C5 Complement Inhibitors Market Size and Forecast 2025 to 2034

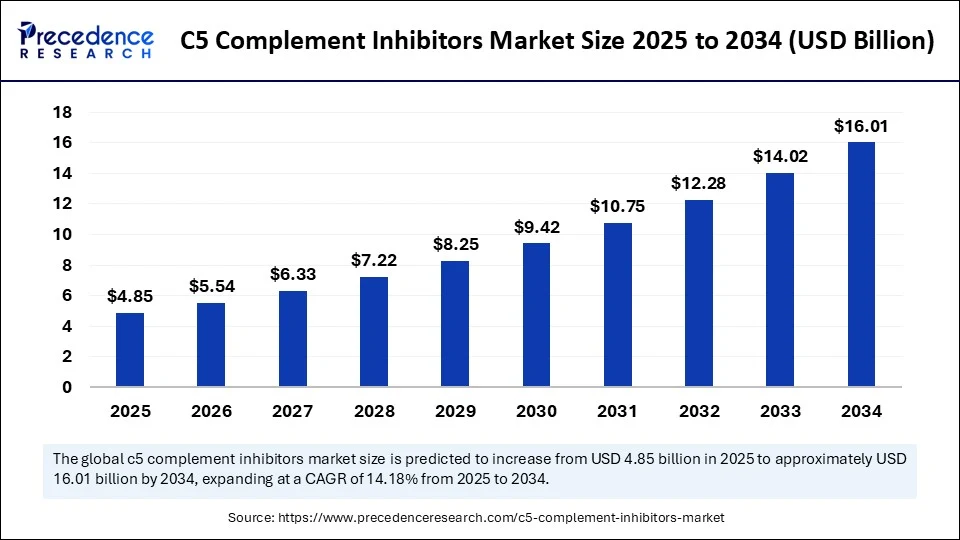

The global C5 complement inhibitors market size accounted for USD 4.25 billion in 2024 and is predicted to increase from USD 4.85 billion in 2025 to approximately USD 16.01 billion by 2034, expanding at a CAGR of 14.18% from 2025 to 2034.The market is significantly growing due to the increased rate of rare and fatal diseases that need C5 inhibitor-based treatment, growing research and development in developed countries for innovative inhibitors, and advancement in the biotechnology area.

C5 Complement Inhibitors Market Key Takeaways

- In terms of revenue, the global C5 complement inhibitors market was valued at USD 4.25 billion in 2024.

- It is projected to reach USD 16.01 billion by 2034.

- The market is expected to grow at a CAGR of 14.18 % from 2025 to 2034.

- North America dominated the global C5 complement inhibitors market in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period of 2025-2034.

- By drug type, the monoclonal antibodies segment led the global market in 2024.

- By drug type, the RNA-based therapeutics segment is expected to witness the fastest CAGR during the foreseeable period.

- By route of administration, the intravenous segment captured the biggest market share in 2024.

- By route of administration, the subcutaneous segment is expected to witness the fastest CAGR during the foreseeable period.

- By application, the paroxysmal nocturnal hemoglobinuria (PNH) segment contributed the highest market share in 2024.

- By application, the neuromyelitis optica spectrum disorder (NMOSD) segment is expected to witness the fastest CAGR between 2025-2034.

- By end user, the hospitals segment held the largest market share in 2024.

- By end user, the home care segment is expected to witness the fastest CAGR during the foreseeable period.

- By distribution channel, the hospital pharmacies segment generated the major market share in 2024.

- By distribution channel, the online pharmacies segment is expected to witness the fastest CAGR during the forecasted years.

How is AI Transforming the C5 Complement Inhibitors Market?

Artificial intelligence technology is significantly impacting the C5 complement inhibitors market by offering insights into various factors of complement inhibitors. Collaboration between AI researchers and pharmaceutical scientists helps companies to make data-driven decisions and accelerate the complete drug development process, offering enhanced accessibility and affordability of healthcare. AI algorithms can analyze huge datasets from different sources, and the results can be used to find out trends and patterns to understand which combination would be more effective as a drug candidate, which further leads to drug development against fatal diseases.

- In August 2025, the leading drugmakers AstraZeneca, Pfizer, and Sanofi are looking to collaborate with Chinese AI biotech firms that offer fast timelines with minimum costs and a state-supported startup ecosystem. (Source:https://restofworld.org)

Market Overview

The C5 complement inhibitors market refers to the market for biologic or small molecule drugs that inhibit the activity of the complement component C5, a protein that plays a central role in the complement cascade, a key part of the innate immune system. C5 inhibitors are used to treat rare and severe diseases caused by abnormal complement activation, including paroxysmal nocturnal hemoglobinuria (PNH), atypical hemolytic uremic syndrome (aHUS), neuromyelitis optica spectrum disorder (NMOSD), and others. These inhibitors function by preventing the cleavage of C5 into C5a and C5b, thereby reducing inflammation and cell lysis.

What are the Key Trends in the C5 Complement Inhibitors Market?

Next-gen inhibitors

Researchers and many academic institutes are collaboratively looking to develop improved C5 complement inhibitors with characteristics such as longer half-lives, novel methods for delivery, and efforts to reduce resistance to existing therapies like eculizumab. The adoption of subcutaneous administration instead of IV is a major trend that is a driving factor of the C5 complement inhibitors market, while offering convenience to patients and significant healthcare cost savings.

Advancement in biotechnology

Growing research and development in the biotechnology sector led to increasing innovation in the C5 inhibitor sector, including RNA-based processes and gene therapy, with the advancement of diagnostic tools to take care of patients more effectively. Growing research in non-viral approaches for C5 inhibitors, like lipid nanoparticles and extracellular vesicles, will help to minimize complications in reaching directed tissues like the central nervous system.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 16.01 Billion |

| Market Size in 2025 | USD 4.85 Billion |

| Market Size in 2024 | USD 4.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.18% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Route of Administration, Application / Indication, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing rate of complement-mediated diseases

A major driving factor for the expansion of the C5 complement inhibitors market is increasing complement-mediated diseases, which require C5 inhibitors for a better outcome of healthcare treatment. Some rare diseases are driven by uncontrolled complement activation, which includes diseases like PNH and aHUS, leading to severe conditions which has spurred demand for specialized therapies like C5 inhibitors.

These treatment options are highly expanding due to the development of new drugs such as monoclonal antibodies like ravulizumab, eculizumab, and biosimilars, with the RNAi technology exploration, and small molecular approaches further fuelling various treatment options. Developed regions are further advancing their research to innovate in C5 inhibitors, allowing enhanced access to advanced treatments coupled with better diagnostic tools.

Restraint

Infection risk with constant anaemia

A notable drawback that creates a barrier for the expansion of the C5 complement inhibitors market includes possible increased chances of infection and risk of continued detectable anaemia. Though these inhibitors play a critical role against certain bacteria to strengthen the body's defence system, this can develop infections like meningococcal, which might lead to further complications. Hence, these drugs carry a black box warning about this risk. Also, C5 inhibitors cannot fully prevent complement activation upstream, which leads to C3b deposition on red blood cells and is cleared by macrophages in the liver and spleen. This process can further develop persistent anaemia and may require red blood cell transfusions even while taking C5 inhibitor therapy.

Opportunity

Increased rate of R&D for innovative inhibitors

A significant opportunity that C5 complement inhibitors hold is the increasing rate of research and development to find next-gen inhibitors. Many companies are trying to adopt these new inhibitors to enhance the efficiency of the well-established therapies. To date, nearly nine inhibitors have been discovered and approved in various geographical areas. Some of the inhibitors include AVACOPAN, EMPAVELU & ENJAYMO that have been recently discovered. Such inhibitors are seen as a potential therapy for rare diseases, though with the increasing research and development, the oncology area is also trying to leverage the benefits of these inhibitors, which further creates significant opportunities for market growth.

Drug Type Insights

Why are monoclonal antibody drugs preferred mostly?

The monoclonal antibodies segment dominated the global C5 complement inhibitors market. The segment is dominating due to factors like high selectivity and targeting the terminal pathway, as C5 is a critical component for the terminal pathway, which causes formation of the membrane attack complex (MAC), and inflammatory mediator C5a is release with this. Monoclonal antibodies are developed to bind to specific targets such as the C5 component of the complement system. Such a specific target reduces side effects due to off-target effects and therefore lowers the toxicity related to a broader complement.

The RNA-based therapeutics segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The segment is experiencing a significant growth rate due to the highly proliferating C5 complement inhibitors area for the treatment of rare diseases. RNA-based therapeutics can be designed accordingly if the target is fixed, which further allows rapid development cycles. Additionally, RNA-based therapies can be applied to a range of diseases, which has been proven during the COVID-19 period in terms of the high success rate of mRNA vaccines.

Route of Administration Insights

What are the benefits of the intravenous route of administration?

The intravenous segment dominated the global C5 complement inhibitors market. The segment is dominating as it offers the most reliable and easy way to deliver required medications directly into the bloodstream, allowing C5 inhibitors to reach therapeutic concentrations, which is crucial for medical conditions like PNH, where constant complement activation causes rapid cell destruction. Also, the IV administration method bypasses the digestive system, which ensures a complete dose of the medication reaches to bloodstream directly and is absorbed quickly.

The subcutaneous segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The subcutaneous route of administration offers a higher flexibility rate and cost effectiveness in comparison to IV administration. It offers inject formulations by the patient themselves and can be done at home, reducing the compulsion to go out to clinics for infusions. This further minimizes challenges related to the logistics and time required to visit clinics.

Application Insights

How do C5 inhibitors help to treat PNH effectively?

The paroxysmal nocturnal hemoglobinuria (PNH) segment dominated the global market. The segment is dominating due to the rapid results of these inhibitors, which treat the initial symptoms of PNH that includes intravascular hemolysis and complications related to it. PNH is basically a rare blood disorder in which genetic mutations cause a deficiency in proteins. Eculizumab and ravulizumab are some of the C5 inhibitors that directly target and neutralize the complement protein C5, which further prevents the formation of the membrane attack complex and minimizes destruction of red blood cells. Moreover, with the help of C5 inhibitors, intravascular hemolysis, which is a result of PNH.

The neuromyelitis optica spectrum disorder (NMOSD) segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. NMOSD stands for neuromyelitis Optica spectrum disorder, which can be treated with C5 inhibitors. This growth is significant, primarily due to proven efficacy and approval of long-acting C5 inhibitors like Ultomiris, which effectively treat and minimize relapses in patients of NMOSD. C5 inhibitors help reduce tissue damage and the frequency of use of injectables.

End User Insights

Why do the majority of people opt for hospital treatment?

The hospitals segment dominated the global C5 complement inhibitors market. The segment is dominating due to disease specificity, intensive care requirements, along reimbursement of treatment costs. Many patients who need C5 inhibitors are severely ill and suffer from many complications, which require specialized care with constant monitoring, which is properly set in the hospitals, which includes close monitoring of all parameters, like blood test, blood pressure, mechanical ventilations, and need for dialysis, that affect health and recovery if not taken care of precisely.

The home care segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. Patients with chronic conditions opt for care treatment instead of a hospital or clinic. This preference is majorly due to a comfortable treatment experience with flexibility and convenience. One of the notable trends in home care treatment is to deliver to the area near patients' homes, which further minimizes the burden on specialty clinics.

Distribution ChannelInsights

What are the benefits of the hospital pharmacies in the C5 complement inhibitors market?

The hospital pharmacies segment dominated the global C5 complement inhibitors market. The segment is dominating due to complexity in logistics and convenience, like centralized access offered by hospital pharmacies, which ensures timely delivery of C5 inhibitors as they require proper handling, storage, and delivery methods. Hospital pharmacies are equipped to manage all these aspects of logistics and treatment. Moreover, these inhibitors are mainly used in the treatment of rare diseases, which require highly skilled medical professionals with facilities to administer these medications, which is easily achievable due to hospital pharmacies. Many inhibitors like Soliris and utomiris are delivered in the bloodstream by using the IV route, necessitating dedicated infusion centers near hospitals.

The online pharmacies segment is expected to witness the fastest CAGR during the forecasted years of 2025-2034. The segment is experiencing a significant growth rate due to factors like rising e-commerce platforms, increasing internet penetration, and the convenience offered by online platforms to deliver required medications at the doorstep, reducing the need to visit physically in medical stores which is highly beneficial in terms of emergencies. Due to better inventory management, online pharmacies rarely run out of stock, even with special medications like C5 inhibitors, further expanding the segment's growth.

Regional Insights

What factors made North America a major shareholder of the global C5 complement inhibitors market?

North America dominated the global C5 complement inhibitors market. The region is dominating due to a combination of reasons like well-established medical infrastructure, strong reimbursement policies offered by the government, rapid adoption of Novel therapies, growing activities of clinical trials by laboratories, along with the strong presence of pharmaceutical key players. The region boasts a high volume of clinical trials for various diseases, leading to the development of new C5 inhibitors. The region has a highly developed healthcare system with specialized treatment centers and highly advanced diagnostic facilities that support the adoption of C5 inhibitors, driving the region's growth.

The U.S. has a higher rate of diseases like paroxysmal nocturnal hemoglobinuria and atypical hemolytic uremic syndrome, which are treated with C5 inhibitors more effectively with better outcomes. And patients can afford these expensive therapies due to dedicated reimbursement policies, further facilitating the adoption of C5 inhibitors for medical treatments.

How is Asia Pacific contributing to the growth of the C5 complement inhibitors market?

Asia Pacific is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The region is experiencing a significant growth rate due to a growing population with rare diseases that require C5 inhibitors. Increasing awareness of these diseases, such as atypical hemolytic uremic syndrome, causes increased demand for targeted therapies like C5 inhibitors, along with substantial investments in the development of the healthcare system. Additionally, regulatory bodies like the China National Medical Products Administration are playing a key role in supporting the expansion of the market.

Leading key players in Asia Pacific include AstraZeneca, which gained approvals for the use of Soliris in China, CANbridge Pharmaceuticals, which worked to develop and commercialize complement inhibitors, and Beijing Defengrei Biotechnology is actively working in the sector of complement inhibitors, further propelling the market's growth in the region.

C5 Complement Inhibitors Market Companies

- Alexion Pharmaceuticals (AstraZeneca)

- Roche (Chugai Pharmaceutical)

- Novartis AG

- Apellis Pharmaceuticals

- Alnylam Pharmaceuticals

- Regeneron Pharmaceuticals

- Amgen Inc.

- UCB Pharma

- Biogen Inc.

- Johnson & Johnson (Janssen)

- Takeda Pharmaceutical Company

- Horizon Therapeutics

- Silence Therapeutics

- Ra Pharmaceuticals (now part of UCB)

- Roche Glycart

- Omeros Corporation

- IONIS Pharmaceuticals

- Akari Therapeutics

- Annexon Biosciences

- Morphosys AG

Recent Developments

- In June 2025, AstraZeneca signed a research deal worth more than USD 5 billion with the Chinese firm CSPC Pharmaceutical Group. These two companies will find ways to develop pre-clinical candidates for potential chronic diseases.(Source: https://www.bnnbloomberg.ca)

- In June 2025, Novartis AG showcased positive results due to APPULSE-PNH with a phase-3 study that proves the efficacy and safety of oral monotherapy Fabhalta, in adult patients having PNH and Hb levels less than 10g/dL.(Source: https://www.novartis.com)

Segments Covered in the Report

By Drug Type

- Monoclonal Antibodies

- Small Molecule Inhibitors

- RNA-based Therapeutics

- Peptide-based Inhibitors

By Route of Administration

- Intravenous

- Subcutaneous

- Oral

By Application / Indication

- Paroxysmal Nocturnal Hemoglobinuria (PNH)

- Atypical Hemolytic Uremic Syndrome (aHUS)

- Neuromyelitis Optica Spectrum Disorder (NMOSD)

- Myasthenia Gravis

- Other Rare Diseases

By End User

- Hospitals

- Specialty Clinics

- Research & Academic Institutes

- Homecare

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Specialty Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting