What is the Automotive Shock Absorber Market Size?

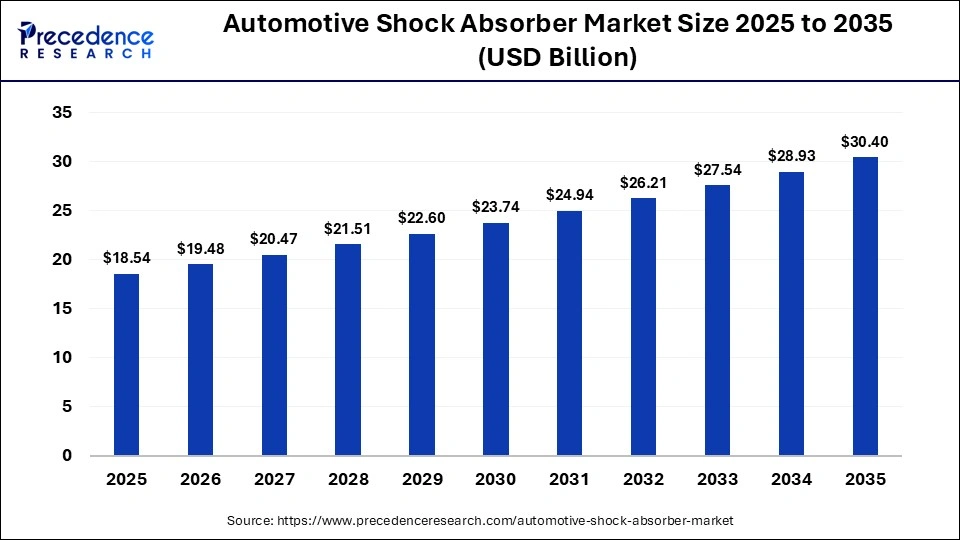

The global automotive shock absorber market size was calculated at USD 18.54 billion in 2025 and is predicted to increase from USD 19.48 billion in 2026 to approximately USD 30.40 billion by 2035, expanding at a CAGR of 5.07% from 2026 to 2035. The global automotive shock absorber market is experiencing significant growth with the rise and expansion of the automotive industry, technological advancements in shock absorbers, and growing demand for electric vehicles and aftermarket demand due to the growing lifespan.

Market Highlights

- Asia Pacific held a major market share in 2025.

- North America is expected to grow at the fastest CAGR between 2026 and 2035.

- By product type, the twin tube segment held a dominant position in the automotive shock absorber market in 2025.

- By product type, the mono tube segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By vehicle type, the passenger vehicle registered its dominance over the global market in 2025.

- By vehicle type, the commercial vehicle segment is expected to grow with the highest CAGR in the market during the studied years.

- By sales channel, the OEM segment held the largest revenue share in the market in 2025.

- By sales channel, the aftermarket segment is expected to expand rapidly in the market in the coming years.

Automotive Shock Absorber Market Overview

The market refers to the development, manufacturing, and distribution of automotive shock absorbers for a variety of industries. In the automotive sector, the shock absorber is a key component in vehicle suspension. It is used to absorb the impact from road irregularities and to dampen the overall impact. It ensures that the vehicle remains in optimal contact with the ground while providing comfort for the rider. It improves ride quality by reducing the wear and tear on suspension parts, providing enhanced braking performance and stability by controlling the ‘up and down' motion of the wheel in the vehicle.

As demand for vehicle production in the automotive industry is increasing, the market for shock absorbers is also rising. Manufacturers are heavily investing in developing innovative solutions in shock absorbers to improve the ride comfort and vehicle handling. Recently, electric vehicles have also boosted the demand for shock absorbers. They help compensate for the weight distribution of heavier battery weights in EVs. The awareness about vehicle maintenance and aftermarket replacement is also helping in increasing demand for shock absorbers.

Vehicle owners are actively investing in high-end premium absorbers for sports handling capacity, off-road capability, and load bearing in vehicles. Thus, as the automotive industry is evolving and expanding, the market for shock absorbers is also in high demand as they directly influence vehicle safety, comfort, and control.

What is the Role of AI in the Automotive Shock Absorber Market?

Artificial intelligence (AI) plays a vital role in the market by assisting researchers in designing customized shock absorbers based on the conditions of different nations. AI and machine learning (ML) algorithms can analyze vast amounts of data and learn and adapt to individual driving habits, personalizing the suspension experience for every driver. AI-based sensors provide real-time insights into driving data and suggest appropriate adjustments in real-time driving. Leading companies integrate predictive algorithms that detect and respond to potential road irregularities before the vehicle encounters them.

Automotive Shock Absorber Market Trends

- Rising Ownership and Vehicle Production

As emerging markets are experiencing rising disposable income, in countries such as India, Indonesia, and South Asia, leads to an increase in vehicle ownership. As more middle-class income families are upgrading to two-wheelers or passenger cars, more demand for suspension components, including good-quality shock absorbers, is expected to drive market growth.

- Demand for Comfort and Vehicle Safety

As modern consumers are prioritizing comfort, stability, and safety in vehicle rides, the demand for high-quality suspension systems is increasing rapidly. Shock absorbers play a critical role in ensuring better handling, minimizing vibrations, and maintaining contact with the road while driving, which encourages the adoption of high-performance dampers in passenger cars.

- Electric Vehicles

In EVs, shock absorbers directly influence battery protection, driving efficiency, and vehicle safety. Every vibration is noticeable with quiet rides, and the heavy weight of batteries increases the load in vehicles; thus, absorbers wear out faster with strain, demanding stronger designs. Manufacturers are now focusing on lightweight materials that can support heavier batteries without compromising on performance.

- Vehicle Maintenance and Aftermath

Worn shock absorbers affect the braking system, reduce the lifetime of tires, and affect their capacity to remain in contact with roads. During long-distance travel, worn-out shock absorbers affect driving. As vehicle ages, shock absorbers create a lucrative market in vehicle maintenance and aftermath, with manufacturers focusing on producing high-quality aftermarket shock absorbers.

- Lightweight Material Innovation

Breakthroughs with metamaterials for safer and reusable shock absorbers are revolutionary. In 2024, Tata Steel Netherlands and the University of Amsterdam developed a metamaterial, which is lightweight, stiff, efficient, and capable of absorbing repeated shocks. Also, additive manufacturing and advanced composites enabled the creation of optimized designs that result in improved performance and reduced weight.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.54 Billion |

| Market Size in 2026 | USD 19.48 Billion |

| Market Size by 2035 | USD 30.40 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.07% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type,Vehicle Type,Sales Channel, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated the Automotive Shock Absorber Market?

The twin tube segment held a major revenue share in the market in 2025, because tin tube shock absorber consists of two tubes, the inner tube and outer tube, to manage the flow of hydraulic fluid. The inner tube is a working cylinder, while the outer one is a reserve chamber. The twin tube is cheaper to manufacture. As it provides comfortable rides, it is mainly used in passenger vehicles to provide comfort and better driving conditions on roads.

The mono tube segment is expected to show the fastest growth with a CAGR over the forecast period, as mono tube use single cylinder that contains oil, high-pressure nitrogen gas, and a floating piston to separate them. Mono tube is more efficient in heat dissipation to increase the shock absorption. It is highly used in high-performance vehicles and off-roading, such as in SUVs and trucks.

Vehicle Type Insights

Why Did the Passenger Vehicle Segment Dominate the Automotive Shock Absorber Market?

The passenger vehicle segment accounted for the highest revenue share in the market in 2025. In this segment, as passenger cars remain in high demand around the world, the demand for robust and high-quality shock absorbers keeps growing. Due to consumers' preference for safety and a smooth ride, high-performance shock absorbers are in demand. A passenger car shock absorber, along with the spring, forms the end link between the suspension and the vehicle body.

The commercial vehicle segment is expected to witness the fastest growth in the market over the forecast period. Heavy load-bearing vehicles such as SUVs, trucks, and buses require high loading and durable shock absorbers. Shock absorbers for commercial vehicles help control spring oscillation and keep tires on the road. They are in high demand for commercial vehicles as they keep trucks, trailers, buses, and other commercial equipment safe and profitable.

Sales Channel Insights

How the OEM Segment Dominated the Automotive Shock Absorber Market?

The OEM segment registered its dominance over the global market in 2025. This segment involves the supply of shock absorbers provided directly to vehicle manufacturers for new vehicle assembly. It is a high-volume market that involves long-term contracts for supply to manufacturing companies such as Ford and Toyota. Clients benefit from direct supply from OEMs, as they do not need to pay extra charges to distributors.

The aftermarket segment is expected to grow with the highest CAGR in the market during the studied years, due to the increasing number of older vehicles. Frequent replacement of shock absorbers is necessary for older vehicles. Supply chain influences the aftermarket of shock absorbers. Key drivers also include branding, e-commerce, replacement demand, and the growing need for coverage of older vehicle models.

Regional Insights

How Asia-Pacific Dominated the Automotive Shock Absorber Market?

Asia Pacific dominated the market in 2025, due to high vehicle production and a strong manufacturing base. The market is also driven by rapid growth in two-wheelers and passenger cars; this region dominates global production and consumption of automobiles. India and China are at the forefront of the market with the increase in manufacturing and sales of EVs and expanding logistics infrastructure. Government bodies launch initiatives to support the manufacturing of EVs and provide funding.

China Automotive Shock Absorber Market Trends

China is one of the world's largest automobile-producing countries. The market in China is primarily driven by ongoing technological advancements, rapid urbanization, diverse driving environments, and strong manufacturing capabilities, which are accelerating the demand for shock absorbers in China. It is also one of the major hubs for EV vehicles, along with two-wheelers, which accelerate the market for new shock absorbers, as well as vehicle maintenance and the aftermarket.

For instance, According to the International Energy Agency, China is a global electric car manufacturing hub, accounting for over 70% of global production in 2024. The production is supported by the presence of domestic manufacturers, representing more than 80% of domestic production.

How is North America Growing in the Automotive Shock Absorber Market?

North America is expected to host the fastest-growing market in the coming years. The increasing demand for vehicle production and the demand for comfort and safety are rising among consumers, accelerating the market in North America. The region is also experiencing rising sales of luxury and premium vehicles, along with the growth of advanced suspension systems, which are creating new opportunities for the market in the region. Several government and private organizations provide funding for R&D and manufacturing processes to the leaders and researchers in the automotive sector.

U.S. Automotive Shock Absorber Market Trends

In the North America region, the U.S. holds a majority market share. To meet consumers' criteria, manufacturers are heavily investing in innovation, safety, and product development. As some of the major automotive manufacturers are present in the U.S., high-quality shock absorbers to improve the vehicle performance and safety are in high demand. As high loading vehicles such as SUVs and pickup trucks holds largest share in U.S. vehicle sales, the demand for high loading shock absorbers is increasing in the U.S. Also, long-distance travel and extensive highway use in the country play an important role in aftermarket branding and sales in the market.

Value Chain Analysis – Automotive Shock Absorber Market

- Inbound logistics

It involves receiving, storing, and distributing raw materials, such as steel tubes and rods, aluminum components, springs, and fasteners, for production.

- Operations

It involves the process that transforms input into finished products and services. Tube cutting and machining, welding and sealing, heat treatment, and final testing are involved in operations to improve precision.

- Outbound logistics

It involves the handling of storage and distribution of the final product to customers. Packaging, labeling, transportation of products to distributors and retailers, and warehousing are involved. It ensures delivery on time and prevents any damage.

- Marketing and sales

Informing and persuading customers to purchase the products and services. Branding and competitive pricing are involved in marketing. Aftermarket promotions are also included to increase sales.

- Service

All the activities that maintain and enhance the product's value after sale. Technical support and warranty handling are provided in services. It also includes replacement and installation of the product, which improves customer confidence and satisfaction, helping with revenue.

Who are the Major Players in the GlobalAutomotive Shock Absorber Market?

The major players in the automotive shock absorber market include KYB Corporation, ZF Friedrichshafen AG, Tenneco (Monroe) , Hitachi Astemo Ltd., Mando Corporation, Marelli (Magneti Marelli), Showa Corporation, Gabriel India Ltd., Arnott Inc., Profender, and Gabriel India Ltd.

Recent Developments in the Automotive Shock Absorber Market

- In April 2025, Marelli received a 2025 Automotive News PACEpilot Award for its fully active electromechanical suspension. This technology is based on an electromechanical system that actively manages the vertical dynamics of a vehicle's suspension in a new way. It represents an innovative alternative to traditional shock absorber solutions. (Source:https://www.marelli.com)

- In June 2025,ZF Aftermarket, a German company, launched its new Sachs air shock absorbers developed in original equipment (OE) quality for the aftermarket. As the number of vehicles equipped with air springs continues to rise, ZF aftermarket is responding to this trend. The new product is available for initial applications, such as Audi Q7, Porsche Cayenne, and VW Touareg models. (Soure:https://www.aftermarketinternational.com)

- In December 2025, Profender, a Thai company, launched its electronic adjustable shock absorber, highlighting smart suspension technology designed to meet real-world driving conditions in Thailand. Entirely built by a Thai engineering team, this new product combines convenience, stability, and safety, reflecting the growing capability of Thailand's automotive industry on the global stage. (Source:https://www.nationthailand.com)

Segment Covered in Report

By Product

- Mono Tube

- Twin Tube

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Sales Channel

- OEM

- Aftermarket Segment

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content