Data Center Server Rack Market Size and Forecast 2025 to 2034

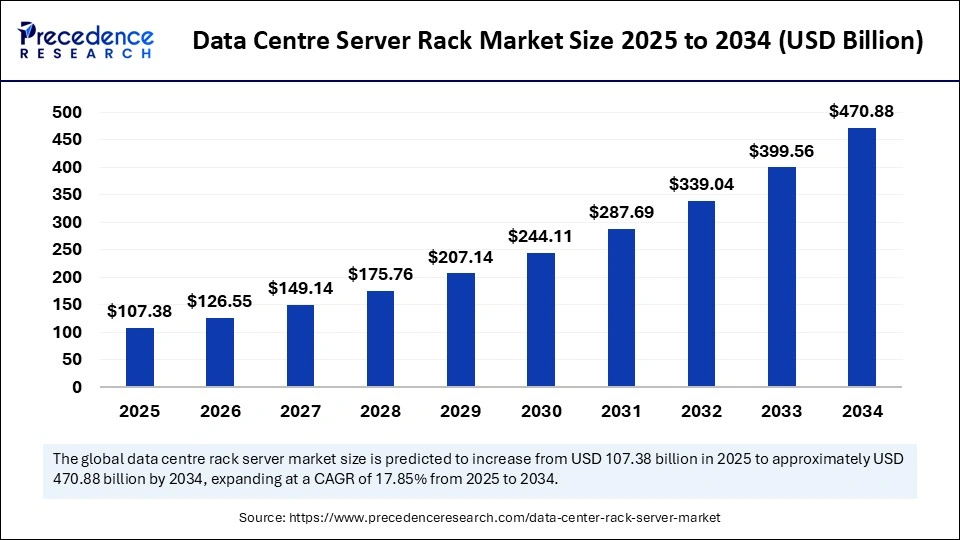

The global data center server rack market size accounted for USD 91.12 billion in 2024 and is predicted to increase from USD 107.38 billion in 2025 to approximately USD 470.88 billion by 2034, expanding at a CAGR of 17.85% from 2025 to 2034. The data center server rack market has experienced significant growth in recent years, reflecting the increasing reliance on digital platforms for freelance and gig-based work. As of 2024, the market size is estimated at USD 91.12 billion. The data center rack market forms the structural foundation of modern computing environments, housing the servers, storage, and networking equipment that power digital operations.

Data Center Server Rack Market Key Takeaways

- In terms of revenue, the global data center server rack market was valued at USD 91.12 billion in 2024.

- It is projected to reach USD 470.88 billion by 2034.

- The market is expected to grow at a CAGR of 17.85% from 2025 to 2034.

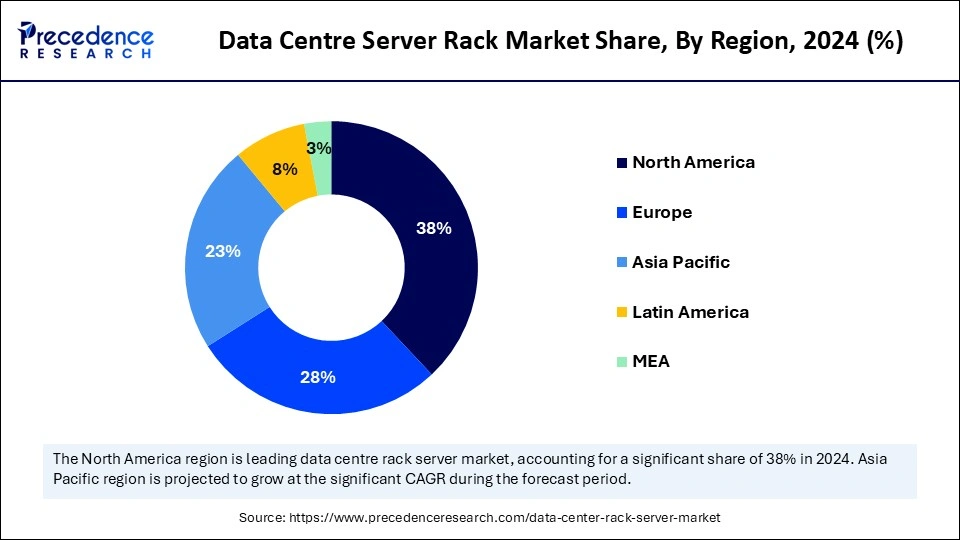

- North America dominated the data center server rack market with the largest market share of 38% in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By product type, the rack enclosures segment held the biggest market share of 58% in 2024.

- By product type, the open-frame racks segment is expected to grow at the fastest CAGR during the forecast period.

- By rack height, the ≤42U segment accounted for the significant market share of 50% in 2024.

- By rack height, the 43U–52U segment is projected to experience the highest CAGR between 2025 and 2034.

- By rack width, the 19-inch standard segment captured the highest market share of 72% in 2024.

- By rack width, the other customized widths segment is expected to experience the fastest growth CAGR from 2025 to 2034.

- By data center type, the hyperscale data centers segment contributed the maximum market share in 2024.

- By data center type, the edge data centers for advanced modalities are the fastest growing from 2025 to 2034.

- By end-use industry, the IT & Telecom segment led the market in 2024.

- By end-use industry, the healthcare segment is projected to expand rapidly during the forecast period.

- By service type, the installation & deployment are the fastest-growing from 2025 to 2034.

- By service type, the design & consulting segment generated the major market share in 2024.

Market Overview

The data center server rack market refers to the global industry focused on manufacturing and supplying physical rack systems such as server racks, network racks, cabinets, enclosures, accessories, and related services used to house and support computing, networking, power, and cooling equipment in data centers and IT facilities.

The market for data center server racks has grown far beyond traditional enclosures, now encompassing integrated systems optimized for airflow, power, and density. Rising demand for high-performance computing is pushing the adoption of advanced rack solutions tailored for dense workloads. Vendors are innovating with modular formats that allow flexible expansion while minimizing floor space. Both colocation providers and hyperscalers are fueling demand as digital workloads surge. At the same time, enterprises are increasingly modernizing legacy facilities to keep pace with evolving requirements. Together, these dynamics create a robust environment for growth in rack solutions.

How AI Is Reshaping the Data Center Server Rack Market

Artificial intelligence is transforming the data center server rack market by increasing demand for racks capable of supporting high-density GPU clusters. AI workloads require enhanced cooling, higher power capacity, and optimized airflow, driving design innovation. Intelligent racks equipped with sensors and AI-driven monitoring tools are becoming more common, enabling predictive maintenance and energy efficiency. Vendors are embedding smart features to dynamically adjust cooling and load balancing in real time. This convergence of AI-driven workloads and AI-enabled rack management is reshaping customer expectations. Ultimately, AI is both a demand driver and a design disruptor for the rack server market.

Market Key Trends

- Adoption of modular rack systems to support scalable deployment.

- Growing demand for high-density racks tailored for AI and HPC applications.

- Integration of liquid cooling solutions directly into rack designs.

- Rise of intelligent racks with IoT and AI-enabled monitoring systems.

- Increased customization for edge data centre deployments.

- Sustainability-focused designs emphasizing energy and water efficiency.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 470.88 Billion |

| Market Size in 2025 | USD 107.38 Billion |

| Market Size in 2024 | USD 91.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Rack Height, Rack Width, Data Center Type, End-Use Industry, Service Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Powering the Growth Curve

The surge in cloud computing and colocation services is a primary driver of the data center server rack market. Rising enterprise digitalization requires robust infrastructure to support AI, analytics, and IoT workloads. Government and private investments in hyperscale facilities are adding momentum. Businesses are under pressure to enhance data security and reliability, resulting in infrastructure upgrades. Edge computing expansion is also fueling demand for compact, modular racks. Together, these drivers position the rack market for sustained growth.

Restraints

Barriers on the Expansion Path

Despite strong growth, the data center server rack market faces challenges related to high capital costs and installation complexity. Smaller enterprises often delay upgrades due to budget constraints. Thermal management remains a critical pain point, especially with growing density requirements. Compatibility with legacy infrastructure also slows adoption. Supply chain disruptions and fluctuations in raw material costs can hinder timely deployments. These restraints must be addressed to fully realize market potential.

Opportunity

Unlocking the Next Wave of Growth

Opportunities abound in edge deployments where compact, high-performance racks can support localized data processing. Smart rack solutions integrating AI, IoT, and predictive analytics offer significant potential for differentiation. Sustainability-driven innovation, such as liquid cooling racks, creates new avenues for growth. Emerging markets in Asia-Pacific, Latin America, and the Middle East offer untapped demand. Partnerships between rack providers and cloud or telecom companies can accelerate penetration. These opportunities underscore the transformative potential of the market.

Product Type Insights

Why Are Rack Enclosures Is Dominating the Data Center Server Rack Market?

Rack enclosures dominate the data center server rack market because they provide enhanced security, airflow management, and cable organization. Enterprises prefer enclosed racks to protect sensitive servers and storage equipment from dust, tampering, and environmental factors. They also support advanced thermal management through integrated fans and airflow ducts. The ability to house high-density IT workloads in a structured and secure manner drives adoption. Enclosures are widely deployed across hyperscale, colocation, and enterprise data centers alike. Their versatility and protective features ensure their leading position in the market.

The growth of AI and HPC workloads has further solidified the demand for rack enclosures. These workloads require optimized cooling and higher power densities, which enclosed racks can efficiently handle. Vendors are innovating with enclosures that integrate liquid cooling, IoT-based monitoring, and modular expansion options. Enterprises also value the ability to lock and segment racks for compliance and security. With the push toward smart and sustainable facilities, enclosures are becoming more sophisticated and energy-efficient. This makes them the long-standing choice for large-scale and mission-critical deployments.

Open frame racks are the fastest-growing product type due to their cost-effectiveness and flexibility. These racks are widely adopted in test labs, telecom closets, and edge environments where security is less critical. Their open structure enables easy access to equipment for maintenance and upgrades. Open frames also support better airflow in small-scale deployments, reducing cooling costs. For organizations with limited budgets, they present an attractive entry point. This affordability and ease of use drive their rapid adoption.

Their growth is further accelerated by edge and modular data centre deployments. As edge facilities expand to support 5G and IoT workloads, open racks offer a practical solution for compact installations. Vendors are enhancing designs with accessories for better cable management and stability. These racks also appeal to startups and mid-sized enterprises looking for quick, low-cost infrastructure solutions. With digital transformation expanding beyond core data centres, demand for open frames continues to climb. This positions them as the fastest-growing category in the product type segment.

Rack Height Insights

Why Are ≤42Us Dominating the Data Center Server Rack Market?

Racks up to 42U remain the dominant height category in the data center server rack market due to their widespread adoption in enterprise and mid-sized data centers. These racks provide sufficient capacity for most IT workloads while remaining manageable in size. Enterprises prefer them for their ease of installation, maintenance, and space optimization. Standardization around 42U ensures compatibility with a wide range of equipment. Their balance between capacity and footprint makes them the industry standard. This dominance is reinforced by continued demand across traditional data centres.

The reliability of 42U racks also lies in their cost-effectiveness and wide availability. Most data centre equipment manufacturers design products to fit seamlessly into this height range. Their manageable scale reduces operational challenges and minimizes the need for specialized handling equipment. Additionally, many colocation providers prefer 42U racks for shared facilities, offering predictable capacity allocation. With strong adoption across multiple industries, these racks remain the most trusted and widely deployed option. As digital infrastructure expands, their role will remain central.

Larger racks between 43U and 52U are the fastest-growing category in the data center server rack market, fuelled by hyperscale and high-density workloads. These racks offer greater space efficiency, allowing data centers to maximize floor utilization. With AI, HPC, and cloud workloads demanding higher server densities, taller racks are increasingly essential. The adoption of liquid cooling and advanced airflow systems makes these larger racks practical. They reduce the number of racks required for deployment, optimizing real estate costs. This scalability drives their rapid growth in modern facilities.

The segment's momentum is also supported by hyperscale operators who prioritize cost-per-watt and cost-per-square-foot efficiency. Larger racks enable the integration of more power and cabling infrastructure, thereby reducing per-unit overhead. Vendors are investing in modular, taller designs that support both IT and power infrastructure within the same frame. These racks are also finding applications in advanced enterprise facilities upgrading to artificial intelligence-ready environments. With the rise of data-hungry applications, taller racks are fast becoming the preferred choice for next-generation deployments. Their growth trajectory is significantly steeper than that of traditional sizes.

Rack Width Insights

Why 19-Inch Standard Is Dominating the Market for Data Center Server Racks?

The 19-inch rack width continues to dominate the global data center server rack sector. Most networking, server, and storage equipment is manufactured to align with this width, ensuring universal compatibility. Enterprises value the predictability and uniformity of 19-inch racks. Their standardization simplifies design, procurement, and deployment across facilities. Colocation and hyperscale providers also prefer this width to streamline operations. This consistency has cemented their dominance for decades.

In addition to compatibility, the 19-inch racks provide other unique benefits from widespread support accessories like cable managers and power distribution units. The strong ecosystem around this format ensures easy customization and scalability. Data center operators rely on them for efficient, tried-and-tested deployment. With IT vendors continuing to design equipment around this standard, 19-inch racks maintain strong relevance. Even as newer widths emerge, the inertia of standardization preserves their leading position. They remain the cornerstone of global rack infrastructure.

Other customized rack widths are the fastest-growing category as operators seek optimized designs for specific workloads. AI and high-performance computing deployments, for instance, often require wider racks to house GPU-intensive servers and advanced cooling systems. Customized widths also allow for integration of cable trays and power units tailored to unique site conditions. Edge and modular data centers frequently adopt non-standard widths for compact or constrained spaces. This flexibility is driving their popularity. Enterprises seeking differentiation are increasingly embracing this trend.

The growth of personalized liquid cooling systems is also accelerating the adoption of customized widths. Wider racks accommodate advanced coolant distribution units and integrated manifolds. Vendors are responding with bespoke solutions that meet the needs of large cloud providers and industry-specific deployments. Healthcare, banking, and telecom industries are showing interest in such tailored designs. This shift reflects a broader trend toward hyper-personalization of infrastructure. As a result, customized rack widths are quickly emerging as a dynamic growth segment.

Data Center Type Insights

Why Hyperscale Data Centers Is Dominating the Data Center Server Racks Market?

Hyperscale facilities dominate the data center server rack market because they deploy racks in massive quantities. Cloud giants like AWS, Microsoft, and Google lead demand with thousands of racks per site. These facilities prioritize high-density enclosures and tall racks for efficiency. Vendors rely heavily on hyperscale partnerships for recurring business. Hyperscale projects also drive technological innovation, as operators push for sustainable and liquid-cooled rack solutions. Their enormous purchasing power ensures their dominance in the market.

The demand from hyperscale operators is amplified by constant expansion across regions. These data centres require racks that can support AI, big data, and IoT workloads. Operators often commission custom-designed racks tailored for energy efficiency and operational optimization. Their ability to scale infrastructure rapidly makes them key market drivers. As digital transformation accelerates globally, hyperscale operators will continue to anchor demand. This ensures their commanding role in shaping the rack industry.

Edge data centers represent the fastest-growing segment due to their proximity-based processing needs. With 5G and IoT proliferation, demand for localized, compact rack systems is rising sharply. Edge sites often require modular and ruggedized racks to operate in non-traditional environments. Their rapid deployment capability makes them attractive for telecom and retail networks. Edge data centers also adopt open frame and customized racks due to space constraints. This surge positions them as the fastest-expanding category.

The expansion of autonomous vehicles, smart cities, and industrial IoT further boosts edge deployments. Operators require racks that balance compactness with performance, spurring innovation in modular designs. Vendors are targeting this segment with portable, prefabricated rack solutions. Telecom providers are investing heavily in edge nodes, amplifying demand. Edge facilities also rely on racks with built-in monitoring systems to reduce on-site maintenance. Collectively, these factors accelerate edge as the fastest-growing market category.

End Use Industry Insights

Why IT & Telecom Is Dominating the Market for Data Center Server Racks?

The IT and telecom sector dominates the data center server racks market due to its insatiable demand for data processing and storage. Telecom operators and cloud providers account for the largest rack installations worldwide. These industries require both hyperscale and edge racks to support 5G, streaming, and cloud services. Constant technological upgrades ensure recurring rack demand. Large capital investments in digital infrastructure reinforce the dominance. IT and telecom thus remain the backbone of rack adoption globally.

This segment benefits from strong synergies between cloud expansion and telecom modernization. Racks are critical to supporting latency-sensitive applications such as video conferencing and real-time gaming. Telecom operators are expanding edge deployments, while IT firms demand more capacity in colocation hubs. The scale and pace of infrastructure rollouts make IT and telecom the largest customer base. Their role in enabling digital transformation globally ensures lasting dominance. Vendors prioritize this sector for volume-driven growth.

Healthcare is the fastest-growing end-use industry in the data center server rack market, driven by the digitization of patient records and the adoption of telehealth. Hospitals and research institutions require racks to house sensitive medical data and AI-powered diagnostic systems. The surge in wearable health devices also fuels demand for robust backend infrastructure. Compliance with data security regulations further accelerates the adoption of secure rack enclosures. Telemedicine platforms need scalable data centres to manage patient interactions and imaging data. These trends make healthcare a rapidly expanding customer base.

The pandemic highlighted the importance of digital healthcare infrastructure, pushing providers to invest in resilient data centers. AI applications in drug discovery, imaging, and diagnostics demand high-performance computing racks. Hospitals increasingly partner with colocation providers to expand IT capacity. Vendors are designing specialized racks with enhanced security and thermal controls for healthcare facilities. Rising global healthcare spending supports long-term demand in this segment. Together, these drivers establish healthcare as the fastest-growing vertical.

Service Type Insights

Why Installation & Deployment Is Dominating the Data Center Server Rack Market?

Installation and deployment services dominate the market for data center server racks as they are essential for operationalizing racks. Enterprises and hyperscalers rely on professional services to handle large-scale installations. These services ensure optimal alignment with cooling, cabling, and power systems. The complexity of deployment in modern data centres makes outsourcing critical. Vendors often bundle installation services with rack sales to ensure seamless adoption. This reliance sustains their dominant role.

Demand is further reinforced by hyperscale expansions requiring thousands of racks per project. Large-scale rollouts necessitate coordinated deployment services for efficiency and speed. Enterprises also depend on service providers to integrate racks with existing infrastructure. Professional deployment reduces downtime and enhances rack performance. Vendors invest heavily in global service networks to capture this opportunity. As data centres continue to scale, deployment services will remain central to the market.

Design and consulting services are the fastest-growing category as data centres adopt more complex infrastructure. Enterprises require expert guidance to optimize rack selection, airflow, and cooling strategies. Consulting services help operators tailor solutions to unique workloads such as AI, IoT, or healthcare data. Sustainability goals also drive demand for specialized design expertise. Vendors offering design advisory create opportunities for long-term customer relationships. This value-added focus accelerates growth in this segment.

The rise of edge computing and modular deployments amplifies the need for consulting services. Operators demand tailored rack solutions to fit space, budget, and compliance requirements. Consulting firms provide simulations and digital twins to predict rack performance under various conditions. This proactive approach reduces operational risks and improves efficiency. As infrastructure complexity grows, consulting services will outpace traditional deployment in growth rate. This positions design and consulting as a key opportunity area.

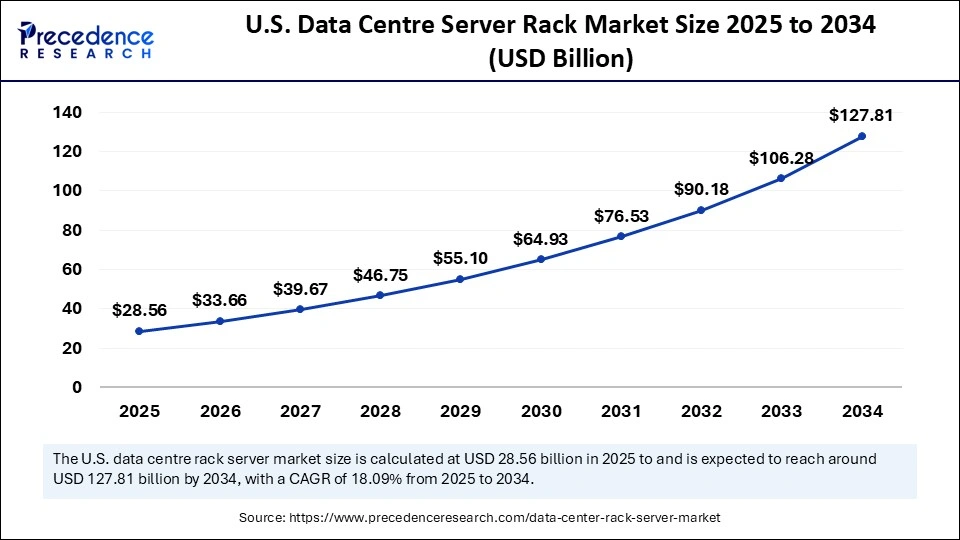

U.S. Data Center Server Rack Market Size and Growth 2025 to 2034

The U.S. data center server rack market size was exhibited at USD 24.24 billion in 2024 and is projected to be worth around USD 127.81 billion by 2034, growing at a CAGR of 18.09% from 2025 to 2034.

How is North America the Powerhouse of the Data Center Server Rack Market?

North America dominates the data center server rack market due to its concentration of hyperscale operators and advanced enterprise IT adoption. Leading cloud providers such as AWS, Microsoft, and Google are continuously expanding infrastructure, fueling demand for high-density racks. Enterprises across industries are upgrading legacy data centers with modular and intelligent racks. Investment incentives and strong digital infrastructure policies further enhance regional growth. The presence of global technology vendors accelerates innovation and competitive dynamics. Collectively, these factors ensure North America's leadership position.

The region also benefits from a strong focus on sustainability and advanced thermal management. AI-driven monitoring systems are increasingly adopted, enhancing rack efficiency and performance. Data center colocation providers are expanding footprints, requiring scalable rack deployments. The rise of edge computing across healthcare, retail, and finance adds new demand layers. Investments in 5G infrastructure further amplify rack requirements. As a result, North America remains the cornerstone of global market dominance.

How Asia Pacific Is Dominating the Data Center Server Rack Market?

Asia Pacific is witnessing the fastest growth in the data center server rack market, driven by rapid digitalization and urbanization. Countries such as China, India, and Singapore are investing heavily in cloud infrastructure and smart city projects. Rising internet penetration and e-commerce expansion are creating massive data processing needs. Regional governments are actively supporting digital infrastructure as part of economic transformation agendas. Local enterprises are embracing digital-first strategies, further fuelling demand. These dynamics make the Asia Pacific the growth engine of the global market for data center server racks.

The region's growth is amplified by the rise of hyperscale projects and data centre hubs in markets like Singapore, India, and Australia. Telecom providers are heavily investing in 5G networks, boosting edge deployment and demand for compact racks. Global vendors are entering joint ventures with local operators to capture market share. Cost-effective labor and construction resources support rapid build-outs. Increasing adoption of AI and Internet of Things across industries accelerates rack deployment requirements. Altogether, Asia Pacific's trajectory signals exponential future growth.

Data Center Server Rack Market Companies

- Schneider Electric

- Vertiv

- Eaton

- Rittal

- Hewlett Packard Enterprise (HPE)

- IBM

- Cisco

- Fujitsu

- Dell Technologies

- Legrand S.A.

- Oracle

- Belden

- nVent / Schroff

- Panduit

- Great Lakes Data Racks & Cabinets

- Chatsworth Products

- Tripp Lite

- Supermicro

- Black Box (AGC Networks)

- Canovate

Recent Developments

- In September 2025, the surging power demands of AI data centers have led to a phenomenon known as power bursting, sudden, unpredictable spikes in energy consumption driven by the heavy computational load of GPU servers running AI applications. These short-term surges (SSOs) can inflict significant and costly damage, not only to data center infrastructure but also to the broader power grid, which is often ill-prepared to absorb such volatile fluctuations. If left unchecked, these bursts can result in transformer overheating, ferroresonant disturbances, and other forms of equipment failure. This makes it critical for operators to proactively detect and manage SSO events before they escalate into expensive outages and long-term system disruptions.

(Source: https://www.eaton.com)

Segments Covered in the Report

By Product Type

- Rack Enclosures (Closed-Frame Cabinets)

- Open-Frame Racks

- Wall-Mount Racks

- Accessories (Cable Management, PDUs, Airflow Kits, Shelves)

By Rack Height

- ≤42U

- 43U–52U

- 52U

By Rack Width

- 19-Inch Standard

- 23-Inch Standard

- Other Customized Widths

By Data Center Type

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Edge Data Centers

By End-Use Industry

- IT & Telecom

- BFSI

- Healthcare

- Government & Defense

- Energy & Utilities

- Manufacturing

- Retail & E-Commerce

- Media & Entertainment

- Transportation & Logistics

By Service Type

- Design & Consulting

- Installation & Deployment

- Maintenance & Support

By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting