Bioresorbable Polymers Market Size and Growth 2025 to 2034

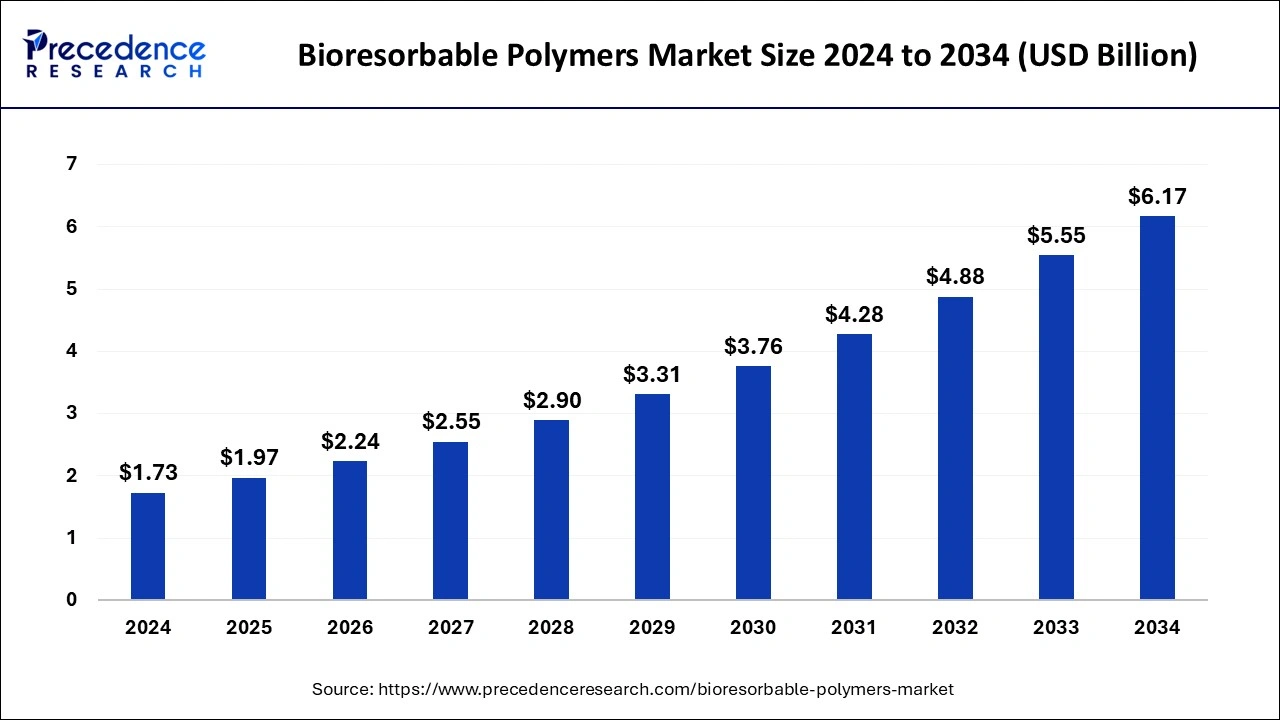

The global bioresorbable polymers market size was estimated at USD 1.73 billion in 2024 and is predicted to increase from USD 1.97 billion in 2025 to approximately USD 6.17 billion by 2034, expanding at a CAGR of 13.56% from 2025 to 2034. When utilized in medical applications, such as implants or medication delivery systems, bioresorbable polymers lower the possibility of immunological responses or unpleasant reactions because they are compatible with biological systems.

Bioresorbable Polymers Market Key Takeaway

- The global bioresorbable polymers market was valued at USD 1.73 billion in 2024.

- It is projected to reach USD 6.17 billion by 2034.

- The market is expected to grow at a CAGR of 13.56% from 2025 to 2034.

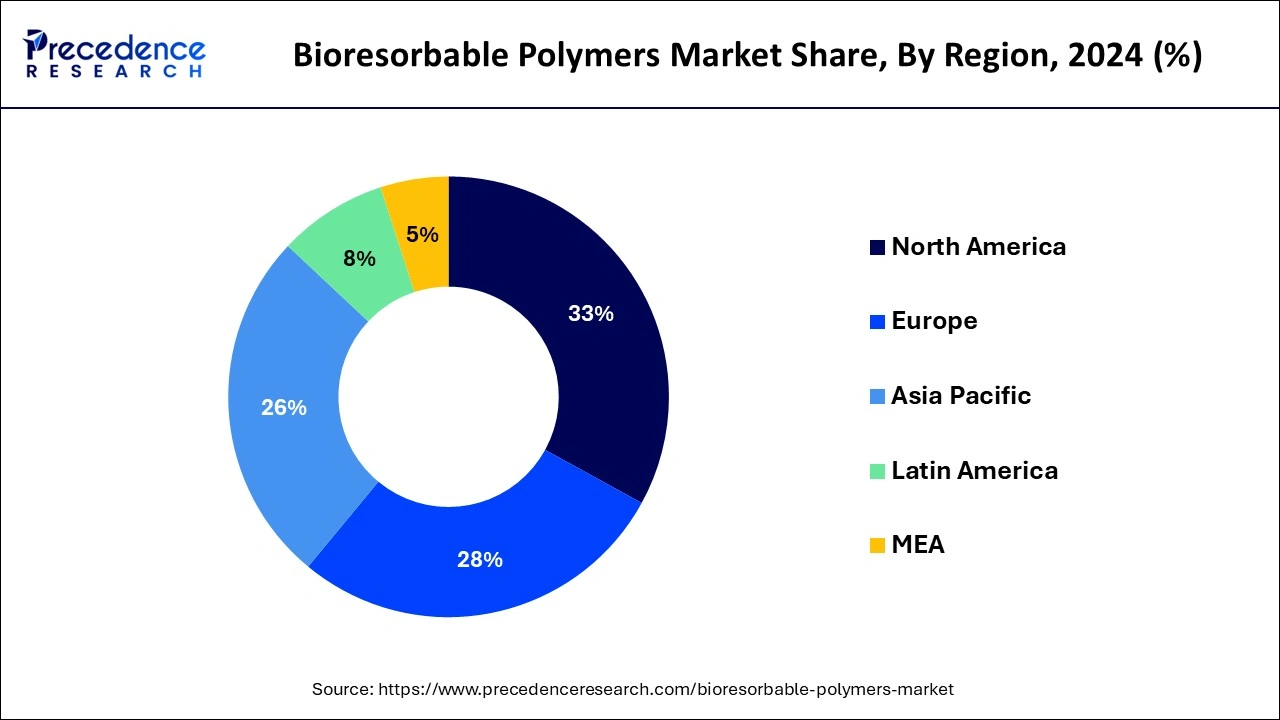

- North America has held the largest share of 33% in 2024.

- Asia Pacific is emerging as the fastest-growing region in the global market.

- By polymer type, the polylactic acid (PLA) segment led the market share of 33.50% in 2024.

- By polymer type, the poly (lactic-co-glycolic acid) (PLGA) segment is expected to grow at a significant CAGR of 9.20% over the projected period.

- By application, the medical devices segment held the biggest market share of 45.10% in 2024.

- By application, the tissue engineering segment is expanding at a significant CAGR of 10.30% from 2025 to 2034.

- By end user, the hospitals and clinics segment dominated the market with the largest share of 52.70% in 2024.

- By end user, the academic and research segment is expected to grow at a significant CAGR of 9.60% from 2025 to 2034.

- By manufacturing process, the extrusion segment led the market with a major market share of 28.90% in 2024.

- By manufacturing process, the 3d printing/additive manufacturing segment is expected to grow at a significant CAGR of 11.10% over the projected period.

U.S.Bioresorbable Polymers Market Size and Growth 2025 to 2034

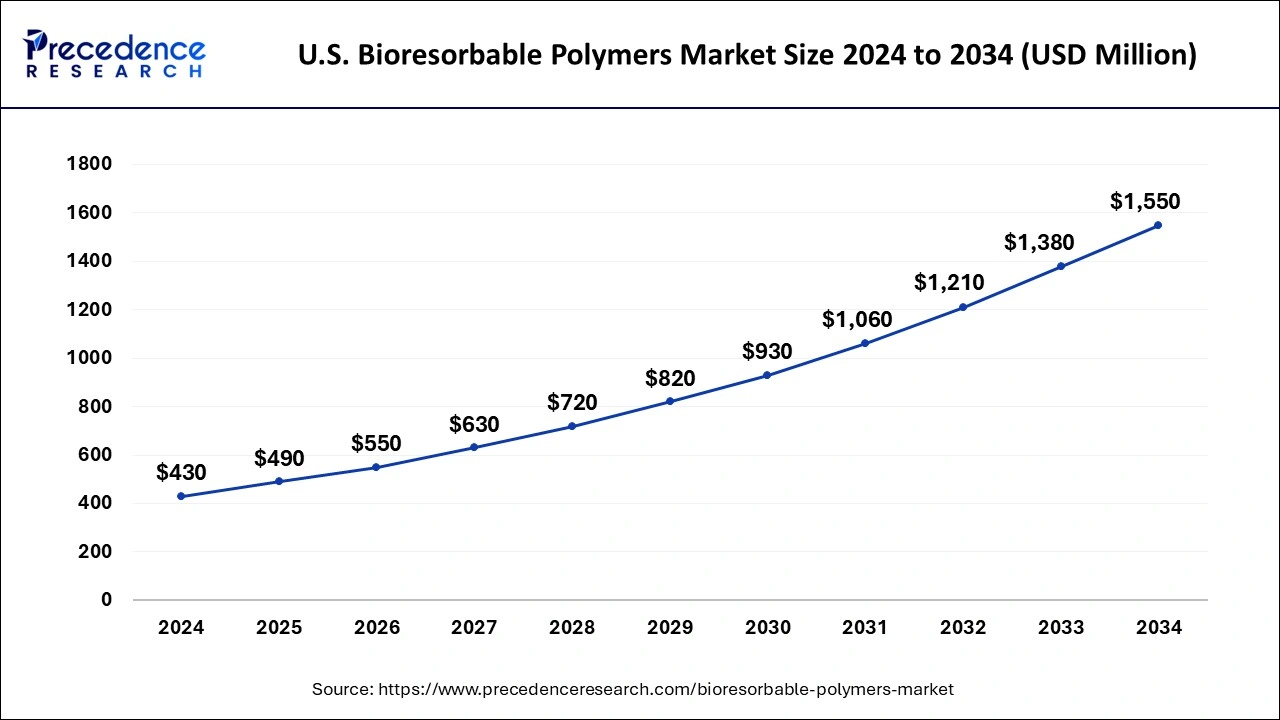

The U.S. bioresorbable polymers market size was estimated at USD 430 million in 2024 and is predicted to be worth around USD 1,550 million by 2034, at a CAGR of 13.68% from 2025 to 2034.

North America held the largest share of the bioresorbable polymers market in 2024. Due to the rising demand for bioresorbable polymers in a variety of applications, including packaging materials, drug delivery systems, and medical devices, the market for these polymers has been expanding rapidly in North America. These polymers can be used for a variety of purposes because of their benefits, which include biocompatibility, biodegradability, and flexibility. Innovative medical devices with improved biocompatibility and a lower risk of consequences are in greater demand due to the aging population and the rise in chronic diseases. The bioresorbable polymers market is expanding as a result of ongoing R&D efforts to create sophisticated, improved-property bioresorbable polymers. A growing number of people are interested in bioresorbable polymers as sustainable alternatives to conventional plastics due to rising environmental awareness and worries about plastic pollution.

Asia Pacific is emerging as the fastest-growing region in the global bioresorbable polymers market. The region's market has grown significantly in recent years due to a number of factors, including rising healthcare costs, growing public awareness of sustainable and biodegradable materials, and expanding demand for cutting-edge medical technologies. Key participants in this market include China, Japan, India, and South Korea because of their sizable patient populations and strong healthcare infrastructures. Further driving up demand for bioresorbable polymers used in implants and medical equipment is the region's recent boom in medical tourism. The need for bioresorbable polymers is growing in the area due to the rising incidence of chronic illnesses and technological developments in medicine.

Market Overview

The bioresorbable polymers market is primarily driven by their wide applicability in medical settings, including tissue engineering, orthopedic implants, drug delivery systems, and sutures. These polymers are very attractive in the medical field since they can break down within the body into non-toxic metabolites, removing the need for removal operations. Bioresorbable polymers are finding more and more uses in eco-friendly packaging solutions outside of the medical field.

Advanced bioresorbable polymers with enhanced qualities like mechanical strength, degradation rate control, and medication compatibility have been developed as a result of ongoing research and development activities. The bioresorbable polymers market is anticipated to keep growing due to technological developments, an increase in applications, and growing consumer awareness of environmental sustainability. The market for biodegradable and compostable packaging materials is expanding as a result of legislation designed to reduce plastic waste and growing environmental concerns.

Despite promising development potential, obstacles, including elevated production costs and restricted scalability of production processes, persist. Ongoing initiatives to address these issues, together with rising R&D spending, offer market participants extremely profitable prospects. The bioresorbable polymers market is expanding significantly worldwide, but it is primarily growing in North America and Europe because of their developed healthcare systems, robust research programs, and supportive policies that encourage the use of biodegradable materials.

Bioresorbable Polymers Market Growth Factors

- Bioresorbable polymers find widespread application in medicine, including wound closure, tissue engineering, orthopedic implants, and drug delivery systems. One of the main factors driving the market has been the rising demand for cutting-edge medical procedures and equipment.

- Excellent biocompatibility allows bioresorbable polymers to be safely taken and digested by the body without triggering harmful reactions. Because they lower the chance of inflammation and rejection, this characteristic makes them perfect for use in medical implants and devices.

- Bioresorbable implants, in contrast to conventional implants composed of durable materials like metal, progressively deteriorate and are absorbed by the body over time. This lessens patient agony and medical expenses by removing the need for follow-up surgeries to remove the implant after it has fulfilled its intended function.

- Bioresorbable medical device development and commercialization have received support from regulatory bodies, including the Food and Drug Administration (FDA) in the United States. In the market for bioresorbable polymers, investment, and innovation have been stimulated by clear regulatory channels for approval.

- When it comes to the environment, the bioresorbable polymers market is preferable to conventional non-biodegradable materials. An increasing number of people are interested in employing bioresorbable polymers as an environmentally acceptable substitute in a variety of applications as society grows more conscious of sustainability.

- Both the public and commercial sectors have made large investments in the bioresorbable polymers market, which has encouraged cooperation between academic institutions, research centers, and business leaders. These partnerships quicken the process of developing new products and bringing them to market, which in turn drives up market expansion.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.56% |

| Market Size in 2025 | USD 1.97 Billion |

| Market Size by 2034 | USD 6.17 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Research and development

Within the larger subject of biomaterials science, bioresorbable polymer research and development is a fascinating area. These polymers also referred to as bioabsorbable or biodegradable polymers have attracted a lot of interest because of their potential uses in a variety of industries, such as tissue engineering, regenerative medicine, drug delivery systems, and medical devices. In order to enhance a bioresorbable polymer's mechanical strength, degradation kinetics, and biocompatibility, researchers are always creating new ones or changing ones that already exist. Bioresorbable polymers are being functionalized to give them certain qualities or functions, like controlled medication release, cell adhesion, or antibacterial action. As the bioresorbable polymers market grows, so does the need to meet regulatory criteria and guarantee the efficacy and safety of the products.

Restraint

Degradation rate variability

One factor that significantly affects the bioresorbable polymers market in a variety of industries, including packaging, medicine, and pharmaceuticals, is the market's variability in degradation rates. Biodegradable or bioresorbable polymers are substances that, when broken down over time, produce harmless byproducts that the body can either absorb or eliminate. The rate at which bioresorbable polymers degrade can be affected by the processing techniques employed to create those products. The polymer's crystallinity, shape, and degradation kinetics can all be impacted by processing variables like temperature, pressure, and solvent choice. While stabilizers and antioxidants can prolong the polymer's shelf life or slow down breakdown, fillers, and reinforcing agents can change the kinetics of degradation by altering the migration of enzymes and water molecules into the polymer matrix.

Opportunity

Tissue engineering and regenerative medicine

The goal of the exciting fields of tissue engineering and regenerative medicine is to replace damaged human organs and tissues with functioning ones. In these domains, the bioresorbable polymers market is important because it offers matrices or scaffolds for the development of cells and tissues. Because of the way these polymers break down over time, the scaffold will eventually be replaced by freshly created tissue. Global population aging is predicted to increase demand for regenerative medicine and tissue replacements, which will propel the market for bioresorbable polymers in tissue engineering. The exact creation of complex tissue scaffolds utilizing bioresorbable polymers has been made possible by developments in 3D printing, microfabrication, and biomaterial processing. This has expanded the use of these scaffolds in regenerative medicine.

Polymer Type Insights

The polylactic acid (PLA) emerged as the dominant material in the market in 2024, primarily due to its favorable properties, including biodegradability, biocompatibility, and relatively low cost. These features make PLA a preferred choice for various medical and industrial applications. Derived from renewable resources such as cornstarch or sugarcane, PLA serves as a more sustainable alternative to petroleum-based plastics. Its biodegradability, which allows microorganisms to break it down, enhances its appeal. This characteristic makes PLA suitable for medical applications, including implants and drug delivery systems. Additionally, PLA possesses strong mechanical properties, such as stiffness and strength, which make it appropriate for use in orthopedic devices like screws, pins, and plates.

The poly (lactic-co-glycolic acid) (PLGA) segment is the fastest-growing area in the market. This growth is attributed to PLGA's biocompatibility, adjustable degradation rates, and diverse applications, particularly in drug delivery and tissue engineering. PLGA can be engineered for controlled and sustained drug release, and its FDA approval for various uses reinforces its status as a preferred material in the healthcare sector. It is utilized in drug delivery systems, tissue engineering scaffolds, sutures, and implants. Moreover, the ratio of lactic acid to glycolic acid in PLGA can be tailored to control the degradation rate, allowing customization for specific applications.

Application Insights

The medical devices segment dominated the market in 2024, because of the increasing demand for minimally invasive procedures and advanced materials in orthopedic applications, alongside the growing prevalence of chronic diseases. The trend towards minimally invasive surgeries, which involve smaller incisions and reduced tissue damage, has heightened the need for advanced medical devices that are biocompatible, durable, and flexible. Ongoing advancements in polymer formulations and manufacturing processes have further improved the performance, biocompatibility, and degradation rates of bioresorbable polymers, leading to their wider adoption in various medical applications. These polymers facilitate natural tissue regeneration, eliminating the need for secondary surgeries to remove implants.

The tissue engineering segment is the fastest-growing application in the market, driven by the rising demand for regenerative medicine and advancements in biomaterials for tissue regeneration. This growth is propelled by the increasing prevalence of chronic and degenerative diseases, creating a need for effective tissue repair and replacement therapies. Bioresorbable polymers are gaining popularity due to their biocompatibility and their ability to mimic the natural extracellular matrix, which supports cell adhesion, proliferation, and tissue regeneration. Additionally, 3D printing technology enables the creation of customized scaffolds with complex architectures that replicate natural tissue, while smart polymers can respond to biological signals for controlled drug delivery and tissue regeneration.

End User Insights

The hospitals and clinics segment leads the bioresorbable polymers market in 2024, as these institutions play a crucial role in performing specialized surgical procedures, particularly those involving bioresorbable implants in orthopedic, cardiovascular, and other complex cases. Hospitals have the necessary infrastructure, trained personnel, and financial resources to adopt and implement these advanced technologies, while also handling large patient volumes and providing post-operative care. Furthermore, the shift towards value-based care models in hospitals incentivizes the use of bioresorbable implants to reduce readmissions and shorten hospital stays, ultimately lowering overall healthcare costs.

On the other hand, the academic and research segment is the fastest-growing area in the market during the forecast period. This growth is driven by a focus on innovation and development through extensive research and collaboration. This segment is dedicated to discovering new applications, improving existing materials, and developing novel formulations. Academic and research institutions are at the forefront of exploring new bioresorbable polymer materials and their potential applications. They conduct fundamental research to understand polymer properties, degradation mechanisms, and biocompatibility. These institutions also develop and refine advanced techniques for polymer synthesis, processing, and characterization, including 3D printing and nanofabrication.

Manufacturing Process

The extrusion segment dominated the market in 2024. This was largely due to its versatility, cost-effectiveness, and ability to produce a wide range of product forms, including films, filaments, and tubes. These characteristics make extrusion ideal for various medical and packaging applications. It is also a continuous process, which allows for high-volume production and efficient manufacturing. Moreover, extrusion is generally more cost-effective compared to some other methods, like injection molding, particularly for large-scale production. Advances in extrusion technology, such as the development of specialized extruders for bioresorbable polymers and the integration of 3D printing with extrusion, further reinforce its leading position.

In contrast, 3D printing, also referred to as additive manufacturing, is anticipated to experience the fastest growth in the market. This is mainly attributed to its capability to produce complex, customized geometries with minimal waste, making it especially suitable for biomedical applications like implants and drug delivery systems. 3D printing offers precise control over material placement and porosity, which is essential for creating structures that mimic natural tissues and enable controlled drug release. The ability to accurately control material placement allows for the development of scaffolds with specific porosity and interconnected pore networks, which are crucial for tissue engineering applications. Additionally, 3D printing facilitates rapid prototyping of new designs, leading to faster development and testing of bioresorbable polymer-based products.

Bioresorbable Polymers Market Companies

- Corbion N.V.

- Evonik Industries AG

- Foster Corporation

- KLS Martin Group

- DSM Biomedical

- Ashland Global Holdings Inc.

Recent Developments

- In April 2024, With the introduction of a new end-to-end licensed technology called CAPSULTM for the continuous manufacturing of polycaprolactone (PCL), a biodegradable polyester frequently used in the packaging, textile, agricultural, and horticultural industries, Swiss technology company Sulzer is broadening its line of bioplastics.

- In November 2023, BASF's most recent addition to its extensive line of chemicals for laundry detergent applications is BVERDE GP 790 L. This novel anti-redeposition polymer is easily biodegradable and was developed to satisfy consumer demand for products that prioritize sustainability without sacrificing functionality.

Segment Covered in the Report

By Polymer Type

- Polylactic Acid (PLA)

- High L-Content PLA

- High D-Content PLA

- Polyglycolic Acid (PGA)

- Homopolymers

- Copolymers

- Polycaprolactone (PCL)

- Semi-crystalline

- Amorphous

- Poly (lactic-co-glycolic acid) (PLGA)

- Various ratios (e.g., 50:50, 75:25)

- Other Aliphatic Polyesters

- Polyhydroxybutyrate (PHB)

- Poly(1,4-dioxanone) (PDO)

- Natural Bioresorbable Polymers

- Collagen

- Chitosan

- Gelatin

- Fibrin

By Application

- Medical Devices

- Stents (e.g., coronary, peripheral)

- Orthopedic Implants (e.g., screws, pins, sutures)

- Dental Implants

- Drug Delivery Systems

- Microspheres and Nanoparticles

- Injectable Depots

- Implantable Devices

- Tissue Engineering

- Scaffolds

- Sutures

- Skin Substitutes

- Wound Management

- Dressings

- Films and Hydrogels

- Others

- Temporary support structures (e.g., spinal implants)

By End User

- Hospitals & Clinics

- General Surgery

- Orthopedic Surgery

- Cardiovascular Interventions

- Pharmaceutical & Biotechnology Companies

- Drug formulation and sustained release products

- Academic & Research Institutes

- Regenerative medicine research

- Biomedical material development

By Manufacturing Process

- Extrusion

- Injection Molding

- Solvent Casting & Particulate Leaching

- Electrospinning

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting