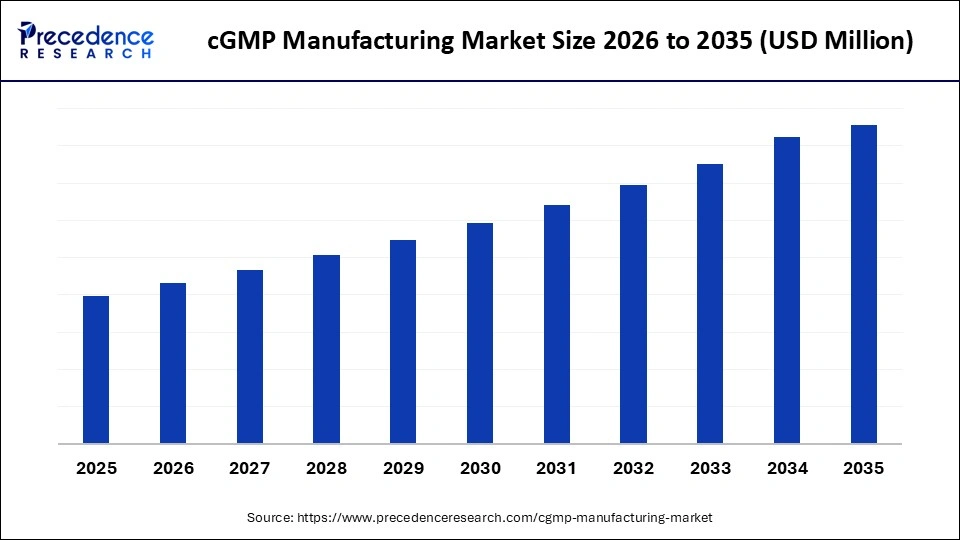

What is the cGMP Manufacturing Market Size?

The global cGMP manufacturing market is growing as pharma and biotech companies invest in compliant, high-quality production systems for drugs, biologics, and advanced therapies.The cGMP manufacturing market is driven by rising demand for biologics and stringent global regulatory compliance requirements.

Market Highlights

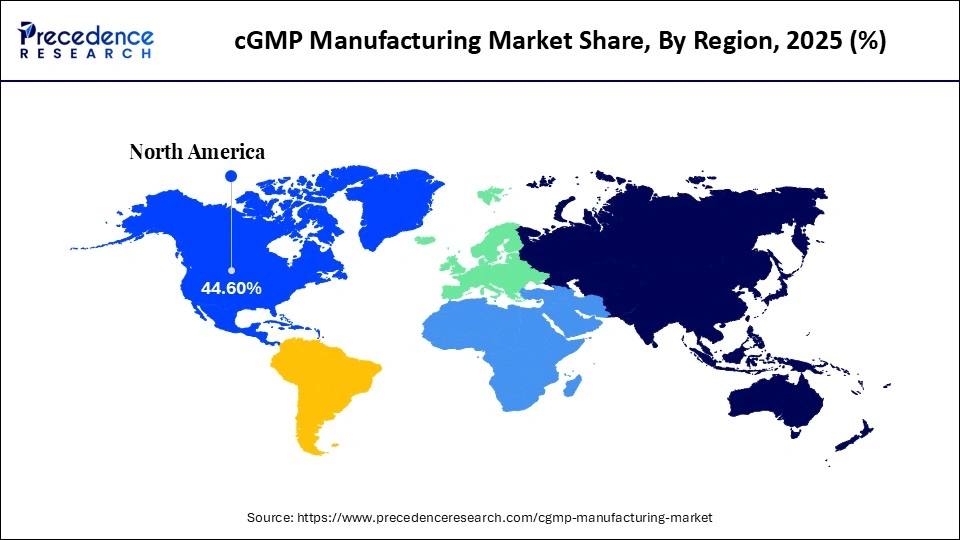

- North America dominated the market, holding the largest market share of 44.6% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 8.4% between 2026 and 2035.

- By product type, the biologics segment held the major market share of 45.8% in 2025.

- By product type, the cell & gene therapies segment is expected to grow at a CAGR of 7.5% between 2026 and 2035.

- By process type, the upstream processing segment contributed the highest market share of 53.4% in 2025.

- By process type, the fill-finish segment is growing at a strong CAGR of 7.8% between 2026 and 2035.

- By scale of operation, the clinical segment captured the highest market share of 54.7% in 2025.

- By scale of operation, the commercial is set to grow at a remarkable share of 7.5% CAGR between 2026 and 2035.

- By service type, the manufacturing services segment accounted for the largest market share of 46.8% in 2025.

- By service type, the packaging & fill-finish services segment is expected to grow at a solid CAGR of 7.6% between 2026 and 2035.

- By therapeutic area, the oncology segment held the largest share of 42.8% in the market during 2025.

- By therapeutic area, the rare diseases is expanding at a healthy CAGR of 7.5% between 2026 and 2035.

- By end-user, the pharmaceutical and biotechnology companies segment contributed the highest market share of 43.7% in 2025.

- By end-user, the CDMOS / CMOS segment is expected to expand at a remarkable growth rate of 7.7% CAGR between 2026 and 2035.

Redefining Biopharmaceutical Production: How cGMP Manufacturing Is Powering the Next Wave of Advanced Therapies

The cGMP manufacturing market is the heart of the current biopharmaceutical manufacturing, which guarantees that drugs, biologics, cell and gene therapies, and vaccines are manufactured to global standards of quality, safety, and consistency. The market is at the interfaces of a broad spectrum, both upstream and downstream processing, as well as formulation, aseptic filling, analytical testing, and regulatory documentation. With the increasingly complex therapeutic pipelines and tightened controls of regulatory authorities, the presence of cGMP-certified facilities and technologies is becoming a necessity.

The expansion of the cGMP manufacturing market is driven by the rapid expansion of biologics, which are monoclonal antibodies, recombinant proteins, and biosimilars that necessitate highly controlled environments to manufacture them. Increased cell and gene therapies have further exacerbated the need to supply specialized cleanrooms, viral vectors, and advanced single-use systems. Pharmaceutical firms are gaining more and more exposure to outsourcing to CDMOs to cut down on capital, speed up the schedules, and gain access to the latest capabilities. Moreover, the FDA, EMA, and other international regulatory bodies are increasing regulatory demands, which compel producers to resort to automation, digital quality assurance/quality control solutions, real-time oversight, and streamlined procedures.

Key AI Integration in the cGMP Manufacturing Market

The adoption of AI in the cGMP production market is redefining the state of biopharmaceutical production, control, and release by making it automatable, predictive, and real-time throughout the entire chain of value. Quality control and real-time release testing based on AI will be used to identify deviations in the initial stages and allow for maintaining closer control over important process parameters and minimizing failures in batches. AI can be applied in process development, wherein the data obtained through the process history is analyzed to improve cell culture conditions, purification workflows, and yield consistency, and minimize experimentation time.

AI is also able to simplify regulatory documentation by use of intelligent batch records, automatic SOP updates, and audit readiness checks by use of data integrity. As the production process is shifted towards sophisticated biologics and cell therapy and gene therapies, AI increases efficiency, reliability, and compliance, becoming one of the key sources of digital transformation in the modern GMP plants.

CGMP Manufacturing Market Outlook

The growth rate in the industry is tremendous due to higher demands for quality and compliant manufacturing in the biologic, cell, and gene therapies and personalized medicines. Automation, digital quality systems, and single-use technologies are accelerating operational efficiency and reducing the risk of production.

The world is expanding, and the U.S, Europe, and Asia-Pacific are investing a lot in GMP facilities to assist in clinical and commercial biologics pipelines. Other emerging markets like Singapore, South Korea, and India are also becoming significant outsourcing destinations in biomanufacturing.

The major competitors, such as Thermo Fisher Scientific, Lonza, Catalent, WuXi AppTec, and Samsung Biologics, have been expanding their GMP-certified capacity. These firms are investing in large-scale production of biomanufacturing, viral vectors, as well as integrated CDMO.

Andelyn Biosciences, ElevateBio, and Resilience are startup companies that are developing an advanced cGMP cell and gene therapy production platform. Some of the innovation centers that target high-demand niches include Vibalogics and the Center for Breakthrough Medicines (CBM), which specializes in viral vectors and fast scale-up solutions.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Process Type, Scale of Operation, Service Type, Therapeutic Area, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

cGMP Manufacturing Market Segment Insights

Product Type Insights

The biologics segment held a 45.8% share in the cGMP manufacturing market in 2025. Biologics are delicate, complex molecules that demand advanced bioprocessing facilities, aseptic conditions, and robust quality management, which are of great interest to special GMP facilities. The rise in the number of chronic diseases, oncology treatment, immunotherapies, and autoimmune disorder therapy further boosted the demand for biologics.

Also, as the industry transitioned to high-potency biologics and next-generation modalities, e.g., antibody-drug conjugates, the requirement for compliant manufacturing suites with high-performance purification, single-use technologies, and real-time monitoring systems increased. With increased quality demands by the regulatory agencies, the most resource-intensive and strategically focused class of products in GMP manufacturing is the biologics.

The cell & gene therapies segment captured a 7.5% market share in 2025 and is expected to grow significantly. The pipeline of CAR-T therapies, gene-editing technology, viral vectors, and regenerative medicine is all on the path of growth as they head out of clinical testing into commercialization. The FDA and EMA approvals increased, venture capital investment and government financing have led to an increase in requirements for GMP-compliant cleanrooms, production suites with vectors, closed system automation, and cryogenic supply chains.

The high dependence on CDMOs by numerous biopharma firms is driven by the fact that many of them lack in-house GMP expertise, which increases the outsourcing. With the maturation of manufacturing technologies and the increase in the capability of scaling, the CGT segment will see a healthy double-digit growth of the segment moving towards broader clinical accessibility and commercial viability.

Process Type Insights

In 2025, the upstream processing segment controlled 53.4% of the cGMP manufacturing market due to its position in the middle of yield, productivity, and overall efficiency of biomanufacturing. As the biologics, biosimilars, and cell-based therapies continue to expand, the total demand for the high-capacity bioreactors, ideal cell culture systems, and advanced media formulations has also reported a surge.

The most scalable part of the bioprocessing is upstream operations, including: cell line development, expansion, fermentation, and bioreactor management, which necessitate significant investment in controlled environments and monitoring technologies, as well as automation. Upstream dominance was further enhanced due to the emergence of single-use bioreactors, continuous perfusion, and AI-enhanced process optimization, which enhanced flexibility and reduced the risk of contamination, as well as increased production cycles.

The fill-finish segment captured a 7.8% share of the cGMP manufacturing market in 2025. Fill-finish is considered one of the most important processes in drug production as it guarantees sterility, accurate dosing of products, and integrity of final products of biologics, vaccines, and injectables. Increasing demand for sterile injectables, lyophilized formulations, prefilled syringes, and high-potency biologics that demand advanced aseptic filling facilities contributed to its growth.

Most biopharma firms outsource their fill-finishing business to CDMOs due to the expensive nature of maintaining sterile lines and technical skills. The adoption will increase with the growing use of robotic filling, barrier technologies, and automated inspection systems, slowly making fill-finish significant in the manufacturing process of overall GMP.

Scale of Operation Insights

The clinical segment led the market while holding a 54.7% share in 2025. Clinical manufacturing needs small, highly controlled, and flexible production environments that meet changing regulatory requirements concerning investigational products. Increased R&D expenditure, more IND submissions, and expedited approval programs, including Fast Track, Breakthrough Therapy, PRIME, and RMAT, have dramatically increased demand for GMP-compliant clinical supply.

The modular clean rooms, single-use technologies, as well as rapid scale-up abilities of CDMOs are central in enabling sponsors to transition candidates between preclinical and first-in-human studies. Also, there is a clinical phase with intense characterization, analytics, and refinement of the process that is necessary to provide safety and reproducibility, which necessitates GMO manufacturing. With the diversification of innovative therapies and an increase in the number of trials across the world, clinical manufacturing is the most popular and the most active sector of the cGMP market.

The commercial segment is expected to grow at a significant CAGR over the forecast period, with a 7.5% market share. The growing number of regulatory approvals, growing indications, and maturing pipelines are creating the demand for a high-volume, GMP-certified facility that can produce large amounts of products consistently. More commercial manufacturing is also being outsourced to CDMOs by biopharma companies to ensure a reduction in capital expenditure and supply chain risks, access to improved bioreactors, continuous manufacturing, and automated fill-finish technologies. The increase in consumption of biologics in the world, especially in the fields of oncology, autoimmune diseases, and rare genetic disorders, encourages the necessity of an effective commercial supply.

Service Type Insights

In 2025, the manufacturing services segment controlled 46.8% of the cGMP manufacturing market. As pipelines continue to expand to include monoclonal antibodies, recombinant proteins, vaccines, and other advanced therapies, businesses are increasingly relying on dedicated GMP-qualified facilities so that they can conduct complex upstream, downstream, and aseptic operations. The transition to shorter clinical cycles, increased productivity, and reduction of risk has also led to an increase in outsourcing to CDMOs, which offer batch size flexibility, single-use systems, and digitalized GMP spaces.

Demand was further reinforced by the emergence of cell and gene therapies, whose high standards of sterility and small-scale production of individualized therapies. Manufacturing services are the base of GMP activities, as biopharma companies are interested in the speed-to-market and the quality of their products, which is constant.

The packaging & fill-finish services segment is poised for substantial growth in the cGMP manufacturing market, holding a 7.6% share in 2025, as the global market keeps increasing the need for sterile injectables, prefilled syringes, vials, and advanced biologics demand in the use of precise and aseptic fill-finish operations. With the increase in the market share of biologics and vaccines, firms are increasingly relying on GMO-certified filling lines that have isolators, robotics, and high-speed inspection systems to maintain sterility and product integrity.

Also, new technologies in the field of lyophilization, cold-chain packaging, and non-tamper-proof serialization are increasing the value chain of this segment. With regulatory attention to the risk of contamination growing, fill-finish services will only keep growing as a quality-oriented, critical component of the cGMP manufacturing ecosystem.

Therapeutic Area Insights

The oncology segment held a 42.8% share in the cGMP manufacturing market in 2025. With the cancer therapies prevailing in global R&D pipelines, regulatory approvals, and commercial markets of biologics. The explosive growth of monoclonal antibodies, checkpoint inhibitors, targeted therapies, ADCs, cancer vaccines, and cell therapies has necessitated the unprecedented demand for GMP-certified plants. The manufacturing of oncology drugs is very precise, sterile, and controlled since it is a very potent drug with complex molecular structures, and the therapeutic window is narrow.

Moreover, treatment of cancer, such as CAR-T-based therapies, requires cleanrooms to be specialized, viral vectors to be produced, and automated systems to handle cells, all of which must be regulated by GMO. The rate of cancer infection keeps on increasing in many countries, and as oncology drug trials increase in emerging markets, firms are making significant investments in safe and scalable production of oncology treatments.

The rare diseases segment is poised for substantial growth in the cGMP manufacturing market, holding a 7.5% share in 2025, due to the growth in popularity of gene therapies, orphan drugs, and precision biologics with regulatory backing and funding. Drugs used to treat rare diseases are based on novel modalities, including AAV-based gene therapies, enzyme replacement therapies, RNA-based drugs, and cell therapies, which will require highly specialized manufacturing environments of GMO quality. Orphan drug exclusivity, priority review vouchers, and tax credits are global incentives accelerating the development activity with more than 7,000 rare diseases without approved treatments.

Small-scale production in high-value, small-population patients also demands small-batch production, which is driving more business to CDMOs with modular cleanrooms, single-use bioreactors, and vector manufacturing platforms. Regulatory authorities are also promoting innovation by providing accelerated programs that are making more rare disease candidates reach clinical and commercial pipelines.

End-User Insights

The pharmaceutical & biotechnology companies segment led the market while holding a 43.7% share in 2025, since they continue to be the main drivers of drug discovery, biologics development, and commercialization. Such organizations will spend a lot of money on sustaining the GMP-compliant manufacturing suites, analytical capacity, and quality systems to facilitate in-house production and regulatory compliance. As pipelines in the biopharma industry continue to expand in oncology, immunology, vaccine, and gene therapy, biopharma firms turn to on-site and strategic outsourcing to keep up with the increasing clinical and commercial demand.

Their management status is supported with heavy R&D budgets, high-tech bioprocessing technologies, and extended manufacturing experience. Also, there is a growing trend in the pharmaceutical industry towards the use of digital GMP tools, AI-based monitoring, and automated quality systems to simplify the batch release and enhance reliability.

The CDMOs / CMOs segment is projected to grow at a significant CAGR over the forecast period, holding a 7.7% share in 2025. Incorporating CDMOs, companies are turning to them to gain access to specialized infrastructure, skilled GMO staff, hi-tech bioreactors, and aseptic technology without massive capital investment in their own plants. The emergence of biologics, viral vectors, and cell therapies, which require their own custom, flexible, small-scale GMO production facilities, has further increased the pressure on outsourced production.

CDMOs are also instrumental in increasing speed in scale-up, technology transfer, analytical development, and regulatory documentation to decrease time-to-market of novel therapies. Their worldwide presence, modular clean rooms, and single-use systems enable sponsors to expand clinical programs on an efficient scale and reduce the risk in their supply chain.

cGMP Manufacturing Market Region Insights

North America led the global market with the highest market share of 44.6% in 2025, fuelled by the large presence of major pharmaceutical, biotechnology, and contract development and manufacturing organizations (CDMOs). It triggers a favorable aspect of clear regulatory standards in the region, as implemented by the U.S. Food and Drug Administration (FDA) and Health Canada, which promotes a high standard of quality compliance and organized manufacturing standards. An explosion in biologics, cell and gene therapies, and individualized medicine, especially in the U.S., is also driving the demand towards higher capacity cGMP plants.

Besides, high spending on research and development, high rates of clinical trials, and adopting technology such as automation, AI-driven quality control, and single-use bioprocessing systems expedite capacity growth. There is also a well-developed healthcare ecosystem and strategic alliances between pharma companies, academic institutions, and CDMOs, which are also beneficial for the region.

The U.S. is the most significant player in the North American cGMP manufacturing market because of strong pharmaceutical innovation and investment in life science research. Local production capacity is reinforced by the fact that global industry leaders, such as Pfizer, Moderna, Thermo Fisher Scientific, Catalent, and Lonza, are present. Other COVID-19-related developments have resulted in increased growth in biologics and vaccine manufacturing capacity in the country, coupled with the rapid establishment of new advanced therapies, including mRNA vaccines and CAR-T treatments. Federal policies to promote the manufacture of drugs domestically and the resilience of supply chains, and the growth of cGMP-certified biopharma facilities accelerate growth further.

Asia-Pacific has been estimated to achieve the highest CAGR throughout the forecast period with 8.4% market share, because of low-cost production, the rising pharmaceutical infrastructure, and the regulation modernization by the government. Such countries as China, India, South Korea, and Singapore are also fast modernizing their facilities to international standards to draw in global CDMO partnerships. The high patient population in the region, the increase in the chronic disease burden, and the growth of clinical trials are speeding up biologics and biosimilars production.

Also, there are changing trends in outsourcing to the Asia-Pacific region, where Western-based firms are in search of cost-effective but compliant manufacturing power. With the intensification of regional regulatory bodies with compliance systems, coupled with the intensified investment in digital manufacturing and automation, the Asia-Pacific is becoming a key hub for the manufacturing of cGMP-certified scale production and export-oriented pharma development.

China cGMP Manufacturing Market Trends

China is coming out as one of the most significant players in the cGMP manufacturing growth in the Asia-Pacific region. The National Medical Products Administration (NMPA) has played a big role in enhancing the regulatory system of the country to bring its standards closer to those of the FDA and EMA. The fast expansion of local biopharma corporations and Contract Development Organizations (CDMOs) (e.g., WuXi Biologics and BeiGene) has prompted the expansion of global collaborations and transfers of technology. Self-sufficiency in the production of drugs, particularly biologics, vaccines, and oncology-based therapeutics, is also of interest to China. Also, the increasing interest in China towards biosimilars, mRNA vaccines, and cell therapy production is still driving the market.

The cGMP manufacturing market in Europe has been significantly growing because of the robust regulatory implementation by the European Medicines Agency (EMA), the increased demand for biologics, biosimilars, and advanced therapy medicinal products (ATMPs). It boasts of well-established R&D and pharmaceutical facilities, especially in Germany, Switzerland, the U.K., and France. Increase is also promoted by government subsidies to increase pharmaceutical production on the domestic level and decrease the dependence on external suppliers after the pandemic.

There is a trend amongst European CDMOs and pharma companies towards high-tech sterile-based manufacturing, digital systems of quality control, and sustainable biomanufacturing processes. Regulatory stringency, technological development, and a robust biopharma ecosystem remain the factors that increase the influence of Europe in worldwide cGMP production.

UK CGMP Manufacturing Market Trends

U.K. remains a strategic part of the European cGMP manufacturing market with its well-developed biotech sector, favourable regulatory framework, and increased investment in advanced therapies. The Medicines and Healthcare products Regulatory Agency (MHRA) has developed clear routes for quickening approvals of innovative biologics, gene therapies, and rare treatments, which drives the increase in compatible manufacturing capacity. Cambridge, London, and Manchester are the centres of research that keep luring international collaborations in the field of contract manufacturing and bioprocessing. As demand for CDMO outsourcing is increasing and constant investments in scalable biologics and ATMP facilities are being made, the U.K. market is set to grow.

The Middle East & Africa region is over-taking the pace of the cGMP manufacturing industry, as nations strive to make healthcare systems stronger, achieve pharmaceutical sovereignty, and reduce dependence on imported drugs. Investment in pharma infrastructure, especially in Saudi Arabia, the UAE, and South Africa, is being promoted by the governments and leads to the expansion of the facilities and harmonisation of the regulations. The interest in vaccine manufacturing, biologics manufacturing, and essential medicines has been accelerating after the pandemic, resulting in more collaborations with global CDMO and biotech companies.

Certifications and compliance upgrades are other priorities established in the region to entice the outsourcing of international pharmaceuticals. The MEA market remains at an early phase of development, with the foreign investments, technology transfers, and public-private partnerships on the rise in it, thus becoming an emerging player in the global cGMP arena.

Why is the Latin American cGMP Manufacturing Market Emerging Rapidly?

Latin America is quickly becoming a competitive market in the global ecosystem of cGMP manufacture through better regulatory reforms, growing pharmaceutical production, and growing demand for cheaper generic and biosimilar medicines. Brazil and Mexico, as well as Argentina and Colombia, are busy updating their manufacturing facilities to meet the FDA, EMA, and the WHO GMP requirements in order to enhance their ability to export.

The increased growth is further boosted by government support to modernize pharmaceuticals, local production of vaccines, and strengthening of the regional supply chain. The increasing investments by the CDMOs and multinational biopharma firms also serve to enhance the maturity of the market. With the ongoing quality compliance improvement, Latin America will be a major growth center in terms of cost-efficient but globally compliant cGMP manufacturing.

cGMP Manufacturing Market Companies

- Lonza Group

- Thermo Fisher Scientific / Patheon

- Catalent Pharma Solutions

- Samsung Biologics

- Fujifilm Diosynth Biotechnologies

- Boehringer Ingelheim BioXcellence

- WuXi AppTec / WuXi Biologics

- AbbVie Contract Manufacturing

- AGC Biologics

- Novartis Gene Therapies

- Baxter BioPharma Solutions

- Recipharm

- Jubilant Biosys/Jubilant Pharmova

- Lonza's Cell & Gene Therapy Unit

- Rentschler Biopharma

Recent Developments

- In September 2025, NFIL inaugurated Phase 1 of the new cGMP-4 plant at its plant in Dewas, Navin Molecular, with the participation of the European partner companies. It is a large acquisition for the global presence of the company in the specialty chemicals and CDMO markets.(Source: https://www.indiapharmaoutlook.com)

- In August 2025, ProBio proclaimed its manufacturing services of cGMO Adeno-Associated Virus (AAV) in a new 128000 sq. ft. facility in Hopewell, New Jersey. The expansion will be in response to a growing supply requirement in viral vectors and will make ProBio stronger in gene and cell therapy development.(Source: https://www.biospectrumasia.com)

- In July 2025, The Flamma Group announced the opening of another cGMP production plant in Dalian, China. The facility enhances its ability to aid in the synthesis and manufacturing of New Chemical Entities and late-stage intermediates for the worldwide pharmaceutical innovators.(Source: https://www.contractpharma.com)

cGMP Manufacturing Market Segments Covered in the Report

By Product Type

- Small Molecules

- Biologics

- Cell & Gene Therapies

- Vaccines

By Process Type

- Upstream Processing

- Downstream Processing

- Fill-Finish/Final Packaging

By Scale of Operation

- Preclinical

- Clinical (Phase I–III)

- Commercial

By Service Type

- Manufacturing Services

- Analytical & Quality Control Services

- Packaging & Fill-Finish Services

- Technology Transfer & Scale-Up

By Therapeutic Area

- Oncology

- Immunology

- Rare Diseases

- Infectious Diseases

By End-User

- Pharmaceutical & Biotechnology Companies

- CDMOs / CMOs

- Research Institutes

- Hospitals / Clinical Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting