What is the Automotive Junction Box Market Size?

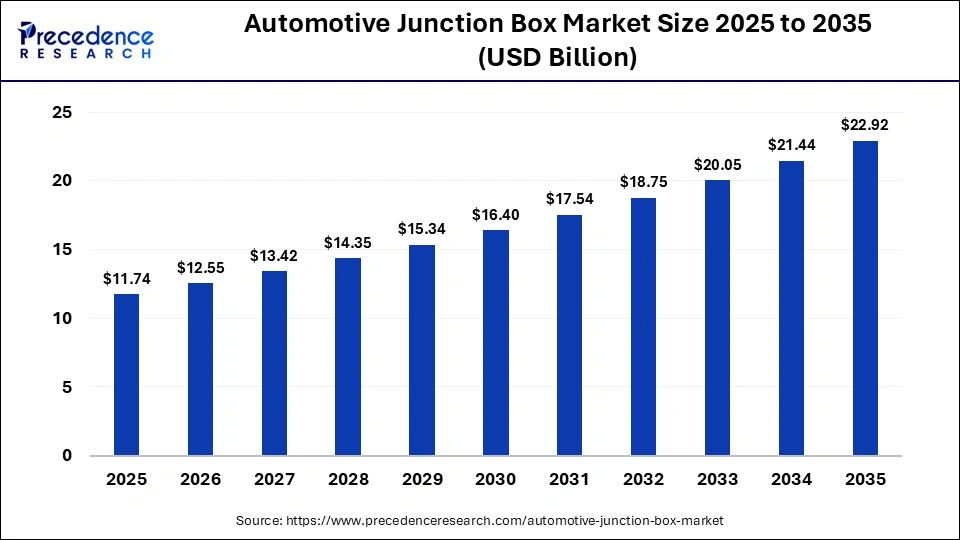

The global automotive junction box market size accounted for USD 11.74 billion in 2025 and is predicted to increase from USD 12.55 billion in 2026 to approximately USD 22.92 billion by 2035, expanding at a CAGR of 6.92% from 2026 to 2035. The market is driven by the surging demand for advanced electronic components from the automotive sector, as well as the rapid investment by automotive companies in opening new production facilities. Moreover, technological advancements in the electric vehicle industry, along with the increasing sales of commercial vehicles globally, are contributing to market growth.

Market Highlights

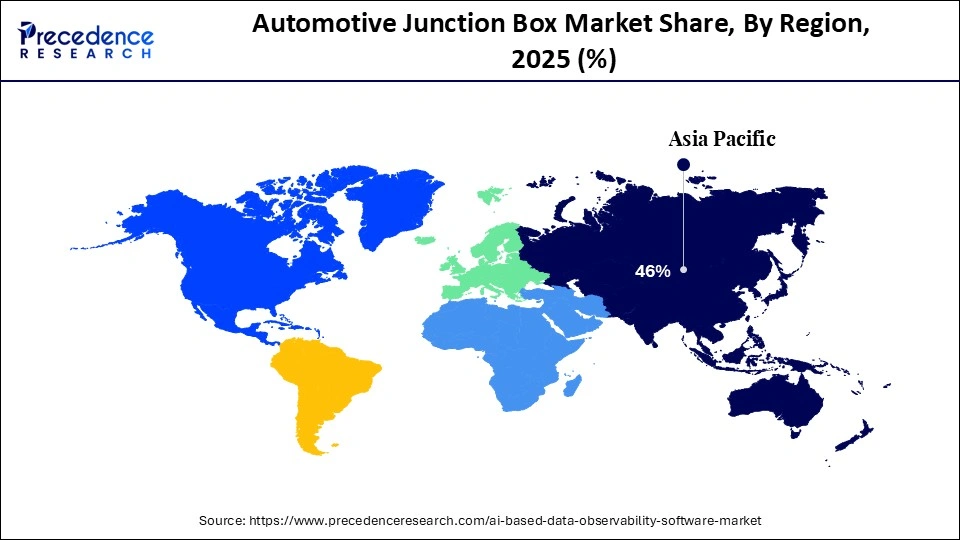

- Asia Pacific led the automotive junction box market with the largest share of 46% in 2025.

- North America is expected to grow at the fastest CAGR between 2026 and 2035.

- By type, the power distribution junction box segment held the largest share of the market in 2025.

- By type, the fuse junction box segment is expected to grow at a considerable CAGR between 2026 and 2035.

- By material, the plastic segment dominated the market in 2025.

- By material, the metal segment is expected to expand at a significant CAGR between 2026 and 2035.

- By application, the body control module segment held the largest share of the market in 2025.

- By application, the infotainment system segment is expected to expand at a remarkable CAGR between 2026 and 2035.

- By vehicle type, the passenger vehicles segment held the highest share of the market in 2025.

- By vehicle type, the electric vehicles segment is expected to grow at the highest CAGR between 2026 and 2035.

Why is the Automotive Junction Box Market Evolving?

The automotive junction box market is evolving due to the rapid growth of electric and hybrid vehicles, which require more sophisticated power distribution and safety management systems. The automotive junction box industry is a crucial branch of the automotive sector. This industry deals in the production and distribution of junction boxes for automotive companies across the globe. There are several types of junction boxes available in the market, comprising power distribution junction boxes, fuse junction boxes, and relay junction boxes. The growing sales of luxury cars in developed nations and the rising application of advanced electronics in modern vehicles are also driving the market.

Why is AI Integral in the Automotive Junction Box Industry?

AI plays a prominent role in shaping the landscape of the automotive industry. Automotive manufacturers have started adopting AI for enhancing several applications, including predictive maintenance, quality control, supply chain optimization, and design. In recent times, the automotive junction box companies are deploying AI in their manufacturing plants to enhance product development, improve fault detection, and lower manufacturing costs. AI helps manufacturers optimize design, production, and energy efficiency, aligning with the growing demand for safer, connected, and intelligent automotive systems.

- In January 2026, Neural Concept launched an AI-based platform. This platform is developed to enhance product development in the automotive sector.

Automotive Junction Box Market Trends

- Surging Sales of EVs: The rising sales of EVs in different parts of the world have increased the application of junction boxes. According to the International Energy Agency, over 360,000 electric cars were sold in the U.S. in the first quarter of 2025.

- Business Expansions: Numerous market players are engaged in opening new production centers to increase their manufacturing capabilities. For instance, in March 2025, Yazaki Corporation opened a new production facility in Chengalpattu, Tamil Nadu, India. This manufacturing center is inaugurated to increase the production of wire harnesses for the automotive sector.

- Increasing Production of Commercial Vehicles: The growing manufacturing of commercial vehicles in several nations, including Germany, China, India, and Argentina, is boosting the demand for passive junction boxes. According to the OICA, 3,091,486 commercial vehicles were manufactured in China in 2025.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.74 Billion |

| Market Size in 2026 | USD 12.55 Billion |

| Market Size by 2035 | USD 22.92 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Material, Vehicle Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Why Did the Power Distribution Junction Box Segment Dominate the Automotive Junction Box Market?

The power distribution junction box segment dominated the market while holding the largest share in 2025. This is mainly due to the increased use of power distribution junction boxes in modern vehicles to distribute power from the battery to all components, such as infotainment, lights, engine control, and advanced safety systems (ADAS). Moreover, the surging use of these junction boxes in electric cars to enable advanced features, optimize energy, and manage high voltage is ensuring the long-term growth of the segment.

The fuse junction box segment is expected to expand at a considerable CAGR over the forecast period. The growth of the segment is driven by the rising application of fuse junction boxes in commercial vehicles to manage and protect electric systems. These boxes help in circuit protection, signal routing, and monitoring electronic components, enhancing the safety of vehicles while driving. With the increasing complexity of modern vehicles, the demand for reliable circuit protection has grown significantly, contributing to segmental growth.

Material Insights

What Made Plastic the Leading Segment in the Automotive Junction Box Market?

The plastic segment led the market with a major revenue share in 2025. This is mainly due to the increased use of plastic-based junction boxes in low-range passenger vehicles. Its excellent insulating properties ensure electrical safety, while its moldability allows manufacturers to create compact, modular, and complex designs that integrate multiple functions. Also, numerous advantages of plastic-based junction boxes, such as corrosion resistance, cost-effectiveness, durability, ease of installation, and lightweight, have boosted their adoption.

The metal segment is expected to grow at a significant CAGR between 2026 and 2035. The growth of the segment is driven by the rising use of metal-based junction boxes in luxury cars and heavy commercial vehicles. Several benefits of these junction boxes, including fire safety, RFI shielding, temperature tolerance, high longevity, and secure mounting, are boosting their adoption. Additionally, metals enable long-lasting, reliable enclosures for complex electrical systems, making them a preferred choice in applications where safety and structural integrity are paramount.

Application Insights

Why Did the Body Control Module Segment Dominate the Market?

The body control module segment dominated the automotive junction box market in 2025. This is because body control module serve as the central hub for managing a vehicle's electronic systems, including lighting, windows, door locks, climate control, and security features. With the growing complexity of modern vehicles and increasing demand for comfort, safety, and convenience features, BCM-integrated junction boxes have become essential for efficient power distribution and system coordination.

The infotainment system segment is expected to grow at a remarkable CAGR in the upcoming period. This is because the infotainment system requires reliable power distribution and circuit protection. The rising adoption of Android-based infotainment systems by EV manufacturers to enhance the vehicular experience is driving the demand for junction boxes, as they support infotainment systems by ensuring stable energy delivery, protecting sensitive electronics, and managing complex wiring. Moreover, junction boxes in infotainment systems act as central electrical hubs for organizing, protecting, and distributing power and signals to various components, including speakers, screens, and connectivity modules.

Vehicle Type Insights

What Made Passenger Vehicles the Dominant Segment in the Automotive Junction Box Market?

The passenger vehicles segment dominated the market while holding the largest share in 2025. This is mainly due to the increased sales and production of passenger vehicles in several nations, including the U.S., India, Germany, China, and Italy. The rapid investment by the automotive companies in opening passenger car manufacturing centers, along with the growing use of passive junction boxes in passenger vehicles, also bolstered the market. Moreover, partnerships among passenger car manufacturers and automotive suppliers to integrate high-quality junction boxes in modern cars are expected to propel the market growth.

The electric vehicles segment is expected to expand at the highest CAGR between 2026 and 2035. This is mainly due to the surging adoption of electric vehicles for lowering emissions in several nations, such as Canada, Denmark, the UAE, and the UK. There is an increasing focus of automakers on manufacturing mid-range BEVs, along with the rising use of high-voltage junction boxes (HVJBs) in electric vehicles, which is positively contributing to the market. Moreover, the rapid investment by the EV brands in manufacturing electric buses and electric trucks is expected to drive the growth of the market.

Regional Insights

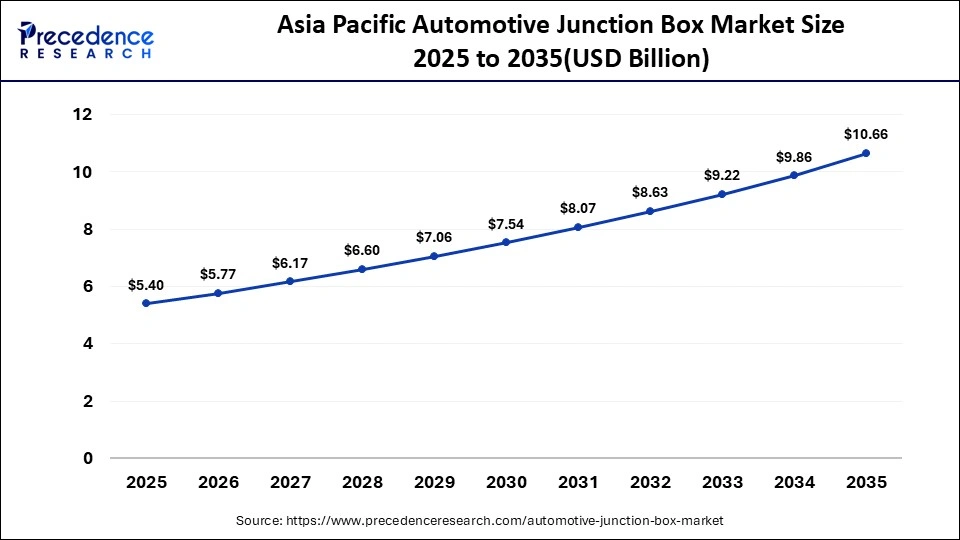

What is the Asia Pacific Automotive Junction Box Market Size?

The Asia Pacific automotive junction box market size is expected to be worth USD 5.40 billion by 2035, increasing from USD 10.66 billion by 2025, growing at a CAGR of 7.04% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Automotive Junction Box Market?

Asia Pacific dominated the automotive junction box market by capturing the largest share in 2025. The region's dominance is attributed to increased sales and production of commercial vehicles in several nations, including China, Japan, South Korea, and India. Also, the rapid investment by the automakers in opening new production facilities, along with the rise in the number of automotive workshops, is playing a prominent role in shaping the market in the region. Moreover, the presence of various market players, such as Hyundai Mobis, Zhejiang Asia-Pacific Mechanical & Electronic Co., Ltd., and Kyungshin Corporation, is accelerating the industrial expansion in this region. According to the OICA, 889,270 commercial vehicles were manufactured in Japan in 2025.

China Automotive Junction Box Market Analysis

The market in China is expanding at a significant rate due to the growing investment by electronics companies in opening new manufacturing units for producing a wide range of automotive electronics solutions. Additionally, the availability of raw materials at reasonable prices, as well as the abundance of a skilled workforce, is accelerating market growth.

- In March 2025, Vexos opened a production center in Dongguan, China. This new manufacturing center is inaugurated to produce a wide range of electronics components for the automotive industry.

How is the Opportunistic Rise of North America in the Automotive Junction Box Market?

North America is expected to expand at the fastest CAGR between 2026 and 2035. The rising adoption of electric vehicles by eco-conscious consumers for lowering emissions in several countries, including the U.S., Canada, and Mexico, is boosting the market. The rapid investment by the government for strengthening the automotive sector, as well as technological advancements in the vehicle manufacturing industry, are positively contributing to the market. Moreover, the presence of several junction box manufacturers, such as Borgwarner, Lear Corporation, and TE connectivity is expected to boost the growth of the automotive junction box industry in this region. According to Statistics Canada, around 45,366 electric vehicles were registered in Canada during the 3rd quarter of 2025.

U.S. Automotive Junction Box Market Analysis

The growing demand for autonomous vehicles from the elite-class consumers and numerous government initiatives aimed at mandating ADAS in vehicles are major factors driving the market in the U.S. Moreover, the growing investment by the automakers in acquiring small electronic brands for developing a wide range of electronics solutions to cater to the needs of the automotive sector is positively contributing to the market.

- In December 2025, the U.S. House of Representatives launched the ADAS Functionality & Integrity Act (HB 6688). This initiative is aimed at mandating ADAS in different parts of the U.S.

Automotive Junction Box MarketValue Chain Analysis

- Raw Materials Procurement

The raw materials used in the production of automotive junction boxes include engineered plastics, metals, and conductive components.

Key Companies: BASF, Covestro, and DuPont.

- Quality Control

Quality control (QC) for automotive junction boxes is a multi-stage process aimed at ensuring their safety, reliability, and functionality in vehicles.

Key Companies: Pro QC International, Mayco International, and Knauf Industries.

- Distribution Channel

The distribution channel of automotive junction boxes comprises OEMs, the aftermarket, and e-commerce platforms.

Key Companies: Amazon, Panasonic, and Aptiv.

Who are the Major Players in the Global Automotive Junction Box Market?

The major players in the automotive junction box market include Bosch GmbH, Continental AG, Denso Corporation, Lear Corporation, Fujikura Ltd., Delphi Technologies, TE Connectivity Ltd., Panasonic Corporation, Aptiv PLC, HELLA GmbH & Co. KGaA, Marelli Holdings Co., Ltd., NXP Semiconductors N.V., Renesas Electronics Corporation, Valeo S.A., Hyundai Mobis, Zhejiang Asia-Pacific Mechanical & Electronic Co., Ltd., Kyungshin Corporation, Mitsubishi Electric Corporation, Sumitomo Electric Industries, Ltd., and Yazaki Corporation.

Recent Developments

- In November 2025, General Motors announced to invest around US$ 250 million. This investment is made to develop the Parma Metal Center for increasing the manufacturing of a wide range of automotive products in the U.S.(Source: https://news.gm.com)

- In April 2025, Thaco Industries invested around US$550 million. Through this investment, this brand opened a new automotive component production unit in Chu Lai, Quang Nam, China.(Source: https://thacogroup.vn)

- In February 2025, Magna announced to open a production facility in Pune, India. This new manufacturing center is inaugurated to produce a wide range of automotive components for end-users. (Source: https://www.manufacturingtodayindia.com)

Segments Covered in the Report

By Type

- Power Distribution Junction Box

- Fuse Junction Box

- Relay Junction Box

By Material

- Plastic

- Metal

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

By Application

- Body Control Module

- Engine Control Module

- Infotainment System

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content