Decarbonization Service Market Size and Forecast 2025 to 2034

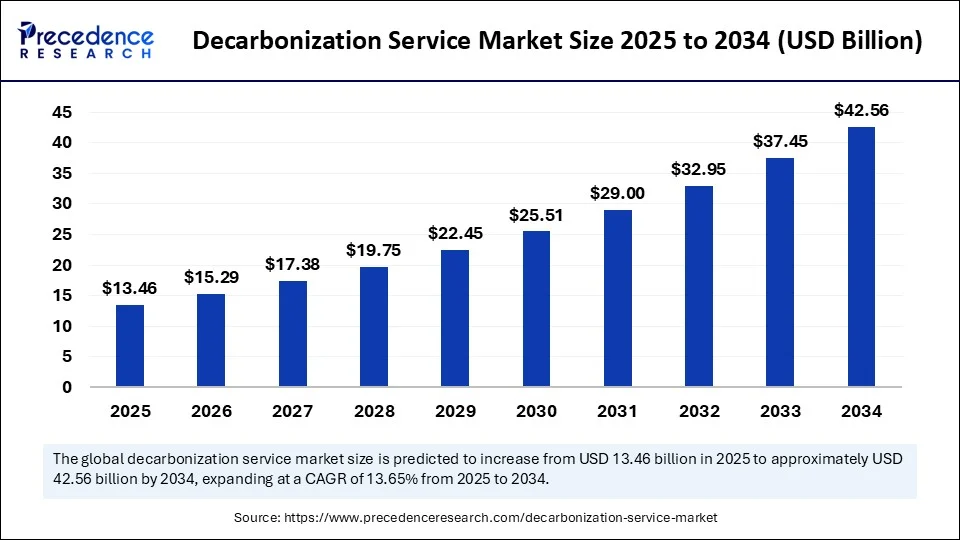

The global decarbonization service market size was calculated at USD 11.84 billion in 2024 and is predicted to increase from USD 13.46 billion in 2025 to approximately USD 42.56 billion by 2034, expanding at a CAGR of 13.65% from 2025 to 2034. The market growth is attributed to rising renewable energy adoption, stricter climate regulations, and increasing corporate commitments toward achieving net-zero emissions.

Decarbonization Service Market Key Takeaways

- In terms of revenue, the global decarbonization service market was valued at USD 11.84 billion in 2024.

- It is projected to reach USD 42.56 billion by 2034.

- The market is expected to grow at a CAGR of 13.65% from 2025 to 2034.

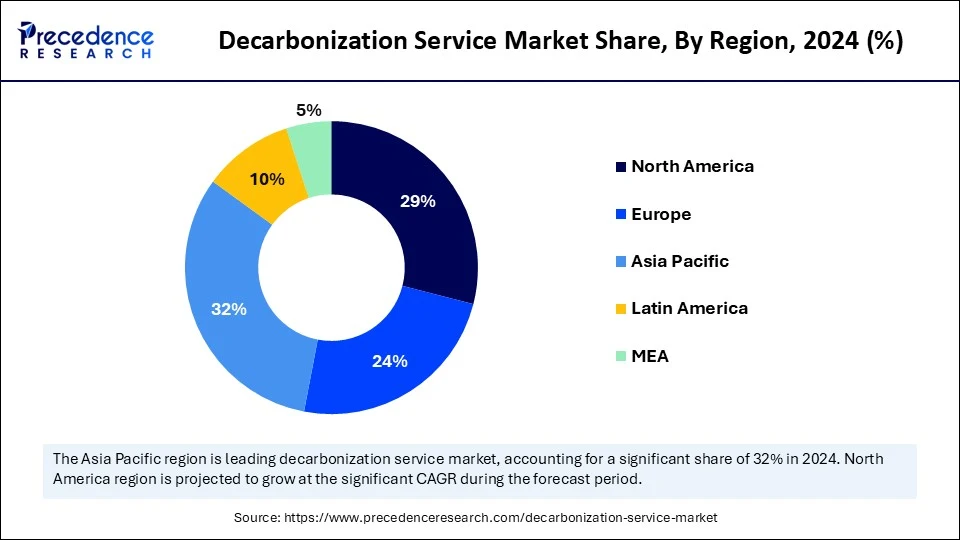

- Asia Pacific dominated the global decarbonization service market with the largest share of 32% in 2024.

- Europe is expected to grow at a notable CAGR from 2025 to 2034.

- By service type, the consulting & advisory segment held the major market share of 22% in 2024.

- By service type, the carbon capture, utilization & storage (CCUS) services segment is projected to grow at a CAGR between 2025 and 2034.

- By technology/solution, the renewable energy integration (solar + onshore wind) segment contributed the biggest market share of 30% in 2024.

- By technology/solution, the green hydrogen (electrolyzer integration) security segment is expanding at a significant CAGR between 2025 and 2034.

- By contract/delivery model, the turnkey EPC contracts segment captured the highest market share of 28% in 2024.

- By contract/delivery model, the performance-based contracts/ESCO model segment is expected to grow at a significant CAGR over the projected period.

- By end-user industry, power generation & utilities dominated the global market with the largest share 24% in 2024.

- By end-user industry, the steel & metallurgy decarbonization services segment is expected to grow at a notable CAGR from 2025 to 2034.

- By deployment scale/ project size, medium (facility-level projects) generated the major market share of 40% in 2024.

- By deployment scale/ project size, large / industrial-cluster projects are expected to grow at a notable CAGR from 2024 to 2034.

- By customer type, the industrial segment held the major market share in 2024 that held a market share of about 36%.

- By customer type, the public sector / municipal decarbonization programs segment is projected to grow at a CAGR between 2025 and 2034.

- By technology provider type, the equipment manufacturers segment held the largest market share of 3%% in 2024.

- By technology provider type, the specialized CCUS / DAC providers segment is projected to grow at a CAGR between 2025 and 2034.

- By performance/outcome focus, the operational emissions reduction (scope 1 & 2) segment contributed the biggest market share of 45% in 2024.

- By performance/outcome focus, the carbon removal / negative emissions segment is expanding at a significant CAGR between 2025 and 2034.

- By funding & payment structure, the CapEx-funded projects segment accounted for the significant markets share of 50% in 2024.

- By funding & payment structure, the pay-for-performance / shared savings models segment is expected to grow at a significant CAGR over the projected period.

Impact of Artificial Intelligence on the Decarbonization Service Market

Artificial intelligence (AI) is one of the key aspects to transform the decarbonization service market, offering new tools to fast-track emission savings strategies and increase overall efficiency. AI improves the accuracy of carbon accounting, helping firms keep up with compliance regulations but also earn more credibility among regulators and other stakeholders. Furthermore, it also enhances integrating renewable energy to predict supply and stabilizing grids, and optimising energy storage, thus, clean energy becomes more reliable and affordable.

Asia Pacific Decarbonization Service Market Size and Growth 2025 to 2034

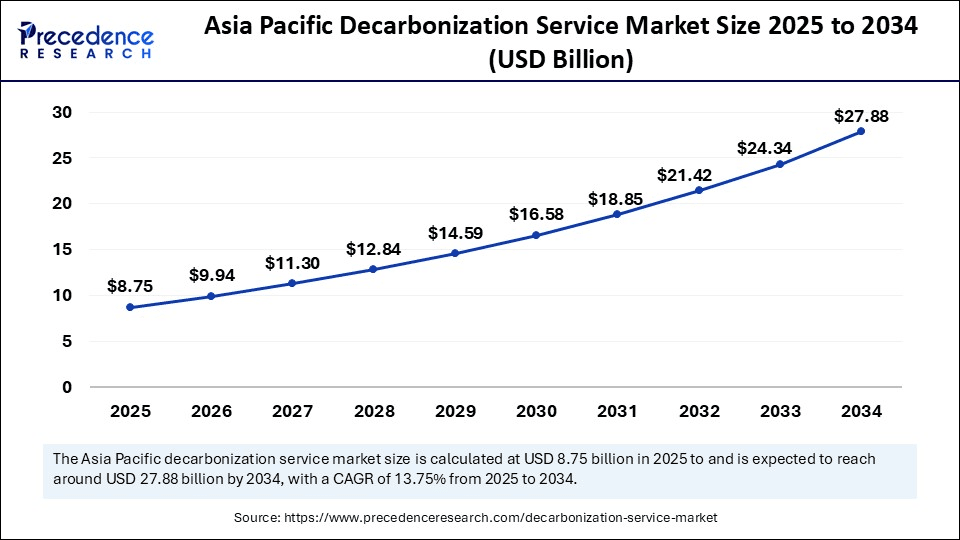

The Asia Pacific decarbonization service market size is evaluated at USD 8.75 billion in 2025 and is projected to be worth around USD 27.88 billion by 2034, growing at a CAGR of 13.73% from 2025 to 2034.

How Is Asia Pacific Positioned as the Largest Regional Hub in the Decarbonization Service Market?

Asia Pacific led the market, capturing the largest revenue share in 2024, due to fast urbanization and the reliance of the region on the power supply through coal. According to IRENA, the region installed 413 GW of renewable energy last year, its highest growth ever, and China led all countries with more than 62% of the global solar PV and 69% of the newly installed wind energy. It is expected that China's 2060 carbon-neutral roadmap and its 2030 goal of 1,200 GW of solar and wind capacity will further heighten demand for a variety of services to decarbonize.

It is expected that India will speed up adoption with its National Green Hydrogen Mission, which has funding of 19,744 crore (2.3 billion) and aims to reach 500 GW of non-fossil fuel capacity by 2030. Energy-intensive exporters are unlikely to achieve this without ramping up decarbonization spending due to corporations in Asia needing to step up spending on decarbonization to align with global supply-chain regulations and the EU Carbon Border Adjustment Mechanism (CBAM) in particular. Additionally, BlackRock, Brookfield, IFC, and other global investors are investing enormous amounts of capital in clean infrastructure in the Asia Pacific, thus facilitating the industrial decarbonization service market.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the powered by ambitious climate goals, advanced regulatory frameworks, and strong industrial decarbonization momentum. The Fit for 55 package requires the EU to cut by 55% the use of greenhouse gases by the year 2030, and the European Green Deal will put the region on the path toward net-zero emissions by 2050. Furthermore, the European Commission is pursuing the Carbon Border Adjustment Mechanism (CBAM), which is also likely to drive exporting firms in energy-intensive sectors to pursue bold decarbonization plans to remain competitive on the global stage.

Market Overview

Increasing investments in renewable energy projects are expected to widen the demand for decarbonization services, leading to high demand in the decarbonization service market. Intelligent systems used by organizations include cloud-based platforms that leverage the IoT, AI, and big data analytics. This captures real-time emissions data and models energy consumption to develop low-carbon pathways dynamically. Drishti IAS confirms that after added almost 510 GW of new capacity in 2023. The swiftest yearly rate of addition in 20 years, and all demand growth should be met by low-emissions sources through 2026, increasing its share to almost 50% by 2026.

The IEA anticipates that the magnitude of global clean-technology funding will reach USD 2 trillion in 2024, twice that of fossil fuel investment, and strengthen the feasibility of decarbonization efforts. The suppliers of services implement modular digital solutions that help connect renewable energy growth and carbon accounting to allow companies to shift to more sustainable energy sources as quickly as possible. Additionally, this technological and service-based transformation is expected to be motivated further by increasing corporate sustainability commitments.

Decarbonization Service Market Growth Factors

- Driving Demand for Carbon Accounting Tools: The growing need for transparent emissions tracking is driving the adoption of advanced carbon accounting and reporting services.

- Boosting Digital Twin Integration: Rising deployment of digital twins in industrial operations is boosting process optimization and energy efficiency in decarbonization efforts.

- Fuelling Green Hydrogen Initiatives: Expanding government-backed hydrogen projects are fuelling the demand for decarbonization services across transportation and heavy industries.

- Rising Circular Economy Practices: Growing emphasis on waste-to-energy and material reuse is rising as a driver for decarbonization-focused business models.

- Propelling Electrification of Fleets: Increasing transition toward electric mobility is propelling the requirement for services that enable low-carbon logistics solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 42.56 Billion |

| Market Size in 2025 | USD 13.46 Billion |

| Market Size in 2024 | USD 11.84 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.65% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Technology / Solution, Contract / Delivery Model, End-user Industry (verticals), Deployment Scale / Project Size, Customer Type, Technology Provider Type, Performance / Outcome Focus, Funding & Payment Structure, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Are Increasing Government Regulations and Climate Commitments Accelerating Demand for Decarbonization Services?

Increasing government regulations and climate commitments are expected to drive the decarbonization service market. Regional policymakers bring severe Nationally Determined Contributions (NDCs) and emissions trading regulations, which force industries to engage in low-carbon operation. According to the UNEP Emissions Gap Report 2024, countries need to make deeper cuts in greenhouse gas emissions of 42% by 2030 and 57% by 2035 in comparison to 2019 levels to reduce greenhouse gas emissions in line with 1.5 °C pathways, UNEP - UN Environment Programme.

Governments attach rewards and incentives to complying, and UNEP reported a record 57.1 GtCO2e in global emissions in 2023, 1.3% greater than 2022, emphasizing the need to improve services that can facilitate speedy mitigation. State of Energy Policy 2024 by IEA reveals that almost 150 countries, which cover 95% of total global energy demand, follow the new clean-energy policies associated with carbon reduction. This demonstrates the increasingly broad space of contribution in advisory and implementation services, IEA Blob Storage. Additionally, the Surging investments in renewable energy projects are projected to accelerate the adoption of decarbonization services in the coming years.

Restraint

How Have High Implementation Costs Challenged the Decarbonization Service Market?

Adoption through high implementation costs is expected to hinder the market. The services related to decarbonization need sizeable investments in complex technologies, renewable integration, and energy-efficient systems that increase the initial costs of investments. Many small and mid-sized enterprises cannot afford to set aside the funds, thus making their adoption difficult. Furthermore, this restraint reduces market penetration in cost-sensitive industries such as textiles, cement, and agriculture, thus hindering the market.

Opportunity

How Are Growing Corporate Sustainability Commitments Reshaping the Decarbonization Service Market?

Growing corporate sustainability commitments are anticipated to create immense opportunities for the players competing in the market for decarbonization services. Global businesses become more in line with science-based goals and the net-zero commitments. Now encompassing 92% of global GDP and 88% of global emissions in 2024, following the Science Based Targets initiative, and CDP had reported a historic 22,700 firms disclosed environmental data in 2024, the first time with record participation of corporate climate reporting.

Automakers, energy companies, and consumer goods companies incorporate carbon management into strategic planning by using AI-driven analytics and offset initiatives to achieve aggressive goals. The World Economic Forum has noted the amount of money invested in clean energy by companies pledging net-zero emissions in 2024. This represents a high number of global clean energy investments and illustrates the size of the private-sector contribution to climate pathways. There is a deepening of partnerships between corporates and service providers, where organizations are turning to third-party expertise. Furthermore, this impetus is turning decarbonization into a competitive driver, rather than just a compliance requirement, further solidifying the long-term growth prospects of specialized service providers in international markets around the world.

Service Type Insights

Why is Consulting & Advisory Emerging as the Cornerstone of the Decarbonization Service Market?

The consulting & advisory segment dominated the decarbonization service market in 2024, accounting for an estimated 22% market share, as a result of the increasing complexity of regulation and disclosure requirements. Companies brought in consultants to interpret EU ETS and CBAM requirements and make reports ISSB/IFRS S2 compliant.

They are getting ready to provide SEC climate disclosures with an expected increase in demand for transition planning, scenario analysis, and governance. Furthermore, according to the IEA, in 2024, governments accounting for more than 70% of total energy demand across the globe enacted new or revised efficiency policies. They were likely to have further entrenched demand for advisory services to assist industries in ensuring compliance and retrofitting initiatives.

The carbon capture, utilization & storage (CCUS) services segment is expected to grow at the fastest CAGR in the coming years, owing to the growing capture of process emissions in cement, steel, chemicals, and refining industries. Policy tailwinds and cluster development are projected to augment front-end engineering, permitting, and storage site characterization services. Furthermore, as buyers are increasingly demanding voluntary MRV of their purchases, analysis of leakage risk and credit-grade lifecycle analysis, this is likely to drive more advisory and assurance work related to eligibility under compliance and high-integrity voluntary schemes.

Technology / Solution Insights

How Are Renewable Energy Integration Services Driving the Largest Share in the Decarbonization Service Market?

The renewable energy integration (solar + onshore wind) segment held the largest revenue share in the decarbonization service market in 2024, accounting for 30% of the market share, as organizations focused on immediate abatement with the mature, low-cost assets. Service providers implemented interconnection studies, grid-code compliance, and curtailment mitigation.

Those who are bound to create sustainability in forecasting and management of grid congestion. Furthermore, the repowering and lifecycle asset optimization were hastened by developers that be predicted to lengthen the duration of performance advantages and the strengthening of integration services as the key technology track.

The green hydrogen (electrolyzer integration) segment is expected to grow at the fastest rate in the coming years, as hard-to-abate industries need feedstocks or fuels where there are zero process emissions. Additionally, integration of green hydrogen technology or solutions is further expected to be facilitated by government programs, thus driving the segment growth.

Contract / Delivery Model Insights

Why Do Long-Term Service Contracts Dominate the Decarbonization Service Market Structure?

The turnkey EPC contracts segment dominated the decarbonization service market in 2024 that holding a market share of about 28%, as firms sought to have a single point of accountability in decarbonization projects where design, procurement, and construction were contemplated.

Large industrials and utilities were anticipated to be attracted to EPC constructs to simplify permitting, build in high technology, and guarantee on-time delivery of solar, wind, and efficiency retrofits. Moreover, the increased compliance standards, health, and safety regulations, and audit finance grade are likely to further strengthen the demand for turnkey EPC delivery in mission-critical low-carbon infrastructure.

Performance-based contracts / ESCO models segment is expected to grow at the fastest CAGR in the coming years. Corporations and municipalities see merit in pairing contracts with specific and tangible improvements to energy performance and emissions levels. Clients were anticipating an attraction to pay-on-performance models that lessen the burden of initial capital investment with long-run efficiency improvements. Furthermore, the green bonds and financing institutions were expected to finance ESCO schemes more easily as creditworthy assurances spread over jurisdictions, thus further boosting the market.

End-user Industry Insights

What Makes the Power & Energy Sector the Leading Adopter in the Decarbonization Service Industry?

The power generation & utilities segment held the largest revenue share in the decarbonization service market in 2024, accounting for an estimated 24% market share, due to the growing demand for decarbonization services. Various industries stepped up sets toward eliminating coal and ramping up renewables to an unprecedented level. Moreover, the key role of the sector in electrifying transport, heavy industry, and buildings likely cement its status as one of the cornerstone demand drivers of decarbonization services on a global basis through 2030.

The steel & metallurgy decarbonization services segment is expected to grow at the fastest rate in the coming years, as the sector intensifies efforts to reduce coal dependency and integrate renewables. The IEA 2024 report indicates that steelmaking emits close to 2.8 gigatonnes of CO2, a proportion of 7-9% of all emissions. This underlines the need to drastically reduce emissions through abatement. The 2024 status report of the global CCS Institute confirmed the CO2 capture global pipeline has exceeded 50 new large-scale development projects, opening the prospects of metallurgy service clusters around the CCUS hubs in Europe, the U.S., and Asia.

The services in relation to decarbonization are forecasted to be concentrated on carbon capture retrofits and the implementation of electronic arc furnaces (EAFs), which are projected to substitute blast furnaces that rely on coking coal. It is foreseen that steelmakers accelerate the industrial pilots, fuelling the need to provide specialized engineering, hydrogen integration, and MRV systems services. Additionally, the U.S. Inflation Reduction Act is estimated to trigger low-carbon steel service uptake and growing demand for decarbonization solutions and services.

(Source: https://www.iea.org)

(Source: https://www.globalccsinstitute.com)

Deployment Scale / Project Size Insights

How Are Large-Scale Industrial Projects Shaping the Decarbonization Service Market Leadership?

The medium (facility-level projects) segment dominated the decarbonization service market in 2024, accounting for an estimated 40% market share, as they have quicker approvals, clear ownership sites, and specific ROI horizons. Project owners had used prior utility interconnections, brownfield footprint, and established technologies that were expected to accelerate engineering, acquisition, and start-up. Furthermore, the growing interest in single-site energy efficiency retrofits, heat recovery, on-site solar with storage, and boiler and kiln retrofit is anticipated to fuel the market for decarbonization services.

The Large / industrial-cluster projects segment is expected to grow at the fastest CAGR in the coming years, as heavy industry and ports seek to share infrastructure for hydrogen production, CO 2 transport and storage, and clean power. Additionally, the initial hub successes develop portable templates of risk sharing and finance sequencing. This is likely to expand institutional capital involvement and support cluster projects as the most rapidly expanding level of deployment.

Customer Type Insights

Why Are Large Enterprises Holding the Largest Share in the Decarbonization Service Market?

The industrial segment held the largest revenue share in the decarbonization service sector in 2024, accounting for 36% of the market share. Primarily, steel, cement, chemical, and refining companies were focused on the decarbonization services. They are implementing measures to decrease the risk of regulatory exposure, meet net-zero commitments, and eliminate dependence on fossil fuels.

Approaches, such as carbon capture retrofits, electrification of high-temperature processes, and on-site renewable power integration, were anticipated to be pursued by operators to hit sectoral roadmaps. The IEA 2024 report has shown that the industry has almost 38% of total global final energy consumption, and approximately 30% of the CO2 poisoning. This highlights why industry plants continue to feature in decarbonization efforts. Furthermore, the increasing regulatory attention to lifecycle emissions accounting within ecosystems like the EU Corporate Sustainability Reporting Directive 2024 report and ISSB standards is expected to fuel the growth of the market.

The public sector / municipal decarbonization programs segment is expected to grow at the fastest rate in the coming years, as governments are also expected to raise their levels of commitment to national climate targets and net-zero strategies. In the UNFCCC Global Covenant of Mayors 2024, over 13,000 cities and local governments with a population of more than 1 billion people globally have taken on climate neutrality goals. Additionally, the increased funding for low-carbon tours of heat, energy-saving community residential areas is expected to drive the demand for decarbonization services.

Technology Provider Type Insights

How Are Equipment Manufacturers Maintaining Dominance in the Decarbonization Service Market?

The Equipment Manufacturers segment dominated the decarbonization service market in 2024, accounting for an estimated 35% market share, due to the growing number of technology buyers choosing reliable hardware and pre-integrated systems to roll out large-scale decarbonization efforts. Post-sale support, performance warranties, and the ability to install worldwide are likely to continue to make equipment manufacturers central to decarbonization implementations in the utility, industrial, and transport segments, thus propelling the segment.

The specialized CCUS / DAC providers segment is expected to grow at the fastest CAGR in the coming years, owing to the high focus on the removal of residual and process emissions, where other solutions are weakened. Engineering companies and technology startups are predicted to increase around industrial clusters and point-source retrofits in cement, chemicals, and refining. Furthermore, the contracted purchases of carbon removal and characterization of storage sites potentially play a role in driving the demand for the market.

Performance / Outcome Focus Insights

Why Is Operational Emissions Reduction the Prime Focus in the Decarbonization Service Market?

The operational emissions reduction (Scope 1 & 2) segment held the largest revenue share in the market for decarbonization services in 2024 that holding a market share of about 45%, due to the increasing environmental regulation pressures. Organizations were estimated to seek engagement of third-party bodies in providing digital monitoring systems, emissions accounting systems, and audits at the plant level to get it correct under the ISSB and CDP frameworks. Additionally, the decarbonization initiatives are likely to be funded with more commitment as they raise short-term to medium-term returns as a result of being less energy-intensive and light on regulatory compliance costs.

The carbon removal / negative emissions segment is expected to grow at the fastest rate in the coming years, as the consensus builds that efficiency and adoption of renewables alone cannot address residual industrial and agricultural emissions. Such technologies as direct air capture (DAC), bioenergy with carbon capture and storage (BECCS), and enhanced mineralization are predicted to be scaled up, with evidence provided by global climate projections provided by the IPCC indicating that large-scale removals are critical to stay in the 1.5 o C trajectory. Governments and multinationals were anticipated to enhance investment in engineered removals and nature-based solutions, thus further fuelling the demand for decarbonization services.

Funding & Payment Structure Insights

What Makes CapEx-Funded Projects the Backbone of the Decarbonization Service Market?

The CapEx-funded Projects segment dominated the decarbonization service market in 2024, accounting for 50% of market share, as major corporations and utilities moved to direct ownership of renewable energy assets, efficiency retrofits, and carbon capture infrastructure. Strong balance sheet organizations are likely to prefer the CapEx-heavy forms owing to the ability to own assets, attain long-term operational savings, and have access to tax credits or green subsidies. Additionally, the globalization of supply networks in multinational corporations, with a tendency to duplicate CapEx implementation strategies at various sites, made the segment strengthen in this market.

The pay-for-performance/shared savings models segment is expected to grow at the fastest CAGR in the coming years, owing to the growing trend of firms aiming to minimize financial risks and factor payments on any confirmed reductions in verified emissions. It was expected that this structure would appeal to small and mid-sized firms and municipal governments to customers in the public sector, which limited budgets available. Furthermore, increasing pressure on investors to implement transparent ESG reporting is bound to lead to a more rapid uptake in the adoption of these types of models.

Decarbonization Service Market Companies

- ABB

- Air Liquide

- Baker Hughes

- Ballard Power Systems

- Cummins Inc.

- Daikin Industries

- General Electric (GE Renewable Energy / GE Power)

- Hitachi Energy

- Honeywell

- Johnson Controls

- Linde plc

- Mitsubishi Heavy Industries

- Nel ASA

- Plug Power

- Schneider Electric

- Siemens Energy

- Siemens Gamesa Renewable Energy

- Thyssenkrupp

- Vestas Wind Systems

- Wärtsilä

Recent Developments

- In July 2025, Schneider Electric introduced Zeigo Hub, a digital platform designed to help companies decarbonize their supply chains. The platform enables organizations to engage suppliers, develop tailored decarbonization programs, set targets, and track emissions progress by supplier. Key features include guided supplier onboarding, a streamlined user interface, emissions calculation tools, real-time analytics, and structured data supporting frameworks like CDP, CSRD, and TCFD. Invited suppliers gain access to customized decarbonization roadmaps and solution providers, with participation costs covered by the sponsoring organizations.(Source: https://www.esgtoday.com)

- In March 2025, Amazon launched a carbon credit service to help U.S.-based partners invest in high-quality nature-based projects and carbon removal technologies. This initiative aligns with Amazon's goal to reach net-zero emissions by 2040 through operational decarbonization, renewable energy adoption, fleet electrification, and efficiency improvements. The program channels private-sector funding toward impactful carbon removal solutions beyond Amazon's operations.(Source: https://www.aboutamazon.com)

- In August 2024, GE Vernova unveiled its GRiDEA portfolio at the CIGRE 2024 event in Paris, showcasing innovative solutions for electrical grid decarbonization. The portfolio integrates advanced electrification technologies to enhance grid sustainability and support global energy transition initiatives.

- In May 2023, ADNOC launched the Global Decarbonization Technology Challenge: ADNOC, supported by AWS, bp, Hub71, and the Net Zero Technology Center, announced a global competition to discover innovative solutions for energy decarbonization. Over 1,000 policymakers, innovators, and industrial leaders participated in the launch at the UAE Climate Tech Forum. Ten finalists will compete for up to $1 million in piloting opportunities, focusing on CCUS, emissions reduction, digital applications, advanced materials, and nature-based decarbonization solutions.(Source: https://www.adnoc.ae)

Segments Covered in the Report

By Service Type

- Consulting & Advisory

- Energy Audit & Benchmarking

- Engineering, Procurement & Construction (EPC)

- Detailed Design & FEED

- Technology Supply & Integration

- Installation & Commissioning

- Operation & Maintenance (O&M)

- Performance Contracting / Energy Service Companies (ESCO)

- Financing & Project Structuring (incl. Green Financing)

- Carbon Accounting, Verification & Certification

- Monitoring, Reporting & Verification (MRV) Platforms

- Emissions Trading & Carbon Portfolio Management Services

- Training & Capacity Building

- Decommissioning / Repowering Services

By Technology / Solution

- Renewable Energy Integration (Solar PV, Onshore Wind, Offshore Wind, Small Hydro)

- Energy Storage Systems (BESS, Thermal Storage)

- Electrification Solutions (HVAC electrification, electric boilers, heat pumps)

- Green Hydrogen (electrolyzer supply, integration)

- Fuel Switching (biomass, biogas, renewable fuels)

- Carbon Capture, Utilization & Storage (CCUS) — capture, transport, storage, utilization

- Industrial Process Electrification & Heat Pumps (low/medium/high temp)

- Waste-to-Energy & Waste Heat Recovery

- Carbon Removal & Direct Air Capture (DAC)

- Fuel Cells & Power-to-X solutions

- Smart Grid, Microgrid & Demand Response

- Energy Efficiency Retrofits (buildings, process)

- Industrial Catalysts & Material Substitutions (low-carbon inputs)

- Digital Solutions (energy management software, analytics, AI/ML platforms)

By Contract / Delivery Model

- Turnkey EPC Contracts

- Build-Own-Operate (BOO) / Build-Operate-Transfer (BOT)

- Operation & Maintenance (O&M) Contracts

- Performance-Based Contracts (guaranteed savings)

- Time & Materials / Fee-for-Service

- Managed Services / SaaS (MRV, EMS platforms)

- Joint Ventures & Consortium Models

- Equipment Leasing /-as-a-Service

By End-user Industry (verticals)

- Power Generation & Utilities

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemicals & Petrochemicals

- Steel & Metallurgy

- Cement & Lime

- Mining & Minerals

- Manufacturing (discrete & process)

- Buildings & Construction (commercial, residential, institutional)

- Transportation & Logistics (fleet electrification, modal shift)

- Automotive & Aerospace (manufacturing decarbonization)

- Food & Beverage / Agribusiness

- Data Centers & IT Infrastructure

- Pharmaceuticals & Life Sciences

- Waste Management & Water Utilities

- Maritime & Ports

By Deployment Scale / Project Size

- Small (pilot & site-level upgrades)

- Medium (facility-level projects)

- Large (multi-facility / utility-scale / industrial cluster)

- Mega (nation-scale / multi-GW / CCUS hubs & clusters)

By Customer Type

- Industrial (manufacturing, heavy industries)

- Commercial (offices, retail, campuses)

- Residential (multi-family retrofit offerings)

- Public Sector (municipalities, government bodies)

- Utilities & Grid Operators

- Project Developers / IPPs

- Fleet Operators (logistics, public transport)

By Technology Provider Type

- Equipment Manufacturers (turbines, electrolyzers, CCS modules, heat pumps)

- EPC & Engineering Firms

- Software & Digital Platform Providers

- Financial & Investment Partners

- Specialized CCUS / DAC Providers

- ESCOs & Retrofit Contractors

By Performance / Outcome Focus

- Operational Emissions Reduction (scope 1 & 2)

- Supply-Chain Emissions Reduction (scope 3)

- Carbon Removal / Negative Emissions

- Renewable Energy Procurement & PPAs

- Energy Cost Reduction & Efficiency Gains

- Compliance & Regulatory Reporting

By Funding & Payment Structure

- CapEx-funded Projects

- Debt-financed (project finance)

- Equity / JV-funded

- Pay-for-Performance / Shared Savings

- Green Bonds / Sustainability-linked Financing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting