What is the Cyclic Olefin Polymer Market Size?

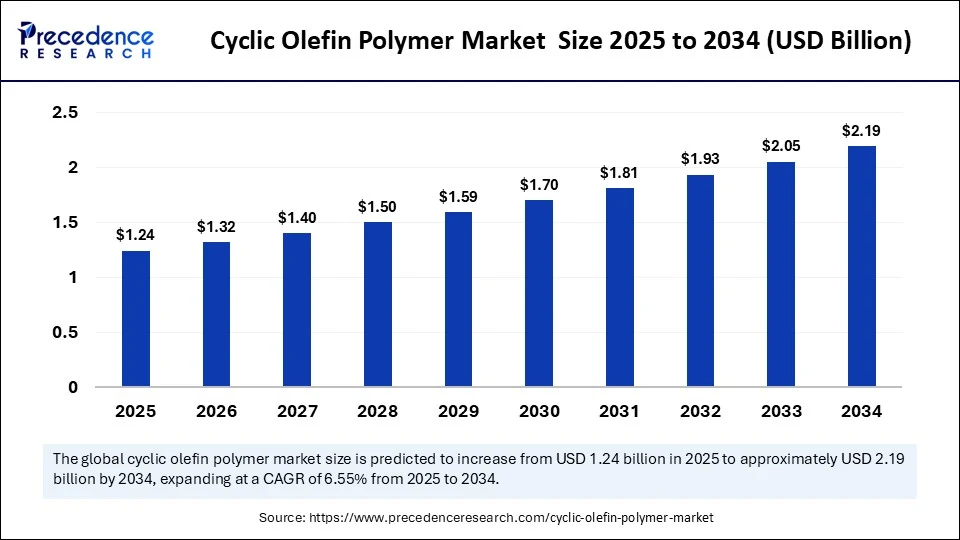

The global cyclic olefin polymer market size accounted for USD 1.24 billion in 2025 and is predicted to increase from USD 1.32 billion in 2026 to approximately USD 2.19 billion by 2034, expanding at a CAGR of 6.55% from 2025 to 2034. The market growth is attributed to rising adoption of high-purity, chemically inert polymers in advanced medical, diagnostic, and optical applications across regulated industries.

Cyclic Olefin Polymer MarketKey Takeaways

- In terms of revenue, the global cyclic olefin polymer market was valued at USD 1.16 billion in 2024.

- It is projected to reach USD 2.19 billion by 2034.

- The market is expected to grow at a CAGR of 6.55% from 2025 to 2034.

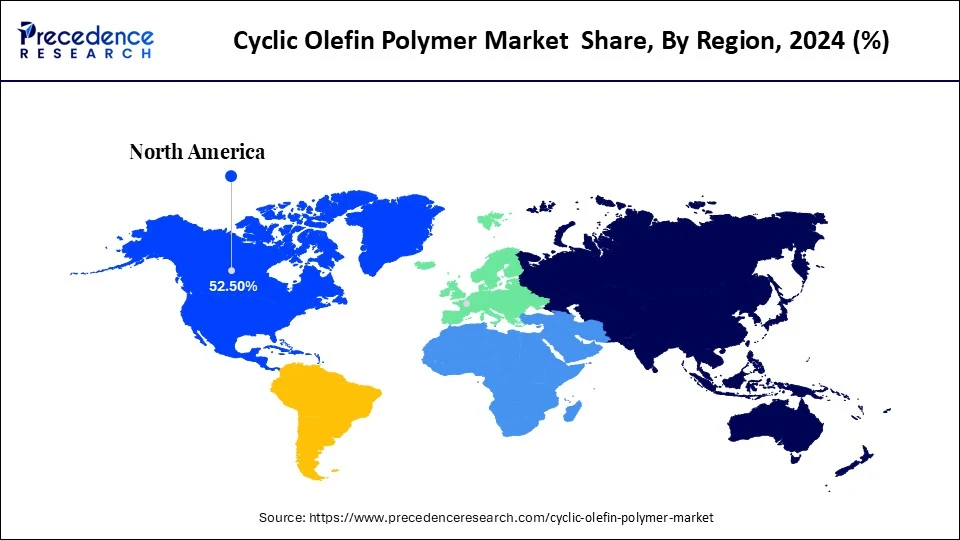

- North America dominated the cyclic olefin polymer market with the largest share of 52.5% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By type, the cyclic olefin copolymer segment held the major market share of 68.3% in 2024.

- By type, the cyclic olefin polymer segment is projected to grow at a CAGR in between 2025 and 2034.

- By application, the pharmaceutical and medical application segment contributed the biggest market share of 61.4% in 2024.

- By end-user, the healthcare and life science segment held the highest market share of 64.7% in 2024.

- By end-user, the electronics and semiconductor industry segment is expected to grow at a significant CAGR over the projected period.

Impact of Artificial Intelligence on the Cyclic Olefin Polymer Market

Artificial intelligence has sized up the development, production and application of cyclic olefin polymers (COPs) significantly. The design of high-performance COPs with niche applications, such as diagnostics and pharmaceutical packaging. AI systems also can be used in the field of manufacturing, where they continuously adjust process parameters to produce products in a consistent way, minimize defects, and decrease operating costs. Furthermore, the machine learning algorithms are also used in companies to predict the demand trend and optimal logistic administration of products to ensure effective supply chain functioning.

What is the Cyclic Olefin Polymer Market?

Cyclic Olefin Polymers (COPs) are a class of amorphous polymers synthesized through the copolymerization of cyclic olefins (such as norbornene) with other olefins like ethylene. These polymers exhibit exceptional transparency, low moisture absorption, high thermal resistance, excellent biocompatibility, and chemical inertness, making them suitable for a wide range of applications in pharmaceutical packaging, optical components, medical devices, and electronics.

The intense demand of high end drug delivery packaging and diagnostic packaging is likely to propel the market as the pharmaceutical firms are demanding more chemically inert and high-clarity materials. Applications using these polymers include prefilled syringes, diagnostic cuvettes and microfluidic systems and semiconductor lens systems. The U.S. FDA cleared COC materials such as TOPAS (supplied by Cytec in the U.S.) by Food Contact Notification 1104, to provide regulatory harmonization when used in parenteral packaging, lab consumables and other applications. Furthermore, the increased adoption of COP in LiDAR, smartphone optical and wearable sensors is also expected to drive the further fuels demand for these type of polymers.

What are Major Trends in Cyclic Olefin Polymer Market?

- Boosting Adoption in Sustainable Inhalation Devices: Growing environmental focus in respiratory drug delivery is fuelling the use of recyclable and extractable-free cyclic olefin polymers.

- Driving Demand from Precision Diagnostics: Rising need for accurate microfluidic platforms is propelling interest in COP/COC due to their optical clarity and dimensional stability.

- Growing Role in Cell and Gene Therapy Logistics: Increasing biopharma investments in ultra-sensitive therapies are driving demand for inert, contamination-free packaging materials.

- Accelerating Integration in Smart Optoelectronics: Expanding application of AR/VR and automotive sensors is boosting demand for low-birefringence optical polymers like COP.

- Rising Focus on Cold Chain Compatibility: Expanding global vaccine distribution is fuelling the shift to polymers resistant to thermal stress and moisture permeation.

- Enhancing Regulatory Alignment in Emerging Markets: Improving harmonization of polymer safety standards across Asia, LATAM, and MEA is driving increased material certification and adoption.

- Propelling Use in Lab-on-Chip Devices: Surge in point-of-care diagnostics is boosting demand for biocompatible, injection-moldable materials in compact testing devices.

Market Outlook

- Industry Growth Overview: The upward trend in demand is primarily due to the progress in the healthcare sector, advanced packaging, and various other applications in optics, electronics, which are all accompanied by higher investments, manufacturing improvements, and evolving polymer specifications.

- Sustainability Trends: The entire industry is turning towards the whole area of sustainable processes for production, recyclable polymer development, the design of materials that are friendly to the environment, and the practice of resource-efficient and responsible manufacturing throughout.

- Global Expansion: The market is growing in all the major regions, and this is made possible by factors such as expansion, investment, and demand that is already rising, together with manufacturing advancements and the application of the world's end-use markets becoming stronger.

- Major Investors: The main companies investing in this sector are Mitsui Chemicals, Zeon Corporation, Polyplastics, JSR Corporation, and Topas Advanced Polymers, and they are the ones who drive innovation and create products that will help the market.

- Startup Ecosystem: The market is composed of a few large and already established companies, but their growth is supported by innovation, research partnerships, collaborative development, and the opening up of strategic R&D-driven advancement opportunities.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.19 Billion |

| Market Size in 2025 | USD 1.24 Billion |

| Market Size in 2026 | USD 1.32 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.55% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application,End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Shift Toward High-Barrier Packaging Transforming the Cyclic Olefin Polymer Market?

Increasing demand for high-performance packaging materials is expected to accelerate the cyclic olefin polymers market growth. These polymers bring together purity, optical clarity, and superior barrier performance and usefully be applied to syringes and vials and diagnostic containers, particularly in a biologic and sensitive product form. The FDA database notes several drug-device combination products cleared with cyclic olefin copolymer (COC) or polymer (COP) components have been proven to be safe and compatible in terms of regulatory clearance at 21 CFR 177.1520 and USP <661>. The selected COP vials used in the EMA licensed biologic drug, Imlygic 12, a herpesvirus-based therapy, recently approved by the European Medical Agency (EMA) in its public assessment report.

They are specifically chosen to mitigate against adsorption risks and leaching, two major structural risks in advanced biologics. The recyclability and REACH compliance of several grades of COP has been confirmed by RecyClass and the European Chemicals Agency (ECHA), which help in achieving the sustainability objectives and gaining access to Europe. Furthermore, the rising number of approved biologics that rose to 55 in 2018 and reached more than 130 at the end of 2024 as per FDA, Center for Drug Evaluation and Research (CDER), thus further fuelling the market.

Restraint

Limited recyclability and end-of-life concerns impede wider application of cyclic olefin polymers

Recyclability and end-of-life concerns of cyclic olefin polymer is expected to hinder the market growth. In spite of having performance advantages, the chemical composition of COP does not allow it to be integrated with traditional mechanical recycling. In contrast to PET, or HDPE, COP be processed in specialized sorts and handled, which is hardly present at municipal waste systems.The use of circular materials is gaining more and more attention through regulatory frameworks, including those informed by the European Chemicals Agency (ECHA) Likewise, an increasing number of regulatory frameworks promote extended producer responsibility (EPR) policies. Furthermore, the COP drawbacks unless manufacturers create solutions of closed-loop recycling or certified bio-degradable variants, both of which are at the infancy of development.

Opportunity

How Are Material Innovations and R&D Investments Accelerating Growth in the Cyclic Olefin Polymer Market?

Rising investments in advanced material research and innovation are likely to create immense opportunities for the players competing in the market. Major research centers, such as NIST are investing in the mapping of polyolefin architectures and modelling processing behaviour. They are aiming of enhancing characterisation and recyclability with the focus on materials.

These novel polymerization methods, such as living coordination chain transfer polymerization (LCCTP) that allow manufacturers to make narrow-distribution, high-precision polyolefin grades suited to COP use. Improvements related to injection molding, such as nitrogen hopper purging, temperature precision near Tg+10 and the design of nozzles, are the results of molding principles recommended by ISO. Furthermore, this concurrent R&D activity enables processing by injection molding, blow molding, and the newly emerging3D printing is expected to facilitate the growth of the cyclic olefin polymer market.

Type Insights

Why Did the Cyclic Olefin Copolymer (COC) Segment Capture largest share of the Market Share in 2024?

Cyclic olefin copolymer (COC) segment dominated the cyclic olefin polymer market in 2024 accounting for 68.3% of total market share, due to the its good moisture barrier properties, which are important features of optical lenses, medical syringes or diagnostics constituents. In the glass like injection and injection blow molding precision industries, COC low birefringence and dimension stability as QAISO and ASTM standard qualities. They allowes long term high volume consistent injection and injection blow mold. Food Contact Notification no. 1104 issued by the FDA certified that TOPASGuard TOPAS?COC was biocompatible and safe per USP. Furthermore, the adoption of COC was backed by regulatory approvals by EMA and Health Canada thus strengthening its market hegemony in healthcare.

The cyclic olefin polymer (COP) segment is projected to grow at the fastest rate in the forecast years. COP is an exemplary material when it comes to stability of refractive index over the UV-NIR spectra, and extremely low birefringence, which has been proven by NIST and ASTM optical measurement systems. The high temperature resistance (up to ~140 C) and chemical resistance allow this high grade of COP polymer to be deployed even in applications requiring such elevated capability.

Investment in the grades of COP to meet the precision-optics needs is helping with the quick market growth and increasing adoption in specialized industries. Additionally, the growing developments indicate a broader use of the COP in the medtech, life sciences and precision manufacturing industries, thus boosting the segment in the coming years.

Application Insights

What Drove the Pharmaceutical and Medical Segment to Dominate the Market in 2024?

Pharmaceutical and Medical segment dominated the market accounting for61.4% market share, due to the increased advanced healthcare technology and precision diagnostics. COP is UV-NIR refractively stable and has ultra-low birefringence, both characteristics recorded in both NIST and ASTM optical metrology reports. Thus adapted to microfluidic chips, imaged-based devices and disposable optics. Japan The Pharmaceuticals and Medical Devices Agency (PMDA) of Japan has also approved COP-based diagnostic cartridges based on successful sterilization with gamma and EtO sterilization processes to be used as IVD. Furthermore, the EMA and FDA regulatory focus on extractables/leachables have resulted in the switch by healthcare producers out of legacy plastics into COP.

End User Insights

Why Did the Healthcare & Life Sciences Segment Dominate the Cyclic Olefin Polymer Market Share in 2024?

Healthcare & life sciences segment dominated the cyclic olefin polymer market in 2024 with 64.7% of total market share, due to the its attractive optical transparencies and superb moisture-barrier properties, and its ultra-low extractables. TOPAS COC has been qualified by the U.S FDA under Food Contact Notification process 1104 to be used as food contact and medical materials. COP/COC was cited in EMA master files by combination products, used to support regulatory filings of pre-filled syringes, blister packs and point-of-care devices.

COC was among the recommended materials in aqueous and biologic containers because of exhibiting inert properties and good moisture barrier. ISO D7436 and ISO 11607 certification gives assurance of performance by COC in sterile barrier packages, and ASTM D6705 gives the optical and mechanical specifications. This division was boosted by an increase in number of approvals of biologics-more than 130 worldwide in 2024, as indicated by the EMA records-a factor that pushed up the demand of packaging that is contamination-free and preservative-resistant. Additionally, the solid support and trade-standard conversion further boosts the market in this sector.

Electronic & semiconductor industry segment is observed to grow rapidly in the cyclic olefin polymer market in the coming years, owing to the increasing product demand of superior optical and insulating polymers. High refractive index and uniformity, combined with low birefringence, are also in compliance with NIST and IEC standards in the precision optics and photonic components areas. At the wafer-level packaging and lens arrays COP/COC is more and more commonly used by semiconductor manufacturers given that the metal ion contribution cannot exceed the level of ppm depending on the impurity aline with the BIS and Health Canada.

A 2022 Wiley review highlights cyclic olefin copolymer as a primary material for microfluidic platforms, citing its low water absorption, electrical insulation, and chemical resistance. The use of automotive lidar sensors backed by the capability of COP within residential, commercial and industrial thermal cycling. The tolerance range of the UV environment to IEC 60825 standard should place a faster adoption of materials. Furthermore, since miniaturisation of devices and the need to achieve high resolution imaging gain grounds in the smartphones and autonomous systems, this segment facilitating the utilization of these polymers.

(Source: https://onlinelibrary.wiley.com)

Regional Insights

U.S. Cyclic Olefin Polymer Market Size and Growth 2025 to 2034

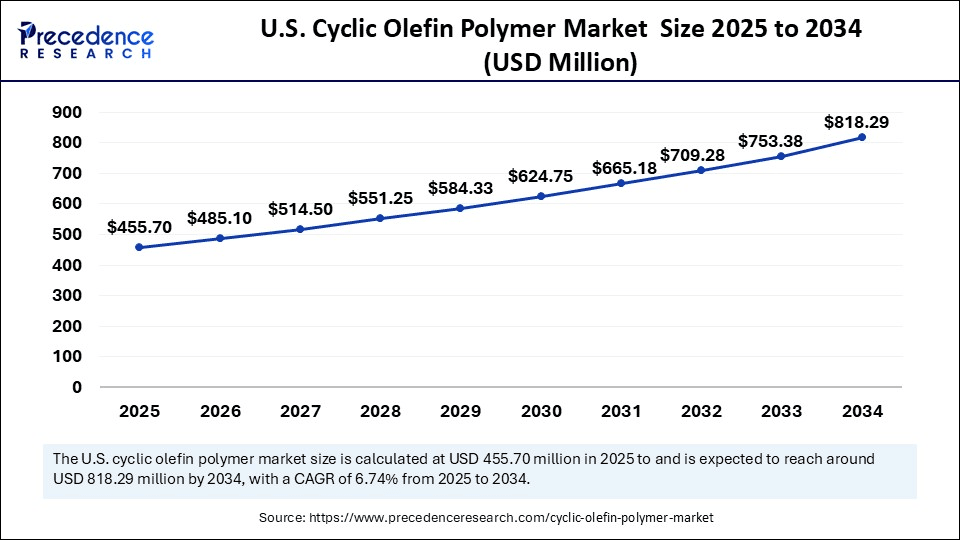

The U.S. cyclic olefin polymer market size is exhibited at USD 455.70 million in 2025 and is projected to be worth around USD 818.29 million by 2034, growing at a CAGR of 6.74% from 2025 to 2034.

North America led the cyclic olefin polymer market, capturing the largest revenue share in 2024

North America led the cyclic olefin polymer market, capturing the largest revenue share in 2024, due to their fastest rate stimulated by a sophisticated pharmaceutical and electronics industry and a wide regulatory background. The USFDA Food Contact Notification 1104 TOPAS 1104 COC plus the USP 1104 Class VI/ISO 10993 supported the use of cyclic olefin polymer. Optical performance NIST and IEC standards allow and stress on COP/COC usage in photonic sensors and high resolution lenses. Diagnosis manufacturing trends are now including onshoring, which has been speeded up with post-COVID development. This creates a request in COP based cuvettes and test kits.

In 2024, the FDA approved high number of new companion diagnostic devices, which opened more potential over COP-based platforms in regulated laboratories. The licenses have been issued to manufacturers of rapid test kits with sterilizable polymer housing by Health Canada, and this is one of the indicators of how COP complies with ISO 11607 and ISO 10993. The NIST invested CHIPS Act polymer metrology programs to help test material of photonics and microelectronics between June and September 2024. Moreover, the low-birefringence thermoplastics used to make optical components and made direct references to formulations of cyclic olefins used in making lenses, thus further propelling the market in this region.

(Source: https://www.nist.gov)

Asia Pacific Cyclic Olefin Polymer Market Trends

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the increasing level of usage of COP/COC-based vials and prefillable devices. The COP materials applied by Japan manufacturers with the help of Ministry of Health, Labour and Welfare (MHLW). Further they being controlled with PMDA are built on ISO 10993 to support diagnostic and injectable packaging, which strengthened the uptake of the region. The region has many manufacturers focusing on quality and traceability as required by the ASEAN-Japan health meetings that further invest in COP- compatible production lines.

China and Japan are key growth enabled poles in the Asia Pacific region that export healthcare and electronics applications of cyclic olefins polymers. Local production of medical grade plastics was a focus of state sponsored efforts aimed at the Made in China 2025 strategy that was having the effect of promoting upstream investments into cyclic olefin processing plants. Electronics manufacturers of Japan especially those around Osaka and Tokyo-tech-corridors were showing an increasing use of COP into optical sensors. Additionally, the growing adoption of COC/COP-based microfluidics and diagnostic cartridges is expected to boost the market in the coming years.

(Source: https://orcasia.org)

What to Expect from Europe's Cyclic Olefin Polymer Market?

The Europe region is expected to hold a notable revenue share of the market, as strong stringent regulatory codes and the rise in demand of the materials on account of sustainability and high performance materials. In 2024, the European Pharmacopoeia Commission formally recognised monographs Ph. Eur. 3.1.16 and 3.1.17, making COP and COC compliant substances with primary packaging of pharmaceuticals. Such insertions standardized using material in the EU applications like prefillable syringes, vials and cartridge diagnostics. Furthermore, the intensive investments in research under EU Horizon initiatives, make Europe region encouraging regulatory-proofed and circular ready introduction of cyclic olefin polymers to life science and high tech applications.

(Source: https://www.edqm.eu)

Value Chain Analysis

- Feedstock procurement: efficiently sourcing, learning, and receiving the raw cyclic olefin materials, which are required for the whole process.

Key Players: Reliance Industries and TotalEnergies - Chemical synthesis and processing: the final polymers are produced by going through controlled chemical reactions applied to the raw feedstock.

Key players: SABIC, Sumitomo Chemical, and Chevron Phillips Chemical - Compound formulation and blending: the requirements of physical, chemical, and application properties are achieved by the mixing of synthesized polymers with additives.

Key Players: Aether Industries - Quality testing and certification: finished products are tested to confirm compliance, and the company obtains certifications that align with the specified customer requirements.

Key Players: Bureau of Indian Standards (BIS) and the International Organization for Standardization (ISO) - Packaging and labelling: products are packed, and labels are affixed that communicate the vital transport, storage, and marketing info.

Key Players: World Packaging Organisation

Key Players' Offering

- Zeon Corporation: Zeon Corporation is known for its world-leading and best-selling optical and diagnostic applications under ZEONEX and ZEONOR brands, which are high-purity grades of COC/COP.

- TOPAS Advanced Polymers: TOPAS Advanced Polymers produces TOPAS brand COC resin, which has ultra-high purity and is used in medical, diagnostic, and packaging applications in various industries.

- Mitsui Chemicals, Inc.: Mitsui Chemicals transparently presents its APEL COC resin, which has a high refractive index, is heat-resistant, and offers excellent molding, thus benefiting both the optics and packaging sectors.

Cyclic Olefin Polymer Market Companies

- Zeon Corporation

- TOPAS Advanced Polymers (Daicel Group)

- Mitsui Chemicals, Inc.

- JSR Corporation

- Polyplastics Co., Ltd.

- Sumitomo Chemical

- SABIC

- BASF SE

- Dow Inc. (involved in olefin-based specialty polymers)

- Eastman Chemical Company

Recent Developments

- In May 2023, At the recent RAPID + TCT event in Chicago, polySpectra introduced COR Bio, a new biocompatible 3D printing material based on Cyclic Olefin Resin (COR). This marks the company's third material launch and its first designed specifically for medical-grade applications. COR Bio is engineered for end-use production in healthcare, including medical device components, dental products, surgical tools, microfluidic devices, and select consumer goods. The material offers impressive physical properties—135°C glass transition temperature, high impact strength, 100% elongation at break, and a high working temperature—making it ideal for performance-critical uses.

- In October 2024, polySpectra also announced COR Zero, a manufacturing-grade cyclic olefin resin tailored for home and workshop 3D printing, launched via Kickstarter. Developed over a decade, COR Zero offers a safe, low-cost resin option that can be printed using affordable desktop equipment. Founder and CEO Raymond Weitekamp emphasized the democratization potential of COR Zero, stating it empowers individual inventors and creators—especially those looking to launch their own physical products through platforms like Kickstarter.

- In November 2023, Gerresheimer has introduced advanced cyclic olefin polymer (COP) vials optimized for storing and filling sensitive biologic formulations, including mRNA-based therapeutics. These vials, engineered to perform reliably at cryogenic temperatures down to -80°C, blend the advantages of glass and plastic—offering crystal-clear transparency, superior break resistance, and strong oxygen and moisture barrier properties. The COP vials integrate seamlessly into various filling systems, including multi-fill and isolator-based setups, and form part of the company's growing Ready-to-Fill (RTF) portfolio for high-value pharmaceuticals.

- In May 2023, Borealis, in collaboration with TOPAS Advanced Polymers, has launched Stelora, a novel class of sustainable engineering polymer that combines cyclic olefin copolymers (COCs) with polypropylene (PP). The result is ethylene-propylene-norbornene (EPN), a new material offering exceptional durability, heat resistance, and mechanical strength. Designed for use in advanced applications such as e-mobility and renewable energy systems, Stelora represents a major innovation in sustainable material science, aligning performance with environmental responsibility.

- In June 2025, Inkbit introduced Cyclic Olefin Thermosets (COT) low-loss dielectric materials for mmWave applications, entering the antenna systems market. The materials aim to provide a strong alternative to traditional GRIN lenses and components for various industries.

https://www.tctmagazine.com - In April 2025, PolySpectra and Tethon 3D launched ThOR 10, a high-performance composite photopolymer, at Rapid + TCT, enhancing Cyclic Olefin Resins for improved production and additive manufacturing possibilities.

https://www.voxelmatters.com

Latest Announcements by Industry Leaders

- In April 2025, Borouge, a leading petrochemicals provider specializing in innovative and differentiated polyolefin solutions, unveiled a series of strategic asset expansion projects aimed at accelerating its growth. These developments are projected to add over 200,000 tonnes per annum of new capacity and contribute between $165 million and $200 million in annual EBITDA. Hazeem Sultan Al Suwaidi, CEO of Borouge, stated: “By increasing production at our EU2, PE4, and PE5 units, along with executing the Borouge 4 mega project, we are strategically positioned for accelerated growth.

The expansions of our ethylene and polyethylene capabilities will allow Borouge to address rising market demands, tap into new revenue streams, and enhance our global market footprint. These initiatives underscore our focus on innovation, operational excellence, and long-term sustainable growth.”

(Source: https://www.indianchemicalnews.com)

Segments Covered in the Report

By Type

- Cyclic Olefin Polymer (COP)

- Low Molecular Weight COP

- High Molecular Weight COP

- Cyclic Olefin Copolymer (COC)

- COC with High Glass Transition Temperature (Tg)

- COC with Low Glass Transition Temperature (Tg)

By Application

- Pharmaceutical & Medical Applications

- Pre-filled Syringes

- Vials & Ampoules

- Diagnostic Containers

- IV Containers

- Microfluidic Devices (Lab-on-a-chip)

- Inhalers and Drug Delivery Systems

- Optical Applications

- Camera Lenses

- Light Guides

- Optical Films

- LED Lenses

- Electronics Applications

- Semiconductor Packaging

- Wafer Carriers

- Display Components (Light Guides, Backlight Units)

- Sensors and Housings

- Packaging (non-pharmaceutical)

- Food Packaging (high-clarity films)

- Cosmetic Packaging

- Others

- 3D Printing Materials

- Research Tools and Lab Consumables

- Analytical Devices

By End User

- Healthcare & Life Sciences

- Pharmaceutical Companies

- Biotech Firms

- Medical Device Manufacturers

- Electronics & Semiconductor Industry

- Food & Beverage Packaging Industry

- Cosmetic Industry

- Academic & Research Institutions

- Contract Manufacturing Organizations (CMOs) & CDMOs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting