What is the Cell Encapsulation Technology Market Size?

The global cell encapsulation technology market is witnessing strong growth as therapeutic cells are encapsulated to protect them from immune rejection and ensure sustained efficacy.The growth of the market is driven by rising demand for efficient sample management solutions and advancements in automation and storage technologies.

Cell Encapsulation Technology Market Key Takeaways

- North America led the cell encapsulation technology market with around 45% share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 15% in the market between 2025 and 2034.

- By encapsulation method, the microencapsulation segment held approximately 65% share of the market in 2024.

- By encapsulation method, the nanoencapsulation segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By polymer type, the natural polymers segment captured around 60% market share in 2024.

- By polymer type, the synthetic polymers segment is expected to expand at a notable CAGR over the projected period.

- By application, the drug delivery segment dominated the market with approximately 50% in 2024.

- By application, the regenerative medicine segment is expected to expand at a notable CAGR over the projected period.

- By technology, the extrusion segment held approximately 40% market share in 2024.

- By technology, the electrostatic dripping segment is expected to expand at a notable CAGR over the projected period.

- By end-user, the pharmaceutical & biotechnology companies segment captured around 55% market share in 2024.

- By end-user, the academic & research institutes segment is expected to expand at a notable CAGR over the projected period.

What are the Driving Forces Behind the Cell Encapsulation Technology Market?

The primary driving forces for the cell encapsulation technology market include the growing demand for precision medicine and the increasing use of advanced therapies in treating chronic conditions, such as diabetes and cancer. Cell encapsulation is a technology that occurs when living cells are enclosed in semi-permeable membranes, which allow the exchange of nutrients and therapeutic molecules with the surrounding environment while protecting the enclosed cells from rejection by the immune system.

Cell encapsulation supports cell viability, controlled therapeutic release, and its adoption in regenerative medicine and biotechnology research. Increased investment in cell-based therapies and biocompatible materials, along with innovations in microencapsulation and three-dimensional cell culture systems, will promote market growth. Additionally, an increase in clinical studies demonstrates its promise for developing personalized and regenerative therapeutics in healthcare.

How is AI Redefining the Encapsulate Cells Technology?

AI is advancing research in cell encapsulation through single-cell analysis, predictive design of hydrogels, and real-time screening of formulations. AI systems identify previously hidden cell subtypes to help narrow encapsulation parameters while still enhancing viability and immune evasion strategies. AI/ML-based modeling systems are helping with molecular simulations and finite-element studies of hydrogels to optimize mechanics and permeability for long-term graft survival.

Now, AI-enabled polymer analytics platforms shorten formulation cycles for encapsulation membranes, while targeted funding has created calls for AI approaches in T1D cell therapy to promote translational work. In summary, these advances are moving encapsulation research from prototyping to clinically transferable devices by reducing experimental iterations and identifying new mechanistic biomarkers for implantation outcomes.

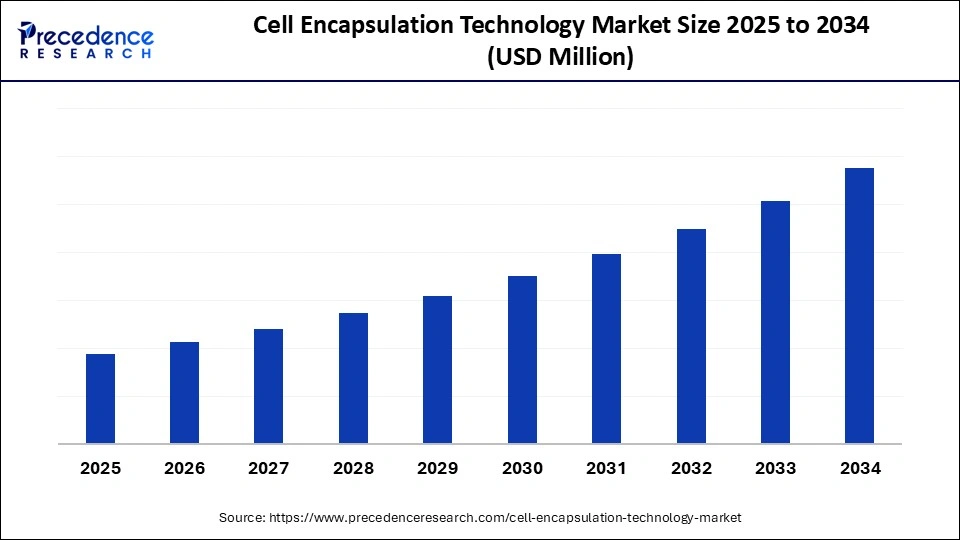

Cell Encapsulation Technology Market Outlook

- Market Growth Overview: The market is poised for significant growth between 2025 and 2034, driven by strong translational momentum and funding mechanisms that prioritize clinical proof-of-concept over immediate commercial returns. Support from initiatives such as NIH/NIBIB R01 grants, for example, those focused on programmable encapsulation, and early-phase randomized controlled trials involving encapsulated islets, are accelerating progress and validating new technologies.

- Global Expansion: The emergence of academic and clinical programs, along with a growing body of peer-reviewed animal and human studies across the U.S., Canada, and Europe, reflects the global diffusion of R&D in this field. Additionally, harmonization of regulatory frameworks, such as FDA guidances for cellular and tissue-engineered medical products (TEMP), is enabling multi-country trial designs and supporting cross-border commercialization strategies.

- Major Investors & Funding Signals: The federal government continues to serve as the primary early-stage investor, with NIH, HHS, and related agencies issuing regular funding solicitations through platforms like Grants.gov. This consistent, peer-reviewed capital significantly lowers the entry barrier for industry stakeholders, especially those outside traditional for-profit ventures, and reduces early development risk.

- Startup Ecosystem: University spinouts and early-stage biotech companies are leveraging federal R&D awards and academic collaborations, such as those with the Wyss Institute or NIBIB-funded programs, to advance encapsulation technologies from preclinical research into IND-enabling studies and first-in-human trials. These ventures often pursue exit strategies through licensing deals or acquisition by larger biopharmaceutical firms.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Encapsulation Method, Polymer Type, Application, Technology, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Need for Immune-Protected Cell Therapies

At the heart of this innovation is the critical need for safer, immune-protected cell therapies, particularly for chronic diseases such as Type 1 diabetes and macular degeneration. Innovations in technology have enabled encapsulated cells to evade immune system attacks while remaining functionally viable. For instance, using microfluidic electrospray, hydrogels with porous alginate shells have demonstrated greater than 90% viability of β-cells within 30 minutes, and bio-systems of encapsulated cells were shown to regulate blood glucose concentrations when transplanted into diabetic mice.

- In March 2025, the FDA approved Encelto (NT-501), an encapsulated cell therapy for idiopathic macular telangiectasia (MacTel), as the first licensed treatment for devastating neurodegenerative retinal disease, macular telangiectasia type 2 (MacTel).(Source: https://www.asgct.org)

Moreover, the convergence of advanced biomaterials engineering and evolving regulatory pathways for encapsulated cell therapies is expected to accelerate the transition of cell encapsulation technologies from preclinical models to real-world clinical applications. Recent advancements in biomaterials engineering, including the development of synthetic polymers, bioinert hydrogels, and responsive smart materials, have significantly improved the performance, durability, and safety of encapsulation systems. These innovations enhance cell viability, function, and immune protection.

Restraint

Which is a Key Factor Hindering the Market Growth?

The most significant factor limiting the adoption of cell encapsulation technology is the immune response and fibrotic overgrowth caused by the encapsulation materials and the encapsulated cells. Even highly purified polymers (for example, alginate) can begin to elicit immune responses, and if the cells shed antigens or contain immunogenic sequences (from their vectors), it may increase fibrotic overgrowth.

For instance, clinical studies with encapsulated pancreatic islets for patients with Type 1 diabetes may show good insulin production for 6-12 months, but this activity declines over time as fibrotic overgrowth occurs, inhibiting nutrient diffusion.The immune-driven loss of cell viability and functionality makes it challenging to achieve long-term durability, and many cellular therapies in capsule form have not yet been approved.

Opportunity

What Advances in Immunomodulatory Encapsulation are Creating New Opportunities?

A significant area of opportunity for cell encapsulation technology involves integrating active immunomodulation into encapsulation systems. While immunosuppression is currently the standard of care for preventing immune attacks from grafts, encapsulation systems offer an alternative approach to avoid systemic immunosuppression. For example, in 2025, researchers at University College London (UCL) developed an encapsulation system using ultrapure alginate beads filled with tacrolimus-microparticles for the delivery of hiPSC-derived dopaminergic neuron progenitors (for Parkinson's disease). The system decreased T-cell activation by ~3-fold in vitro, maintained viability, and produced dopamine as the cells matured.(Source: https://pubs.rsc.org)

Similarly, advances in dual-porous immunoprotective membranes promote both prevention of T cell infiltration and enhanced vascularization in animal models, ensuring nutrient/oxygen flow while protecting cells from unwanted immune interactions. These developments reduce the need for lifelong immunosuppression and decrease the risk of immune-related side effects. At the same time, the effectiveness of encapsulated cell therapies will enhance the acceptability of treatments for neurodegenerative and metabolic conditions.

Segment Insights

Encapsulation Method Insights

Why Did the Microencapsulation Segment Dominate the Market in 2024?

The microencapsulation segment dominated the cell encapsulation technology market, holding about 65% share in 2024. This method has gained popularity due to its scalability, cost-effectiveness and the ability to effectively keep cells alive. The wide acceptance of microencapsulation for drug delivery and cell therapy applications led to higher usability and ultimately significance in the commercial market as it became increasingly employed in biopharmaceutical manufacture and controlled release.

The nanoencapsulation segment is expected to grow at the fastest CAGR during the forecast period due to the growing number of applications in precision drug delivery and targeted therapeutics. This method of encapsulation promotes higher permeability, lower immune rejection, and greater encapsulation efficiency, with strong applications in personalized, next-generation medicine and regenerative medicine.

Polymer Type Insights

Which Type of Polymer Leads the Cell Encapsulation Technology Market?

The natural polymers segment led the market with approximately 60% share in 2024. This is mainly due to the increased adoption of natural polymers, such as alginate, chitosan, and collagen, driven by their biocompatibility and biodegradability, as well as their reaction to induce low immune response. Their widespread use in cell therapy and regenerative medicine functions to enhance therapeutic potency and allow for continued cell viability.

The synthetic polymers segment is likely to grow at the fastest rate in the coming years. They are regarded to have better mechanical stability, tunable degradation rates, and consistent cell encapsulation functionality for advanced biomedical applications. Synthetics are adaptable to customized drug release and scalable processes, which increase their adoption in academic and commercial bioprocessing.

Application Insights

Why Did the Drug Discovery Segment Holds the Largest Share of the Cell Encapsulation Technology Market?

The drug delivery segment held about 50% market share in 2024. Cell encapsulation technology allows for the controlled and sustained-release of therapeutic agents, which promotes enhanced bioavailability of the drug and reduced side effects. Its robust penetration into pharmaceutical R&D and chronic disease management applications makes it a mainstay of modern therapeutic innovation.

The regenerative medicine segment is likely to grow at a 10% CAGR during the projection period. The growth of the segment is attributed to the increasing demand for tissue engineering as well as cell-based therapies. Developing encapsulated cells to restore damaged tissue and organs is opening up new opportunities for regenerative medicine applications in stem cell therapy, wound healing, and organ regeneration.

Technology Insights

Which Technology Dominate the Cell Encapsulation Technology Market?

The extrusion technology segment dominated the market, accounting for approximately 40% share in 2024. This is mainly due to its ease of use, low cost, and ability to yield capsules of a relatively similar size and optimal cell viability. Its scalability, and compatibility with a variety of biomaterials makes it the preferred method for large-scale pharmaceutical and biotechnological applications.

The electrostatic dripping segment is likely to expand at the fastest CAGR in the upcoming period. While electrostatic dripping gives more precise control over capsule size and higher cell survival rates making it more three-dimensional for sensitive therapeutic and research applications, it is also increasing in accuracy and reproducibility for advanced cell therapy and tissue engineering.

End User Insights

Which End-User Holds the Largest Share of the Cell Encapsulation Technology Market?

The pharmaceutical & biotechnology companies segment held around 55% share of the market in 2024. This is primarily due to their appetite for cell-based drug development, regenerative therapies, and biomanufacturing is the main driver of adoption of encapsulation technologies. These companies utilize encapsulation both for controlled drug release and immune protection, as well as to harness larger production scales for therapeutics.

The academic & research institutes segment is expected to grow at a 12% CAGR in the market. This is largely due to increasing funding by governments, both in responsive and collaborative R&D programs, and continually advancing further into cell therapy research. They provide facilities in which new encapsulation materials can be studied, as well as novel biomedical applications of cell encapsulation technology.

Regional Insights

Why Did North America Dominate the Cell Encapsulation Technology Market?

North America registered dominance in the cell encapsulation technology market by holding about 45% share in 2024. This leadership is driven by substantial venture and public funding for cell and gene therapies, a robust pipeline of clinical trials involving encapsulated islet and stem cell products, and a mature infrastructure that includes experienced CROs and scalable manufacturing capabilities. The presence of large academic transplant centers, frequent investigator-initiated studies, and active regulatory engagement with the FDA, through mechanisms like pre-BLA meetings and guidance frameworks, has significantly accelerated clinical translation, often reducing timelines by more than six months compared to other regions.

The U.S., in particular, holds a competitive edge due to its concentration of academic and research excellence, specialized CROs, and significant funding support from state (e.g., CIRM), federal (e.g., NIH), and private (e.g., VC firms) sources. Multiple first-in-human trials and device studies focused on encapsulated islets and β-cell replacement therapies are underway. Strong industry–academic partnerships are helping to de-risk both the technical and regulatory pathways, which enhances investor confidence and solidifies the U.S. as the practical commercial and clinical leader in North America.

What Factors are Boosting the Growth of the Asia Pacific Cell Encapsulation Technology Market?

Asia Pacific is expected to expand at a 15% CAGR during the forecast period, driven by an increasing number of government-backed biotechnology initiatives, rising investment in regenerative medicine, and the establishment of regional manufacturing hubs. Countries such as Japan, South Korea, and Singapore are advancing rapidly, expanding their clinical and translational research infrastructure with a dual focus on biomaterials and stem-cell applications. The region also offers cost-effective clinical trial operations and faster regulatory approval pathways compared to Western markets, making it an attractive destination for global biotech firms to form R&D partnerships and initiate trials.

China is leading the regional market, underpinned by a national strategy that prioritizes stem-cell and engineered tissue technologies. The National Medical Products Administration (NMPA) has implemented fast-track mechanisms for the clinical approval of advanced therapy medicinal products (ATMPs), enabling local firms to accelerate development and commercialization of encapsulated cell therapies. Key innovation hubs, such as universities and biotech parks in Beijing, Shanghai, and Shenzhen, are developing advanced biomaterials, including hydrogel-based encapsulation and oxygen-permeable membranes. Additionally, provincial-level funding supports pilot manufacturing of encapsulated islet and neural cell therapies, further bolstering China's leadership in the region.

Top Companies Operating in the Cell Encapsulation Technology Market

Tier I – Major Players

These are the companies seen as market leaders, with major pipelines, significant R&D investment, or broad product/commercial scale in cell encapsulation.

- ViaCyte, Inc.: ViaCyte is a clinical-stage regenerative medicine company developing encapsulated cell therapies for type 1 diabetes, notably via its PEC Encap / PEC Encap tra device which protects implanted pancreatic progenitor cells using a semi-permeable membrane in collaboration with W.L. Gore & Associates. Their work has already progressed into Phase 2 clinical trials where the encapsulated cells are shown to engraft and secrete both insulin and glucagon, moving the field toward practical human application.

- Sigilon Therapeutics, Inc. (Now part of Lilly): Sigilon pioneered the Shielded Living Therapeutics platform using its proprietary Afibromer biomaterial, which encapsulates engineered cells (e.g. insulin producing β-cells) to sustain function while resisting immune/fibrotic reaction, aiming to treat diseases like type 1 diabetes without immunosuppression. The company has attracted substantial funding (Series B financing) and has been acquired by Lilly in 2023 to accelerate development of its lead encapsulated cell therapy candidate, SIG 002.

- ViLiving Cell Technologies Ltd.: ViLiving Cell Technologies Ltd. develops or advances encapsulation platforms aimed at regenerative medicine and therapeutic cell delivery, though publicly disclosed details of their offerings remain limited.

- Merck KGaA: Merck KGaA provides capabilities in encapsulation technologies, likely via materials, biotech platforms, or partnership/licensing in regenerative medicine.

Tier II – Mid Level Contributors

These firms are important players; they may have more narrow niches, smaller commercial scale, or earlier stage products, but contribute significantly to market growth.

Sernova Corporation

PharmaCyte Biotech Inc.

Beta O2 Technologies Ltd.

Living Cell Technologies Ltd

Tier III – Niche, Emerging, Regional Players

These are smaller biotechs or firms with more limited commercial presence, often focused on specific applications, earlier stage products, or local/regional markets.

Neurotech Pharmaceuticals, Inc.

Encapsys, LLC

NovaMatri

Sigilon / Others of similar scale

Recent Developments

- In February 2025, Netherlands-based biotechnology research company Ourobionics launched CHIMERA, a biofabrication and biomanufacturing platform that combines five different technologies, including encapsulation technology that can work with cells, cell clusters, genes, and gene clusters.(Source: https://3dprintingindustry.com)

- In June 2025, AgroSpheres announced the profitable launch of FUN-THYME, a revolutionary, broad-spectrum biofungicide derived from thyme oil and delivered through the company's proprietary AgriCell encapsulation platform.(Source: https://www.businesswire.com)

- In January 2025, BASF's Personal Care business introduced encapsulation technology for retinol, utilizing BASF's patented solid lipid encapsulation technology to stabilize retinol in cosmetic preparations.(Source: https://www.indianchemicalnews.com)

Experts Analysis

The global cell encapsulation technology market is poised at a critical inflection point, propelled by synergistic advancements in biomaterials science, regenerative medicine, and immuno-isolation platforms. With increasing translational activity and a growing compendium of preclinical and early-phase clinical data, the field is transitioning from conceptual promise to therapeutic feasibility, particularly in applications such as islet cell transplantation, engineered cellular implants, and allogeneic stem cell delivery.

The market trajectory is being favorably impacted by rising government and institutional funding, such as NIH, CIRM, and EU Horizon grants, that de-risk early development pipelines. Concurrently, regulatory bodies like the U.S. FDA and EMA have introduced structured guidance for ATMPs (Advanced Therapy Medicinal Products), including encapsulated cell therapies, enabling harmonized global clinical strategies. This convergence has stimulated cross-border collaborations and accelerated the path from IND to early commercial validation.

Moreover, the integration of next-gen biomaterials (e.g., oxygen-permeable hydrogels, immune-shielding polymers) with cell engineering technologies offers opportunities for IP consolidation and platform scalability. Academic spinouts and VC-backed biotechs are leveraging these innovations to target high-unmet-need indications, particularly in endocrine disorders (e.g., Type 1 diabetes), CNS regeneration, and oncology.

As encapsulation technologies mature from proof-of-concept to implantable, retrievable, and scalable solutions, the market is expected to witness increased M&A activity, licensing deals, and downstream partnership opportunities. Tier I players and CDMOs are beginning to build capacity for modular GMP-compliant encapsulation systems, underscoring the field's readiness for industrialization.

Segments Covered in the Report

By Encapsulation Method

- Microencapsulation

- Nanoencapsulation

- Macroencapsulation

By Polymer Type

- Natural Polymers (e.g., alginate, chitosan)

- Synthetic Polymers (e.g., polyethylene glycol, polyacrylates)

By Application

- Drug Delivery

- Regenerative Medicine

- Cell Transplantation

- Research & Development

- Probiotics

By Technology

- Extrusion

- Electrostatic Dripping

- Rotating Disk Atomization

- Layer-by-Layer Coating

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Academic & Research Institutes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting