What is the Spintronics Market Size?

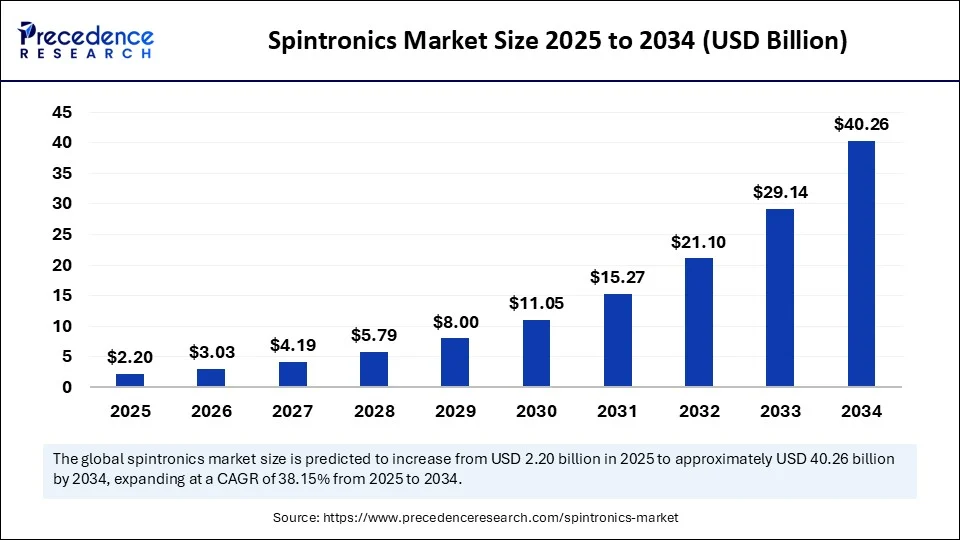

The global spintronics market size was calculated at USD 2.20 billion in 2025 and is predicted to increase from USD 3.03 billion in 2026 to approximately USD 49.33 billion by 2035, expanding at a CAGR of 36.48% from 2026 to 2035. The market is growing due to the rising demand for energy-efficient, high-speed memory and data processing technologies in consumer electronics and data centers.

Spintronics Market Key Takeaways

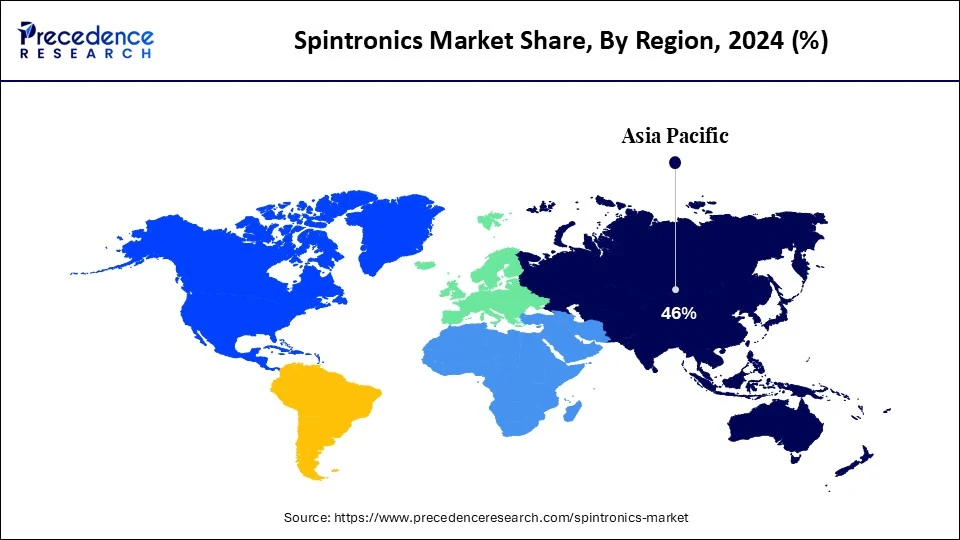

- Asia Pacific dominated the spintronics market with the largest share of 46% in 2025.

- North America is expected to grow at a notable CAGR in the coming years.

- By device type, the metal-based devices segment dominated the market, under which the tunnel magneto resistance (TMR) sub-segment held the largest share of 38% in 2025.

- By device type, the semiconductor-based devices segment is expected to grow at the fastest rate, under which the spin field effect transistors (Spin-FETs) segment is leading the charge.

- By application, the memory devices segment led the market, under which MRAM sub-segment held the largest share of 42% in 2025.

- By application, the logic devices segment is expected to grow at the fastest CAGR, under which the spin logic gates sub-segment is expected to lead the charge in the coming years.

- By material, the ferromagnetic materials segment held the largest market share of 35% in 2025.

- By material, the graphene and 2D materials segment is emerging as the fastest-growing.

- By end user, the consumer electronics segment captured the biggest market share of 33% in 2025.

- By end user, the automotive segment is expected to grow at the fastest CAGR during the forecast period.

How is artificial intelligence transforming the spintronics market?

Artificial Intelligence (AI) revolutionized the spintronics industry by accelerating research, optimizing device design, and enhancing performance prediction. Machine learning models analyze large datasets to identify materials with desired spintronic properties, thereby minimizing trial and error. AI improves simulations as well as facilitates quicker and more affordable prototyping. AI is utilized to enhance the efficiency and real-time learning capabilities of spintronic devices in advanced applications, such as neuromorphic computing. AI integration is also driving innovation in new spintronic applications, such as quantum computing, sensors, and non-volatile memory. In addition to reducing development time, AI is opening the door for next-generation spintronic technologies by facilitating faster experimentation and smart design.

Market Overview

Spintronics (spin-based electronics) refers to the study and application of the intrinsic spin of electrons and their associated magnetic moment in solid-state devices. Unlike traditional electronics, which rely solely on the charge of electrons, spintronics leverages both the charge and spin properties of electrons, enabling non-volatile data storage, high-speed processing, and reduced power consumption. The spintronics market primarily focuses on devices such as magnetic sensors, spin-transfer torque memory (STT-MRAM), and spin diodes, which are used in data centers, automotive, consumer electronics, and industrial applications.

Spintronics Market Growth Factors

- Energy Efficiency: Spintronic devices consume less power, making them ideal for modern, low-energy electronics.

- Data Storage Demand:The growing need for fast, non-volatile memory, such as MRAM, is boosting its adoption.

- Automotive Applications: Used in EVs and ADAS for reliable sensing and performance.

- R&D Investments: Increased funding in nanotech and quantum tech is accelerating innovation.

- Semiconductor Integration: Compatibility with CMOS is driving the development of new processor designs.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 49.33 Billion |

| Market Size in 2026 | USD 3.03 Billion |

| Market Size in 2025 | USD 2.20 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 36.48% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Device Type, Material, Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Need for High Speed, Low Power Memory

Ultra-fast data access with low power consumption is possible with spintronic technologies, particularly Magneto Resistive Random Access Memory (MRAM). As scalability constraints confront traditional memory types such as DRAM and SRAM, spintronic memory offers a promising substitute. It is ideal for embedded and mobile systems due to its non-volatility, which guarantees data retention without continuous power. In industries such as data centers and edge computing, where speed and energy efficiency are paramount, this is driving adoption.

Surge in Electric Vehicles and Advanced Automotive Electronics

The rising demand for EVs and advanced automotive electronics drives the growth of the spintronics market. Sensors are essential to ADAS and electric vehicles (EVs) for their safety systems, particularly for motion detection and positioning. Spintronic sensors provide high sensitivity, robustness, and dependability across a broad temperature range. In applications that demand greater precision and energy efficiency, they are gradually replacing Hall effect sensors. As automotive electronics continues to progress, spintronics is emerging as a key technology in vehicle design.

Restraints

Challenges in Magnetization Control at the Nanoscale

Precise manipulation and stability of spin states, especially at nanometer scales, remain a complex challenge. External magnetic interference, temperature fluctuations, and quantum effects can impact spin behavior, affecting performance and data retention. Overcoming these issues requires further innovation in materials science and magnetic shielding, which slows commercial adoption.

Low Awareness and Limited Industry Expertise

Spintronics remains a highly specialized field, and many electronics manufacturers lack the in-house expertise to implement or even explore spintronic solutions. This skill gap, coupled with limited awareness of the tangible advantages of spin-based devices, has led to slow uptake outside of niche applications, such as aerospace, defense, and high-end computing.

Opportunities

Rising Demand for MRAM in Data Centers and AI Workloads

Data storage made possible by magneto-resistive random-access memory (MRAM) is quick, non-volatile, and power-efficient. MRAM can significantly lower latency and energy consumption as AI and machine learning workloads increase. MRAM is being investigated by data centers as a next-generation memory substitute to reduce power consumption and heat production. Due to its durability, it performs well in high-performance computing environments that require continuous use.

Integration with Flexible and Wearable Electronics

It is possible to create spintronic memory and sensors with thin, flexible materials. This opens the door to possibilities in bendable electronics, smart textiles, and wearable health monitors. Spintronics is ideal for continuous, real-time tracking applications due to its low power requirements and high durability. Spintronics may emerge as a crucial enabling technology as the spintronics market for smart wearables continues to expand.

Segment Insights

Device Type Insights

How does the tunnel magneto resistance (TMR) sub-segment dominate the spintronics market in 2025?

The tunnel magneto resistance (TMR) sub-segment dominated the market with the largest share in 2025 due to its exceptional magnetoresistance performance. TMR increases the sensitivity and efficiency of spintronic devices. Because TMR is more scalable, thermally stable, and compatible with conventional CMOS technology, it is particularly preferred in magnetic sensors and MRAM applications. Its extensive use in industrial systems, automotive sensors, and consumer electronics is a result of these benefits.

The spin field effect transistors segment is expected to grow at the fastest rate due to their potential to drastically reduce power consumption in logic operations. By utilizing electron spin rather than charge, these devices promise energy-efficient and faster computing solutions. Ongoing research and pilot projects across global universities and chipmakers are paving the way for spin-FET commercialization in the coming years.

Application Insights

Why did the MRAM sub-segment dominate the spintronics market in 2025?

The MRAM sub-segment dominated the market, holding the largest revenue share in 2025, due to its high endurance, rapid switching speeds, and non-volatility. It performs better than DRAM and flash in terms of energy efficiency and durability, making it ideal for demanding settings such as automotive and aerospace. Large semiconductor companies, such as Everspin and Samsung, have incorporated MRAM into their product offerings. Its market dominance has been further strengthened by its suitability for embedded systems and Internet of Things devices.

The spin logic gates sub-segment is expected to expand rapidly over the forecast period, as they represent a breakthrough in reducing energy dissipation in logical operations. These gates offer high-speed performance with minimal heat loss, making them ideal for ultra-low-power processors. Their adoption is being accelerated by increasing investments in spin-based quantum computing and neuromorphic architecture. Several startups and research institutions are exploring spin logic to drive the future of computing.

Material Insights

What made ferromagnetic materials the dominant segment in the spintronics market?

The ferromagnetic materials segment dominated the market in 2025 due to their demonstrated abilities in spin injection manipulation and detection. Ferromagnetic alloys, such as CoFeB and NiFe, exhibit low damping constants, possess good magnetic properties, and are easily integrated into commercial spintronic devices. Their popularity is increased by their extensive use in read heads, spin valves, and MRAM. Furthermore, they are preferred materials for large-scale production due to their affordability and the support of established manufacturing ecosystems.

The graphene and 2D materials segment is likely to grow at the fastest CAGR in the coming years due to their outstanding spin coherence, high carrier mobility, and tunable properties. These characteristics make them ideal for cutting-edge spintronic applications, including spin transistors and quantum devices. With significant R&D investments globally, graphene-based devices are being developed for wearable tech, high-speed computing, and biomedical spintronic sensors. Their potential for miniaturization and flexibility is accelerating adoption in next-gen electronics.

End User Insights

Why did the consumer electronics segment dominate the spintronics market in 2025?

The consumer electronics segment led the market in 2025, driven by the need for faster and more efficient memory and sensors in smartphones, tablets, game consoles, and wearables. Spintronics enhances data retention and reduces power consumption without requiring miniaturization, and intelligent features have made TMR sensors and MRAM essential components. In the highly competitive tech sector, businesses are utilizing spintronics to differentiate their products.

The automotive segment is expected to grow rapidly during the projection period, under which the advanced driver assistance systems (ADAS) sub-segment is likely to lead the charge, as vehicles require highly reliable sensors and memory for real-time decision-making. Spintronic sensors provide better sensitivity and durability under extreme conditions, ideal for use in autonomous vehicles and EVs. Government safety regulations and increasing levels of automation are pushing OEMs to adopt spintronics in navigation, braking, and engine control systems.

Regional Insights

Asia Pacific Spintronics Market Size and Growth 2026 to 2035

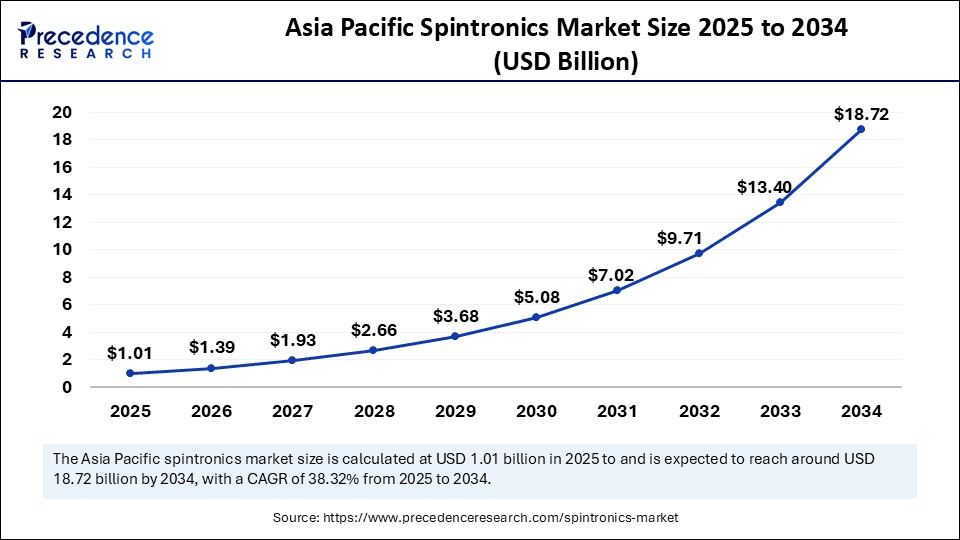

The Asia Pacific spintronics market size was evaluated at USD 1.01 billion in 2025 and is projected to be worth around USD 22.95 billion by 2035, growing at a CAGR of 36.66% from 2026 to 2035.

Why did Asia Pacific dominate the spintronics market in 2025?

Asia Pacific dominated the spintronics market in 2025, holding the largest share due to its large concentration of semiconductor and sophisticated electronics production locations. Strong R&D capabilities, significant investments from large tech firms, and rising demand for energy-efficient electronics all contribute to the region's growth. Further solidifying its dominance are the swift growth of the consumer electronics and automotive industries as well as the robust government support for next-generation memory technologies. It is also a global leader in spintronics innovation, thanks to its access to skilled talent and academic-industry collaborations.

North America is the fastest-growing region in the spintronics market, driven by government initiatives, cutting-edge university research, and startup activity in spin-based computing. The presence of key players in the aerospace, defense, and data center sectors fuels the adoption of high-performance spintronic components. Federal funding from agencies like DARPA and private investments into MRAM and spin logic development accelerate commercialization. The region's early move towards quantum computing and AI hardware integration further supports its rapid growth.

Spintronics Market Companies

- NVE Corporation

- Spin Memory Inc.

- Everspin Technologies Inc.

- Qualcomm Technologies Inc.

- Intel Corporation

- Samsung Electronics Co. Ltd.

- Toshiba Corporation

- IBM Corporation

- Advanced Micro Devices Inc. (AMD)

- Infineon Technologies AG

- STMicroelectronics N.V.

- Honeywell International Inc.

- Applied Spintronics Technology, Inc.

- SK hynix Inc.

- Micron Technology, Inc.

- Renesas Electronics Corporation

- Hitachi Ltd.

- Canon Inc.

- Fujitsu Ltd.

- Western Digital Technologies, Inc.

Recent Developments

- On 5 July 2025, Renesas announced that it launched its RA8P1 AI MCU, integrating 1Mb embedded MRAM, targeting edge AI and real-time analytics applications built on TSMC's 22 nm process. (Source:https://www.mram-info.com)

- On 12 June 2025, A Danish-German research team launched a major quantum spintronics project to develop foundational tech for the future quantum internet, marking a significant leap in the field. (Source: https://www.sciencedaily.com)

- On 17 January 2025, University of Utah & UC Irvine announced the discovery of a novel anomalous Hall torque, a new spin-orbit torque mechanism that enables advanced neuromorphic and spin-based computing. (Source:https://www.spacedaily.com)

Segments Covered in the Report

By Device Type

- Metal-based Devices

- Giant Magneto Resistance (GMR)

- Tunnel Magneto Resistance (TMR)

- Spin-Valves

- Others (Spin-torque nano-oscillators, etc.)

- Semiconductor-based Devices

- Spin Field Effect Transistors (Spin-FETs)

- Spin Diodes

- Spin Filters

- Others (Resonant Tunneling Diodes, etc.)

By Application

- Memory Devices

- MRAM

- STT-MRAM

- Toggle MRAM

- Others

- MRAM

- Sensors

- Magnetic Sensors

- Biosensors

- Others

- Logic Devices

- Quantum Computing Elements

- Spin Logic Gates

- Optoelectronics

- Spin LEDs

- Optical Isolators

- Spin Lasers

- Others

- Microwave Devices

- Oscillators

- Interconnects

By Material

- Ferromagnetic Materials

- Cobalt (Co)

- Iron (Fe)

- Nickel (Ni)

- Alloys (e.g., Permalloy)

- Semiconductor Materials

- Gallium Arsenide (GaAs)

- Silicon (Si)

- Indium Arsenide (InAs)

- Graphene and 2D Materials

- Others

- Oxide Materials

- Multiferroics

By End-Use Industry

- Consumer Electronics

- Smartphones

- Wearables

- Laptops

- Automotive

- Advanced Driver Assistance Systems (ADAS)

- Infotainment Systems

- IT & Telecommunication

- Data Storage

- Cloud Servers

- Industrial

- Automation Equipment

- Robotics

- Healthcare

- Biosensing

- Medical Imaging

- Others

- Defense & Aerospace

- R&D Institutions

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content