What is the Current Sense Amplifier Market Size?

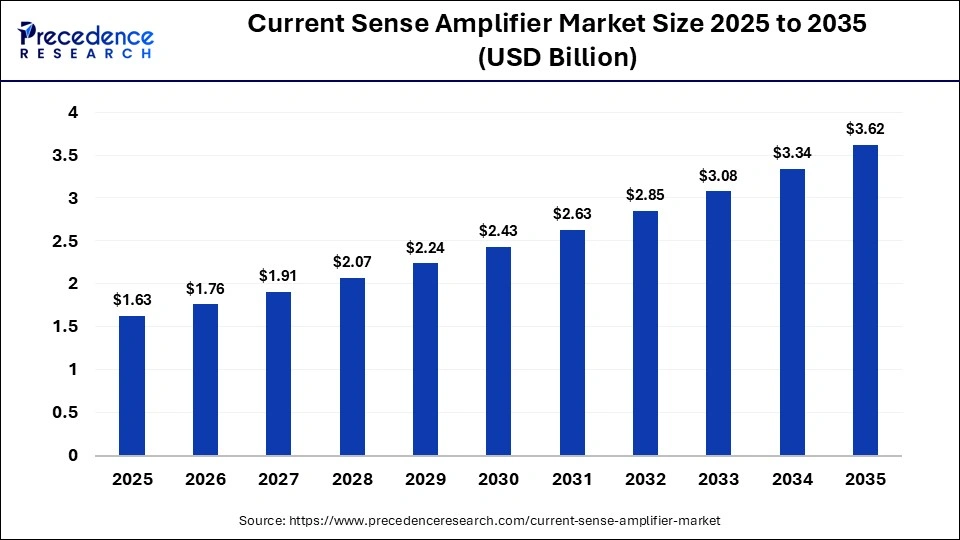

The global current sense amplifier market size accounted for USD 1.63 billion in 2025 and is predicted to increase from USD 1.76 billion in 2026 to approximately USD 3.62 billion by 2035, expanding at a CAGR of 8.34% from 2026 to 2035. The market is growing with increasing adoption in electric vehicles, renewable energy systems, industrial automation, and power-efficient consumer electronics requiring accurate current monitoring. Current sense amplifiers are primarily used for protection, power monitoring, and optimizing battery performance.

Market Highlights

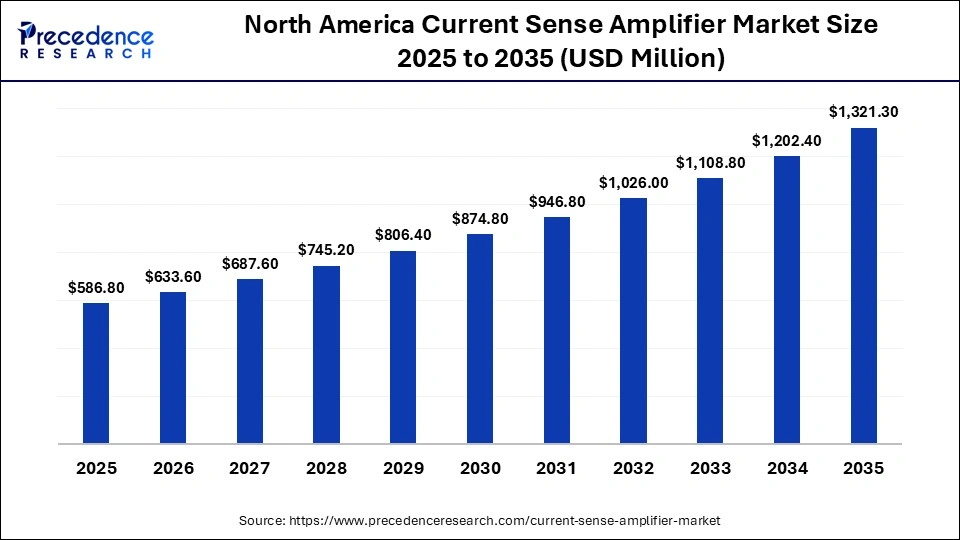

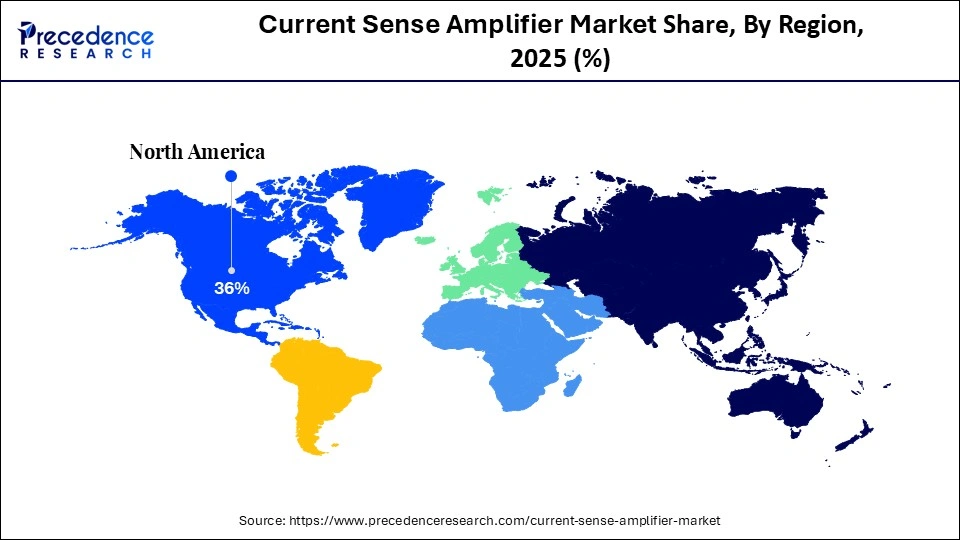

- North America led the market with the largest share of 36% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR in the current sense amplifier market between 2026 and 2035.

- By product type, the integrated current sense amplifiers segment held a dominant market share in 2025.

- By product type, the resistor-based current sense amplifiers segment is expected to grow at a solid CAGR between 2026 and 2035.

- By application, the automotive segment led the market in 2025.

- By application, the industrial automation segment is expected to expand at the highest CAGR from 2026 to 2035.

- By end use, the industrial segment dominated the market in 2025.

- By end use, the residential segment is expected to expand at the fastest CAGR from 2026 to 2035.

What is a Current Sense Amplifier?

The current sense amplifier market involves the development and distribution of an analog integrated circuit (IC) that provides a means for measuring the amount of flowing electricity. A current sense amplifier (CSA) amplifies very small voltages produced when an electrical current passes through a device to generate feedback on the electrical system's overall current status. CSAs are therefore essential in providing insight into how much energy is used by various types of electronics, including automotive systems, industrial controls, solar cells, smart meters, and consumer electronics.

Additionally, as improvements continue to be made in both bidirectional and high-side current sensing, many companies are observing increased adoption of CSAs in electric vehicle (EV) battery management systems and smart grid applications. New types of amplifiers are emerging from technological advancements that incorporate low-power, high-precision, and diagnostic-ready capabilities. As technology continues to evolve and digital integration and system-level capabilities continue to drive competitive dynamics within the industry, companies that manufacture semiconductors are embracing this evolution and expanding their capabilities to serve a wider range of applications.

AI-Driven Innovations are Shifting the Current Sense Amplifier Market

The growing influence of artificial intelligence (AI) on the market will enable process improvements through improved design quality, faster development cycles, and improved performance/reliability. Companies can now utilize AI-based tools to create and optimize configurations for the sense amplifier, a crucial component in managing power and maintaining signal fidelity in automotive, industrial, and consumer electronics applications. This enables semiconductor manufacturers to reduce their time-to-market and defect rates.

Additionally, the ability of AI to positively impact the design and manufacturing of semiconductors results in increased confidence and potential for higher revenue generation, with many company executives identifying AI as the largest contributor to growth and productivity across chip sectors. As AI-enabled products are becoming available to more companies globally, the development and creation of smart brands and amplifiers will achieve a significant advantage over their competitors.

What are the Current Trends in the Current Sense Amplifier Market?

- EV-Driven Precision: EV powertrains require high-accuracy current measurements to enhance battery protection, control over temperature, and improve overall energy efficiency.

- PMIC Integration: CSAs become increasingly integrated into power management ICs to create more compact designs and facilitate more cost-effective power monitoring.

- Industrial Automation: Current sensing is used in the automation of industrial systems for real-time control of motors, detection of faults, and energy optimization in smart manufacturing environments.

- Low-Power Accuracy: Manufacturers of CSAs are focusing on designing devices with ultra-low power consumption and improved offset accuracy to support the development of portable electronics and battery-operated devices.

- High-Voltage Sensing: Increased demand for high-voltage and bidirectional current sensing is being driven by the growing need for clean and renewable sources of electricity, fast charging systems, and advanced power electronics applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.63 Billion |

| Market Size in 2026 | USD 1.76 Billion |

| Market Size by 2035 | USD 3.62 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.34% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type,Application,End-User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Outlook

Product Type Insights

Which Product Type Segment Dominated the Current Sense Amplifier Market?

The integrated current sensors segment dominated the market in 2025 because of their small size, factory calibration, and ability to minimize external components. This results in less complexity in system design and increased reliability of automotive electronics, industrial power management, and consumer electronics. Their ability to provide a precise measure of current under variable thermal and electrical conditions makes them the preferred form of current sense monitoring for design engineers in high-performance space-constrained electronic architecture.

The resistor-based current sense amplifiers segment is expected to be the fastest-growing segment of the market in the coming years, due to the need for low-cost yet flexible and scalable solutions for measuring current in cost-sensitive applications. By selecting the external shunt resistor based on current and power ratings for specific applications, these amplifiers can be integrated into custom designs. As the power supply, battery management, and mid-range industrial equipment markets continue to grow, the demand for these amplifiers will continue to rise.

Application Insights

How the Automotive Segment Dominated the Current Sense Amplifier Market?

The automotive segment dominated the market in 2025, due to the growing significance of electronic control units, advanced driver assistance systems (ADAS), and EV powertrain technologies. In EV and hybrid vehicle applications, CSAs play an integral part in the operation of battery management, motor control, and power distribution. Additionally, stringent safety standards imposed on automotive original equipment manufacturers (OEMs) and their Tier 1 suppliers, combined with the necessity for automotive manufacturers to monitor current in real-time, maintain the high demand for CSAs in the automotive industry.

The industrial automation application segment is expected to grow at a rapid CAGR during the forecast period, due to the increasing digitisation of factories and use of motor drives, robotics, and programmable logic controllers (PLCs). CSAs allow for precise monitoring of energy consumption, fault detection, and predictive maintenance of automated systems. The continued growth of smart manufacturing, energy-efficient infrastructure, and modernisation within the industrial environment is increasing the acceptance and use of current sensing amplifiers.

End-User Insights

Why Did the Industrial Segment Dominate the Current Sense Amplifier Market?

The industrial segment held the largest market share in 2025, due to the extensive use of CSAs in multiple areas, including power supply circuitry, motor control circuitry, renewable energy systems, and heavy machinery and industrial equipment. Industrial environments require accurate and reliable current sensing, promoting the demand for CSAs. Additionally, the ongoing growth of industrial electronic devices and the corresponding growth of energy management systems are also driving the demand for high-reliability CSAs.

The residential segment is expected to grow with the highest CAGR of XX% in the market during the studied years, due to the increasing number of consumers connecting smart home devices, energy-efficient appliances, and holding home solar systems. CSAs enable consumers to accurately track and protect the power consumption of household electronic devices. Increased awareness among consumers regarding energy efficiency and smart grid compatibility will drive the segment's growth into residential electrical and electronic system applications.

Regional Insights

How Big is the North America Current Sense AmplifierMarket Size?

The North America current sense amplifier market size is estimated at USD 586.80 million in 2025 and is projected to reach approximately USD 1,321.30 million by 2035, with a 8.46% CAGR from 2026 to 2035

Why North America Dominated the Current Sense Amplifier Market?

North America held a major market share in 2025, due to its well-developed semiconductor fabrication (fab) technologies, early adoption of embedded high-performance analog components, and the large presence of both automotive and industrial electronic systems. In working closely with each other (foundries and design houses), the design house has been able to speed up the incorporation of precision sensing into their systems for use in power management and safety. Energy efficiency and the use of sophisticated electronic control units (ECUs) drive the need for highly accurate current sensing solutions for many different applications.

What is the Size of the U.S. Current Sense AmplifierMarket?

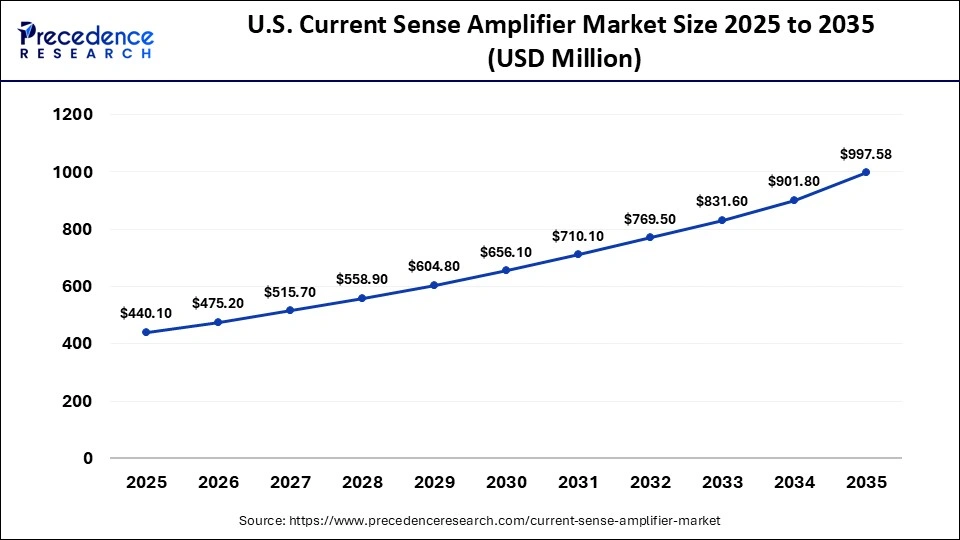

The U.S. current sense amplifier market size is calculated at USD 444.10 million in 2025 and is expected to reach nearly USD 997.58 billion in 2035, accelerating at a strong CAGR of 8.53% between 2026 and 2035.

U.S. Current Sense Amplifier Market Trends

The U.S is holds a major market share, because of the presence of numerous semiconductor designers and system integrators. The U.S. researchers adopt advanced technologies to develop better solutions related to CSAs. This includes research in EVs, data centre power supplies, and IoT devices. Developers actively work to create solutions with low noise and high speeds. Working together with research institutions to optimize performance will continue to cement the USA's position as a leading source of advanced current sensing solutions.

How is Asia Pacific Growing in the Current Sense Amplifier Market?

The Asia Pacific region is expected to experience the fastest growth in the market over the studied years, due to increased automation within industries, as well as increased investments in electric mobility and broader acceptance of consumer electronics. Additionally, due to having large manufacturing bases, the Asia Pacific region has the capacity to rapidly scale production and distribute technology to the market. An increased focus on creating intelligent infrastructure, implementing renewable energy systems, and maximizing efficiency in managing electrical power contributes to the growth of current-sensing technology in multiple industries worldwide.

China Current Sense Amplifier Market Trends

China is the largest manufacturer of electronics within the Asia-Pacific region and has significant ambitions related to the electrification in diverse sectors through advancements in smart devices, such as EVs and next-generation consumer electronics. Numerous domestic manufacturers are integrating CSAs into their EV powertrains, renewable energy inverters, and next-generation consumer electronics products. Furthermore, the Chinese government emphasizes supporting semiconductor self-sufficiency through localized innovative technologies to enhance China's strategic position within the high-performance market.

Will Europe Grow in the Current Sense Amplifier Market?

The growing demand for EVs, industrial automation, and IoT in European nations promotes the use of CSAs. The European government and regulatory authorities make constant efforts to establish a suitable battery and EV manufacturing capacity within the region. In 2024, more than 1.4 million new BEVs were registered in the EU, representing an increase of 13.6% from the previous year. The region is home to numerous key players that provide CSAs to fulfil local demands. Companies like Mouser Electronics, NOVOSENSE, and ROHM Semiconductor are major contributors to market growth.

Value Chain Analysis for the Current Sense Amplifier Market

- Research and Development – Researchers develop innovative CSAs that enhance their performance in terms of accuracy, bandwidth, and low power consumption, and design IC layouts according to automotive, industrial, and consumer electronics requirements.

Key Companies: Analog Devices, ON Semiconductor, STMicroelectronics, Texas Instruments.

- Semiconductor Manufacturing - The design of the CSA circuits is manufactured on silicon wafers using complementary metal oxide semiconductor (CMOS) or BiCMOS technologies to create the required electrical characteristics for the completed semiconductor devices.

Key Companies: Infineon Technologies, Renesas Electronics, STMicroelectronics, Texas Instruments, and ON Semiconductor.

- Assembly, Packaging, and Testing: Manufactured and packaged CSA chips are tested and validated for reliability, accuracy, thermal performance, and compliance with the necessary harsh operating environments for automotive and industrial applications.

Key Companies: Amkor Technology, ASE Group, ON Semiconductor, Texas Instruments, and STMicroelectronics.

- Distribution and End-User: The finished CSA chips are distributed through a global supply chain and then incorporated into the end-user product, e.g., EV, power supplies, industrial automation, and consumer electronics.

Key Companies: Arrow Electronics, Avnet, Digi-Key Electronics, Bosch, and Schneider Electric.

Who are the Major Players in the Global Current Sense Amplifier Market?

The major players in the current sense amplifier market include Texas Instruments Incorporated, Analog Devices, Inc., Maxim Integrated Products, Inc., Infineon Technologies AG, ON Semiconductor Corporation, NXP Semiconductors N.V., STMicroelectronics N.V., Microchip Technology Inc., Vishay Intertechnology, Inc., and ROHM Semiconductor

Recent Developments in the Current Sense Amplifier Market

- In December 2025, STMicroelectronics launched an operational amplifier, TSZ901, to deliver exceptional accuracy, speed, and stability for precision electronics. The amplifier combines zero-drift technology with a 10 MHz gain-bandwidth, making it suitable for applications that require high performance and reliability.

(Source: https://www.newelectronics.co.uk) - In October 2025, Vishay Intertechnology, Inc. introduced the high-power-density WSLF1206 Power Metal Strip current sense resistor, delivering up to 5 W in a compact 1206 footprint, boosting efficiency and saving board space in compact applications. The resistor offers power ratings higher than standard resistors, promoting efficient use of board space in high-power applications.(Source:https://www.quiverquant.com)

- In March 2025, Texas Instruments, Inc. unveiled new power-management ICs for data centers, improving power-density, efficiency, protection, and integration to support high-performance computing and AI workloads with advanced 48-V architectures. The power-management chips support data center hardware and processing needs, and a new family of integrated GaN power stages in transistor outline leadless packaging.(Source: https://www.edn.com)

Segments Covered in the Report

By Product Type

- Integrated Current Sense Amplifiers

- Resistor-Based Current Sense Amplifiers

- Others

By Application

- Automotive

- Consumer Electronics

- Industrial Automation

- Telecommunications

- Others

By End-User

- Commercial

- Residential

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content