Elemental Boron Market Size and Forecast 2025 to 2034

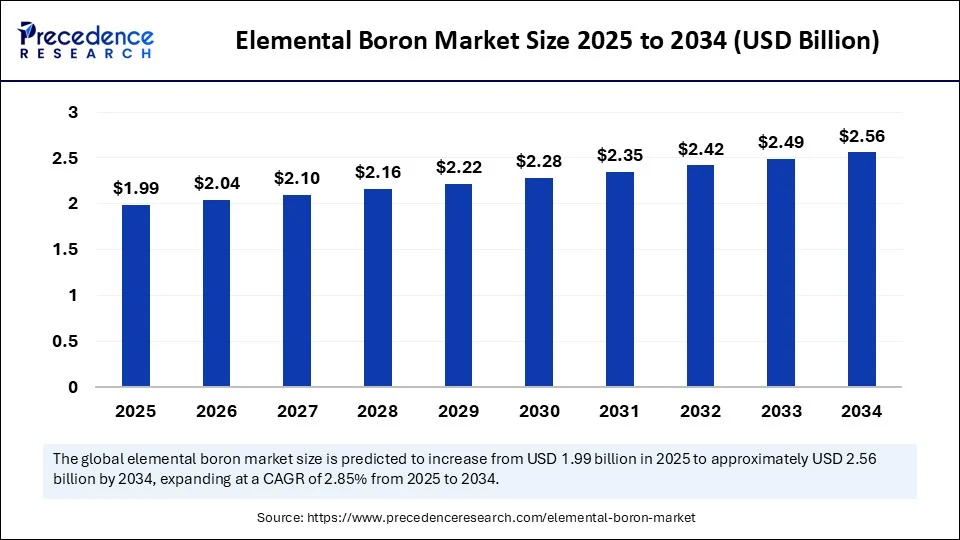

The global elemental boron market size accounted for USD 1.93 billion in 2024 and is predicted to increase from USD 1.99 billion in 2025 to approximately USD 2.56 billion by 2034, expanding at a CAGR of 2.85% from 2025 to 2034.The market is significantly growing due to the unique properties of the boron element that are highly beneficial for diverse sectors like healthcare, manufacturing, aerospace and defense, and others.

Elemental Boron MarketKey Takeaways

- In terms of revenue, the global elemental boron market was valued at USD 1.93 billion in 2024.

- It is projected to reach USD 2.56 billion by 2034.

- The market is expected to grow at a CAGR of 2.85% from 2025 to 2034.

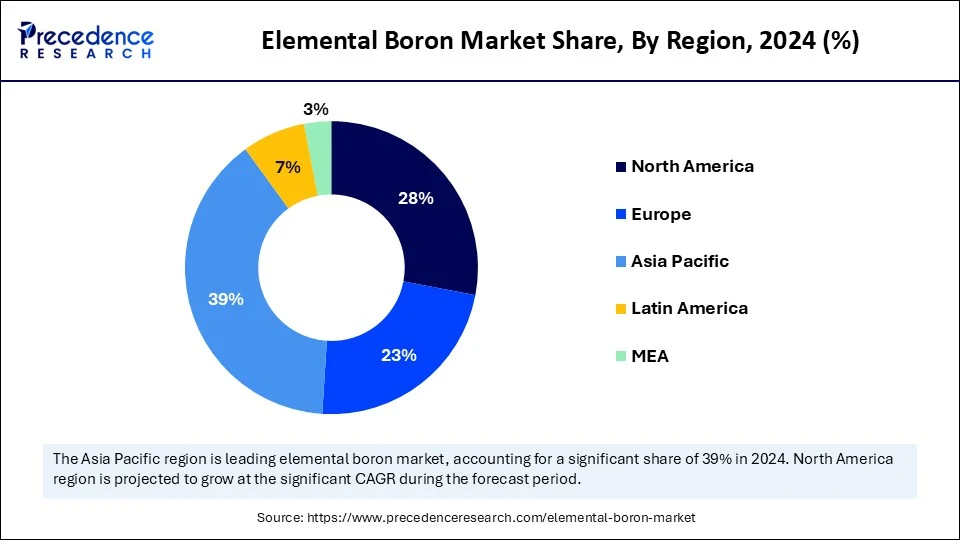

- Asia Pacific dominated the elemental boron market with the largest market share of 39% in 2024.

- The Middle East & Africa is expected to witness the fastest growth during the foreseeable period.

- By form, the amorphous boron segment led the market in 2024 and is expected to grow further in the coming years.

- By purity level, the high purity (>99%) captured the biggest market share in 2024.

- By purity level, the high purity (>99%) segment is expected to witness the fastest growth CAGR during the foreseeable period of 2025-2034.

- By application, the metallurgy segment generated the major market share in 2024

- By application, the electronics & semiconductors segment is expected to witness the fastest CAGR between 2025 and 2034.

- By distribution channel, the direct sales (OEMs & Tier 1 suppliers) segment held the largest market share of 47% in 2024.

- By distribution channel, the e-commerce & online portals segment is expected to witness the fastest growth CAGR during the foreseeable period.

How is AI Transforming the Elemental Boron Market?

Artificial intelligence can be used for various aspects of elemental boron, including research and development, which plays a crucial role in expanding the market globally. Algorithms can enhance the process of identification of new boron-containing materials and predict their properties, and help in the synthesis process. AI-based workflows can analyze huge datasets about boron compounds and identify their properties, including mechanical strength, electron mobility, and their response under certain conditions with thermal stability.

Generative AI can be useful in guidance of novel boron-containing materials with targeted properties and support researchers by reducing their extra efforts. Machine learning models can be further trained on existing datasets about boron and its properties and behavior of boron with other materials under certain environments. Optimization of the boron production method can also be achievable by using AI algorithms and their data-based prediction.

Asia Pacific Elemental Boron Market Size and Growth 2025 to 2034

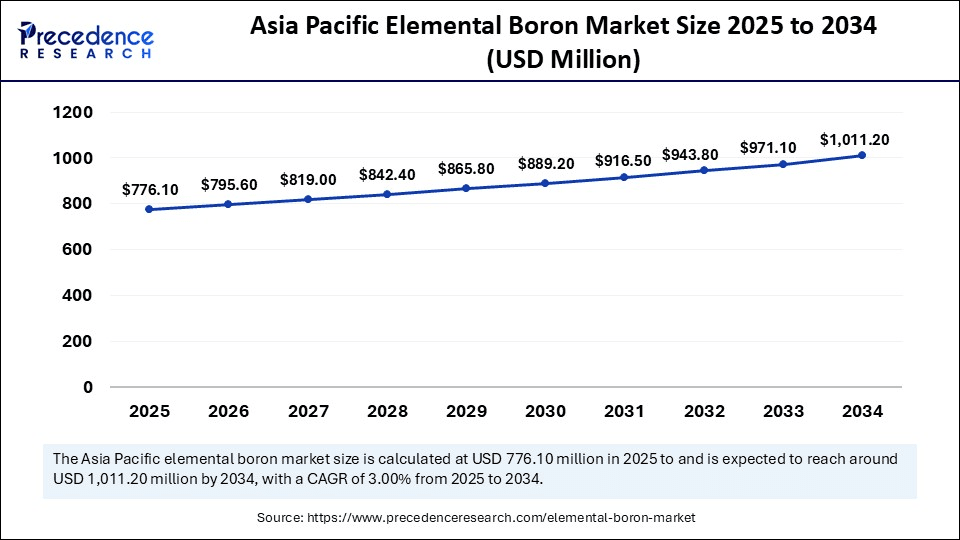

The Asia Pacific elemental boron market size was exhibited at USD 752.70million in 2024 and is projected to be worth around USD 1011.20 million by 2034, growing at a CAGR of 3.00% from 2025 to 2034.

What are the Major Reasons Behind the Dominance of the Asia Pacific in the Elemental Boron Market?

The dominance of Asia Pacific is attributed to a couple of factors, including the growing rate of industrialization in developing countries, the advancement and rapid adoption of emerging technologies, and the increasing demand for elemental boron in diverse sectors like advanced electronics, military devices, and renewable energy sources. The growing shift to adopt modern technologies like neutron absorption and military grade armor, along with other innovative boron-based technologies in the defense sector, instead of traditional ones, is fueling the higher production of elemental boron.

Increasing adoption of boron in advanced battery technology creates a significant growth rate of renewable energy systems like solar power and energy storage systems. Supportive government policies are further promoting the application of elemental boron in smart factories, AI technologies, and digital infrastructure. On a country level, Japan, India, and South Korea are significantly contributing to the market growth due to their increasing manufacturing strength, defense capabilities, and rapid adoption of boron-based technologies for it. China is a leader in the region, as a major consumer and producer of elemental boron due to strategic partnerships and substantial investment in refinement technologies for boron production.

- In October 2024, an innovative technology was developed by a Chinese scientist at the China Institute of Atomic Energy of the China National Nuclear Corporation. They have generated enriched boron-10 with 70% abundance. This breakthrough has created a platform for China's higher production ability for boron isotopes on a significant level.(Source:https://interestingengineering.com)

Which Countries are Leveraging Elementary Boron in the Middle East and Africa

The Middle East & Africa is expected to witness the fastest growth during the forecast period of 2025-2034. The growth is driven by growing infrastructure development, strategic investments in sectors like renewable energy and defense development, showcasing the region's potential to grow prominently in the elemental boron market. Boron offers neutron-absorbing technologies that are crucial for nuclear reactors and radiation shielding. This is leveraged by regions like the UAE and Africa as they are highly investing in energy infrastructure and research areas, along with the development and adoption of advanced materials that would be beneficial for applications in defense and aerospace, fostering the production and demand for high-purity borons.

Market Overview

The elemental boron market refers to the global production, processing, distribution, and end-use application of boron in its elemental form (symbol B, atomic number 5). Elemental boron is a metalloid with exceptional hardness, a high melting point, and a low density. It is primarily used in specialized industrial applications such as semiconductors, nuclear reactors, aerospace alloys, defence-grade Armor, ceramics, permanent magnets, and high-energy fuels. The market encompasses both amorphous and crystalline forms of elemental boron and is driven by demand in electronics, defence, metallurgy, pharmaceuticals, and energy sectors.

What are the Key Trends in the Elemental Boron Market?

- Increasing Demand for Boron Element in Clean Energy: The boron element is critical in the neodymium magnets production which are useful for wind turbines and electric vehicle motors, further supportive renewable energy and electric mobility. Boron elements are further applicable in nuclear fusion and energy storage. In nuclear fusion reactors, boron hydrides are used as a neutron moderator for ongoing trials such as ITER. Boron-based compounds are explored due to their potential application in lithium-boron batteries and solid-state batteries to achieve high-performance in energy storage systems.

- Boron Usage in Agriculture:The application of boron plays a crucial role in agriculture, as an insufficient level of boron does not offer enough nutrients. Use of elemental boron is highly efficient for crops, as they can grow in any environment, get protected, and flourish to the maximum. Boron can offer numerous benefits when used for farming, which include inhibition of pathogens, maintaining a good pH balance in the soil, and preventing fungal development in the plants, which further increases crop production while keeping their quality and nutritional value high.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.56 Billion |

| Market Size in 2025 | USD 1.99 Billion |

| Market Size in 2024 | USD 1.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.85% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Purity Level, Distribution Channel, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Application of Boron Compounds for Hydrogen Storage and the Renewable Energy Area

Boron compounds like boranes and borohydrides hold immense potential to use them as hydrogen carriers owing to their high hydrogen capacity by weight. These elements offer a gravimetric density of hydrogen, which makes them suitable contenders for an energy storage system. Similarly, amine boranes hold high hydrogen capacity and less release of hydrogen. In addition to this, the renewable energy sector is expanding significantly, aiming to achieve decarbonization.

Boron plays a critical role in the decarbonization of fossil fuels. Boron-based chemicals can be used for fuel consumption, which further minimizes the emission of carbon dioxide and other greenhouse gases. The renewable energy industry is expanding and employing more people to work with as compared to the other energy sectors. According to the European Wind Energy Association, nearly 400,000 jobs were offered by the wind power sector alone. Further, by doubling investment into the renewable energy sector, 24 million new green jobs would have been created up to the year 2030, as per the prediction of the IEA.

Restraint

Complex Extraction of High-Purity Boron

The extraction and refining of elemental boron are complex processes and need highly advanced production technologies, which are already limited, creating a barrier for the growth of the elemental boron market. These complexities can further add to the higher cost for high-purity boron production. The increasing trend for sustainability and eco-friendly production is gaining momentum, which impacts the market in terms of production cost. Moreover, other factors like fluctuations in demand, market volatility about prices, and supply chain blockages can further create hurdles for the market growth.

Opportunity

Application of Boron in the Nanotechnology Sector

Nanotechnology sectors show promising applications for boron elements, such as boron nanoparticles or nano powder. Boron nanoparticles have extensive applications due to their thermal properties, as boron's gravimetric heat of combustion is higher than traditionally used liquid hydrocarbon fuels. Thus, boron nanoparticles can be used as a protective coating, anti-freezing agents, neutron capturers in cancer treatments, corrosion inhibitors, and others. Boron is basically versatile element that can be used at the nanoscale, such as boron nanoparticles, nanopowder, nanoribbons, nanowires, and nano belts, due to their exceptional thermal properties. These properties are highly reflective when boron is used as a nanoparticle in various applications, creating a lucrative opportunity for the elemental boron market.

Form Insights

Which Form of Elemental Boron is Majorly Used in the Various Applications?

The amorphous boron segment led the market in 2024, with the fine powder sub-segment holding a share of 42%. Dominance of this segment is attributed to the unique properties and diverse applications of amorphous boron-fine powder, as it offers high surface area, the capacity to form alloys, and reactivity. These characteristics make it an ideal candidate for various industrial applications, including defense, metallurgy, the energy sector, and aerospace. Also, amorphous boron-fine powder is chemically reactive as compared to crystalline boron, which is useful for solid fuels and chemical reactions.

The nano powder sub-segment of the amorphous boron segment is expected to witness the fastest CAGR during 2025-2034. The nanoscale size of the powder creates a large surface area that increases its reactivity, which is essential for applications like catalysis and combustion. It also possesses low density in comparison with metals, making it an attractive option for areas where weight is a concerned, like the aerospace sectors, supporting the market growth.

Purity Level Insights

Why is Semiconductor Grade Purity in Demand in the Elemental Boron Market?

The high purity (>99%) dominates the global market, with the semiconductor grade sub-segment holding a market share of 36% in 2024. The segment is driven by factors like growing demand for efficient and high-purity borons in the semiconductor sector, especially for the doping process for silicon wafers. This high purity is critical to acquire expected results about electrical properties for highly advanced electronic devices by controlling the electrical conductivity of the materials. The segment is further proliferating due to increasing demand for compact yet efficient electronic devices or gadgets, the development and rapid adoption of 5G technology that needs ultra-high purity boron, along with the expanding semiconductor sector across the globe.

The nuclear-grade sub-segment of the high-purity (>99%) segment is expected to witness the fastest CAGR during 2025-2034. High-purity boron offers the excellent property of neutron absorption, which is crucial for the safety and security of nuclear reactors, and it prevents explosive runaway chain reactions. The nuclear energy sector is expanding due to its clean energy nature, directly impacting the segment's growth further.

Application Insights

Why Have Steel & Alloy Found Extensive Applications of the Boron Element?

The metallurgy segment led the market in 2024, with the steel & alloy sub-segment holding a share of 28%. The boron element naturally possesses the ability to enhance hardenability of steel and improve its strength and durability, even when used at very low concentrations, which offers greater production of high-quality steels, which are mainly used in industries like construction, automotive, and heavy machinery, where boron plays a critical role in manufacturing steel components. Boron-based steels are also highly used in cutting tools, military applications, and in the nuclear industry also as they possess unique characteristics.

The electronics & semiconductors segment is likely to expand quickly, particularly the doping agent sub-segment. The boron element is widely used in semiconductor manufacturing as a dopant, especially in silicon-based devices. Boron doping helps to create high-performing and budget-friendly transistors to enhance their speed and productivity. It also supports identical units of transistors with low-energy requirements. At the same time, the semiconductor industry is expanding significantly due to its applications in cutting-edge technologies like IoT, smartphones, and others.

Distribution Channel Insights

Which Factors Support Direct Sales in the Elemental Boron Market?

The direct sales (OEMs & Tier 1 suppliers) segment holds the largest market share due to a couple of factors. Most important is, direct sales offer manufacturers to interact face to face with consumers and build a reliable connection, as boron is crucial for many sectors like aerospace, healthcare, defense, and others. Every consumer buys boron with a specific and unique intent, which can be served better when it is provided via a direct sales channel. Also, to incorporate boron as per the requirement needs special expertise and skills that can also be offered by a direct sales channel.

The e-commerce & online portals segment is expected to witness the fastest growth. It is expanding significantly in the global elemental boron market as it offers high convenience and accessibility for boron elements, even for underserved areas, due to increased internet penetration and the use of smartphones. These platforms offer competitive prices and discounts, making them an affordable option to buy boron elements in bulk.

Elemental Boron Market Companies

- American Elements,

- SB Boron Corporation,

- 3M,

- ABSCO Limited,

- Strem Chemicals,

- Materion Corporation,

- Boron Specialties LLC,

- Höganäs AB,

- Dandong Chemical Engineering Institute (DCEI),

- New Metals and Chemicals Ltd.,

- SkySpring Nanomaterials,

- H.C. Starck Solutions,

- Advanced Abrasives Corporation,

- Baoding Zhongpuruituo Technology Co., Ltd.,

- Beijing Xing Rong Yuan Technology Co., Ltd.,

- BASF SE,

- Thermo Fisher Scientific,

- Henan Yuxing Sino-Crystal Micro-Diamond Co., Ltd.,

- Zhejiang Yamei Nano Technology Co., Ltd.

Recent Developments

- In June 2025, a Canadian frontier in sustainable fertilizer, Lucent Bio, launched an innovative granular fertilizer named Soileos Boron-Zinc to enhance the absorption of boron nutrients use by mitigating losses caused by leaching and aligning nutrient stock as per crop demand. It is a granular, water-insoluble, slow-release, and seed-safe boron fertilizer, built on Lucent Bio's patented cellulose delivery matrix. (Source: https://news.agropages.com)

- In June 2025, Indo Borox firm announced planns to build a boron oxide facility, which is highly dedicated for the's manufacturing with 4,000 metric tons per year in Madhya Pradesh, India. The total capital expenditure for the project is estimated at Rs 20 crore, which will be financed entirely through internal accruals.

(Source: https://www.capitalmarket.com)

Segments Covered in the Report

By Form

- Crystalline Boron

- High-Purity Crystalline Boron

- Low-Purity Crystalline Boron

- Amorphous Boron

- Fine Powder

- Granular

- Nano powder

- Others

- Boron Fibers

- Boron Films

By Purity Level

- High Purity (>99%)

- Semiconductor Grade

- Nuclear Grade

- Medium Purity (95–99%)

- Low Purity (<95%)

- Others

- Composite-Grade Purity

By Application

- Electronics & Semiconductors

- Doping Agent

- P-Type Semiconductors

- Metallurgy

- Steel & Alloys

- Superalloys

- Defense & Military

- Ballistic Armor

- Pyrotechnics

- Reactive Materials

- Aerospace

- Rocket Fuels

- Thermal Protection Coatings

- Energy

- Nuclear Reactors (Control Rods)

- Fusion Reactors

- Medical & Pharmaceuticals

- Boron Neutron Capture Therapy (BNCT)

- Drug Delivery Systems

- Ceramics & Glass

- Boron Carbide Ceramics

- Optical Glass

- Others

- Chemical Synthesis

- Laboratory Research

By Distribution Channel

- Direct Sales (OEMs & Tier 1 Suppliers)

- Distributors & Resellers

- E-Commerce & Online Portals

- Others

- Custom Supply Agreements

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting