://www.autocarpro.in) - In March 2024, Schaeffler Korea launched a new ‘Schaeffler TruPower' CV Coolant in Korean market. This new commercial vehicle coolant comes in a 4-liter (L) specification and is available for purchase through 'Junwoo APS,' a specialized automotive aftermarket distributor. This coolant contains additives that prevent corrosion of the engine and internal parts, thus enhancing the engine's lifespan.

(Source: https://www.schaeffler.co.in)

Segments Covered in the Report

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Chemical Type

- Ethylene Glycol

- Propylene Glycol

By Coolant Type

- IAT

- OAT

By Region

- North America

- APAC

- Europe

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting