Data Center CPU Market Size and Forecast 2025 to 2034

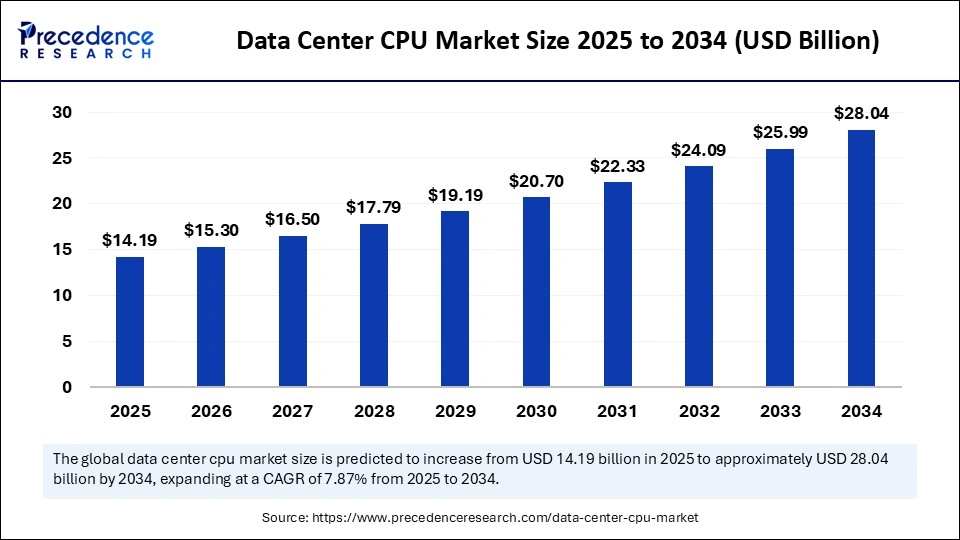

The global data center CPU market size was calculated at USD 13.16 billion in 2024 and is predicted to increase from USD 14.19 billion in 2025 to approximately USD 28.04 billion by 2034, expanding at a CAGR of 7.87% from 2025 to 2034. The market is growing due to rising demand for cloud computing, AI workloads, and high-performance data processing.

Data Center CPU Market Key Takeaways

- In terms of revenue, the global data center CPU market was valued at USD 13.16 billion in 2024.

- It is projected to reach USD 28.04 billion by 2034.

- The market is expected to grow at a CAGR of 7.87% from 2025 to 2034

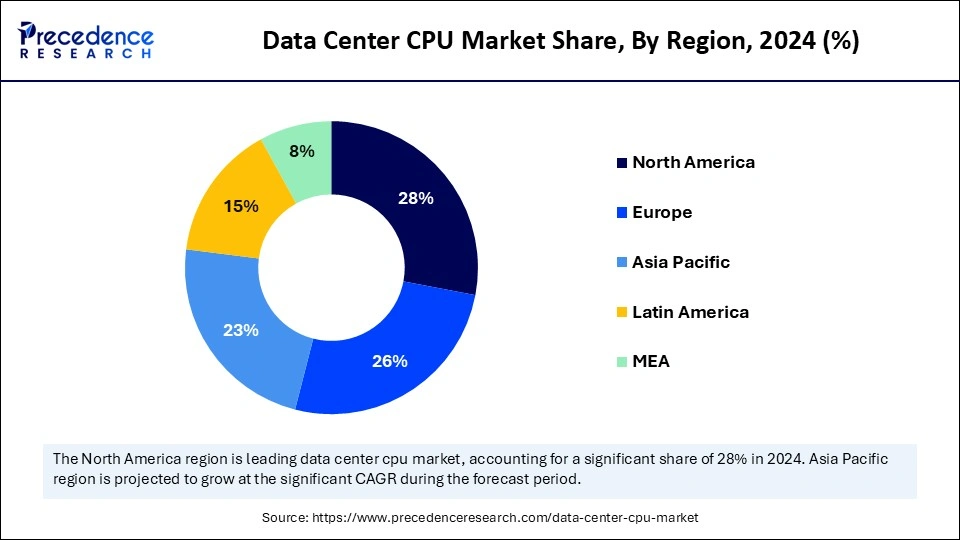

- North America dominated the data center CPU market with the largest market share of 28% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By processor architecture, the x86 segment captured the biggest market share of 60% in 2024.

- By processor architecture, the ARM segment is expected to grow at the fastest CAGR during the forecast period.

- By server form factor, the rackmount servers segment held the largest share of 40% in 2024.

- By server form factor, the microservers segment is projected to grow at the fastest CAGR during the forecast period.

- By application, the cloud computing segment contributed the maximum market share of 35% in 2024.

- By application, the AL/ML segment is the fastest-growing during the forecast period.

- By end-user industry, the IT & telecommunications segment generated the major market share of 34% in 2024.

- By end-user industry, the healthcare & life sciences segment is emerging as the fastest growing.

Market Overview

What is driving the growth of the data center CPU market, and why is it gaining momentum?

The data center CPU market is gaining strong momentum as higher core counts, integrated AI acceleration, and energy efficiency are in high demand as cloud and enterprise operators grow quickly to accommodate AI, machine learning, and big data workloads. Architectural diversity and market expansion are being driven by innovations such as AMD's Epic and rack-scale systems, Intel's Xeon 6 series, and the growing designs, along with the move toward edge and 5G infrastructure, are also quickening the market's growth trajectory. A confluence of growing workloads, innovative architecture, and market diversification is driving a strong data center CPU ecosystem.

- In February 2025, Intel announced the launch of the Intel Xeon 6700P series, featuring increased core counts, doubled memory bandwidth, and AI acceleration in every core.(Source: https://newsroom.intel.com)

How Is the Rise of AI and Machine Learning Shaping the Demand for Next-Generation Data Center CPUs?

From generative AI and LLM training to real-time inference, the rapid expansion of artificial intelligence (AI) and machine learning workloads has raised the need for high high-performance energy energy-efficient data center CPU that can manage hybrid compute stacks and power next-generation accelerators, leading to growth in the data center CPU market. Chipmakers are responding with advanced architectures, custom silicon, and ecosystem integrations that better support AIs' mixed workloads and energy requirements. Meanwhile, cloud hyperscalers and AI-driven enterprises are seeking CPUs with AI accelerators, effective memory integration, and tight GPU/CPU interconnects.

- In May 2024, Alphabet (Google) launched the Trillium offering nearly 5X faster AI performance and 67% better energy efficiency over its TPU v5e to accelerate AI workloads in its data centers.(Source: https://www.reuters.com)

U.S. Data Center CPU Market Size and Growth 2025 to 2034

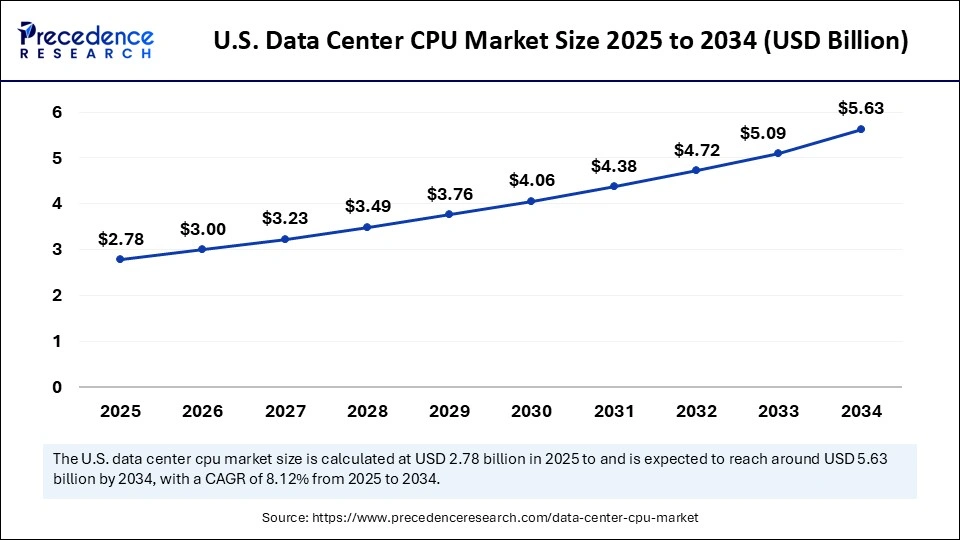

The U.S. data center CPU market size was evaluated at USD 2.58 billion in 2024 and is projected to be worth around USD 5.63 billion by 2034, growing at a CAGR of 8.12% from 2025 to 2034.

Why Does North America Lead the Global Data Center CPU Market?

North America dominated the market because of the concentration of hyperscale cloud providers, advanced IT infrastructure, and strong R&D capabilities. The U. S. Major data centers in Canada support AI and enterprise workloads, which adds to the ongoing demand for CPU power. High adoption of new technologies and well-established manufacturers support North America's dominant position. Furthermore, government policies that encourage private sector investment and technological innovation foster an atmosphere favorable to market expansion. North America is likely to continue leading the market for some time to come, thanks to its early adoption of cutting-edge CPU architectures.

The Asia Pacific region is the fastest-growing market due to rapid digital transformation, rising cloud adoption, and the expansion of data center infrastructure. Investments in AI, telecom, and e-commerce are driving high demand for CPUs. This region offers substantial growth potential as digital infrastructure continues to expand, and modern computing solutions are adopted. Increasing investments, government initiatives for smart infrastructure, and the adoption of AI-based services further accelerate CPU market growth in the region.

Data Center CPU Market Growth Factors

- Rising Cloud Adoption: The rapid shift of enterprises toward cloud computing services is driving demand for high-performance CPUs in hyperscale and colocation data centers.

- AI and Machine Learning Workloads: Increasing deployment of artificial intelligence, deep learning, and big data analytics requires a CPU with higher core counts and faster processing capabilities.

- 5G and Edge Computing Expansion: The rollout of 5G and growing edge data centers is boosting demand for efficient CPUs to handle low-latency processing closer to end users.

- Data Traffic Surge: The exponential growth in internet usage, video streaming, and enterprise digitization is increasing the need for more powerful CPUs to process and manage large data volumes.

- Virtualization and Workload Consolidation: Rising adoption of server virtualization and containerization technologies is pushing demand for CPU optimized for multi-threading and workload density.

- Energy-Efficient and Advanced Architectures: Ongoing innovations in CPU architectures, such as SRM-based and X86 processors, with better performance per watt, are accelerating adoption in modern data centers.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 28.04 Billion |

| Market Size in 2025 | USD 14.19 Billion |

| Market Size in 2024 | USD 13.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.87% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Processor Architecture, Server Form Factor, Application, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growth of Cloud Computing and Hyperscale Data Centers

The continuous transition to cloud services, including hybrid and multi-cloud environments is driving demand in the data center CPU market. To run databases, analytics platforms, virtual machines, and containerized apps, hyperscale data centers require an enormous amount of processing power. Due to this expansion, data center managers are being compelled to utilize more powerful, adaptable CPUs that can effectively manage a range of workloads.

- In May 2025, Qualcomm confirmed re-entry into the data center CPU market with a new server CPU supporting NVIDIA NVLink Fusion for AI workloads.

(Source: https://www.datacenterdynamics.com)

Advanced Manufacturing and Chiplet Designs

New developments in the production of semiconductors, like smaller process nodes and chiplet-based architectures, are promoting improved thermal management and performance. By incorporating specialized accelerators like artificial intelligence or graphics processing units, these developments enabled data centers to scale processing power, modularly improving workload management and overall efficiency.

Restraints

Intense Competition Among Vendors

Intel, AMD, and ARM-based providers are among the major players that dominate the market. Market share pricing and margins are all under pressure from fierce competition, which makes it difficult for newcomers to get a foothold. The competitive landscape is constantly evolving due to aggressive marketing, rapid product launches, and frequent feature updates. Maintaining relevance requires constant innovation from businesses, which puts additional strain on their finances and operations. Profits may be further squeezed if the competition results in the commoditization of specific CPU segments.

- In April 2025, AMD announced a new line of EPYC processors to compete with Intel Xeon in hyperscale data centers.(Source: https://www.amd.com)

Supply Chain Constraints and Component Shortages

Reliance on chip foundries, manufacturing holdups, and global semiconductor shortages can all impact CPU availability, leading to delayed deployments and increased costs in the data center CPU market. Natural disasters and geopolitical unrest and geopolitical unrest can make these supply chain vulnerabilities even worse. Unpredictable lead times may force businesses to make cautious plans and keep bigger stockpiles. Such ambiguities may restrict the rate at which new data centers are introduced or old ones are renovated, which would impede the expansion of the market as a whole.

Opportunities

Growth in Cloud Computing

The increasing use of cloud computing by businesses is driving up demand in the data center CPU market with the help of infrastructure that is reliable, dependable, and energy efficient. For hyperscale cloud providers, CPUs that can manage a variety of workloads with little downtime are essential because of their ability to balance cost and performance. Mid-range 15-core and 32-core CPUs are becoming more popular. This quick market growth can benefit vendors who offer CPUs that are optimized for multi-tenant cloud environments.

Energy Efficient Focus

Low-power CPUs, such as ARM-based ones, are becoming increasingly popular for data center operations that are economical and environmentally friendly. As data center power demands increase globally, it is imperative to reduce energy consumption. CPUs that minimize electricity and heat expenses while maintaining high performance have a competitive edge. Manufacturers are likely to see greater adoption if they incorporate energy-efficient designs without sacrificing functionality or speed.

Processor Architecture Insights

Why Does the x86 Architecture Continue to Dominate the Global Data Center CPU Market?

X86 architecture dominates the data center CPU market because of its longevity, broad software compatibility, and dependability for heavy enterprise workloads. For general-purpose computing, cloud computing, and virtualization, CPUs with an x86 architecture, primarily from AMD and Intel, offer excellent performance. Businesses and hyperscale data centers favor them because of their well-established ecosystem and compatibility with a broad variety of operating systems and applications. Strong support networks and established manufacturing procedures also help x86 processors guarantee stability and confidence among IT decision-makers. Their dominance is further reinforced by the fact that they can manage a variety of workloads without necessitating major infrastructure changes.

ARM architecture is the fastest growing segment, because it is scalable and energy efficient. For AI workloads, cloud-native apps, and edge computing, ARM-based processors are very advantageous because they use less power and produce less heat. The market is growing rapidly, and new data center deployments are increasingly utilizing ARM solutions, as major cloud providers are adopting them due to their performance and affordability. Because of ARM's open architecture and flexibility, businesses can create unique designs that address workloads, allowing them to stand out from the competition. Growing environmental consciousness is another factor fueling the expansion as businesses look for more environmentally friendly and energy-efficient computing options.

Server Form Factor Insights

How Do Rackmount Servers Support the Data Center CPU Market?

Rackmount servers dominate the market due to their adaptability, uniform design, and appropriateness for extensive cloud and enterprise deployments. Their high compute density and compatibility with various networking and storage configurations make them perfect for workloads in multi-tenant clouds, virtualization, and databases. Furthermore, rackmount infrastructures' dominance is reinforced by the fact that IT administrators are accustomed to managing them. In addition, rackmount servers offer superior cooling and maintenance choices over other form factors, allowing for dependable long-term operation. Because of their scalability, businesses can easily grow their infrastructure without having to make major redesigns.

Microservers are the fastest growing segment due to their compact design, energy efficiency, and suitability for lightweight workloads. These servers are particularly popular in edge computing, distributed cloud environments, and applications requiring scalable yet cost-effective solutions. Their rapid adoption is driven by the growing need for small-form-factor servers that can efficiently handle specific workloads in emerging markets and edge locations. Microservers also allow organizations to deploy computer resources closer to end-users, reducing latency for critical applications. The modularity and low operational costs make Microservers a highly attractive option for experimental and specialized deployments.

Application Insights

Why Do IT and Telecommunications Companies Account for the Majority of the Data Center CPU Market?

Cloud computing segment is dominating the market, driven by businesses moving workloads to private, public, and hybrid clouds. Cloud applications require CPUs that can support high scalability, virtualization, and reliability, all of which are offered by x86 and high-performance CPUs. Demand for processors tailored for cloud environments will continue to grow as SaaS, IaaS, and PaaS solutions continue to expand. Additionally, the growing demand for fast deployment cycles and secure multi-tenant infrastructure supports the dominance of cloud computing. The leading position in the segment is reinforced by high-density rackmount deployments, which further boost CPU utilization.

AI/ML segment is growing rapidly as organizations increasingly deploy deep learning, data analytics, and AI-driven applications. CPUs optimized for AI inference and training are in high demand to handle massive computations efficiently. Growth in AI adoption across healthcare, finance, and autonomous systems is accelerating the need for specialized processors capable of supporting AI workloads. Furthermore, AI workloads are increasingly moving from research labs into production environments, driving higher investments in powerful CPUs. Companies that can provide AI-optimized processors with energy efficiency and reliability are likely to capture a significant market share.

End-User Industry Insights

Why Did the IT & Telecommunications Lead the Data Center CPU Market in 2024?

The IT & telecommunications segment has dominated the market, as it serves as the foundation of the world's digital infrastructure. Cloud services, networking platforms, and enterprise workloads that demand dependable and high-performance CPUs are housed in the massive data centers run by these industries. They continue to dominate the market due to their size and ongoing demand for processing power. Furthermore, ongoing expenditures on cloud expansion and 5G networks raise CPU demand even more. Strong service-level agreements that demand high-performance hardware and the early adoption of cutting-edge technologies reinforce dominance.

Healthcare & life science segment is growing fast due to increasing reliance on data-intensive applications like AI diagnostics, genomics, and personalized medicine. Hospitals, research labs, and biotechnology companies require high-performance CPUs to process complex datasets efficiently. The need for precision, speed, and reliability in medical and research computing drives the rapid adoption of this sector. Moreover, government initiatives and funding for digital healthcare infrastructure are accelerating CPU deployment. The increasing integration of telemedicine, AI-driven imaging, and cloud-based medical platforms further fuels growth in this segment.

Data Center CPU Market Companies

- Intel Corporation

- Advanced Micro Devices (AMD)

- NVIDIA Corporation

- Amazon Web Services (AWS)

- Google LLC

- Broadcom Inc.

- Arm Holdings plc

- Qualcomm Incorporated

- IBM Corporation

- Microsoft Corporation

- Alibaba Group Holding Limited

- Meta Platforms, Inc.

- Tencent Holdings Limited

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- Micron Technology, Inc.

- Monolithic Power Systems, Inc.

- Huawei Technologies Co., Ltd.

- Dell Technologies Inc.

- Super Micro Computer, Inc.

Recent Developments

- In March 2025, Arm Holdings projects its share of the global data center CPU market to increase from approximately 15% IN 2024 TO 50% by the end of 2025. This anticipated growth is attributed to the rising demand for energy-efficient processors driven by artificial intelligence applications.

(Source: https://www.reuters.com) - In August 2025, Meta Platforms announced plans to invest over $600 billion in artificial intelligence over the next three years. This substantial investment is expected to benefit companies involved in AI and data infrastructure, including those in the data center CPU market.(Source: https://www.barrons.com)

Segments Covered in the Report

By Processor Architecture

- x86

- ARM

- RISC-V

- Power

- Others

By Server Form Factor

- Tower Servers

- Rackmount Servers

- Blade Servers

- Microservers

By Application

- Cloud Computing

- Artificial Intelligence / Machine Learning

- High-Performance Computing (HPC)

- Big Data Analytics

- Web Hosting

- Database Management

- Virtualization

- Edge Computing

- Blockchain / Cryptocurrency

By End-User Industry

- IT & Telecommunications

- BFSI (Banking, Financial Services, Insurance)

- Healthcare & Life Sciences

- Retail & E-commerce

- Manufacturing

- Government & Public Sector

- Education

- Energy & Utilities

- Media & Entertainment

- Transportation & Logistics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content