What is the Bioinformatics-as-a-Service (BaaS) Market Size?

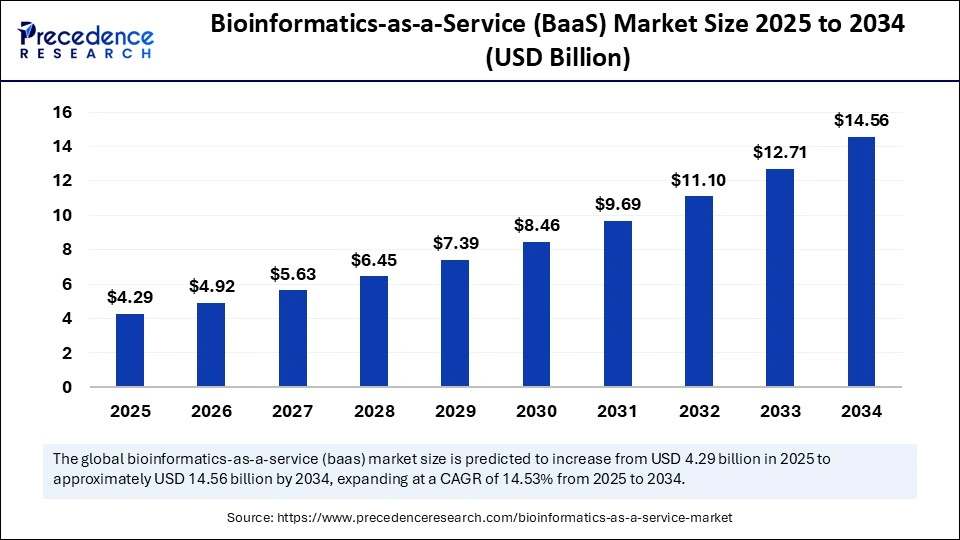

The global bioinformatics-as-a-service (BaaS) market size was calculated at USD 3.75 billion in 2024 and is predicted to increase from USD 4.29 billion in 2025 to approximately USD 14.56 billion by 2034, expanding at a CAGR of 14.53% from 2025 to 2034. The bioinformatics-as-a-service (BaaS) market is an emerging sector that offers computational solutions for analyzing biological data.

Market Highlights

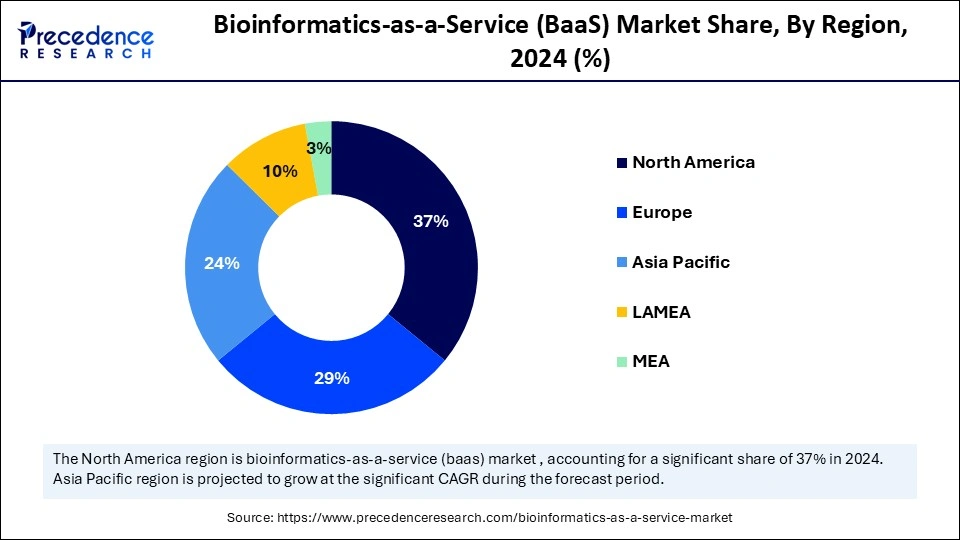

- North America dominated the market, holding the largest market share of 37% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR in the bioinformatics-as-a-service (BaaS) market between 2025 and 2034.

- By service type, the sequence analysis (DNA) segment held the largest market share of 28% in 2024.

- By service type, molecular modeling and simulation are expected to grow at a remarkable CAGR between 2025 and 2034.

- By deployment mode type, the cloud-based segments held the largest market share of 42% in 2024.

- By deployment mode type, hybrid cloud energy is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application type, the genomics segment held the largest market share, accounting for 33% of the market in 2024.

- By application type, the clinical diagnostics segment is expected to grow at a remarkable CAGR in the bioinformatics-as-a-service (BaaS) market between 2025 and 2034.

- By end-user type, the pharmaceutical & biotechnology segment held the largest market share of 38% in 2024.

- By end-user type, clinical & diagnostic labs are expected to grow at a remarkable CAGR between 2025 and 2034.

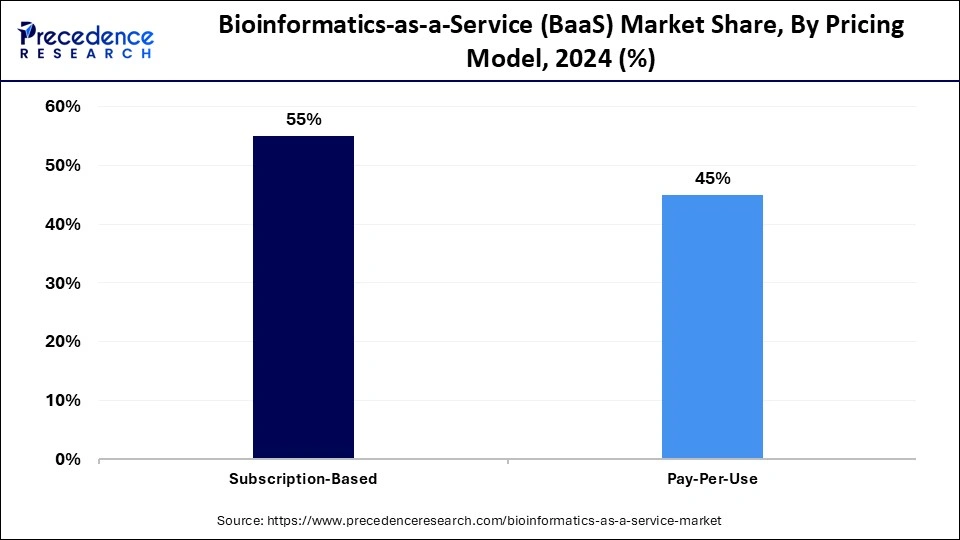

- By pricing model type, the subscription-based segment held the largest share of the bioinformatics-as-a-service (BaaS) market, accounting for 55% of the market share in 2024.

- By pricing model type, pay-per-use is expected to grow at a remarkable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 3.75 Billion

- Market Size in 2025: USD 4.29 Billion

- Forecasted Market Size by 2034: USD 14.56 Billion

- CAGR (2025-2034): 14.53%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is the Bioinformatics-as-a-Service (BaaS) Market?

The Bioinformatics-as-a-Service (BaaS) Market encompasses outsourced, cloud-enabled, and subscription-based bioinformatics platforms that deliver computational power, analytical pipelines, and data management capabilities for complex biological datasets. Instead of maintaining costly infrastructure and in-house expertise, organizations leverage BaaS to process next-generation sequencing (NGS), omics data, molecular modeling, and systems biology workflows. These services provide scalability, speed, and cost efficiency through AI- and ML-driven analysis, enabling pharmaceutical firms, healthcare providers, academics, and CROs to accelerate discovery and diagnostics: rising genomics initiatives, precision medicine programs, and agricultural biotechnology research fuel adoption. With secure cloud deployment, customizable workflows, and flexible pricing models, BaaS is positioned as a critical enabler for integrating big data into life sciences and healthcare innovation globally.

The Bioinformatics-as-a-Service (BaaS) market is expanding rapidly, driven by the growing demand for efficient handling of complex biological data. It offers cloud-based subscription models that provide organizations with scalable computational and analytical resources, eliminating the need for heavy infrastructure investment. The adoption of BaaS is accelerated by growing initiatives in genomics, precision medicine, and agricultural biotech. These services leverage artificial intelligence and machine learning to deliver faster, cost-effective analysis, benefiting pharmaceutical companies, healthcare institutions, and research organizations. Secure cloud deployment and customizable workflows are key features that support a wide range of applications in the healthcare and life sciences sectors. Overall, BaaS is becoming an essential component for integrating big data into global health and scientific research advancements.

Bioinformatics-as-a-Service (BaaS) Market Outlook

- Industry Growth Overview: Growth is propelled by three converging forces: profusion of high-throughput assays, rising demand for translational analytics, and the scarcity and hence premium of skilled bioinformaticians. As life-science organizations focus on core discovery or clinical missions, outsourcing the complexity of analytics becomes an operational imperative. Startups and incumbent platform providers compete to provide faster turnarounds, certified pipelines, and domain expertise, driving improvements in price-performance. The commercialisation of multi-omics and the need for federated analyses across distributed cohorts create a sustained demand for secure, interoperable service layers.

- Sustainability Trends: Sustainability in BaaS is manifested through energy-efficient computing, green cloud practices, and software designs that optimize resource utilization; serverless and spot-instance strategies reduce the carbon footprint, as analyzed. Providers are increasingly publishing lifecycle assessments for compute-intensive pipelines and negotiating renewable energy credits with cloud partners to align environmental claims with measurable actions. Data minimisation and retention policies not only protect privacy but also curtail storage overheads, contributing to sustainable operations. On the laboratory side, in silico methods that reduce wet-lab iterations lower reagent waste and associated emissions. Circular procurement, which reuses validated container images and standard pipelines, reduces duplicated development effort and the attendant computational waste. Collectively, these practices make bioinformatics services both scientifically efficient and ecologically conscious.

- Major Investors: Capital flows into the BaaS space from specialist life-science venture funds, cloud infrastructure investors, and corporate venture arms of large pharmaceutical companies seeking strategic analytics capabilities. Growth equity and private capital players favor platform providers with stable ARR, a regulatory pedigree, and institutional clients. Strategic cloud partnerships and co-investment arrangements also emerge as investors seek to mitigate the risks associated with scaling up compute-bound businesses. Impact- and mission-oriented funds occasionally underwrite projects that democratize access for under-resourced regions, recognizing the public good value. In aggregate, investor interest aligns with measurable traction: validated pipelines, recurring revenue, and defensible domain expertise attract the deepest pockets.

- Startup Economy: The startup ecosystem is effervescent. Boutique firms specialize in niche domains, such as single-cell deconvolution, microbiome analytics, and immunopeptidomes, while full-stack providers assemble modular platforms and developer-friendly APIs. Academic spinouts populate the innovation funnel, translating novel algorithms into service offerings underpinned by early adopter collaborations. Incubators and cloud credits programmes lower barriers to entry, enabling lean teams to validate market fit rapidly. Yet scaling remains the crucible: moving from bespoke analyses to certified, auditable services requires investment in engineering, compliance, and client success. Consequently, successful startups either double down on vertical specialization or pursue platform convergence through strategic partnerships, mergers, and acquisitions (M&A).

Key Technological Shift in the Bioinformatics-as-a-Service (BaaS) Market

The definitional technological shift is the migration from ad hoc scripts and bespoke pipelines to cloud-native, containerized, and reproducible workflow ecosystems orchestrated via APIs. This architectural reorientation enables horizontal scalability, continuous integration of new algorithms, and deterministic provenance, which is vital for regulatory acceptance. Equally transformative is the integration of federated analytics and privacy-preserving computation, which allows multi-cohort studies without centralizing sensitive data. Advances in automated annotation, ontology mapping, and standardized metadata schemas reduce human bottlenecks, thereby accelerating turnaround times. Finally, the commoditization of GPU and specialized accelerator resources democratizes computationally intensive tasks, such as structural prediction and large-scale machine learning-based training. Collectively, these shifts transform bioinformatics from an artisanal craft to an industrial service.

Market Key Trends

- Platformisation: modular BaaS stacks offering end-to-end pipelines and developer APIs.

- Federated and privacy-preserving analytics for cross-institutional studies.

- Vertical specialisation in domains such as oncology, rare diseases, and agrigenomics.

- Certification and auditability are becoming procurement prerequisites for enterprise clients.

- Edge analytics and on-prem hybrid models for regulated clinical workflows.

- Bundled value: analytics plus interpretation, regulatory support, and data management.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 3.75 Billion |

| Market Size in 2025 | USD 4.29 Billion |

| Market Size by 2034 | USD 14.56 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Deployment Mode, Application, End User, Pricing Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

From Data to Decision: The Value Imperative

The primary driver is the imperative to convert voluminous biological data into clinically and commercially actionable decisions with speed and defensibility. Organizations increasingly prioritise outcomes, validated biomarkers, go/no-go criteria, and regulatory narratives over raw computational outputs. BaaS providers who can guarantee reproducible, auditable, and clinically interpretable results, therefore capture disproportionate value. The model reduces time-to-insight and shifts capital from infrastructure to interpretation, aligning stakeholder incentives. Consequently, the ability to deliver decision-grade analytics at scale, with compliance seals, seals the market's adoption.

Restraint

Trust and Triage: The Validation Bottleneck

A central restraint is the requirement for validated, auditable pipelines, and the slow institutional appetite for entrusting critical decisions to external services without extensive triage. Clinical and regulatory stakeholders demand provenance, version control, and rigorous performance metrics requirements that elevate the barrier to entry. Data heterogeneity and variable annotation standards further complicate cross-study comparability, making vendor selection a challenging task. As a result, procurement cycles lengthen and vendors must invest disproportionately in compliance, documentation, and client validation. Until industry-wide standards gain traction, this validation bottleneck will temper the rapid commoditization of these technologies.

Opportunity

Democratising Discovery: Access at Scale

The prime opportunity is to democratize sophisticated bioinformatics capabilities for smaller biotechs, academic consortia, and emerging-market health systems that lack in-house expertise. By packaging validated, pay-as-you-go services, providers in the bioinformatics-as-a-service (BaaS) market can unlock latent demand and accelerate translational pipelines globally. Complementary services regulatory dossiers, payer evidence generation, and clinical interpretation layers create additional monetization avenues. Partnerships with cloud hyperscalers and regional data centers can also address concerns related to latency, sovereignty, and cost. In short, scaling access to reliable analytics converts a niche technical capability into a ubiquitous element of modern bioscience.

Segment Insights

Service Type insights

Why Is Sequence Analysis (DNA) Dominating the Bioinformatics-as-a-Service (BaaS) Market?

Sequence analysis (DNA) is dominating the bioinformatics-as-a-service market, holding a 28% share, driven by its primacy. Its primacy stems from the ubiquity of DNA sequencing in both research and clinical applications, where accurate mapping of genetic variations forms the bedrock of modern biology. Pharmaceutical companies, research institutes, and diagnostic laboratories depend heavily on sequence analysis tools for drug discovery and biomarker identification. Its integration with machine learning algorithms further enhances predictive power, making it indispensable in precision medicine. The reliability and scalability of sequence analysis workflows provide users with confidence in their findings. Consequently, this segment enjoys steady and consistent demand.

Molecular modeling and simulation are emerging as the fastest-growing service type, propelled by their transformative impact on drug development and protein engineering. These tools enable researchers to predict molecular interactions with unprecedented accuracy, reducing time and costs associated with experimental assays. The integration of advanced algorithms and AI-powered simulations enhances the fidelity of molecular dynamics studies. With the pharmaceutical industry shifting toward targeted therapies, molecular modeling provides a vital toolkit for validating hypotheses and designing therapeutics. Its adaptability to both small molecules and biologics has widened its scope. As a result, this sub-segment is accelerating at an impressive pace.

Deployment mode Insights

Why Is Cloud-Based Dominating the Bioinformatics-as-a-Service (BaaS) Market?

The cloud-based segment is dominating the bioinformatics-as-a-service market, holding a 42% share, driven by its offerings of scalability, cost-effectiveness, and real-time accessibility. Researchers and enterprises favour public clouds for handling massive datasets without the burden of infrastructure maintenance. Leading cloud providers ensure high security, regulatory compliance, and integration with cutting-edge analytics tools. Public cloud models also enable cross-border collaborations, vital in multinational research efforts. The pay-as-you-go flexibility attracts startups and academic institutions, and operating in the cloud remains the preferred deployment mode for most users.

The hybrid cloud model is rapidly gaining traction as the fastest-growing deployment mode. It strikes a balance between security-sensitive operations handled on-premises and large-scale computations executed on the cloud. Pharmaceutical firms and diagnostic laboratories are particularly drawn to hybrid systems for their ability to safeguard proprietary data while leveraging the scalability of the cloud. This model offers flexibility to adjust workloads according to urgency and confidentiality requirements. Its adoption is accelerated by increasing data privacy regulations across geographies. Hybrid cloud thereby emerges as a pragmatic solution for enterprises seeking both agility and security.

Application Insights

Why Genomics Is Dominating the Bioinformatics-as-a-Service (BaaS) Market?

Genomics is dominating the bioinformatics-as-a-service market, holding a 33% share, driven by its surge in genome-wide association studies, personalized medicine initiatives, and agricultural genomics, which underscores its significant market presence. Bioinformatics platforms facilitate faster sequencing, annotation, and comparative genomics with precision. Governments and private entities are investing heavily in population-scale genomics projects, further solidifying this segment's primacy. The downstream impact of genomics extends into oncology, rare disease diagnosis, and preventive healthcare. This persistent relevance makes genomics the anchor of bioinformatics applications.

Clinical diagnostics is the fastest-growing application area, buoyed by the rise of precision medicine and early disease detection. Diagnostic laboratories increasingly rely on bioinformatics to interpret next-generation sequencing (NGS) data in oncology, infectious diseases, and hereditary conditions. AI-driven pipelines are enhancing turnaround times, making diagnostics more accessible to clinicians. The COVID-19 pandemic further highlighted the indispensability of bioinformatics in real-time pathogen tracking. Clinical diagnostics benefits not only healthcare providers but also patients through faster, more personalized treatment plans. Consequently, its growth trajectory surpasses that of other applications.

End User Insights

Why Pharmaceutical & Biotechnology Is Leading the Bioinformatics-as-a-Service (BaaS) Market?

The pharmaceutical & biotechnology industries are dominating the bioinformatics-as-a-service market, holding a 33% share. Their dependence on bioinformatics spans target identification, lead optimization, clinical trial design, and post-market surveillance. These firms utilize bioinformatics platforms to accelerate their drug discovery pipelines, thereby significantly reducing development timelines. Partnerships with bioinformatics providers enhance R&D efficiency while lowering attrition rates. The push toward biologics and gene therapies has only amplified reliance on computational tools. Hence, this end-user group forms the backbone of the bioinformatics-as-a-service market.

Clinical and diagnostic laboratories are the fastest-growing end-user segment, reflecting the healthcare system's transition toward data-driven diagnostics. Labs utilize bioinformatics to accurately interpret patient-specific genomic and proteomic datasets. The rising demand for liquid biopsies and non-invasive testing is driving the acceleration of adoption. The proliferation of affordable sequencing technologies has enabled even mid-sized labs to deploy advanced bioinformatics services. Furthermore, hospital-affiliated labs are integrating bioinformatics into routine workflows. This democratization of access is fueling exponential growth in the segment.

Pricing Model Insights

Why Is Subscription-Based Leading the Bioinformatics-as-a-Service (BaaS) Market?

Subscription-based models dominate the market, accounting for 55%. They provide predictable revenue streams for providers and offer cost certainty for end-users. Customers benefit from continuous access to updated tools, technical support, and compliance features. Subscription packages cater to institutions ranging from small labs to global pharmaceutical giants. The model aligns well with the long-term, iterative nature of scientific research. As a result, subscription-based pricing remains the cornerstone of the market's financial architecture.

Pay-per-use models are registering the fastest growth, driven by their appeal to startups, academic institutions, and resource-constrained laboratories. This model eliminates the burden of upfront commitments, allowing users to access advanced tools only when needed. It provides flexibility to scale usage according to project demands, making it ideal for pilot studies and intermittent research. The democratization of bioinformatics through pay-per-use is widening access across the global research ecosystem. Its adaptability ensures rapid adoption in diverse settings. Ultimately, this pricing model represents the market's most dynamic growth frontier.

Regional Insights

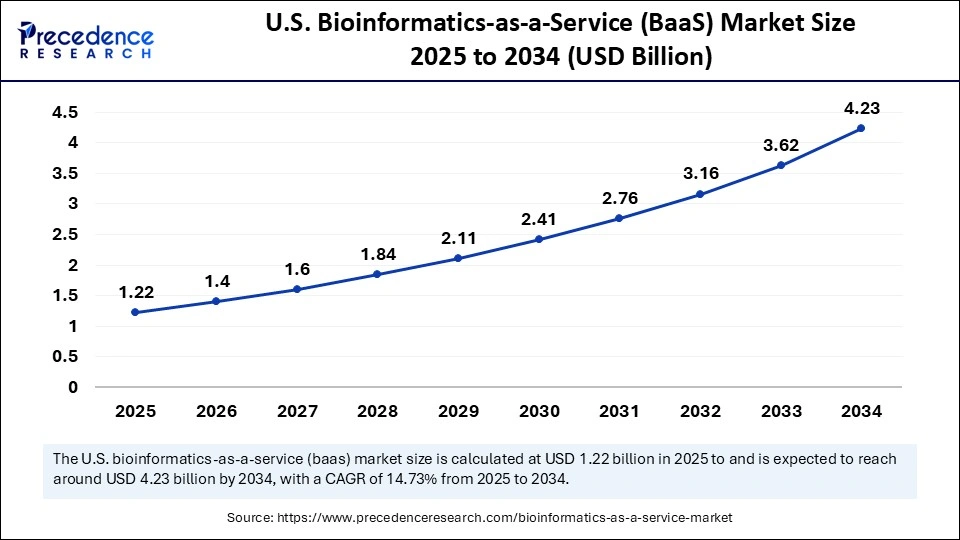

U.S. Bioinformatics-as-a-Service (BaaS) Market Size and Growth 2025 to 2034

The U.S. bioinformatics-as-a-service (BaaS) market size was evaluated at USD 1.07 billion in 2024 and is projected to be worth around USD 4.23 billion by 2034, growing at a CAGR of 14.73% from 2025 to 2034.

Why Does North America Reign Supreme in the Bioinformatics-as-a-Service (BaaS) Market?

North America holds a leading position due to its dense ecosystem of genomic centers, pharmaceutical headquarters, cloud infrastructure, and depth of venture capital. The region benefits from mature clinical trial networks and a culture of early adoption that favours outsourcing of analytics to specialist providers. Providers that demonstrate regulatory-grade pipelines and HIPAA-aligned governance find expansive payor and enterprise markets here. The presence of major cloud hyperscalers and CDMOs reduces time-to-scale for compute-heavy services. Talent pools of bioinformaticians, computational biologists, and regulatory experts further entrench the region's advantage. Consequently, North America remains the fulcrum of both innovation and commercialisation in BaaS.

North America's dominance is reinforced by institutional demand from large pharmaceutical companies for outsourced, auditable analytics, as well as the proliferation of precision medicine initiatives that require scalable bioinformatics backends. Academic medical centres and consortia often act as early adopters, validating pipelines that later transition to commercial clients. Enterprise procurement preferences for vendors with SOC-2, ISO, and clinical validation credentials create high switching costs, favoring established providers. The ecosystem's self-reinforcing feedback loop of capital, talent, and infrastructure sustains growth.

Why Asia Pacific Fastest Growing Bioinformatics-as-a-Service (BaaS) Market?

The Asia Pacific is the fastest-growing region, driven by increasing biotech investments, national genomics initiatives, and the rapid expansion of cloud and computing capacity across major markets. Governments and private sector actors alike are increasing their spending on translational research, while large patient populations provide unparalleled cohorts for multi-center studies. Local providers are emerging with hybrid on-prem/cloud offerings that respect data-sovereignty imperatives while leveraging global algorithms.

Cost-effective talent pools and manufacturing ecosystems also encourage regionalisation of both wet-lab and analytic workflows. As regulatory frameworks mature and regional collaboration deepens, the Asia Pacific is expected to capture an increasing share of global BaaS demand. The region's growth is accentuated by strategic partnerships between local startups and global platform providers, enabling knowledge transfer and capacity building. Investments in regional data centers and compliance frameworks reduce latency and foster trust among health systems and regulators. Domestic pharmaceutical markets seeking to accelerate R&D also incentivise outsourcing to capable local BaaS vendors.

China's rapid scaling of genomic initiatives and sizeable biotech investment pools position it as a powerhouse for large-scale cohort analytics, while India's deep IT and engineering talent base, coupled with cost advantages, make it an attractive site for platform engineering and managed-service delivery.

Bioinformatics-as-a-Service (BaaS) Market: Value Chain Analysis

- Raw Material Sources: Primary “raw materials” are digital: sequencing reads, mass-spec spectra, imaging datasets, and associated clinical metadata that feed analytic pipelines. Secondary inputs include curated reference databases, ontologies, and annotation libraries that enable meaningful interpretation.

- Technology Used: Core technologies include cloud orchestration platforms, containerised workflow managers (CWL, Nextflow), and scalable data lakes integrated with analytics engines and ML toolchains. Security and compliance layers, encryption, IAM, and audit logging are essential components of service delivery.

- Investment by Investors: Investors marshal capital for platform engineering, regulatory compliance capabilities, and strategic partnerships with cloud providers and clinical networks. They prize recurring-revenue models, proven enterprise customers, and demonstrable regulatory pathways.

- AI Advancements: AI expedites feature extraction, phenotype-genotype associations, and predictive modelling, while also automating quality control and anomaly detection across pipelines. Machine learning models enhance variant prioritisation and accelerate multi-omics integration, improving both speed and clinical relevance.

Bioinformatics-as-a-Service (BaaS) Market Companies

- Illumina, Inc.

- Thermo Fisher Scientific

- Qiagen N.V.

- Agilent Technologies

- Fios Genomics

- Seven Bridges Genomics

- DNAnexus

- Eagle Genomics

- Genestack

- Partek Incorporated

- Sophia Genetics

- Advaita Bioinformatics

- Biomax Informatics

- BGI Genomics

- PerkinElmer Informatics

- Basepair Technologies

- Maverix Biomics

- Strand Life Sciences

- Geneious (Dotmatics)

- Qlucore

Recent Developments

- In September 2025, Cardiovascular disease continues to be India's most significant health issue, with its rising incidence resulting in greater morbidity, early fatalities, and substantial healthcare costs. In comparison to Western countries, cardiovascular diseases impact Indians at least ten years earlier and affect them during their most productive years. Our current challenge is to effectively tackle this issue and pave the way for a healthier, more productive nation.

(Source: https://www.hindustantimes.com) - In September 2025, Technology company Lenovo launched the newest iteration of its Genomics Optimization and Scalability Tool (GOAST), an advanced computing system that reduces the time needed to analyze a complete human genome from several days to only 24 minutes. The fourth version of the platform, known as GOAST 4.0, was announced this month and is intended to facilitate extensive genomics initiatives in healthcare, drug development, agriculture, and national health programs. An individual node of the updated system can handle up to 22,000 genomes annually, nearly triple the capability of previous versions.

Segments Covered in the Report

By Service Type

- Sequence Analysis

- DNA Sequencing

- RNA Sequencing

- Protein Sequencing

- Functional & Structural Analysis

- Pathway Analysis

- Protein Structure Prediction

- Data Mining & Integration

- Genome Assembly & Annotation

- Molecular Modeling & Simulation

- Customized Workflows

- Data Storage & Management

- Others

By Deployment Mode

- Cloud-Based BaaS

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Web-Based Platforms

- On-Premises (Managed Services)

By Application

- Genomics

- Transcriptomics

- Proteomics

- Metabolomics

- Drug Discovery & Development

- Clinical Diagnostics

- Agricultural & Environmental Research

- Others

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Clinical & Diagnostic Laboratories

- Contract Research Organizations (CROs)

- Hospitals & Healthcare Providers

- Agricultural & Environmental Organizations

By Pricing Model

- Subscription-Based

- Pay-Per-Use

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting