Container Closure Integrity Testing Service Market Size and Forecast 2025 to 2034

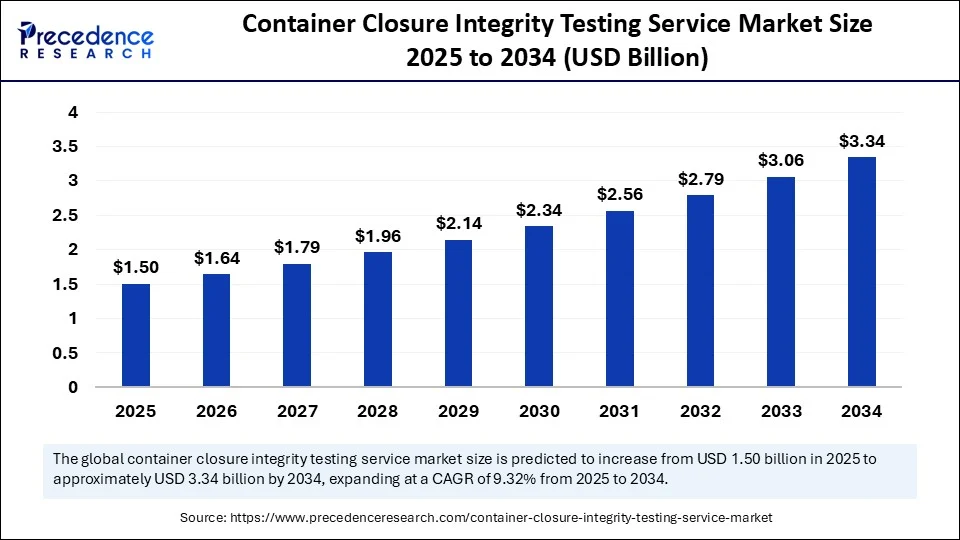

The global container closure integrity testing service market size accounted for USD 1.37 billion in 2024 and is predicted to increase from USD 1.50 billion in 2025 to approximately USD 3.34 billion by 2034, expanding at a CAGR of 9.32% from 2025 to 2034.The container closure integrity testing service market is driven by increasing regulatory compliance, rising demand for sterile pharmaceutical packaging, and the need to ensure product safety, sterility, and quality throughout the drug manufacturing and distribution process.

Container Closure Integrity Testing Service MarketKey Takeaways

- In terms of revenue, the global container closure integrity testing service market was valued at USD 1.37 billion in 2024.

- It is projected to reach USD 3.34 billion by 2034.

- The market is expected to grow at a CAGR of 9.32% from 2025 to 2034.

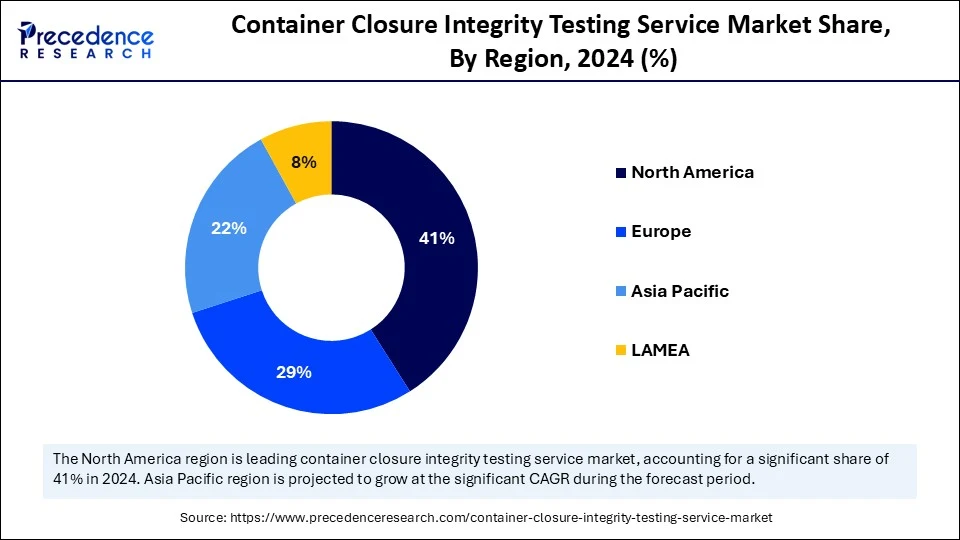

- North America accounted for the largest market share of 41% in 2024.

- The Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By technology, the vacuum decay segment held a significant share in 2024.

- By technology, the laser-based headspace analysis segment is anticipated to show considerable growth in the market over the forecast period.

- By packaging type, the vials segment held a significant share in 2024.

- By packaging type, the pre-filled syringes segment is anticipated to show considerable growth in the market over the forecast period.

- By service type, the routine integrity testing segment held a significant share in 2024.

- By service type, the method development & validation segment is anticipated to show considerable growth in the market over the forecast period.

- By end user, the pharmaceutical companies segment held a significant share in 2024.

- By end user, the CDMOs segment is anticipated to show considerable growth in the market over the forecast period.

- By application, the sterile product testing segment held a significant share in 2024.

- By application, the combination product testing segment is anticipated to show considerable growth in the market over the forecast period.

- By testing mode, the off-site/outsourced testing segment held a significant share in 2024.

- By testing mode, the on-site testing segment is anticipated to show considerable growth in the market over the forecast period.

How Is AI Integration Transforming the Container Closure Integrity Testing Service Market?

Artificial intelligence integration of the container closure integrity testing service market changes the aspect of conducting and analyzing the effectiveness of the performed tests. With AI, real-time monitoring and prediction are possible, and manufacturers can also predict issues with production lines and packaging problems. AI technologies constantly improve; probably, the implementation of these technologies into the work of the CCIT will further enhance the degree of reliability, effectiveness, and scalability in manufacturing in the drug and biopharmaceutical industries.

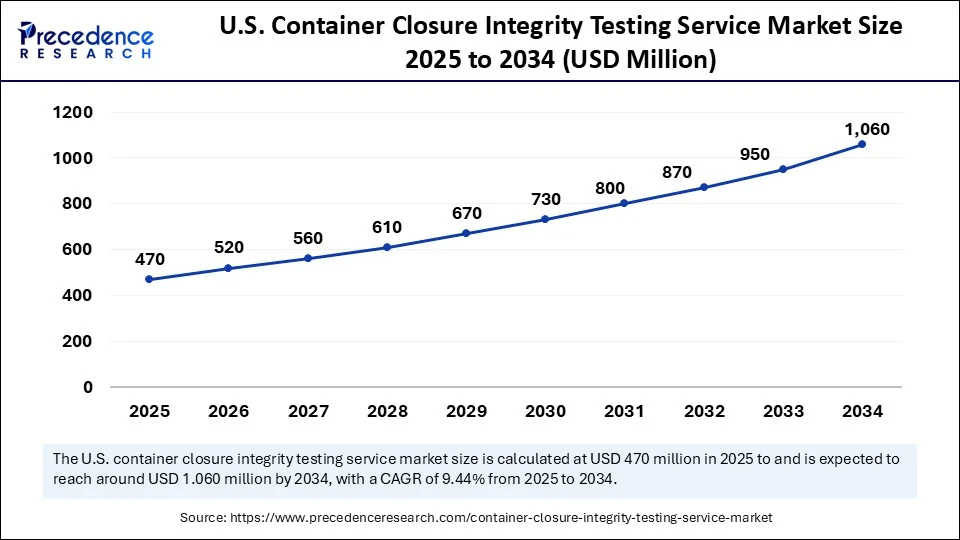

U.S. Container Closure Integrity Testing Service Market Size and Growth 2025 to 2034

The U.S. container closure integrity testing service market size was exhibited at USD 430 million in 2024 and is projected to be worth around USD 1.060 million by 2034, growing at a CAGR of 9.44% from 2025 to 2034.

Why Did North America Dominate the Container Closure Integrity Testing Service Market in 2024?

North America held the dominating share of the container closure integrity testing service market in 2024, due to its well-developed pharmaceutical and biopharmaceutical industry, hostile regulations, and the presence of major players engaged in the industry. The area has a well-developed healthcare infrastructure, well-developed R&D capabilities, and growing concerns related to drug safety and quality. Regulatory authorities such as the U.S. FDA and Health Canada demand that container closure systems must pass through a rigorous test regime, particularly for sterile and injectable drugs. Also, the increased volume of biologics, biosimilars, and high-value therapeutics has contributed to increasing the demand for effective CCIT services within the region.

The U.S. remains the major source of North America's dominance in the market of CCIT services due to massive pharmaceutical manufacturing with advanced testing technologies. Competitive pharmaceutical companies in the United States have begun spending more on progressive packaging technologies and comprehensive quality assurance solutions. The recent development of new biologics, injectables, cell and gene-based products has led to greater importance being placed on container integrity in terms of product stability and sterility. Moreover, organisations based in the U. S. have been outsourcing both routine and special processes of CCIT to another laboratory to ease their operations and reduce compliance risk.

Why Is the Asia Pacific Region Expected to Grow at the Fastest CAGR?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period. This rapid growth is contributed to by the growing pharmaceutical production facilities, expanding healthcare investment, as well as the growing policy pressures to focus on the quality and safety of drugs. India, China, Japan, and South Korea are among the countries that are experiencing significant growth in the production of drugs, mainly in generic and biosimilar drugs, and the subsequent demand for these sources is a compliant and reliable CCIT solution. Regulatory bodies in the region, such as China NMPA and Indian CDSCO, are tightening up their compliance systems, where both local and multinational firms are being urged to adopt proven validated non-destructive methods under CCIT.

China has been one of the countries that has contributed greatly to the development of the CCIT service market in the Asia Pacific region. China has a large population with a booming pharmaceutical trade, and as the country focuses on modernization of its health care industry, the safety and integrity of the drugs and their packaging are explored in these investments. Regulatory enforcement programs, such as the Healthy China 2030 strategy led by the government, are nudging pharmaceutical companies to develop high-quality, compliant solutions in packaging.

What Factors Are Influencing Europe's Container Closure Integrity Testing Service Market Share?

The European container closure integrity testing service market is expected to account for a substantial market share in 2024 due to the developed pharmaceutical industry, the robust drug regulatory environment, as well as the increasing approach to quality assurance in the region. Europe is considered one of the major places with the most advanced pharmaceutical and biotechnology organizations, which have been significantly invested in ensuring, or rather having, the highest product quality and have conformed to very strict regulatory frameworks like the EMA and Good Manufacturing Practices. Advanced testing technologies such as vacuum decay, high-voltage leak detection, and laser-based headspace analysis are also expected to be enhanced in the region.

Automated CCIT systems have been widely adopted in Germany, where pharmaceutical manufacturing is well established, with government-sponsored digital healthcare programs, and in the biologics and injectable drug segment. The leading contributor to the investment in the biotechnology and personalized medicine industry and its demand for precision testing, and its ability to preserve integrity in packaging increases.

Market Overview

Container closure integrity testing services refer to specialized contract-based analytical testing solutions aimed at verifying the integrity of packaging systems—particularly primary packaging—in the pharmaceutical, biotechnology, and medical device sectors. The goal is to ensure that containers (vials, syringes, ampoules, etc.) maintain a sterile barrier against potential contaminants such as microorganisms, gases, or liquids over their intended shelf life. These services are critical in quality assurance and regulatory compliance (e.g., FDA, EMA, USP <1207> guidelines). Outsourcing CCIT helps companies accelerate drug development timelines, meet stringent safety standards, and avoid costly recalls or patient safety risks. Sterile and high-quality pharmaceuticals, like biologics and vaccines, are popular goods that stimulate the growth of the container closure integrity testing service market.

Drug companies are investing in novel tests capable of ensuring the safety and efficacy of drugs, with strict policies being embraced by regulatory agencies to respond to unsafe and ineffective products. Moreover, a rising interest in patient safety, along with an increase in the spread of the pharmaceutical industry around the world, is contributing to the growth of the market.

What Factors Are Fueling the Rapid Expansion of the Container Closure Integrity Testing Service Market?

- Rules and Regulations Conditions: The global regulatory officials, including the FDA and EMA, compel container closure integration assessment to verify the product sterility and safety. Adherence to these regulations is of utmost importance, and this has compelled pharmaceutical companies to consider using the reliable CCIT services in their quality assurance mechanisms, which significantly leads to market growth.

- Biologics/Vaccines expansion: Increased demand for biologics, biosimilars, and vaccines, particularly in a post-pandemic world, entails high-integrity packaging to maintain efficacy. Such sensitive and complicated products are more susceptible to contamination, and this results in the stringent CCIT process.

- Testing Technologies Developments: There are non-invasive, ultra-sensitive, CCIT testing applications such as vacuum decay, microfluidics, and IPs based on lasers, thus altering the landscape of traditional testing. The expansion of the CCIT service market is gaining momentum since more manufacturers that aim to achieve efficiency and accuracy start adopting them.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.34 Billion |

| Market Size in 2025 | USD 1.50 Billion |

| Market Size in 2024 | USD 1.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology/Method, Packaging Type, Service Type, End-user, Application, Testing Mode and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Stringent Regulatory Standards

One of the primary drivers that is increasing the container closure integrity testing service market is increased demand to abide by high regulatory stringents put in place by health organizations such as the United States Food and Drug Administration (FDA), European Medicines Agency (EMA), and others. Such agencies must insist on rigorous testing practice to assure sterility, safety, and efficacy of pharmaceuticals and biological products, and biopharmaceutical products, and in particular injectable medicines, biologic products, and vaccines. Container closure integrity is significant in ensuring that there is no contamination, in addition to maintaining product stability and patient well-being. Consequently, the pharmaceuticals have started to turn towards the outsourcing of CCIT to specialized providers of the service to ensure compliance with these regulations.

Restraint

High Cost of Testing Services

The most significant constraints that inhibited the growth of the container closure integrity testing service market are the cost of purchasing and sustaining technology to conduct technology-based tests. Recent advanced CCIT methods, e.g., laser on headspace analysis, vacuum decay, and microfluidic-based systems, need high-end equipment and a specialized facility. There may be a significant amount of capital to start up such technologies, and hence, small and mid-sized pharmaceutical or contract manufacturing organizations may not be able to attain a blanket testing protocol. Such financial impediments may restrict the capacity of many emerging biotech firms or startups to comply with the strict regulations enforced by the international regulatory bodies to include the FDA and EMA.

Opportunity

Increasing Investment in Healthcare Infrastructure

With the increased investments of governments and private industries in reforming healthcare infrastructures, there is mounting pressure on the higher quality of drug packaging and delivery systems, especially in dealing with sensitive drug formulations such as biologics, biosimilars, and personalized medicines. Such drugs are very sensitive in terms of adequate and perfect packaging, which necessitates the need for the CCIT services. There is also increased usage of injectable therapeutics, cell and gene therapies and temperature and temperature-sensitive vaccines that require increased testing procedures to confirm packaging integrity. This demand provides an opportunity to execute these services by specialized CCIT service providers to provide high-precision and non-destructive testing technologies that meet global quality standards. Such forces are making the CCIT industry more appealing to investors seeking to invest in a long-term, stable way in an industry that is characterized by high growth with regulation.

Technology Insights

Why Does the Vacuum Decay Segment Lead the Container Closure Integrity Testing Service Market?

The vacuum decay segment led the container closure integrity testing service market and accounted for the largest revenue share in 2024, owing to its established sensitivity, accuracy, and broad acceptance by the regulatory authorities. It is a non-destructive, deterministic test method based on the measurement of pressure changes in a vacuum to find pressure leaks in rigid test containers such as vials, syringes, and ampoules. Its sensitive nature in even tiny breaches makes it suitable in cases of pharmaceutical products that are of high risk, such as biologics and injectables, where containers need to maintain their sterile conditions. With the regulator's attention laying strong emphasis, as well as demand increases in sterile packaging, it is apparent that the vacuum decay is the acknowledged standard when it comes to measuring container integrity.

The laser-based headspace analysis segment is expected to grow at a significant CAGR over the forecast period. Innovation of laser-based headspace analysis is swiftly proving to be one of the most proliferative technologies in the CCIT service industry due to its high level of sensitivity and non-invasiveness, as well as its applicability to test out pharmaceutical products. With the application of laser absorption spectroscopy utilizes the concentration of some gases like oxygen, carbon dioxide, or water vapor in the headspace of sealed containers to measure and detect any breach in them, whereby a leak may compromise the stability of such products. This feature gives it superiority in high high-throughput pharmaceutical production facility that wants to introduce real-time quality control. As regulatory agencies move towards deterministic, non-destructive approaches to qualifying CCIT and manufacturing firms continue the trend towards more modern, automated quality assurance systems, headspace analysis through laser technologies.

Packaging Type Insights

Why Did Cardiology Contribute the Most Revenue in 2024?

Vials contributed the most revenue in 2024 and are expected to dominate throughout the projected period. This is mainly because they are common in packaging injectable medicine, vaccines, and biologics, especially in the hospital and clinical environment. Vials are more favoured due to their robustness, sterility, and it is applicable to various types of drugs, including sensitive and high-value formulations. The demand for vials used in both biologics and injectable therapeutics is high globally, and this demand has increased the volume of the packaging. Such containers are subjected to strict tests of integrity to achieve sterility and safety of the patient, and this is a primary concern in CCIT services. Increasing regulatory focus on deterministic testing, mass production of drugs by the pharmaceutical industry, and governmental vaccination efforts further stimulate the demand for reliable CCIT services for products packaged in vials.

The pre-filled syringes segment is expected to grow substantially in the container closure integrity testing service market because of its increased use in delivering vaccines, biologics, and medications for chronic diseases. The pre-filled syringes provide ease of use, decreased dosing incidents, and a reduction in patient visits; thus, they are growing in popularity. Consequently, the pharmaceutical makers are focusing on CCIT schemes that may be highly precise and non-destructive to ascertain the sterility and integrity of the products throughout the supply chain. There has also been increased monitoring by regulatory authorities of pre-filed syringe packaging, and this is fueling the use of high-end integrity testing solutions. As treatments that are administered by the patient and the shift to home-based care increases, pre-filled syringes are becoming a necessity as a drug delivery format.

Service Type Insights

Why Did the Routine Integrity Testing Segment Lead the Container Closure Integrity Testing Service Market in 2024?

The routine integrity testing segment led the container closure integrity testing service market and accounted for the largest revenue share in 2024. This form of testing is carried out regularly during the production process so as to ensure each batch of drug products with container integrity, particularly the high-risk formulations such as biologics and sterile injectables. The need to detect the integrity of the pharmaceutical packaging, like vials, pre-filled syringes, ampoules, and others, is becoming more prevalent, with the rules of various agencies, including the FDA and the EMA, taking stricter positions on this drug packaging integrity. Regular testing enables the identification of micro-leaks, prevents contamination, and ensures the drug efficacy. This increasing scale of drug manufacture, particularly injectables and temperature-sensitive products, has increased the requirement for regular and high-level testing, and integrity testing of products is a key focus in pharmaceutical quality assurance procedures.

The method development & validation segment is expected to grow at a significant CAGR over the forecast period because of the complexity of drug products and packaging systems. The pharmaceutical firms need tailored testing procedures that are approved based on strict regulatory guidelines to receive accurate and trustworthy findings. This service category comprises design and optimization, as well as validation of container closure integrity testing procedures to suit each product and its packaging conformation, as well as the material, and the risk profile. Moreover, prior to regulatory approval of new drugs, validated CCIT techniques are required components affecting the submission of packaging to show container performance during the life of the product. With growing regulatory focus and the industry utilizing more sophisticated container systems, the market will further see growth in this segment due to an increase in life-cycle integrity testing that requires bespoke, science-based testing approaches.

End User Insights

Why Did Pharmaceutical Companies Contribute the Most Revenue in 2024?

The pharmaceutical industry contributed the most revenue in 2024 and is expected to remain dominant throughout the projected period. This can be attributed mainly to the importance of CCIT regarding the therapeutic security of the drug packaging, specifically high-risk items such as injectable products, biologics, and vaccines. As regulatory bodies like the FDA, EMA, and WHO become more scrutinizing, companies in the pharmaceutical industry are finding it more difficult to avoid regulatory penalties or even the shutdown of their operations by making sure their packaging products sustain manufacturing, transportation, and long-term storage processes intact. Routine testing and methods validation help these companies to identify micro-leaks and packaging defects that would affect the quality of products, leading to the safety of patients. An increase in the demand for precision testing has been further aggravated by the increase in biologic therapies, personalized medicine capability, and parenteral drug delivery systems.

The CDMOs segment is expected to grow substantially in the container closure integrity testing service market. CDMOs are gaining more reliance in end-to-end drug development and manufacturing procedures, encompassing the most vital activity of container closure integrity tests. Such organizations have to comply with stringent regulatory agencies and packaging standards of their clients, and all drug products must be packaged safely and securely before distribution. With greater numbers of biopharmaceutical companies, and especially startups and mid-sized firms, choosing to outsource manufacturing, the use of strong and compliant CCIT services in CDMOs. Also, CDMOs provide expertise and flexible infrastructure that enables them to quickly adjust to various drug formats, packaging materials, as well as regulatory requirements. A combination of this flexibility and increasing interest in biologics, cell and gene therapies, and parenteral formulations makes CDMOs one of the most important players in the market growth.

Application Insights

Why Did the Sterile Product Testing Segment Lead the Container Closure Integrity Testing Service Market in 2024?

The sterile product testing segment led the container closure integrity testing service market and accounted for the largest revenue share in 2024. Airtight packaging of sterile drugs, especially injected, biologics, and vaccines, is important to avoid microbial contamination, which may negatively affect safety, effectiveness. The FDA and EMA require strict, validated CCIT of sterile products, which qualifies this use of the product as a priority by the manufacturers. Sterile product testing technologies, such as vacuum decay and laser-based headspace methods, are quite common applications of such technologies, which guarantee compliance and minimize the possibility of product recalls or causing a patient to receive a contaminated product. Further, there is the growing output of temperature-sensitive and high-value pharmaceuticals to enhance attention on sterility during the supply chain.

The combination product testing segment is expected to grow at a significant CAGR over the forecast period. Driven by the emerging innovation of drug-device combination products, including pre-filled syringes, auto-injectors, and inhalers. Such products involve a complex multi-layering of the packaging integrity with pharmaceutical products and delivery systems. To ensure both sterility and functional operation, specialized, usually customized, CCIT techniques are necessary, able to evaluate a specific structural design, and an array of sealing interfaces. As more drug delivery systems and therapeutic applications become more patient-focused and attention has been given to supporting combination products, demand for reliable, non-destructive, and regulatory-compliant testing may continue to drive faster growth of the service market.

Testing Mode Insights

Why Did Off-Site/Outsourced Testing Contribute the Most Revenue in 2024?

The off-site/outsourced testing contributed the most revenue in 2024 and is expected to dominate throughout the projected period. Outsourcing CCIT can improve the capital investment burdens of high-cost equipment, and enables corporations, particularly small to mid-size firms, the opportunity to gain the benefits of validated and advanced techniques of vacuum decay, high-voltage leak detection, and headspace analysis by laser, without having to develop internal expertise to perform the testing. Also, through outsourcing, one has more flexibility and scalability, and turnaround is faster, particularly in a high-volume manufacturing process or in a situation where drugs are being approved more rapidly. With the increasing demands on the complexity of packaging as well as regulatory expectations, companies will probably outsource further to experienced CCIT service partners, and the market is dominated by outsourced testing.

The on-site testing segment is expected to grow substantially in the container closure integrity testing service market, motivated by the increased need to achieve real-time quality control, efficiency of operations, and higher control of the production process. Container closure integrity testing has the advantage of being carried out on-site so that the pharmaceutical producer can perform it at a routine or even a batch level at their facilities, thereby making decisions more quickly. Additionally, firms in the hands of sensitive biologics or custom drug products benefit from the in-sourcing capabilities of CCIT that enable them to have better process control and data management. With the industry trending towards Industry 4.0 and digitized manufacturing plants, the need to have on-site, real-time, and even integrated CCIT solutions will most likely grow, making such segment highly profitable in the future.

Container Closure Integrity Testing Service Market Companies

- SGS SA

- Nelson Labs

- Eurofins Scientific

- West Pharmaceutical Services

- Lighthouse Instruments

- PTI (Packaging Technologies & Inspection)

- Pfeiffer Vacuum

- Stevanato Group

- Qualitest

- WIL Research Laboratories

- Mocon, Inc.

- Albany Molecular Research Inc. (AMRI)

- Labcorp Drug Development

- Cormica

- Nelson Analytical

- Gateway Analytical

- Toxikon Corporation

- Genesis Packaging Technologies

- Analytical Lab Group

- DDL Inc.

Recent Developments

- In May 2025, Pace Life Sciences LLC passed a FDA Pre-Approval Inspection (PAI) at the Lebanon, NJ facility, which demonstrates its mastery of data integrity and regulatory experience. Site, purchased in 2024, has specialists in CCIT, physical testing of drug delivery, and testing of package distribution. (Source: https://www.pacelabs.com)

- In May 2025, CS Analytical Lab made an announcement of the full operational implementation of its expanded package distribution testing services, ASTM D4169-23, and ISTA on its regulatory client-driven packaging capabilities. (Source: https://csanalytical.com)

- In January 2024, Kindeva Drug Delivery added analytical services to its capabilities with a new global business unit providing integrated and standalone support, including container closure integrity, extractables and leachables, and elemental impurities analysis-serving the pharmaceutical, biopharmaceutical, and medical device industries.(Source: https://www.contractpharma.com)

Segments Covered in the Report

By Technology/Method

- Vacuum Decay (Non-destructive)

- Helium Leak Detection

- High Voltage Leak Detection (HVLD)

- Laser-Based Headspace Analysis

- Dye Ingress

- Microbial Ingress

- Ultrasound Detection

- Other Emerging Technologies (e.g., optical coherence tomography, gas tracer methods)

By Packaging Type

- Vials (Glass/Plastic)

- Pre-filled Syringes

- Ampoules

- Cartridges

- IV Bags and Pouches

- Blister Packs

- Bottles

- Other Containers (e.g., BFS containers, tubes)

By Service Type

- Method Development & Validation

- Routine Integrity Testing

- Stability Testing Support

- Regulatory Compliance Consulting

- Failure Investigations/Forensics

By End-user

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Medical Device Companies

- Academic & Research Institutes

By Application

- Sterile Product Testing

- Lyophilized Product Testing

- Liquid Drug Product Testing

- Combination Product Testing

By Testing Mode

- Off-site/Outsourced Testing

- On-site Testing (Mobile Lab/Field Testing)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting