What is the 2D Material Transistor Market Size?

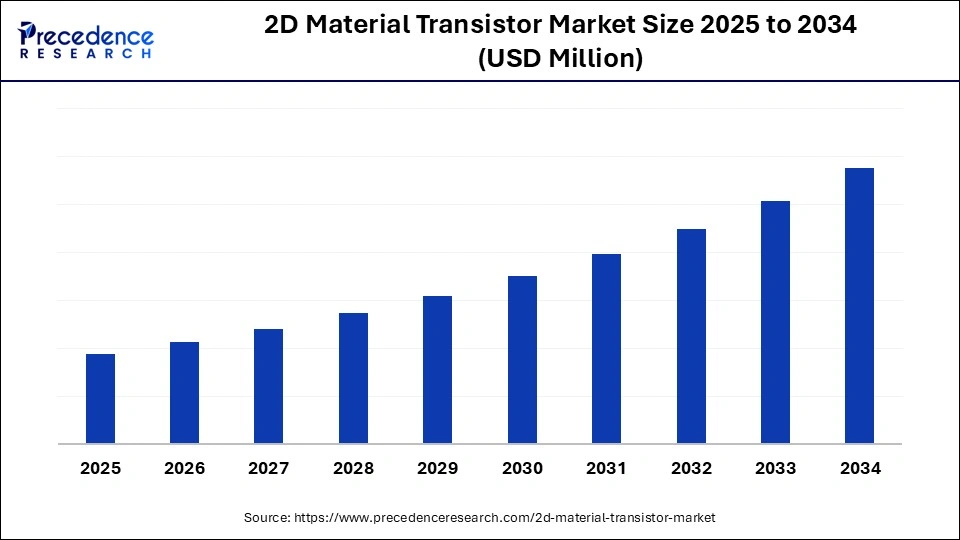

The global 2D material transistor market is witnessing rapid growth as graphene, MoSâ‚‚, and other 2D materials enable smaller, faster, and more energy-efficient transistors.The market growth is driven by rising demand for ultra-fast, energy-efficient, and miniaturized electronic devices.

2D Material Transistor Market Key Takeaways

- North America held the largest share of the 2D material transistor market in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecasted years.

- By material type, the graphene segment held a significant share of the market in 2024.

- By material type, the transition metal dichalcogenides (TMDs) segment is expected to grow at the fastest rate over the projection period.

- By transistor type, the field-effect transistors (FETs) segment led the market in 2024.

- By transistor type, the tunneling FETs segment is expected to show considerable growth in the market over the forecast period.

- By device application, the high-performance computing (HPC) & processors segment held a significant market share in 2024.

- By device application, the flexible & wearable electronics segment is expected to grow at the fastest rate over the forecast period.

- By end user, the semiconductor & electronics companies segment dominated the market in 2024.

- By end user, the research & academia segment is expected to expand at the fastest CAGR in the upcoming period.

- By integration technology, the discrete 2D transistor devices segment held the largest market share in 2024.

- By integration technology, the hybrid 2D/3D semiconductor devices segment is expected to grow at the highest CAGR in the market over the forecast period.

What is 2D Material Transistor?

The 2D material transistor market is an emerging segment of the next-generation semiconductor industry, driven by the demand for high-performance, energy-efficient, and miniaturized electronic devices. 2D material transistor refers to transistors built using two-dimensional (2D) materials such as graphene, transition metal dichalcogenides (TMDs), and hexagonal boron nitride (h-BN). These transistors offer ultra-thin channels, high electron mobility, low power consumption, and excellent scaling potential for next-generation electronics. They are increasingly used in high-performance computing, flexible electronics, IoT devices, sensors, and optoelectronics, driven by the demand for miniaturization, energy efficiency, and advanced semiconductor technologies.

The growing adoption of consumer electronics, telecommunication systems, and IoT devices has accelerated the push for miniaturization and performance efficiency, boosting interest and investment in 2D transistors. As R&D efforts intensify, companies are working to commercialize these technologies by advancing material synthesis, wafer-scale processing, and device integration. These improvements are making 2D transistors increasingly viable for mainstream applications across computing, electronics, and emerging sensor architectures. Furthermore, the rise of flexible, wearable, and ultra-low-power devices continues to drive demand for compact transistors with higher speeds and lower energy consumption.

Key Technological Shifts in the 2D Material Transistor Market Driven by AI

Artificial intelligence is redefining the research, design, and manufacturing processes, which impact the 2D material transistor market. AI algorithms are helping to speed up the material discovery and optimization of new materials, including graphene or transition metal dichalcogenides. Machine learning models are also performing simulations of transistor behavior, optimization of device architectures, and reduction of the trial-and-error of experiments, which reduces development time.

In the manufacturing areas, automated process control and predictive quality process through AI technologies can be used to improve the wafer-scale production and guarantee the improved reliability of the devices. Moreover, the AI-based data analytics are facilitating a smarter design-based-performance framework, incorporating 2D transistors into flex-based electronics, IoTs, and high-performance computing modules with difficulty.

What Factors are Fueling the Growth of the 2D Material Transistor Market?

- Miniaturization Demand: The growing need for faster, smaller, and more energy-efficient electronic devices is driving the adoption of 2D material transistors. These offer ultra-thin channels and high electron mobility, making them ideal for next-generation semiconductor applications.

- High-Performance Computing: The demand for high-speed processors and advanced computing systems is accelerating market growth. 2D transistors offer lower power consumption, faster switching speeds, and better scalability compared to conventional silicon-based technologies.

- Flexible and Wearable Electronics: The rise of flexible and wearable IoT devices is fueling demand for lightweight, compact, and flexible transistors. 2D material-based devices are well-positioned to meet these evolving needs in consumer electronics.

- Government and Industry Support: Increased R&D investments, government funding, and industry collaborations in advanced semiconductor technologies are supporting the global development and commercialization of 2D material transistors.

2D Material Transistor Market Outlook:

- Market Growth Overview: The market is expanding significantly due to rising demand for high-performance, low-power, and miniaturized electronic devices. Leading players such as Intel, IBM, Samsung, TSMC, and Applied Materials are actively innovating with materials like graphene, TMDs, and hybrid transistors, which are being adopted across high-performance computing (HPC), IoT, flexible electronics, and wearable systems.

- Global Expansion: Market uptake is accelerating globally, particularly in North America, Asia Pacific, and Europe, supported by strong R&D ecosystems, manufacturing capabilities, and government support. Cross-border partnerships and commercialization efforts are being led by institutions such as the Samsung Advanced Institute of Technology (SAIT) and CEA-Leti, helping scale the production of 2D material transistor technologies.

- Key Investors: Major investors include Intel, IBM, Samsung Electronics, TSMC, Applied Materials, and GlobalFoundries. These companies are investing in R&D, device fabrication, and integration technologies, accelerating the commercialization and global adoption of high-performance and flexible 2D transistors.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Transistor Type, Device Application, End-User, Integration Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Demand for High-Performance and Energy-Efficient Electronics

The rising demand for high-performance, energy-efficient, and miniaturized electronic devices is a major factor driving the growth of the 2D material transistor market. Traditional silicon-based transistors are increasingly limited by issues related to scaling, thermal efficiency, and switching speed. In contrast, 2D materials such as graphene, transition metal dichalcogenides (TMDs), and hexagonal boron nitride (h-BN) offer superior electron mobility, ultra-thin conductive channels, and lower power consumption. Advances in material synthesis, wafer-scale fabrication, and device integration have further enhanced the commercial viability of these transistors. Momentum is also being fueled by government initiatives, funding programs, and collaborative projects between research institutions and semiconductor companies.

Restraint

High Manufacturing Complexity and Cost Challenges

The complexity of manufacturing and the cost involved in manufacturing defect-free 2D materials at the scale of a wafer are still major challenges. It is challenging and resource-consuming to achieve consistent quality, uniformity, and reproducibility of material when it is being fabricated in large quantities. Also, commercial applications of 2D transistors need many infrastructure modifications and design adjustments, and are consequently slow to deploy in existing CMOS-based fabrics. There is a lack of standardization and regulatory controls on new 2D materials and devices, and this creates uncertainties for manufacturers and investors. The problems will likely dampen the pace of market growth despite high demand for advanced, energy-efficient transistors.

Opportunity

Expansion in Flexible, Wearable, and IoT Electronics

The market potential for 2D material transistors is substantial, driven by the growing adoption of flexible, wearable, and Internet of Things (IoT) devices. With their ultra-thin structure, high electron mobility, and low power consumption, 2D transistors are well-suited for compact and bendable electronics. Rising demand for high-performance, energy-efficient electronics across the consumer, healthcare, and industrial sectors is pushing manufacturers to explore 2D materials as alternatives to conventional silicon-based transistors.

Additionally, recent breakthroughs in wafer-scale production, scalable manufacturing techniques, and device integration are making commercial deployment more viable and cost-effective. As applications like flexible displays, wearable sensors, connected IoT devices, and high-speed computing continue to expand, 2D transistors are poised to become a foundational technology in the next wave of electronic innovation.

Segment Insights

Material Type Insights

Why Did the Graphene Segment Lead the 2D Material Transistor Market?

The graphene segment led the market by holding the largest revenue share in 2024. This is because graphene's ultra-high electron mobility, exceptional conductivity, and one-atom-thick structure, which make it ideal for creating ultra-fast, low-power transistors suited for next-generation electronics. Its flexibility and mechanical strength also make it highly suitable for wearable, flexible, and bendable applications, as well as in high-performance computing and optoelectronic systems. Technological advancements, including wafer-level production, chemical vapor deposition (CVD), and enhanced integration techniques, are accelerating the commercial-scale production of graphene.

Moreover, the growing demand for miniaturized, energy-efficient, and high-speed devices, particularly in the IoT, consumer electronics, and telecommunications sectors, is driving adoption. Leading semiconductor companies and research institutions are also heavily investing in graphene-based research and development (R&D) to address challenges such as defect control and material uniformity, thereby ensuring performance reliability and scalability.

The transition metal dichalcogenides (TMDs) segment is expected to grow at a significant CAGR over the forecast period. TMD materials such as MoSâ‚‚, WSâ‚‚, and WSeâ‚‚ offer tunable band gaps, high on/off current ratios, and mechanical flexibility, making them well-suited for low-power, high-performance transistors, flexible electronics, and sensor applications. The growth of this segment is being driven by advancements in large-area, uniform material deposition and improved integration with existing semiconductor processes, which enhance the scalability and reliability of TMD-based devices.

Furthermore, increasing R&D investments and industry-academia collaborations are accelerating the commercial development of TMD-based transistors for high-speed computing, wearable technology, and IoT applications. As demand for next-generation, energy-efficient, and flexible electronics rises, TMDs are emerging as a strong alternative to graphene for certain applications, positioning this segment as one of the fastest-growing areas of the market in the coming years.

Transistor Type Insights

What Made Field-Effect Transistors (FETs) the Dominant Segment in 2024?

The field-effect transistors (FETs) segment dominated the 2D material transistor material market with a major share in 2024. This is because FETs leverage the high electron mobility, ultra-thin channels, and low power consumption of 2D materials, making them ideal for high-speed, low-power, and scalable electronic devices. These transistors are extensively applied in digital logic circuits, high-performance computing, and IoT devices, as well as flexible electronics, which drives their usage. Further development of the segment is enabled by the constant progress in 2D material integration, device fabrication, and wafer-scale production, which enhances performance, reproducibility, and financial feasibility. Also, the high emphasis on miniaturization, low-power electronics, and high switching speed has boosted the demand for FET-based 2D transistors.

The tunneling FETs segment is expected to grow at the fastest rate in the upcoming period. This is mainly due to their high adoption, driven by their ability to offer steep subthreshold slopes and ultra-low power consumption, making them ideal for low-power electronic applications. Their structure leverages band-to-band tunneling in 2D materials and can be used to switch at significantly lower voltages than traditional FETs. This is particularly important for wearable electronics, Internet of Things devices, and ultra-low-power computing applications, in which power efficiency will be a defining factor.

Device Application Insights

How Does the High-Performance Computing (HPC) & Processors Segment Lead the Market?

The high-performance computing (HPC) & processors segment led the 2D material transistor market, accounting for the largest revenue share in 2024. This is due to the growing demand for ultra-fast, low-energy, and scalable computing devices. Transistors based on 2D materials, including graphene and transition metal dichalcogenides (TMDs), exhibit high electron mobility, low power consumption, and good thermal conductivity, making them particularly suitable for HPC applications in servers, AI processors, GPUs, and data centers.

Competitive developments in wafer-scale production, device integration, and optimization strategies have enhanced transistor performance and reliability, enabling the use of transistors in high-performance computing architectures for commercial applications. Companies and research institutions in the semiconductor industry are making massive R&D investments to capture the benefits of 2D transistors to deploy them in HPC applications.

The flexible & wearable electronics segment is expected to grow at a significant CAGR over the forecast period, driven by rising demand for lightweight, flexible, and energy-efficient devices. 2D material transistors, with their ultra-thin, mechanically robust, and flexible structure, are well-suited for applications such as wearable sensors, flexible displays, health monitors, and IoT-enabled devices. Growing consumer awareness of convenience, portability, and sustainability is driving adoption across the healthcare, fitness, and consumer electronics sectors.

Technological advancements in 2D material synthesis, device miniaturization, and scalable manufacturing are further supporting the industrial deployment of these technologies. In addition, collaborations among electronics manufacturers, semiconductor companies, and research institutions are accelerating innovation and the practical application of flexible transistors in next-generation electronics.

End-User Insights

Why Did Semiconductor & Electronics Companies Contribute the Most Revenue in 2024?

The semiconductor & electronics companies segment contributed the most revenue in 2024, as these companies have been investing heavily in research and commercialization of 2D material transistors to satisfy the increasing needs of high-performance, energy-efficient, and miniaturized electronic devices. These firms use two-dimensional materials, including graphene and TMDs, in the development of very thin, high-speed, and low-power transistors, used in high-performance computing, IoT devices, flexible electronics, and optoelectronics. This is further enhanced by the fact that the development of wafer-scale fabrication, device integration, and testing technologies also enhances the performance of the devices and contributes towards the scalability of these devices being deployed reliably.

The research & academia segment is expected to grow substantially in the market. Novel 2D materials, transistor architectures, and fabrication techniques are being actively developed by universities, research institutions, and startups, thereby accelerating the introduction of new technologies. In academic literature, the investigation of graphene, TMDs, and heterostructures aims to enhance performance and scalability, as well as facilitate integration into future electronics. Government funding, joint research projects, and collaborations with semiconductor companies benefit the segment, creating commercialization and prototyping of advanced transistors at an early stage. Growing interest in electronics, with numerous applications that can be flexible, including IoT devices and next-generation computing applications, continues to be the focus of exploration and experimentation in academia.

Integration Technology Insights

Why Did the Discrete 2D Transistor Devices Segment Dominate the 2D Material Transistor Market in 2024?

The discrete 2D transistor devices segment dominated the market, holding the largest revenue share in 2024, due to their high commercial availability, as they can be easily integrated and are applicable across all applications. Graphene and TMDs are discrete 2D transistors, characterized by high electron mobility, low energy consumption, and ultrasmall channels, which find applications in computing, high-performance computing, the Internet of Things, sensors, and flexible electronic devices. Their independent architecture enables engineers to design, model, and integrate devices into an existing system quickly and easily, without requiring complex fabrication methods. Moreover, the fact that semiconductor and electronics companies have invested heavily in the commercialization of discrete 2D devices strengthens their hegemony as they offer a feasible route for early adoption of next-generation transistor technologies.

The hybrid 2D/3D semiconductor devices segment is expected to grow at a significant CAGR over the forecast period. They are devices that merge 2D materials with conventional architecture, 3D silicon, or other semiconductor architectures, promising greater performance, energy efficiency, and scaling capabilities. Hybrid integration enables advanced capabilities, including faster switching rates, reduced leakage currents, and multi-layer device designs, which are particularly applicable to high-performance computing, memory, and flexible electronics. Continued research in the field of material engineering, fabrication, and device design is accelerating the development of the hybrid device. Greater industry-academia partnerships, pilot manufacturing projects, and government programs support the development of advanced semiconductor technologies, as well as the growth of the segment.

Region Insights

Why Did North America Dominate the 2D Material Transistor Market in 2024?

North America registered dominance in the 2D material transistor market by capturing the largest share in 2024. This is due to its well-established semiconductor and electronics ecosystem, as well as its advanced R&D infrastructure. The region hosts major international companies such as Intel, IBM, and Applied Materials, which are heavily investing in the development, commercialization, and integration of 2D material transistors. Additionally, supportive government initiatives, funding programs, and policies foster cutting-edge semiconductor research and next-generation electronics innovation. The growing demand for high-performance computing, flexible electronics, IoT devices, and wearable technology further drives market adoption, as 2D material transistors offer ultra-thin form factors, low power consumption, and superior electron mobility compared to traditional silicon-based devices.

The U.S. is a major contributor to the North America 2D material transistor market. The U.S. government has initiated efforts to accelerate semiconductor innovation, enhance materials research, and develop next-generation computing technologies in collaboration with industry, academia, and research labs. With robust venture capital and public-private investments, American semiconductor firms are at the forefront of developing high-performance 2D transistors for applications in HPC, AI processors, sensors, and flexible electronics. In 2D transistor technologies, the U.S. is also at the forefront in the generation of intellectual property, patenting, and prototyping, which develops a competitive advantage in the international market.

Why is Asia Pacific Considered the Fastest-Growing Market?

Asia Pacific is expected to experience the fastest growth during the forecast period due to rapid industrialization, expanding semiconductor production capabilities, and rising R&D expenses. Countries such as China, Japan, South Korea, and India have been making significant investments in next-generation semiconductor technologies to support the growth of high-performance computing, flexible electronics, IoT applications, and wearable devices. The region benefits from a strong talent pool of engineers and researchers, a burgeoning startup ecosystem, and close collaboration among governments, academia, and industry. Additionally, the global emphasis on low-power, miniaturized, and energy-efficient electronic components aligns well with regional trends, further driving the adoption of 2D material transistors.

China is a major contributor to the market. It has been investing heavily in next-generation electronics and semiconductor research, together with the development of advanced materials, such as graphene, TMDs, and hybrid 2D/3D devices. Government initiatives and funding programs aim to enhance domestic semiconductor capabilities in China, promote the commercialization of R&D, and reduce dependency on imports to achieve high-end electronic components. New 2D material transistors to enable flexible electronics, high-performance computing, and IoT are being actively investigated by Chinese universities and research institutions, and domestic semiconductor firms are increasing production and prototyping.

Country-level Investments & Funding Trends for 2D Material Transistor Market

- U.S.: The U.S. is the worldwide leader in 2D material transistor R&D, with the government and players such as Intel, IBM, and Applied Materials investing heavily. The projects are favoring the development of wafer-scale graphene, TMDs, and hybrid devices, and the development of high-performance computing, flexible electronics, and Internet of Things (IoT) uses.

- China: China is heavily invested in home-based semiconductor and 2D transistor research, both assisted by government programs and venture funding. The major players include SMIC, Huawei, and spin-offs of Tsinghua University, with their graphene, TMDs, and 2D/3D hybrid device applications primarily focused on the fields of flexible electronics, AI processors, and the Internet of Things.

- South Korea: South Korea is an innovation-driven country in next-generation electronics and semiconductors, and is investing in next-generation 2D material transistor development. The two large manufacturers, such as Samsung Electronics and LG Electronics, are leaders in research on the implementation of graphene, TMDs, and flexible transistors, which are oriented towards HPC, wearable devices, and IoT.

Top Companies in the 2D Material Transistor Market & Their Offerings

- IBM Corporation: IBM Corporation is involved in graphene and 2D materials advanced research in high-speed transistors, providing prototype devices and cooperation in semiconductor research and development.

Intel Corporation: It invents 2D material-based transistor technology to improve scaling, power consumption, and performance in the next-generation processors. - Samsung Electronics Co., Ltd.: Performance in the field of 2D transistors and flexible electronics involving 2D transistors in the creation of high-performance computers and memory devices.

- TSMC (Taiwan Semiconductor Manufacturing Company): The company provides a foundry for fabricating 2D material transistors, thereby enabling the commercialization and integration of complex devices on a wafer scale.

- Applied Materials, Inc.: It is a global leader in supplying equipment and processes for 2D material synthesis, deposition, and integration, which are used in semiconductor fabrication, contributing to the generation of transistor value chain.

2D Material Transistor Market Companies

- GlobalFoundries

- Nantero, Inc.

- Graphenea

- Silvaco, Inc.

- AIM Photonics

- University-based Spinouts (e.g., 2D Fab Lab startups)

- Arizona State University / MIT 2D Device Labs (research-based commercialization)

- Samsung Advanced Institute of Technology (SAIT)

- CEA-Leti (France)

- HRL Laboratories

Recent Developments

- In January 2025, Adisyn acquired 2D Generation, an Israel-based semiconductor IP company, with the deal being finalized on January 9. The acquisition gave Adisyn rights to the patented graphene coating technology used by 2D Generation to develop advanced chip development that consumes less energy.

(Source: https://www.thegraphenecouncil.org) - In January 2025, Researchers at the University at Buffalo invented a process for incorporating new 2D materials into existing silicon technology to enhance the functionality and performance of energy-efficient nanoelectronics.(Source: https://www.buffalo.edu)

- In January 2025, Imec proposed a roadmap to deploy 2D materials in the conduction channels of 2D CFET architectures, aiming to overcome integration issues and enable the logic technology roadmap. (Source: https://www.imec-int.com)

Exclusive Expert Analysis on the 2D Material Transistor Market

The 2D material transistor market is poised at the cusp of transformative growth, driven by the convergence of escalating demands for ultra-miniaturized, energy-efficient, and high-performance semiconductor solutions. From an industry analyst's perspective, the sector embodies a fertile ground for innovation and disruption, underpinned by the intrinsic physicochemical advantages of 2D materials such as graphene, transition metal dichalcogenides (TMDs), and hexagonal boron nitride (h-BN). These materials enable transistor architectures that transcend the limitations of traditional silicon-based technologies, offering unprecedented electron mobility, scalability, and operational efficiency.

Notably, the accelerating adoption of edge computing, Internet of Things (IoT), and wearable electronics is catalyzing demand for transistors with reduced power footprints and flexible form factors, presenting substantial commercial avenues. Furthermore, government-led R&D initiatives and cross-sector collaborations are rapidly bridging the gap between laboratory breakthroughs and scalable manufacturing, thereby enhancing the market's readiness for widespread integration.

The maturation of wafer-scale synthesis and heterostructure fabrication techniques is particularly consequential, as these advances mitigate prior bottlenecks in device reproducibility and cost-efficiency, heralding the imminent mainstreaming of 2D transistor technologies across high-value verticals such as telecommunications, healthcare, and consumer electronics.

Segments Covered in the Report

By Material Type

- Graphene

- Transition Metal Dichalcogenides (TMDs)

- Hexagonal Boron Nitride (h-BN)

- Others (Black Phosphorus, MXenes)

By Transistor Type

- Field-Effect Transistors (FETs)

- Tunneling FETs (TFETs)

- FinFETs

- Multi-gate / Nanowire FETs

By Device Application

- High-Performance Computing (HPC) & Processors

- Flexible & Wearable Electronics

- Sensors & MEMS Devices

- Optoelectronic Devices

- IoT Devices & Edge Electronics

By End-User

- Semiconductor & Electronics Companies

- Consumer Electronics Manufacturers

- Automotive & Transportation

- Healthcare & Medical Devices

- Aerospace & Defense

- Research & Academia

By Integration Technology

- Discrete 2D Transistor Devices

- Integrated Circuits (ICs) with 2D Transistors

- Hybrid 2D/3D Semiconductor Devices

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting