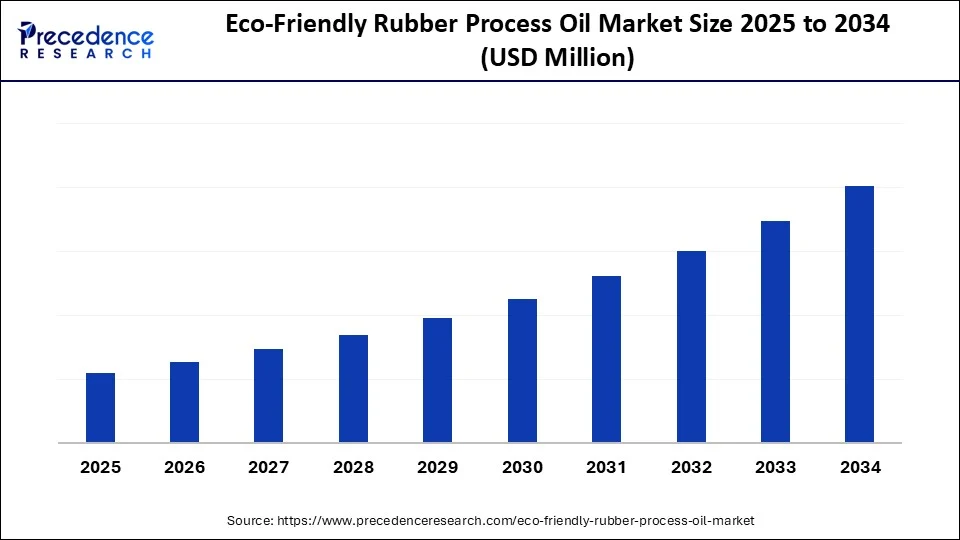

Eco-Friendly Rubber Process Oil Market Size and Forecast 2025 to 2034

The eco-friendly rubber process oil market is gaining traction as increasing awareness of carbon footprint reduction makes these oils essential for sustainable product development and compliance with global standards. The market is growing due to rising demand for sustainable, nontoxic alternatives in tire, automotive, and industrial rubber manufacturing.

Eco-Friendly Rubber Process Oil Market Key Takeaways

- Asia Pacific dominated the eco-friendly rubber process oil market, with the largest market share of 47% during 2024.

- North America is expected to grow at the fastest CAGR during the forecast period.

- By type, the TDAE segment held the biggest market share of 48% in 2024.

- By type, the bio-based/low PAH RAE segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the tires segment contributed the highest market share of 78% in 2024.

- By application, the polymer processing segment is projected to grow at the fastest CAGR during the forecast period.

- By end-use industry, the automotive segment generated the major market share of 50% in 2024.

- By end-use industry, the consumer goods segment is the fastest-growing during the forecast period.

How Is AI Improving Production Efficiency in Eco-Friendly Process Oils?

Eco-friendly rubber processing, oil refinement, and blending are being revolutionized by AI-driven real-time process optimization. Through the integration of intelligent sensors and machine learning models, producers can autonomously adjust parameters to guarantee optimal quality and yield by continuously monitoring critical variables like temperature, pressure, and viscosity. This helps maintain constant product purity and performance in each batch while also reducing energy waste and raw material consumption.

Market Overview

Why Is the Eco-Friendly Rubber Process Oil Market Growing?

The eco-friendly rubber process oil market is growing due to mounting pressure on industries to replace traditional aromatic oils with nontoxic, sustainable alternatives. Growing environmental standards are forcing producers to switch out hazardous oils with more eco-friendly alternatives that guarantee compliance and lessen carbon emissions, particularly in the tire and automotive industries. The demand for safer materials in industrial rubber goods, hoses, seals, and footwear is also increasing, and consumer awareness of eco-friendly products is driving adoption. Eco-friendly rubber process oils are a key factor in the expansion of the green industry, as developments in bio-based oil technologies and government support for sustainable manufacturing are accelerating this shift.

Eco-Friendly Rubber Process Oil Market Growth Factors

- Rising demand for eco-friendly products: Increasing preference for sustainable, non-toxic oils in rubber processing, especially in the tire and automotive industries.

- Stringent environmental regulations: Global restrictions on harmful aromatic oils are driving the adoption of greener alternatives.

- Booming automotive and tire industry: Higher vehicle production and replacement tire demand fuel consumption of eco-friendly process oils.

- Increased industrial applications: Use in footwear, industrial rubber goods, horse, and seals expands market opportunities.

- Growing awareness of worker safety: Safety handling and reduced health risks encourage industries to switch to cleaner oils.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Are Stringent Environmental Regulations Fueling Growth in the Eco-Friendly Rubber Process Oil Market?

The use of hazardous aromatic oils that are rich in PAHs has been drastically decreased by strict environmental regulations, making the use of eco-friendly substitutes all but required. Non-toxic, low PAH oils are becoming increasingly necessary for manufacturers to use to meet consumer safety regulations and maintain their competitiveness. Improvements in the hydrogenation and refining processes, which enable manufacturers to adhere to stringent safety regulations while preserving product performance, support this change.

Why Is the Automotive and Tire Industry a Key Driver of Demand?

The automotive and tire sectors consume most of these rubber process oils during their various production process to enhance rubber compound properties. The automotive and tire industries continue to play a key role in the development of eco-friendly rubber process oils. There is a growing demand for sustainable alternatives that can provide performance without sacrificing environmental safety because of the rise in global vehicle production. Longer tire life, improved rolling resistance, and lower emissions are all advantages of eco-friendly oils that correspond with the growing demand for high-performance and electric vehicle tires.

- On 5 March 2025, ANRPC disclosed that global natural rubber supply will fall short of demand, with production projected at 14.9 million metric tons vs. Demand at 15.6 million tons, highlighting rising pressure on raw materials fueling process oil demand.(Source: https://www.reuters.com)

Restraints

Why Are High Production and Processing Costs Hindering the Eco-Friendly Rubber Process Oil Sector?

The eco-friendly process oils, especially those that are bio-based, require intricate purification and redefining procedures, which raise production costs. Because of this, they are substantially more costly than traditional aromatic oils, which makes price-conscious manufacturers hesitant. Despite regulatory pressure, mass adoption is limited by the additional cost burden, which frequently affects small and mid-sized players that operate on narrow margins. This higher cost will continue to be a hindrance to competitiveness in the global market until large-scale economies of production are realized. Therefore, before making a complete switch, manufacturers exercise caution and weigh concerns about profitability against regulatory compliance.

How Is Limited Raw Material Availability Affecting the Eco-friendly Rubber Process Oil Market?

Eco-friendly oils rely on renewable feedstocks like vegetable oils or refined products, which aren't always consistently available. Seasonal fluctuations and reliance on particular sources for raw materials bring about uncertainty. This scarcity discourages widespread use in vital industries by increasing costs and causing inconsistent product availability. Manufacturers are compelled to switch back to traditional oils when shortages arise, which halts the green transition. This reliance on finite feedstock emphasizes the necessity that they to be more robust and diversified.

Opportunities

Rising Demand for Sustainable and Green Products

Industries are adopting eco-friendly raw materials because of growing global awareness of sustainability and climate change. By using green process oils, rubber producers can set themselves apart and draw in eco-aware consumers. For businesses providing sustainable solutions, this demand generates premium pricing opportunities and strong brand value. It is anticipated that adoption rates will increase in both consumer and industrial markets as sustainability becomes a competitive advantage.

Expansion of Electric Vehicle (EV) and Mobility Markets

The need for tires that are sustainable, long-lasting, and high-performing is being fueled by the quick transition to electric vehicles. This shift is well-suited for eco-friendly rubber process oils that meet green standards while enhancing rolling resistance and lifecycle performance. Long-term contracts with international tire suppliers to the EV industry are thus made possible for manufacturers. The use of eco-friendly rubber process oils in tire manufacturing will become more commonplace as EV adoption increases worldwide.

Type Insights

Why Did the TDAE Segment Dominate the Eco-Friendly Rubber Process Oil Market in 2024?

Treated Distillate Aromatic Extract (TDAE) dominated the eco-friendly rubber process oil market in 2024 due to its wide recognition as a safer substitute for oils with high levels of aromaticity. Manufacturers prefer this type due to its excellent stability, compliance with strict EU REACH regulations, and superior compatibility with rubber formulations. Moreover, TDAE improves tire performance by decreasing rolling resistance and increasing traction, which increases its demand in automotive applications.

- In April 2025, BPCL's MAK Rubber Spray Oil introduces friendly packaging innovations that enhance accessibility through its tailored spray application, not strictly categorized by oil type like TDAE or biobased.(Source: https://www.tyre-trends.com)

Bio-based and low PAH RAE oils are emerging as the fastest-growing segment. These oils are becoming more popular due to their significantly smaller environmental impact and use of renewable feedstocks, driven by the global shift towards sustainability. The need for biobased oils is rising due to growing consumer demand for eco-friendly products and regulatory pressures, particularly among tire and polymer manufacturers.

Application Insights

Why Did the Tires Segment Dominate the Eco-Friendly Rubber Process Oil Market in 2024?

The tire industry is the dominant application area for eco-friendly rubber process oils, accounting for the largest market share. To meet safety regulations while preserving performance efficiency, tire manufacturers are widely implementing low PAH and TDAE oils. This market is also driven by the expanding automobile fleet and the need for replacement tires because eco-friendly oils prolong tire life and lessen environmental risks.

Polymer processing is expected to be the fastest-growing application segment, as businesses use sustainable oils more frequently to produce a variety of rubber-based products. Eco-friendly processed oils increase elasticity, lower energy consumption in production, and improve processing efficiency. The growth of industries like consumer goods, industrial goods, and packaging is opening new growth prospects in this field.

End Use Industry Insights

Why Did the Automotive Segment Dominate the Market in 2024?

The automotive sector leads the end-use industry share, as eco-friendly oils are crucial for making tires, belts, hoses, and seals that are essential for vehicle safety and performance, and demand for automobiles continues increasing with new electric vehicle players entering the space. Manufacturers are being forced to use sustainable process oils by the automotive industry's strict emission regulations and standards. It is anticipated that the market for rubber parts manufactured with low PAH oils will continue to grow as electric and hybrid vehicles continue to innovate.

Consumer goods are projected to be the fastest-growing end-use industry, with increasing uses in lifestyle home and footwear products. The move toward sustainable and non-toxic materials in common consumer goods is fueling adoption of environmentally safe and biobased process oils. This market expansion is further supported by rising consumer awareness of eco-friendly materials and health benefits.

Regional Insights

Why Did Asia Pacific Dominate the Eco-Friendly Rubber Process Oil Market?

Asia Pacific dominates the eco-friendly rubber process oil market because the region is currently seeing extensive automobile and automobile component production, the rapid growth of urban and rural mobility infrastructure feeding the automotive sector, and cost-effective regional manufacturing operations. Regional leadership is being fueled by robust demand from original equipment manufacturers and replacement markets. Sustainable process oils are being adopted at an even faster rate due to growing industrialization and government emphasis on eco-friendly production methods. Asia Pacific is also the world's supply backbone due to its robust export networks and abundance of raw materials.

North America is expected to witness the fastest growth in the eco-friendly rubber process oil market region-wise because of stricter environmental laws, increasing adoption of green technologies, and growing demand for sustainable consumer and automotive products. Faster adoption of bio-based and low PAH oils is being pushed by the existence of manufacturers who are driven by innovation. The region's expansion is also being aided by supportive regulations and consumer preferences for eco-friendly products. Furthermore, increased investment in tire and advanced polymer technologies is establishing North America as a robust growth hub.

Eco-friendly Rubber Process Oil Market Companies

- H&R Group

- Orgkhim Biochemical Holdings

- Total (TotalEnergies)

- Repsol

- CPC Corporation

- IRPC

- Shell

- CNOOC

- Shandong Tianyuan Chemical Co., Ltd

- Suzhou Jiutai Group

- Nynas AB

- HollyFrontier Corporation

- PetroChina

- ExxonMobil

- Indian Oil Corporation Ltd

- Hindustan Petroleum Corporation Ltd (HPCL)

- Chevron Corporation

- Idemitsu Kosan Co., Ltd.

- Sinopec Limited

- Petronas Lubricants International

Recent Developments

- In January 2025, Michelin opened the first industrial-scale demonstration plant for bio butadiene, part of the Bio Butterfly projects, with an investment exceeding US$86 million and an annual capacity of 20-30 metric tons.(Source: https://www.rubbernews.com)

- In 2024, Nynas introduced the EVO line of polymer-modified tire oils, offering instant carbon footprint reductions as drop-in replacements, and achieved an EcoVadis Gold sustainability rating.(Source: https://www.nynas.com)

Segments Covered in the Report

By Type

- TDAE (Treated Distillate Aromatic Extract)

- High-Viscosity Grade

- Low-Viscosity Grade

- MES (Mild Extracted Solvate)

- Light MES

- Heavy MES

- RAE (Residual Aromatic Extract)

- Standard Rae

- Low-PAH RAE

- Naphthenic Oils (NAP)

- Low-Viscosity

- Medium-Viscosity

- High-Viscosity

- Others

- Bio-Based/Low-PAH RAE

- Specialty Hybrid Oils

By Application

- Tires

- Footwear

- Polymer Processing

- Industrial Goods / Others

By End-Use Industry

- Automotive

- Industrial

- Consumer Goods

- Others

By Region

- Asia Pacific

- Europe

- North America

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting