What is the Automotive Secure Element Chip Market Size?

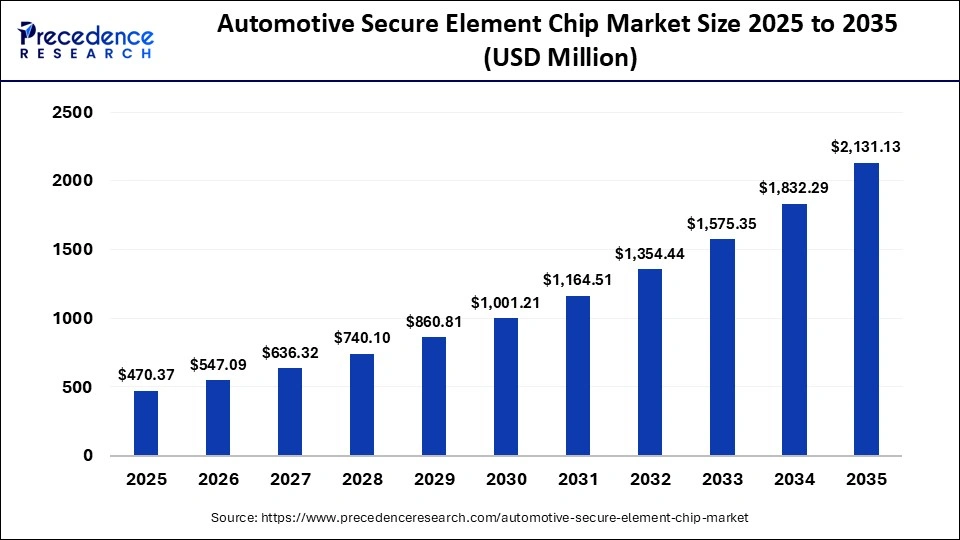

The global automotive secure element chip market size accounted for USD 470.37 million in 2025 and is predicted to increase from USD 547.09 million in 2026 to approximately USD 2,131.13 million by 2035, expanding at a CAGR of 16.31% from 2026 to 2035. The growth of the market for automotive secure element chips is driven by increasing connectivity, autonomous driving features, over-the-air software updates, regulatory and safety compliance requirements, and rising cybersecurity threats.

Market Highlights

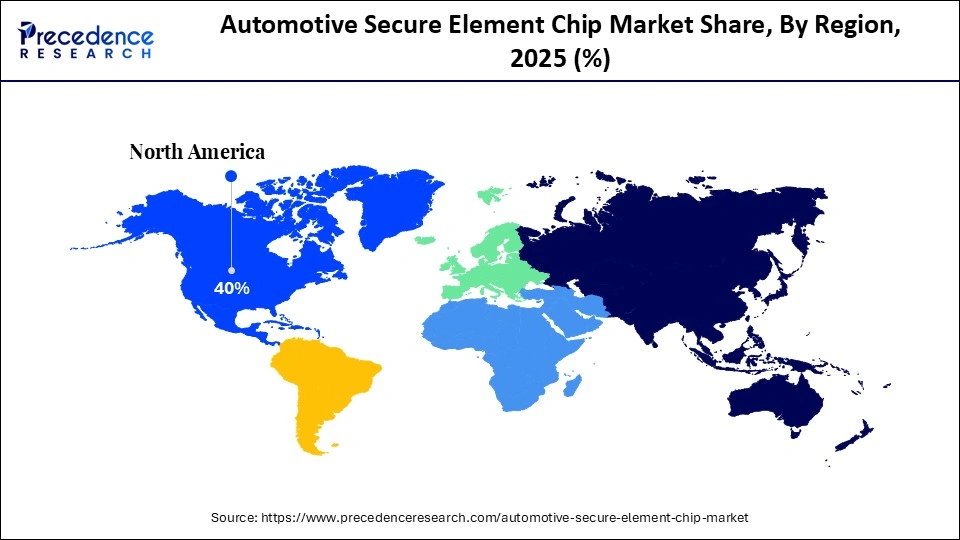

- Asia Pacific is dominating the market, holding a share of 40% in 2025.

- By region, North America is projected to grow at a significant CAGR of approximately 18% from 2026 to 2035.

- By component/chip type, the dedicated secure element chips segment led the market while holding the largest share of 45% in 2025.

- By component/chip type, the secure microcontrollers segment is expected to grow 18% from 2026 to 2035.

- By vehicle type, the passenger car segment led the automotive secure element chip market while holding the largest share of 50% in 2025.

- By vehicle type, the electric & autonomous vehicles segment is growing at a strong CAGR 20% from 2026 to 2035.

- By security application, the secure connectivity & telematics segment led the market while holding the largest share of 38% in 2025.

- By security application, the digital key & vehicle access systems segment is expected to grow at a CAGR of 22% from 2026 to 2035.

- By technology, the hardware-only secure elements segment led the market while holding the largest share of 55% in 2025.

- By technology, the hardware + software hybrid secure solutions segment is expected to grow at a CAGR of 18% from 2026 to 2035.

- By integration type, the embedded on-board secure elements segment led the automotive secure element chip market while holding the largest share of 62% in 2025.

- By integration type, the secure elements with integrated cryptography engines segment is expected to grow at a CAGR of 19% from 2026 to 2035.

- By end-user, the OEMs segment led the market while holding the largest share of 68% in 2025.

- By end-user, the tier-1 automotive suppliers segment is expected to grow at a CAGR of 17% from 2026 to 2035.

- By secure feature type, the encryption & authentication services segment led the market while holding the largest share of 42% in 2025.

- By secure feature type, the trusted execution environment (TEE) support segment is expected to grow at a CAGR of 19% from 2026 to 2035.

- By sales/distribution type, the direct OEM contracts segment led the automotive secure element chip market while holding the largest share of 60% in 2025.

- By sales/distribution type, the tier-1/tier-2 suppliers channels segment is expected to grow at a CAGR of 18% from 2026 to 2035.

What is the Automotive Secure Element Chip Market?

The global automotive secure element chip market comprises embedded hardware security components used to protect critical vehicle systems and digital interactions. These include dedicated secure element chips, Trusted Platform Modules, and hardware-based security modules integrated directly into automotive electronic control units. Together, these components form the hardware root of trust for modern vehicles, enabling cryptographic operations, secure key storage, authentication, secure boot, and data integrity enforcement across in-vehicle systems.

Automotive secure element chips play a central role in safeguarding connected and software defined vehicle functions. They are used to secure over-the-air software updates, vehicle-to-everything communication, telematics services, digital key and vehicle access systems, in-vehicle payment and tolling services, and the protection of sensitive driver and vehicle data. By isolating cryptographic keys and security-critical processes from the main application processor, secure elements reduce the risk of tampering, cloning, and remote attacks.

Market growth is driven by the rapid increase in vehicle connectivity and software complexity. Advanced driver-assistance systems, autonomous driving features, and cloud-connected infotainment platforms significantly expand the vehicle attack surface, making hardware-level security essential. Over-the-air updates, which allow manufacturers to deploy software patches and feature upgrades remotely, further increase reliance on secure authentication and integrity verification mechanisms.

Key Technological Shifts in the Automotive Secure Element Chip Market

Automotive secure element chips are increasingly being integrated as tamper-resistant hardware modules within vehicle electronic systems, strengthening protection for cryptographic keys, digital identities, and sensitive vehicle data. This architectural shift moves security functions away from software-only implementations toward hardware-rooted trust, reducing exposure to physical tampering and remote cyberattacks.

Manufacturers are implementing advanced cryptographic standards, including elliptic curve cryptography, advanced AES encryption, and post-quantum-ready cryptographic frameworks, to address evolving and long-term cybersecurity threats. These technologies support secure authentication, encrypted communication, and trusted secure boot processes, ensuring that only verified software and firmware can be executed within the vehicle.

As vehicle electronics become more centralized, secure elements are increasingly converging with automotive-grade system-on-chips. Secure elements are now embedded within or tightly coupled to automotive SoCs used in infotainment systems, domain controllers, and centralized vehicle computing architectures. This integration improves performance, reduces system complexity, and enables consistent security enforcement across multiple vehicle domains.

Key Market Trends in the Automotive Secure Element Chip Market

- Rising demand for connected and software-defined vehicles: the growth of connected cars and software-defined vehicle architectures is driving strong demand for secure element chips to protect vehicle-to-cloud communication and in-vehicle networks.

- Increasing cybersecurity threats in automotive systems: Growing incidents of vehicle hacking and data breaches are pushing automakers to prioritize embedded security solutions, accelerating SE chip adoption.

- Expansion of electric vehicles and autonomous vehicles: Electric vehicles and autonomous driving platforms rely heavily on secure data exchange, authentication, and payment systems, strengthening the need for robust secure element solutions.

Automotive Secure Element Chip Market Outlook

- Industry Vehicle: The automotive secure element chip market is poised for rapid growth from 2025 to 2034, driven by drivers like over-the-air updates It maintains the integrity and authenticity of the software updates with a digital signature. Another one is in car payments; nowadays the TV monitor screen present in the cars acts as a payment method for the passengers who are using taxis, making it easier for payment after the ride cashless.

- Global expansion: The rapid growth of industrial automation and modernization of supply chain management across regional areas has led to worldwide growth of the automated guided vehicle market. As a result of this rapid development of new manufacturing sites and warehouse construction sites, manufacturers are increasingly utilizing newly emerging markets.

- Major investments: The major investor is NXP Semiconductors, which majorly invests in the cybersecurity systems of the cars by ensuring the safety systems of the car by enabling hacking and robust hardware security.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 470.37 Million |

| Market Size in 2026 | USD 547.09 Million |

| Market Size by 2035 | USD 2,131.13 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 16.31% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component/Chip Type, Vehicle Type, Security Application, Technology, Integration Type, End-User, Security Feature, Sales/Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component/Chip Type Insights

Why Dedicated Secure Element Chips Lead in the Automotive Secure Element Chip Market?

Dedicated Secure Element (SE) Chips: The segment led in the automotive secure element chip market with a 45% share, due to tamper resistance and specially designed security architecture. These chips are designed to securely store cryptographic keys, digital certificates, and sensitive vehicle credentials. Automotive OEMs choose dedicated secure elements for the most critical mission applications like secure boot and identity authentication. The fact that they are separated from the main processor makes them more secure against physical and logical attacks. In addition, conformity with automotive cybersecurity standards allows for less resistance to the spread of this technology. Long product lifecycles in vehicles are one of the reasons why they maintain their dominant position in the market.

Secure Microcontrollers (Secure MCUs): The secure microcontrollers in the automotive secure element chip market are set to be the fastest-growing segment with an expected CAGR of 18%, due to their ability to perform both processing and security functions on a single chip. These devices provide secure storage, cryptographic functions, and application processing from a single chip. Automakers are turning to secure microcontrollers as a means of system simplification and reducing the number of components. Their adaptability supports the future software-defined vehicle architectures. Cost, effectiveness, and scalability are the reasons why they are welcomed in mid-range and mass-market vehicles. The increasing need for multifunctional security solutions is the main reason behind the segment growth.

Vehicle Type Insights

Why Did Passenger Cars Dominate in the Automotive Secure Element Chip Industry During 2025?

Passenger Cars: This segment dominated in the automotive secure element chip market, holding a 50% share, driven by the increased use of connected features such as infotainment, telematics, and digital keys in the cars. To protect user data and vehicle access systems, OEMs are equipping cars with secure elements. The growing awareness of cybersecurity among consumers also acts as a support factor for the demand. Besides that, regulatory pressure for the provision of vehicle data protection is another factor that influences the adoption. In short, these factors have been collectively keeping the segment afloat.

Electric Vehicles (EVs) & Hybrid Vehicles: The segment in the automotive secure element chip industry is 20%, driven by software, dependent, connected, and requiring continuous data exchange. Battery management, autonomous systems, and OTA updates, in this case, need secure authentication and encrypted communication. The massive investment in the autonomous driving technology is leading the way to the demand increase. The segment is exposed to the greatest cybersecurity issues due to its high complexity, which is the case here. As the penetration of the EV and AV rises, the deployment of secure elements follows the same trend.

Security Application Insights

Why Did Secure Connectivity & Telematics Led in the Automotive Secure Element Chip Sector?

Secure Connectivity & Telematics: The segment led in the automotive secure element chip sector is holding a 38% share during 2025, thanks to how fast connected vehicle tech is catching on. Secure elements keep the communication between vehicles, the cloud, and infrastructure safe. With authentication and encryption, the data stays intact and locked down from intruders. Telematics systems need this secure hardware for real-time data sharing. Regulations around handling data securely just pushes adoption further. All this together puts connectivity-focused applications right at the top.

Digital Key & Vehicle Access: The segment is set to be the fastest-growing in the automotive secure element chip market, holding the share of 22%, due to the convenience of using their phones or tapping to get into their cars. Secure elements are essential here; they hold digital credentials and keep them protected. Automakers are jumping on this, rolling out these systems to make cars more personal and easier to use. The rise of car sharing and subscription models just adds fuel to the fire. Security is a big concern, so demand keeps climbing.

Technology Insights

Why Hardware-Only Secure Elements in the Automotive Secure Element Chip Market?

Hardware-Only Secure Elements: The segment in the market for automotive secure element chips held a 55% share in 2025, driven by reliability and standing up well against software-based attacks. These devices handle cryptographic operations in a dedicated space, away from everything else. Car makers count on them for critical systems and anything that needs to last a long time. Their straightforward design makes them robust and easy to certify. Plus, they are tough to tamper with, so trust stays high.

Hardware + Software Hybrid Secure Solutions: The segment in the market hold the share of 18%, due to software-driven platforms. With both hardware roots and flexible software controls, automakers get the best of both worlds. Updates roll out faster, and systems can react quickly to new threats. Scalability and easier lifecycle management are big wins for OEMs. With over-the-air updates now common, these hybrid solutions just make sense. Demand for adaptable, secure systems is pushing their popularity.

Integration Type Insights

Why Did Embedded On-Board Secure Elements Hold the Largest Share in the Market for Automotive Secure Element Chips?

Embedded On-Board Secure Elements: The segment held the largest share in the automotive secure element chip sector, coming in at 62%, because they fit right into the car's electronics. They deliver reliable, low-latency security without needing extra gear. Automakers like them for centralized security control. With fewer external interfaces, there is less risk of attack. These elements handle multiple systems in the vehicle at once. Their performance and stability keep them out in front.

Secure Elements with Integrated Cryptography Engines: The segment is set to be the fastest-growing in the market with an expected CAGR of 19%, driven by faster encryption and authentication, which matters a lot as cars process more data in real time. Automakers want these to support advanced features and keep up with data-heavy applications. It is all about speed and performance, and that is driving rapid growth here.

End-User Insights

Why Are OEMs (Original Equipment Manufacturers) Dominating in the Automotive Secure Element Chip Market?

OEMs (Original Equipment Manufacturers): The segment in the automotive secure element chip market hold a dominant share of 68% because they are the ones building security right into the car from the start. This early integration helps them meet strict security standards and regulations. Their strategies count on hardware-based trust anchors to keep systems safe. With control over the whole vehicle architecture, they can optimize security deployment. Large-scale production and long-term supplier relationships just lock in their leadership.

Tier-1 Automotive Suppliers: The tier-1 automotive suppliers is set to be the fastest-growing in the market with an expected CAGR of 17%, thanks to more responsibility at the system level. They are adding secure elements to ECUs, infotainment, and telematics. OEMs are leaning on them more for cybersecurity know-how. Modular vehicle designs support this shift, and these suppliers are pouring resources into secure design. As a result, Tier-1s are growing fast in the market.

Security Feature Insights

Why Did Encryption and Authentication Dominate in the Automotive Secure Element Chip Sector?

Encryption & Authentication Services: The segment dominated with a 42% share in the market for automotive secure element chips, as secure elements make sure data is exchanged safely and identities get verified properly. These features keep out unauthorized users and stop data breaches. They are must-haves for connectivity, over-the-air updates, and car access. Regulations keep pushing encryption standards higher, so these features are everywhere.

Trusted Execution Environment (TEE) Support: The segment in the automotive secure element chip industry with an expected growth rate between 19%, as they create safe spaces for critical apps and processes, keeping them away from everything else. As car software gets more complicated, people want these secure zones even more. TEEs make it easier to launch and update secure apps. When you combine them with modern operating systems, you get more flexibility. Plus, with cybersecurity threats on the rise, everyone is moving faster to use them.

Sales/Distribution Channel Insights

Why Did Direct OEM Contracts Lead in the Automotive Secure Element Chip Market During 2025?

Direct OEM Contracts: The direct OEM contracts led the automotive secure element chip market holding a 60% share during 2025, because carmakers want tighter control over cybersecurity. They like going straight to the source so they can get the compliance and customization they need. Long-term deals help keep the supply chain secure. When OEMs work directly with partners, they can build security in from the very start. New regulations are pushing this approach, too. The bottom line: direct OEM contracts are growing fast.

Tier-1 / Tier-2 Suppliers: The segment is set to grow at a CAGR of 18%, as these suppliers build secure elements right into full automotive modules, which makes things easier for car makers. Tight collaboration between suppliers and OEMs helps get new tech on the road faster. Tier-1s can bundle security with other features, and as cars get more modular, this channel just keeps expanding.

Regional Insights

How Big is the North America Automotive Secure Element Chip Market Size?

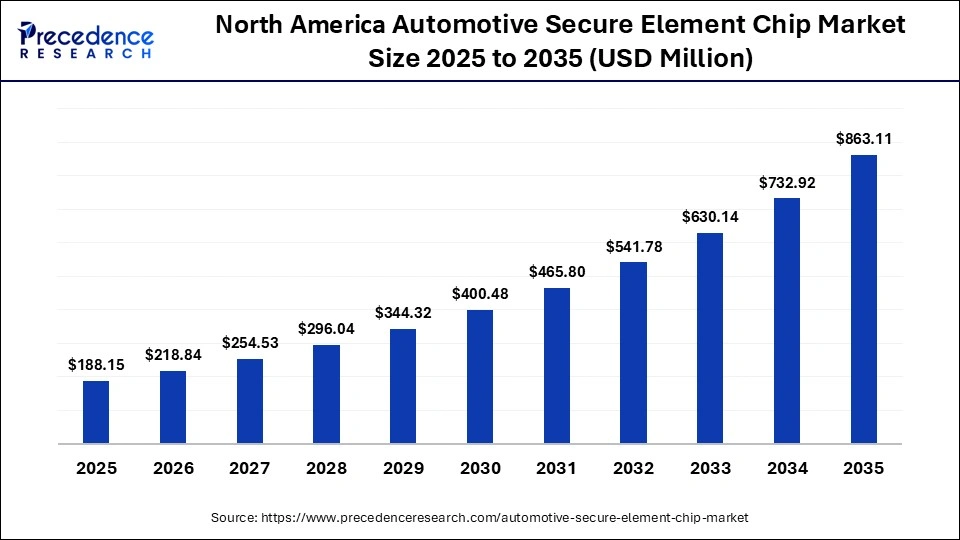

The North America automotive secure element chip market size is estimated at USD 188.15 million in 2025 and is projected to reach approximately USD 863.11 million by 2035, with a 16.45% CAGR from 2026 to 2035.

What Is the Reason North America Is the Fastest Growing in the Automotive Secure Element Chip Market?

North America is the fastest growing in the automotive secure element chip market, set to have a CAGR of 18%, driven by the quick incorporation of connected, autonomous, and software-defined vehicles. As vehicle cybersecurity and data protection gain more prominence, the original equipment manufacturers (OEMs) are investing more in hardware-based security solutions. The region is thus seeing a growing trend of secure elements being used in advanced driver assistance systems (ADAS), telematics, and in-vehicle payment systems. Besides this, the regulatory emphasis on cybersecurity compliance is also pushing up the adoption rate. Also, the high consumer demand for features such as digital car keys and advanced vehicle functionalities is likewise contributing to the market growth.

What is the Size of the U.S. Automotive Secure Element Chip Market?

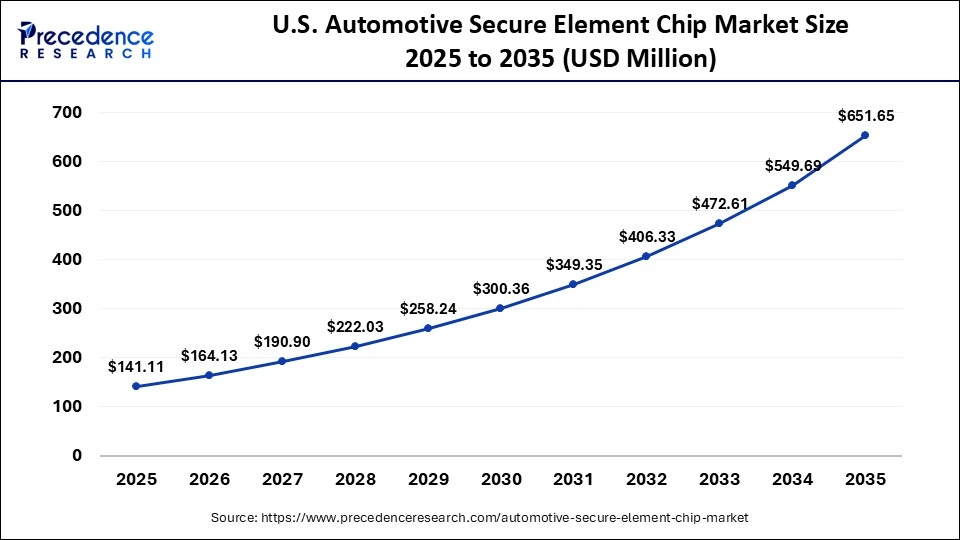

The U.S. automotive secure element chip market size is calculated at USD 141.11 million in 2025 and is expected to reach nearly USD 651.65 million in 2035, accelerating at a strong CAGR of 16.53% between 2026 and 2035.

U.S. Automotive Secure Element Chip Industry Trends

The U.S. leads the regional market due to substantial automotive R&D, early adoption of cybersecurity frameworks, and the presence of top technology players. Canada, on the other hand, is experiencing a gradual rise, which is mainly fuelled by investments in connected vehicle testing and smart transportation infrastructure. Mexico is turning into a manufacturing hub where secure element chip integration in vehicles is targeted to serve the export markets. Cross-border automotive supply chains are contributing to regional growth.

Why Is Asia Pacific Dominating the Automotive Secure Element Chip Market?

Asia Pacific dominated the automotive secure element chip market, holding a 40% share, driven by high vehicle production volumes, particularly across passenger vehicles and electric vehicles. The region's large-scale automotive manufacturing base creates sustained demand for embedded hardware security solutions that can be deployed across mass-market and premium vehicle platforms.

Rising adoption of connected car technologies, digital key systems, and software-defined vehicle architectures is accelerating demand for automotive secure element chips. As vehicles increasingly rely on over-the-air updates, in-vehicle payments, telematics, and vehicle-to-everything communication, embedded security modules are becoming essential to protect identities, cryptographic keys, and sensitive vehicle data throughout the vehicle lifecycle.

Government support for automotive digitalization and smart mobility programs further strengthens regional leadership. Policy initiatives promoting electric mobility, intelligent transport systems, and connected infrastructure across countries such as China, Japan, and South Korea are pushing automakers to integrate hardware-rooted security into next-generation vehicle platforms.

China Automotive Secure Element Chip Industry Trends

China is the market leader, largely motivated by its enormous automotive production capacity and fast-paced adoption of connected and electric vehicles. Japan is a key player due to its emphasis on the innovation of automotive electronics and the setting of strict safety and cybersecurity standards. South Korea has a strong point of expertise in the semiconductor industry and the integration of secure elements in advanced infotainment and ADAS platforms. India is a potential market, with vehicle digitization on the rise and government-led smart mobility initiatives as its backbone. Taiwan is a contributor through its advanced chip fabrication capabilities.

What Is the Reason Europe Is the Fastest Growing in the Automotive Secure Element Chip Market?

Europe is becoming a significant market for automotive secure element chips, primarily due to the enforcement of strict regulations governing automotive safety, cybersecurity, and data protection. Regulatory frameworks increasingly require manufacturers to demonstrate secure software lifecycle management, protected vehicle communications, and robust safeguards against cyber threats, which is accelerating the adoption of hardware-based security solutions within vehicle electronic architectures.

The region's strong emphasis on data privacy and vehicle security has led automakers to integrate secure element chips to protect cryptographic keys, digital identities, and sensitive in-vehicle data. These hardware-rooted security components are increasingly used to support secure boot processes, authenticated access control, and encrypted communication between vehicle systems and external networks.

Germany Automotive Secure Element Chip Industry Trends

Germany is at the forefront of the market owing to its solid automotive manufacturing base and its leadership in the development of connected and autonomous vehicles. France is progressing the adoption with the help of investments in vehicle cybersecurity and digital mobility initiatives. In Italy, there is a continuous growth trend that is being backed by the production of luxury vehicles and upgrades of electronic systems. The United Kingdom is endowed with strong capabilities in automotive engineering, and innovation in connected vehicle technologies is a major advantage here.

Automotive Secure Element Chip Market Value Chain

- R&D: R&D is working to develop advanced, cryptographically secured, tamper-evident microcontrollers for connected mobile vehicles (MVs), whose digital keys and communications with various devices will be protected from possible cyberattacks.

Key players: STMicroelectronics, Texas Instruments, and Renesas Electronics.

- Testing and Quality Control: The testing and quality control mandates the means of detecting failures and safely deal with them to avoid system failure ASIL A-D, which typically includes some form of safety mechanism, e.g., built-in self-test, error-correcting code (ECC), redundant circuits, etc.

Key players: ARM holdings

Top Companies in the Automotive Secure Element Chip Market

- NXP Semiconductors

- Qualcomm

- Infineon Technologies

- STMicroelectronics

- Texas Instruments

- Renesas Electronics

- ON Semiconductor

- Broadcom

- Microchip Technology

- Analog Devices

Recent Development

- In December 2025, Tata Electronics just teamed up with Japan's ROHM Co. to start assembling and testing top-tier power semiconductors for cars right in India. This move really matters; it is not just another business deal. It kickstarts a homegrown supply chain for electric vehicles, so India is not stuck relying on imports anymore. Instead, the country is diving into local, high-value manufacturing.(Source: https://www.domain-b.com)

Segment Covered in Report

By Component/Chip Type

- Dedicated Secure Element (SE) Chips

- Trusted Platform Modules (TPMs)

- Embedded Hardware Security Modules

- Secure Microcontrollers (Secure MCUs)

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs) & Hybrid Vehicles

- Autonomous Vehicles

By Security Application

- Secure Connectivity & Telematics

- Secure OTA Updates

- Digital Key & Vehicle Access

- Payment & In-Car Transactions

- V2X / V2G Communication Security

- Secure Data Storage & ECU Protection

By Technology

- Hardware-Only Secure Elements

- Hardware + Software Hybrid Secure Solutions

- Virtual Secure Elements

- Cloud-Connected Secure Element System

By Integration Type

- Embedded On-Board Secure Elements

- Removable/External Secure Elements

- Secure Ele/External Integrated Cryptography Engines

By End-User

- OEMs (Original Equipment Manufacturers)

- Tier-1 Automotive Suppliers

- Aftermarket/Retrofit Provider

By Security Feature

- Secure Boot & Firmware Integrity

- Secure Key Storage/HSM Functions

- Encryption & Authentication Services

- Anti-Tamper & Physical Protection

- Trusted Execution Environment (TEE) Support

By Sales/Distribution Channel

- Direct OEM Contracts

- Through Tier-1/Tier-2 Suppliers

- Aftermarket Distribution

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting