What is the Data Center Rack Market Size?

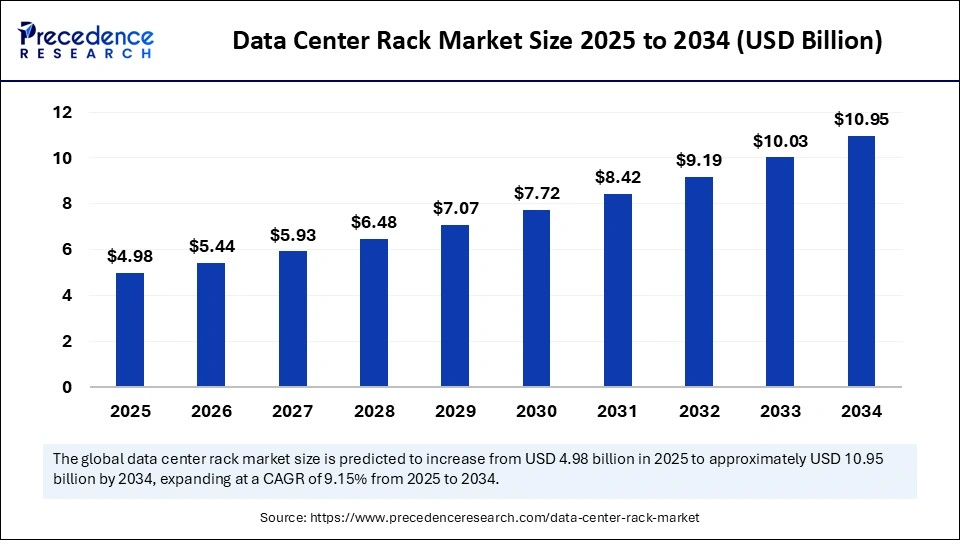

The global data center rack market size is calculated at USD 4.98 billion in 2025 and is predicted to increase from USD 5.44 billion in 2026 to approximately USD 10.95 billion by 2034, expanding at a CAGR of 9.15% from 2025 to 2034. The demand for data center racks has increased due to a rapid surge in hyperscale data centers and colocation facilities, driving the global market. The market is further experiencing growth due to the increased adoption of cloud and edge computing.

Data Center Rack Market Key Takeaways

- In terms of revenue, the global data center rack market was valued at USD 4.56 billion in 2024.

- It is projected to reach USD 10.95 billion by 2034.

- The market is expected to grow at a CAGR of 9.15% from 2025 to 2034.

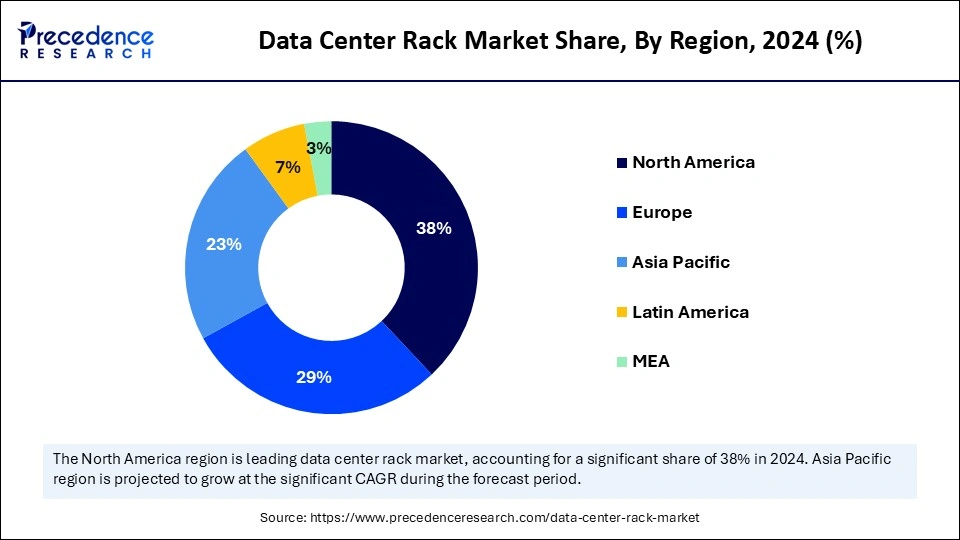

- North America dominated the global data center rack market with the largest market share of 38% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By rack type, the enclosed racks/cabinets segment contributed the biggest market share of 60% in 2024.

- By rack type, the open frame racks segment is expected to grow at a notable CAGR between 2025 and 2034.

- By rack height, the 37U–48U segment captured the biggest market share of 45% in 2024.

- By rack height, the 49U & above segment will grow at a notable CAGR between 2025 and 2034.

- By rack width, the 19-inch racks segment held the maximum market share of 70% in 2024.

- By rack width, the 23-inch racks segment will grow rapidly between 2025 and 2034.

- By rack depth, the 1001 mm–1200 mm segment held the largest market share of 40% in 2024.

- By rack depth, the above 1200 mm segment will grow at a significant CAGR between 2025 and 2034.

- By mounting type, the floor-mounted racks segment accounted for the considerable share of 80% in 2024.

- By mounting type, the wall-mounted racks segment will grow significantly between 2025 and 2034.

- By application, the servers segment captured the largest market share of 50% in 2024.

- By application, the networking equipment segment will grow at a notable CAGR between 2025 and 2034.

- By end-user, the colocation data centers segment generated the major market share of 35% in 2024.

- By end-user, the cloud service providers segment will grow significantly between 2025 and 2034.

Market Overview

The global data center rack market refers to the design, manufacturing, and deployment of standardized enclosures used to house servers, networking equipment, storage devices, and other IT infrastructure within data centers. These racks are critical for efficient space management, cooling, cable organization, and scalability of modern IT operations. They are available in various sizes (based on rack units and width), mounting types (open frame, enclosed cabinets, wall-mounted), and designs optimized for high-density computing environments. The market is driven by the expansion of hyperscale and colocation data centers, growing adoption of cloud computing, edge data centers, and increasing demand for high-density server deployments. The government incentives for local manufacturing, particularly in emerging markets like India, China, and the U.S., are driving significant growth in manufacturing as well as the adoption of data center racks.

AI Impacts on the Data Center Rack Industry

Artificial intelligence is playing a crucial role in increasing the necessity of sophisticated data center racks. The increased use of AI has boosted the need for advanced racks to handle the load. AI workloads need high-performance GPUs and specialized AI accelerators, which increase power consumption. The ability of racks to handle increased electrical loads and the growing need for power-dense servers are accelerating the industry expansion. Data centers are focusing on adopting high-density racks for accommodating more servers in a small space, leading to power reductions. The rise of AI and machine learning (ML) is driving the adoption of high-density IT hardware and racks for supporting their intense workloads is contributing to the areas of industry growth.

What are the Key Trends in the Data Center Rack Market?

- Rise in Modular Data Centers: The modular data centers trend has taken traction, driven by the growing need for deployment of best solutions for scalable data centers, driving the need for modular server racks.

- Sustainable Data Centers: The growing concern over sustainability and eco-friendliness in data centers has boosted demands for the best server and network racks, helping to achieve energy efficiency and sustainability goals.

- Focus on Scalability and Flexibility: The rapid growth of data centers is driving businesses to adopt specialized rack solutions with quick adaptability to changing IT landscapes and support cost-effectiveness in scaling for small and medium-sized data centers.

- Energy-Efficiency Regulations: Regulations such as ASHRAE's guidelines and the EU's energy efficiency directions are fueling demand for energy-efficient data center racks.

- Technological Advancements: The ongoing emphasis on advancements in rack designs with a focus on high-density configurations, remote access capabilities, efficient thermal management, and integration with intelligent software and power is transforming market expansion.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.95 Billion |

| Market Size in 2025 | USD 4.98 Billion |

| Market Size in 2026 | USD 5.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Rack Type, Rack Height, Rack Width, Rack Depth, Mounting Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growth of Cloud and Hyperscale Data Centers

The demand for cloud computing, artificial intelligence, and large data sets has increased, which is contributing to the expansion of hyperscale data centers. Data center racks help to leverage the needed standardization of managing advanced cooling and power requirements. Expanding hyperscale data centers, accelerating range of more than 5,000 servers in a single region, making racks a specialized solution for cooling, high capacity, and adjustability & adaptability. The rapid digitalization and surge toward modular and customized products is creating complexity and driving the need for large-scale deployments. The cloud and hyperscale expansion, driving the requirement of robust liquid cooling capabilities, cable management, efficient airflow, and modular designs for handling high-performance workloads, enhances energy efficiency, optimizes space, and drives the adoption of data center racks.

Restraint

High Initial Costs

The data center racks require high initial investments for installation of comprehensive racks, particularly racks with integrated power and cooling solutions is a major restraint for the global market. High-density racks require extensive and expensive cooling solutions, which can challenge the budget and infrastructure. The floor reinforcement, airflow management, and structured cabling further add to the budget strains. The high cost associated with racks can delay in adoption of cutting-edge, higher-priced racks and increase financial risk for novel entrants.

Opportunity

Growth of E-Commerce and Online Services

The demand for data storage and processing is increasing, driven by the rapid expansion of e-commerce and online services. The growing use of e-commerce platforms and online services is fueling the need for strong data center infrastructure for managing a vast amount of data, which leads to robust demand for data center racks to house server equipment. The use of these two platforms is driving opportunities for specialized and advanced racks with more scalability and high-density IT infrastructure for storing and processing. The large dependency of e-commerce and online services on data center racks for managing databases, hosting websites, and facilitating online shopping is leveraging significant innovations and developments in the rack designs and capabilities.

Rack Type Insights

Which Rack Type Led the Data Center Rack Market in 2024?

In 2024, the enclosed racks/cabinets segment led the market, due to its ability to support large data generation and high-performance workload. These attributes offer security for sensitive equipment, thermal management, and superior airflow. The enclosed racks/cabinets are ideal for thermal management of high-density computing, an organized and structured environment that helps to simplify cable management and maintenance.

The open frame racks segment is driven by its massive adoption in critical environments like network closets, labs, and high-density. The open frame racks are cost-effective compared to other rack types, making them suitable for use in various servers. Exceeding heat dissipation, superior air flow, and easy maintenance and upgrading of these racks make them a prior choice.

Rack Height Insights

Which Rack Height Dominates the Data Center Rack Market?

The 37U–48U segment dominated the market in 2024, due to its ability to offer vertical space for accommodating high-density servers, storage, and networking. The height of racks helps to balance high equipment density, versatility, and efficient space utilization. This height is ideal for modern data centers, particularly for hyperscale and colocation facilities with more capacity needs without extreme heights.

The 49U & above segment is expected to grow fastest over the forecast period, driven by the rising need for high-density deployments. The rack with 49U & above heights maximizes the space and support rising demand for big data, AI, and high-performance computing. For better cable management and increased server capacity, data centers require taller racks, making racks with 49U & above height more suitable.

Rack Width Insights

What Made 19 Inch Racks Dominate the Data Center Rack Market in 2024?

The 19-inch racks segment dominated the market in 2024, due to its suitability as EIA-310 standard equipment. The 19-inch racks are highly standard, broadly compatible with IT equipment, have established reliability, and are space-efficient. These racks are very simple for integration, supporting high equipment density, and also allow scalable and flexible data center designs that ensure efficient utilization of available floor space.

The 23-inch racks segment is expected to grow fastest over the forecast period, due to its increased utilization in addressing thermal challenges in high-density and modern computing environments. These racks have superior space and cable management capabilities that help to improve cooling efficiency and airflow. The ability of racks to increase large and more complex high-density equipment configuration capacity makes them ideal for AI and high-performance computing workloads.

Rack Depth Insights

How 1001 mm-1200 mm Segment Dominated the Data Center Rack Market in 2024?

In 2024, the 1001 mm–1200 mm segment dominated the market, due to expanding hyperscale data centers. The demand for large and denser IT equipment has increased, also the growing need for airflow management and server density, driving the need for racks with large depth for better accommodation. The growing AI deployments and other high-demand workloads make the racks with 1001 mm–1200 mm depth more essential.

The above 1200 mm segment is the fastest-growing segment of the market, growth driven by increased demand for high-density computing. The growing AI and GPU workloads are driving the need for racks with large depth for generating more heat and improving cooling solutions, driving a surge toward racks with above 1200 mm. These racks facilitate enhanced airflow management and support rising thermal and power needs for modern IT infrastructure.

Mounting Type Insights

Which Mounting Type Dominates the Data Center Rack Market?

The floor-mounted racks segment dominated the market in 2024, due to its applications of enabling hot and cold aisle segregation. This growth is fueled by the surge in demand for compact and cost-effective networking solutions in small and medium-sized enterprises (SMEs) and edge locations. The floor-mounted racks enable liquid rear-door exchanges, floor-mounted power meters, and high segregation. These racks are ideal for high-density computing and AI clusters.

The wall-mounted racks segment is growing due to the increased need for compact and affordable networking solutions in small and medium-sized enterprises (SMEs) and edge locations. The growing demand for data storage and processing in large data centers is driving the need for these racks. These racks are very cost-effective compared to floor-mounted racks and are available in various sizes.

Application Insights

Which Application Dominated the Data Center Rack Market in 2024?

In 2024, the servers segment dominated the market due to increased adoption of scalable, robust, and efficiently organized racks in the servers. The growth of data-intensive applications such as AI, ML, cloud computing, and IoT has increased that driving demand for computing power and storage capabilities of racks. The growing need for powerful nd high-density services is driving the adoption of racks in data centers.

The networking equipment segment is the fastest-growing segment in the market, due to the increased growth of hyperscale data centers. The need for cutting-edge infrastructure has increased for supporting technological adoptions like cloud computing, AI, and big data analytics. The rising data volumes are driving demand for high-capacity and high-performance racks. The ability of racks to house high-density servers and cutting-edge cooling systems makes them ideal for managing workloads.

End-User Insights

Which End-User Dominates the Data Center Rack Market?

In 2024, the colocation data centers segment dominated the market, due to increased demand for smaller and more management-deployed racks. The racks with accommodating ability for high-density loads for AI and HPC (high-performance computing) applications are widely used in the colocation data centers. The need for efficient cooling in high-density racks is required in this end-user, driving significant innovations and growth of the rack technology, including cutting-edge contaminated solutions and open-frame racks.

The cloud service providers segment is expected to grow fastest over the forecast period, driven by their construction of vast and hyperscale data centers. The increased demand for cloud computing, AI, and data storage has leevraed cloud service providers for constructing these data centers, leading to increased requirements for large-scale and high-density racks. The growing digitalization, growth in cloud computing adoption, and requirement of scalable and flexible infrastructure for supporting various services, driving the need for advanced rack solutions.

Regional Insights

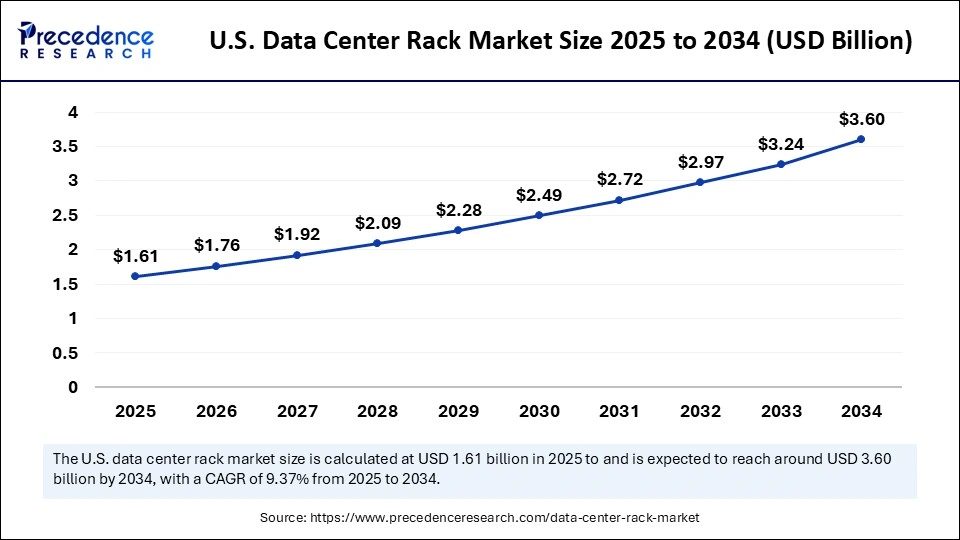

U.S. Data Center Rack Market Size and Growth 2025 to 2034

The U.S. data center rack market size is exhibited at USD 1.61 billion in 2025 and is projected to be worth around USD 3.60 billion by 2034, growing at a CAGR of 9.37% from 2025 to 2034.

North America Data Center Rack Market

North America dominates the global market, driven by increased needs for AI and hyperscale. North America is the hub for hyperscale data centers, which drives record-low vacancy rates in the regional economy. The demand for training and deploying generative AI models is high in North America. The increasing emphasis on increased adoption of modular and high-density rack designs and sustainability concerns is leveraging this growth. The rise in investments for local manufacturers and the development of novel supply chains are accelerating demands, and navigating tariff difficulties is contributing to expanding market areas.

Robust IT Infrastructure: Key Growth Factor for the U.S. Market

The U.S. is a major player in the regional market, driven by the country's robust IT infrastructure and rapid digital transformation. The significant investments in cloud and edge computing are contributing to this growth. Additionally, existing supportive government polices and investments in digital infrastructure and expanded hyperscale data centers are leveraging the need for advanced data center racks in the country.

Asia Pacific Data Center Rack Market

Asia Pacific is the fastest-growing region in the global market, driven by rapid digital transformation in the region. The rising adoption of AI and cloud computing in countries like India, China, Japan, and Malaysia is leading this market growth. The growing data centers in Asia have boosted the need for novel high-density and high-performance racks to support cutting-edge workloads and increase infrastructure investments. Additionally, government initiatives and investments in local manufacturing giants and digital infrastructure are contributing to this growth.

China's Market Trends

China is dominating the regional market due to the country's expanding IT infrastructure, rapid digitalization, presence of key market players, and government support. China's government is investing billions in data center expansion. The growing 4G and 5G networking and optical fiber networking are driving the need for comprehensive data center racks in the country.

Which are the Emerging Countries in the Asian Market?

Australia and India are the significant players in the regional market, growth driven by countries' digital transformation and evolving data center market, with government strategies for optimizing data center resources. Data localization rules are fueling the growth of the data center market, leading to the necessity of adopting data center racks.

Value Chain Analysis

- Raw Material Sourcing (Metals, Electronics)

The raw material sources of data center racks include power distribution units (PDUs), fans & cooling components, and cabling & cable management solutions, which are often made with steel and cold-rolled steel for high strength, durability, and structural integrity.

Key Players: Eaton, Schneider Electric, Rittal, Delta Electronics, Panduit, and Belden.

- Testing and Certification

Testing of data centers involves physical integrity, operational performance before, during, and after deployment, and electrical safety. Certification involves third-party validation for designs, building, and operation against recognized standards.

Key Players: Uptime Institute (for tier standards) and independent testing labs like TUV SUD and TUV NORD.

- Product Lifecycle Management

The product lifecycle management (PLM) includes general principles for integrating data processes and people in highly compact environments of a data center. The strategies help to manage the entire lifecycle of racks from initial designs to retirement and recycling.

Key Players: HPE, Eaton, Siemens Digital Industries Software, and Rittal.

Data Center Rack Market Companies

- Schneider Electric

- Eaton Corporation plc

- Vertiv Group Corp.

- Rittal GmbH & Co. KG

- Dell Technologies Inc.

- Hewlett Packard Enterprise (HPE)

- International Business Machines Corporation (IBM)

- Legrand S.A.

- Cisco Systems Inc.

- Fujitsu

Recent Developments

- In August 2025, Meta demonstrated an NVL36x2 rack configuration Catalina pod at Hot Chips, which is adapted from Nvidia's NVL72 offering. This rack comes with GB200 GPUs equipment; the Catalina pods are utilized in 20kW air-cooled data centers. Each 120kW rack features 18 compute trays and nine switches.

(Source: https://www.datacenterdynamics.com) - In July 2025, a digital transformation of energy management and automation, Schneider Electric announced the launch of new data center solutions engineered for meeting with growing demands of next-generation AI cluster architectures. The company has unveiled its prefabricated modular EcoStruxure pod data center solutions, elevating its EcoStructureTM Data Center Solutions for consolidation infrastructure for liquid cooling, high-density NetShelter Racks, and high-power busway.(Source: https://www.se.com)

- In March 2025, Nvidia officially announced the launch of the Blackwell architecture at the Graphics Technology Conference (GTC). This lunch focuses on its B100 and B200 datacenter accelerators and associated products like eight-GPU HGX B200 broad and the 72-GPU NVL72 rack-scale system, designed to replace copper hopper platforms and become a high-end GPU's dominant solution.(Source: https://w.media)

Segment Covered in the Report

By Rack Type

- Open Frame Racks

- Enclosed Racks/Cabinets

- Wall-Mounted Racks

By Rack Height

- 36U & Below

- 37U–48U

- 49U & Above

By Rack Width

- 19 Inch Racks

- 23 Inch Racks

- Others (custom sizes)

By Rack Depth

- 600 mm–1000 mm

- 1001 mm–1200 mm

- Above 1200 mm

By Mounting Type

- Floor-Mounted Racks

- Wall-Mounted Racks

By Application

- Servers

- Networking Equipment

- Storage Devices

- Others (power distribution units, patch panels)

By End User

- Colocation Data Centers

- Cloud Service Providers

- Enterprises

- Telecom Operators

- Government & Public Sector

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting