Defense Communication Intelligence Market Size and Forecast 2025 to 2034

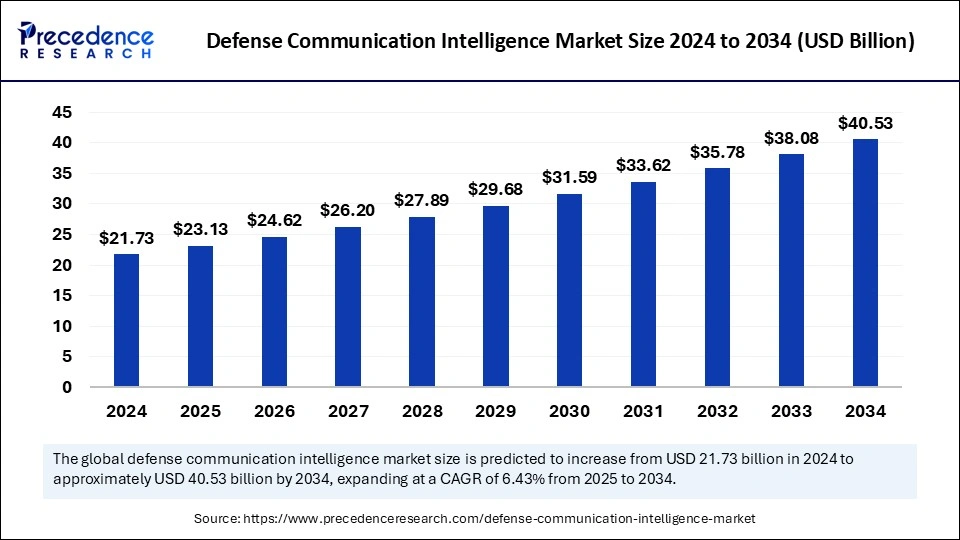

The global defense communication intelligence market size was estimated at USD 21.73 billion in 2024 and is predicted to increase from USD 23.13 billion in 2025 to approximately USD 40.53 billion by 2034, expanding at a CAGR of 6.43% from 2025 to 2034. The defense communication intelligence market is surging due to growing geopolitical tensions, rising defense budgets, mounting cybersecurity threats, and regulatory compliance needs, driving investments in real-time and automated intelligence systems for military operations.

Defense Communication Intelligence Market Key Takeaways

- North America dominated the global market with the largest market share in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By component, the hardware segment contributed the largest market share in 2024.

- By component, the software segment is expected to show considerable growth over the forecast period.

- By installation, the handheld segment accounted for the largest market share in 2024.

- By installation, the fixed segment is anticipated to witness significant growth during forecast period.

- By platform, the land segment captured the biggest market share in 2024.

- By platform, the airborne segment is projected to grow at a solid CAGR during the forecast period.

Artificial Intelligence (AI) Integration in the Defense Communication Intelligence Market

Artificial Intelligence technology in the defense communication intelligence market uses machine learning and natural language processing elements to enhance human capabilities through actions, sensing, understanding, and learning capabilities. Defense applications of artificial intelligence refer to the method of connecting sophisticated technologies to defense equipment to boost operational capabilities and utility.

Technological advances in defense weapons and equipment produce market growth for AI applications in defense usage. Artificial intelligence-based corporate communication monitoring systems utilize their technology to assess whole-company interchanges across multiple platforms, which helps organizations meet compliance obligations and generate business insights through comprehensive speech analysis and risk evaluation capabilities.

- In March 2024, LeapXpert Ltd released through its American business communication platform the GenAI application Maxen for improving relationship manager productivity and communication quality

Market Overview

The communication intelligence system (COMINT) is a wireless technology utilized on the battlefield for radio surveillance, locating radio signals, and jamming opposing radar. Electromagnetic signals facilitate data transmission between two points. This system employs military radio interception and electromagnetic signals to send faxes while also decrypting military communications and converting signals into processed data, which encompasses images, sounds, and other information. Defense forces rely on this technology for crucial support, harnessing modern networking systems and satellite communication that function worldwide.

The current demand for the defense communication intelligence market continues to rise because of strengthening geopolitical tensions, worsening cyber warfare threats, and advancing military modernization programs. Governments throughout the world invest money to construct secure communication networks that integrate AI surveillance mechanisms intended for intelligence gathering and battlefield operation coordination.

The defense communication intelligence market continues to grow because governments rely more intensely on satellite communication technology and electronic warfare infrastructure. Security data transmission requirements by law are fueling ongoing improvements in encryption technologies alongside cybersecurity standards. The global increase in defense budgets creates strong market growth prospects, which secure improved military preparation and national protection.

Defense Communication Intelligence Market Growth Factors

- Rising geopolitical tensions: National security and military awareness receive greater priority because international tensions drive demand for top intelligence technology and protection networks against cyber warfare and electronic surveillance threats.

- Cybersecurity concerns: The protection of military operations requires strong encrypted networks because cyber threats grow, which prevents data breaches and acute threats, including cyber warfare incidents that threaten national security.

- Increased defense budgets: Many nations are spending funds on defense communication intelligence to invest in complex surveillance systems, advanced satellite communications, and electronic warfare technology, which strengthens their strategic advantage.

- Regulatory and compliance needs: The need for regulatory adherence and compliance within defense communication systems pushes governments to maintain their constant improvements of encryption and cybersecurity protocols.

- Technological advancements: Modern defenses achieve better efficiency through their defense communication systems by implementing AI and machine learning with substantial communication.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 40.53 Billion |

| Market Size in 2025 | USD 23.13 Billion |

| Market Size in 2024 | USD 21.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.43% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Installation, Platform, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Security demands for military and defense communications continue to increase.

Military communications demand rigorous security and utmost confidentiality to fulfill the defense sector's requirements. As the amount of IP-based data grows- which encompasses remote sensor information and situational awareness videos shared via industry-standard interfaces—robust data connection security is vital. Given the rising security threats, digital assets across land, air, and space require improved protection, making the prevention of military satellite cyberattacks critical.

Security has become the primary concern in many nations because unauthorized border activities threaten domestic and international safety standards. The need for critical intelligence resources about illegal operations has skyrocketed throughout the past few years for defense organizations and law enforcement communities. Therefore, these elements are anticipated to boost the growth of the defense communication intelligence market.

Restraint

High Costs

The implementation of modern innovative technology in the defense communication intelligence market faces significant challenges for military organizations because of funding limits and inadequate skilled personnel requirements. Advanced communication systems struggle to get implemented because of economic constraints. Various nations work on diverse military system innovations to drive down operational expenses.

Opportunity

The requirement for cyber intelligence

The defense communication intelligence market continues to experience rapid growth because contemporary organizations need enhanced cyber intelligence capabilities to fight against expanding cyber threats. The adoption of Industry 4.0 technologies, including AI, machine learning, and Internet-of-Things (IoT), by military agencies, aerospace industries, and government institutions requires advanced communication intelligence solutions to become critical.

Rising numbers of cyber threats and increasing digitalized operations require quick market expansion. Communication intelligence delivers essential information needed to fight cyberattacks while safeguarding national security and developing defense forces. The expansion of defense infrastructure stocks will drive advanced COMINT solution demand into exponential growth patterns, creating substantial marketplace opportunities in the upcoming years.

- In February 2023, Reckitt Benckiser stated that cybercrimes in Australia reached 76,000 incidents, which marked a 13% surge compared to the past year.

Component Insights

The hardware segment contributed the largest share of the defense communication intelligence market in 2024. Defense Communication Intelligence hardware serves as specialized equipment that military and defense agencies use to collect, examine, and interpret communications signals. Defense communication intelligence hardware performs signal collection activities followed by signal analytical processes to derive defense-related information. The system features specialized tools, technological programs, and professional services.

The software segment is expected to show considerable growth over the forecast period. The increase in software segment sales stems from AI software, which improves IT infrastructure to prevent security breaches. Defense organizations employ defense communication intelligence software to collect, decode, and interpret communication signals as part of their defense operations. The growth of defense spending with the development of advanced AI software and associated software development kits has driven this expansion. Defense communication intelligence software collects communication signals to evaluate their data for military applications. The software system allows defense organizations to monitor electronic messages from hostile parties by intercepting and evaluating their signals.

Installation Insights

The handheld segment accounted for the largest share of the defense communication intelligence market in 2024. Military operations gain real-time data access using portable defense communication intelligence handheld systems. Military and defense users rely on defense communication intelligence for the collection, analysis, and interpretation of communications signals. The devices enable real-time interception of enemy signals while they support radio source location and hostile communication jamming capabilities. The portability of handheld systems, along with real-time data access, benefits field operations as well as on-the-go tasks in manufacturing processes that need rapid decision-making.

The fixed segment is anticipated to witness significant growth in the studied period. Fixed systems present benefits for dealing with large, heavy, and powerful equipment. Military bases, training grounds, and defense facilities will likely experience increased demand for fixed system deployment in the upcoming years. The global fixed market experiences substantial changes mainly because defense forces require advanced warning systems for vehicles, ships, and aircraft to endure battlefield electromagnetic risks. The security solutions market expects growing demand due to global communication intelligence trends alongside defense industry modernization and rising national security investments alongside technological advancements in electronic intelligence during the forecast period.

Platform Insights

The land segment dominated the global defense communication intelligence market in 2024. Defense communications intelligence helps detect, locate, and orient enemies across several platforms, which will create advanced scope for the growth of the market. Communication intelligence serves as a primary defense tool to identify radio facilities while streaming digital transmissions before seizing opposing radar signals. The integration of digital technology into ground-based military forces occurs because combat conditions remain unpredictable and volatile. The market for communication intelligence will experience accelerating growth throughout the prediction period.

The airborne segment is expected to show considerable growth over the forecast period. Defense missions depend heavily on the communication intelligence system to achieve their objectives. Military forces use COMINT to collect and analyze communications signals for protective purposes. Airborne COMINT represents a subset of COMINT operations where intelligence collection occurs through aircraft platforms as well as helicopters and unmanned aerial vehicles (UAVs). Enhanced security solutions within the aerospace and defense sectors are expected to drive the COMINT industry.

- In July 2023, Cobham Aerospace Communications advanced a safe cockpit communications system that became part of Thales Corporation's acquisition to expand its avionic portfolio. As a distinguished technology provider, Thales offers its clients both cost-effective solutions and safer, environmentally sustainable options.

Regional Insights

North America accounted for the largest share of the defense communication intelligence market in 2024. The United States has sustained its position as a technology leader for military defense development, which has created a strong demand for COMINT throughout North America.The increased funding for science, technology, and military and intelligence by nations, including the U.S. and Canada, will eventually benefit from COMINT. The technologies are receiving government support that will drive the regional defense communication intelligence market's expansion. Military activities around the world have been characterized by constant technological advancement and implementation.

- In June 2023, the business intelligence company CyberRisk Alliance (CRA) based in the U.S. acquired LaunchTech Communications through an undisclosed deal. As a U.S.-based public relations agency, LaunchTech Communications develops communication strategies that help to build awareness and credibility among both technical and non-technical audiences.

Asia Pacific is anticipated to witness the fastest growth in the defense communication intelligence market during the forecasted years. The growing need for COMINT platforms is the reason behind this trend. Security technologies developed by China, India, and other nations are used to establish safety and peace across their national borders. The market sector in this area will display continued development because the adoption of network-centric warfare strategies is expected.

Asia Pacific market growth should accelerate because these economies continue enhancing their military systems as part of defense sector development programs. During the forecast period, the market growth in this region will be boosted by elevated military operation expenditures among numerous countries.

- In February 2025, Bharat Electronics Limited (BEL) presented its advanced defense technologies, including communication equipment, electro-optic devices, electronic warfare systems, and weapon systems, at Aero India 2025. The exhibition will also feature cutting-edge technologies like 5G Solutions for Defence and AI-based products.

Defense Communication Intelligence Market Companies

- Thales

- Cubic Corporation

- HENSOLDT

- Elbit Systems Ltd.

- AIRBUS

- IAI (Israel Aerospace Industries)

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Rohde & Schwarz

- Leonardo S.p.A.

- General Dynamics Corporation

- Ultra

- BAE Systems

- Northrop Grumman

Recent Developments

- In September 2024, Hensoldt South Africa showcased its new communications intelligence automation engine at the Africa Aerospace and Defence (AAD) 2024 exhibition.

- In September 2023, SPX CommTech delivered its advanced 953 Communications Intelligence Radio Frequency Receiver to the market for superior hostile RF signal tracking and identification purposes in COMINT and C-UAS tactical operations.

- In May 2023, Estonia signed an agreement with the Israeli Aerospace Company that enabled the purchase of new munitions to achieve enhanced indirect fire capabilities. This new ability makes it possible to attack enemies from longer distances.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Installation

- Handheld

- Vehicle Mounted

- Fixed

By Platform

- Land

- Airborne

- Naval

- Space-Based Platforms

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting