Automotive Switch Market Size and Forecast 2025 to 2034

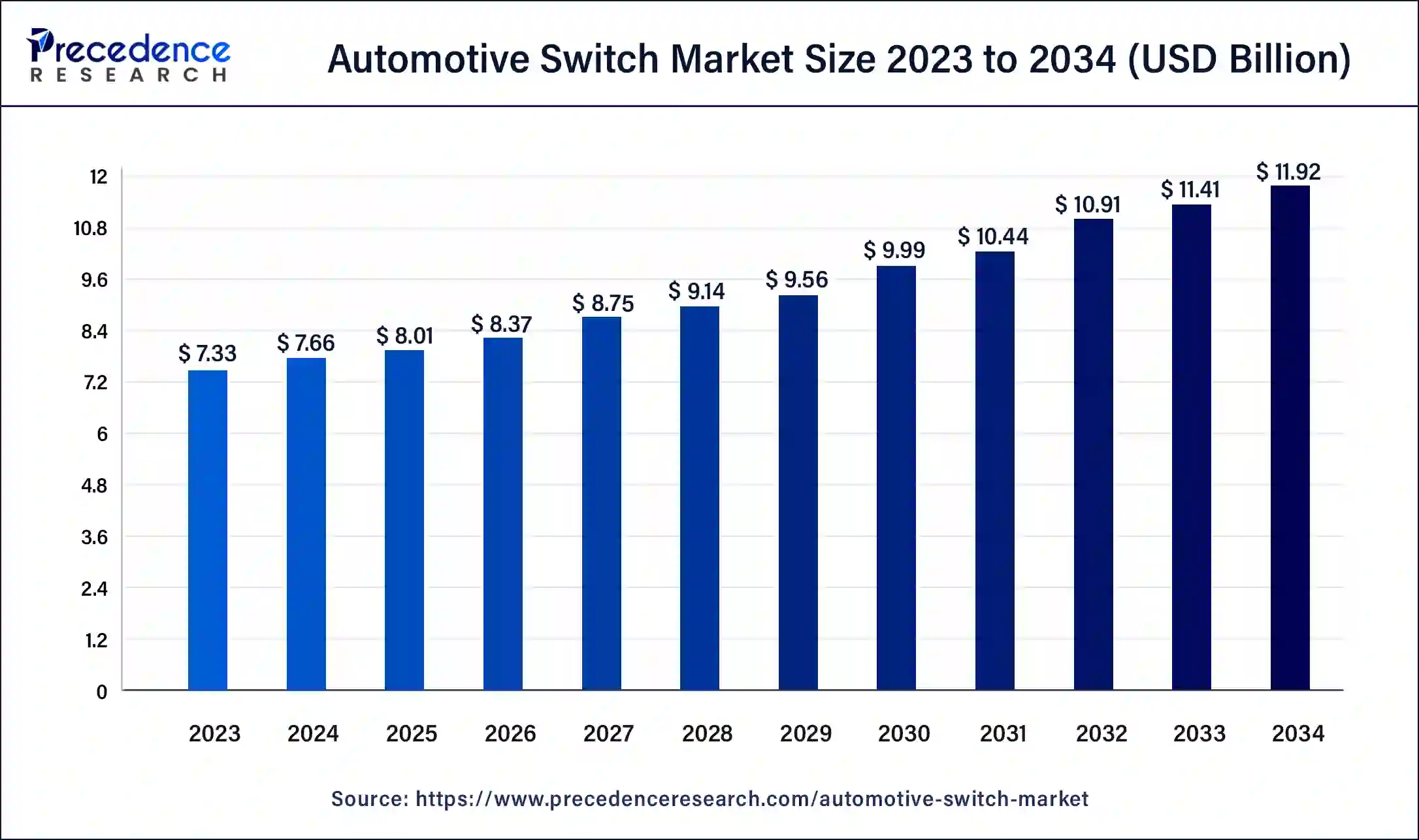

The global automotive switch market size was evaluated at USD 7.66 billion in 2024 and is anticipated to reach around USD 11.92 billion by 2034, growing at a CAGR of 4.52% over the forecast period 2025 to 2034. Growing adoption of EVs and HEVs with highly advanced switches to automate the vehicle's system and configuration is fuelling the automotive switch market.

Automotive Switch Market Key Takeaways

- The global automotive switch market was valued at USD 7.66 billion in 2024.

- It is projected to reach USD 11.92 billion by 2034.

- The automotive switch market is expected to grow at a CAGR of 4.52% from 2025 to 2034.

- Asia Pacific accounted for the largest share of the automotive switch market in 2024.

- North America will register significant growth in the market over the forecast period.

- By type, the HVAC segment registered the largest share of the market in 2024.

- By vehicle type, in 2023, the HCVs segment dominated the global market.

- By sales channel, the OEM segment accounted for the largest market share in 2024.

- By sales channel, the aftermarket segment will grow notably in the market over the forecast period.

AI Impact on the Automotive Switch Market

AI is significantly transforming the automotive switch market due to its unprecedented features that can be applied in diverse sectors, including the automotive sector. The major trend derived from AI in EVs and HEVs is to find the snap switches in the seats. A notable trend is the use of semi-autonomous driving cars. When these cars are in pilot or automatic driving mode, AI can detect the configuration and activate safety mode with the help of automatic switches.

Increasing trend for AI-based safety features in automobiles proliferating the automotive switch market globally. In electric vehicles, the structure can be changed to a fully flat floor with the help of rearrangement of the automobile's interior. In this situation, the AI can detect the position of the seat in order to activate or deactivate the security and safety features like airbags.

Market Overview

The global automotive switch market has seen a profound transformation due to the increasing demand for passenger vehicles and their comfort and safety features equipped with technological advancements. by understanding this trend, manufacturers are creating the most advanced switches that can be applicable and support other systems in automobiles, fuelling the market further. The shift from mechanical to electronic components is expected to significantly increase the demand for various switches in the automotive industry. Since automotive switches can control vehicle lighting and other systems, all systems and switches are, thus, crucial parts of the automobile industry.

Top 10 Automotive AI Startups

| Startup Name | Sub-domain |

| SKAIVISION | Automotive Video Intelligence |

| JuiceServe | EV Computer Vision Platform |

| Mapless AI | Remote Car Operations |

| Revv | AI-powered ADAS Calibrations |

| Ambro | AI-driven Car Damage Inspection |

| LoopX | Autonomous Mining Vehicle Operation. |

| Brego | AI-powered Vehicle Valuation. |

| VisionRD | Automobile Quality Inspection |

| Alpha AI | AI-powered Auto Insurance |

| Strada Routing | Truck Shipment Routing |

Automotive Switch Market Growth Factors

- Rising demand for advanced switches in commercial vehicles.

- Increasing worldwide production of automobiles.

- Convenience of switches to function automatically.

- Expanding the market of EVs and HEVs in Asia Pacific.

- Growing demand for high-end safety features fuels the automotive switch market globally.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.92 Billion |

| Market Size in 2025 | USD 8.01 Billion |

| Market Size in 2024 | USD 7.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.52% |

| Largest Market | Asia Pacific |

| Base Year | 2025 to 2034 |

| Forecast Period | 2024 |

| Segments Covered | Type, Vehicle Type, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising emphasis on automotive safety

A major driver for the automotive switch market is increasing emphasis on overall automotive safety across the globe. Both enterprises and consumers are looking for comprehensive solutions for safety and data exchange between components of automobiles so that to meet growing demands for connectivity solutions, advanced driver assistance systems, and future technologies of automobiles. The development of advanced switches that are capable of integrating other safety features like automatic emergency braking systems, collision possibility warning systems, and lane-keeping systems is crucial.

Many marketers are investing heavily in these technologies and launching innovative vehicles equipped with such features, proliferating the automotive switch market on a broader scale. Since the vehicles are equipped with advanced features, they need some systems to support these features, integrate complex safety systems, and improve overall user control.

Restraint

Volatile nature of raw materials

The major drawback that the automotive switch market is experiencing is the volatility in prices of available raw materials used to create switches. Materials like paper, plastics, and metal sheets are used for the bulk manufacturing of the switches used in automobiles. Noble metals are also called plating materials, and their prices are subject to volatility, causing ups and downs in the global market and, in turn, hindering the market. The conductive part in the switch is made from silver or silver-Cd, which helps in breaking and making the electrical connection called contacts. Since the cost of silver is also variable in nature, it affects the overall price of the raw materials.

Opportunity

Global inclination towards EVs and HEVs

The major opportunity that automotive switch market hols is the inclination towards electric and hybrid vehicles is changing the automotive industry globally led to the substantial changes in the automotive switch technology. Such a transition has occurred due to the changing climate concern. Stringent rules of government in many countries and technological advancement in the battery technologies.

Increasing emphasis on developing the switches which can reduce energy wastage to contribute about overall efficiency of the automotive is creating lucrative opportunity for the global automotive switch market. The features of electric and hybrid light vehicles is the preference for energy efficiency for all components including switches too.

- In 2023, Volkswagen made the announcement of its ambition to spend more than 122 billion euros on electrification and digitalization between 2023 and 2027; in 2023, Honda and Sony launched Afeela, a mobility brand with an ultra-connected zero-emissions prototype equipped with 45 sensors - LiDARs (Light detection and ranging), cameras. Which will be distributed around the outside and inside the vehicle.

Type Insights

The HVAC segment registered for the largest share of the automotive switch market in 2024. The growth of this segment is due to the increasing adoption of the automotive industry for climate control systems in automobiles to mitigate the danger of excessive emission of carbon dioxide, which results in global warming and polar ice melting instances, adversely affecting the ecosystem further.

- In December 2023, Antolin developed a touch control panel for Tata Harrier and Safari SUVs. The panel is positioned below the air vents. It works as a personal command center and allows users to control the fully automatic temperature controller (FATC)-HVAC system and other functions through a hybrid system that uses sliders, capacitive switches, and toggles. It also includes a sleek piano black deco trim that covers the entire instrument panel, direct ambient light (RGB), and advanced electronics.

Vehicle Type Insights

The HCVs segment dominated the global automotive switch market. The segment is growing due to the increasing demand for luxury cars due to their highly advanced features, which offer excellent driving experience and comfortable traveling owing to the various infotainment systems in it. The market is again classified into passenger cars and light commercial vehicles.

Sales Channel Insights

The OEM segment accounted for the largest automotive switch market share in 2024. Although OEM parts are more expensive, it is meet every standard which fuels the segment's growth and provide a warranty for the automobile's parts, making it convenient for buyers to repair damaged parts with affordability and reliability.

The aftermarket segment will grow notably in the automotive switch market over the forecast period. Although aftermarket parts may not meet the same standard as OEM, they are quite inexpensive and specifically suitable for individuals with budget constraints, fuelling the segment's demand further. Aftermarket represents many benefits in the automobile industry.

- In January 2023, the independent automobile aftermarket's top full-range supplier, Hella Pagid, is working to strengthen its position.

Regional Insights

Asia Pacific accounted for the largest share of the automotive switch market in 2024. The dominance of this region is due to the proliferation of the EV sector in leading countries of Asia Pacific, rising production of automobiles, increasing demand by consumers for advanced features in the vehicles, and new and innovative launches for multimedia-equipped vehicles.

Various incentives and policies are offered by many governments for the adoption of EVs in countries like South Korea for a greener future, which is driving the demand for technically advanced EVs, eventually leading to the expansion of the automotive switch market in Asia Pacific. Specialized switches provide benefits like supporting various functions such as regenerative braking and the management of batteries to efficiently manage the energy usage in the vehicles.

- In April 2023, Infineon Technologies introduced its new automotive smart high-side power-switch portfolio, known as PROFET Load Guard 12V. This innovative portfolio features a combination of adjustable overcurrent limitation and capacitive load switching (CLS) mode, offering a flexible response to the diverse requirements of modern secondary power distribution. The technology also includes protection mechanisms essential for the integration of safety-critical advanced driver assistance systems (ADAS).

North America will register significant growth in the automotive switch market over the forecast period. The growth of this region is due to the leading countries like the United States and Canada, which show their dominance over the market. The U.S. market is proliferating due to the increasing demand for the strong presence of market leaders and increasing demand for advanced automobiles and electrification in automobiles, including safety features and law compilation.

- In June 2023, Marvell Technology, Inc., a leading provider of data infrastructure semiconductor solutions, announced the introduction of the Brightlane Q622x family of central Automotive Ethernet switches. These switches represent the highest capacity. It is helpful for an emerging category of devices designed to support computing architectures that enhance safety and enable software-defined services for the next generation of vehicles.

Automotive Switch Market Companies

- Delphi Technologies

- Leopold Kostal GmbH & Co. KG

- Panasonic Automotive Systems Co.

- Valeo

- ZF Friedrichshafen AG

- TRW Automotive US LLC

- Marquardt GmbH

- Preh GmbH

- Ark-Les Connectors

- D&R Technology

- LLC

- Diamond Electric Manufacturing Corporation

- E-Switch Inc

- Honeywell Inc.

Recent Developments

- In January 2024, ZF Friedrichshafen AG announced that ZF Passive Safety Systems offers its belt tensioner with multiple switchable load limiters (MSLL), which helps further reduce the consequences of accidents.

- in April 2024, Switch Mobility, the electric vehicle division of Ashok Leyland launch the IeV 4, its first electric light commercial vehicle, from its Hosur facility. This introduction marks the commencement of manufacturing for Switch Mobility's IeV series of electric light commercial vehicles (e-LCVs).

- In September 2023, Continental and Ethernovia collaborated to create a high-bandwidth, low-latency switch in a 7nm process for software-defined vehicles (SDVs) to move data efficiently and securely.

Segments Covered in the Report

By Type

- HVAC Switches

- Steering Wheel Switches

- Ignition Switches

- Multi-Purpose Switches

- Door & Window Switches

- Seat Control Switches

- Overhead Console Switches

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Sales Channel

- Original Equipment Manufacturers

- Aftermarket

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting